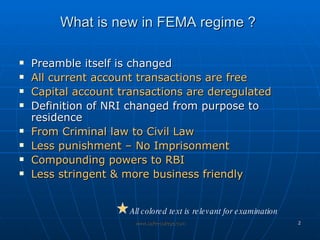

- All current account transactions are now free and capital account transactions have been deregulated under the new FEMA regime. The definition of NRI has changed from purpose to residence. Punishment for violations is now civil instead of criminal with no imprisonment. RBI has been given powers for compounding violations.

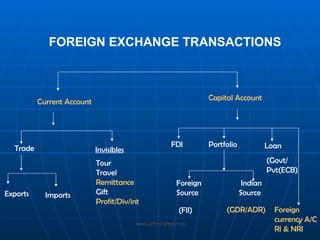

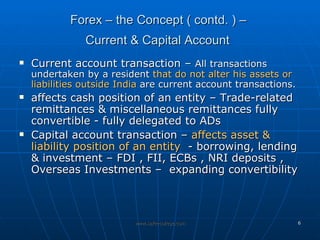

- Current account transactions do not affect the assets/liabilities of an entity while capital account transactions do through activities like borrowing, lending, investment etc. RBI regulates India's foreign exchange market with transactions involving exports, imports and other forex activities.

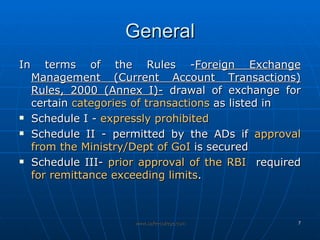

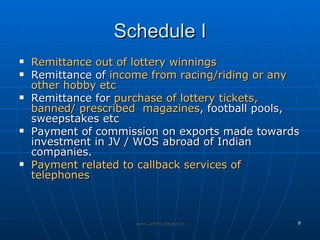

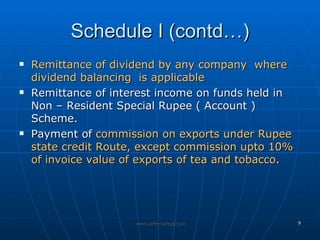

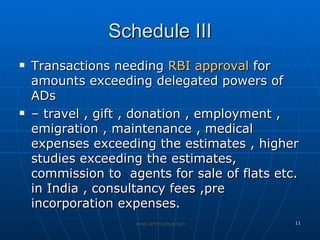

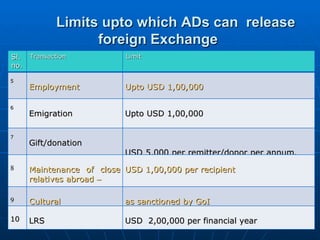

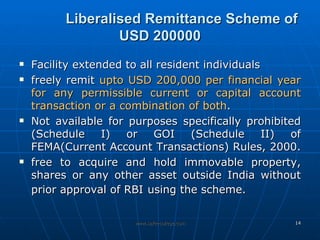

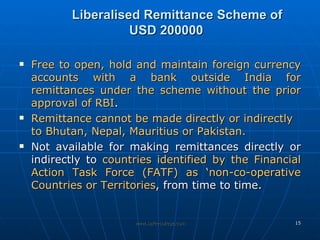

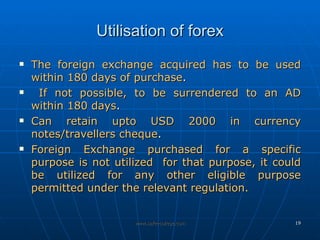

- Schedules I-III specify transactions that are prohibited, permitted with government approval, and requiring RBI approval respectively if exchange limits are exceeded. Liberalized remitt