Embed presentation

Download to read offline

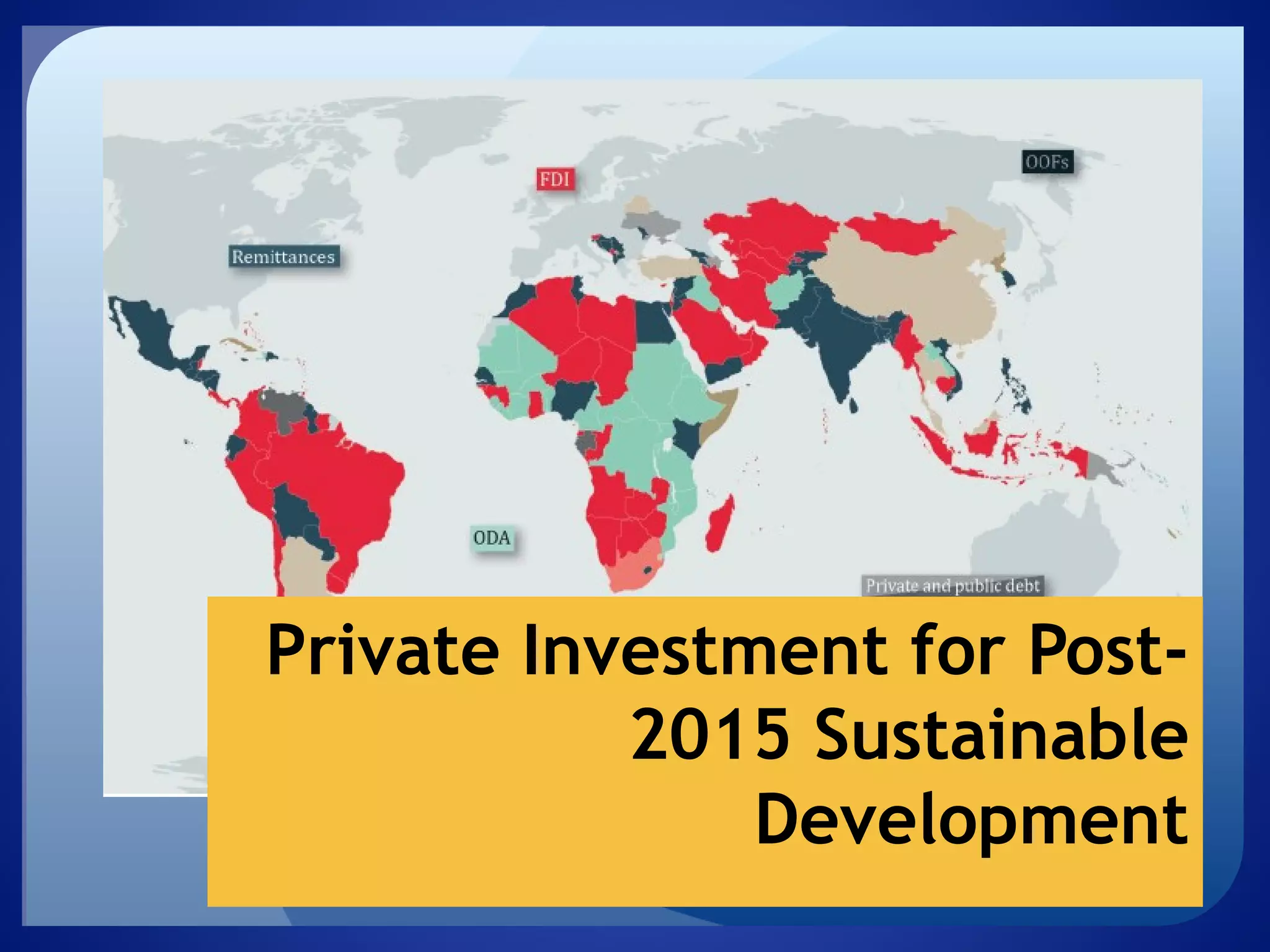

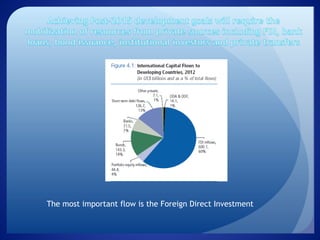

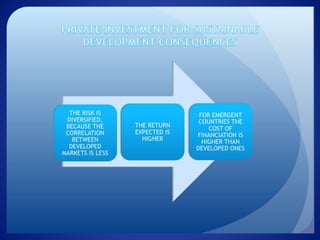

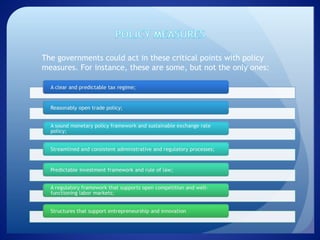

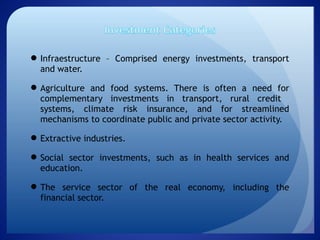

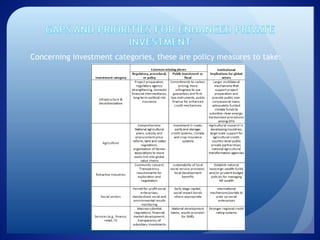

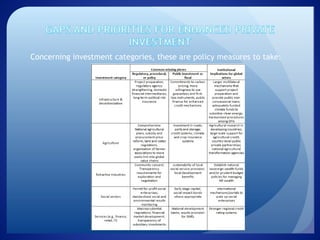

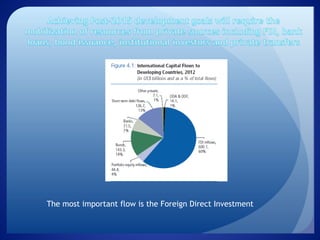

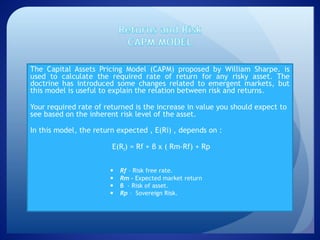

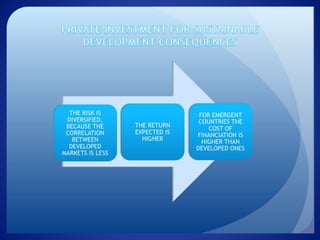

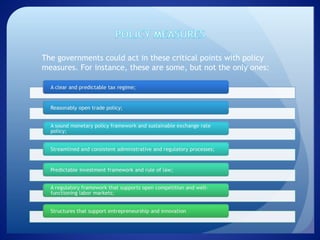

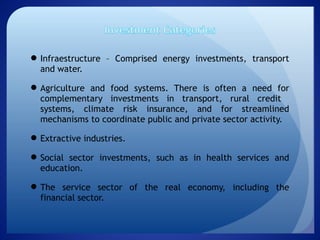

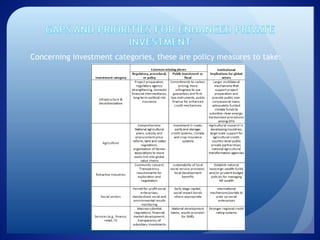

The document discusses how governments can encourage private investment for sustainable development through policy measures. It identifies key areas for investment such as infrastructure, agriculture, extractive industries, and social sectors. The governments' role is to reduce sovereign risk and implement policies that make investments in these areas attractive to private investors through measures related to areas like energy, transport, water systems, rural credit, climate insurance, and coordination between public and private sectors. References are provided on mobilizing private investment and transforming development finance.