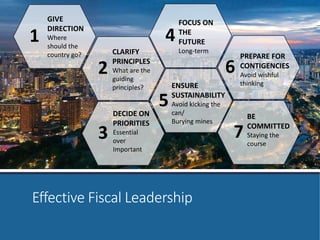

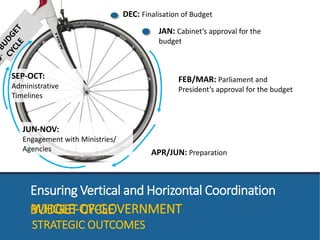

1) The document discusses effective budget management strategies used by the Singapore government, including focusing on long-term priorities, ensuring fiscal sustainability, and preparing for contingencies.

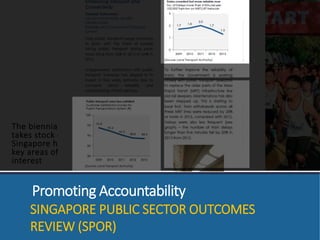

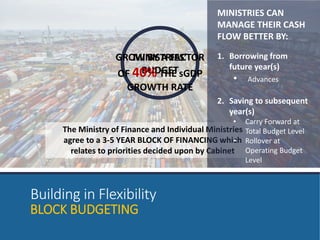

2) Key aspects of Singapore's budgeting approach are establishing medium-term block budgets for ministries, conducting regular reviews of outcomes, and reinvesting a portion of budgets to promote innovation.

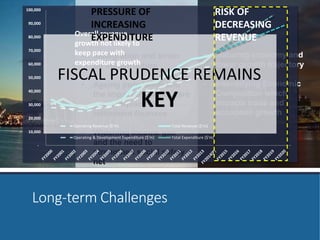

3) Singapore takes a long-term view in its fiscal planning and investment in areas like education, healthcare, and infrastructure to support continued economic growth amid future challenges around immigration, aging population, and competition.