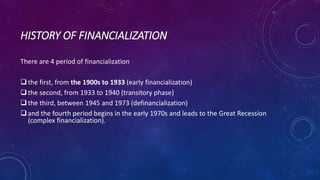

Financialization describes an economic process in which exchange is facilitated through financial instruments rather than real goods and services. It has led to greater revenues and incomes in the financial sector compared to other sectors. There are four periods of financialization dating back to the early 1900s, with the current period beginning in the 1970s and contributing to the Great Recession. Financialization affects macroeconomics and microeconomics by changing financial market structures and influencing corporate behavior and economic policy. It can help build economies by facilitating investment and growth, but it also increases wealth inequality and can divert focus from real industry.