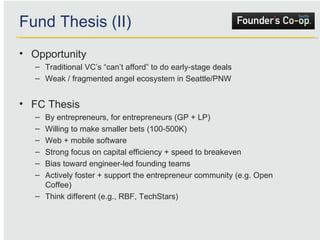

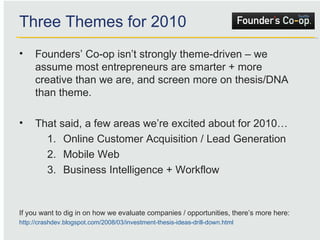

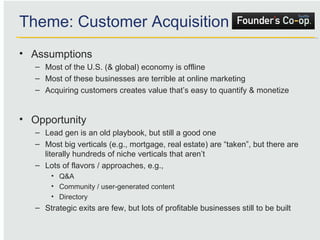

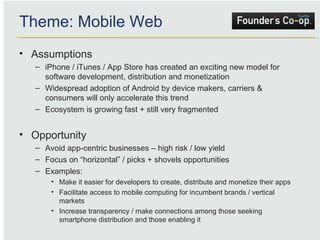

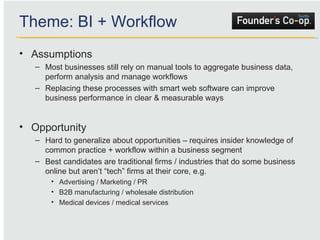

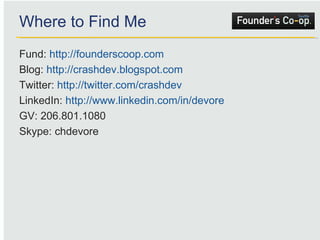

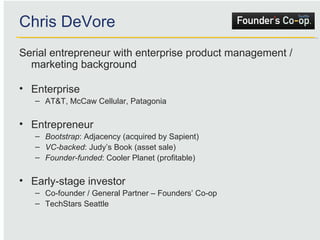

The document outlines insights on Seattle tech startup trends and opportunities for entrepreneurs in 2010, presented by Chris Devore from Founders' Co-op. It discusses the limited availability of funds for early-stage ventures, highlights three main themes for investment - customer acquisition, mobile web, and business intelligence/workflow - and emphasizes the importance of capital efficiency and community support. Founders' Co-op aims to back innovative entrepreneurs with smaller investments and a strong focus on engineer-led teams.

![Seattle Tech Startups Trends + opportunities for tech entrepreneurs in 2010 January 13, 2010 Chris DeVore General Partner, Founders’ Co-op [email_address]](https://image.slidesharecdn.com/fcseattletechstartups2010-100114134721-phpapp01/75/Founders-Co-op-Seattle-Tech-Startups-2010-1-2048.jpg)

![Fund Thesis (I) “ [T]here is plenty of investment capital available for Consumer Internet companies that have demonstrated significant market traction in terms of traffic or revenues, but there’s almost none available for what, up until recently, would be considered the sweet spot of true VCs: Seed or Series A startups." Bill Burnham, The Great Abdication: Consumer Internet, Venture Capital, and Angels "So what do I think is wrong with funds today? Many of them are too big. They need to make big investments to justify fund size and the associated management fees. But companies can create a lot with much less in the way of resources compared to a few years ago. They don’t need as much money. But they take it anyway…” Mike Arrington, On Venture Capital “ Hard” web startup costs zero + VC fund sizes $Billions = Terminal misalignment of goals/incentives](https://image.slidesharecdn.com/fcseattletechstartups2010-100114134721-phpapp01/85/Founders-Co-op-Seattle-Tech-Startups-2010-5-320.jpg)