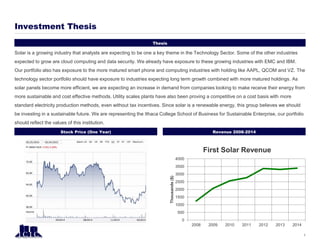

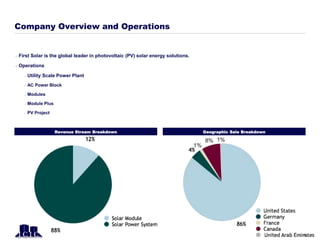

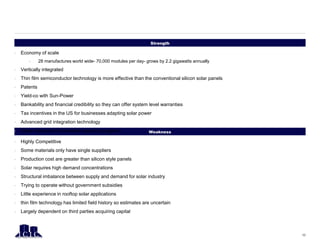

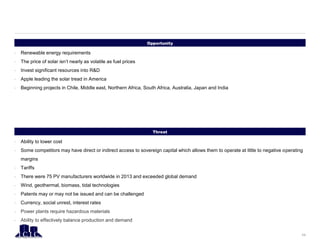

First Solar is a growing company in the solar industry that analysts expect to benefit from increasing demand for renewable energy. The company has established itself as a global leader in photovoltaic solar solutions through its vertically integrated operations and thin film technology. While competition and reliance on subsidies present risks, opportunities exist for First Solar in expanding renewable energy requirements, investing in lowering costs, and developing new markets internationally through projects in regions like India. Analysts have generally favorable recommendations on First Solar given its leadership position and prospects for long term growth in the solar industry.