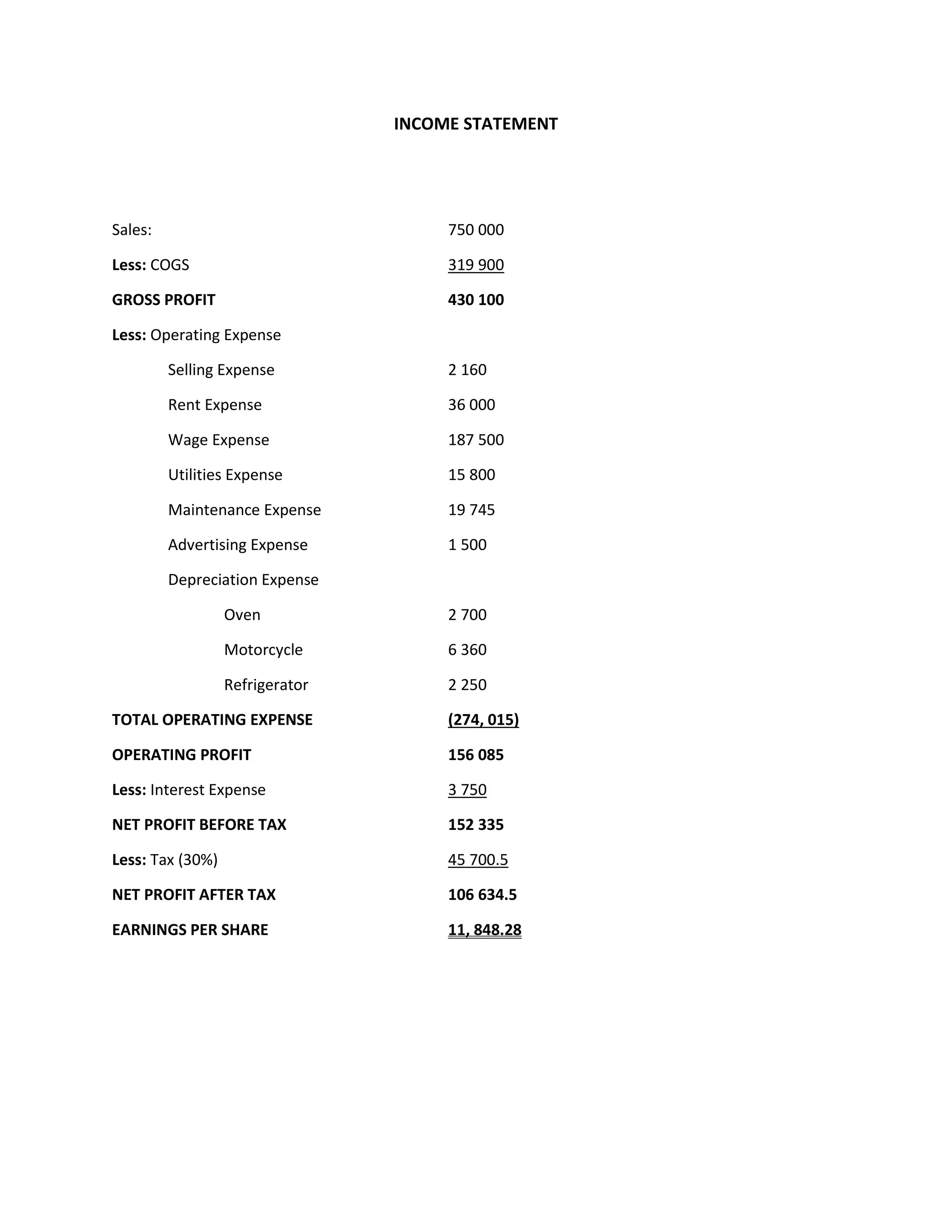

The company had sales of $750,000 and cost of goods sold of $319,900, resulting in a gross profit of $430,100. Total operating expenses were $274,015, giving an operating profit of $156,085. After accounting for interest and tax expenses, the net profit was $106,634.50. Cash flow was positive, with $270,804.50 from operating activities and $250,000 from financing activities, increasing cash by $435,804.50 over the year. Total assets were $698,279.50, including current assets of $624,589.50 and fixed assets of $73,690, financed by total liabilities of $437,210.