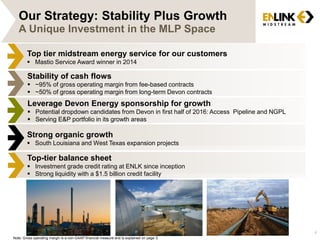

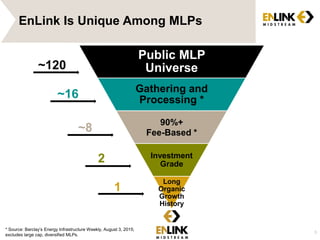

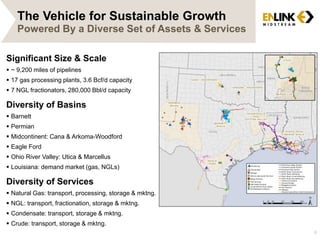

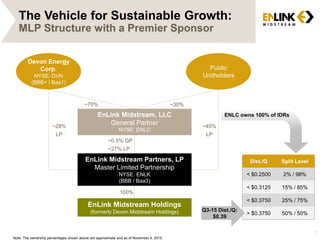

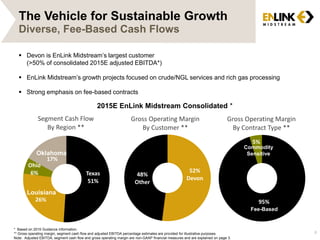

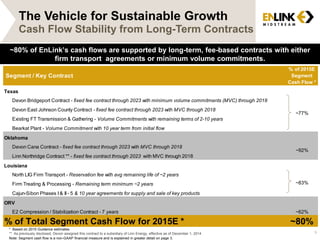

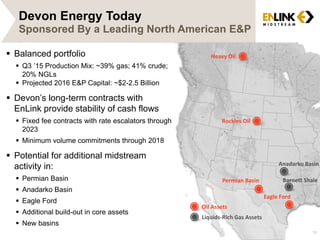

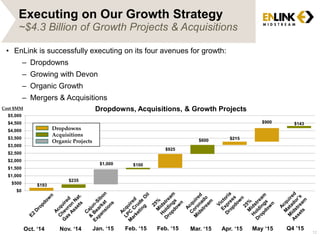

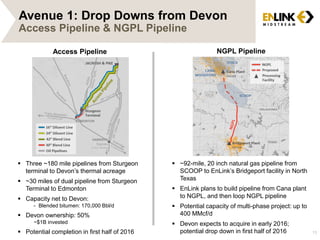

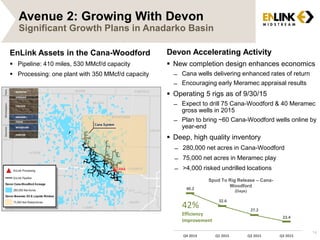

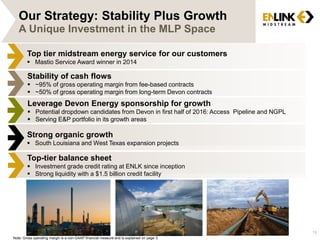

EnLink Midstream provides midstream energy services focused on natural gas gathering, processing, transportation and NGL fractionation. Over 95% of its cash flows are fee-based and supported by long-term contracts, providing revenue stability. Its largest customer is Devon Energy, which accounts for over 50% of adjusted EBITDA. EnLink aims to leverage its relationship with Devon to grow its business through potential future asset dropdowns and expanding services for Devon's growing E&P operations.