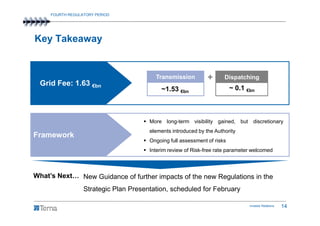

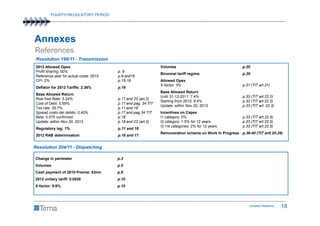

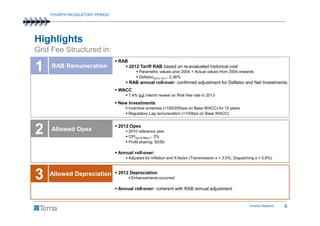

The document summarizes highlights from Terna's fourth regulatory period from 2012-2015. Key points include:

- The regulator defined new rules for transmission, dispatching, and quality of service through several resolutions.

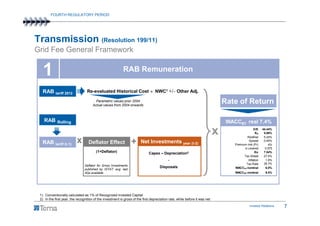

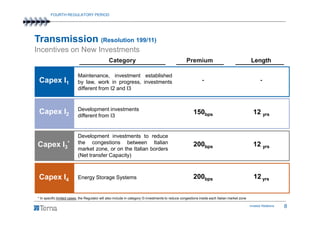

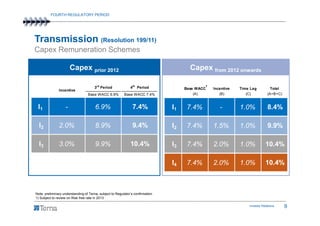

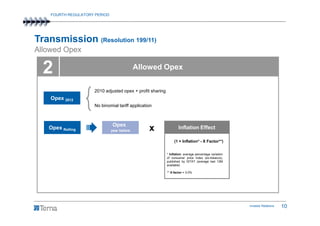

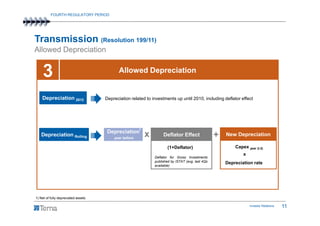

- The allowed grid fee was structured based on remuneration of the RAB, allowed opex, and depreciation. The base WACC was set at 7.4% with incentives for new investments.

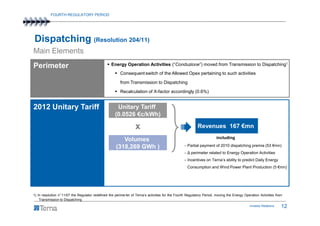

- Dispatching activities and costs were moved from transmission to dispatching. A unitary tariff was set for dispatching.

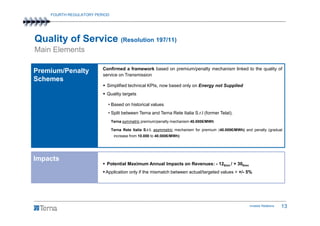

- Quality of service incentives include potential premiums or penalties linked to technical KPIs like energy not supplied.

![FOURTH REGULATORY PERIOD

Highlights

Other Elements of the New Framework

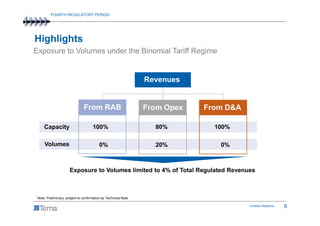

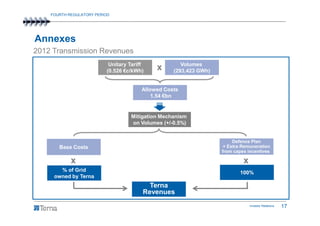

Binomial Tariff In 2012 Unitary tariff applied, based on volumes

From 2013 onwards Switch to binomial tariff regime, based on volumes and available

capacity

Exposure to In 2012 Mitigation mechanism on volumes confirmed

Volumes Exposure only if volumes are in the [- 0.5%; +0.5%] range

If volumes are below -0.5%, compensation covered by the Equalization fund

From 2013 onwards Exposure to Volumes limited only to 20% of the Allowed Opex

Investor Relations 5](https://image.slidesharecdn.com/ternapresentazioneivperiodoregolatoriofinal-120329031930-phpapp02/85/Fourth-Regulatory-Period-Tariffs-for-2012-2015-5-320.jpg)