This document provides an overview of health savings accounts (HSAs), including:

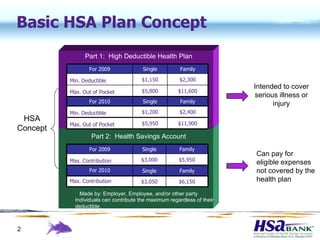

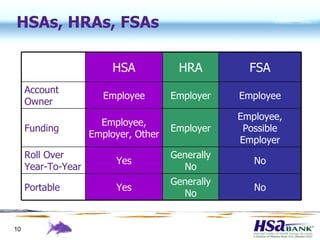

- HSAs are used in conjunction with high deductible health plans and can be funded by employers, employees, and others.

- Contributions up to an annual maximum amount are tax-deductible and the account grows tax-free.

- Funds can be withdrawn tax-free for qualified medical expenses or after age 65 for any purpose.

- HSAs offer portability, tax benefits, and the potential for long-term savings if unused funds are invested.