1. India has ambitious climate targets including 40% renewable energy by 2030 and 100GW of solar power by 2022.

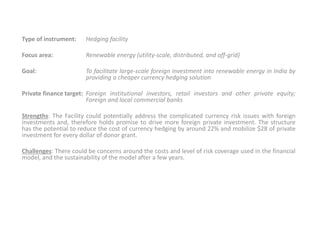

2. A key challenge is the shortage of available financing for renewable energy projects in India.

3. Public-private collaboration will be essential to raising the large amounts of financing needed to meet India's renewable energy targets and support cleaner economic growth.