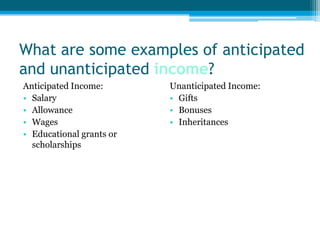

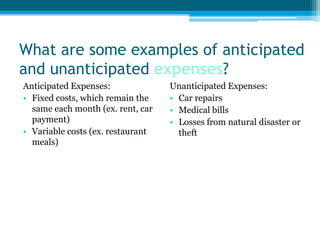

This document discusses key concepts in personal financial planning including short and long term goals, anticipated and unanticipated income and expenses, calculating net worth, creating personal budgets, and how government and economic factors can influence financial planning. Short term goals are for needs above the regular budget like emergencies while long term goals require extensive saving like buying a home. Net worth is calculated by subtracting total liabilities from total assets to understand one's financial position. Government policies on taxes and economic conditions like inflation and unemployment can impact personal financial planning.