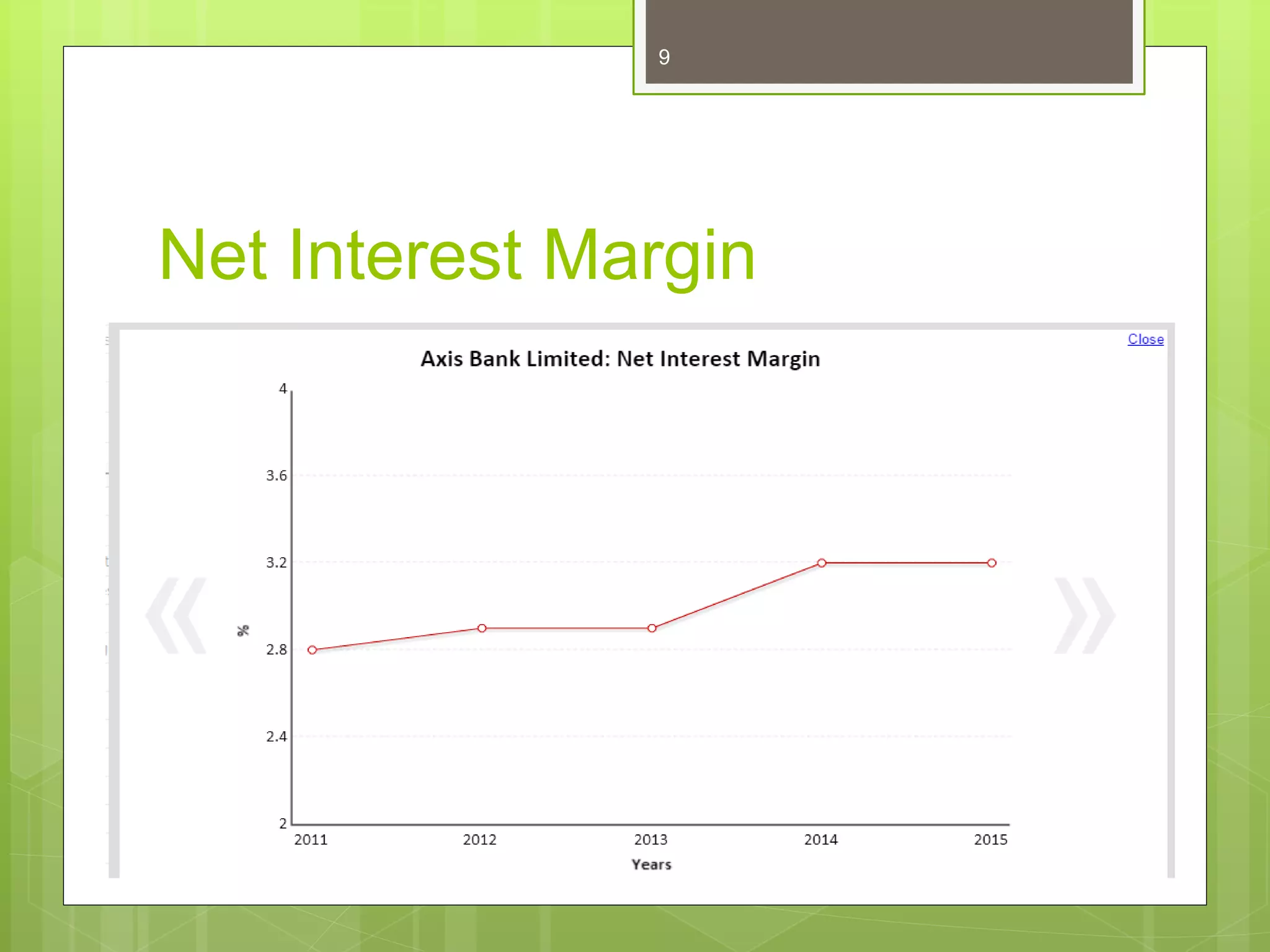

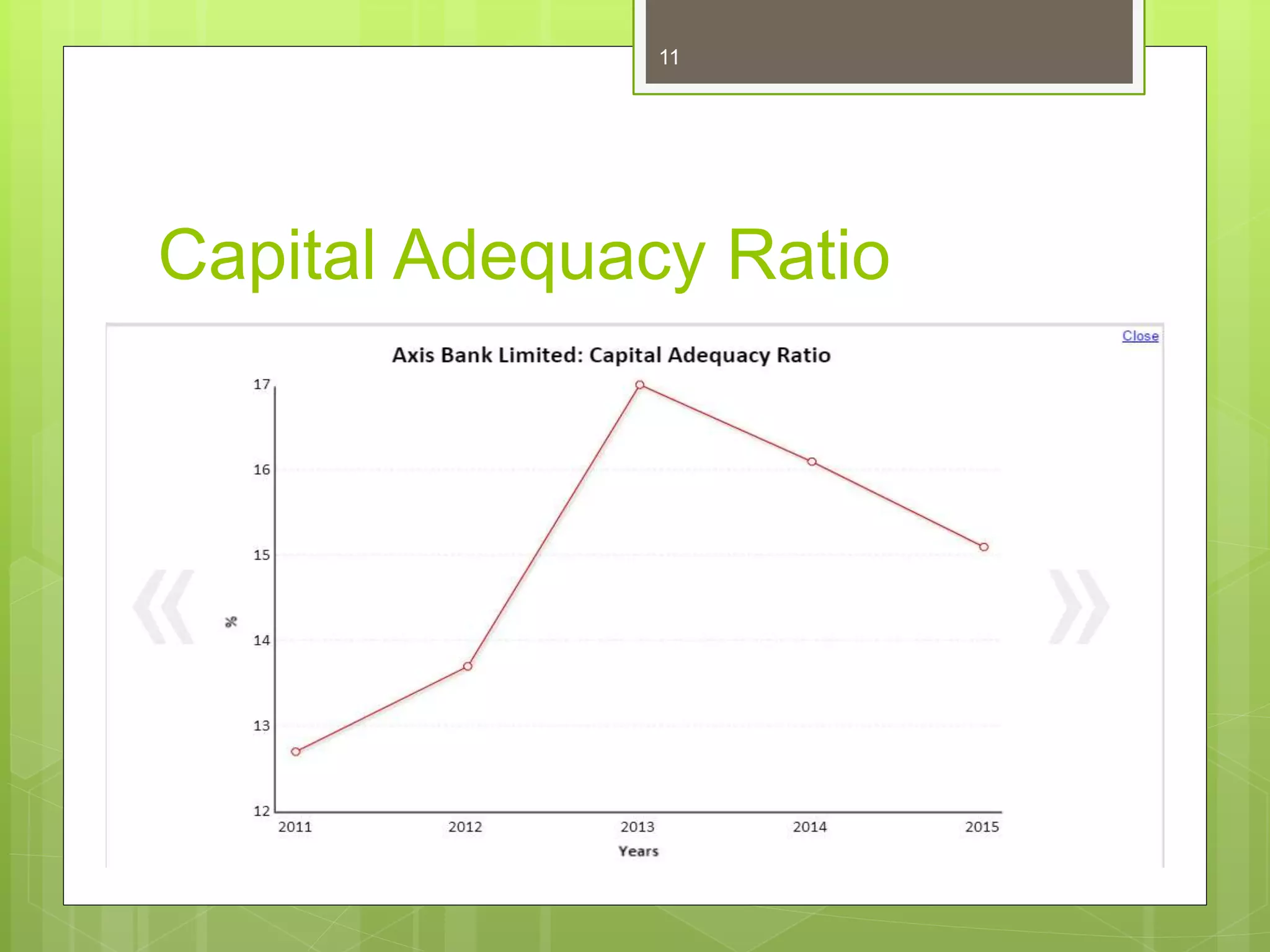

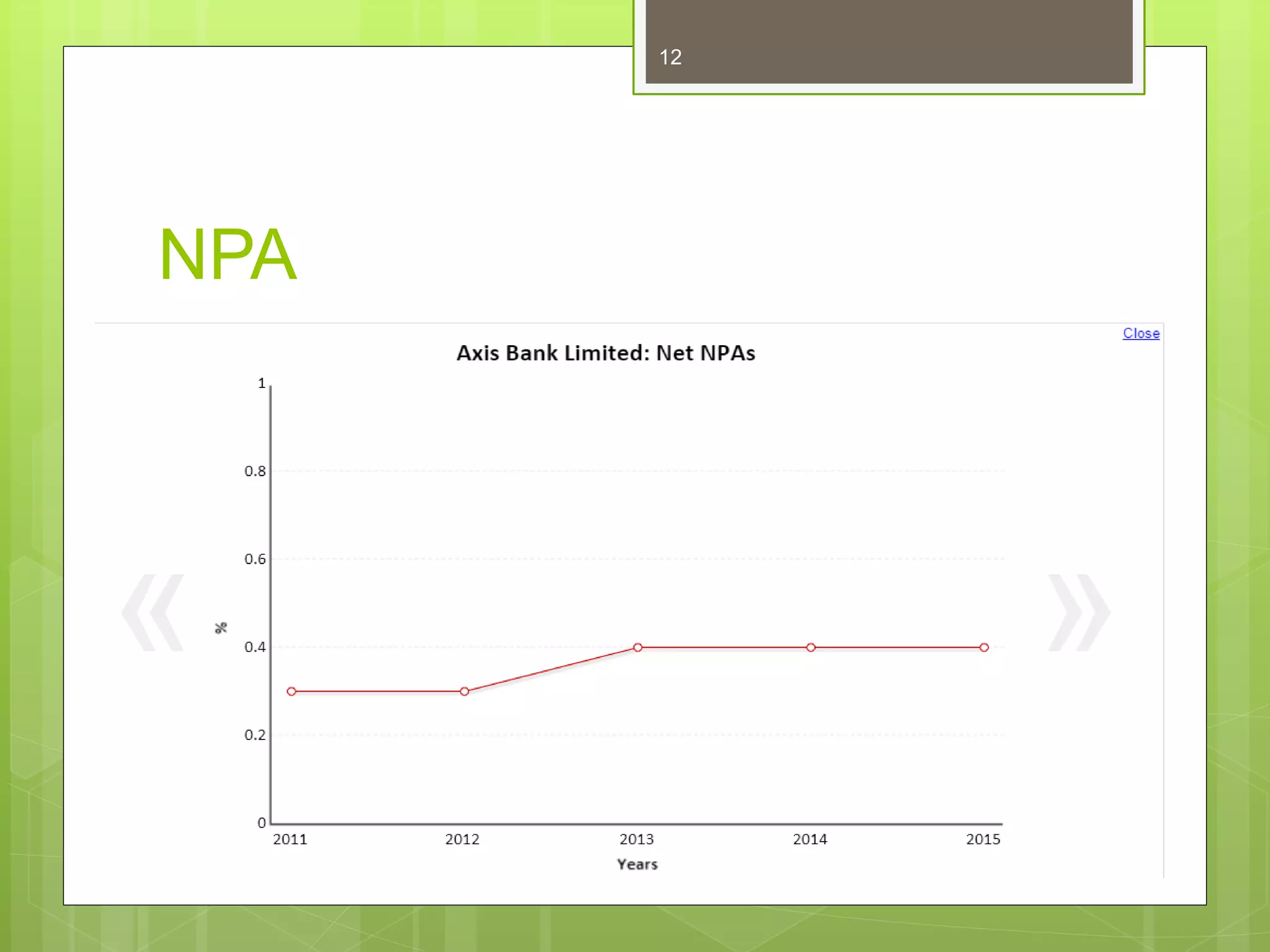

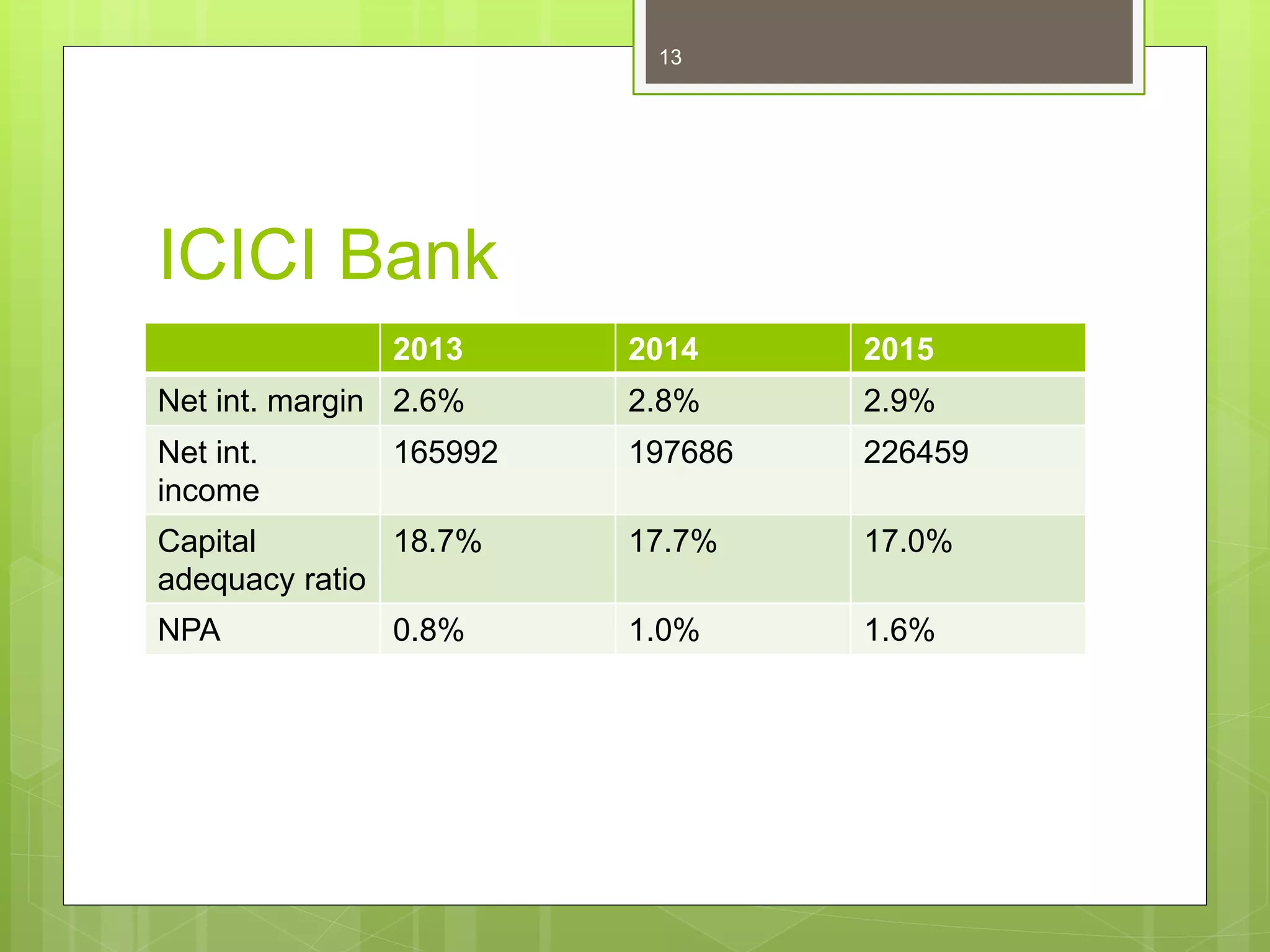

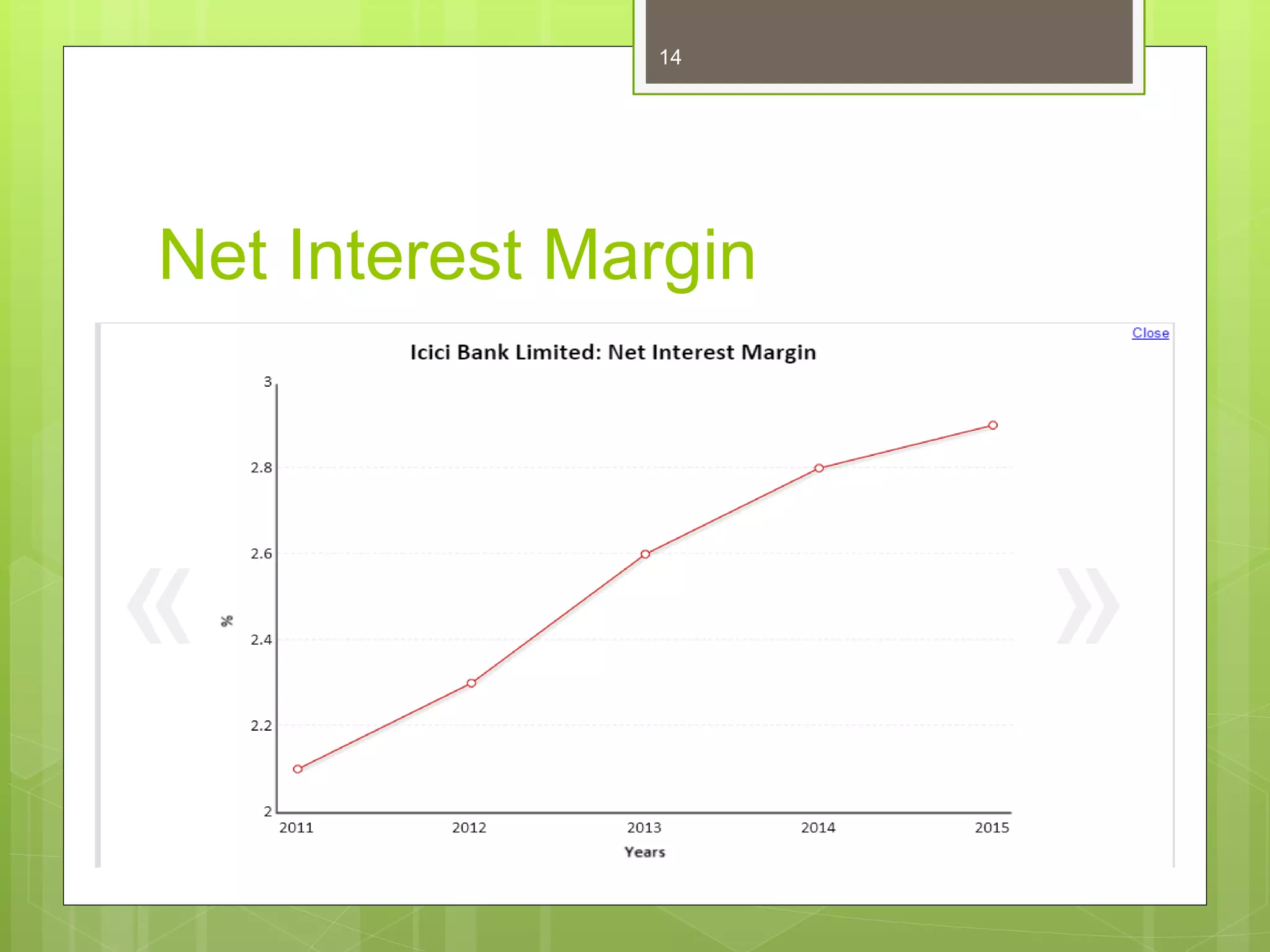

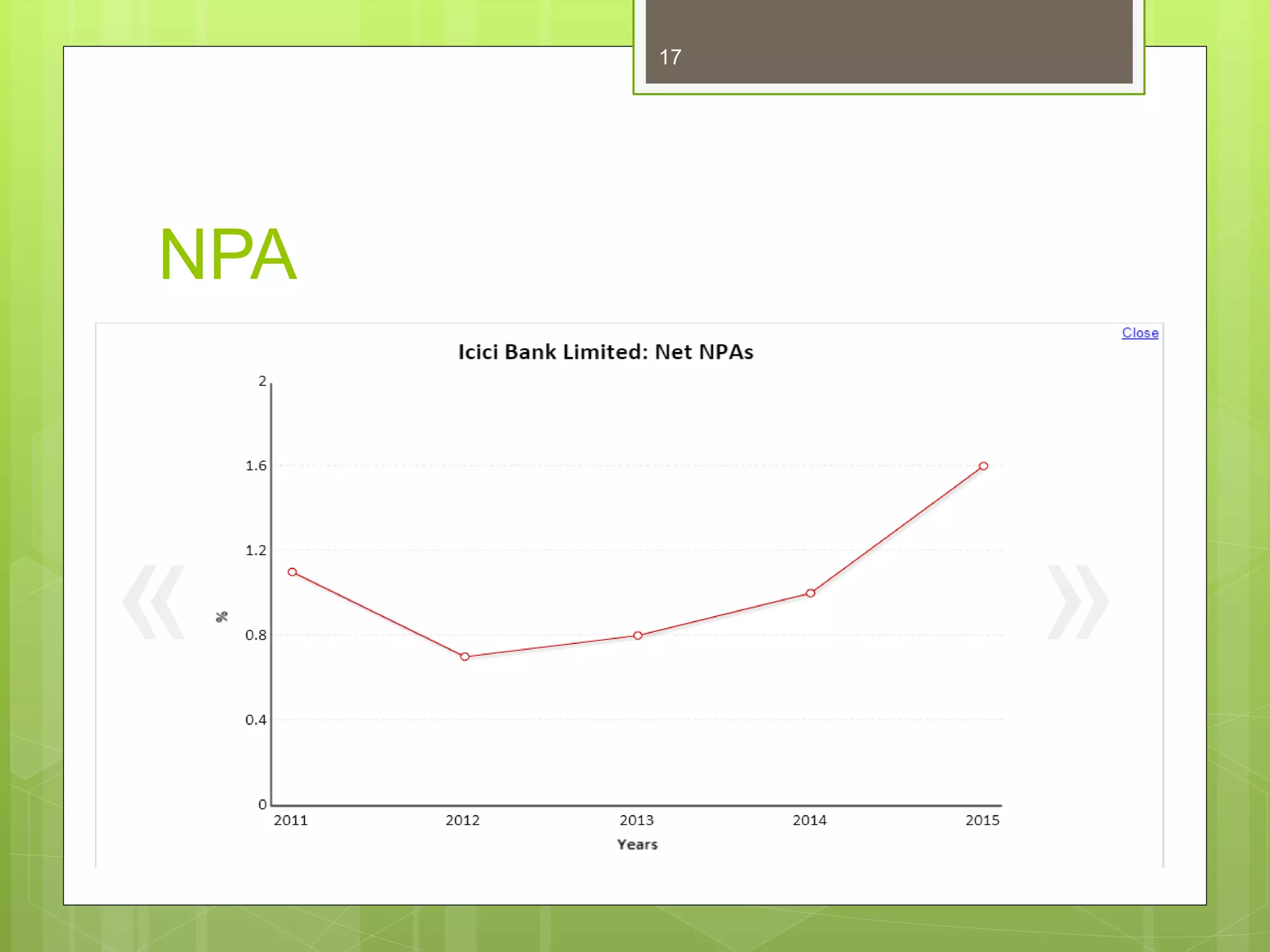

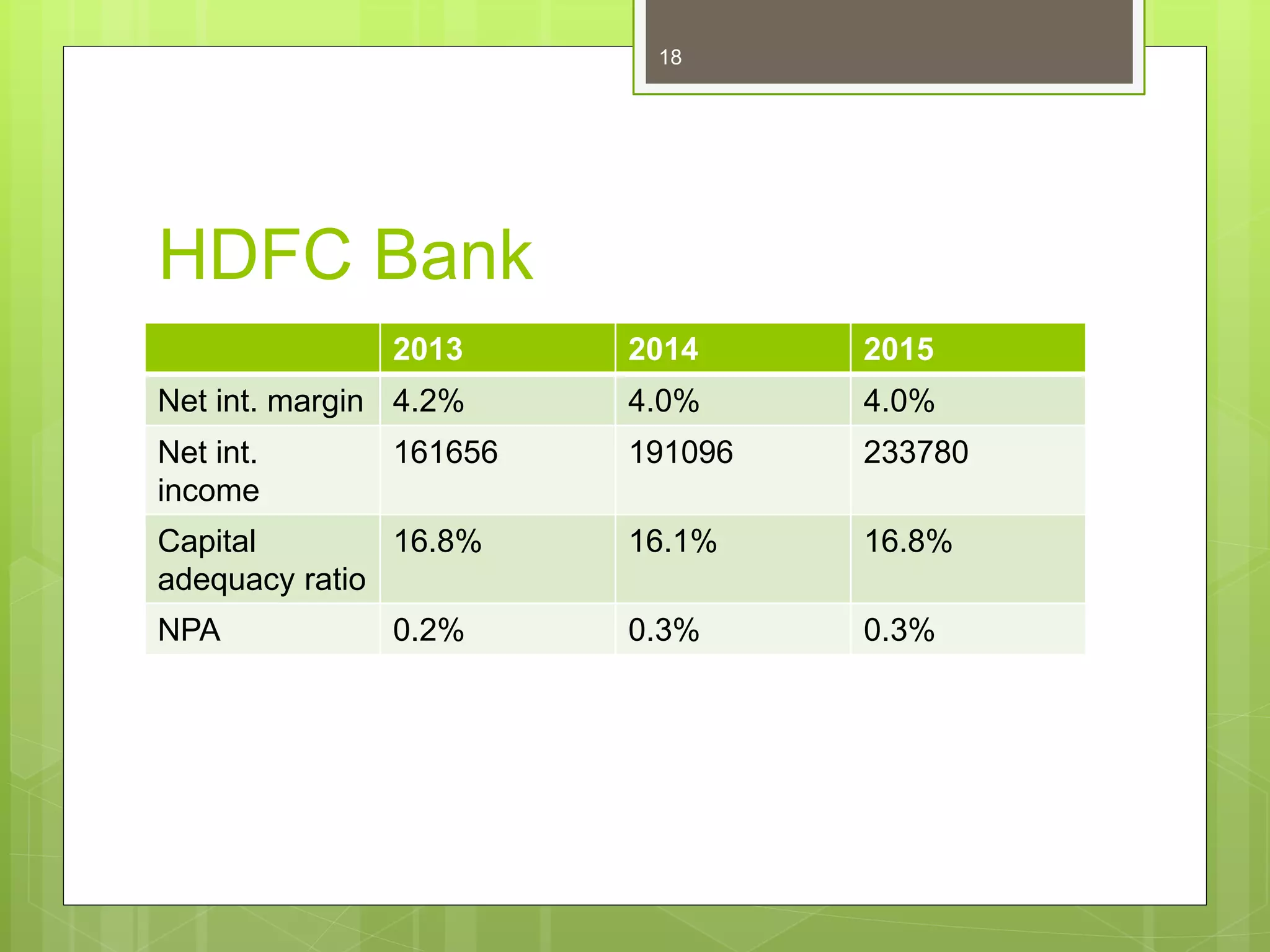

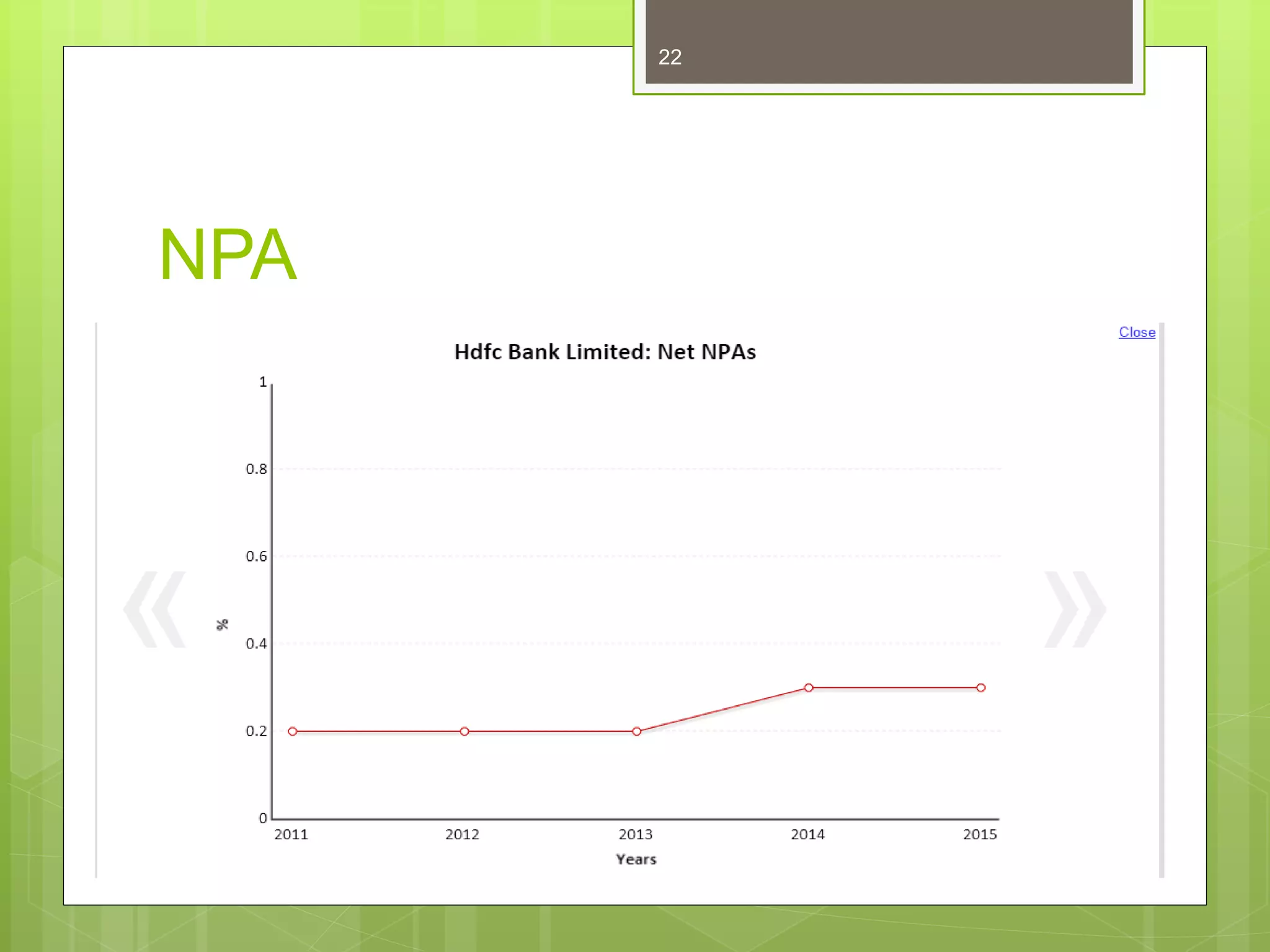

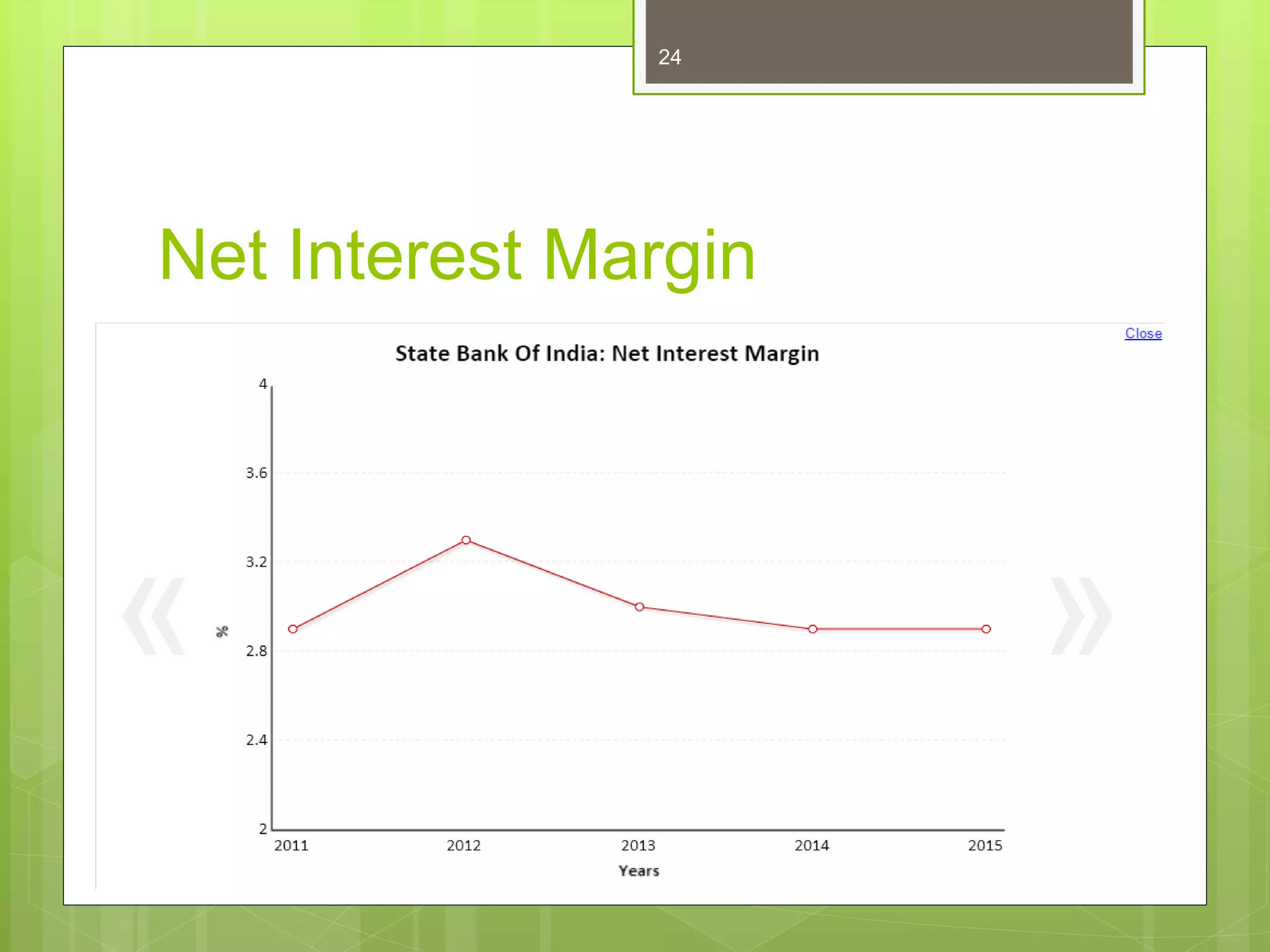

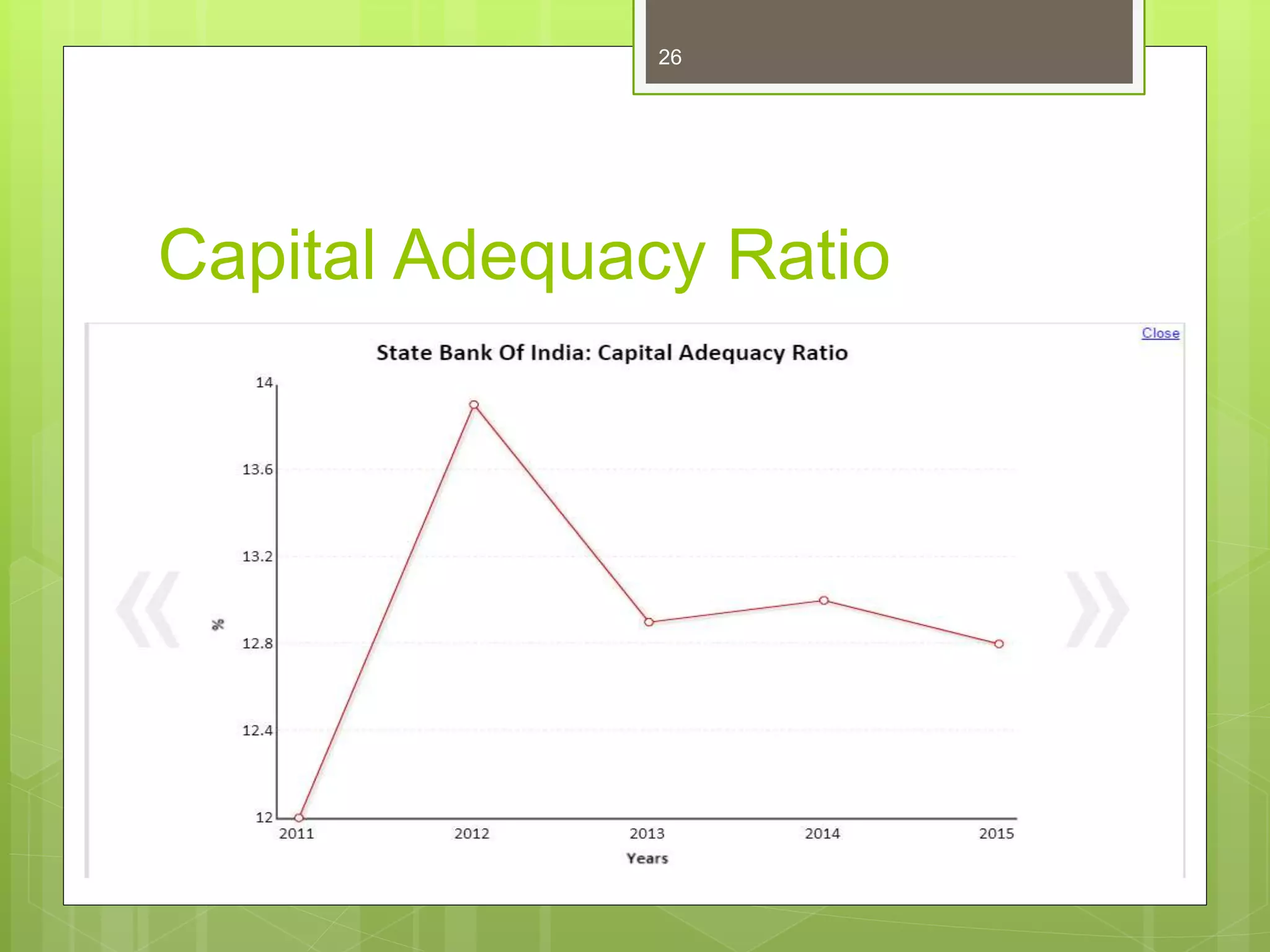

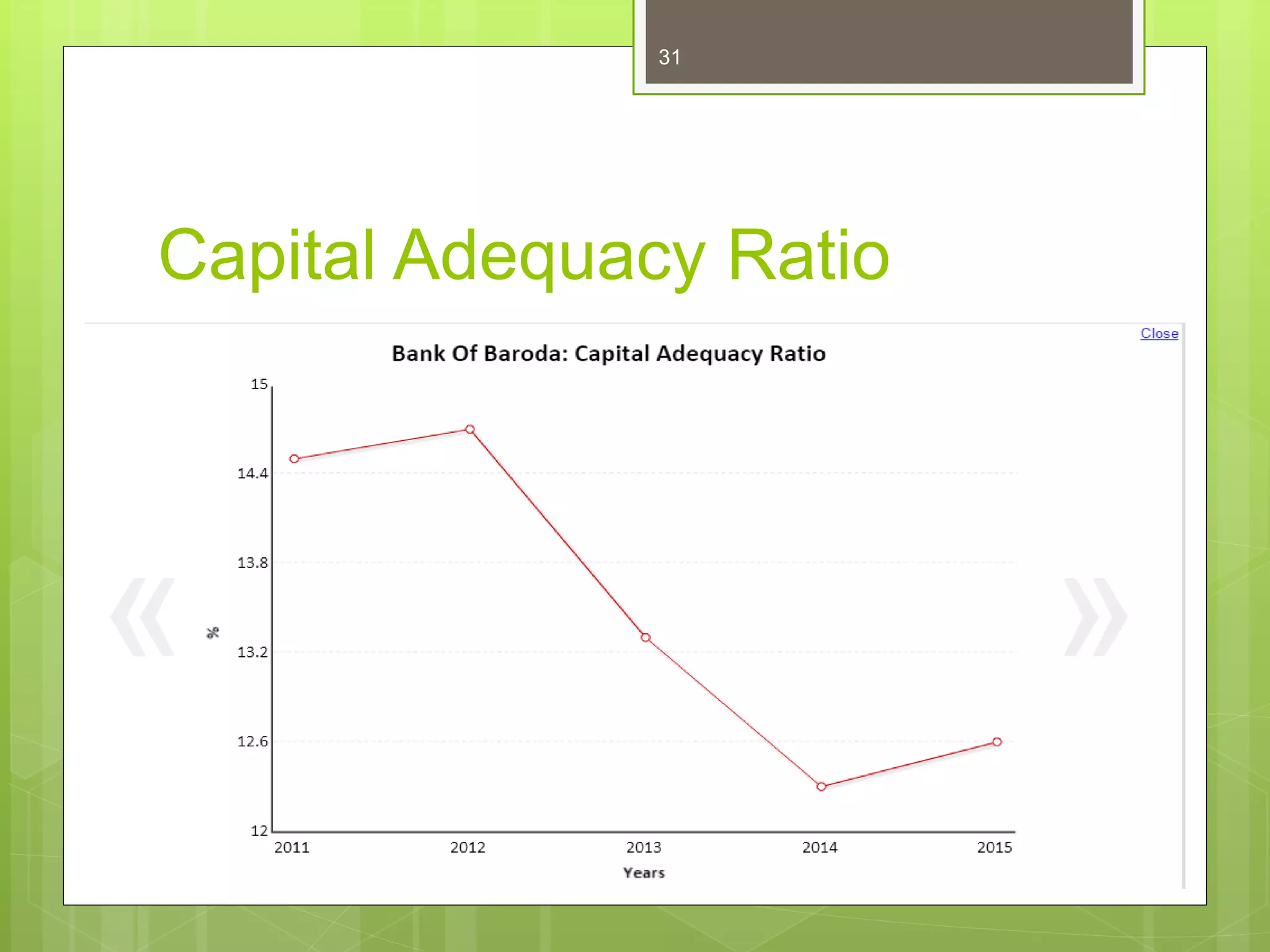

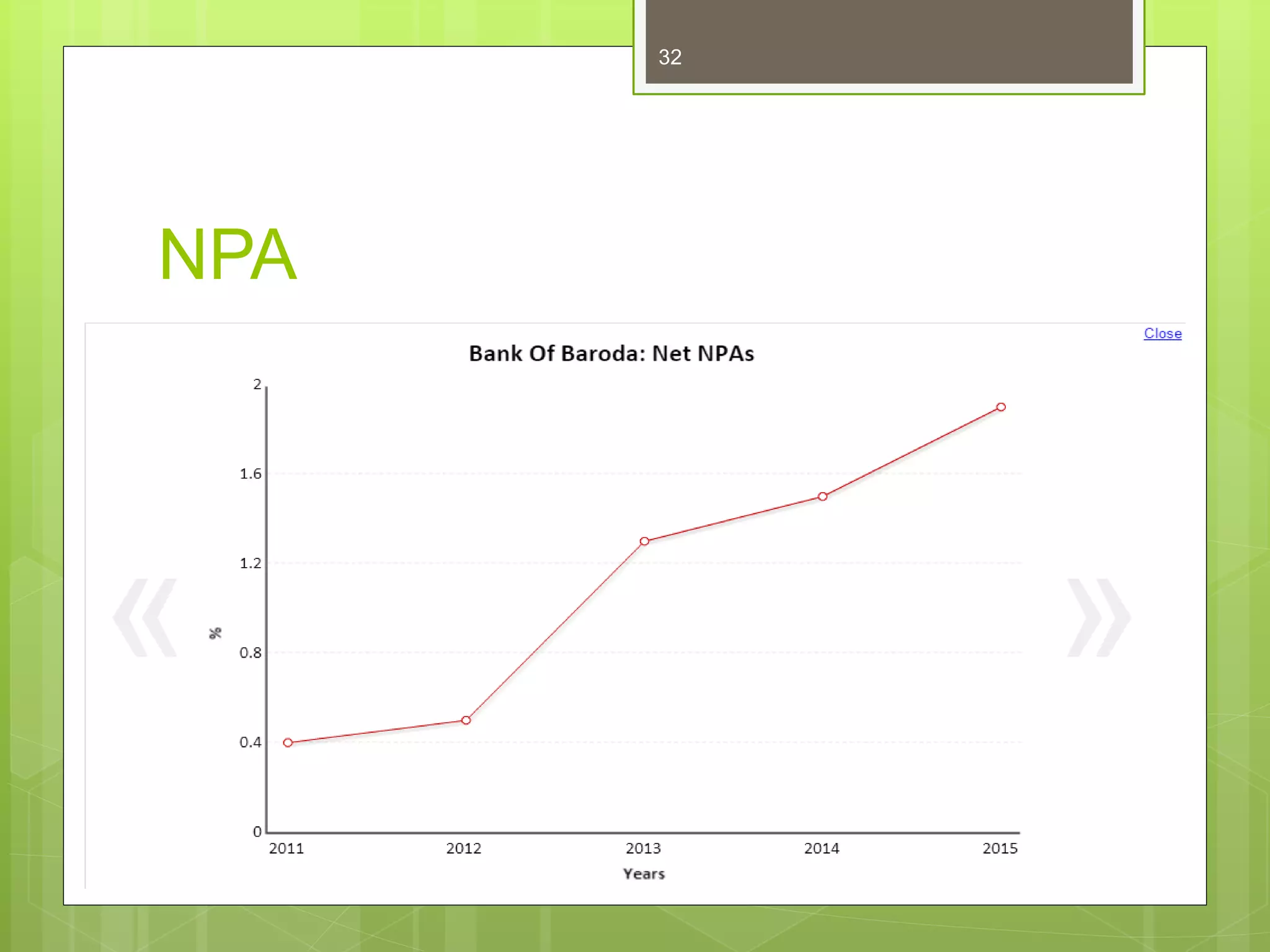

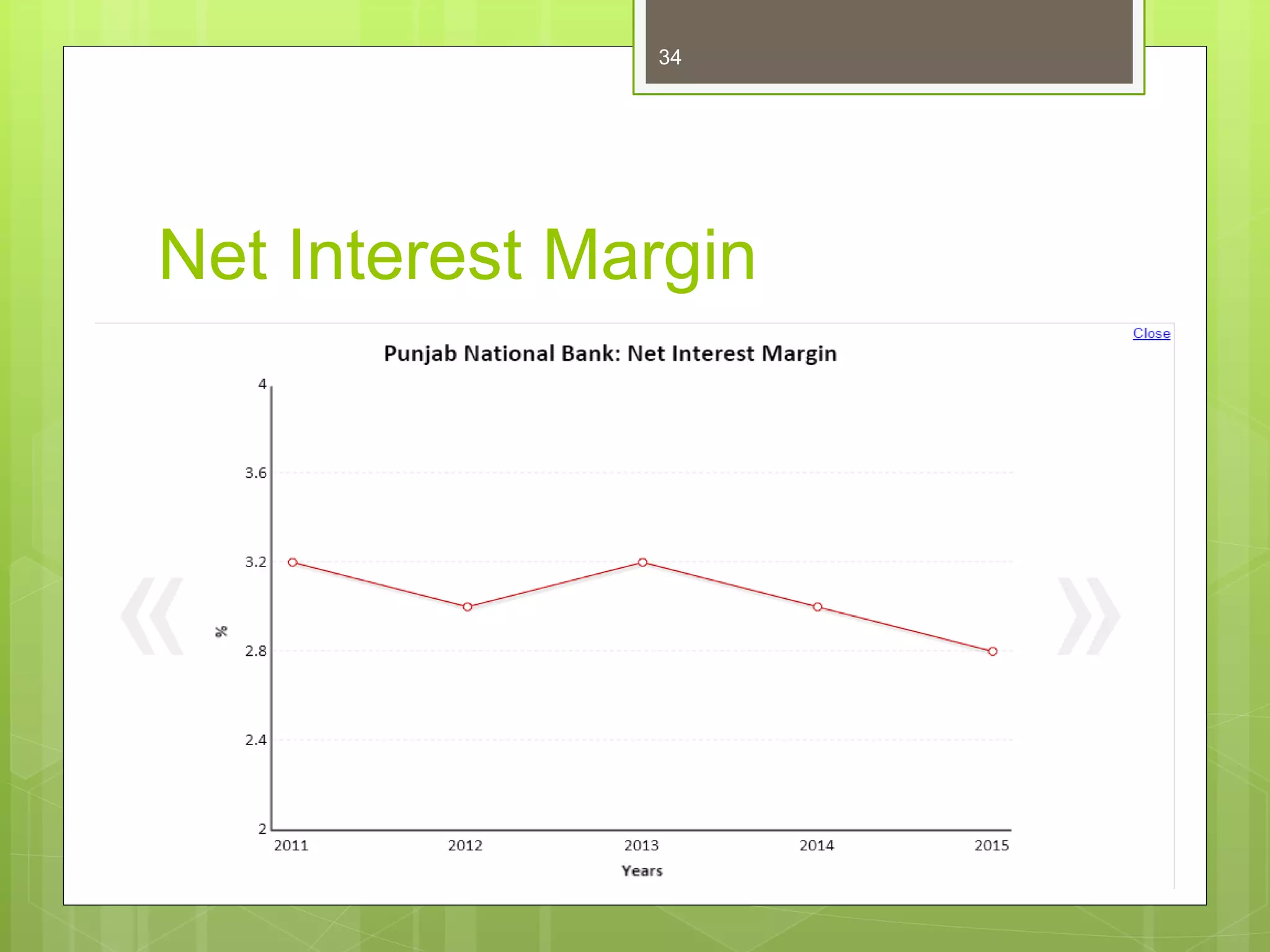

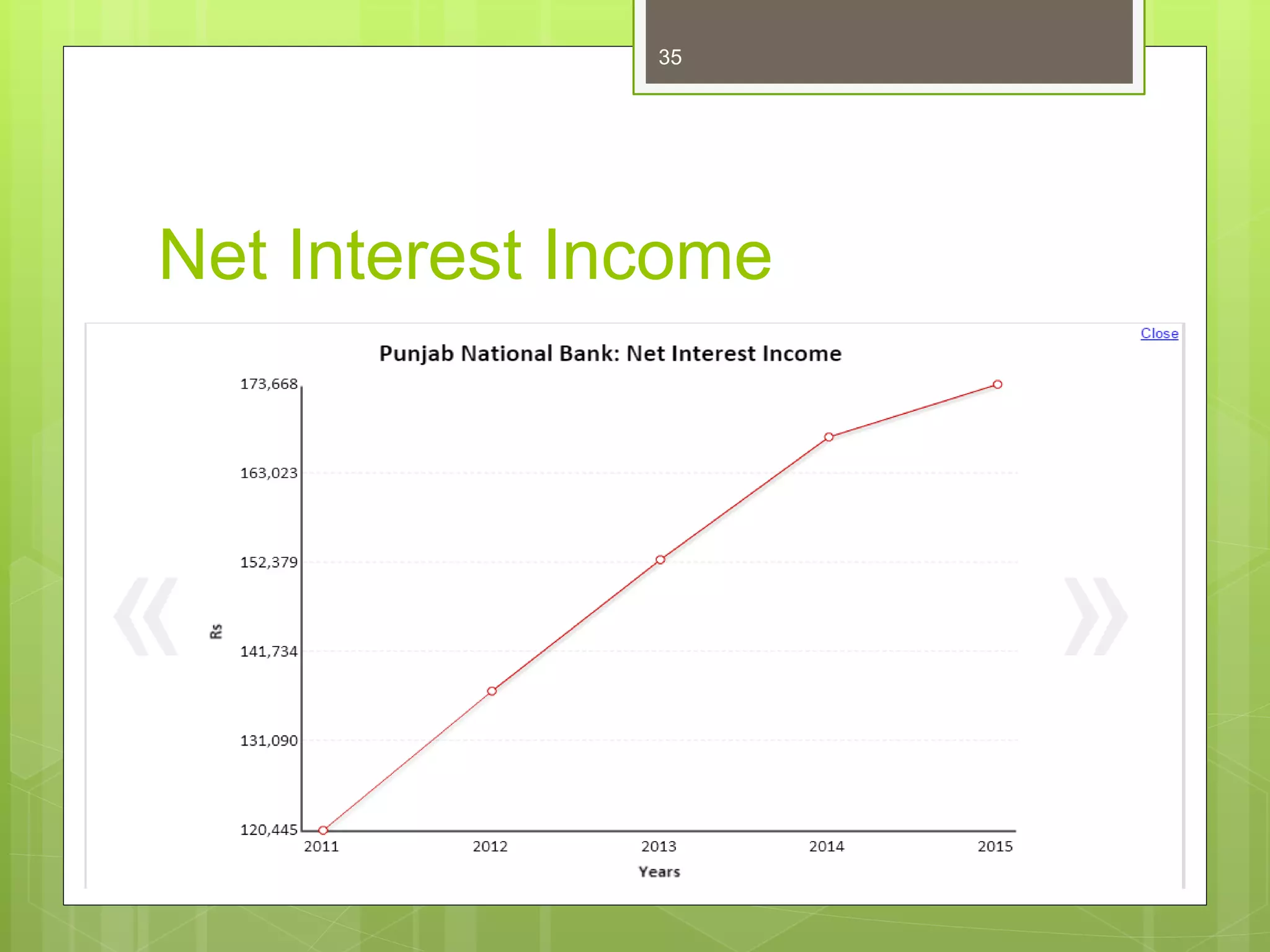

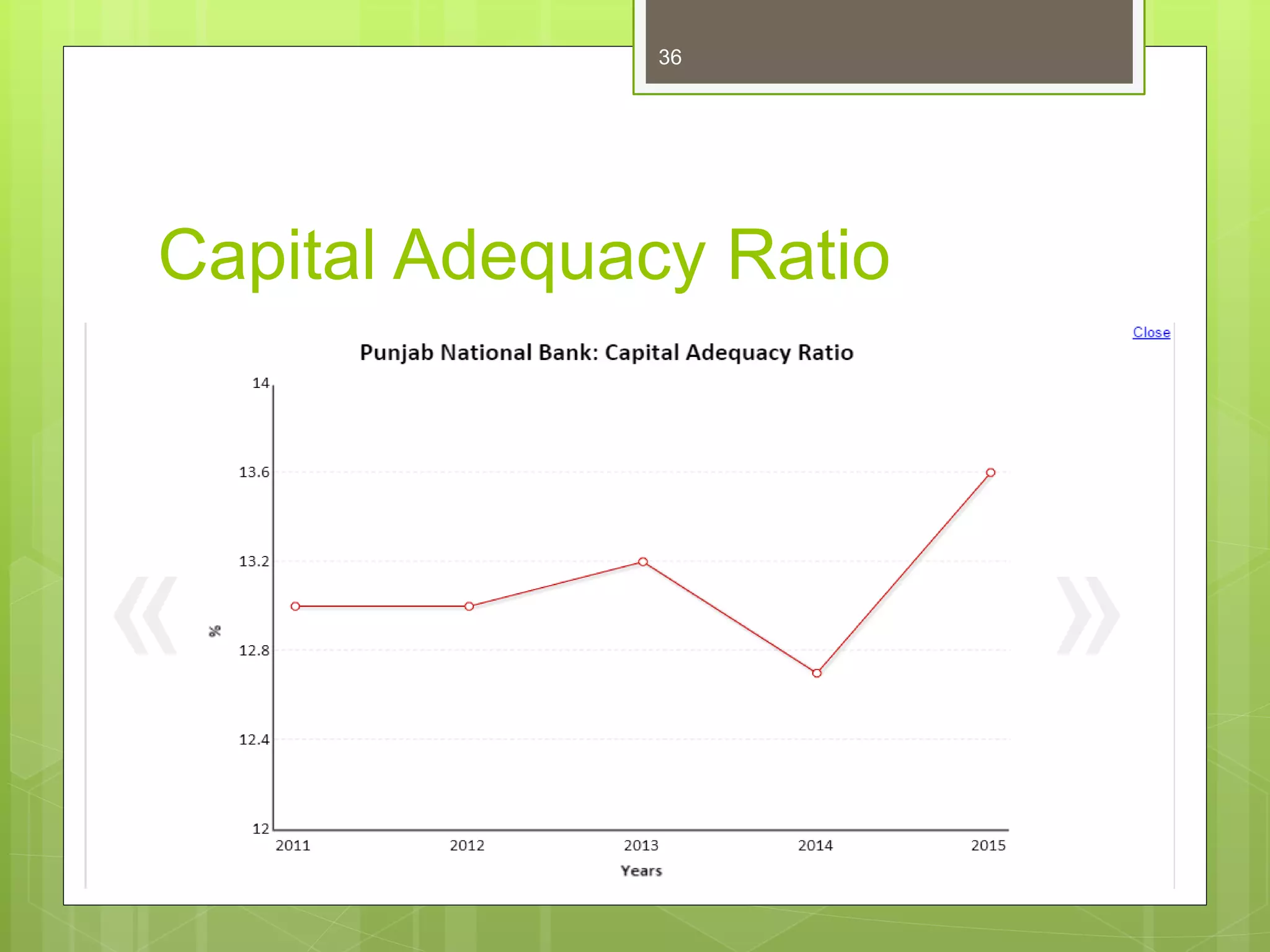

This document presents a fundamental analysis of the banking sector in India. It analyzes key metrics like net interest margin, net interest income, capital adequacy ratio, and non-performing assets for several major public and private sector banks from 2013-2015. The analysis finds that private banks generally had higher net interest margins but higher non-performing assets than public sector banks. It concludes that while the banking sector size is increasing, high interest rates and low investor confidence have led to shrinking growth.