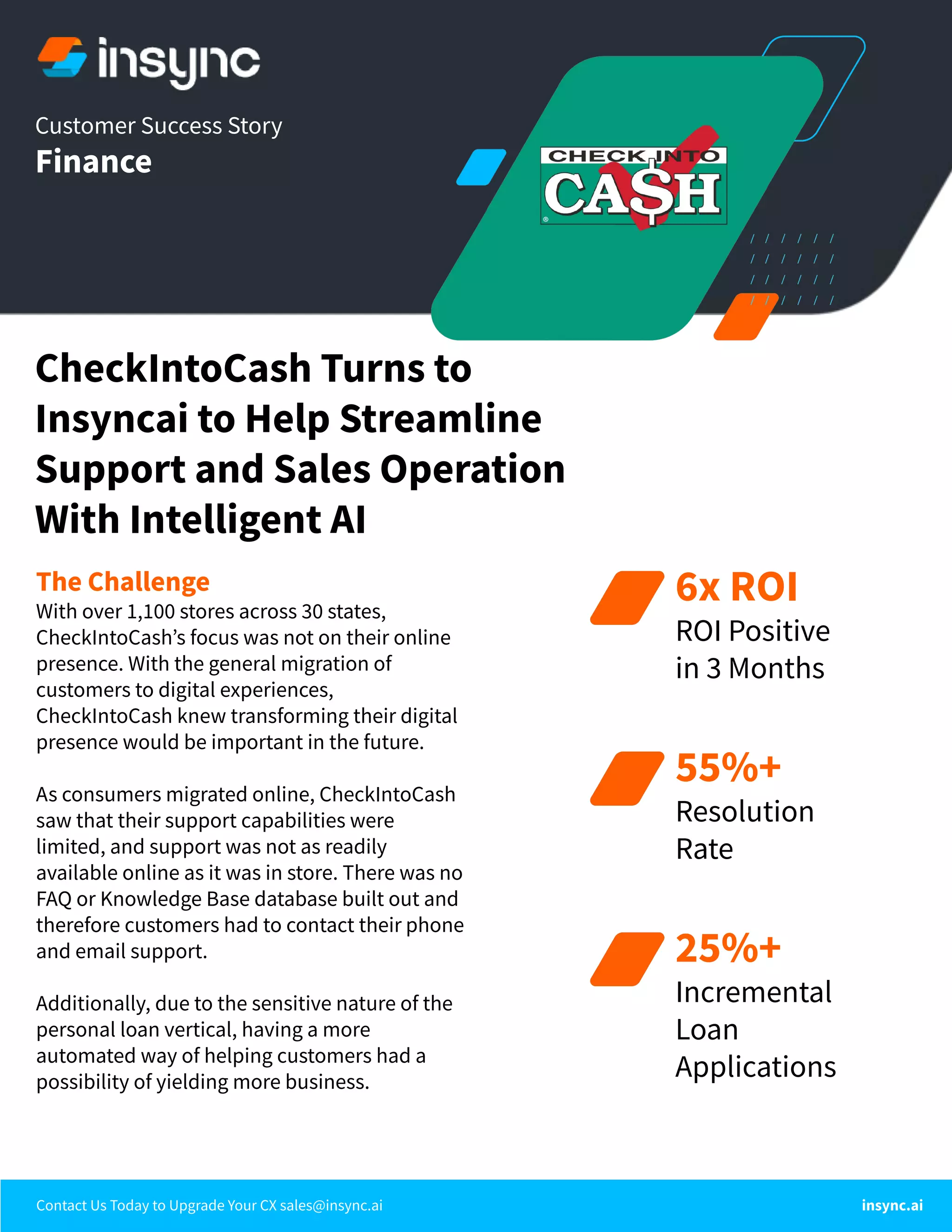

CheckIntoCash partnered with insync.ai to enhance their digital presence and customer support, leading to significant improvements in operational efficiency. The integration resolved over 55% of customer inquiries without human assistance and resulted in a 25% increase in loan applications within just three months. The customized solution allowed CheckIntoCash to automate key customer journey aspects while ensuring a seamless onboarding experience.