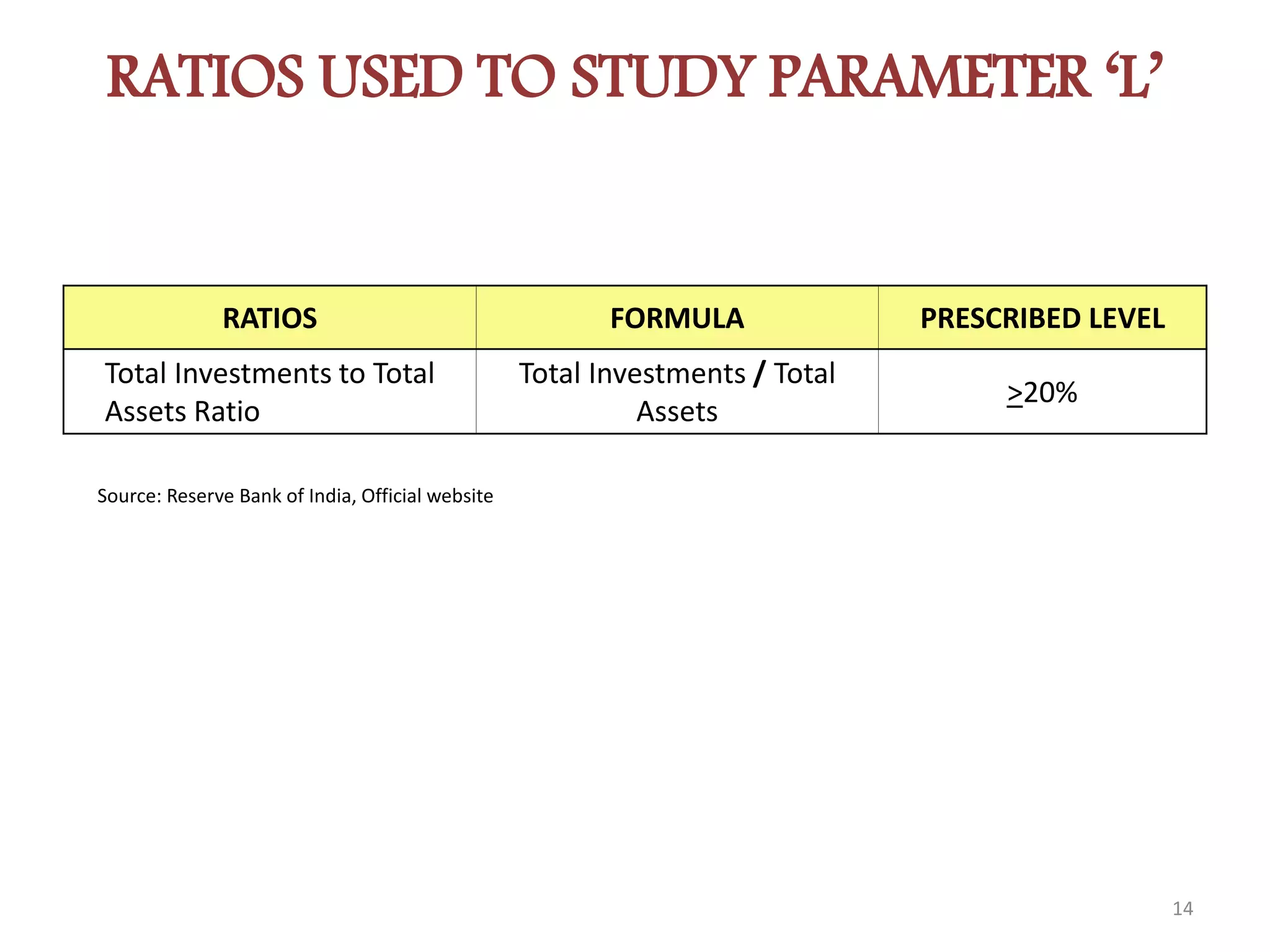

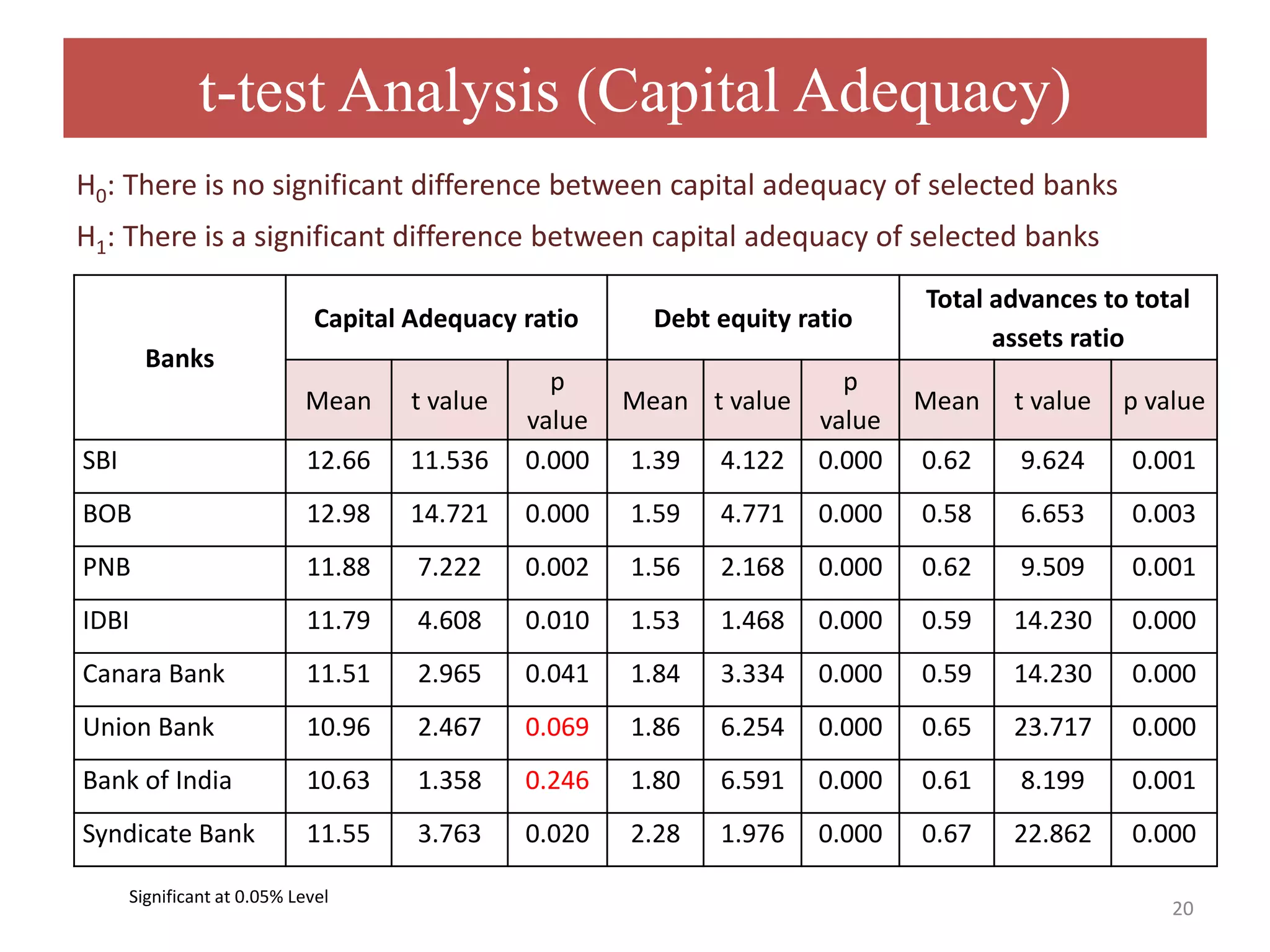

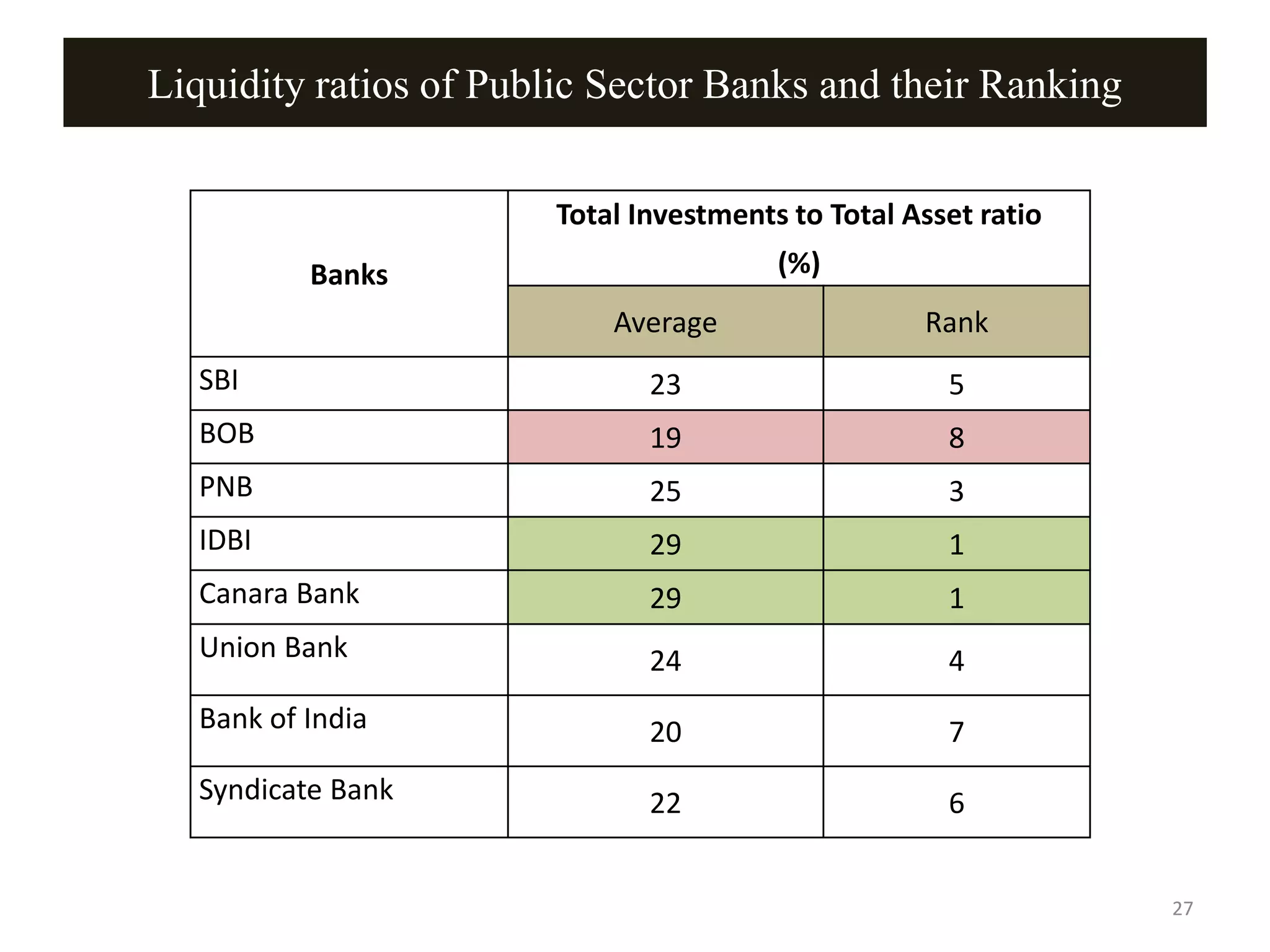

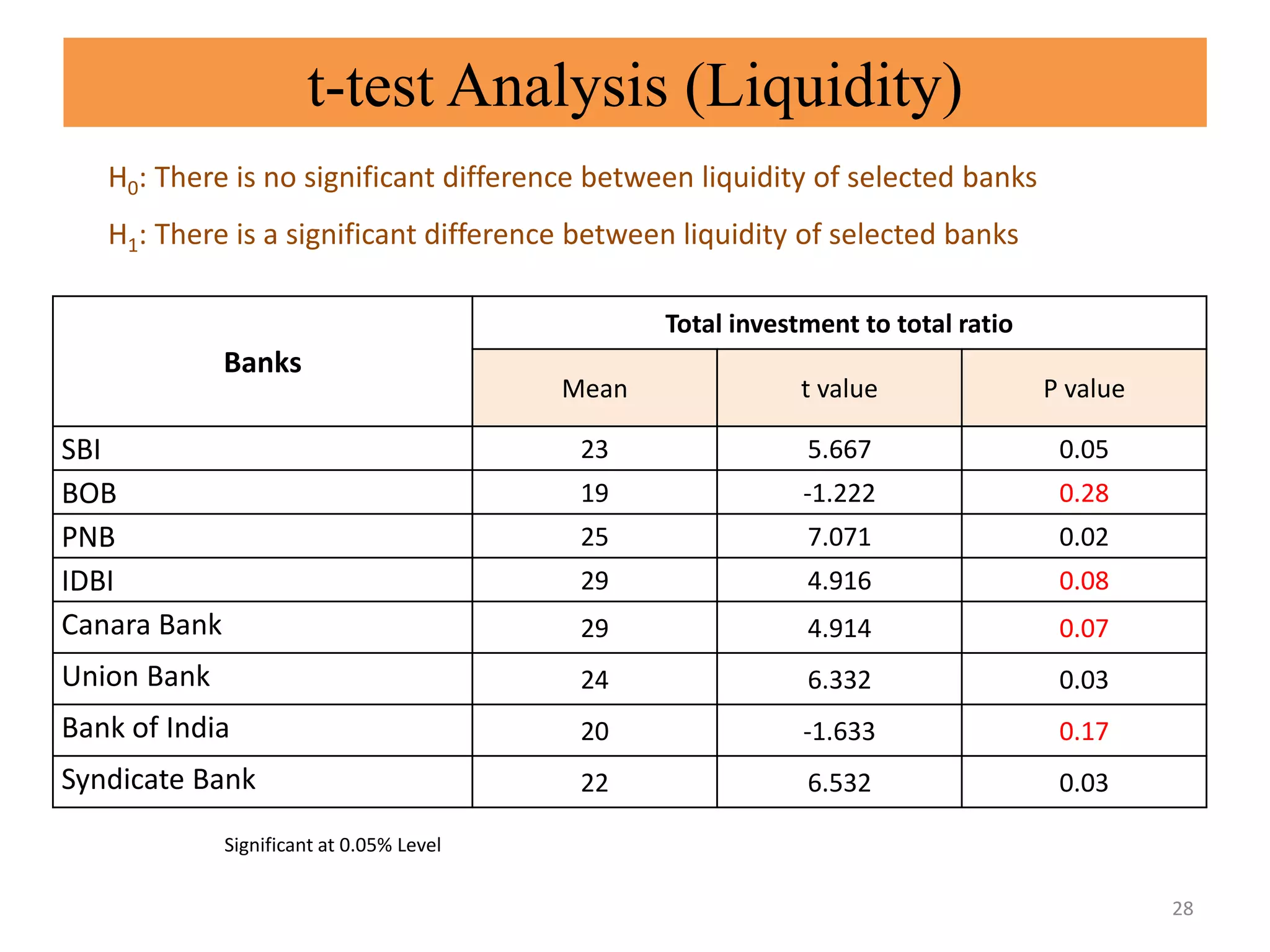

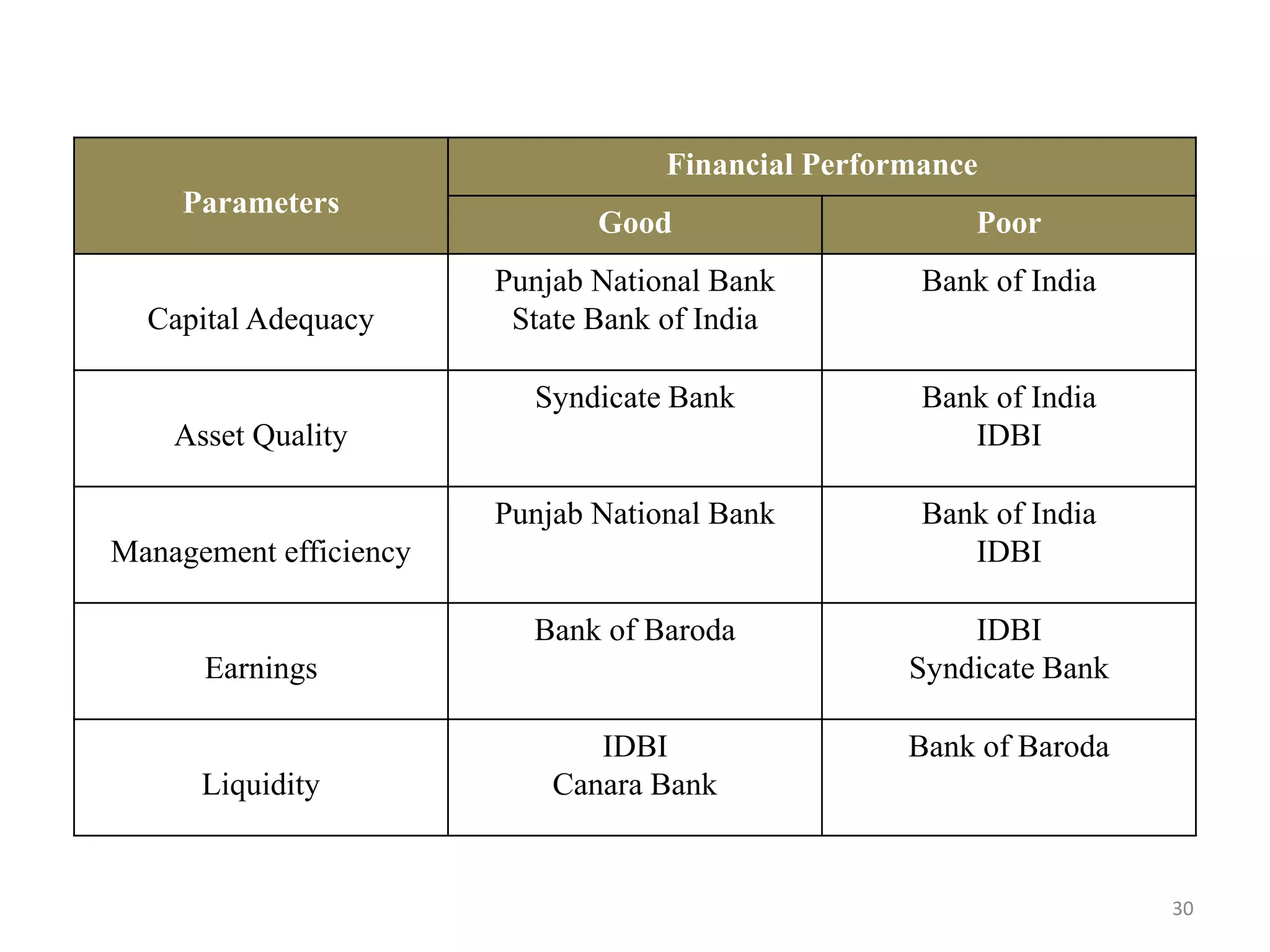

The document analyzes the financial soundness of public sector banks in India using the CAMEL model. It examines 8 public sector banks over 5 years using ratios to evaluate their Capital Adequacy, Asset Quality, Management efficiency, Earnings, and Liquidity (CAMEL). Statistical analysis found significant differences between banks for most CAMEL parameters. Punjab National Bank performed best overall based on its high rankings across CAMEL ratios. IDBI and Bank of India generally performed poorer relative to other banks.