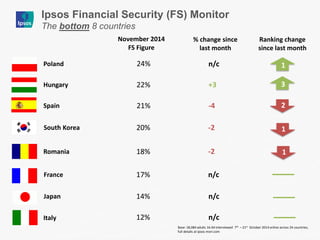

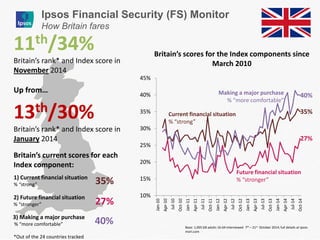

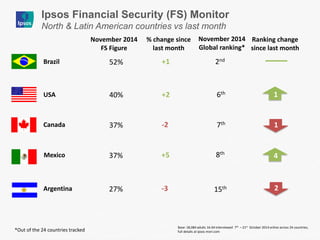

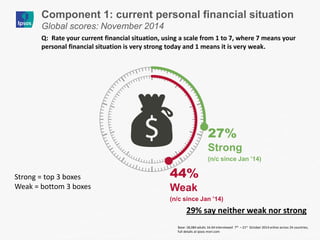

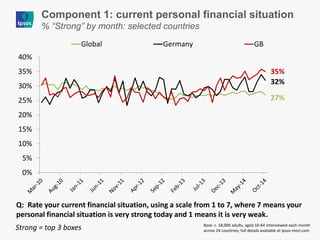

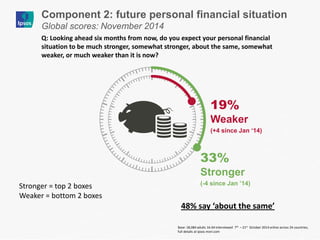

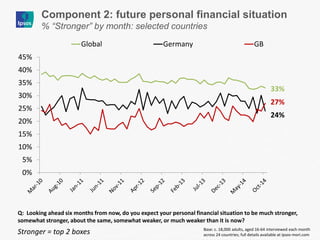

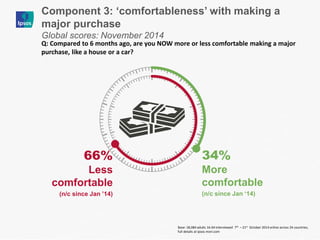

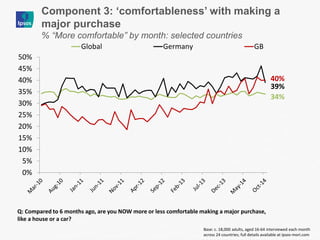

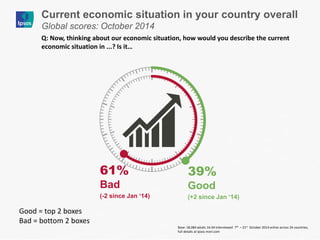

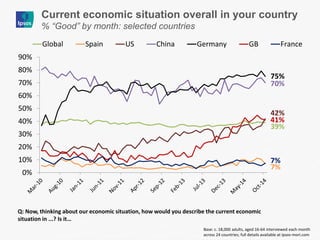

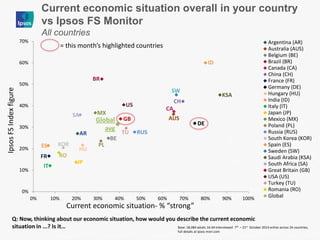

The Ipsos Financial Security Monitor surveys citizens in 24 countries monthly about their financial situation, focusing on current perceptions, comfort with major purchases, and expectations for future financial security. The survey results indicate that European countries generally report lower financial security, with Germany experiencing a notable decline. Britain shows a steady improvement in financial sentiment, moving up in rankings among European countries.