This document provides a workbook for students preparing for financial management examinations. It includes brief summaries of chapters from the textbook, questions and answers on basic concepts, frequently used formulas, practice problems and solutions, and model question papers. The goal is to help students effectively study and review important topics in financial management, such as time value of money, risk and return, security valuation, financial statement analysis, and capital budgeting. Students are advised to thoroughly study the textbook and use this workbook to test and reinforce their understanding.

![Financial Management

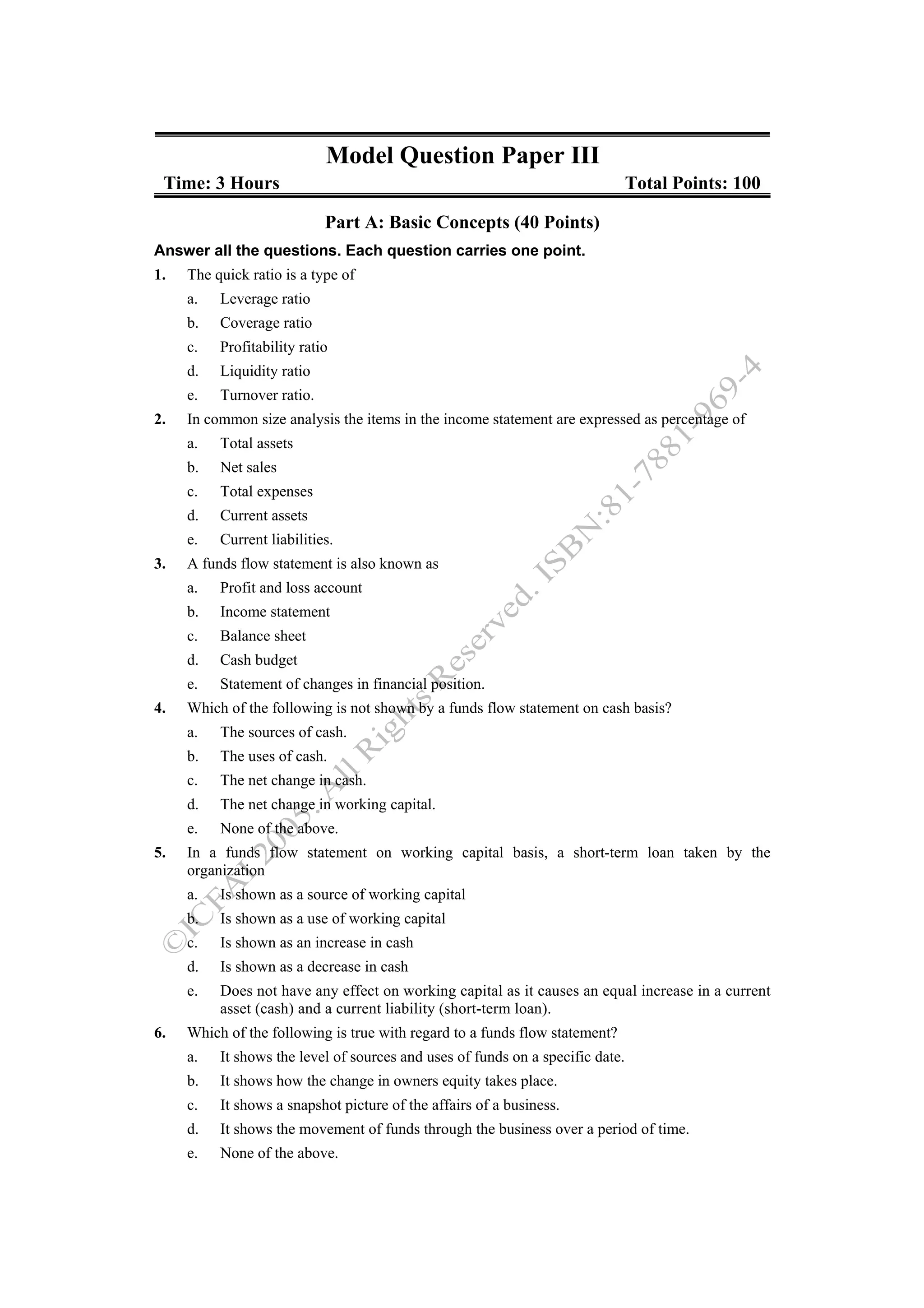

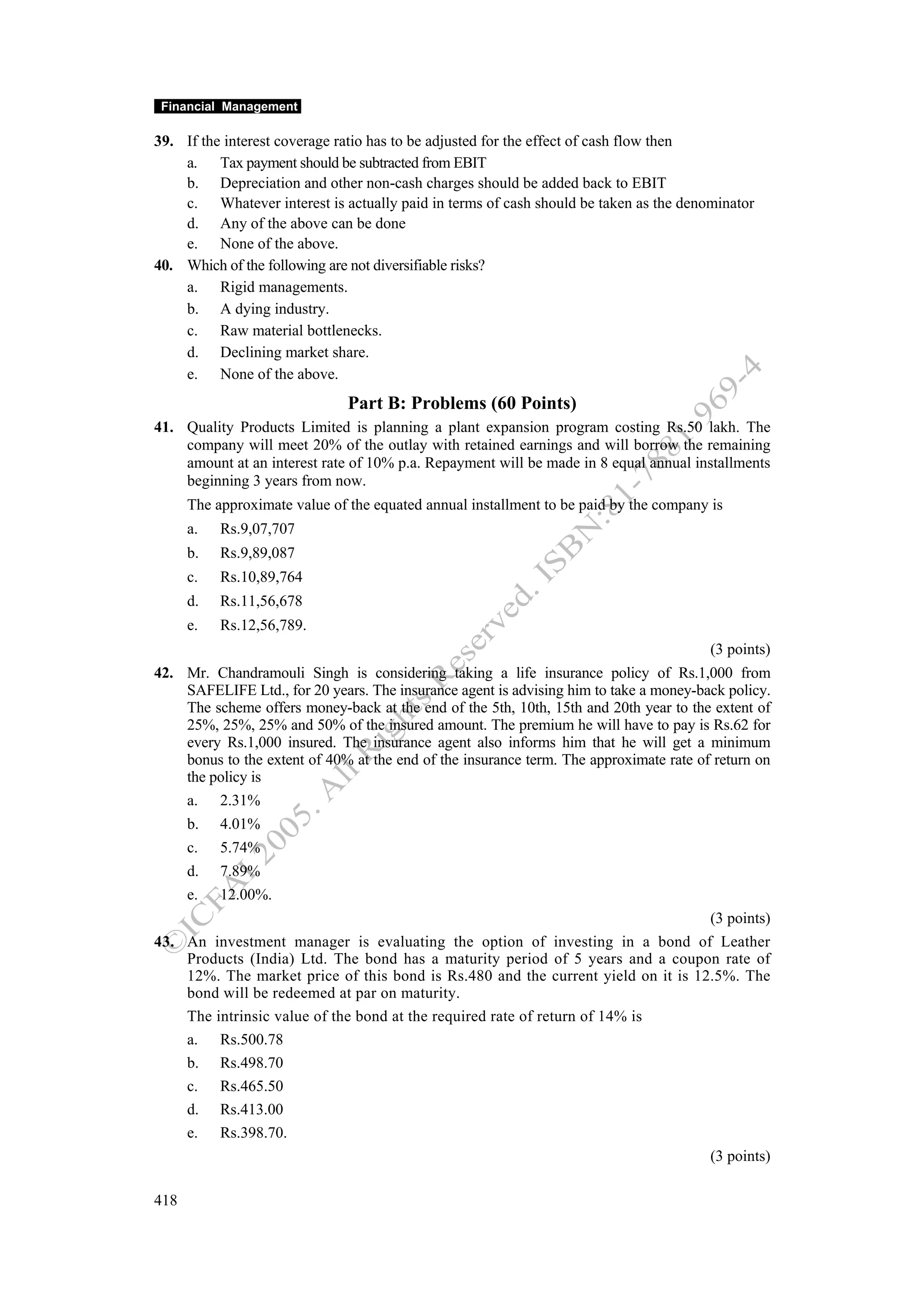

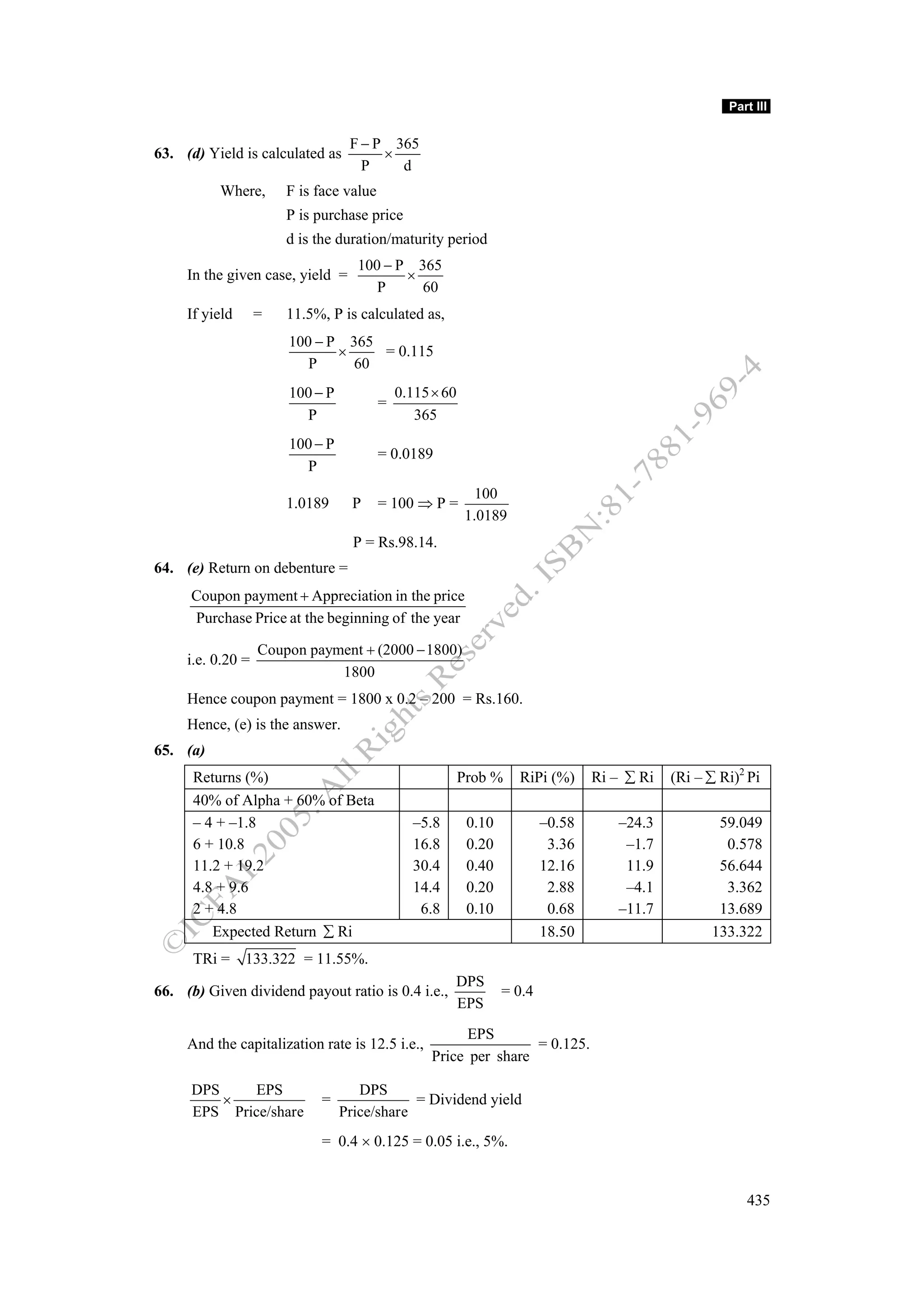

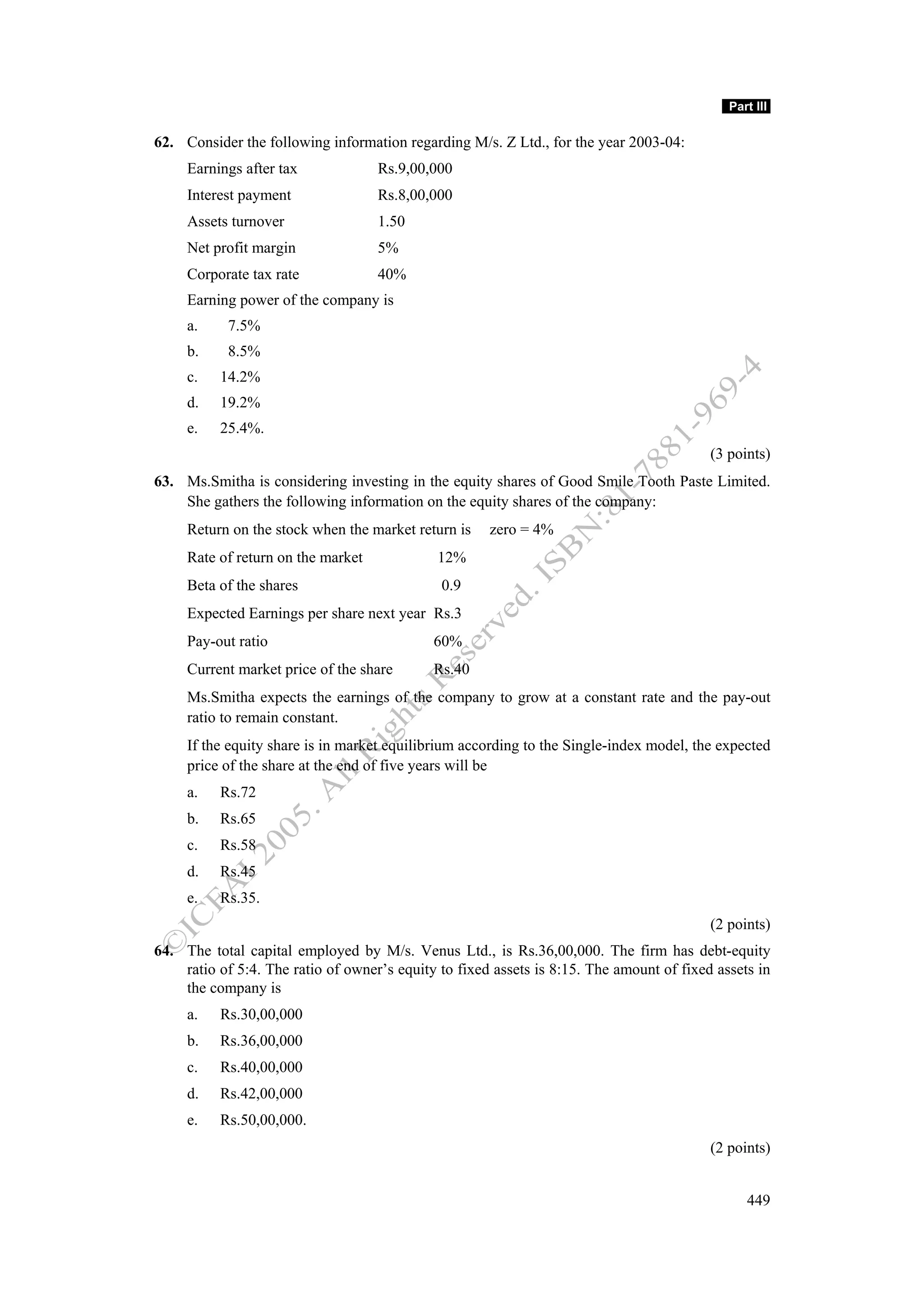

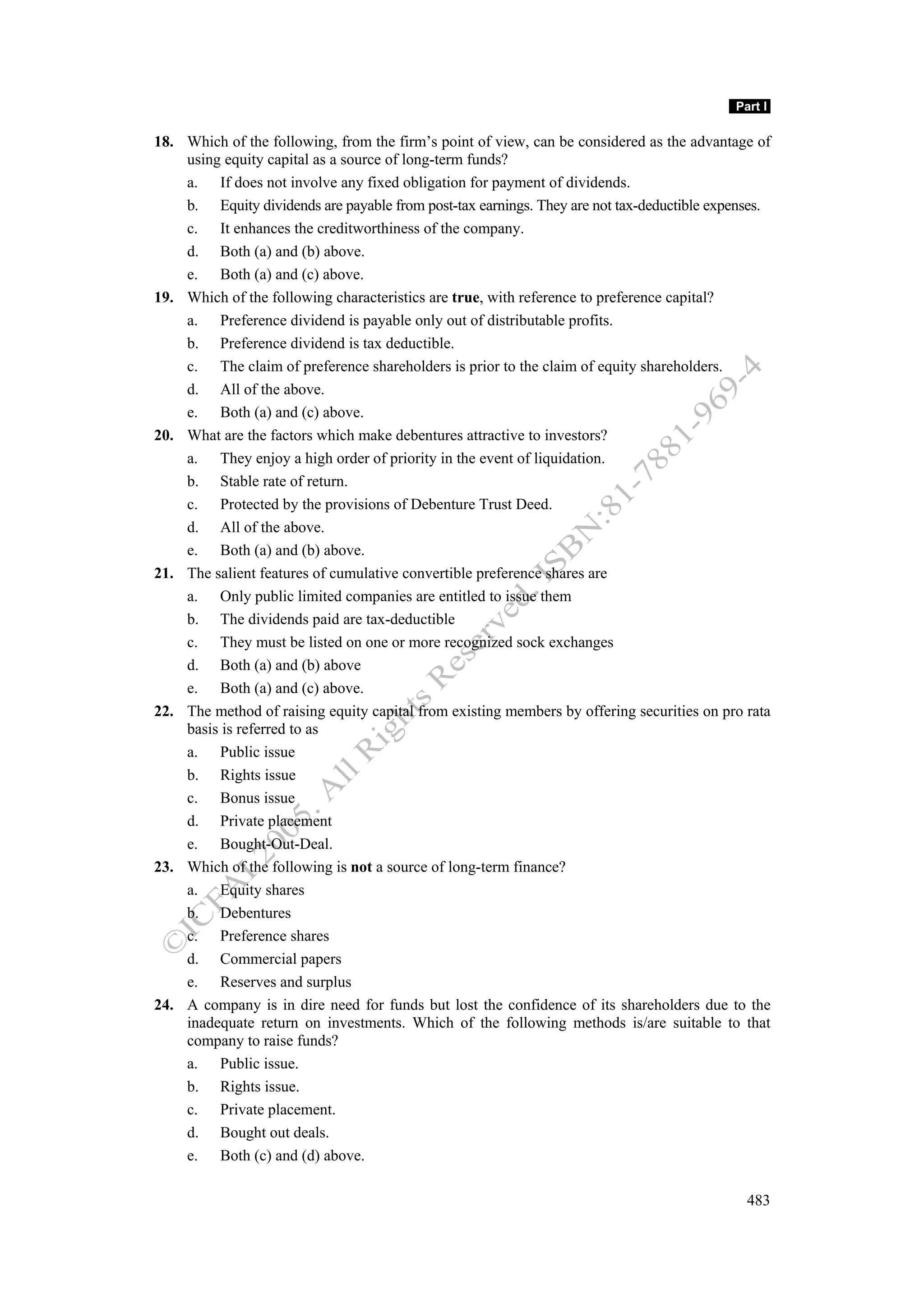

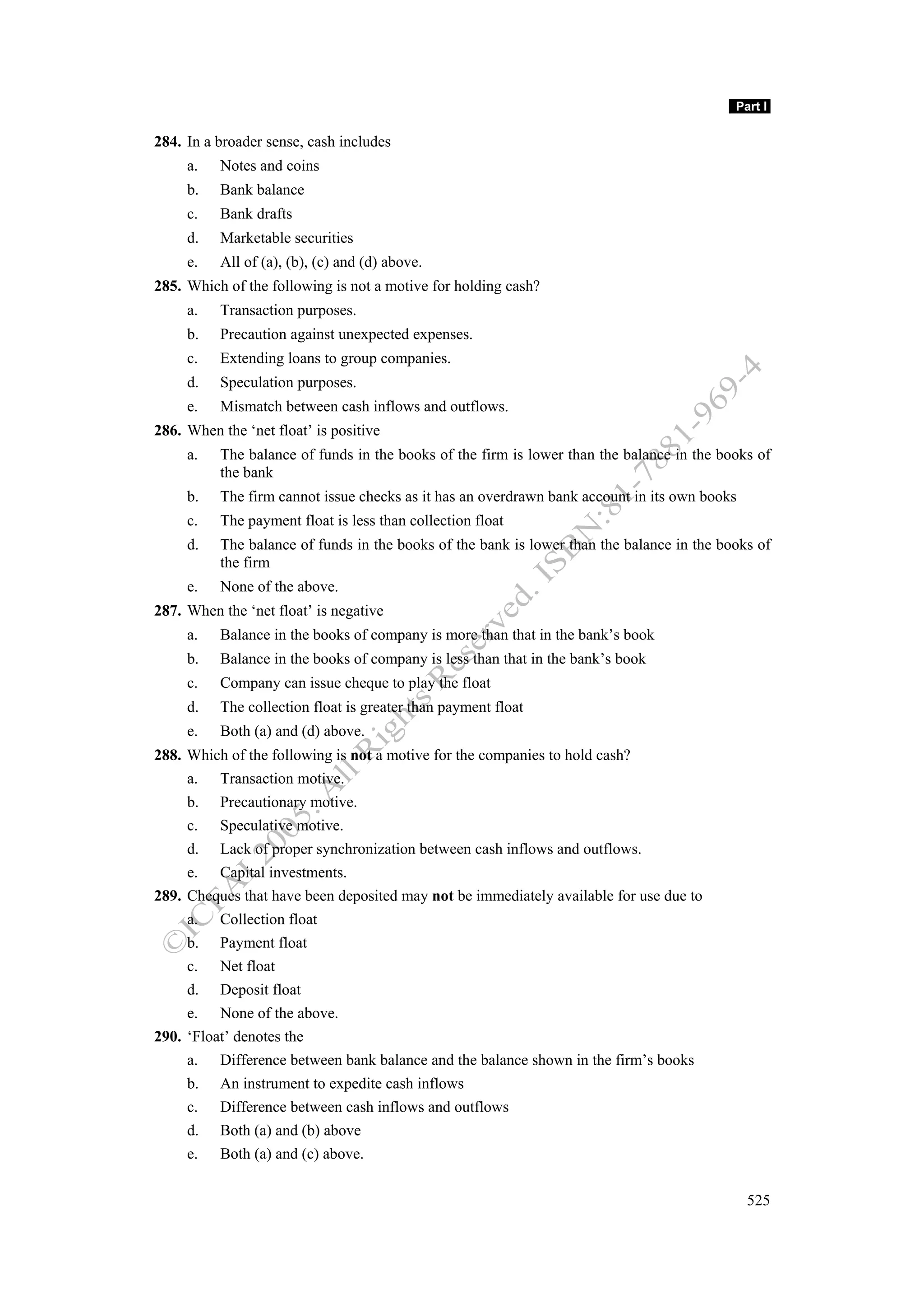

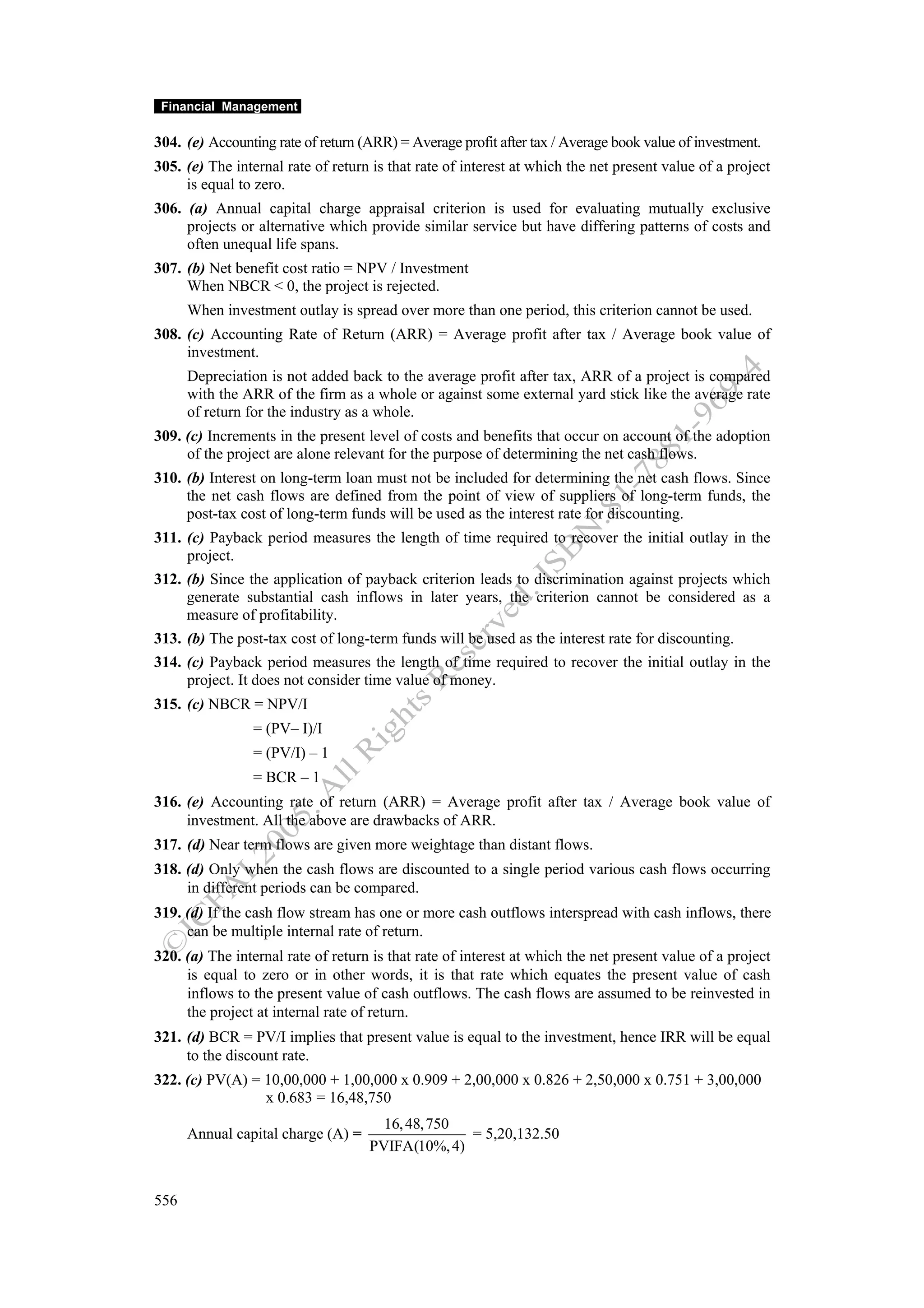

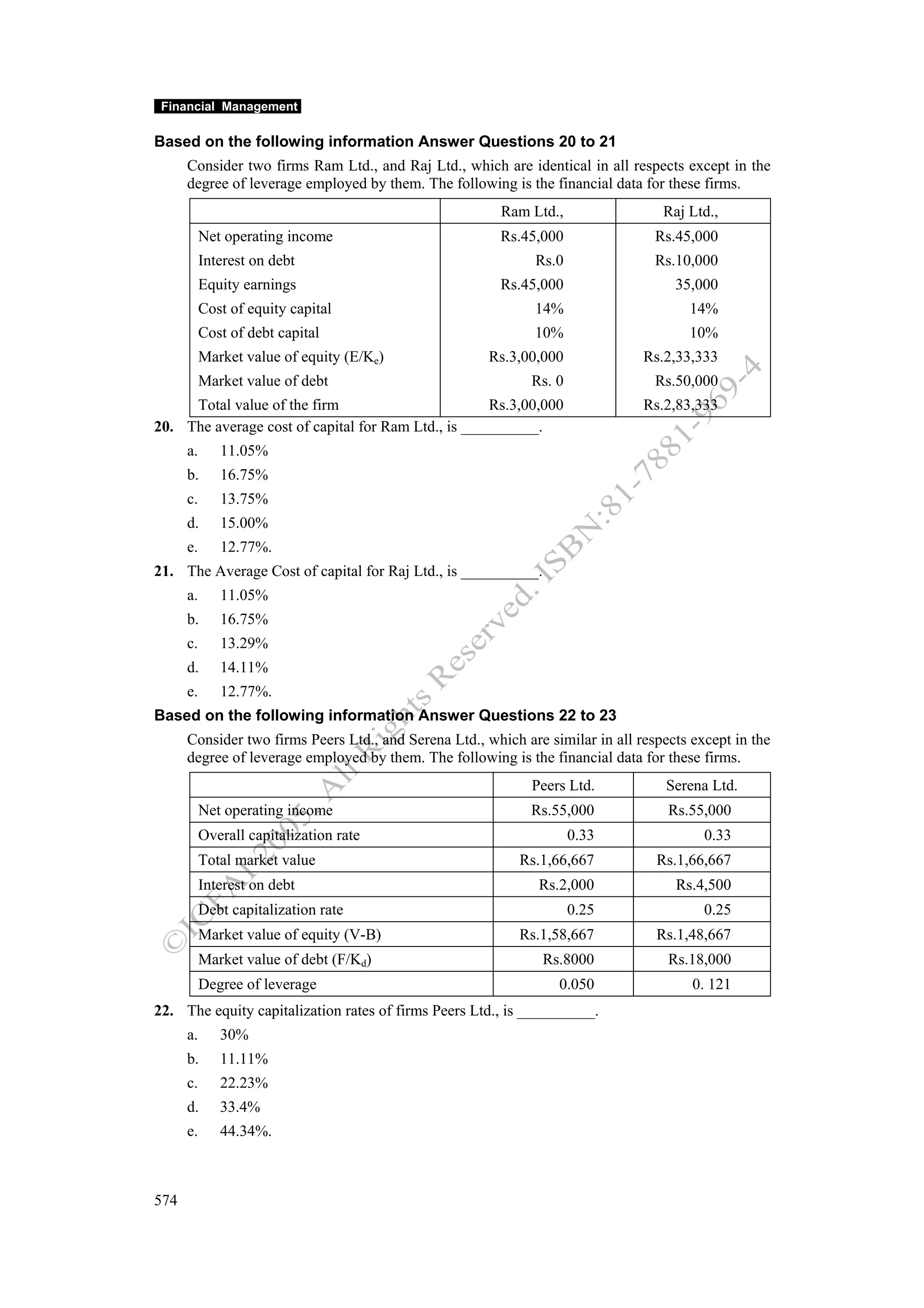

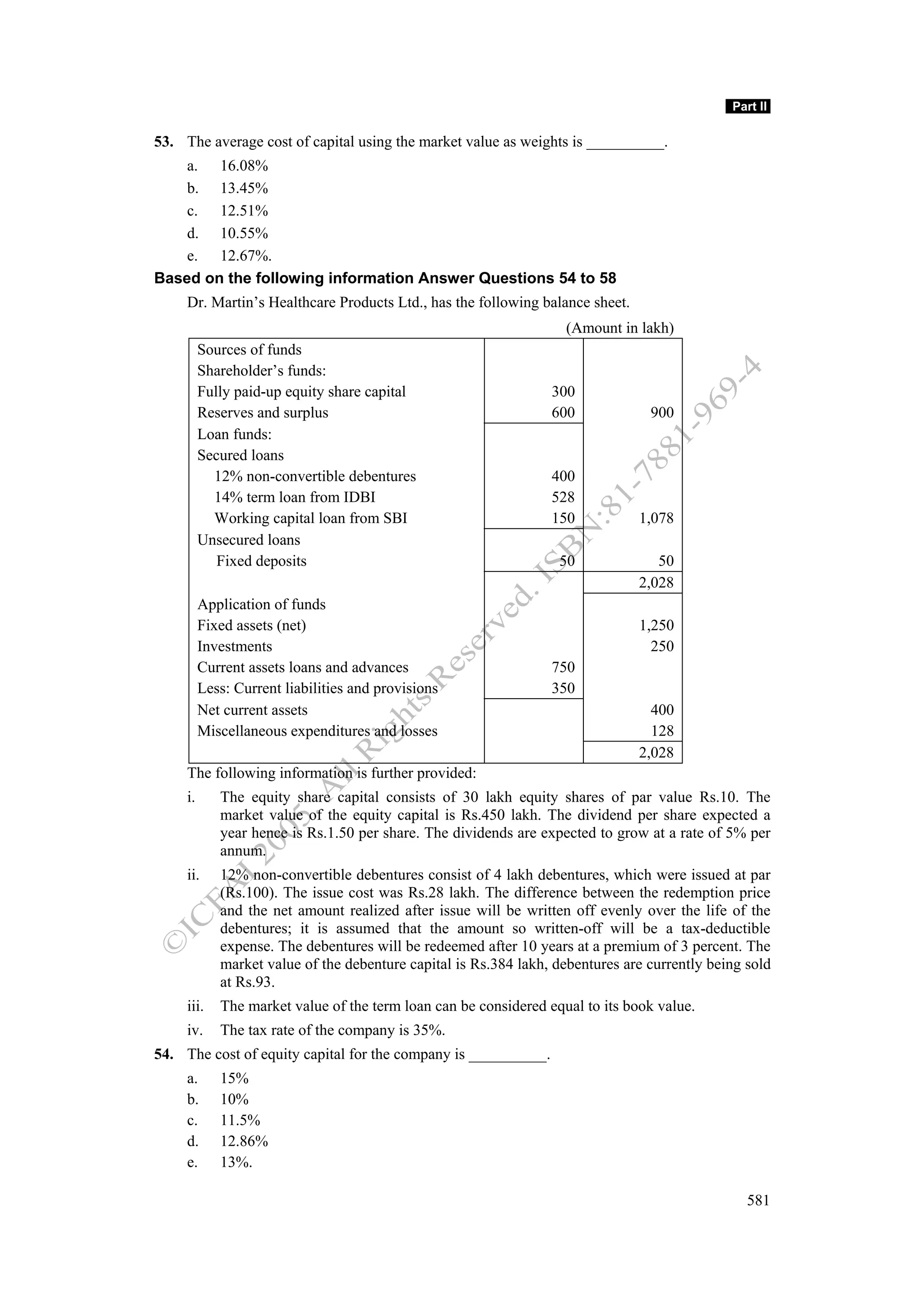

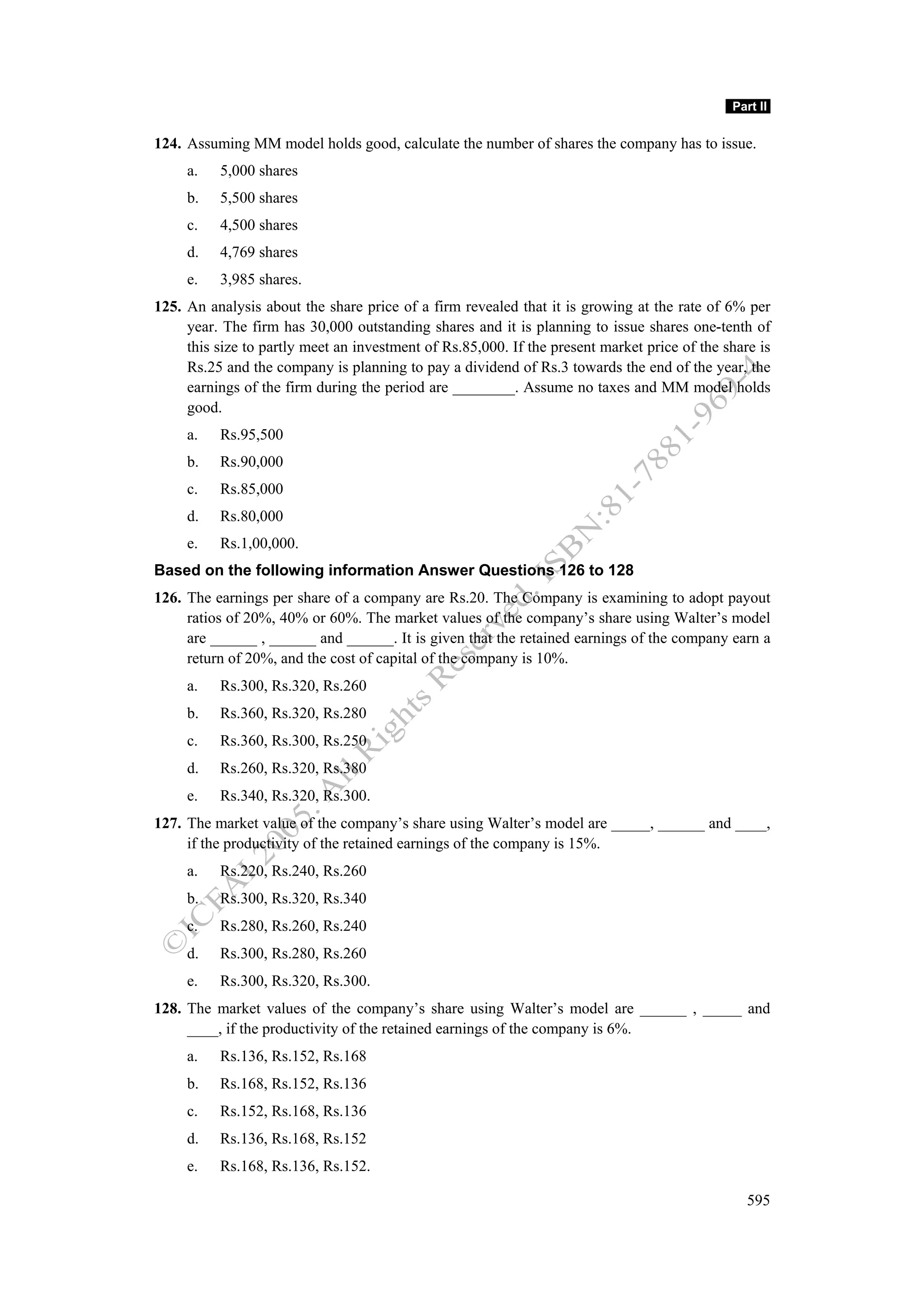

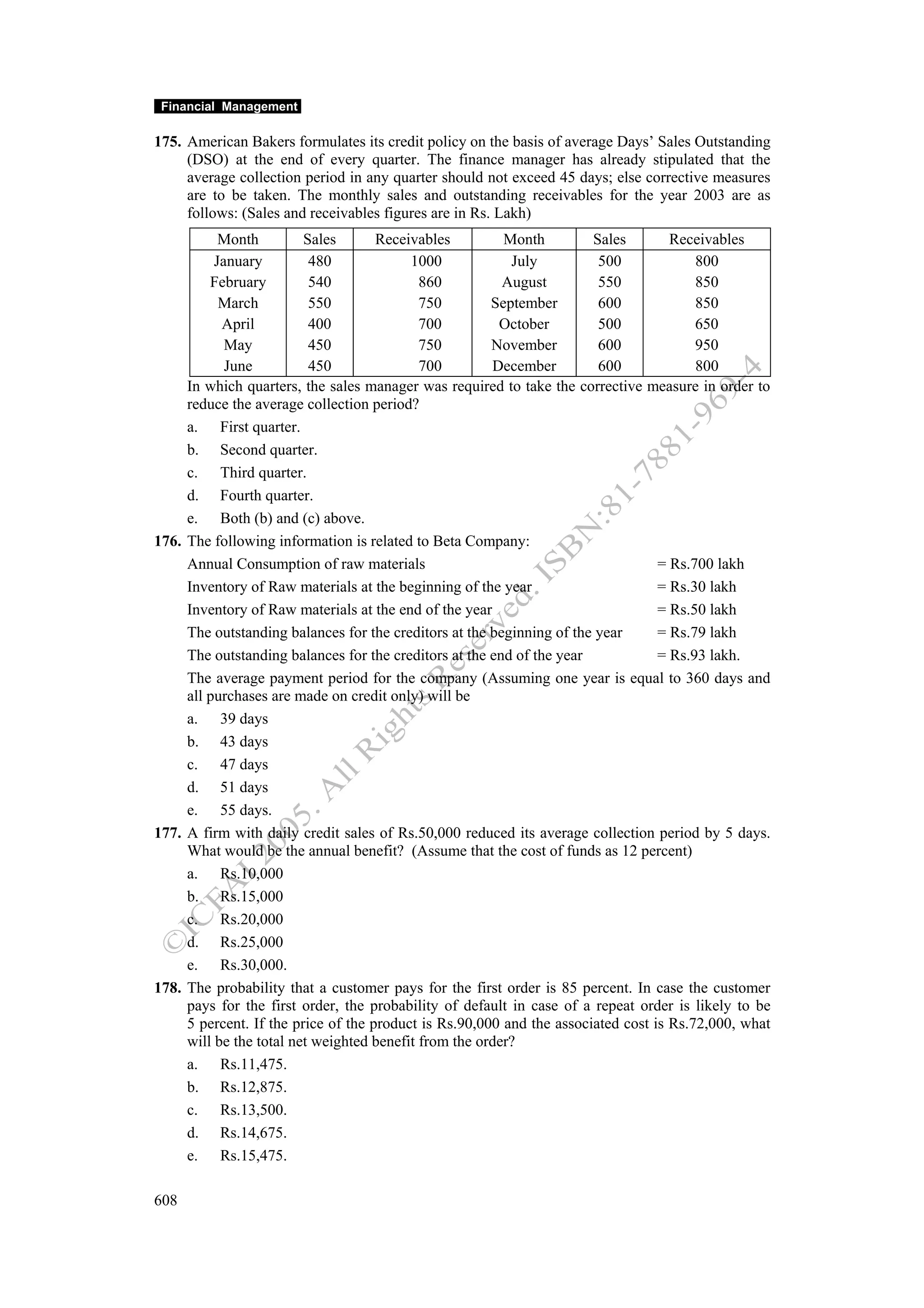

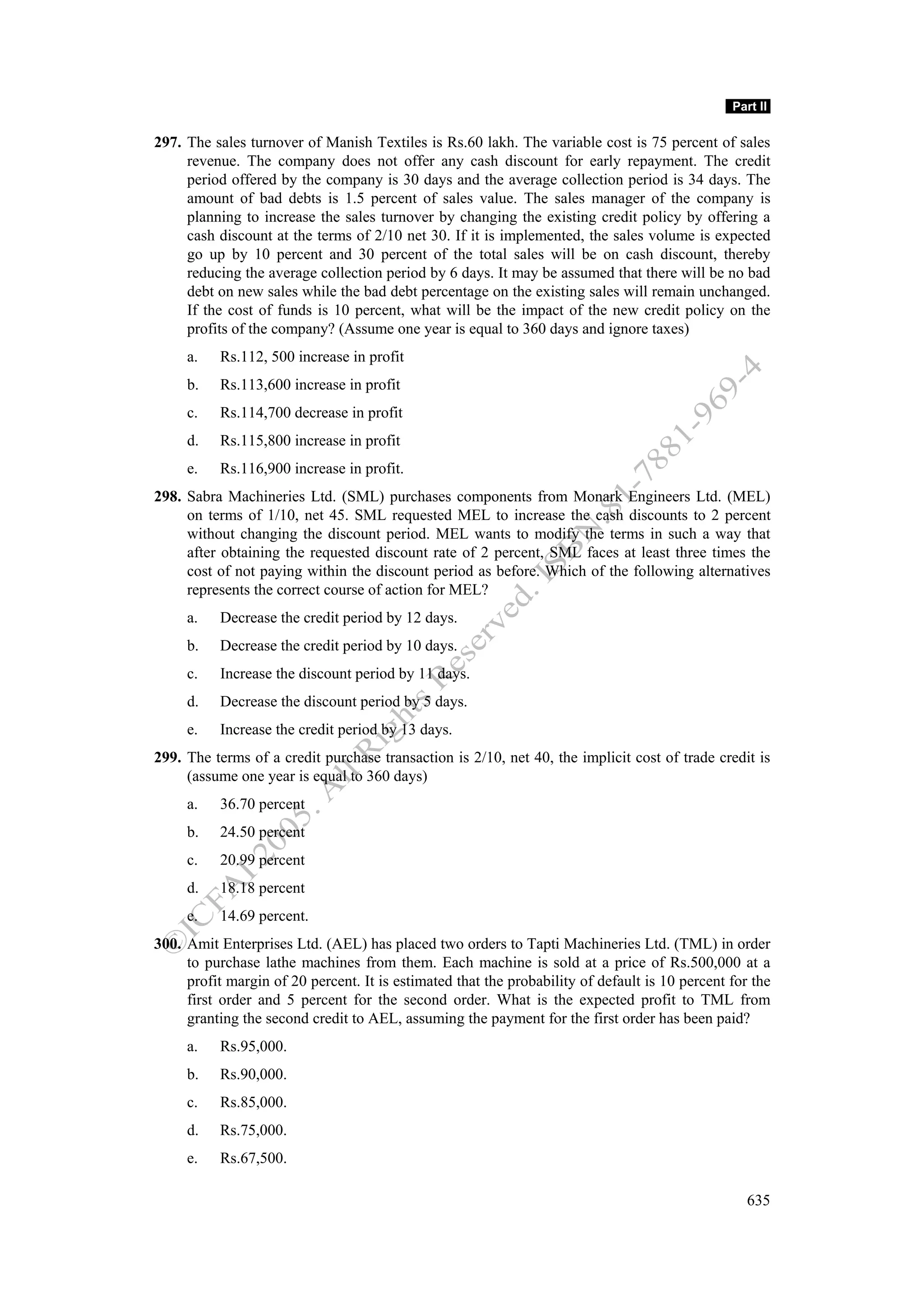

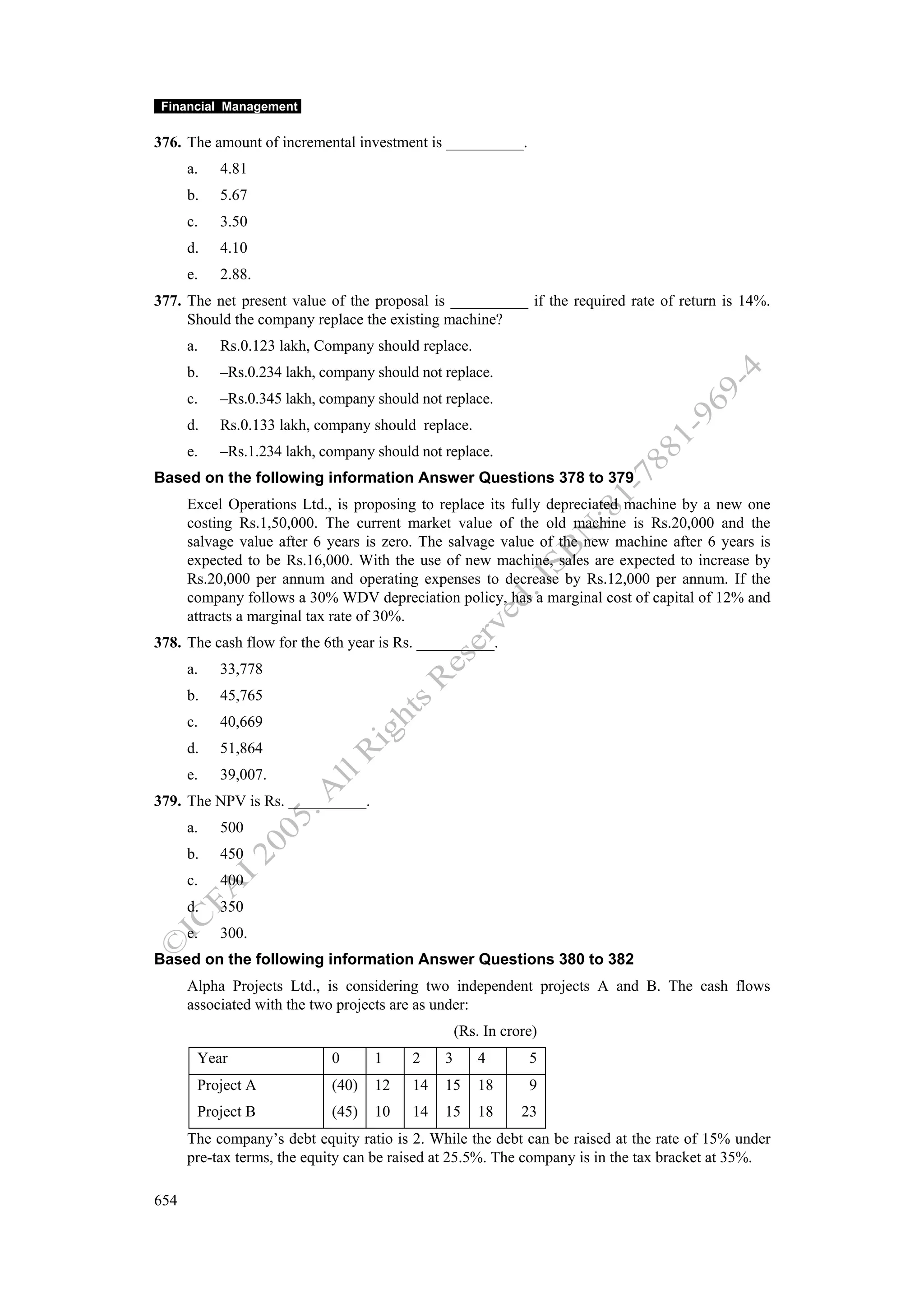

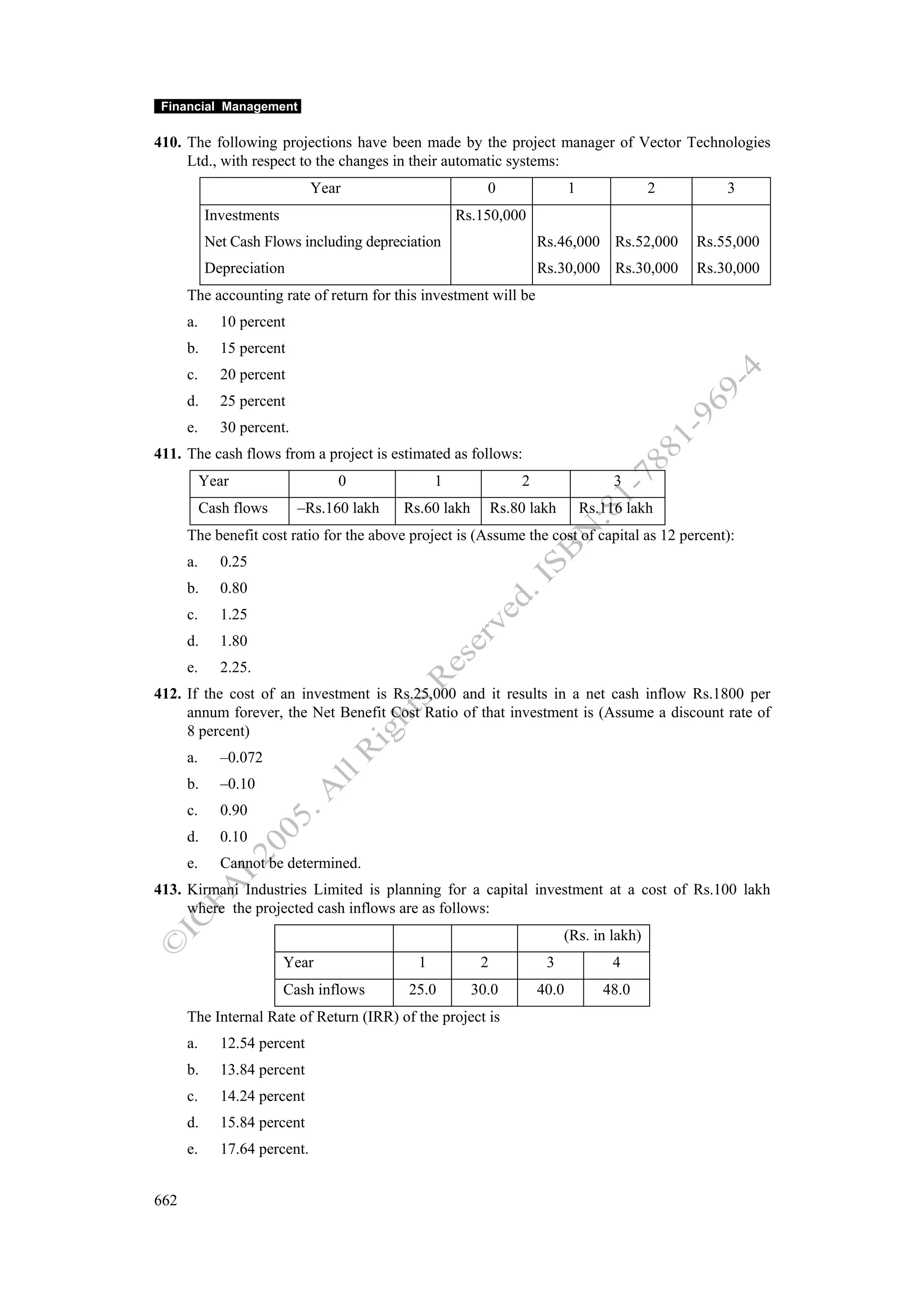

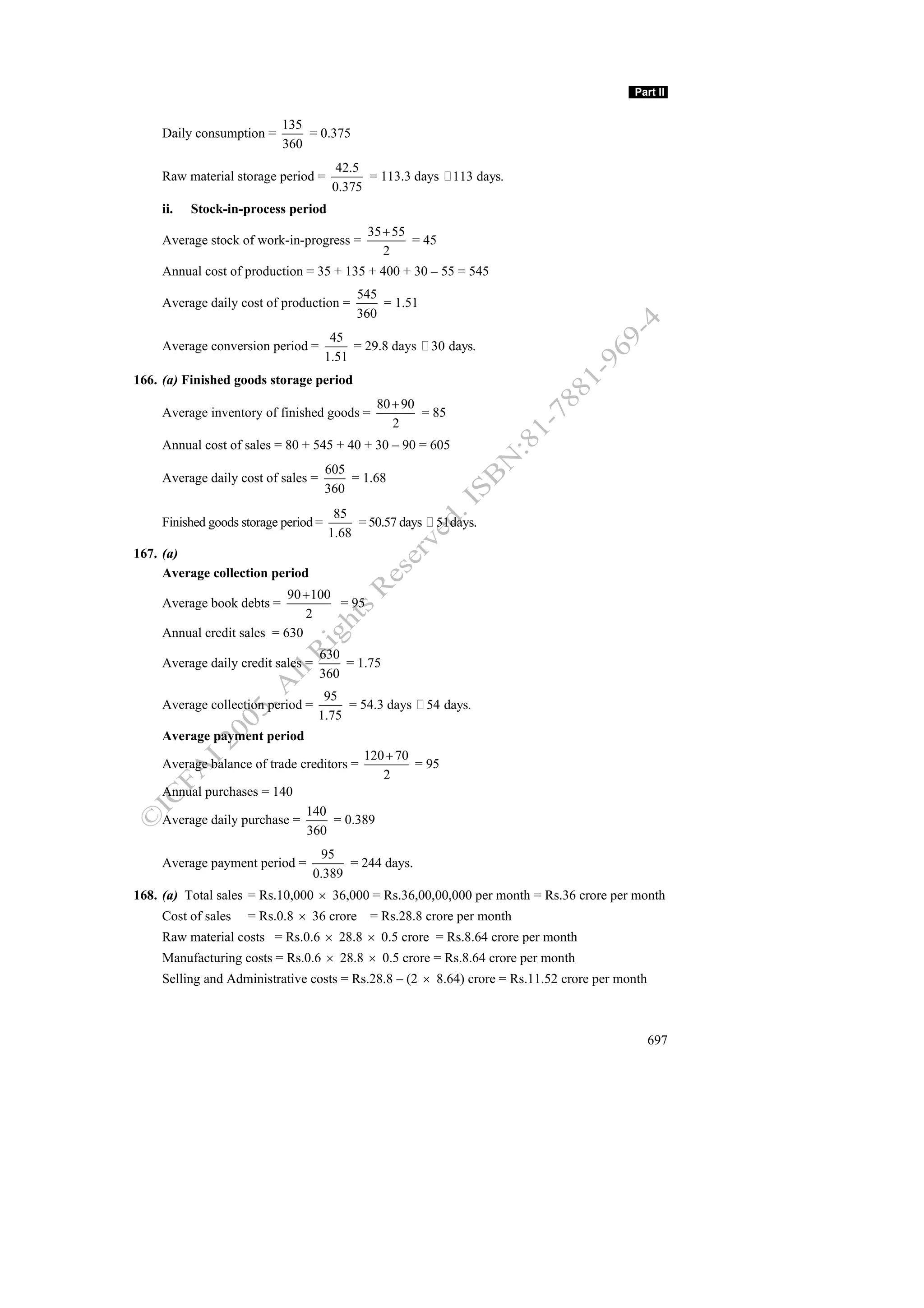

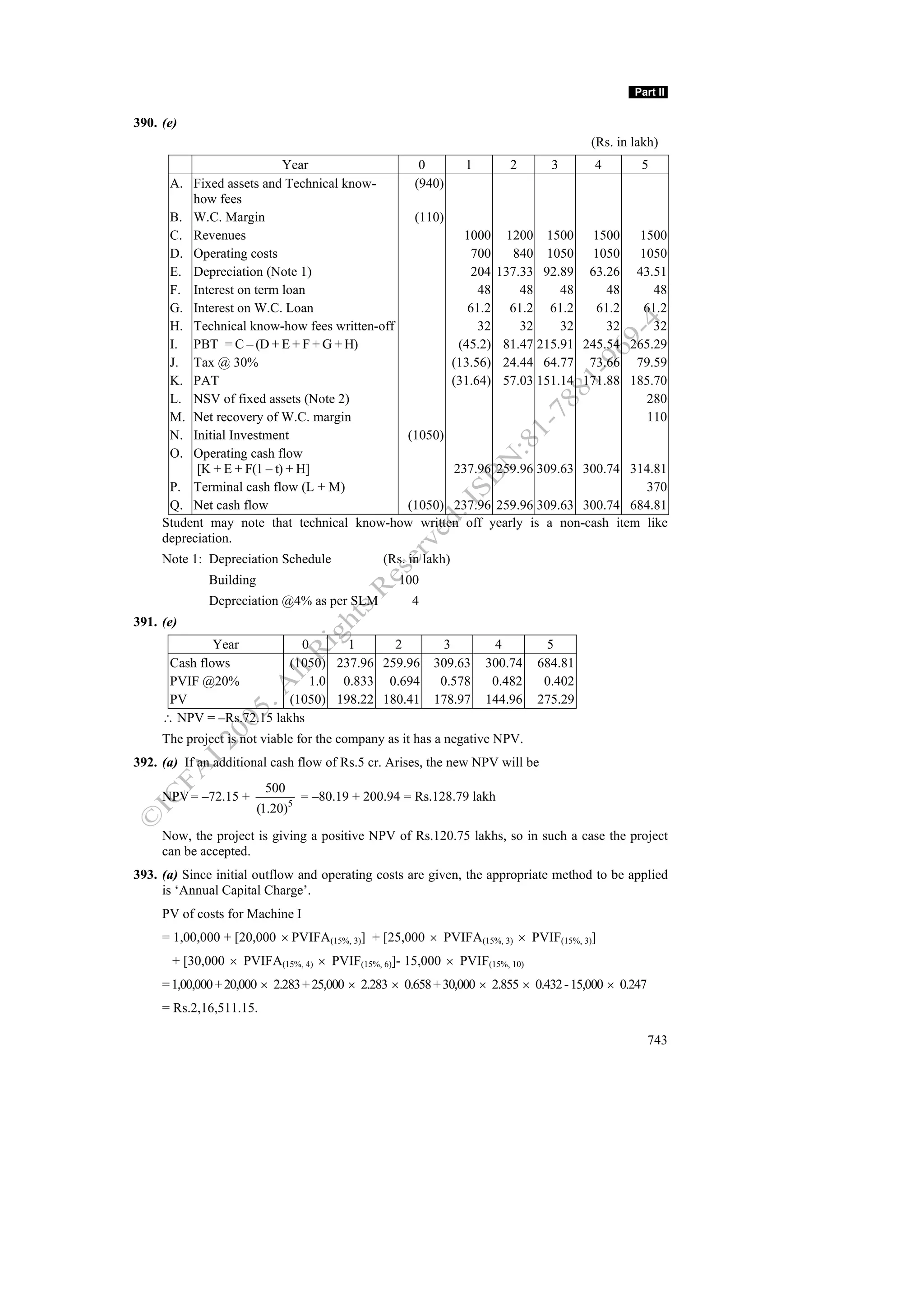

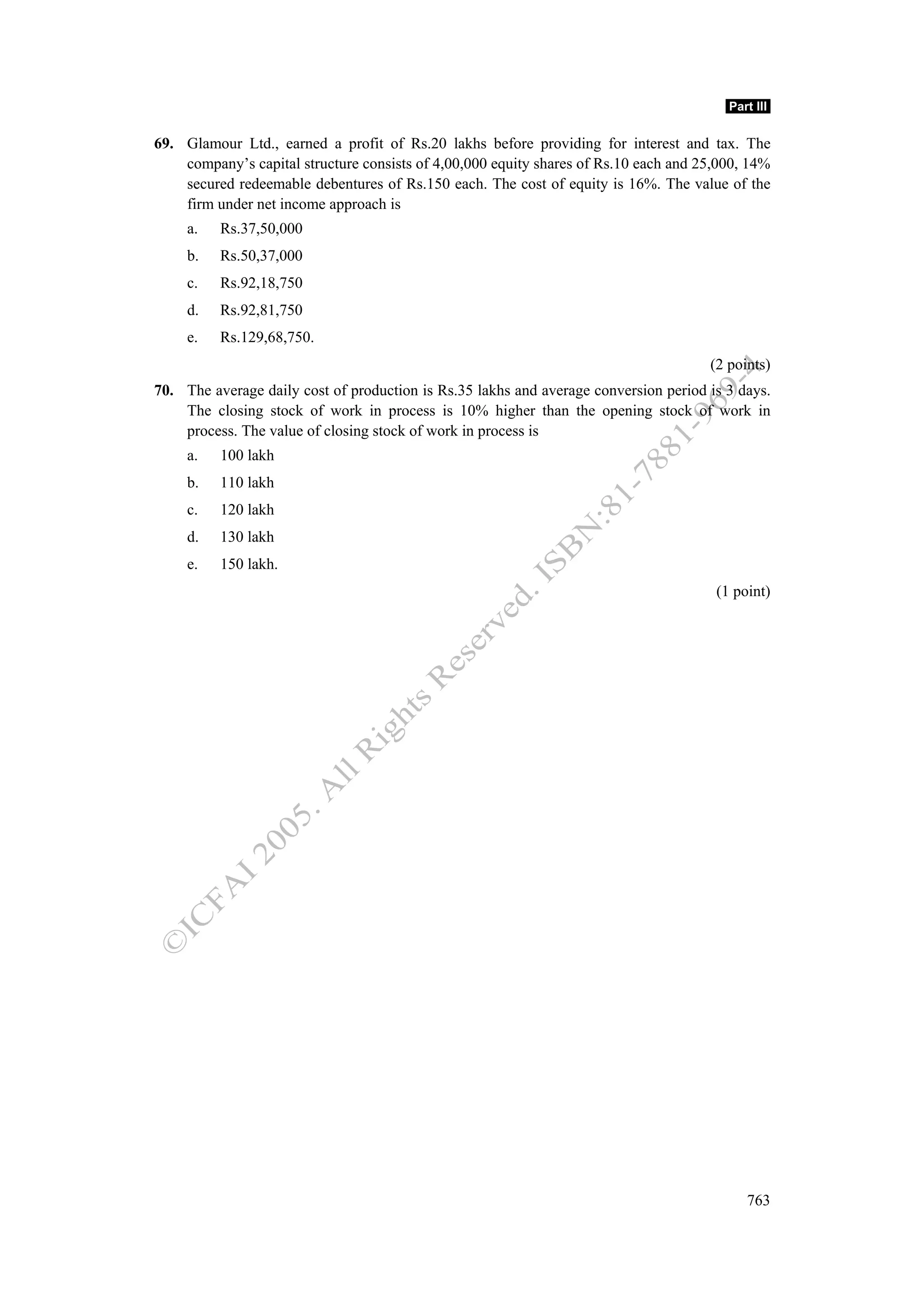

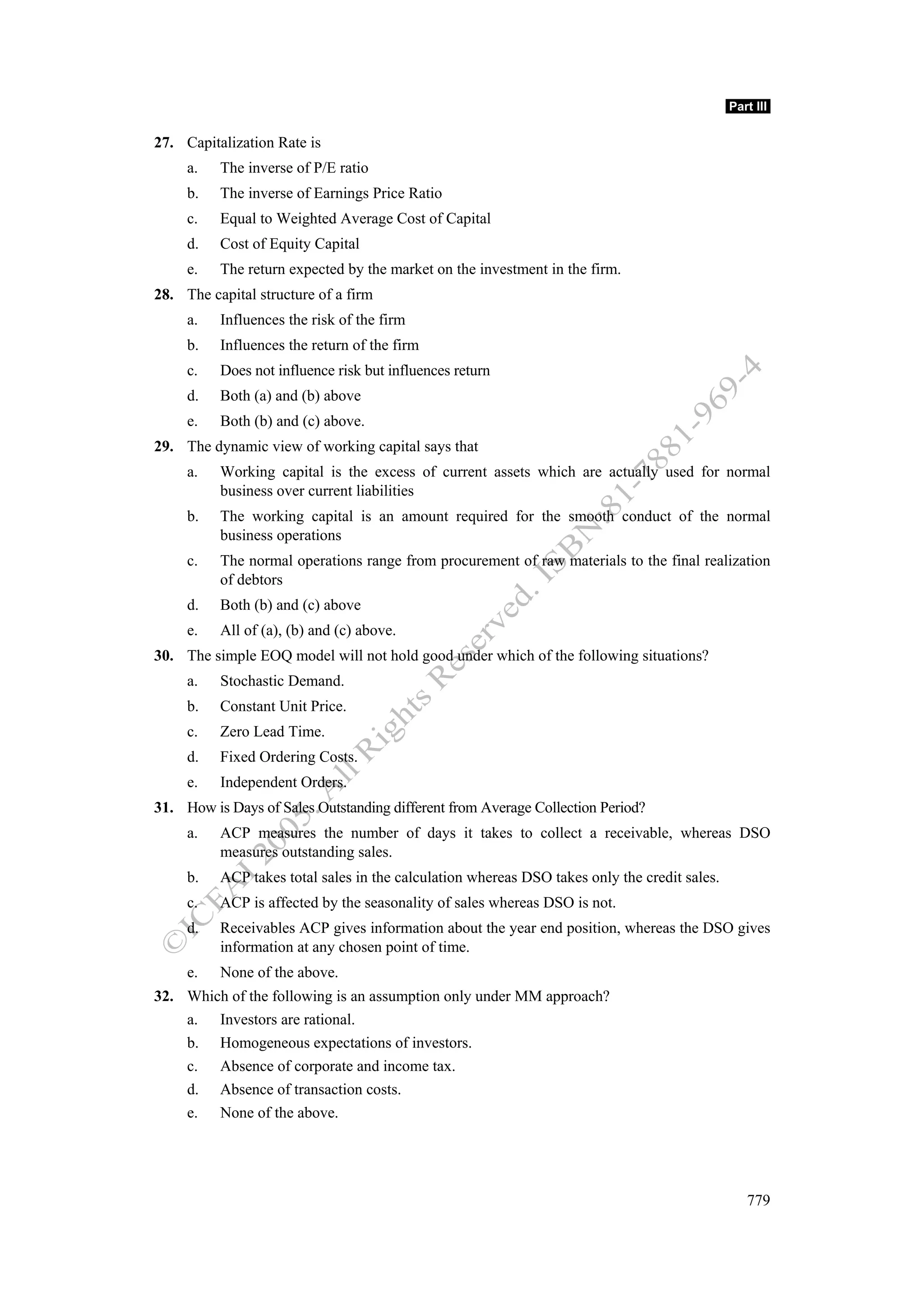

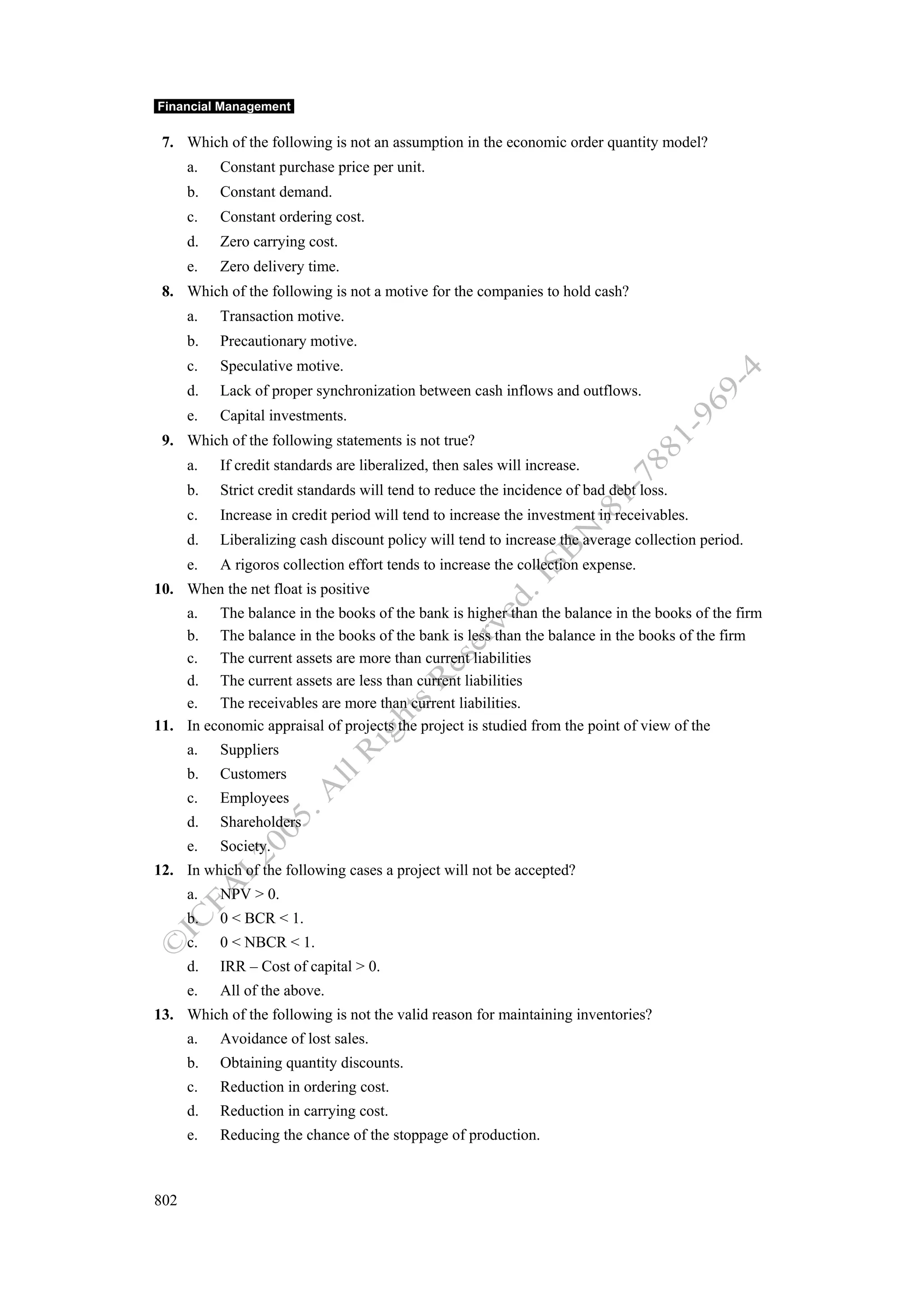

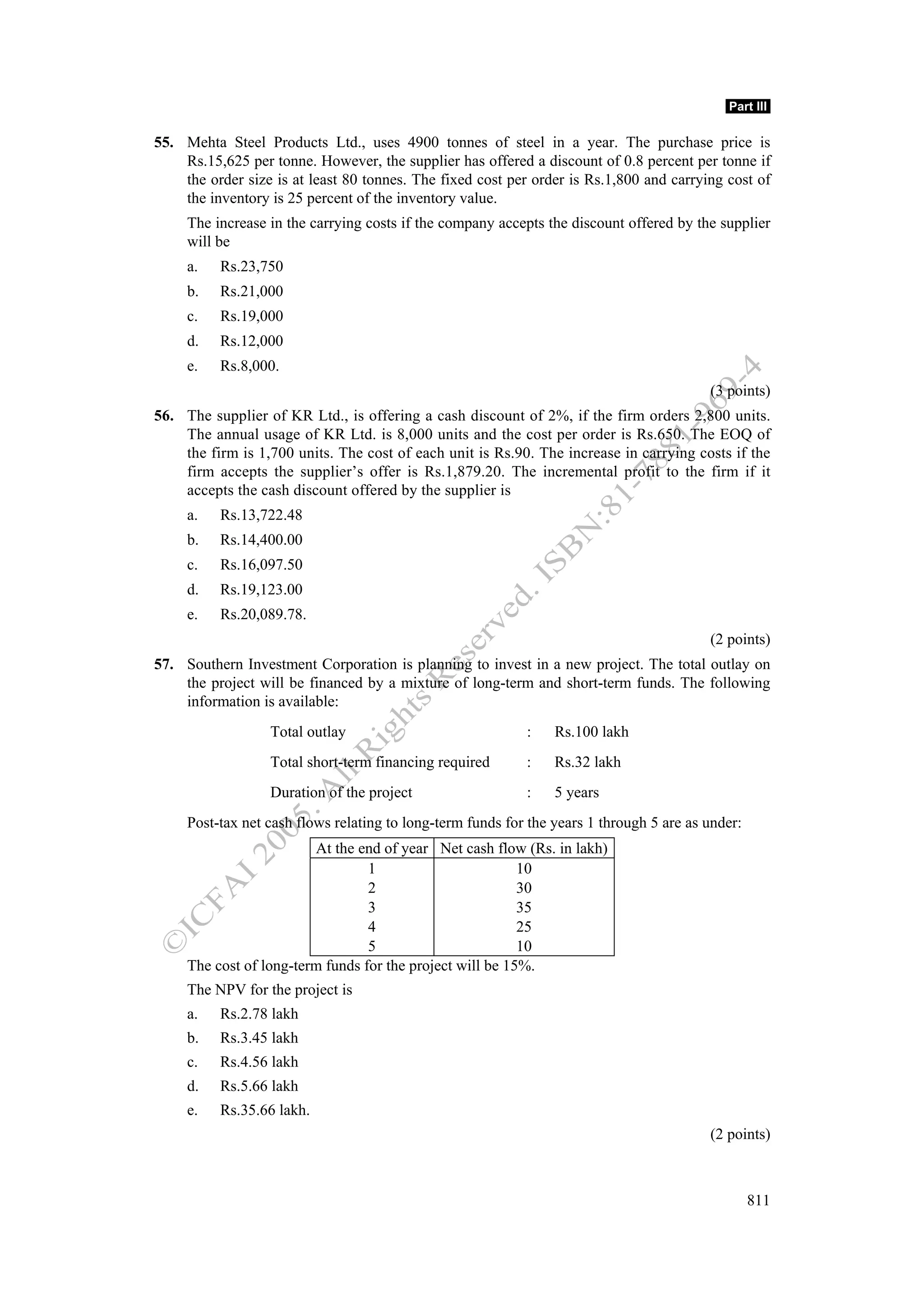

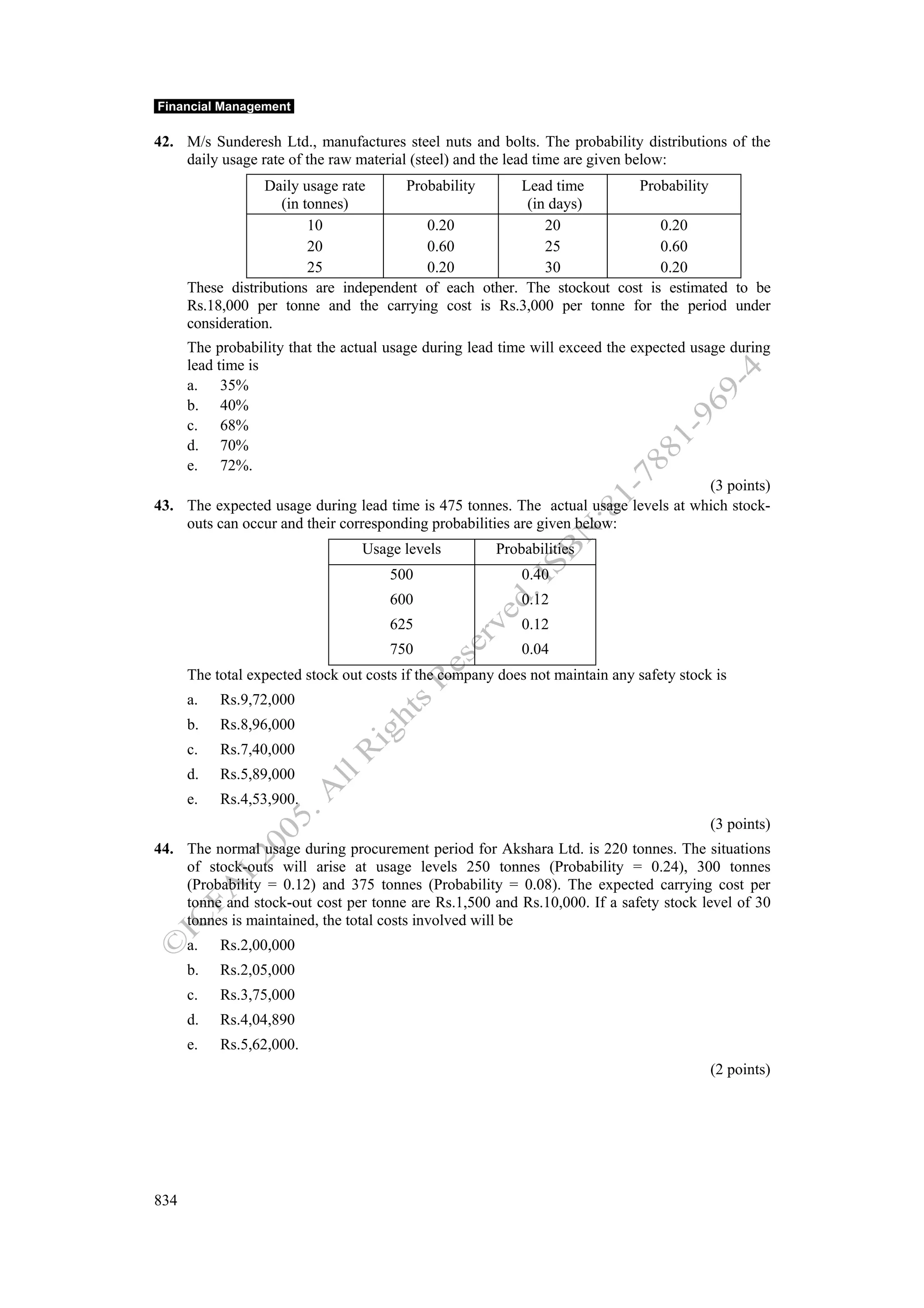

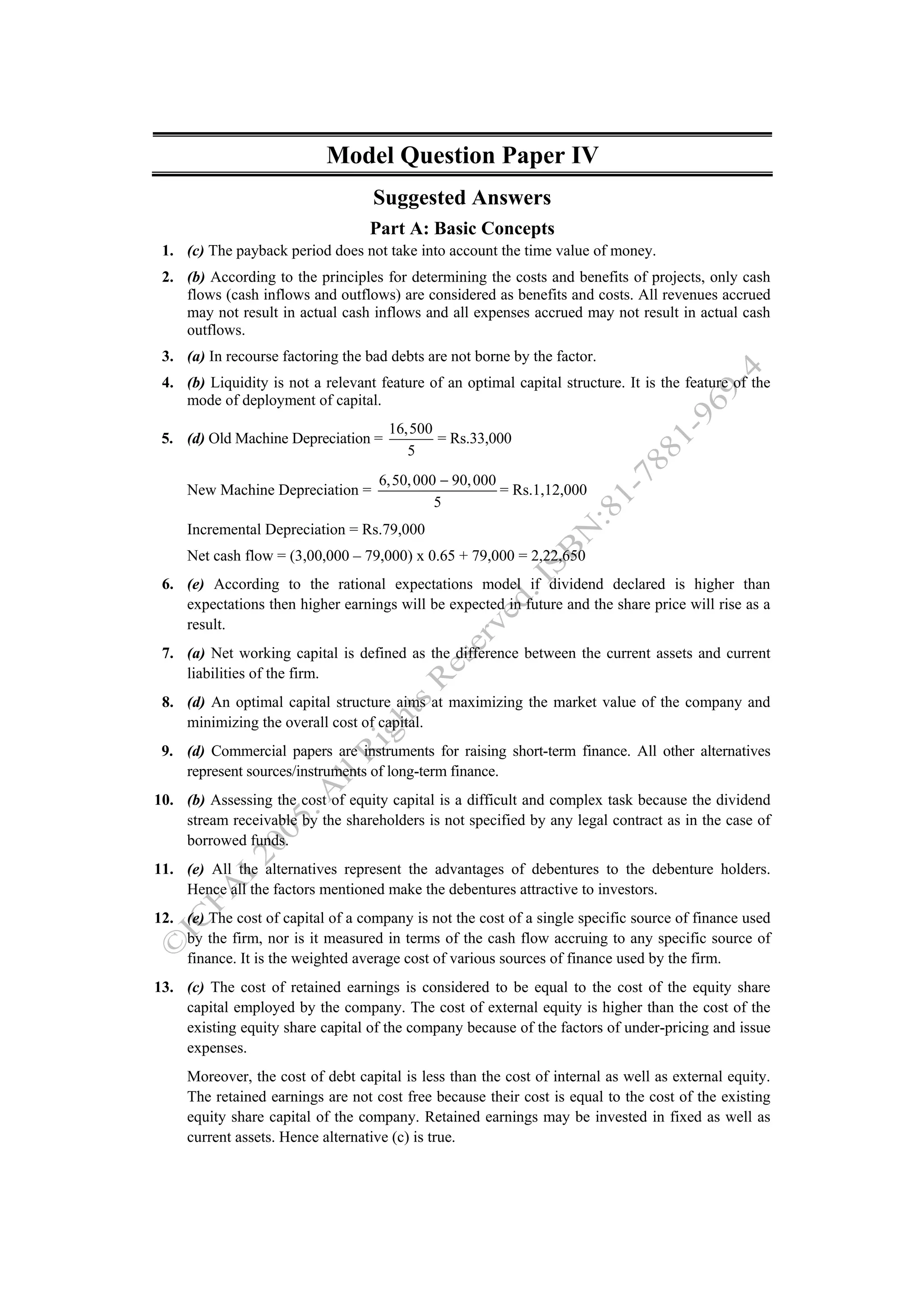

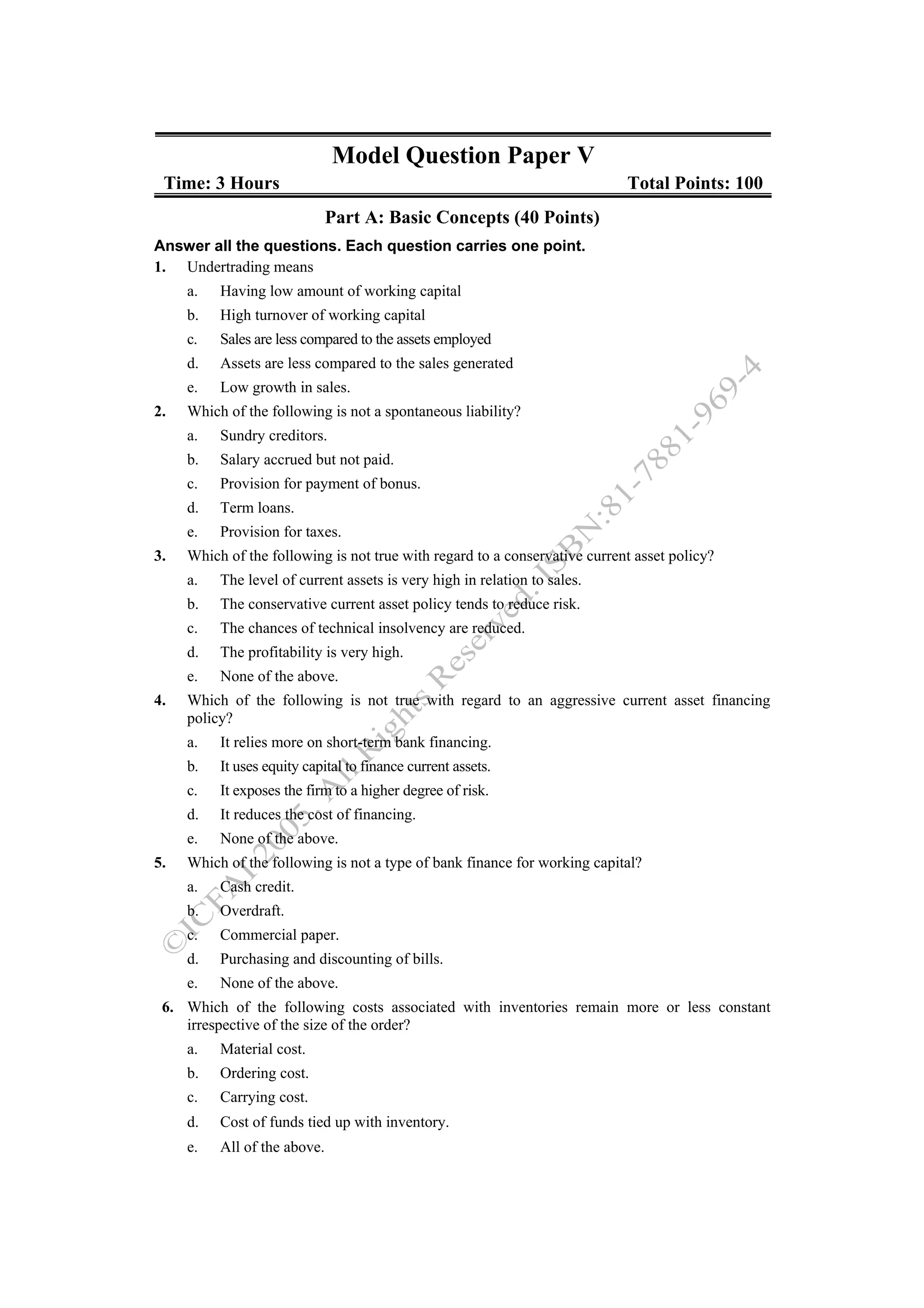

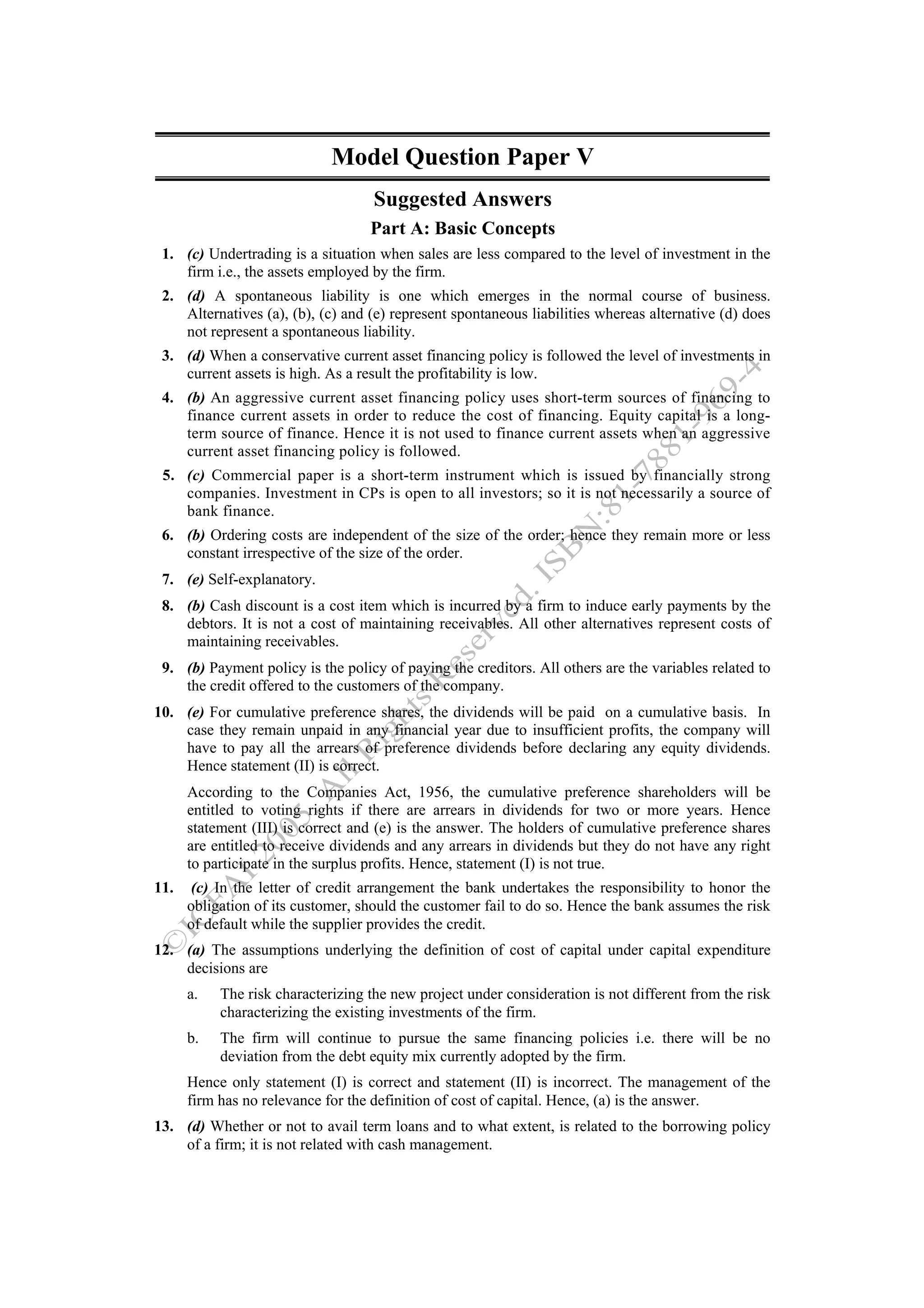

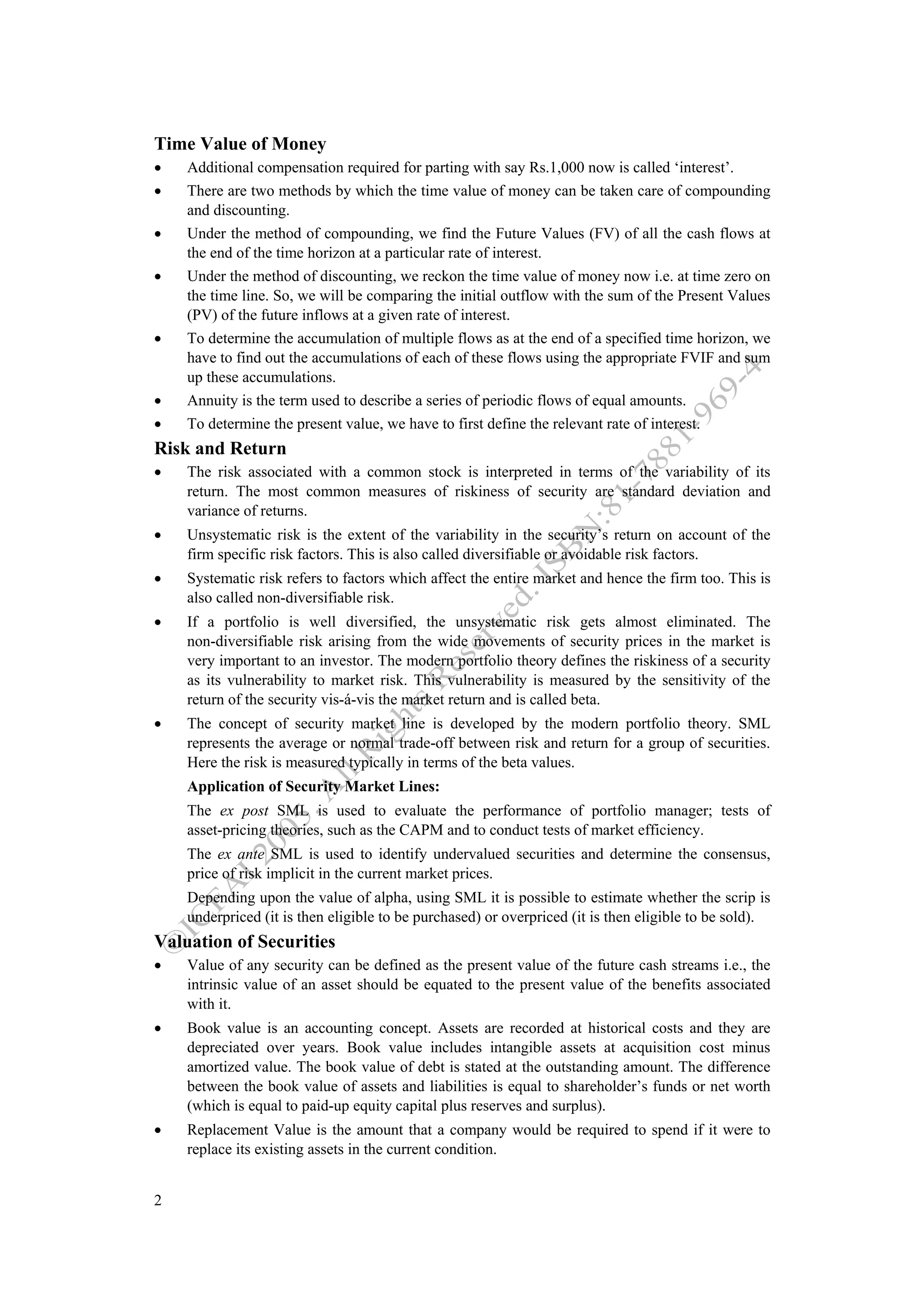

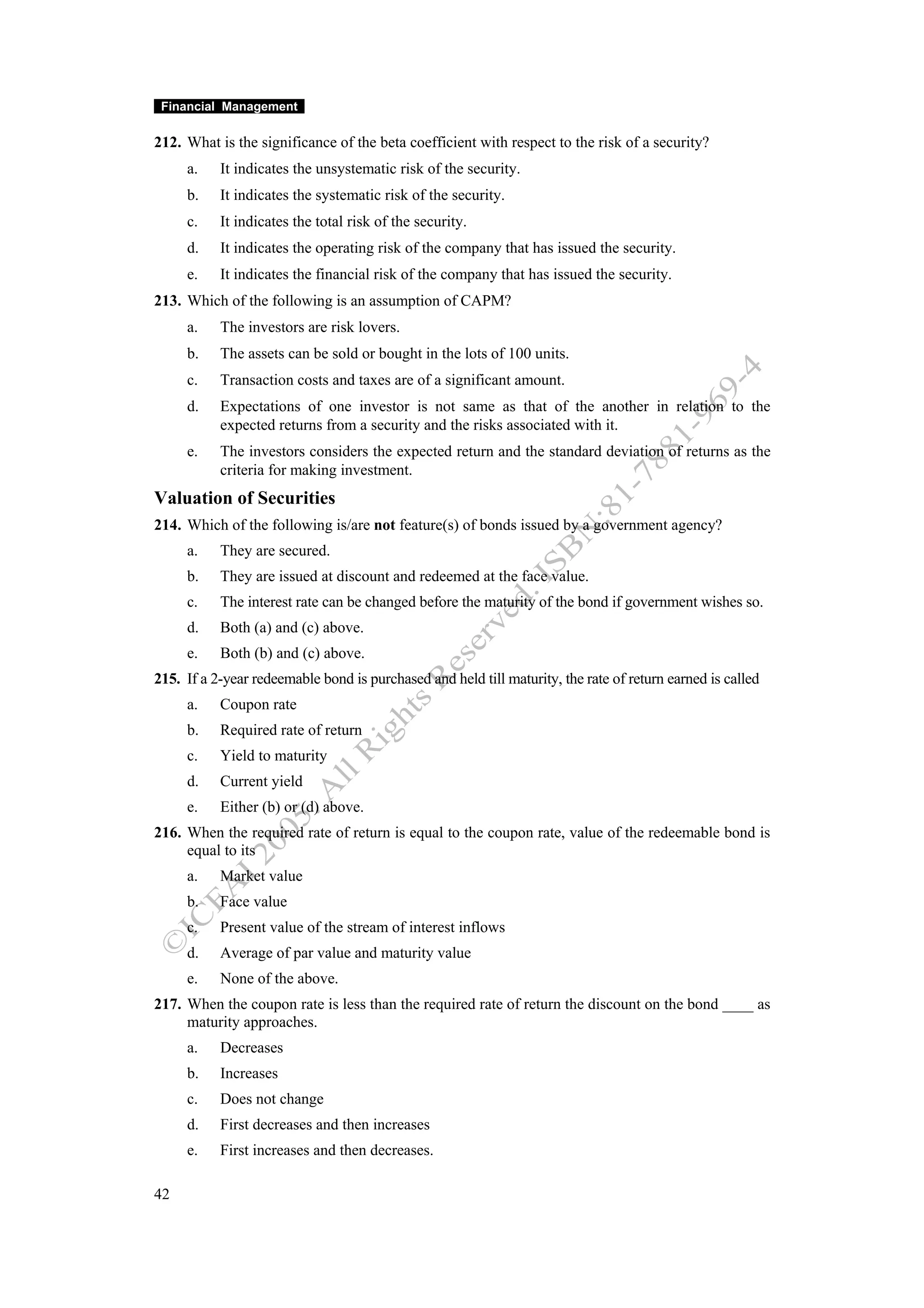

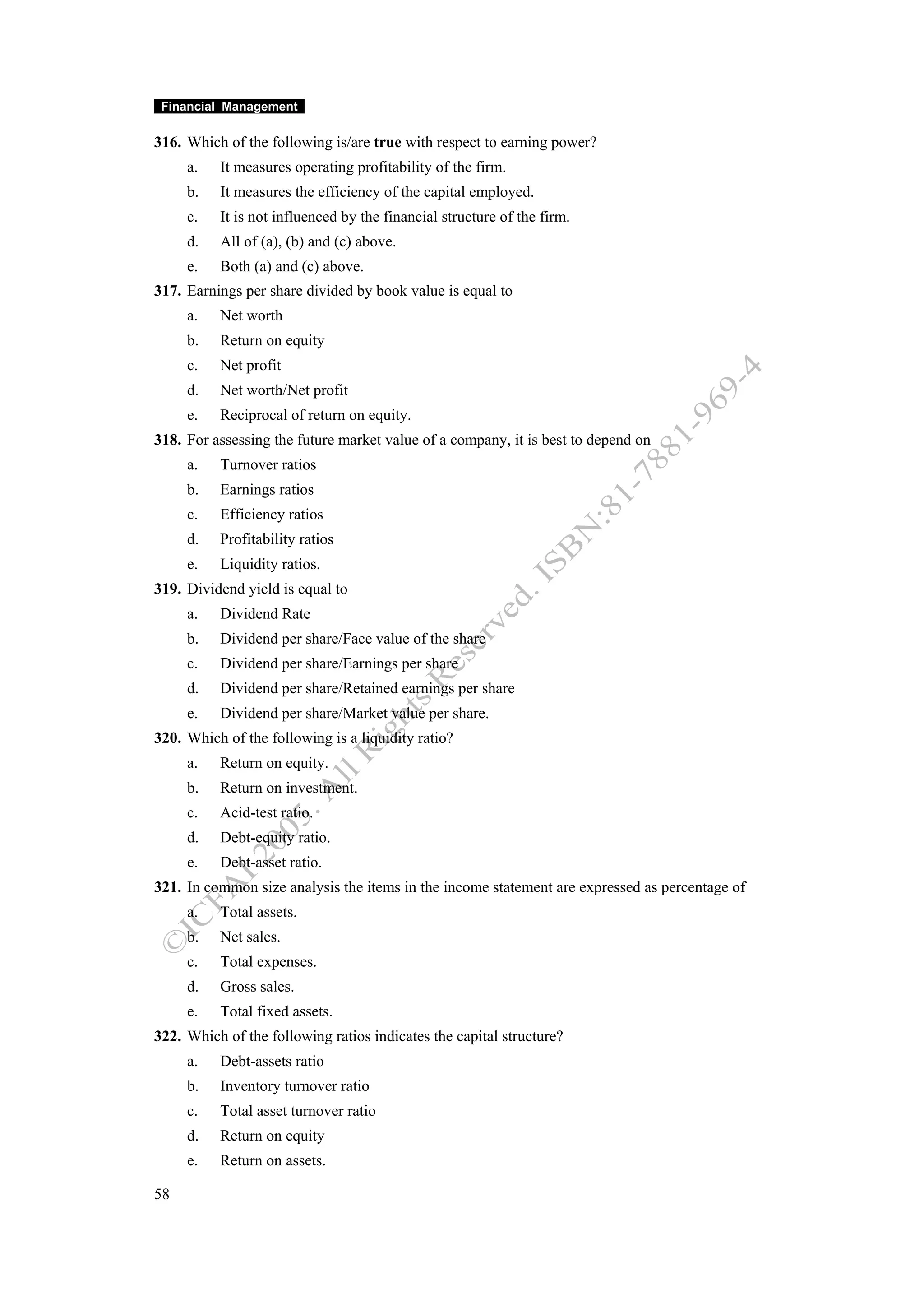

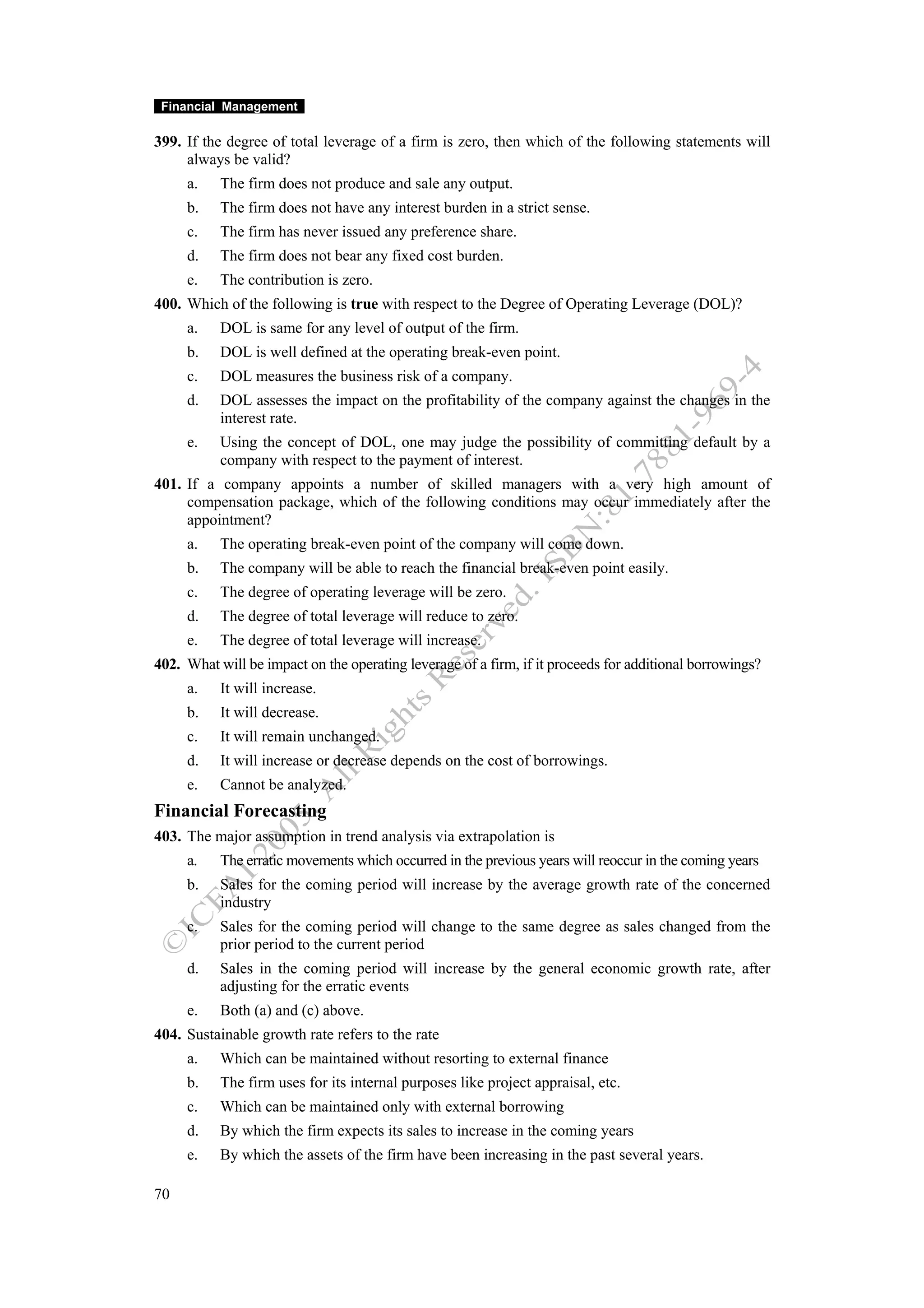

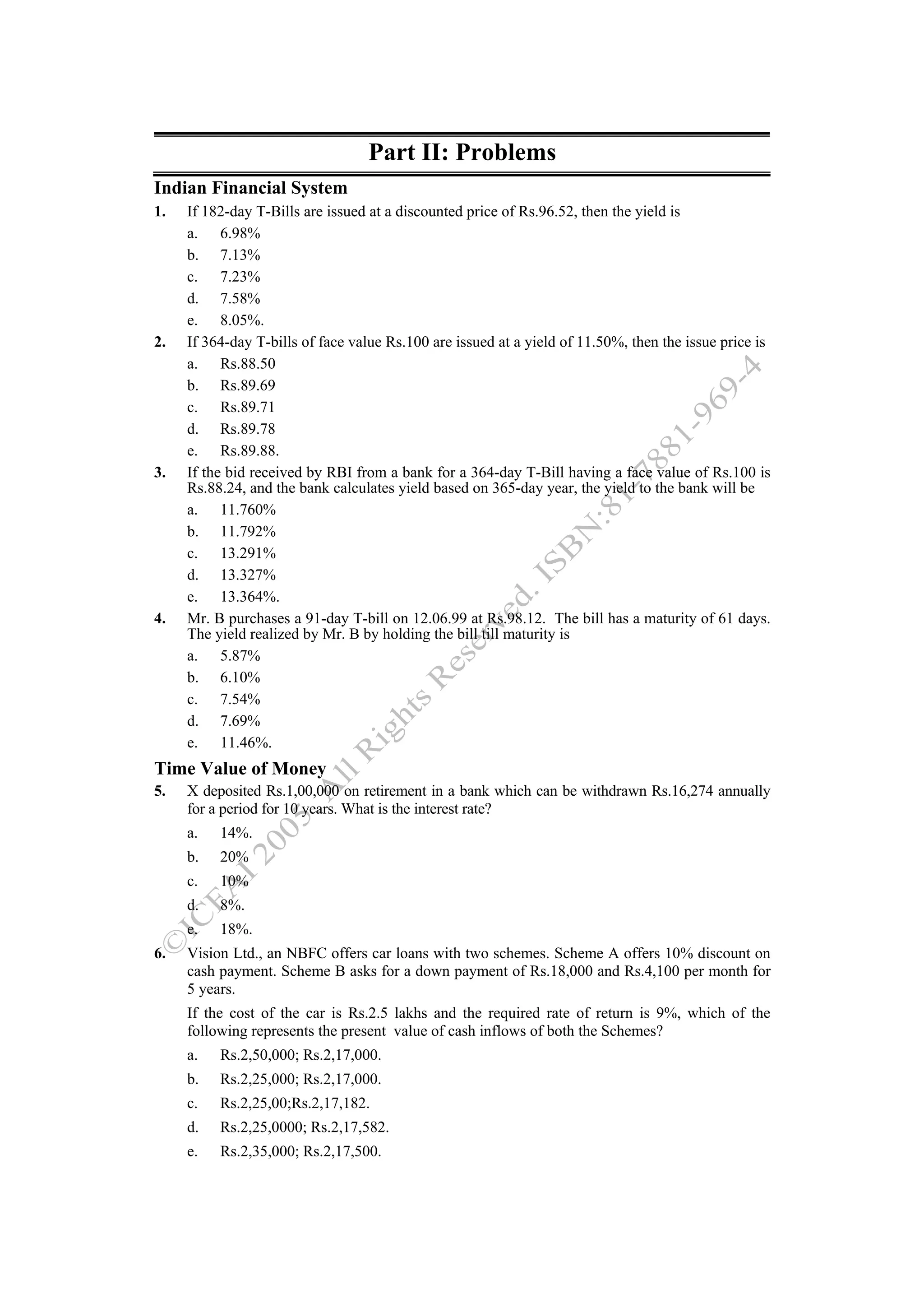

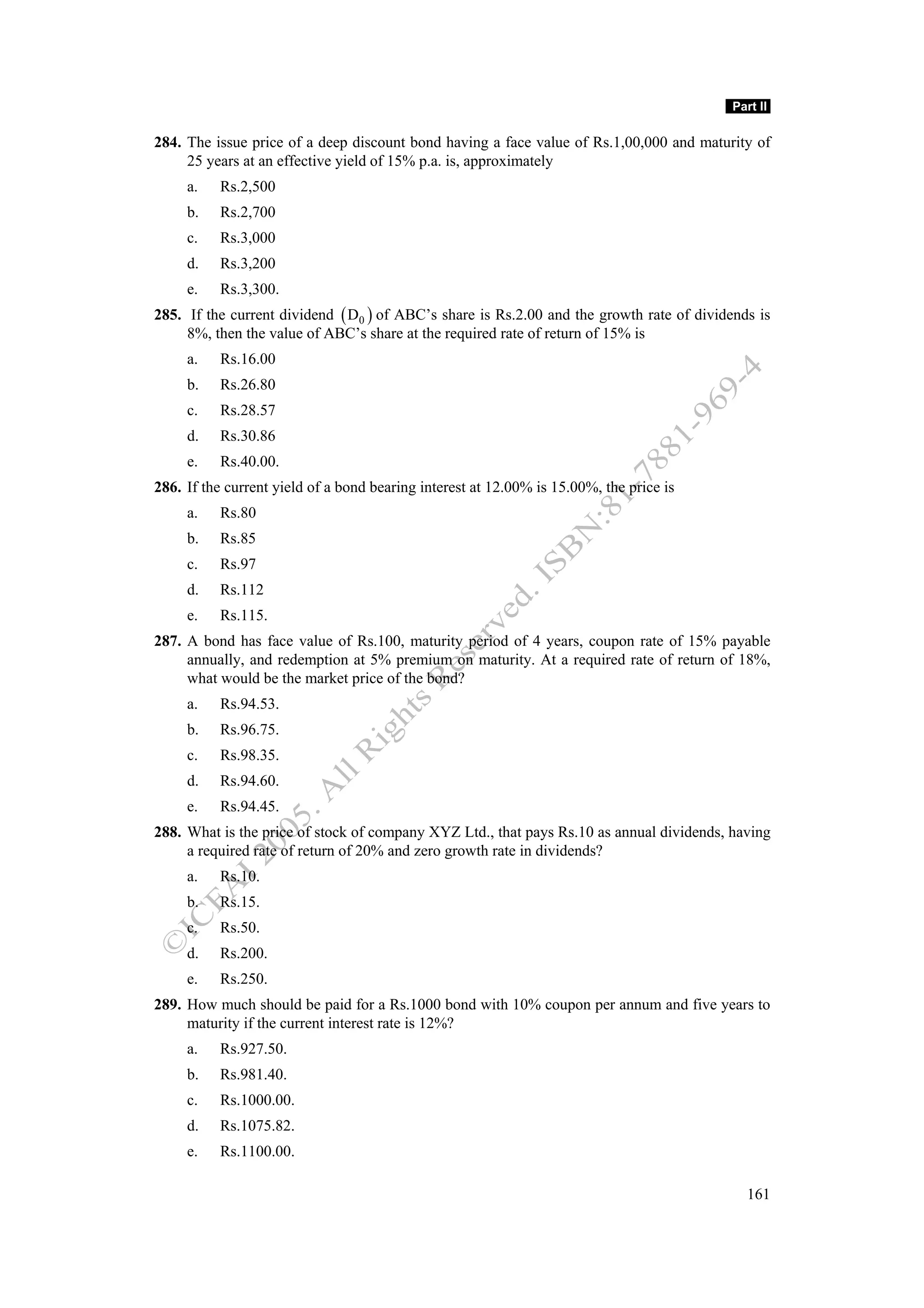

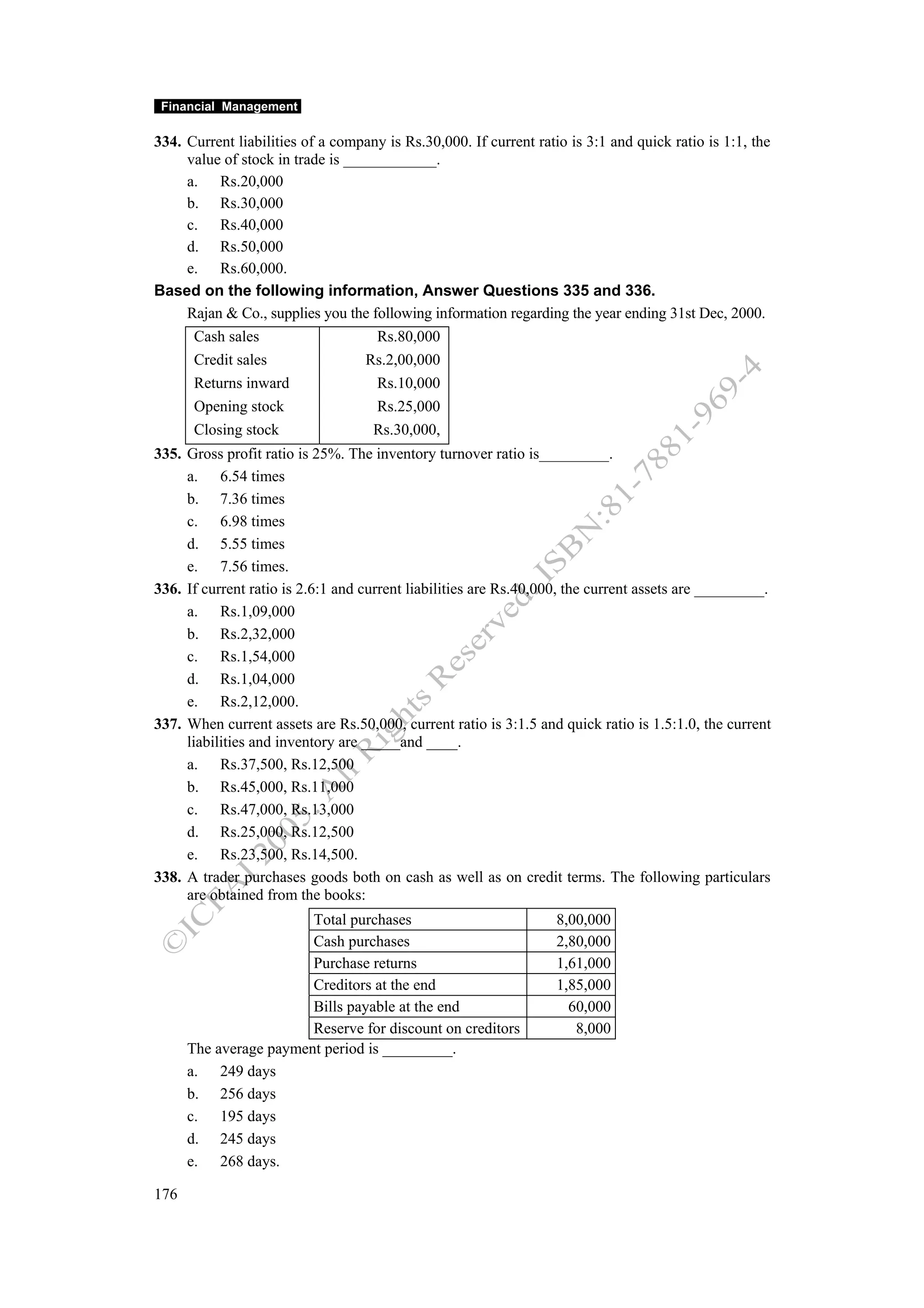

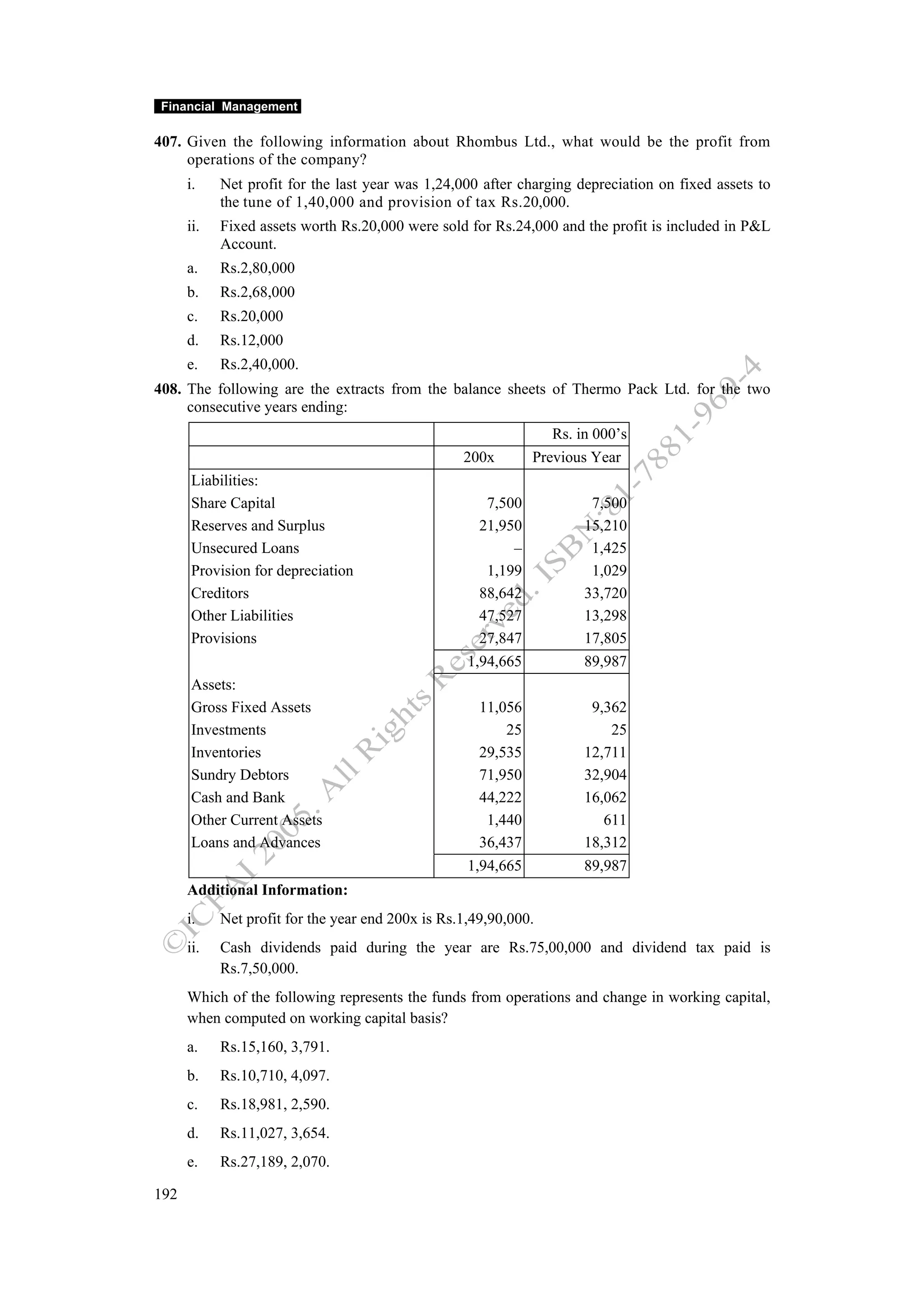

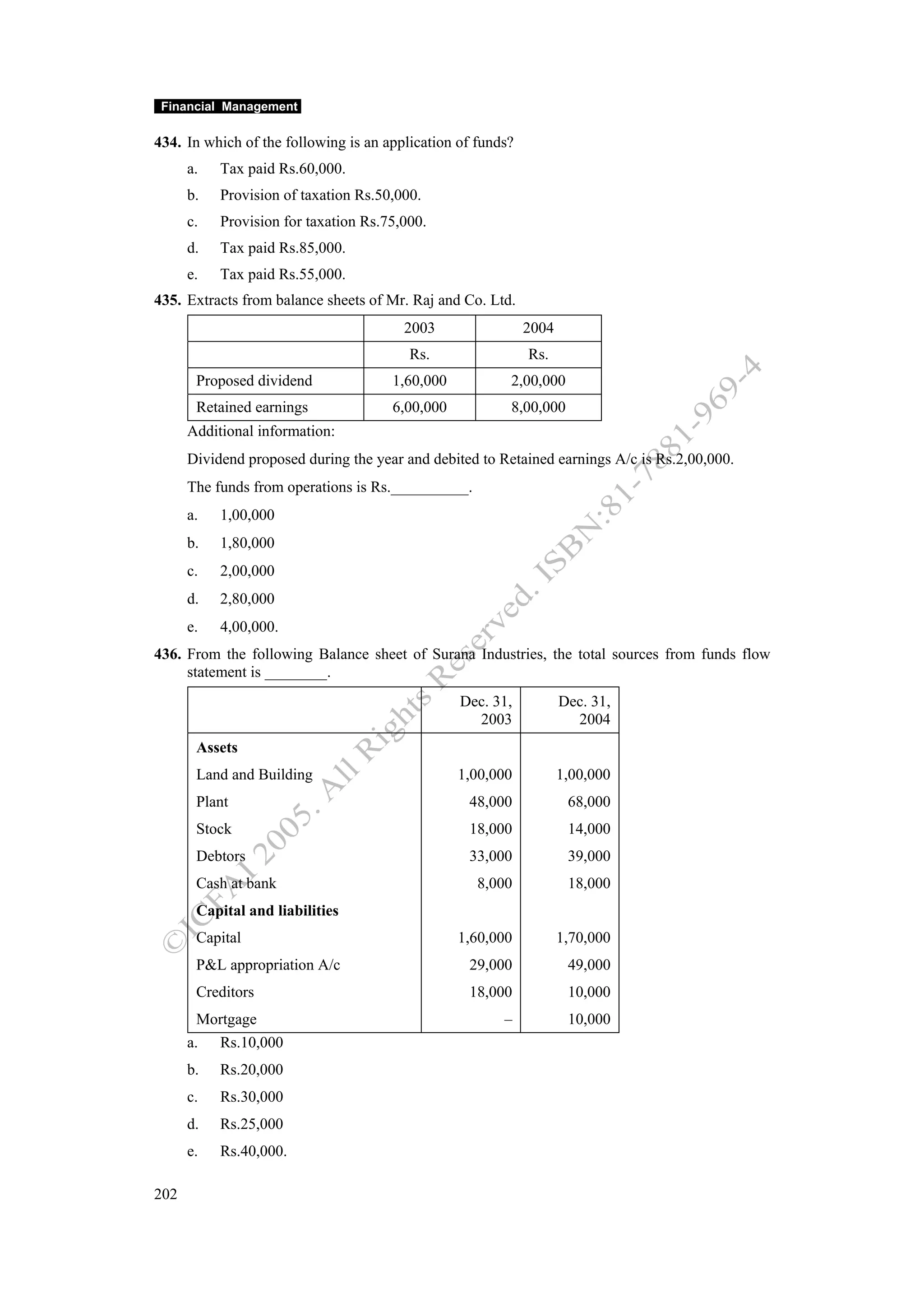

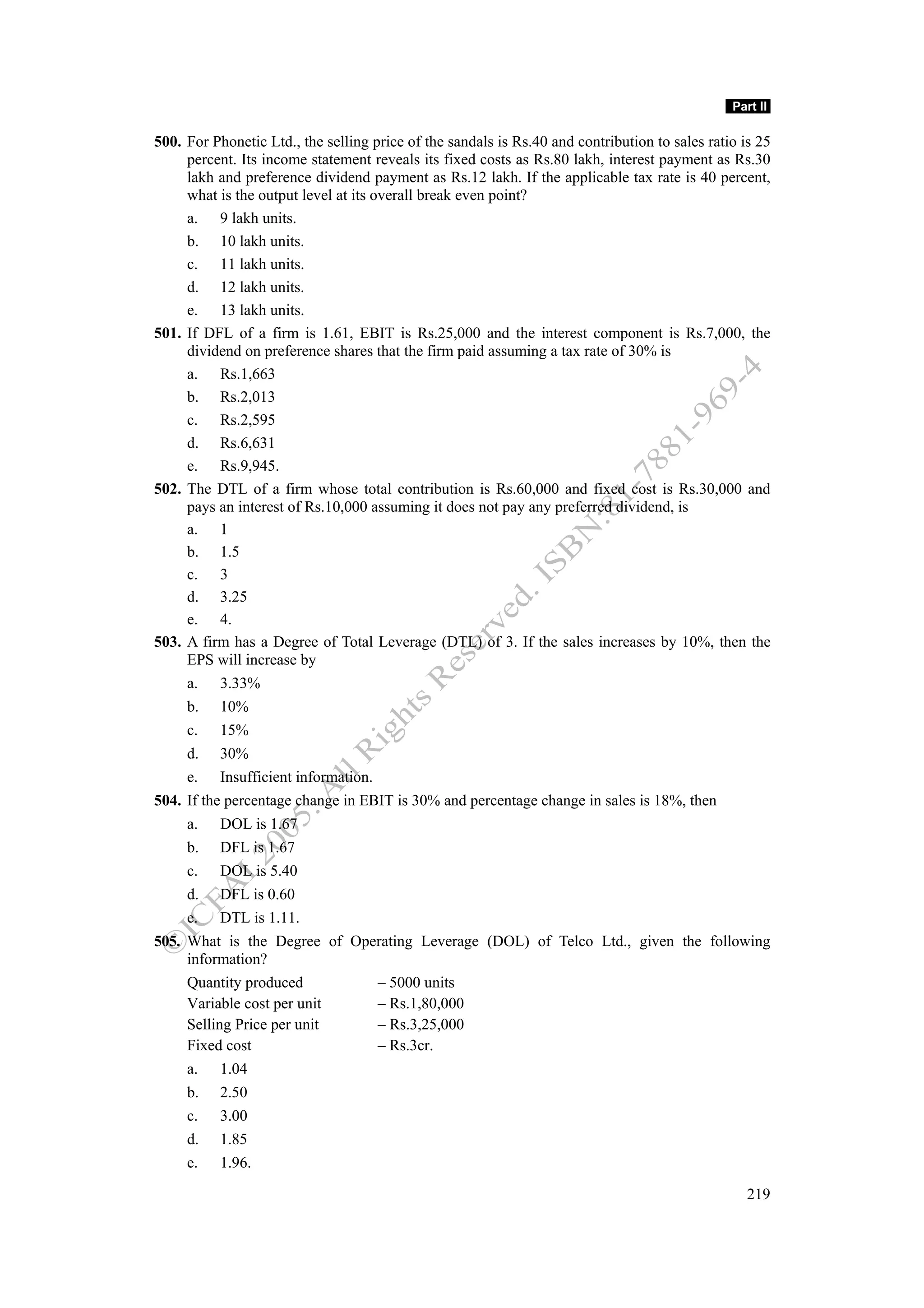

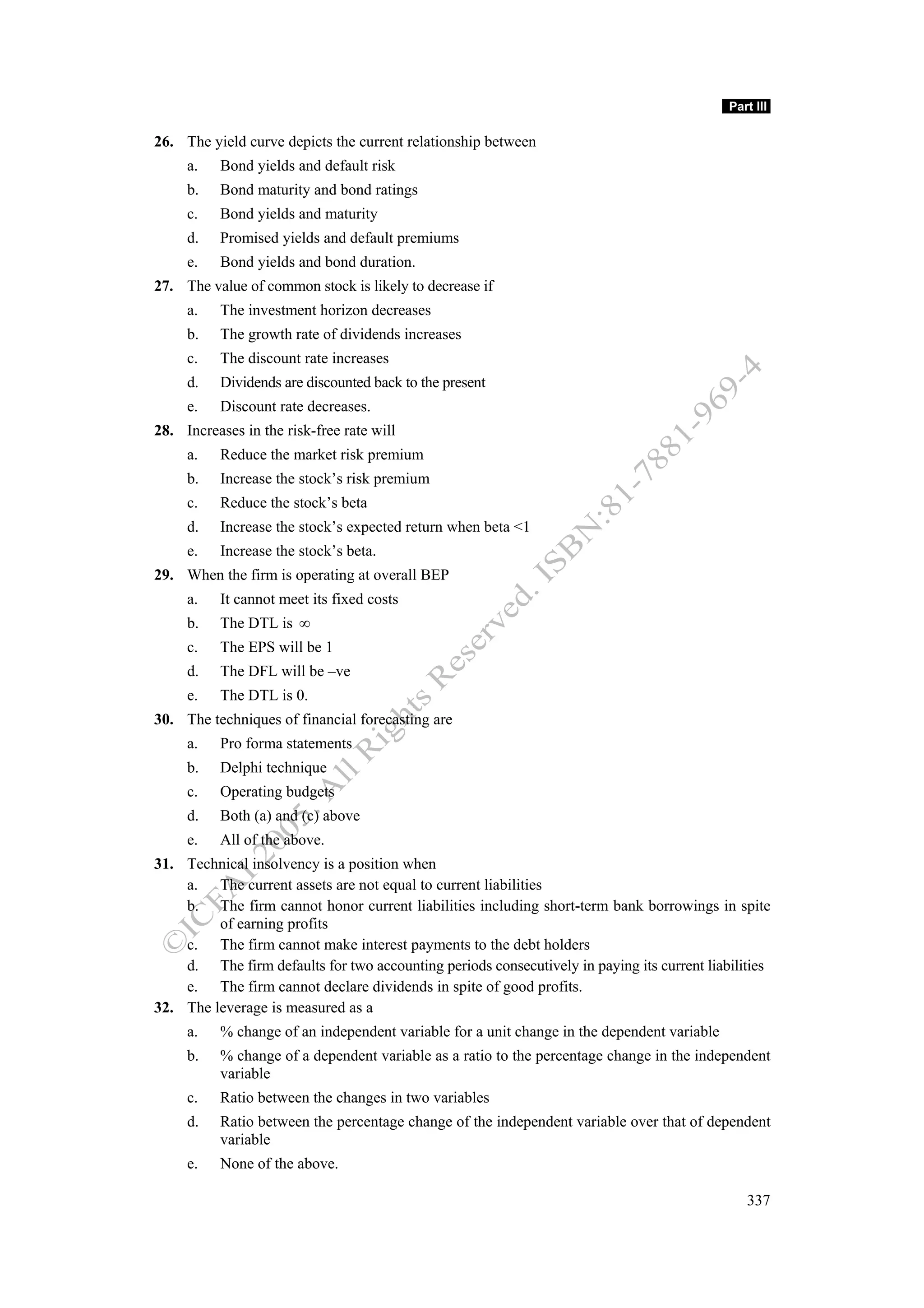

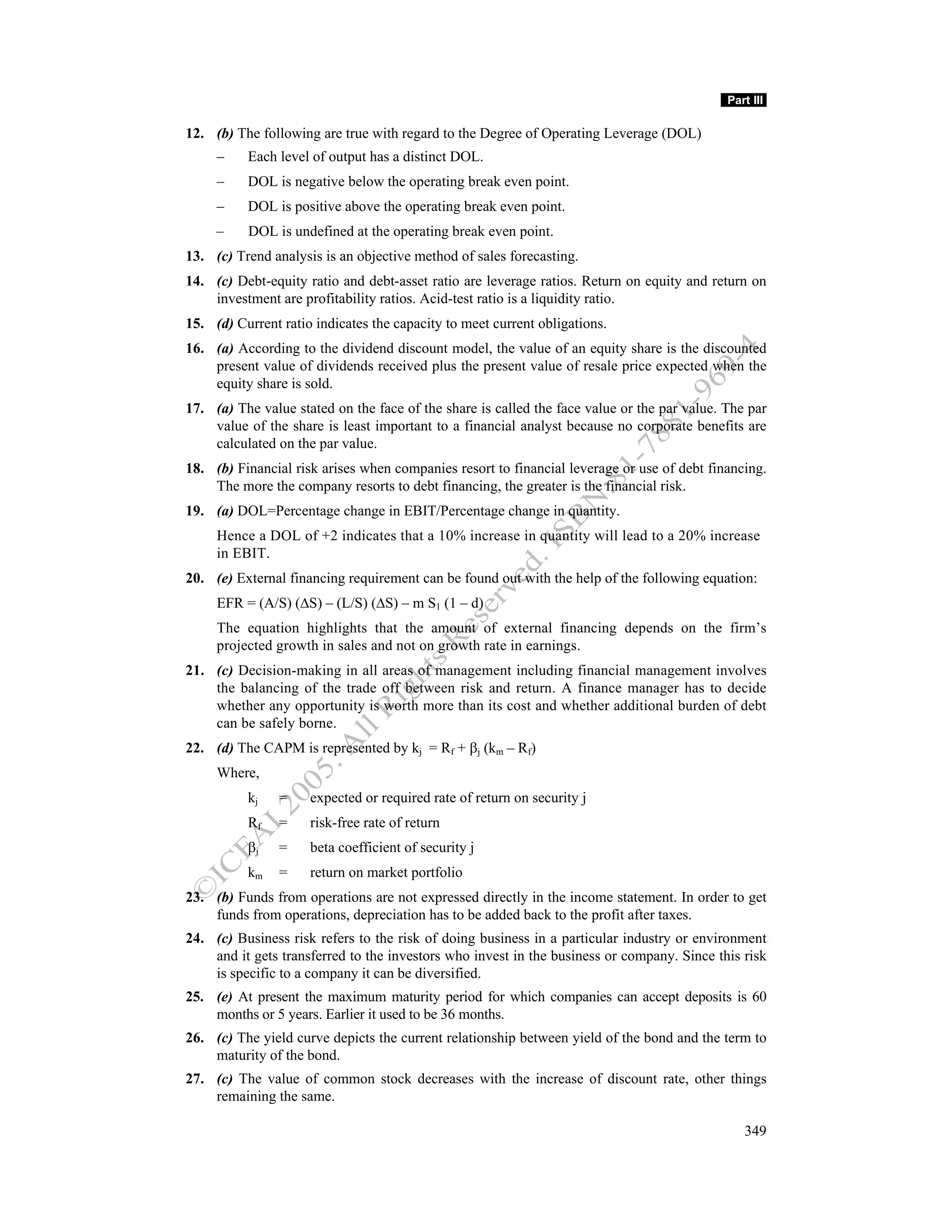

110. The nominal rate of interest is equal to

a. Real Rate + Risk Premium – Inflation

b. Real Rate + Risk Premium + Inflation

c. Real Rate – Risk Premium + Inflation

d. Real Rate – Risk Premium – Inflation

e. Real Rate.

111. The accurate doubling period n given a rate of return R can be calculated by

a. (1 + R)n = 2

b. 72/R

c. 0.35 + 69/R

d. All of the above

e. None of the above

112. The inverse of sinking fund factor is given by

1 − (1+ k) n

a.

k

1

b. − (1+ k) n

k

(1+ k) n 1

c. −

k k

k

d.

(1+ k) n − 1

(1+ k) n − 1

e. .

k

113. If P = principal amount, i = interest rate per annum, m = frequency of compounding per year,

n = number of years and A = accumulation at the end of the year n, then which of the

following expressions is correct?

mn

a. A = P(1 + i/n)

mn

b. P = A(1 + i/m)

m n

c. A = [P(1 + i/m) ]

mn

d. A = P(1 + i/m)

e. None of the above.

114. If ‘k’ is the rate of interest and ‘n’ the number of years, then the capital recovery factor is

given as

k(1+ k) n

a.

(1+ k) n − 1

(1+ k) n (k)

b.

(1+ k) n +1

(1+ k) n − 1

c.

k(1+ k) n

(1+ k) n (1+ k)

d.

(1+ k) n (k)

(1+ k) k (n)

e. .

(1+ k) n − 1

26](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-31-2048.jpg)

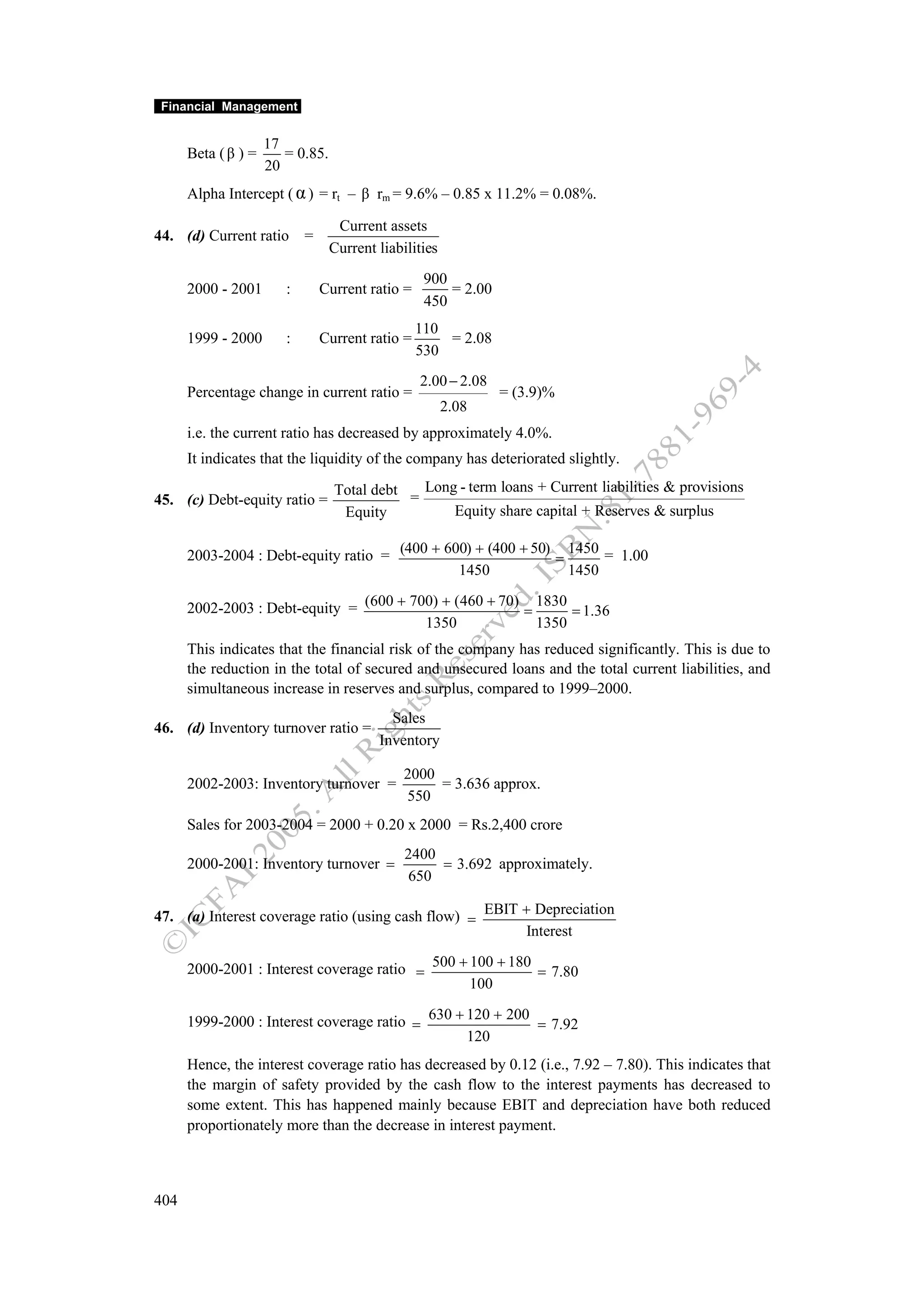

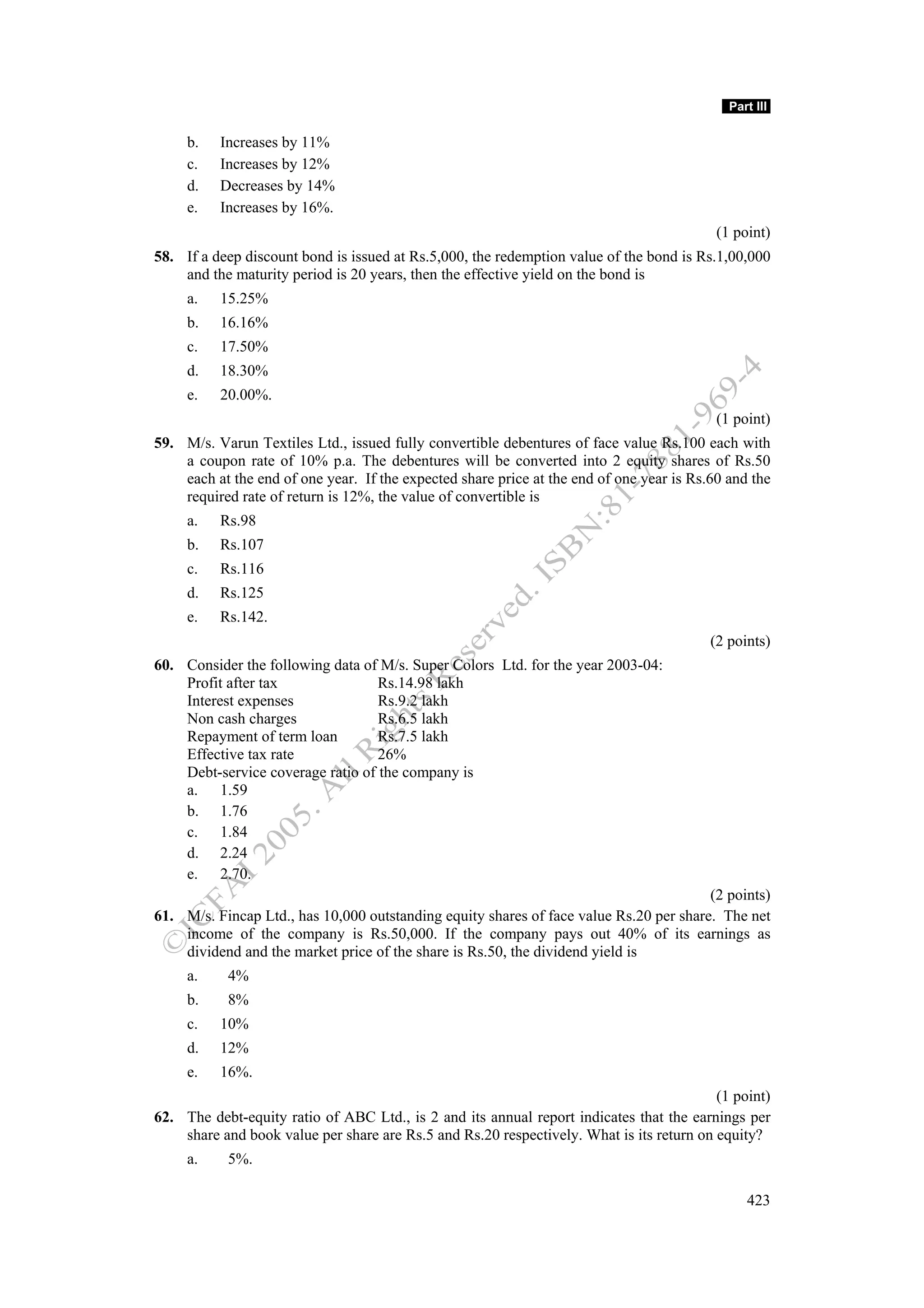

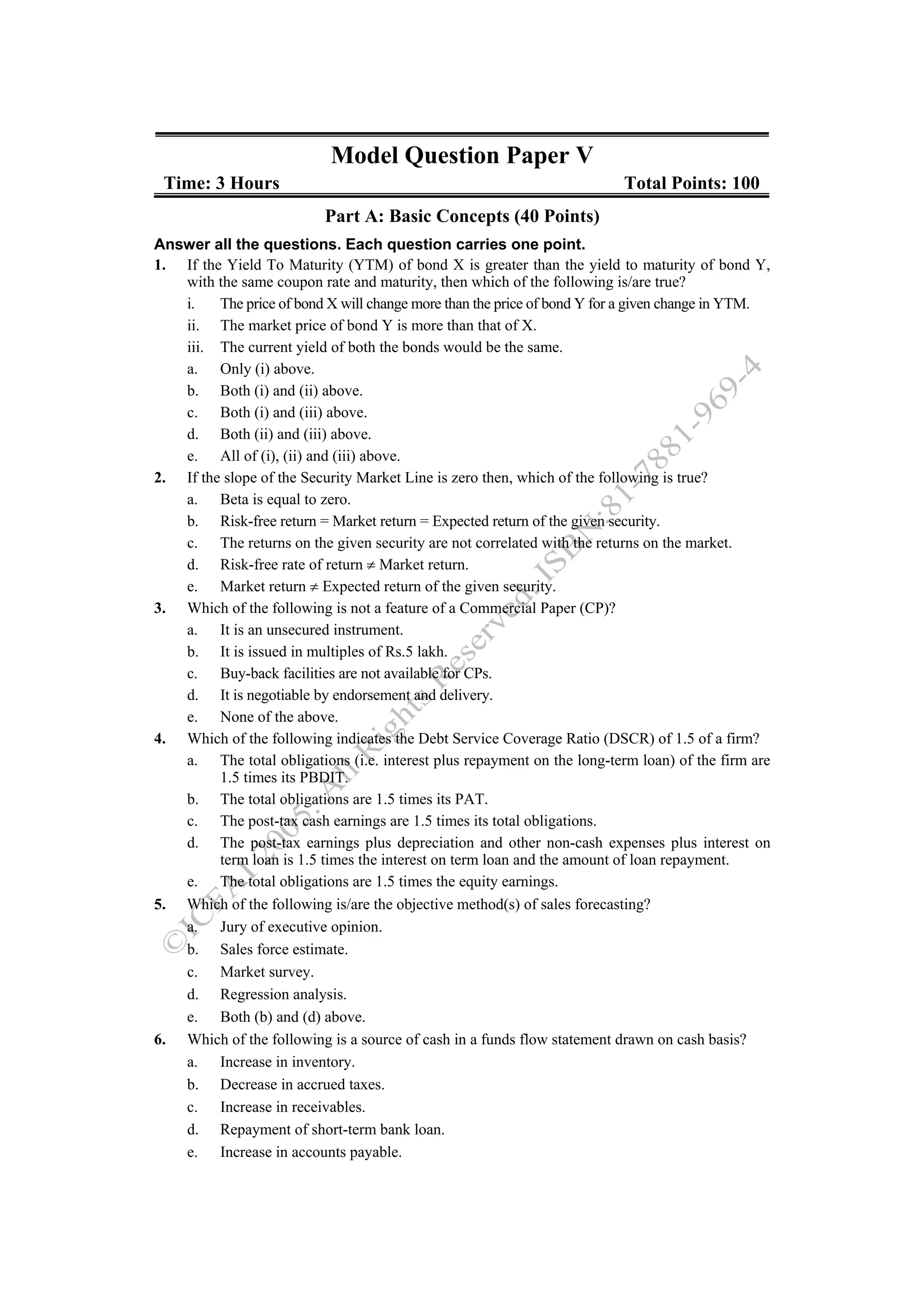

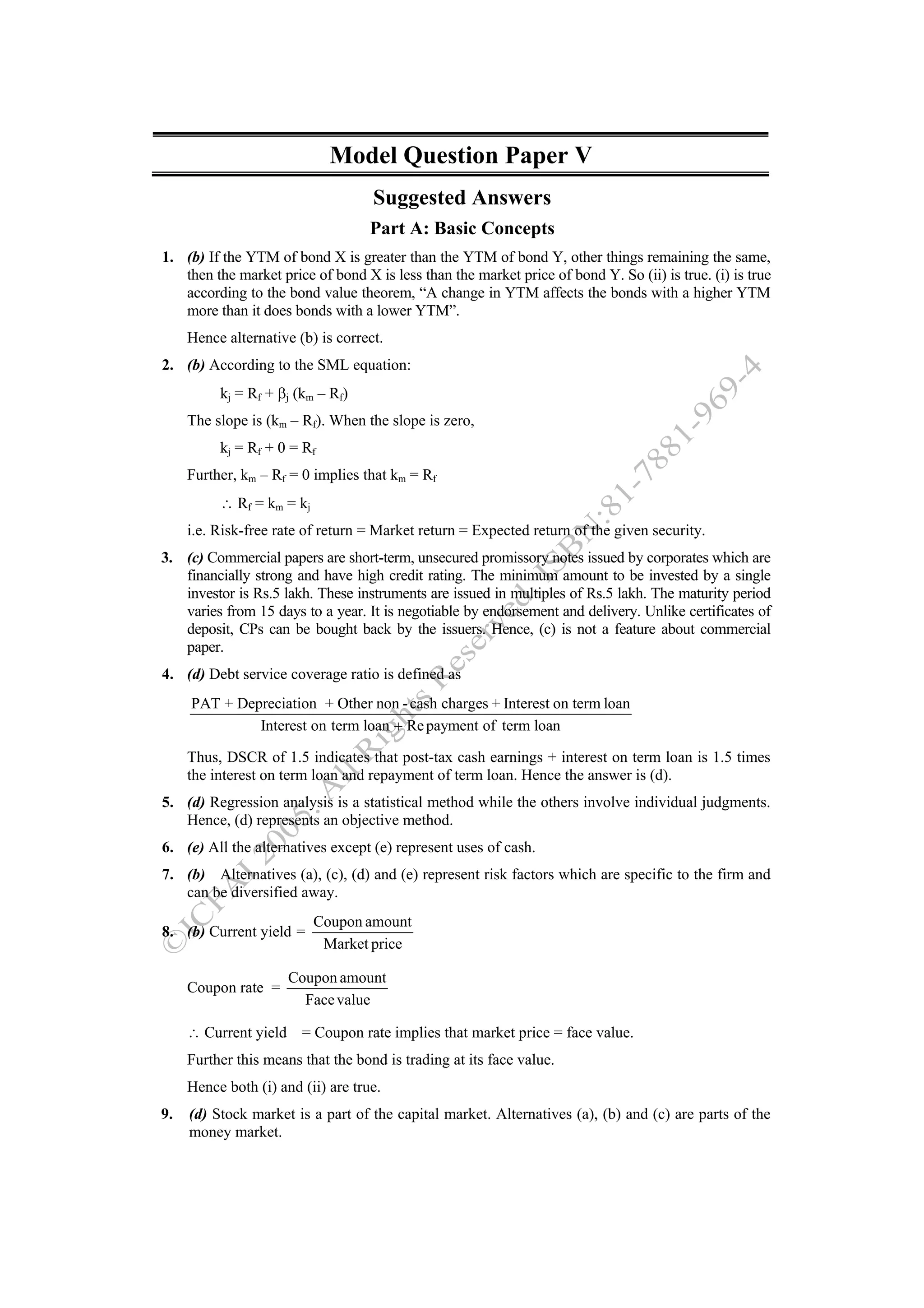

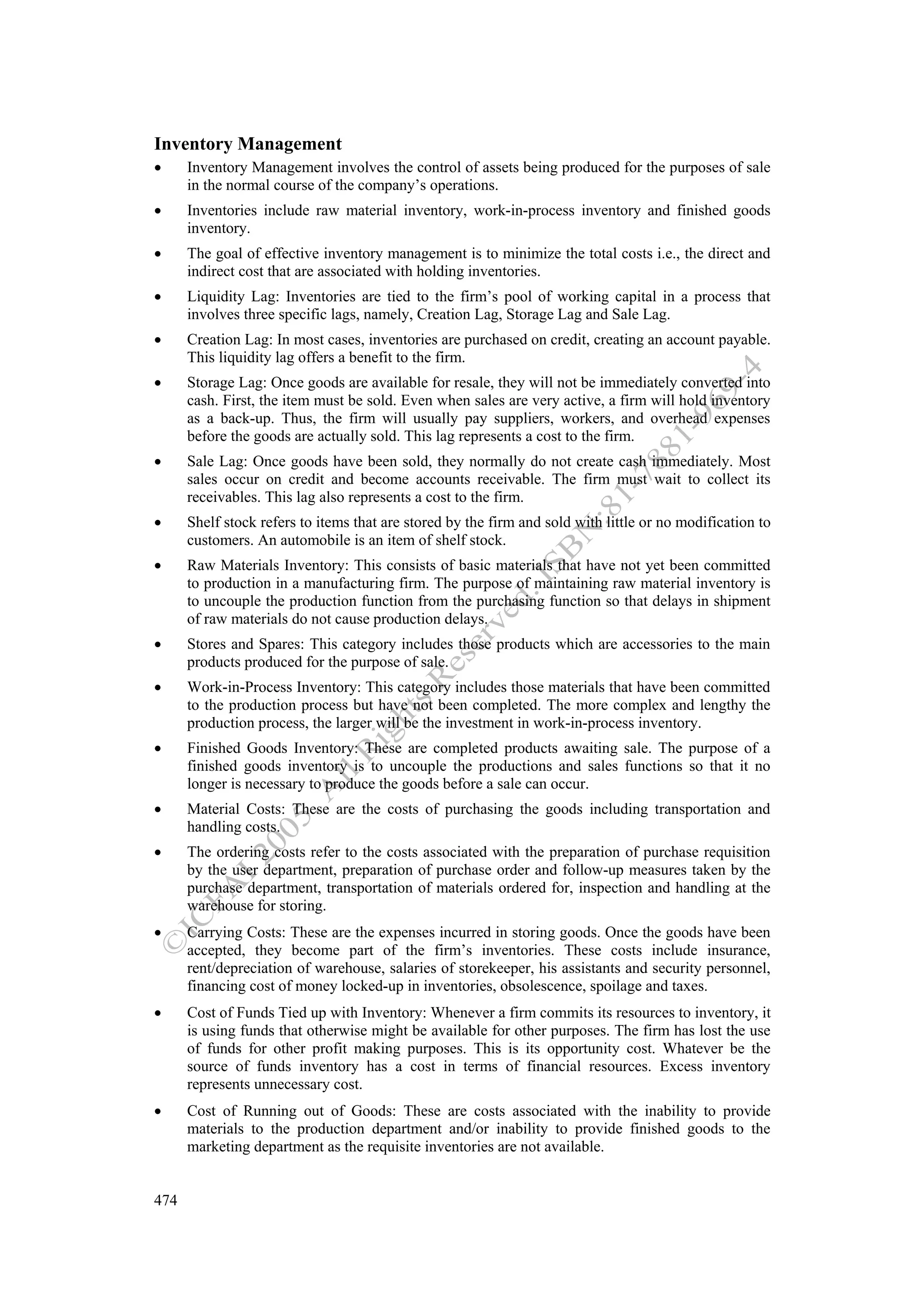

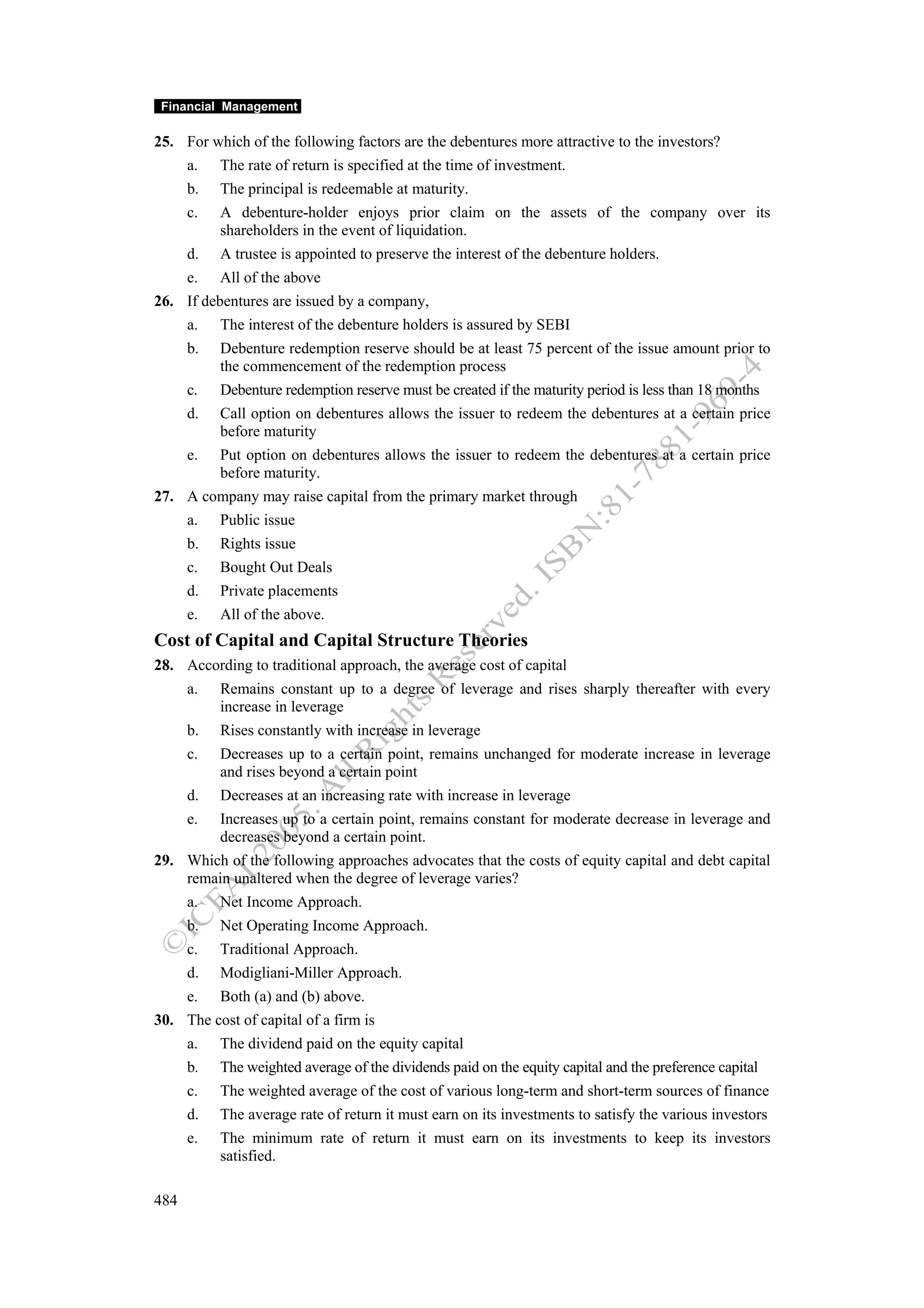

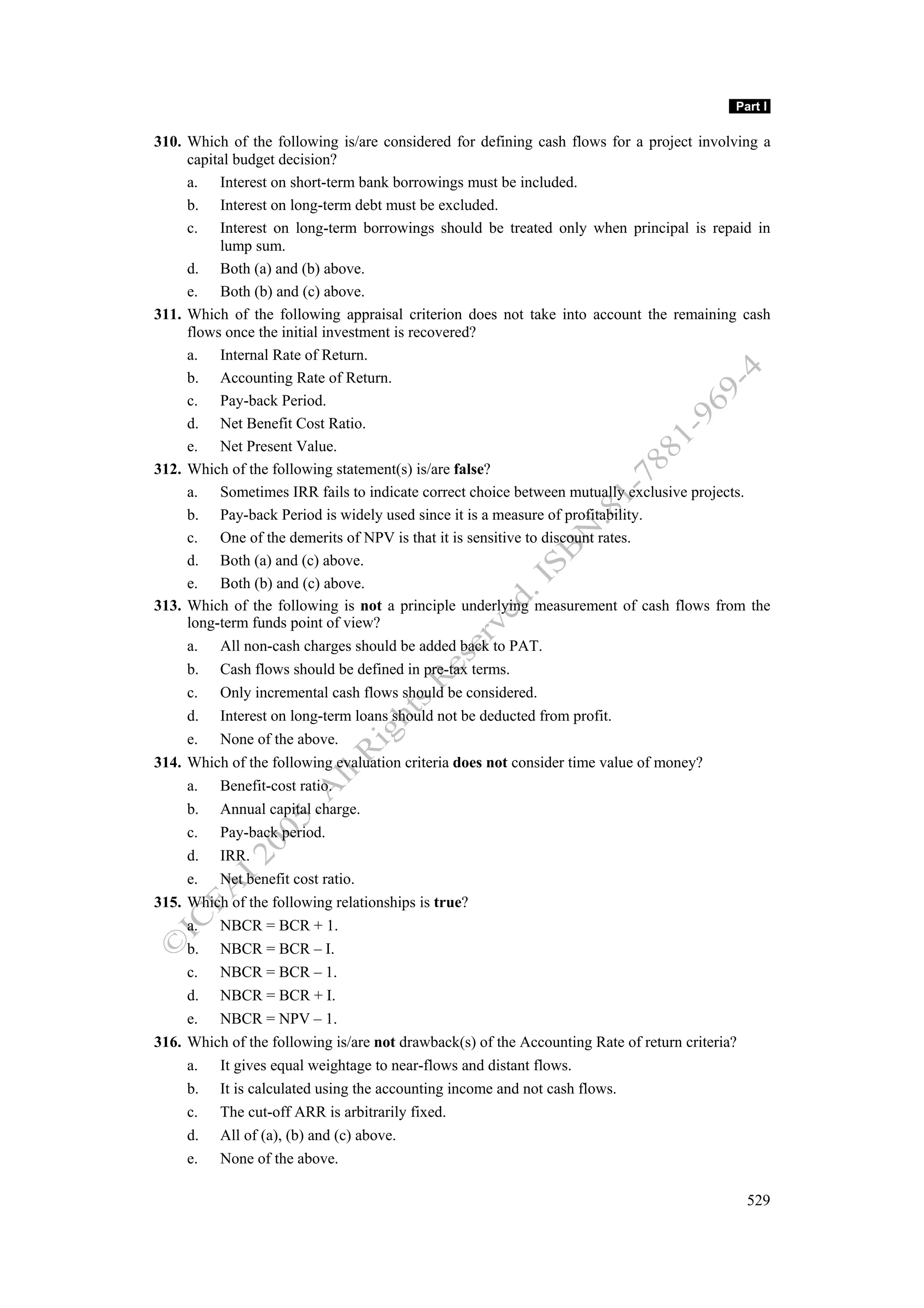

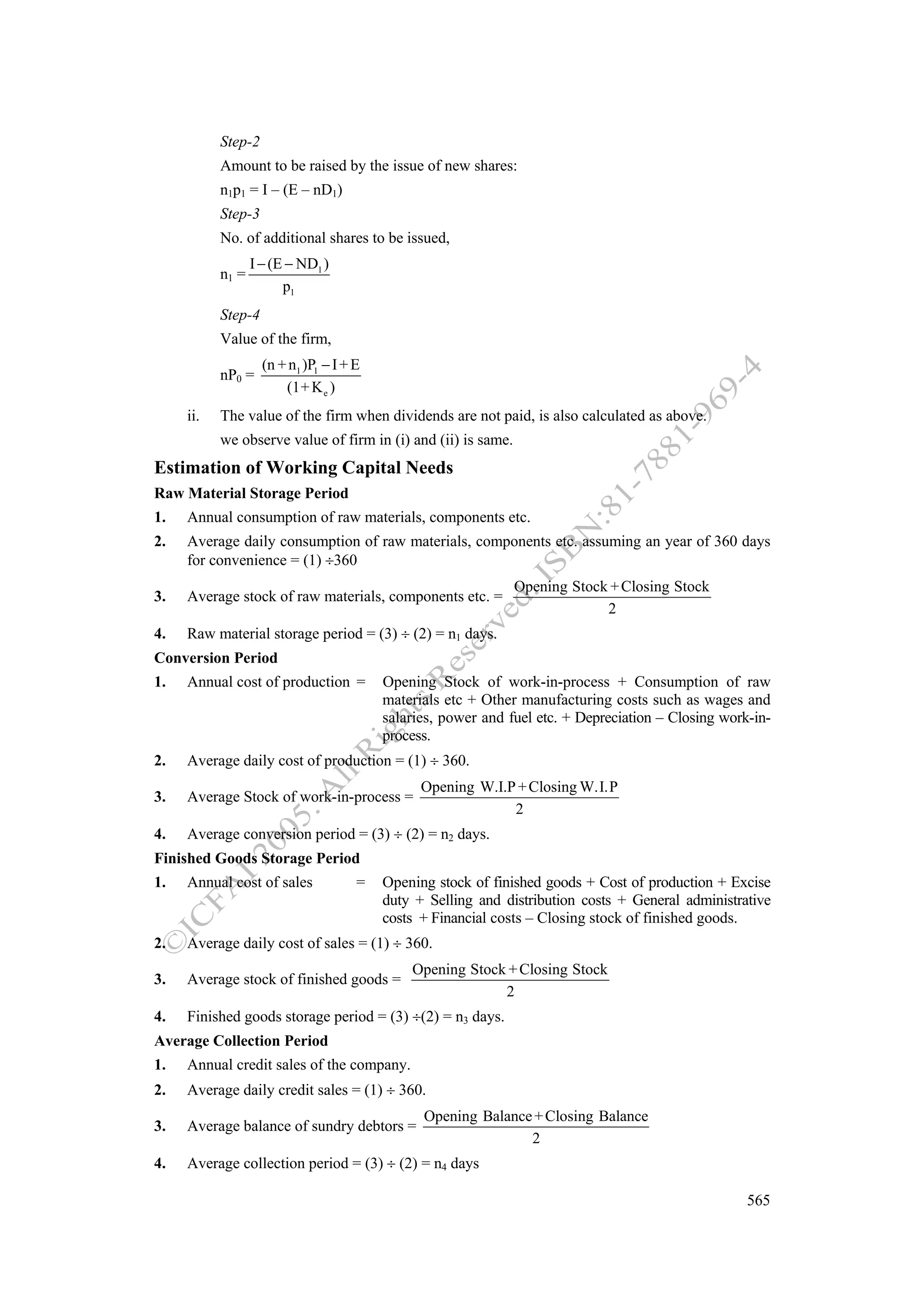

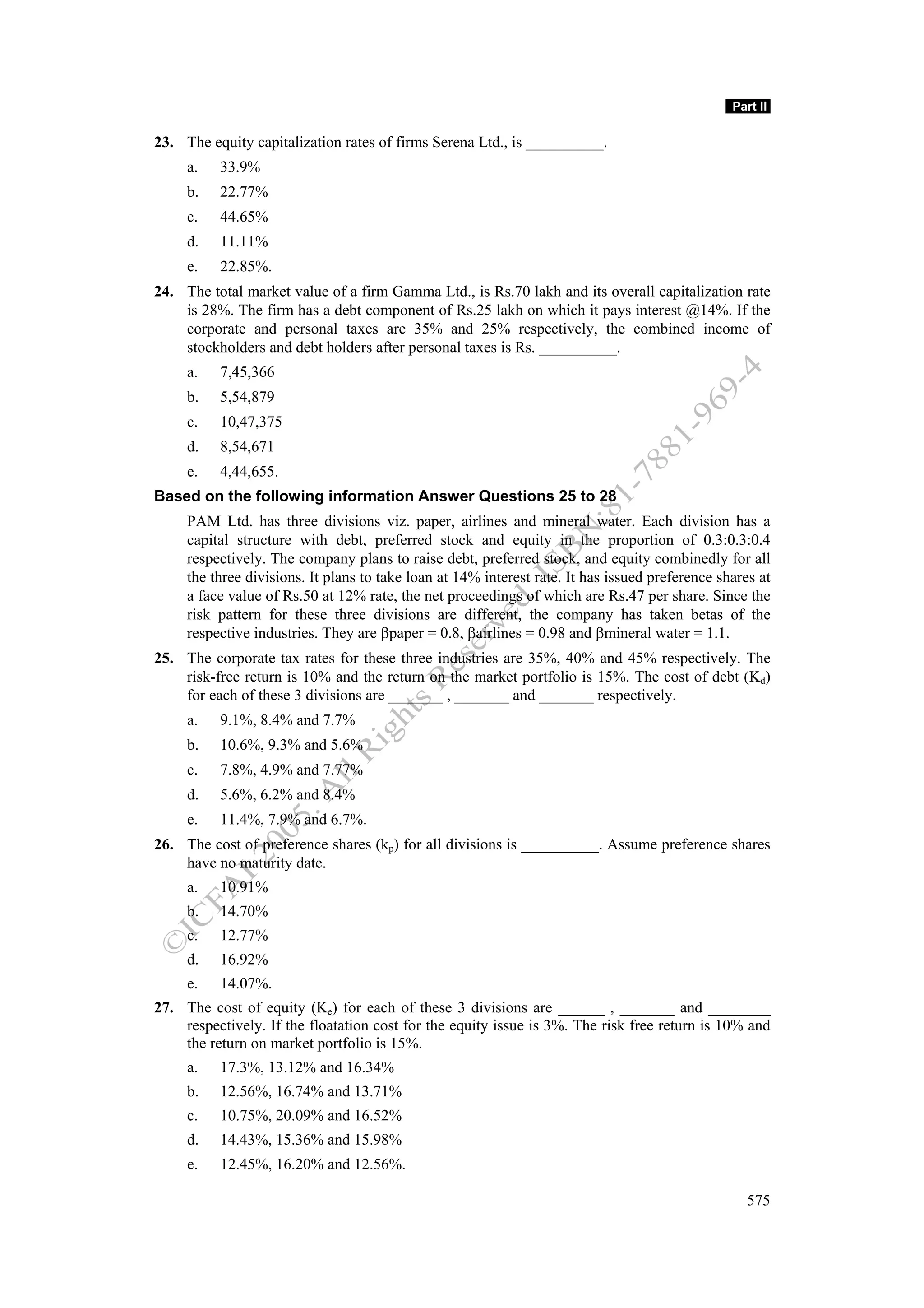

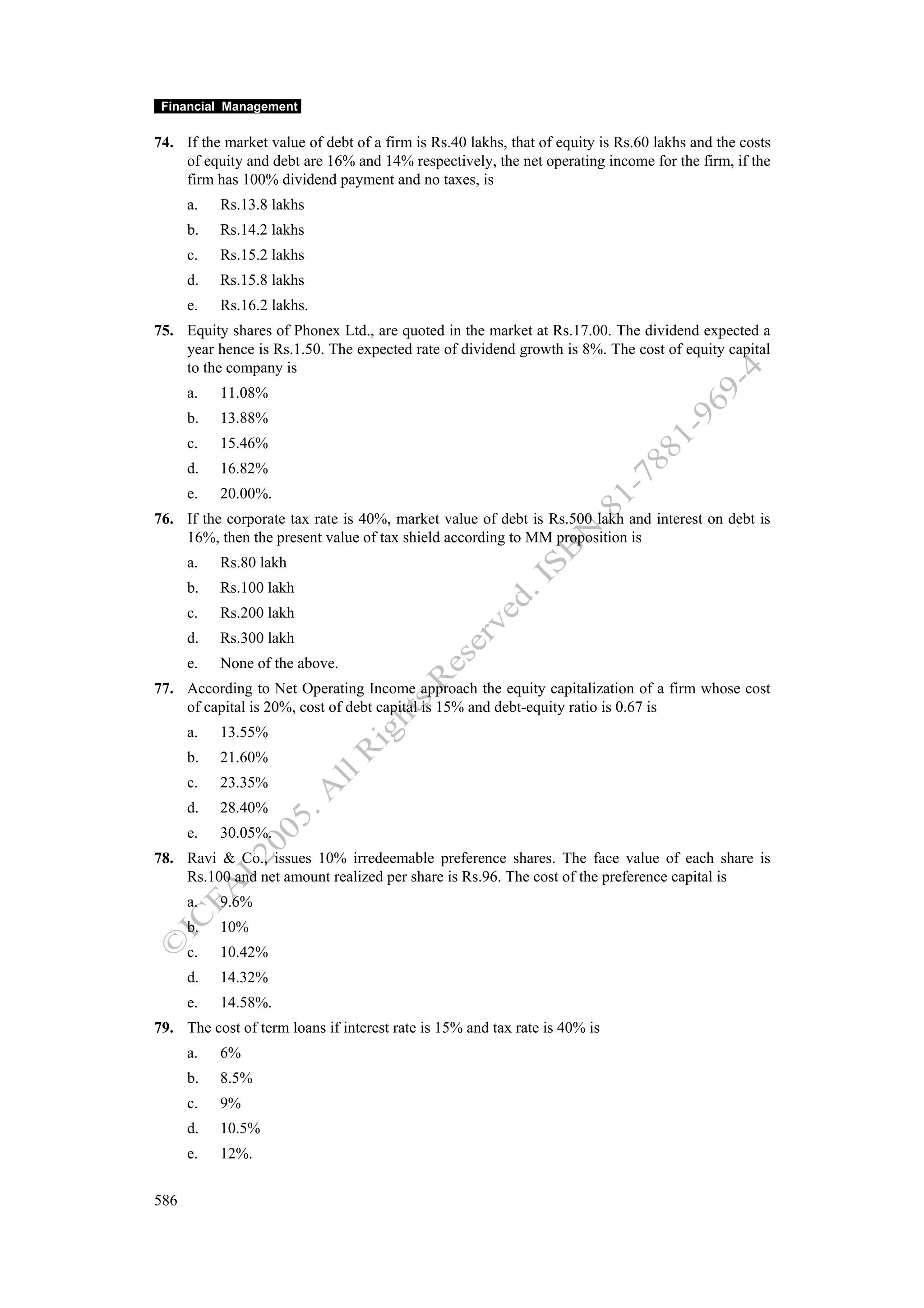

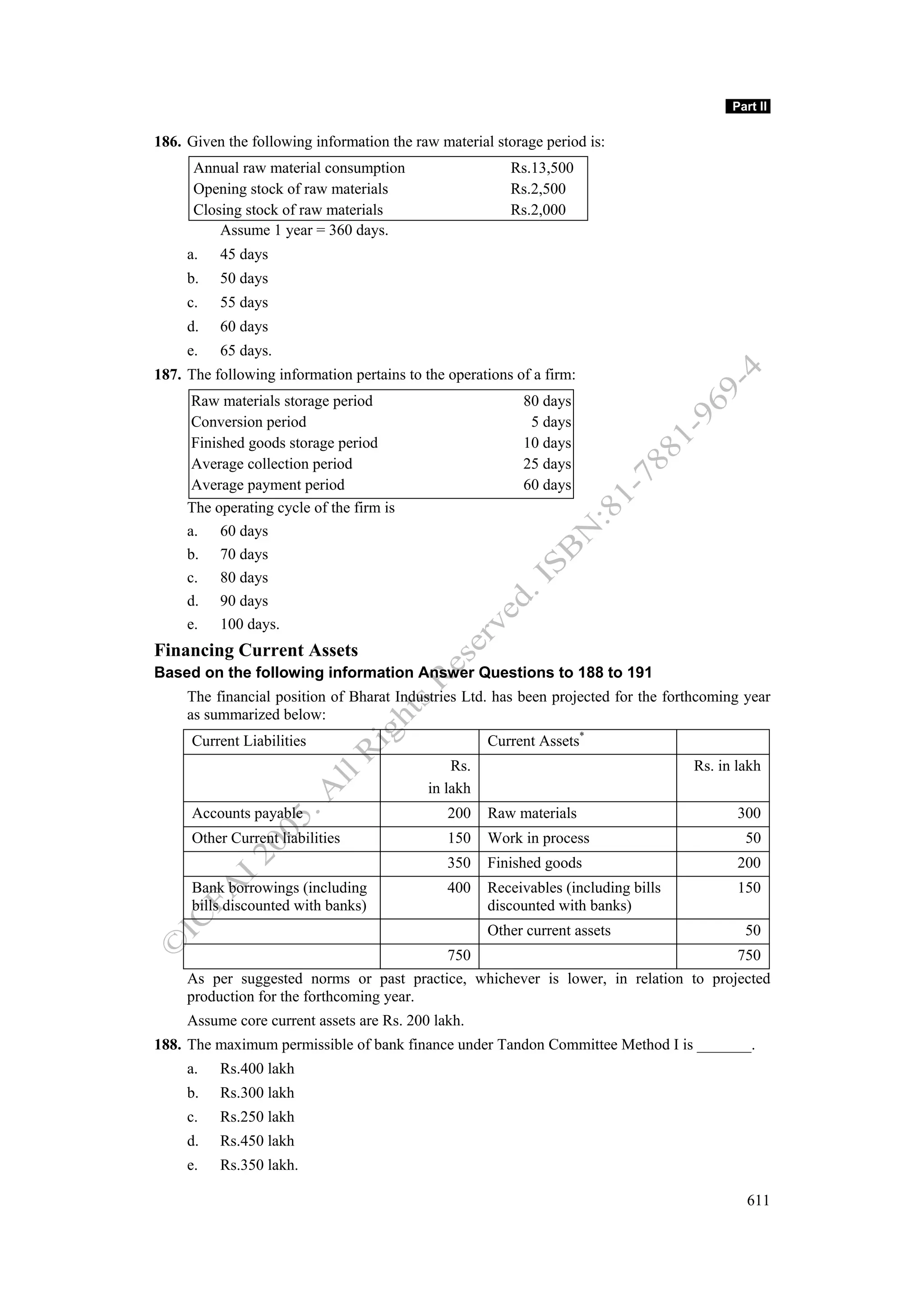

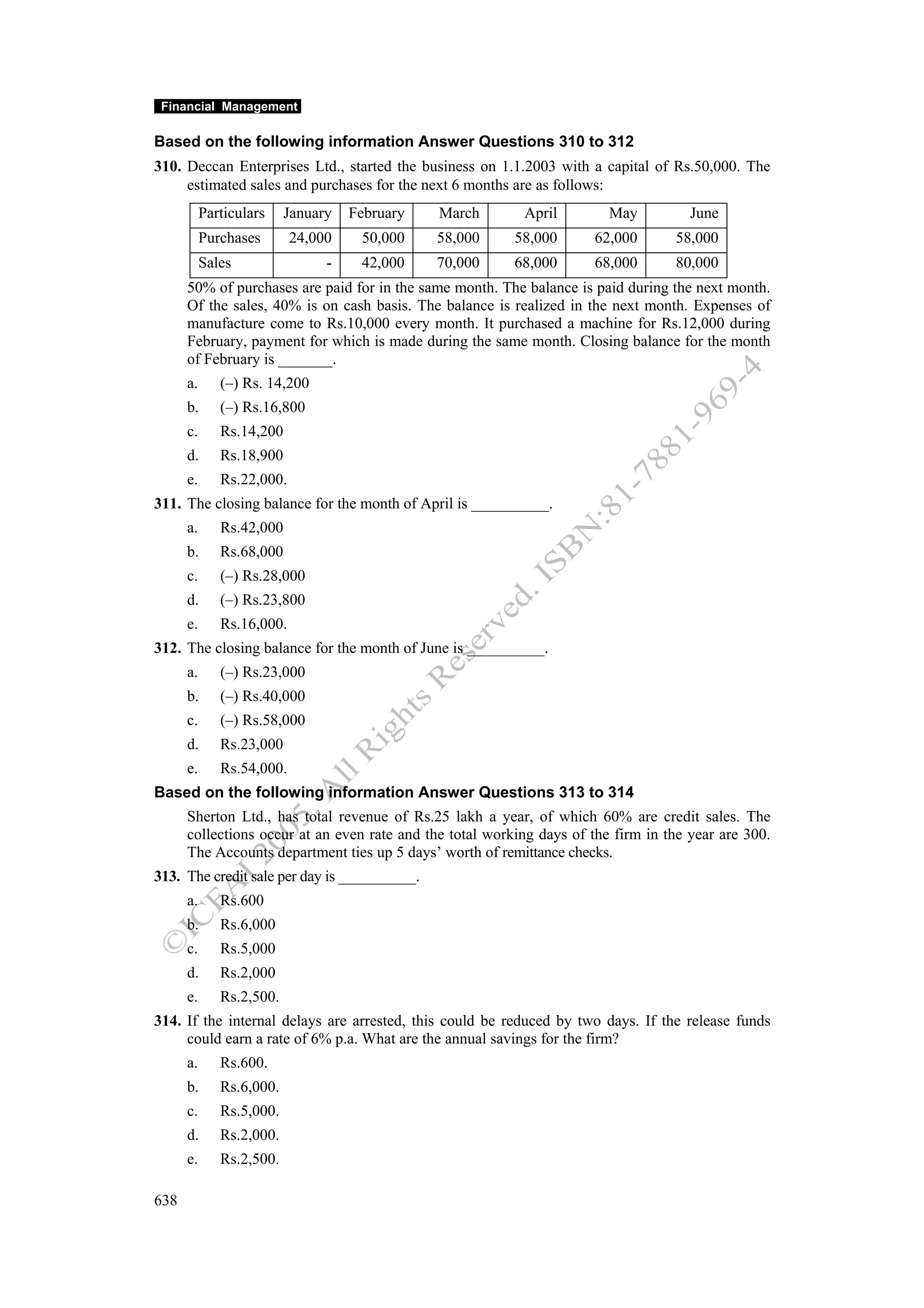

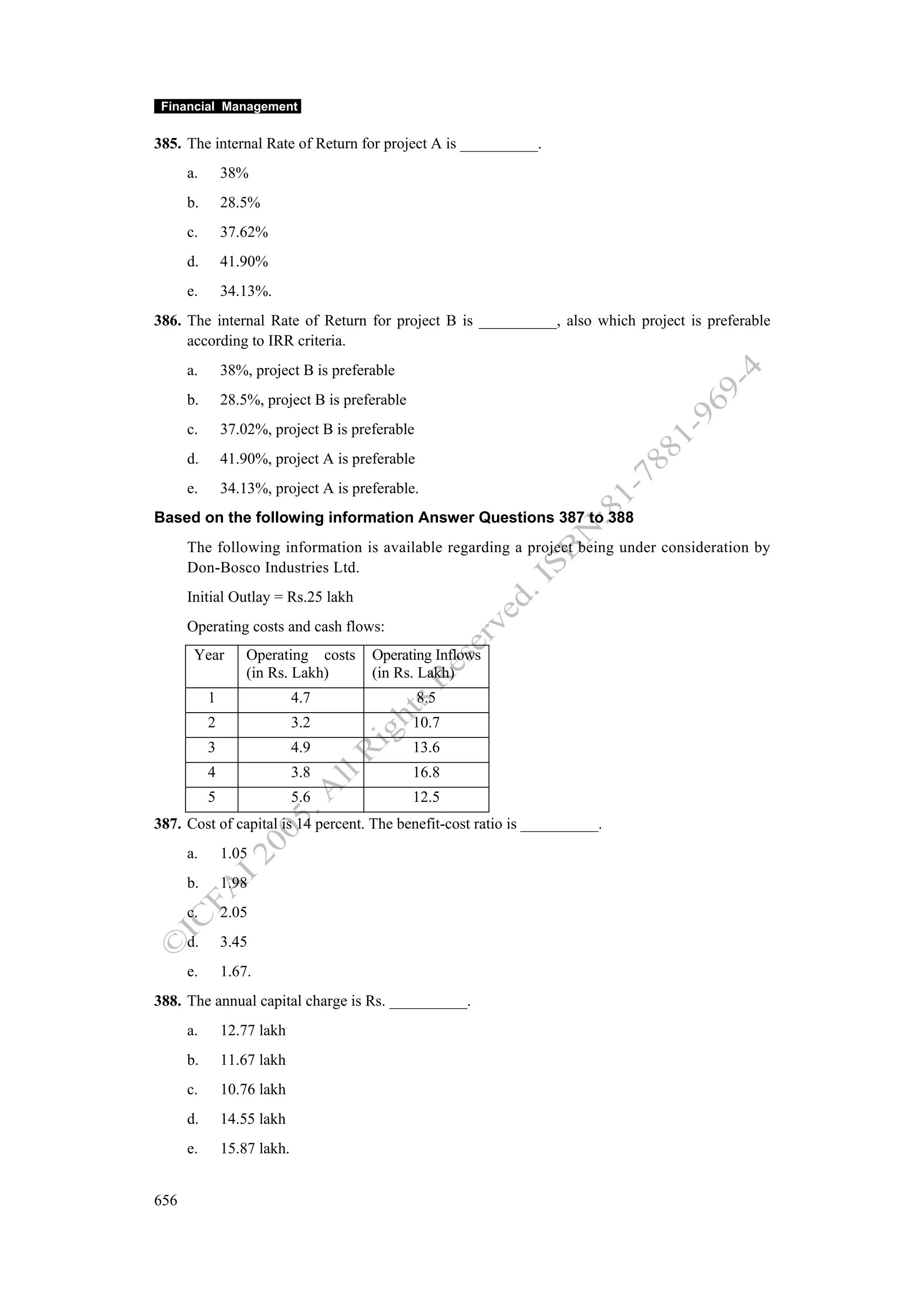

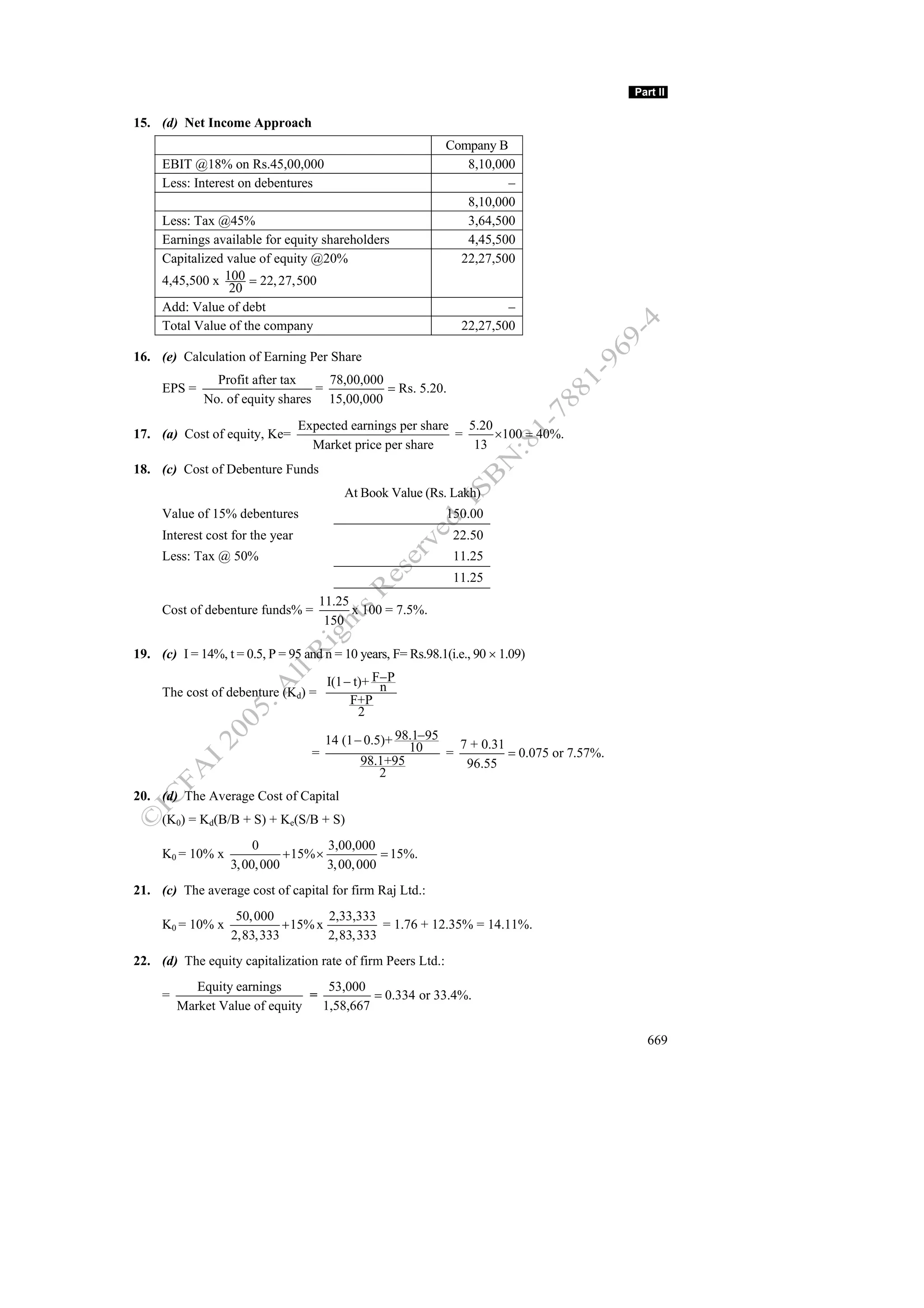

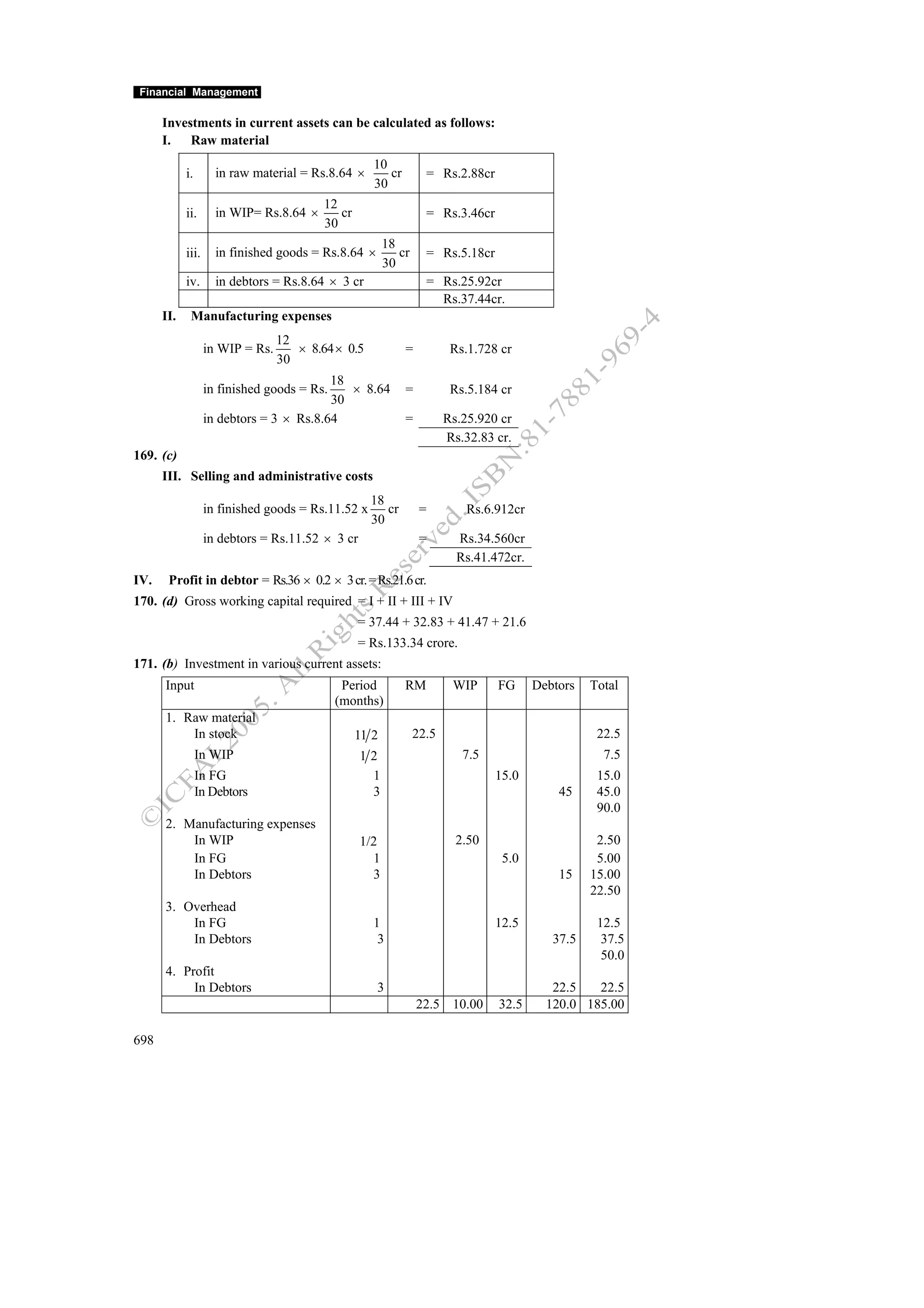

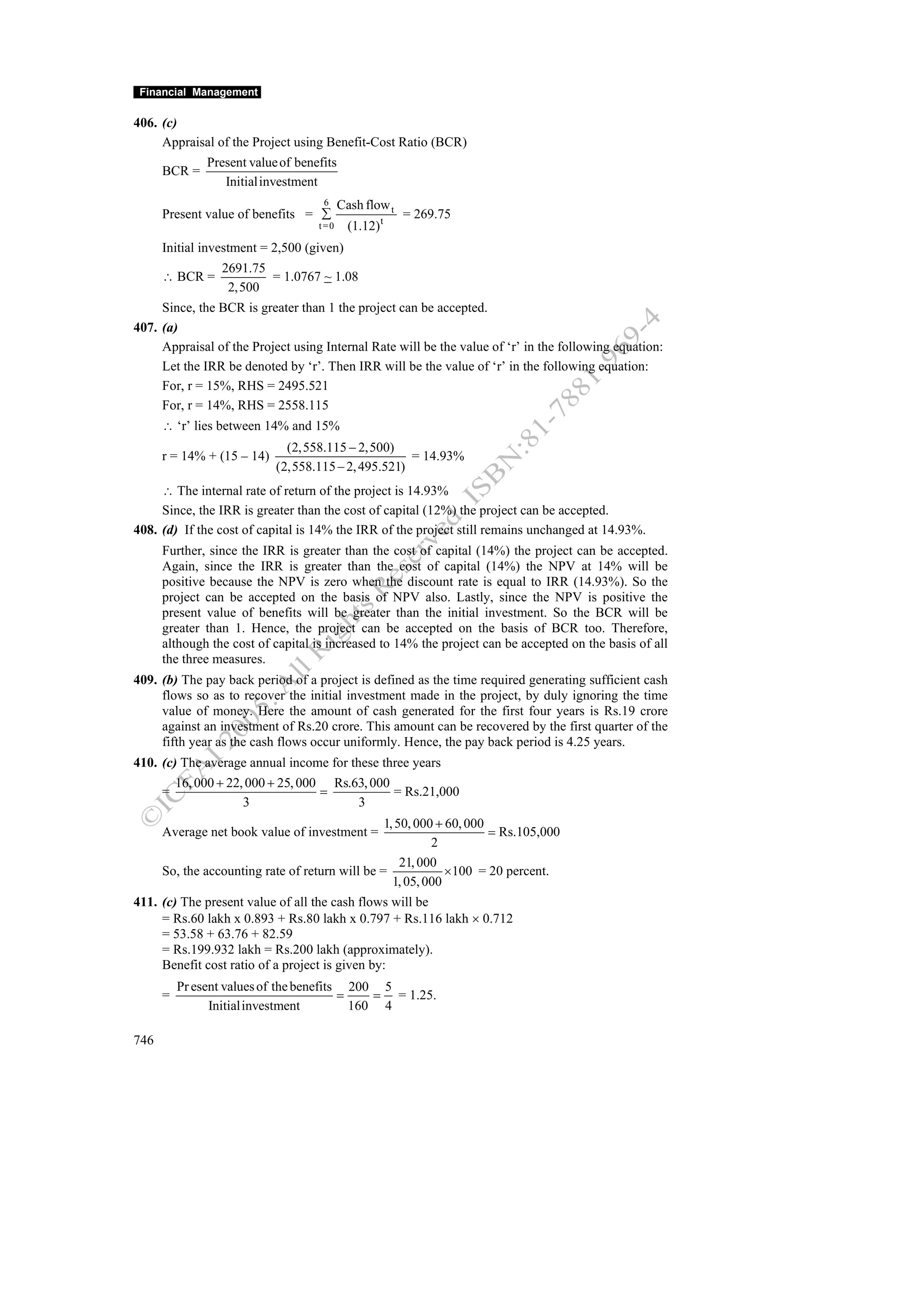

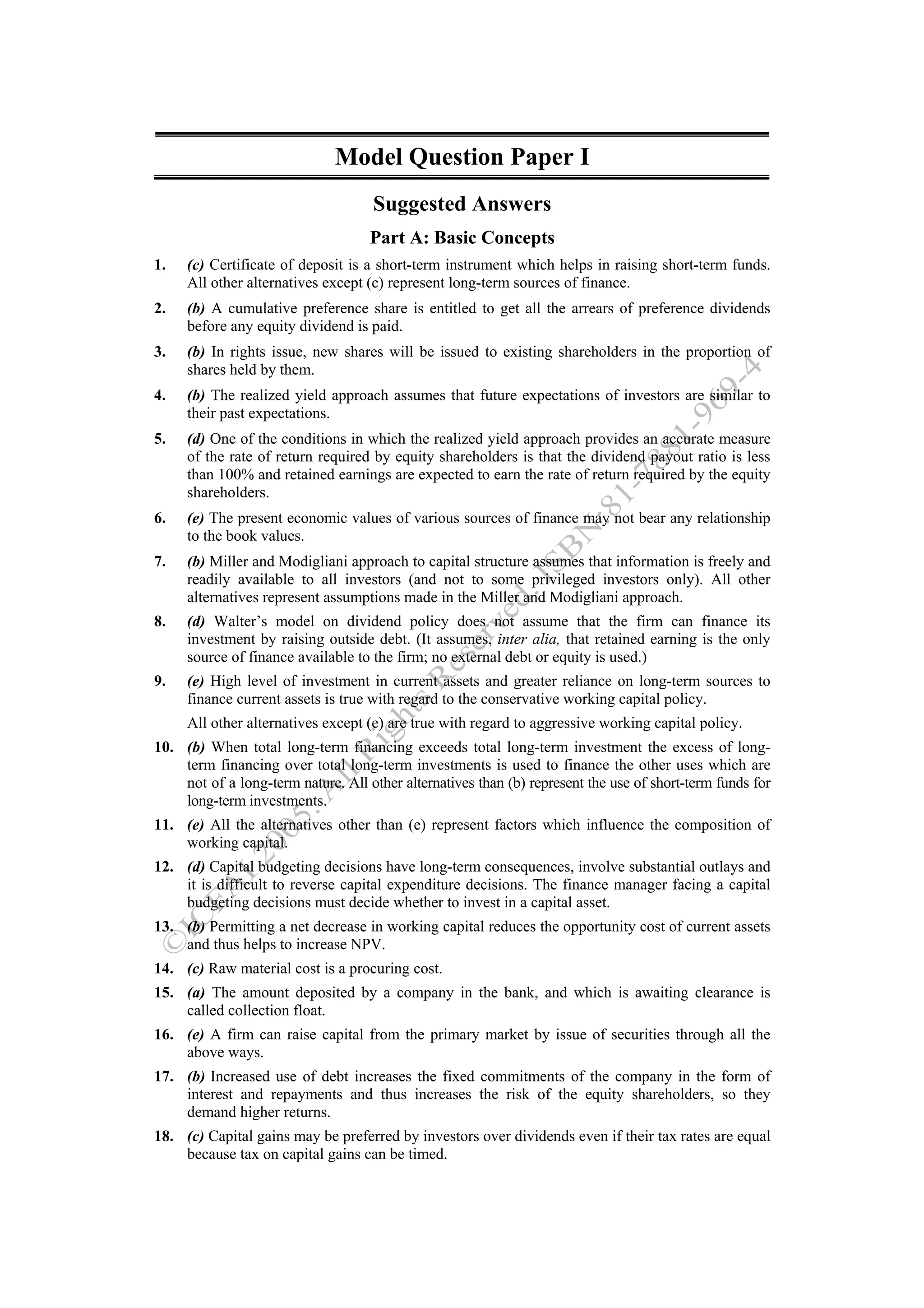

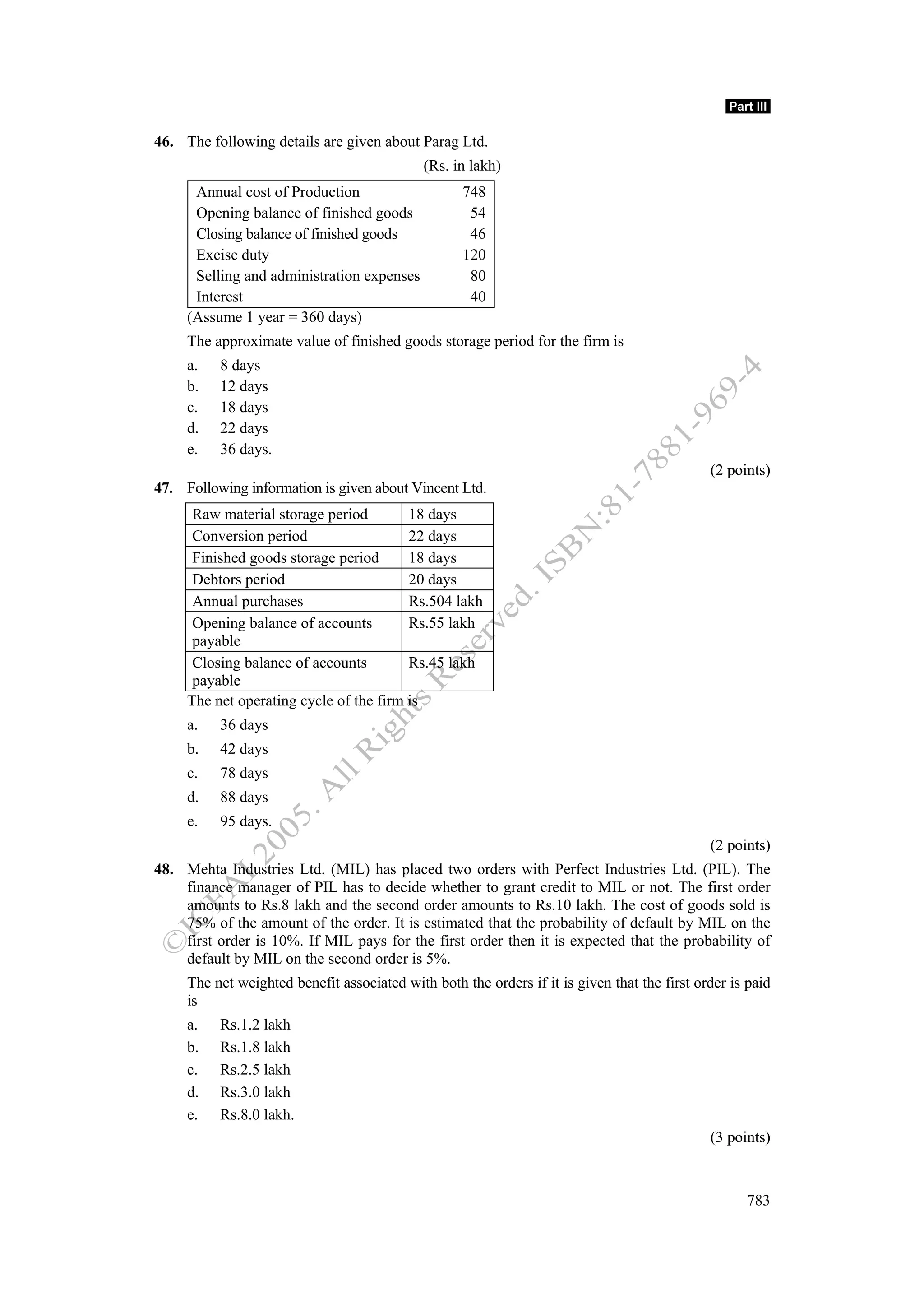

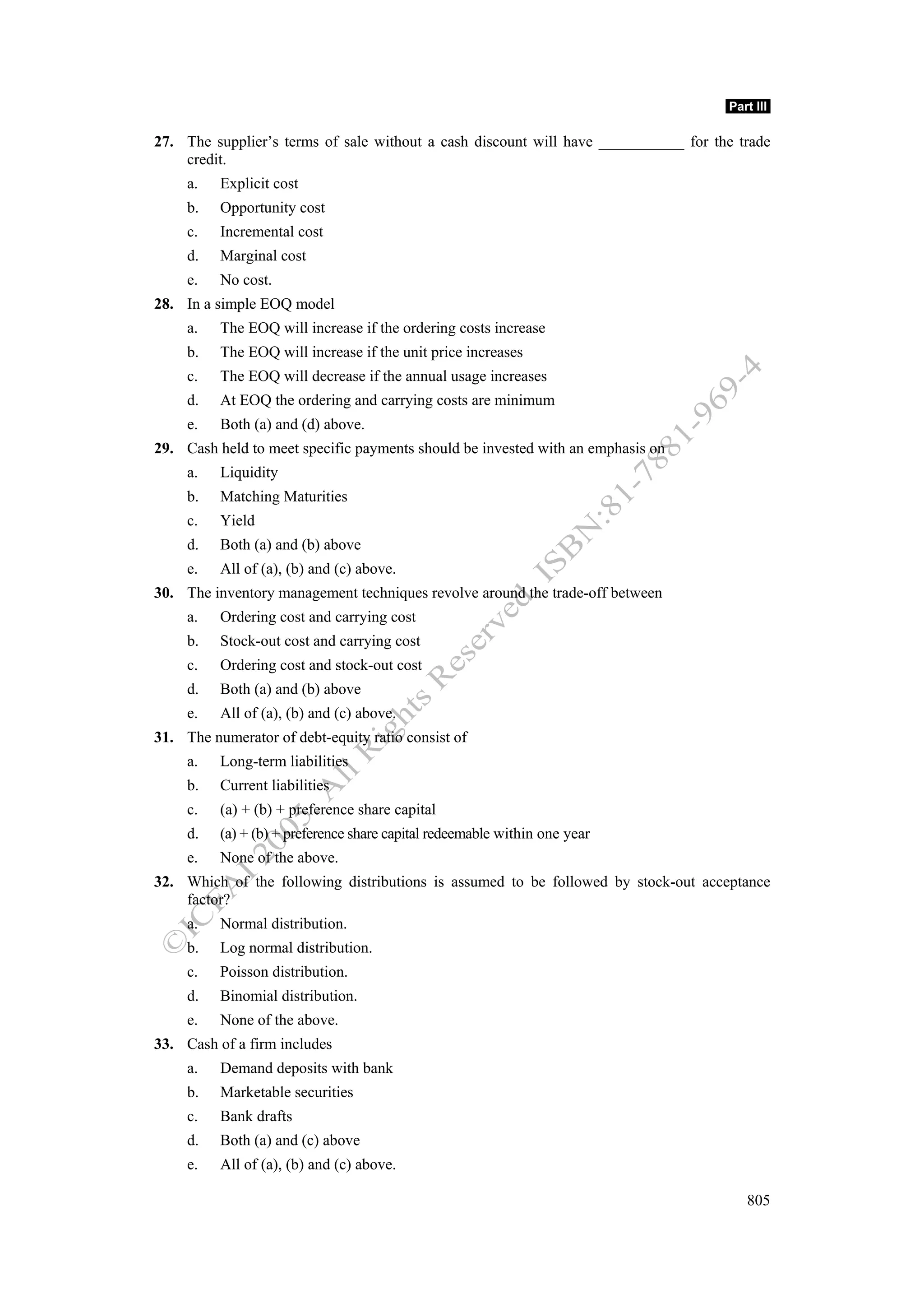

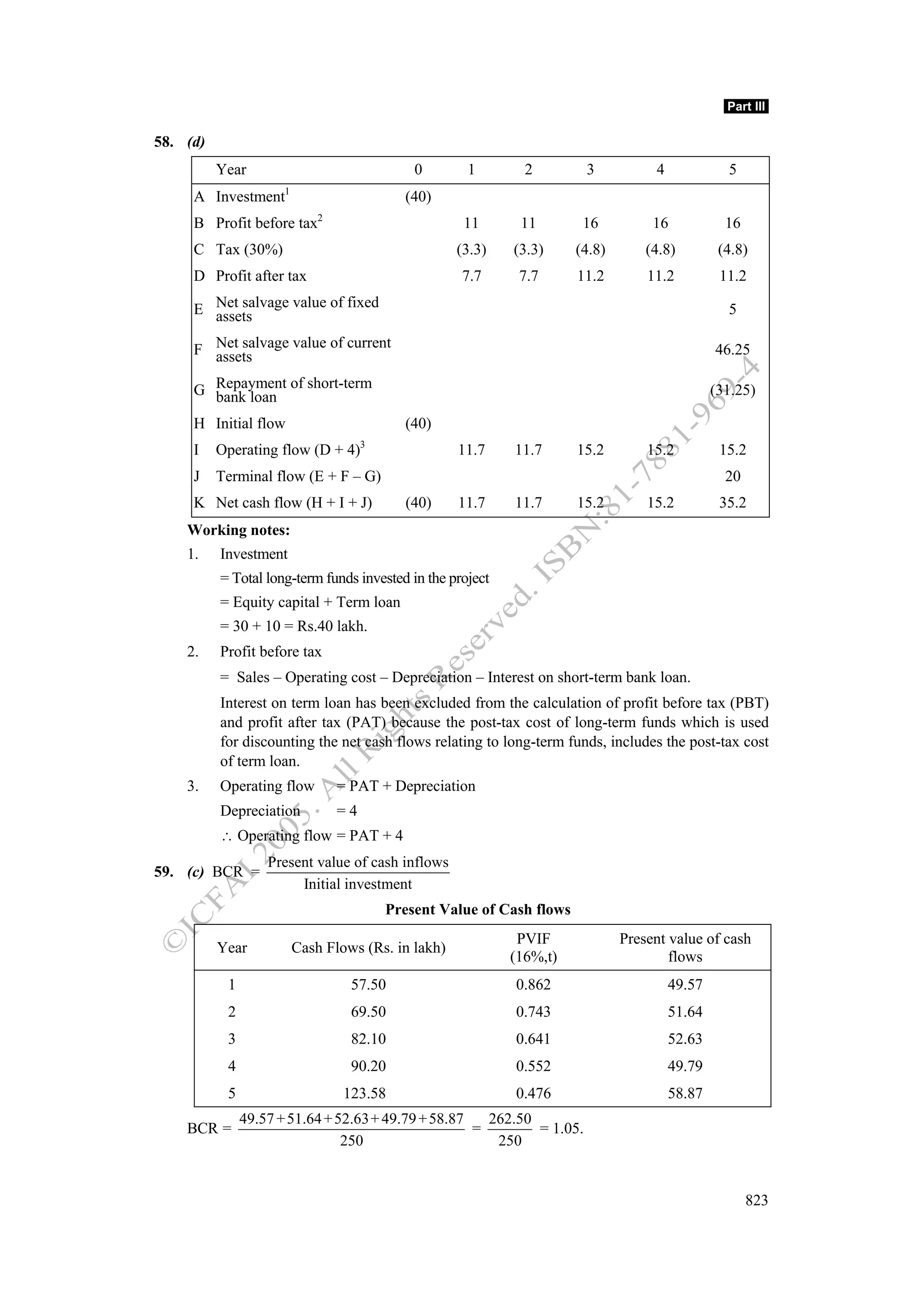

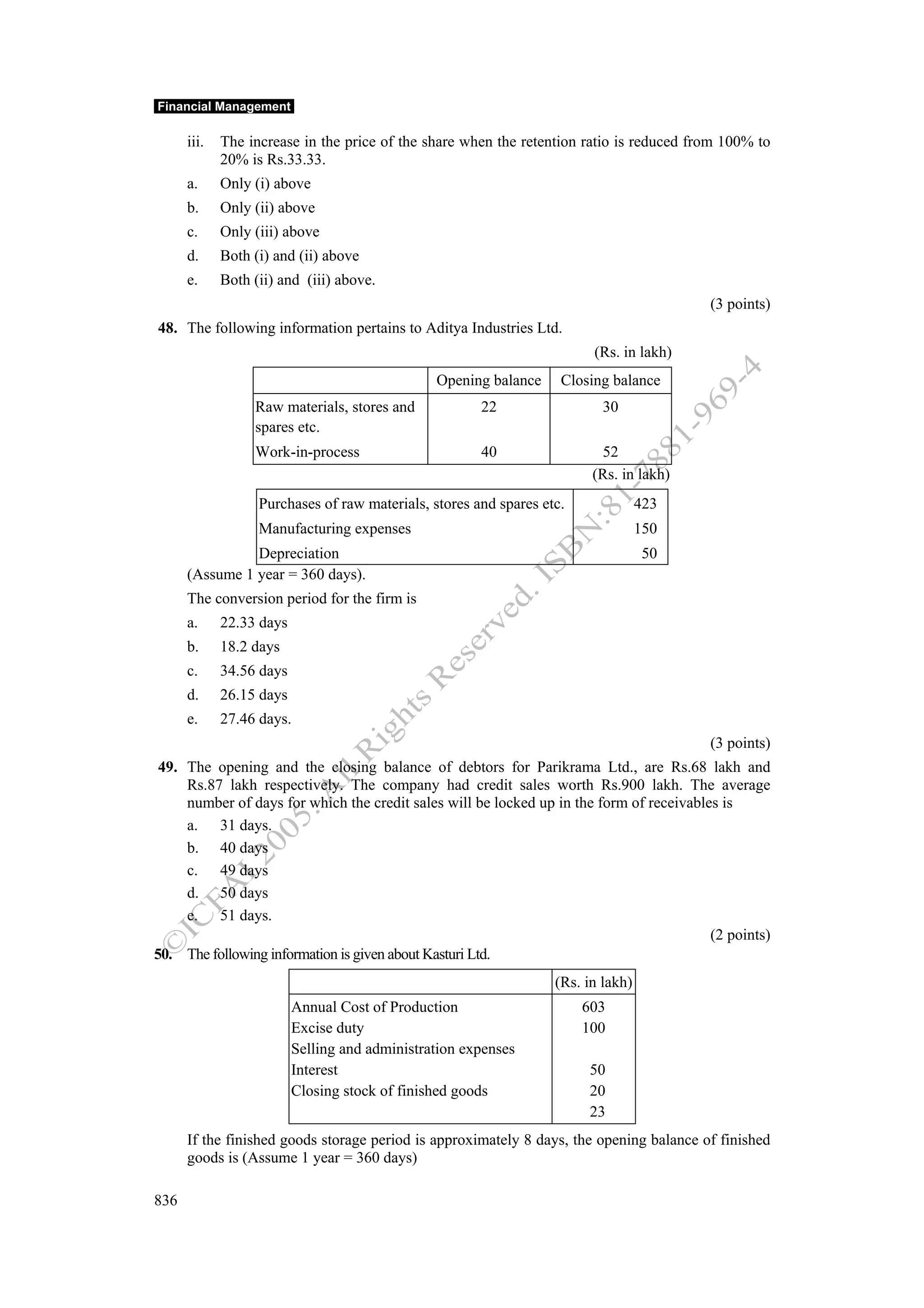

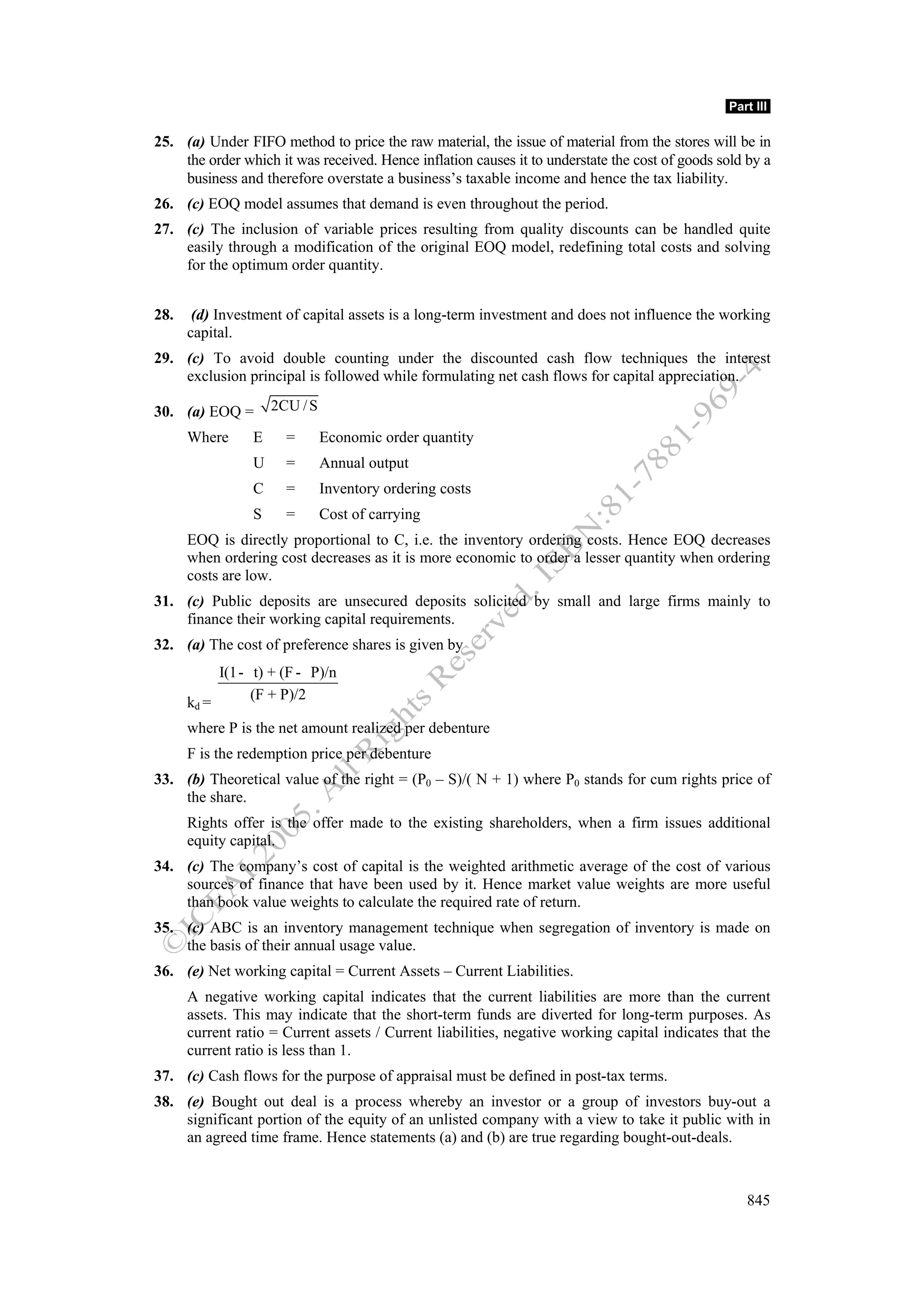

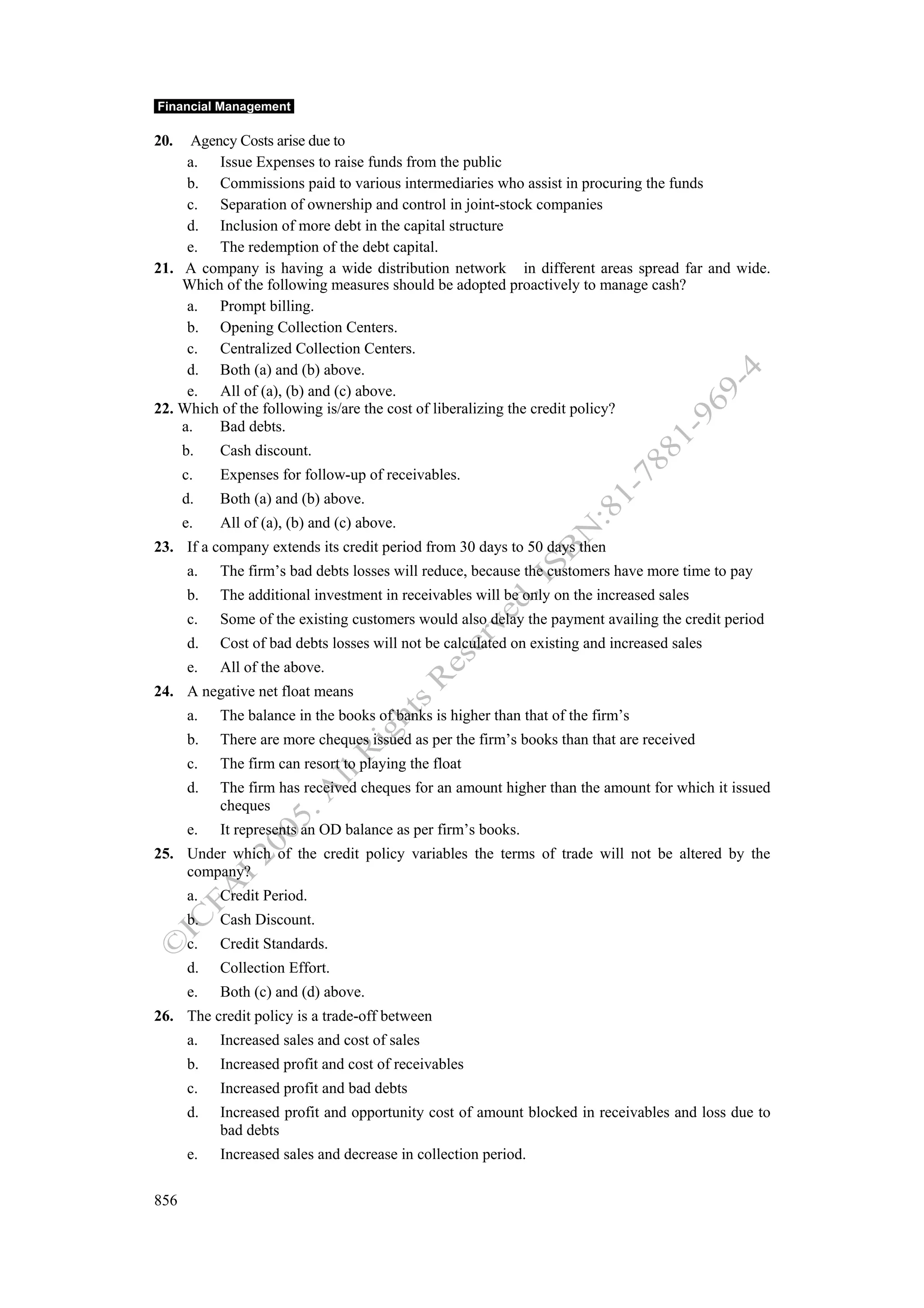

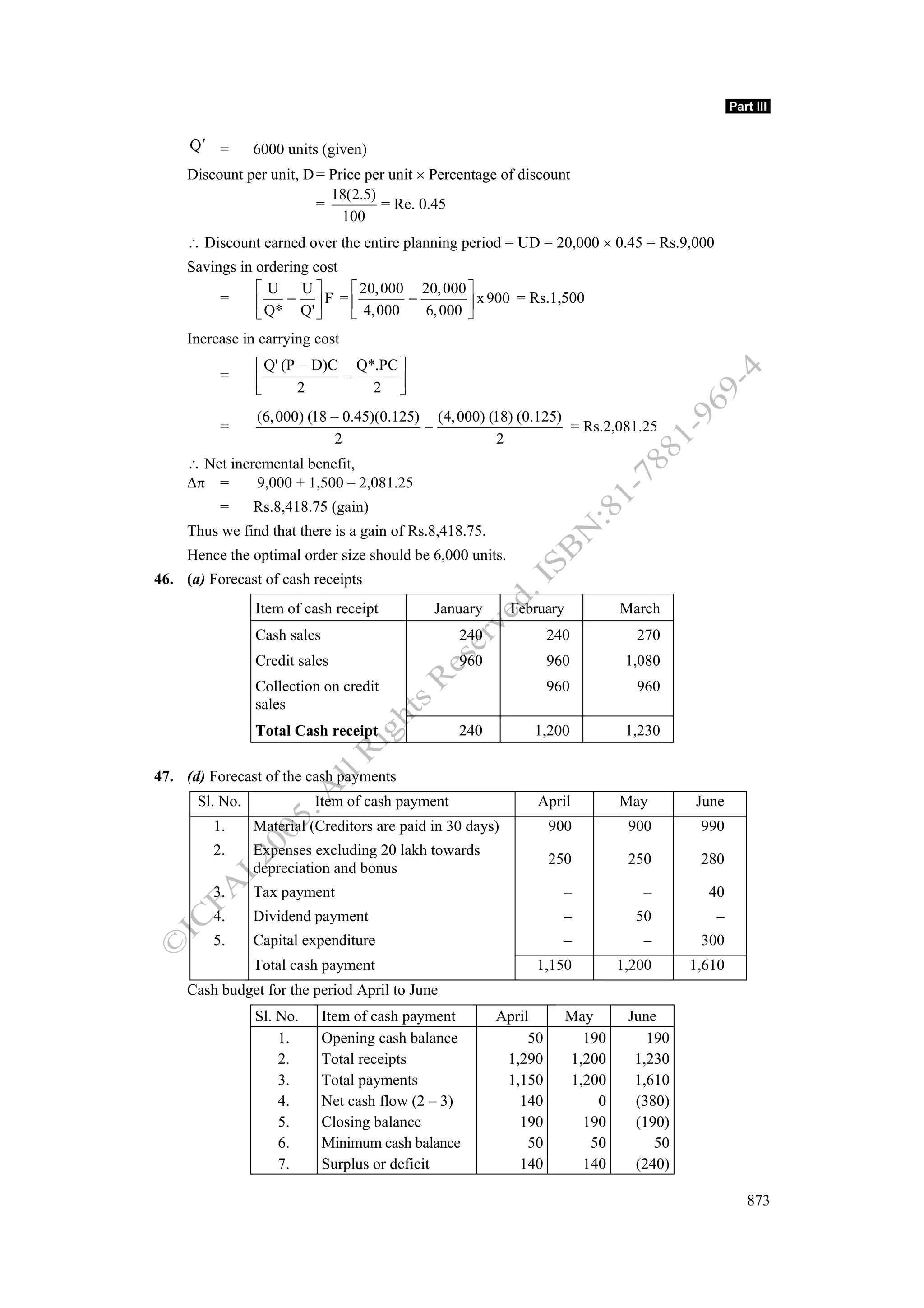

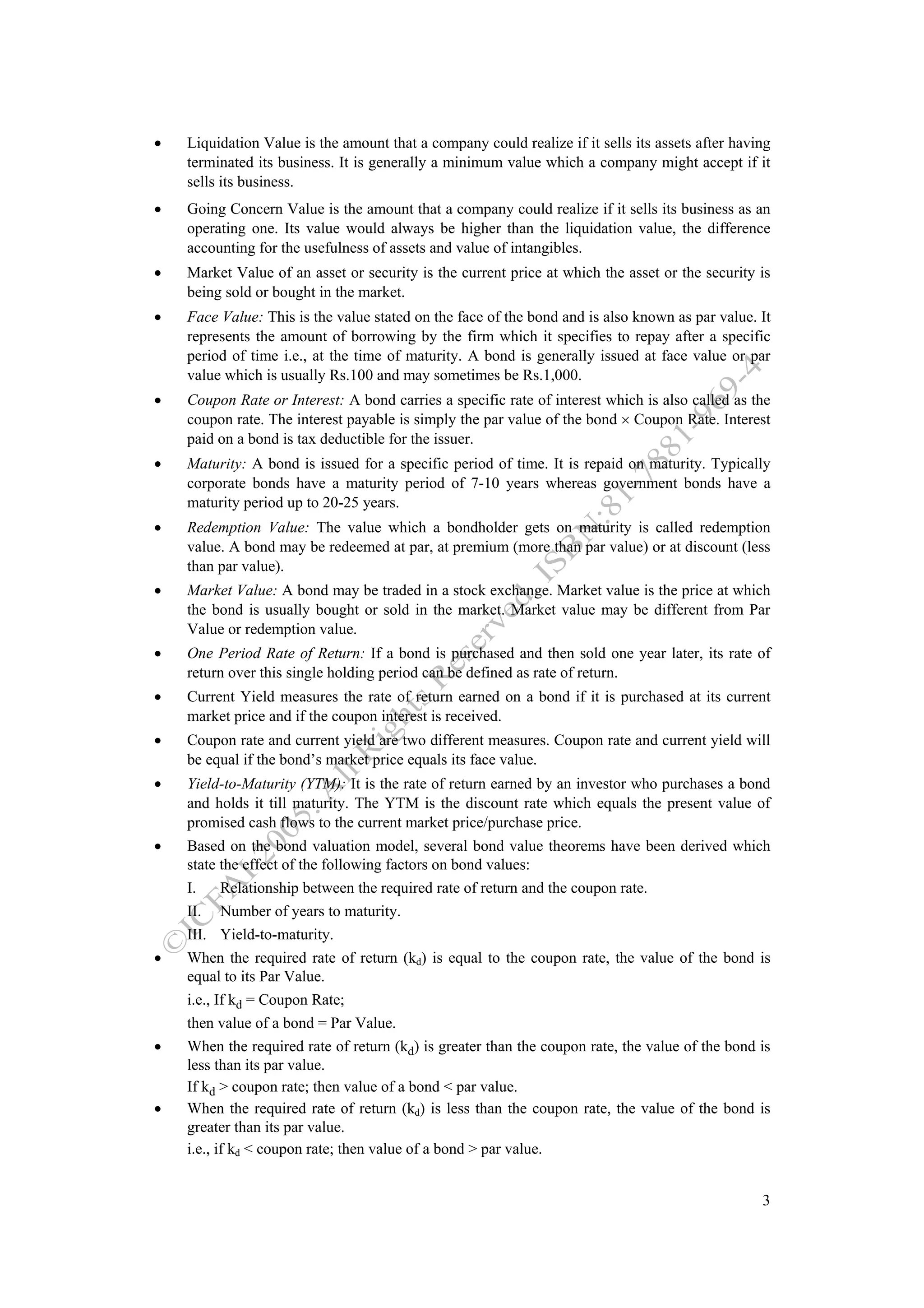

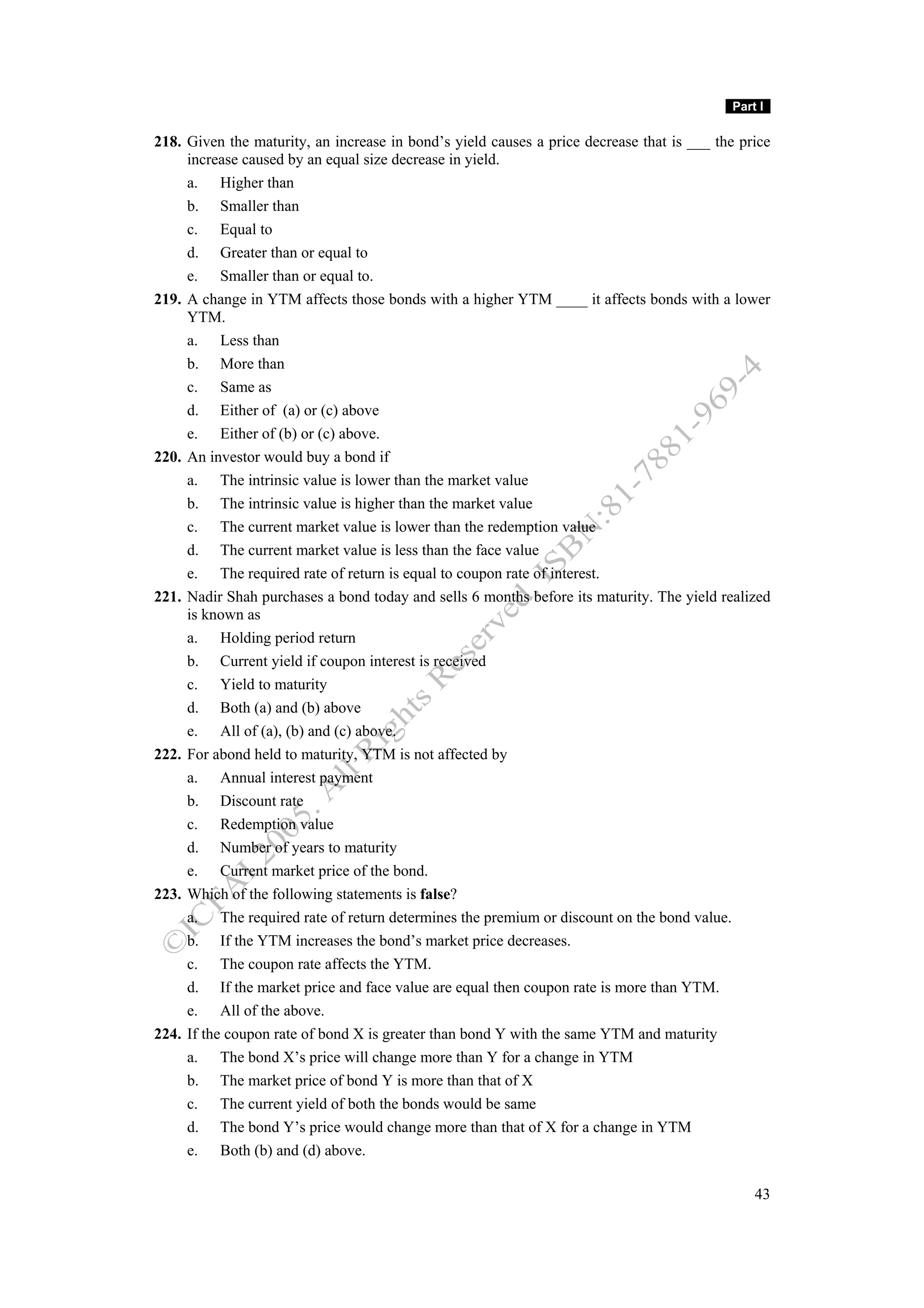

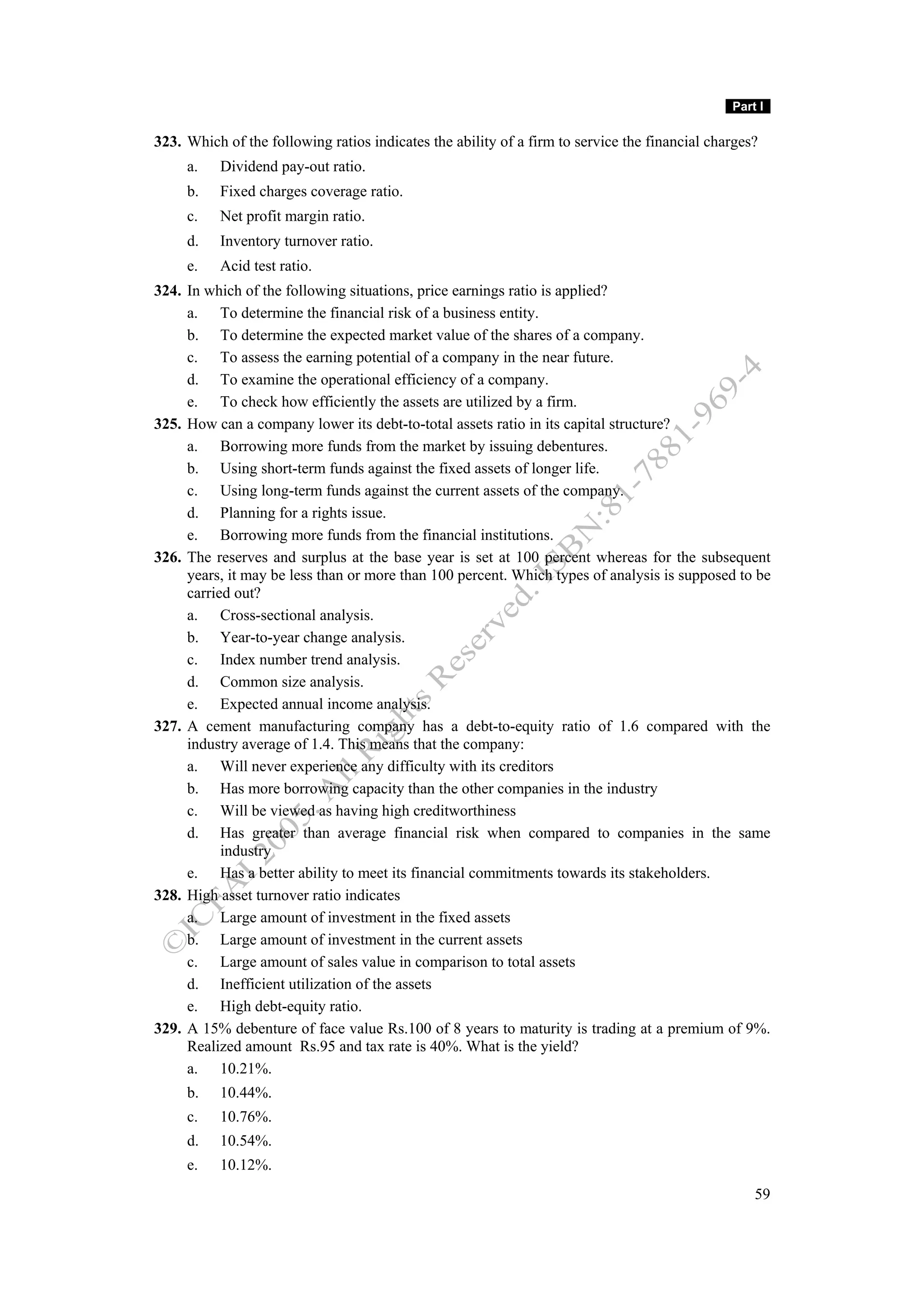

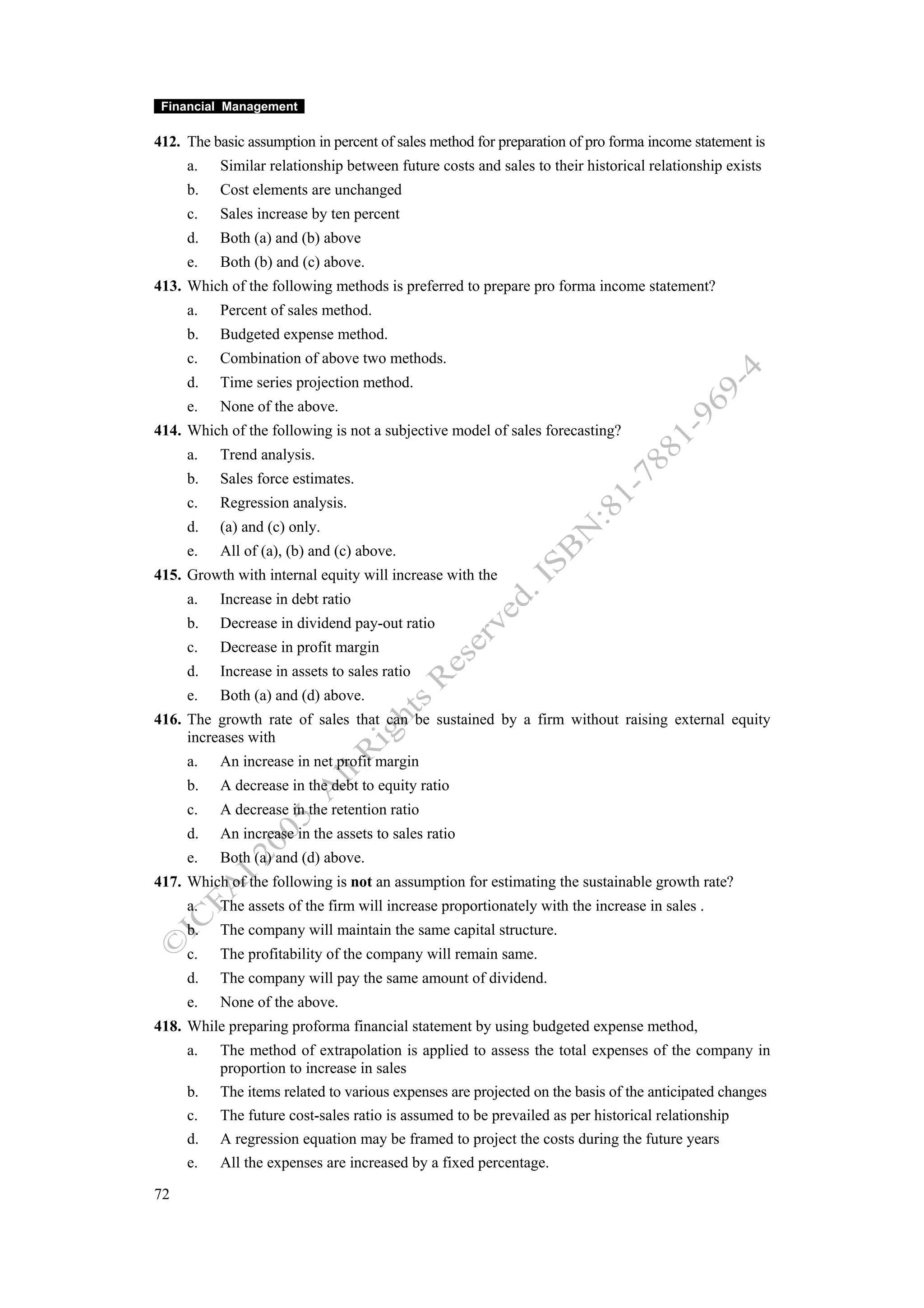

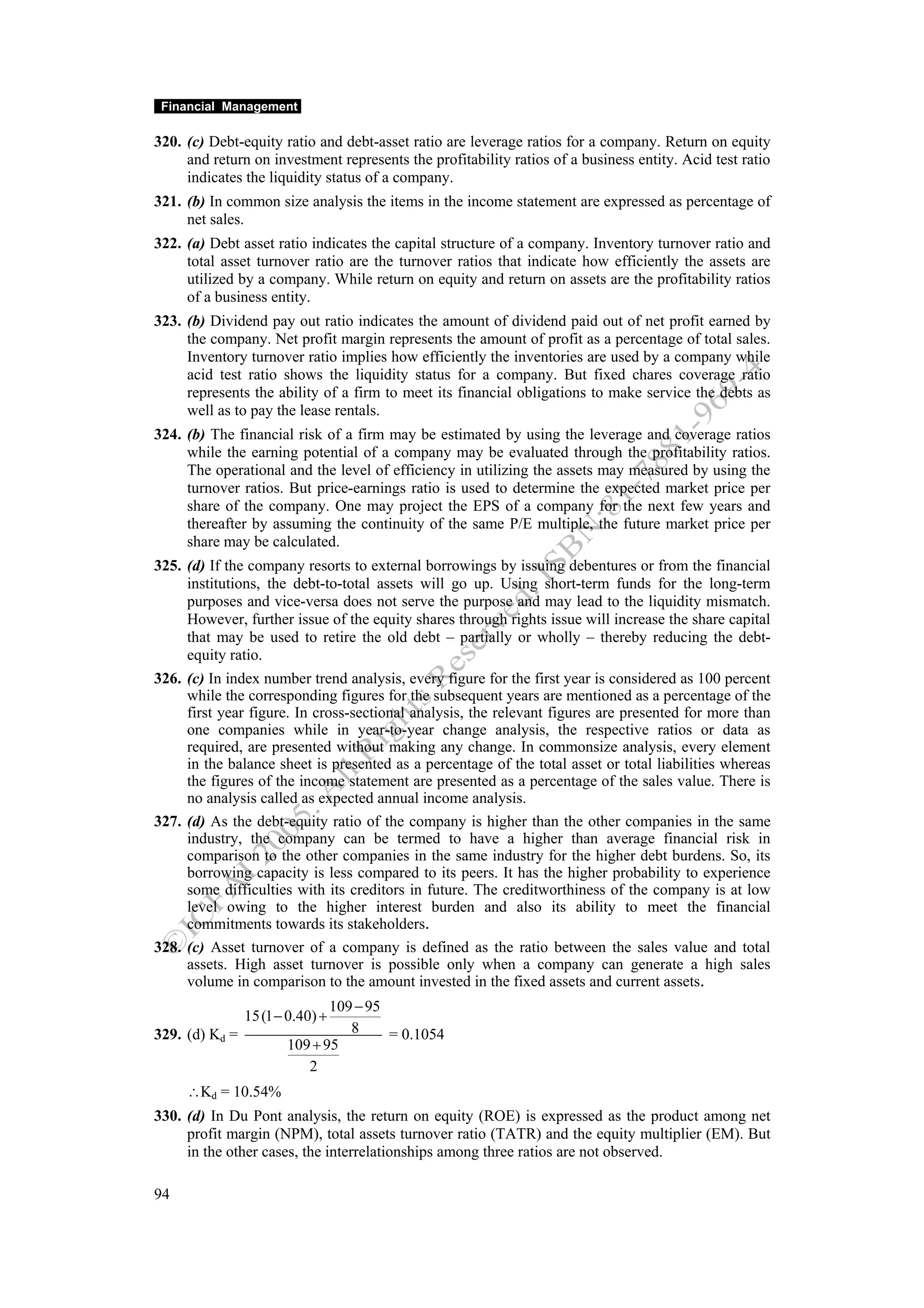

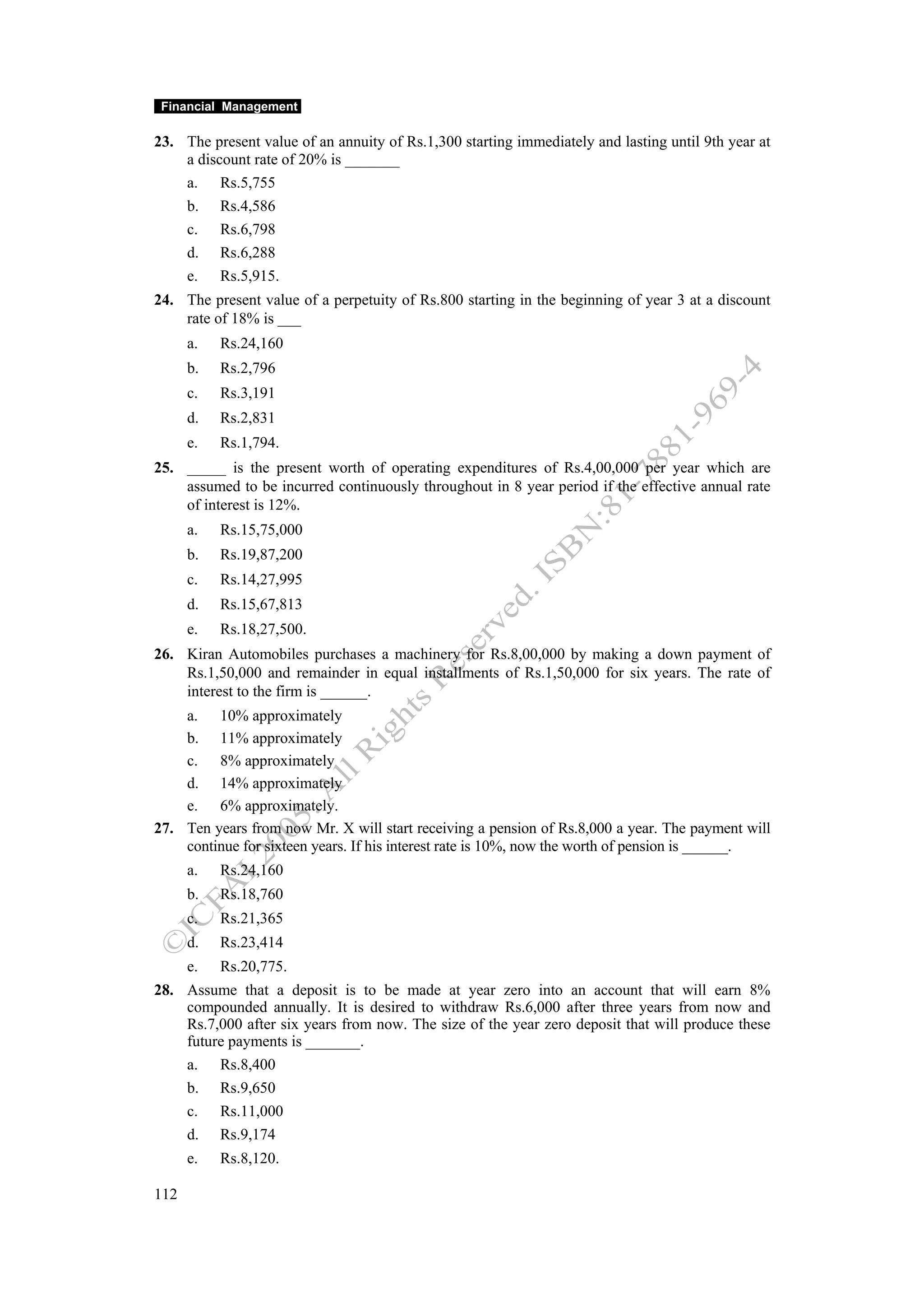

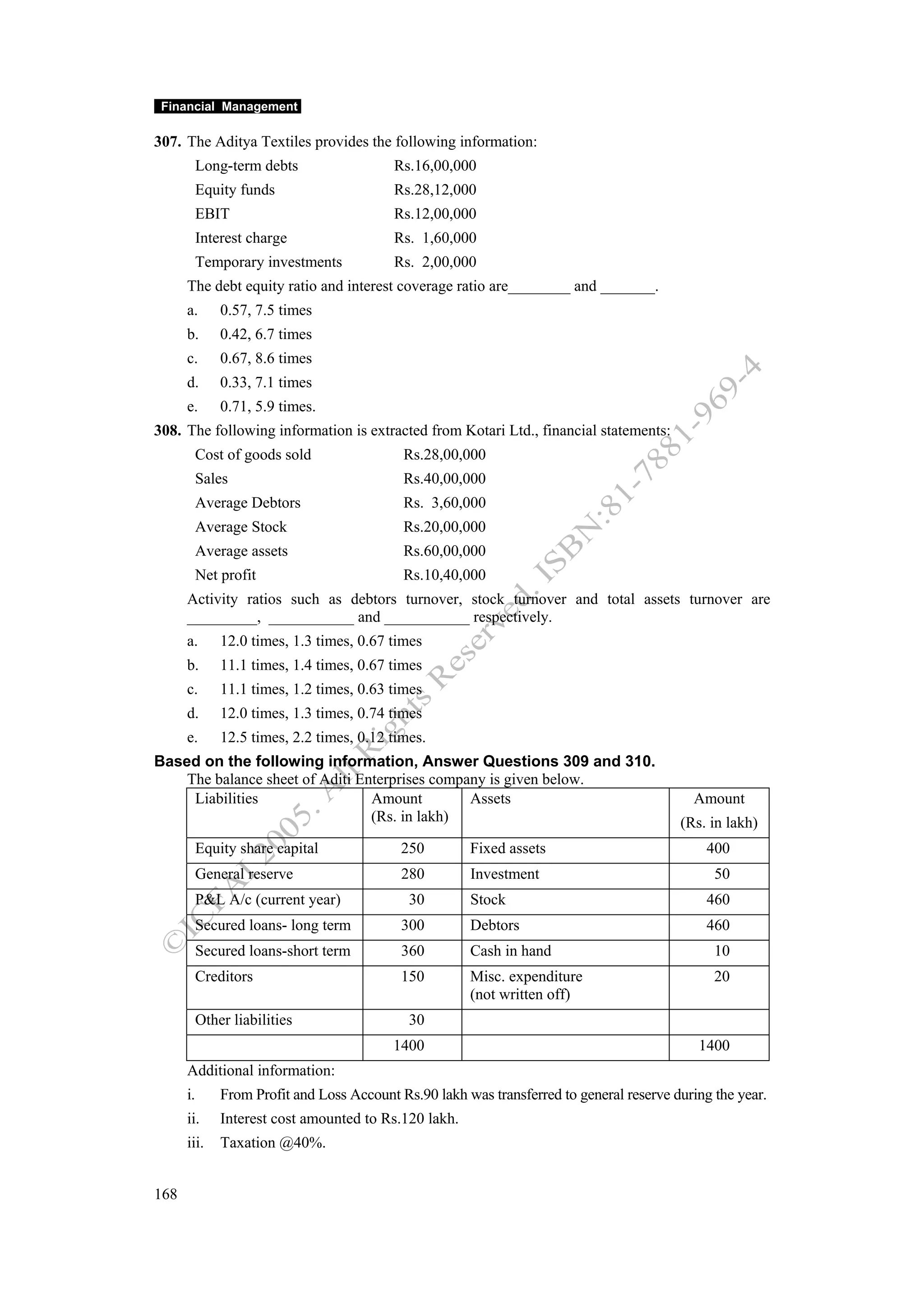

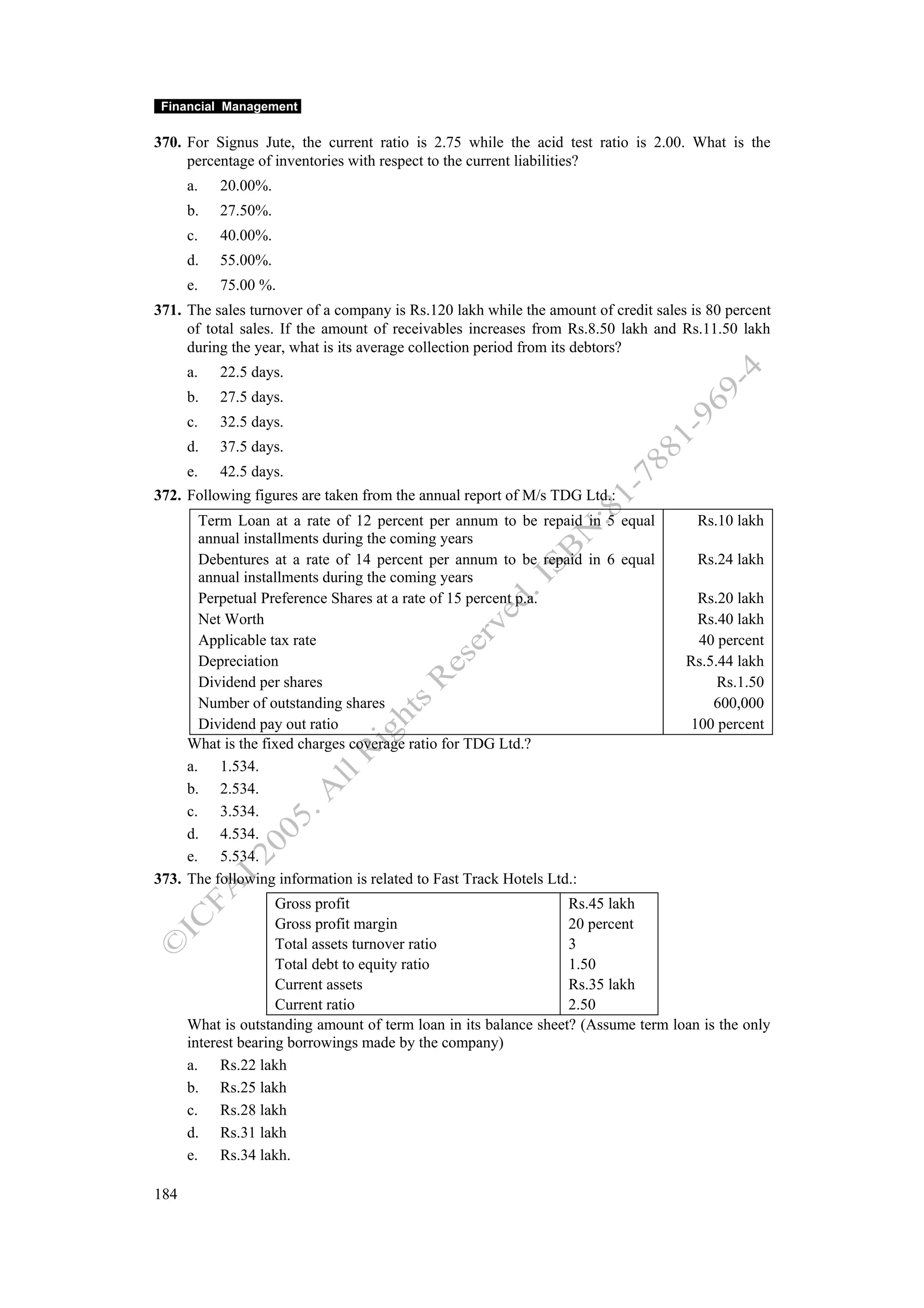

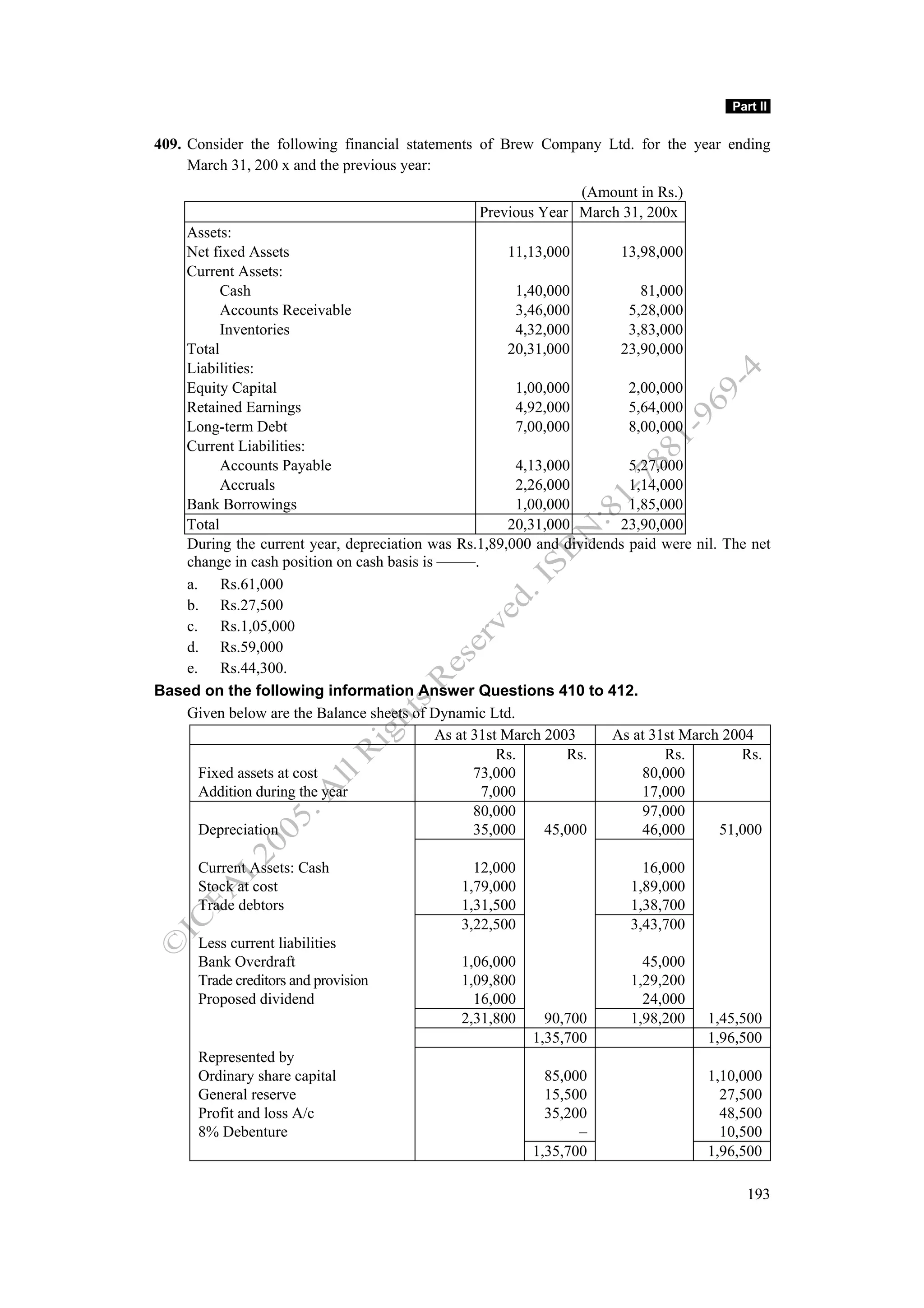

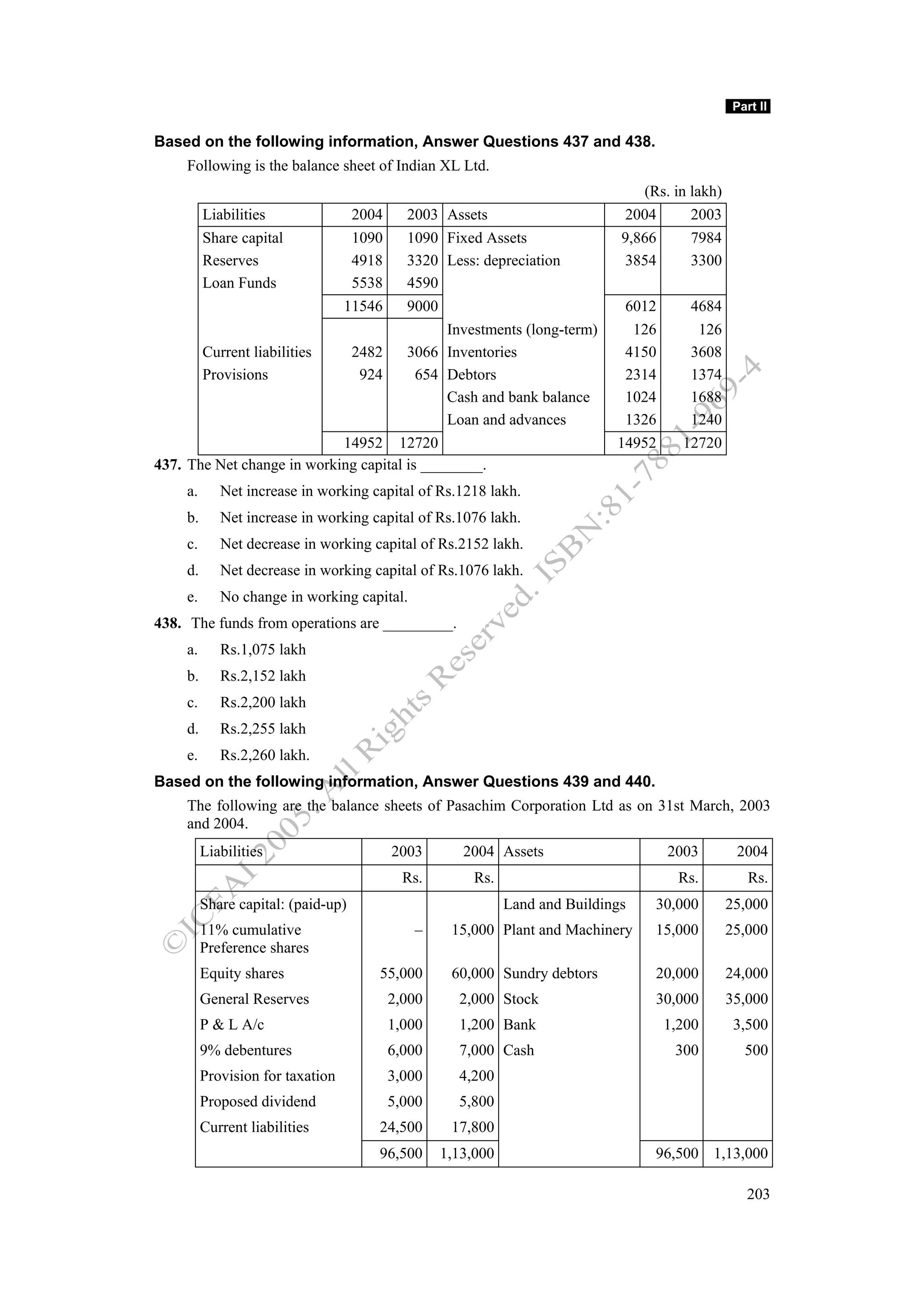

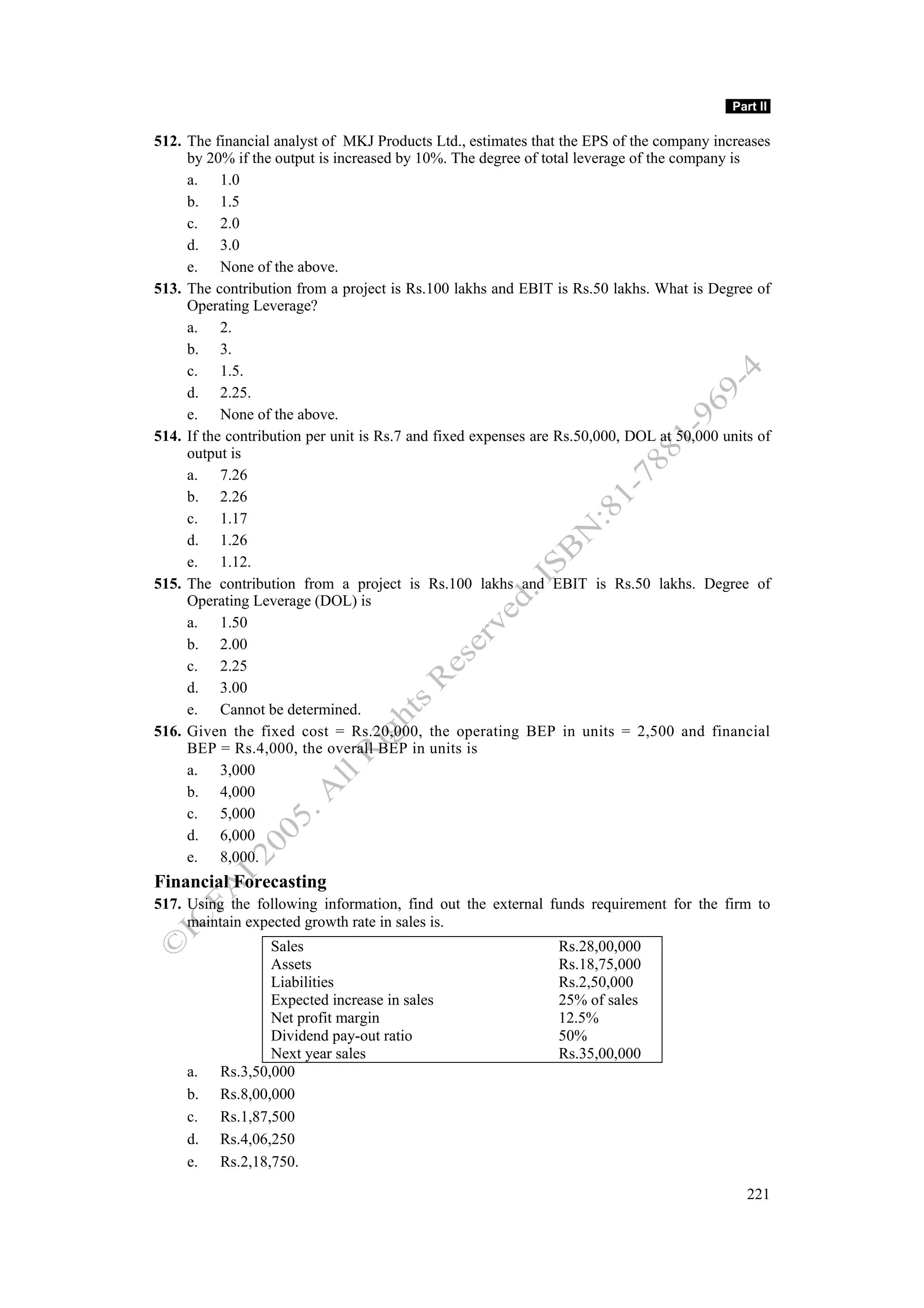

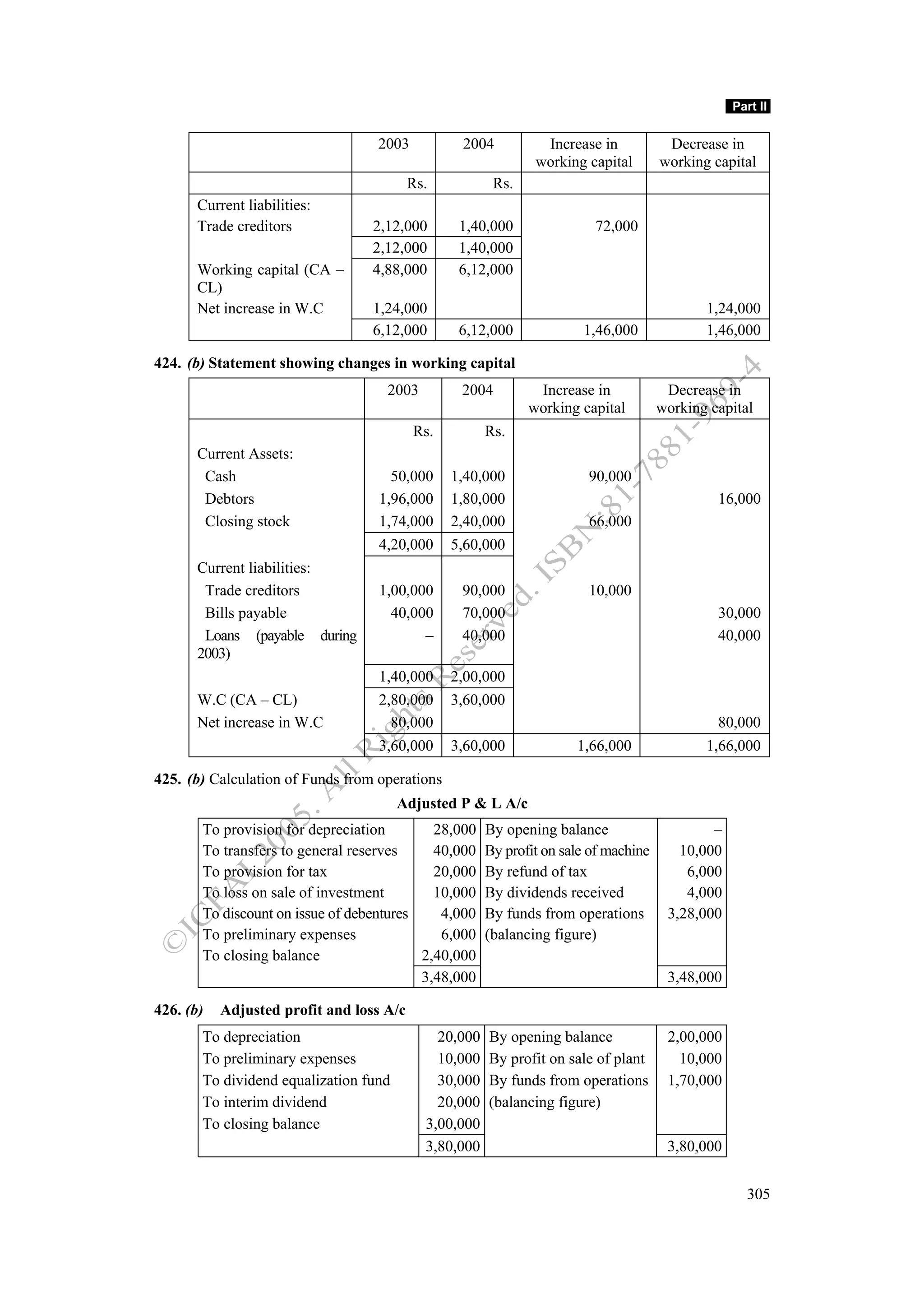

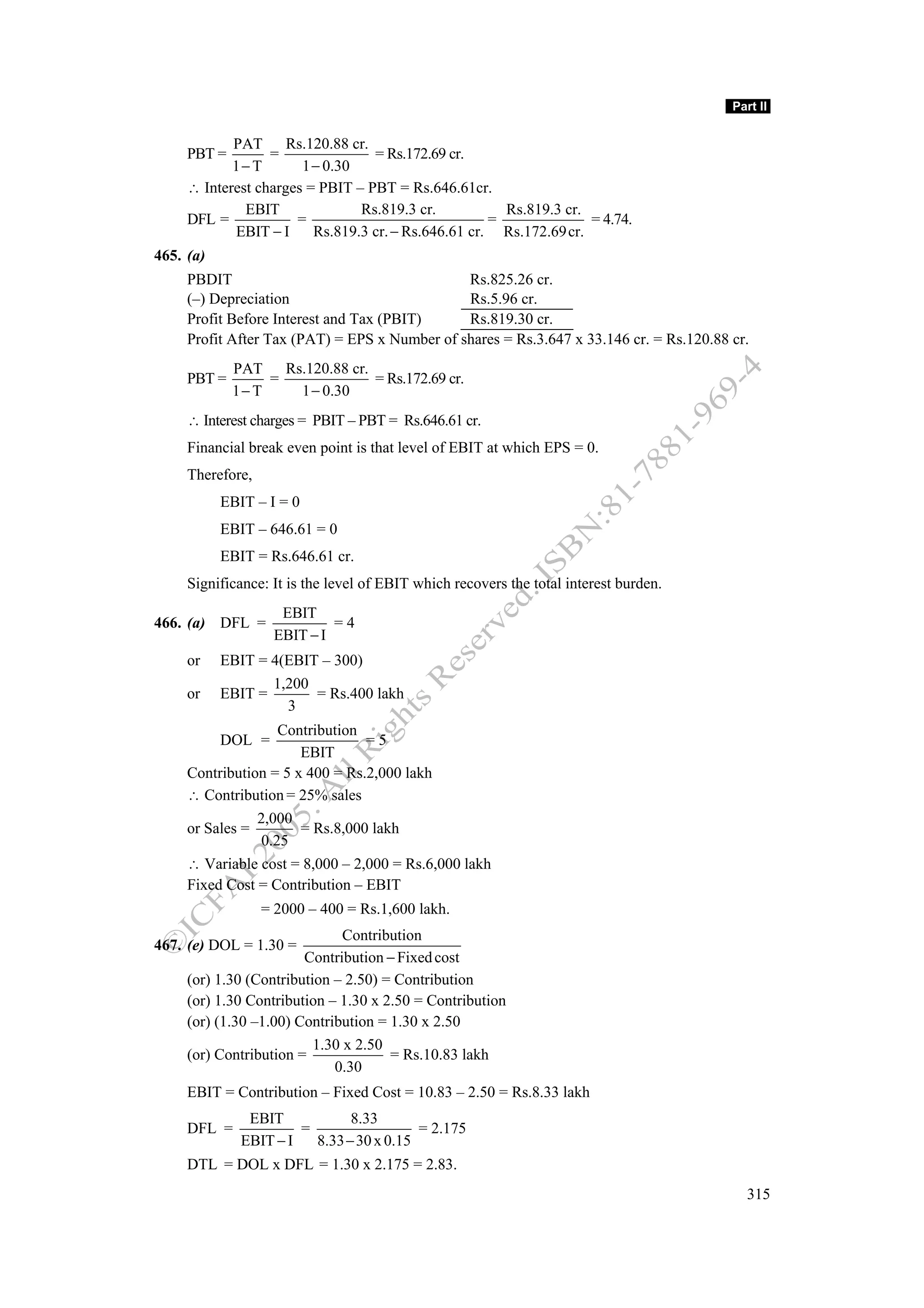

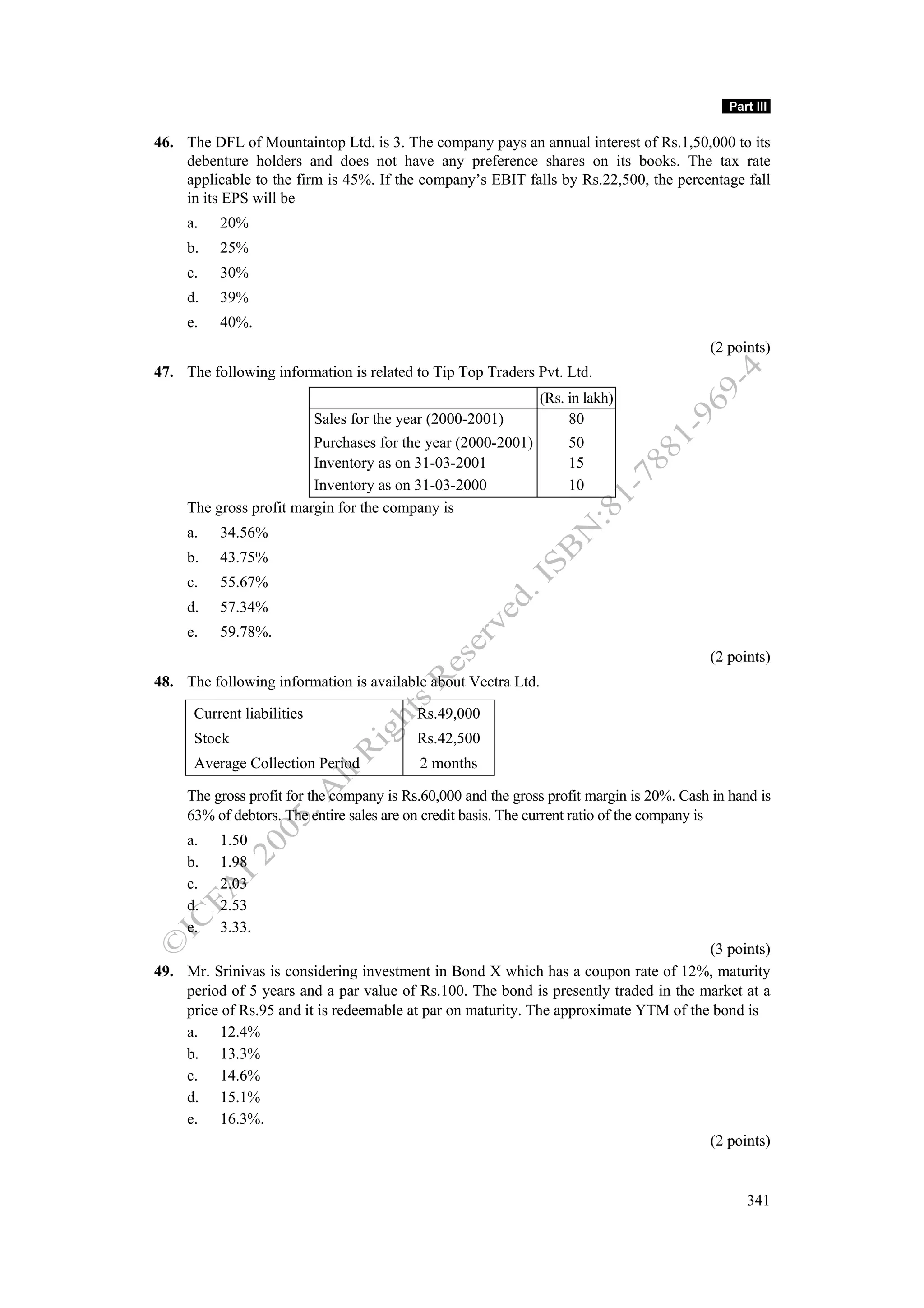

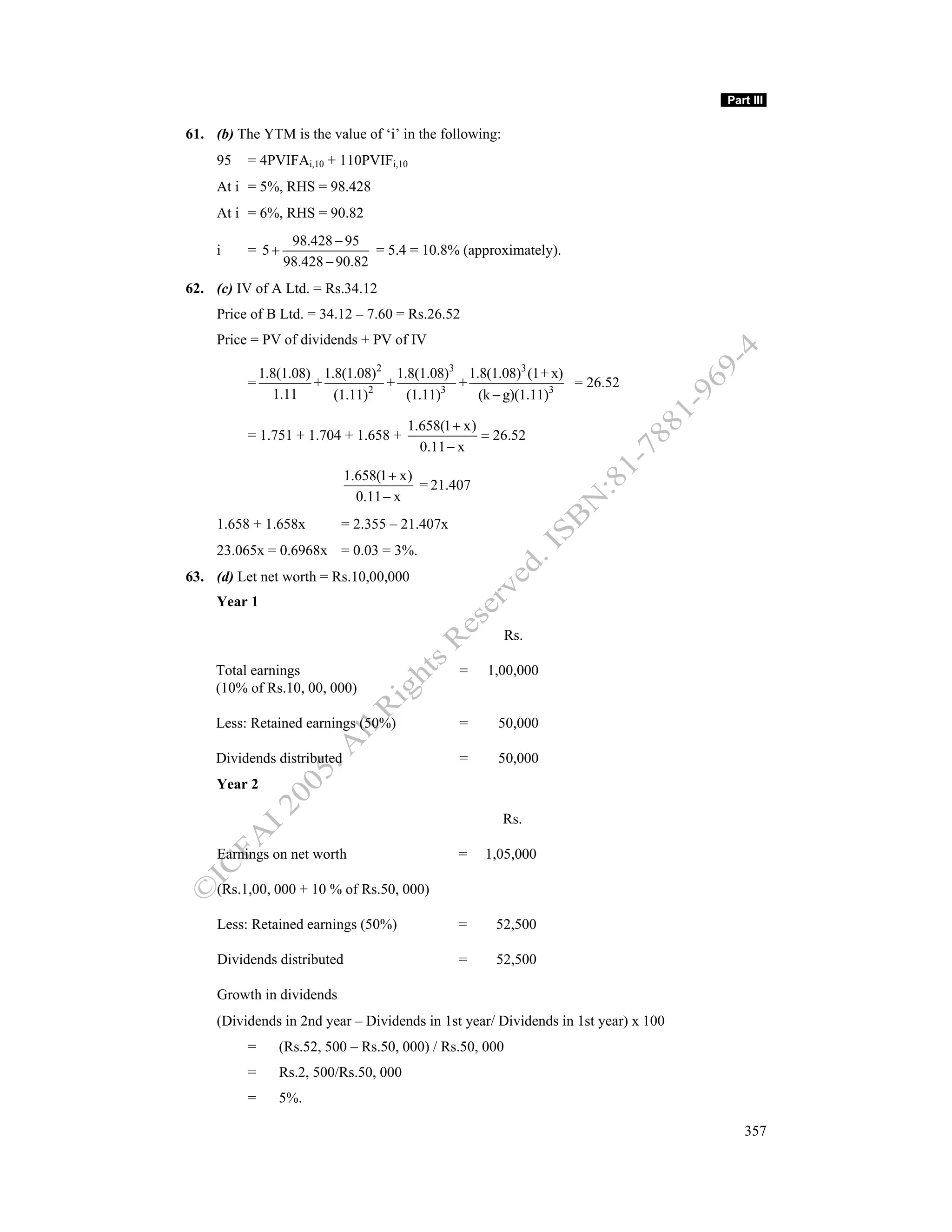

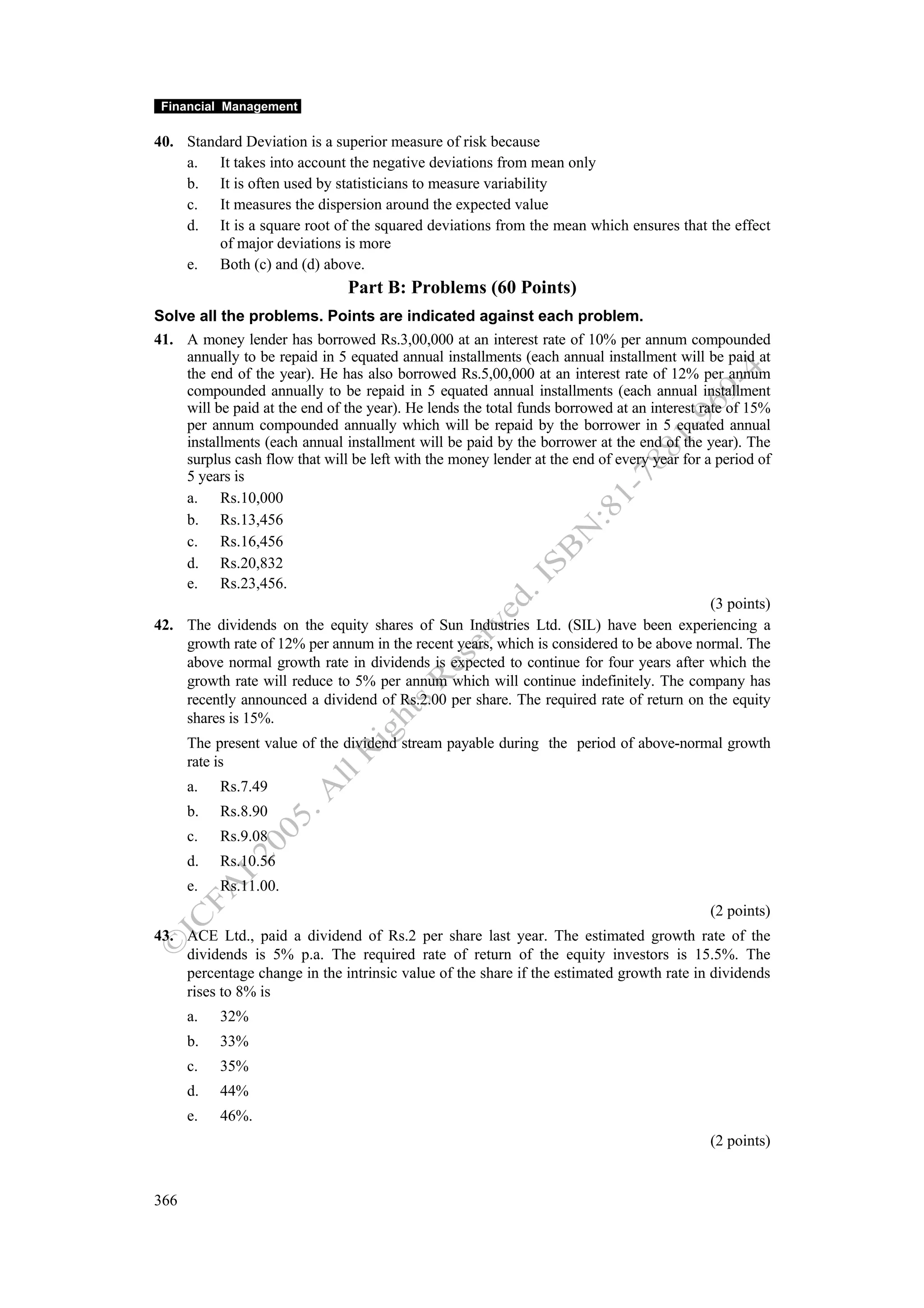

![Net Pr ofit

Net Profit Margin

Net Sales

Net Income

Return on Equity

Average Equity

EBIT

Earning Power

Average Total Assets

Sales

Assets Turnover

Average Assets

Leverage

ΔY / X

1. LY/LX =

ΔX / X

Where,

LY/LX – Measure of the leverage which dependent Y has with independent X

ΔX – Change in X

ΔY – Change in Y

ΔX

– Percentage change in X

X

ΔY

– Percentage change in Y.

Y

2. Total Revenue = Quantity Sold(Q) x Selling Price (S)

Hence,

EBIT = Q x S – Q x V – F = Q(S – V) – F

[Q(S − V) − F − I] (1 − T) − D P

EPS = [(EBIT – I) (1 – T) – DP]/N =

N

Where,

N = Number of Equity Shareholders.

3. DOL = Percentage change in EBIT / Percentage change in Output

ΔEBIT / EBIT

=

ΔQ / Q

EBIT = Q(S – V) – F

Substituting for EBIT, we get

DOL = [Q(S – V)] / [Q(S – V) – F].

4. DFL = (Percentage change in EPS) / (Percentage change in EBIT)

DFL = ( Δ EPS/EPS) / ( Δ EBIT/EBIT)

Substituting Eq.(ii) for EPS we get

EBIT

DFL =

DP

EBIT − 1 −

(1 − T)

106](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-111-2048.jpg)

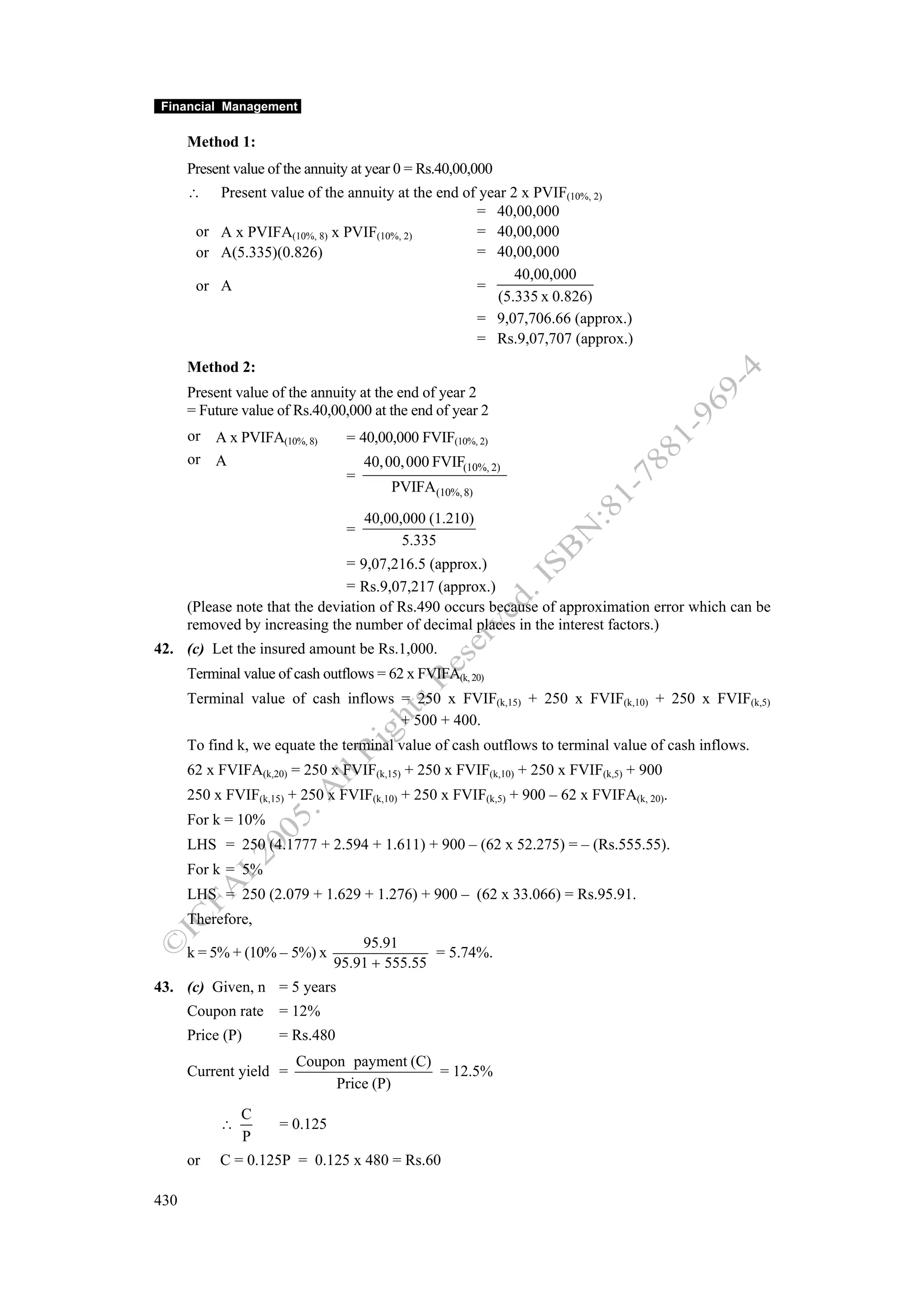

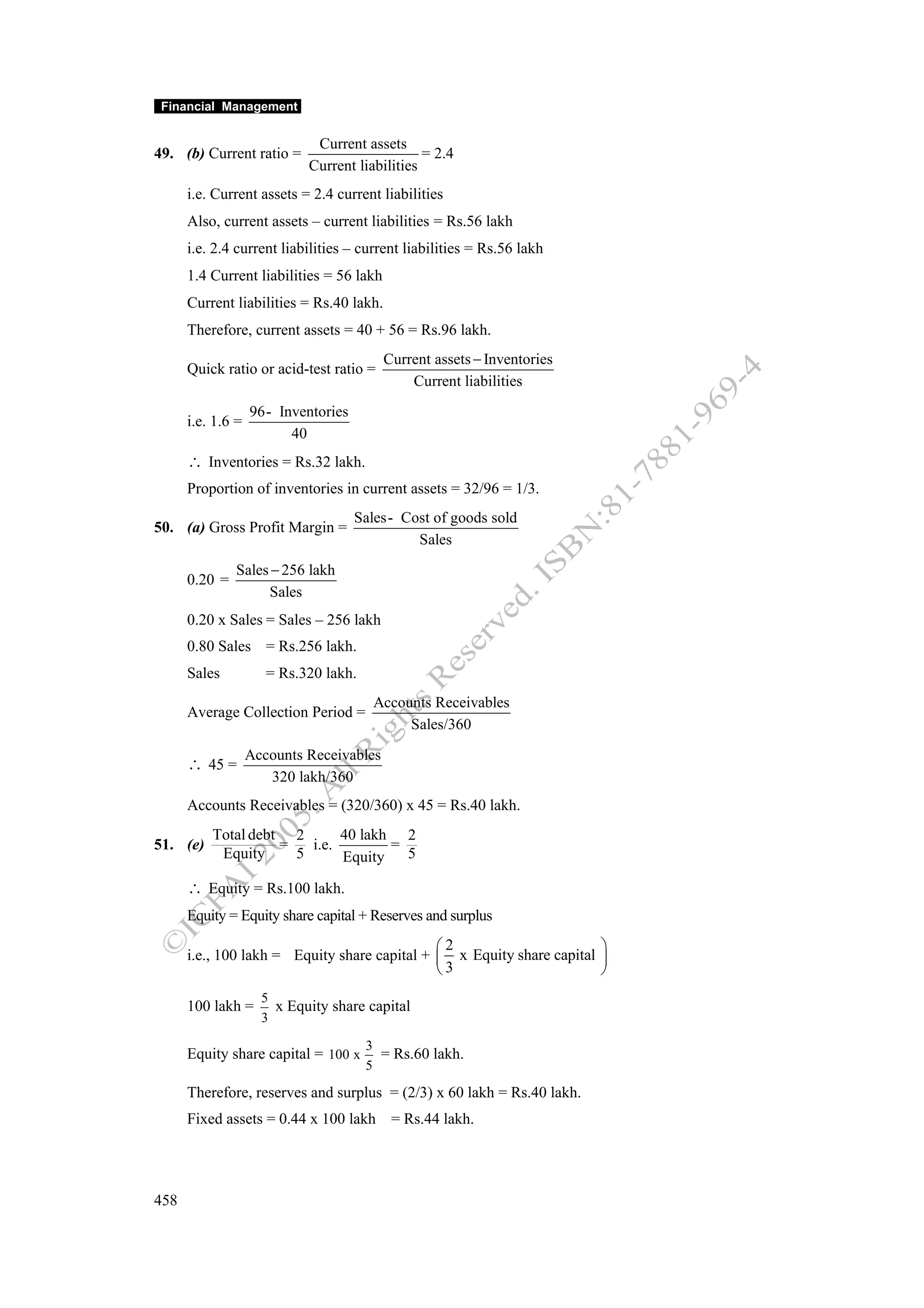

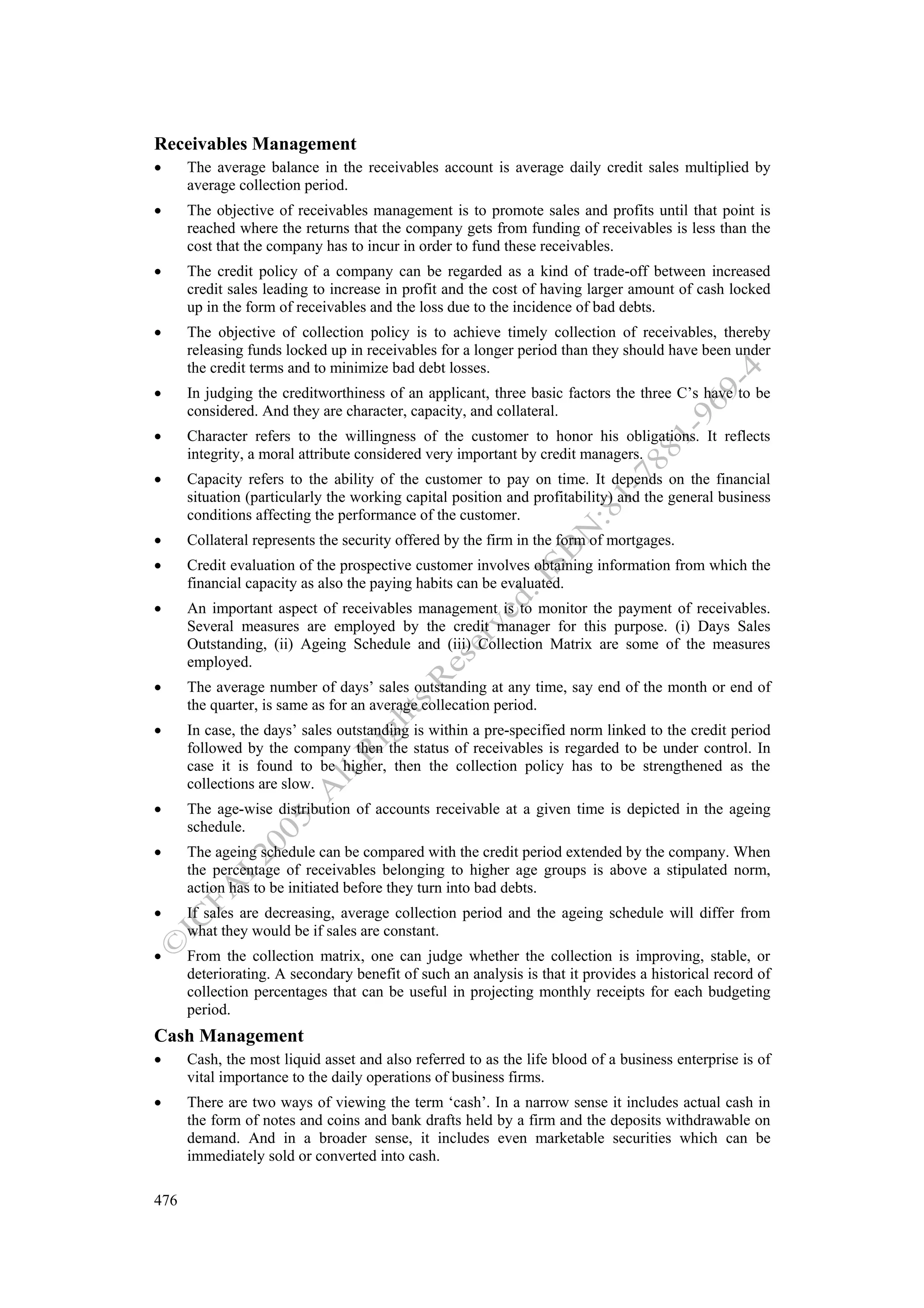

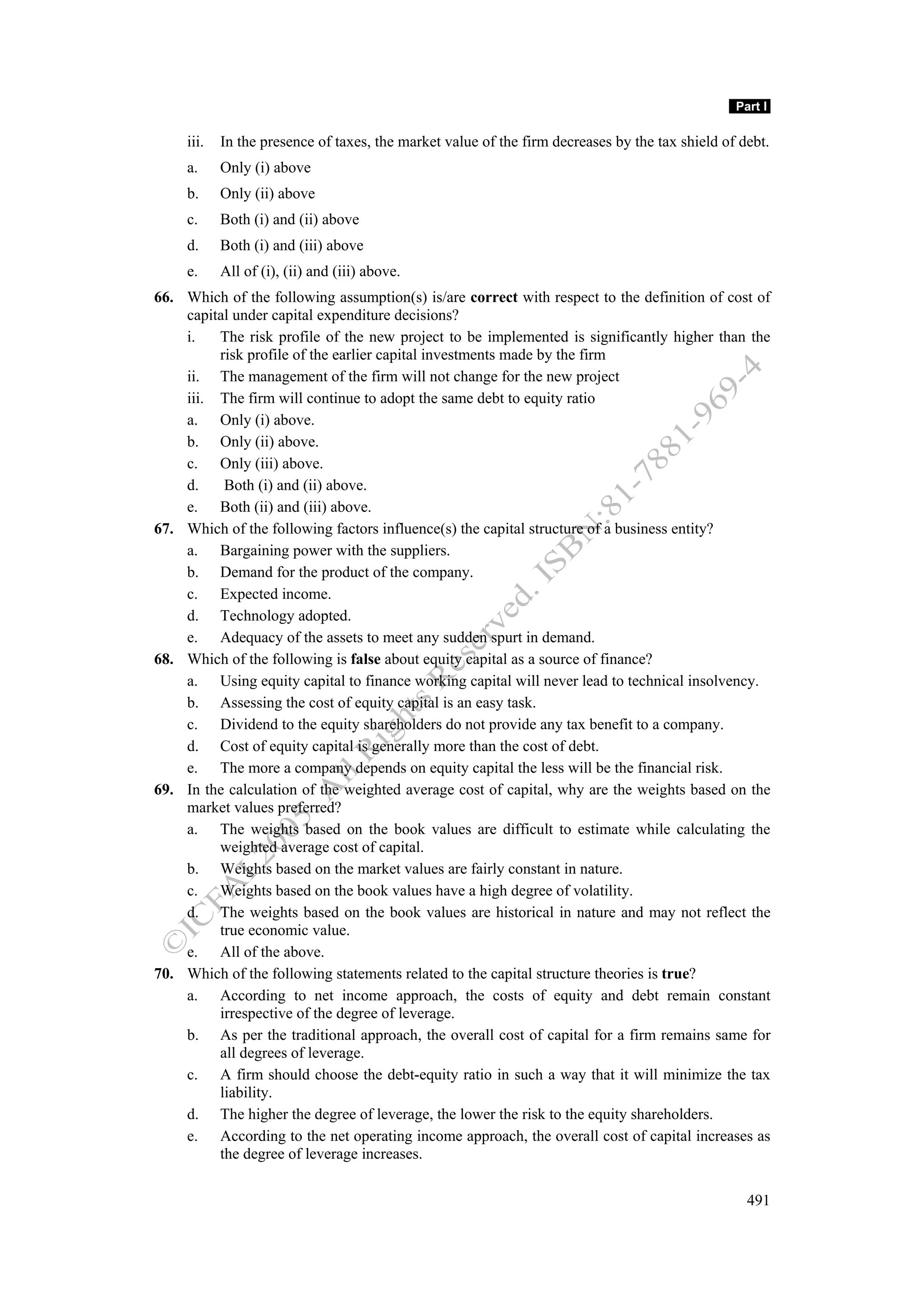

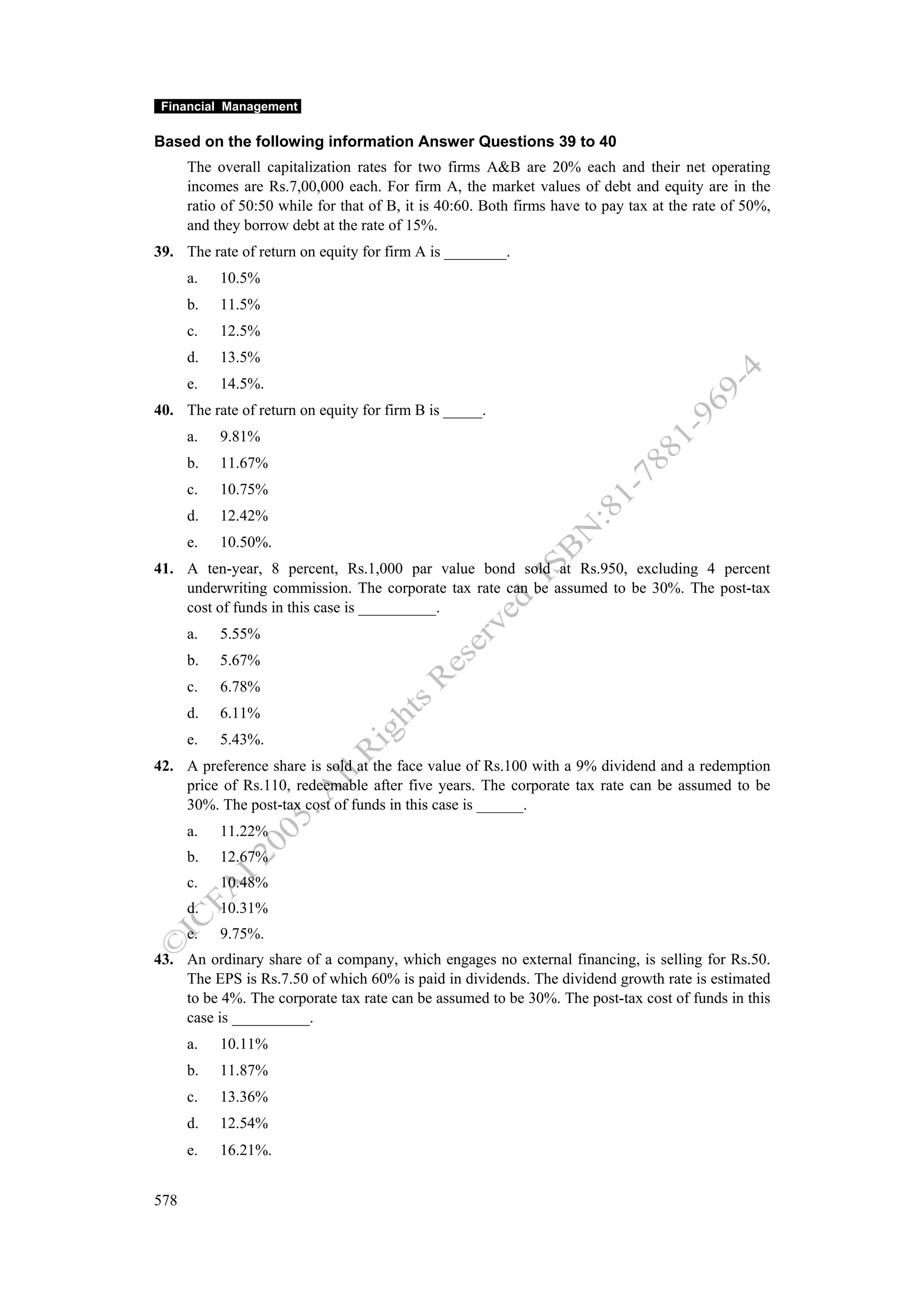

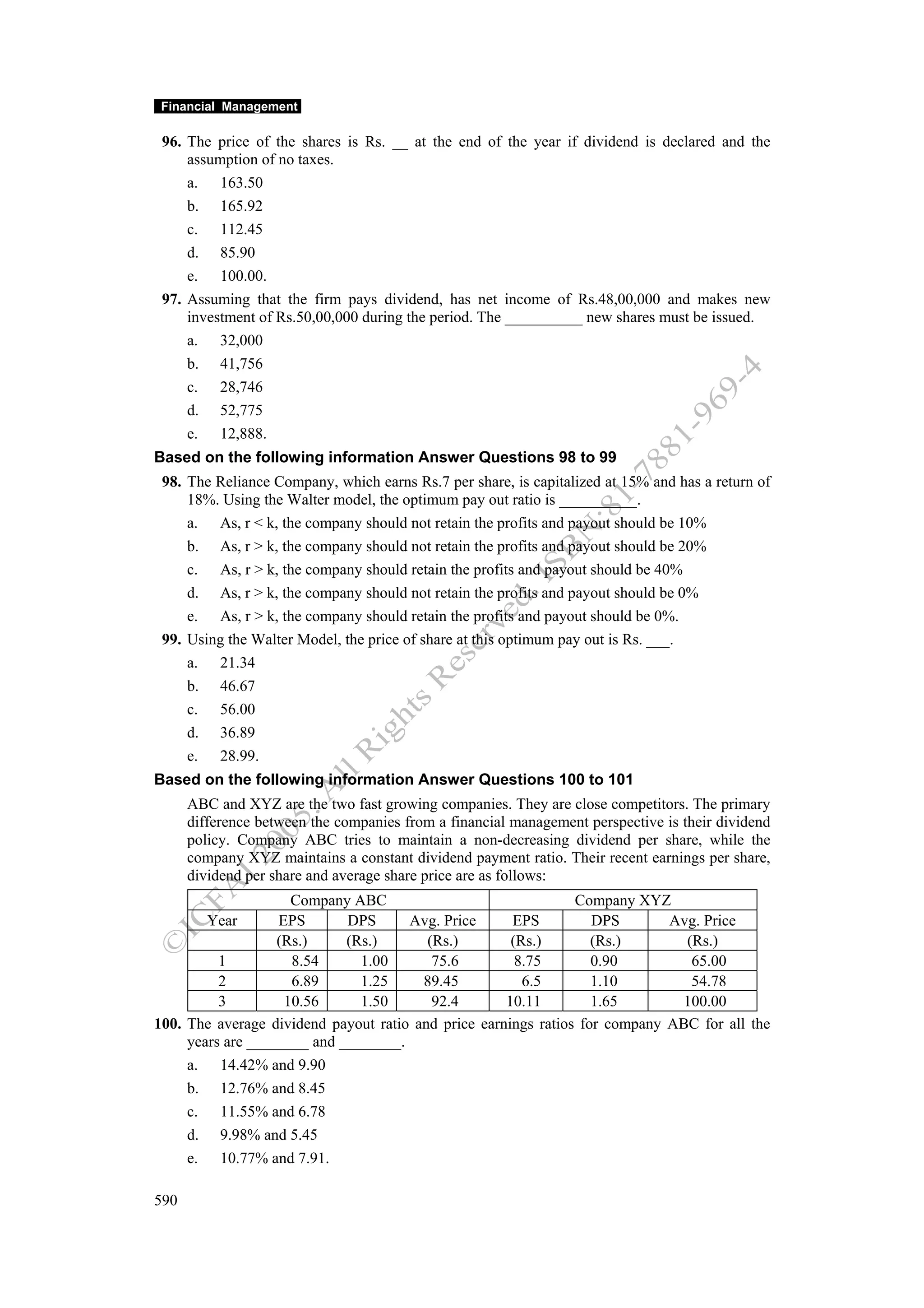

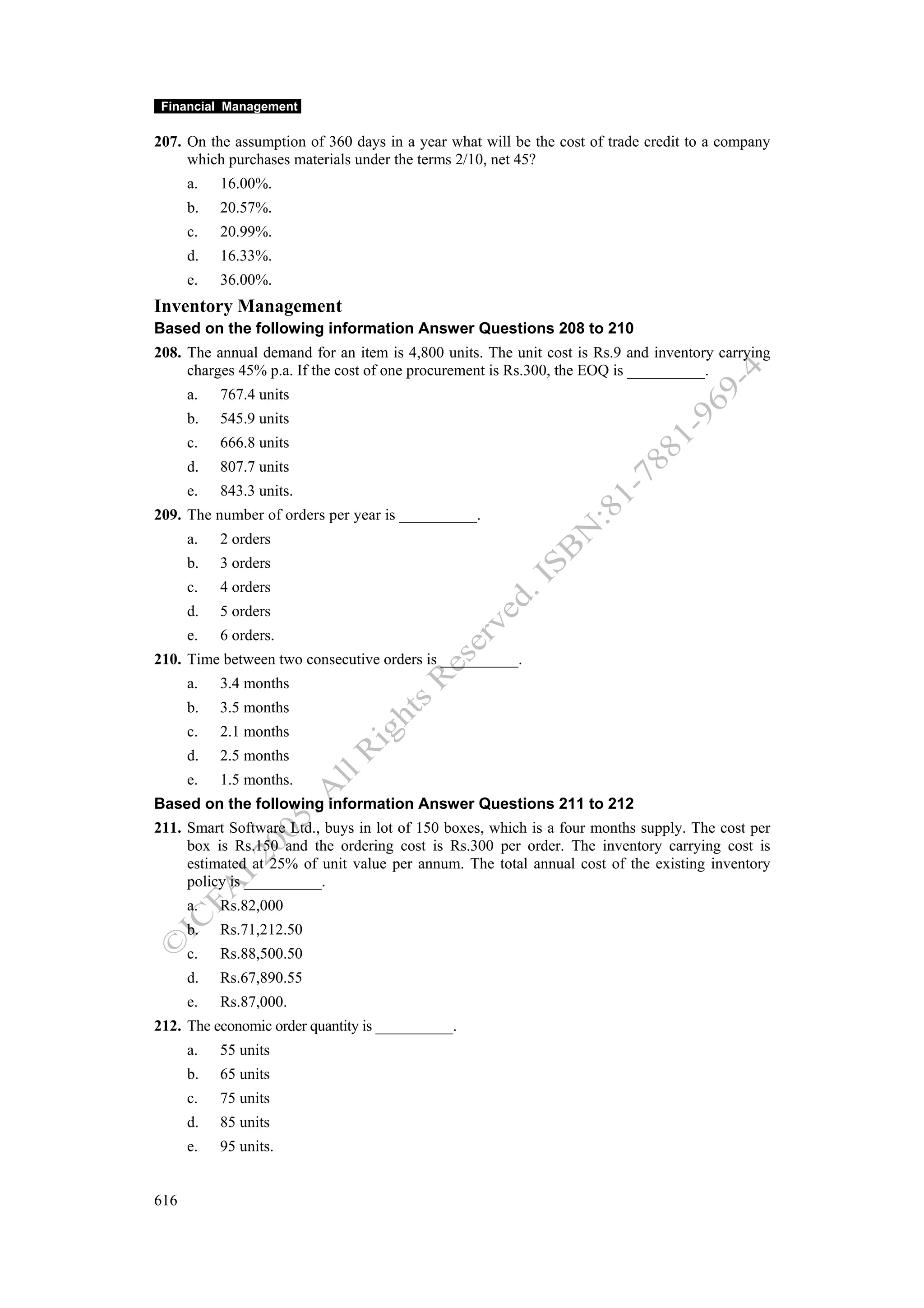

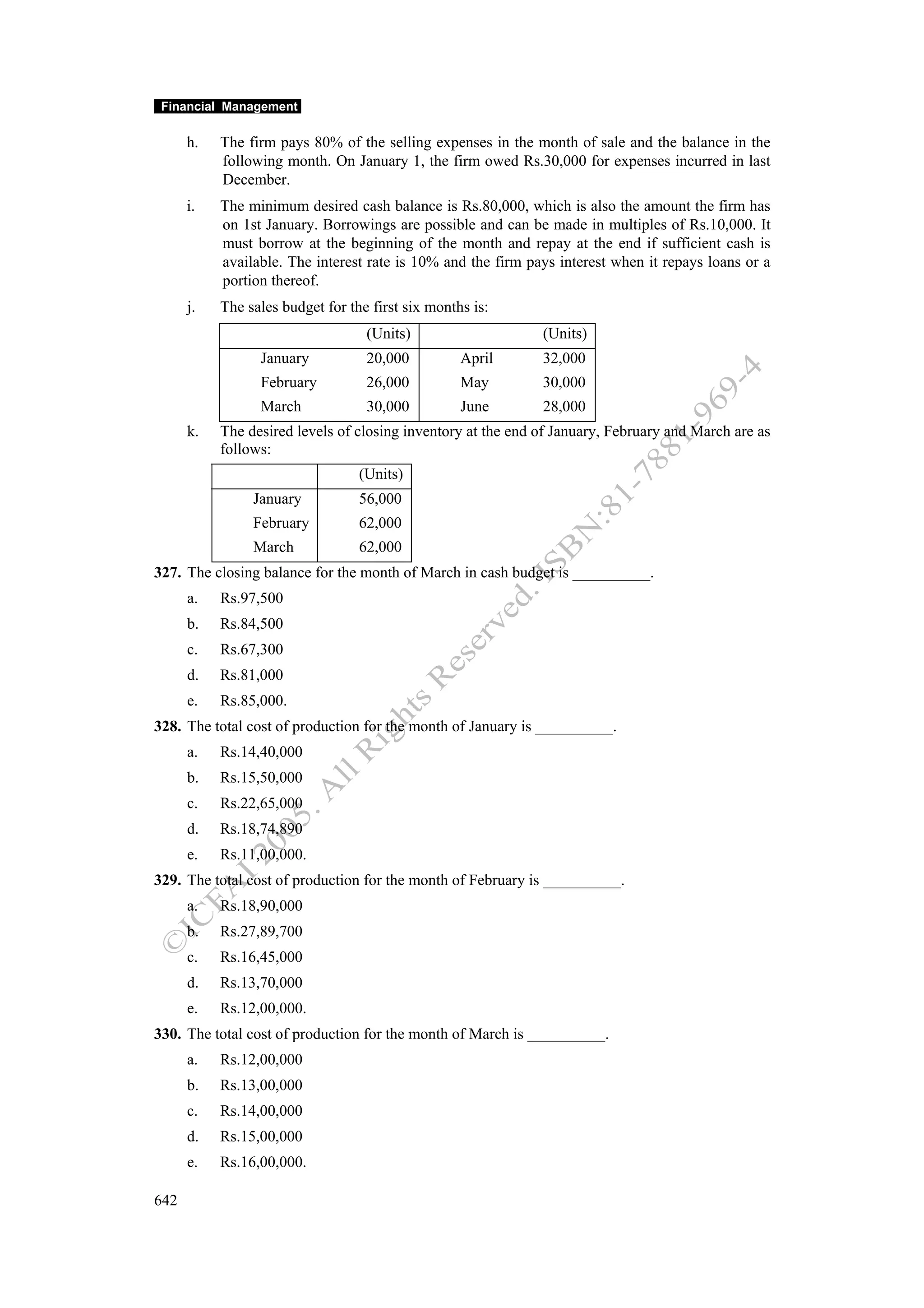

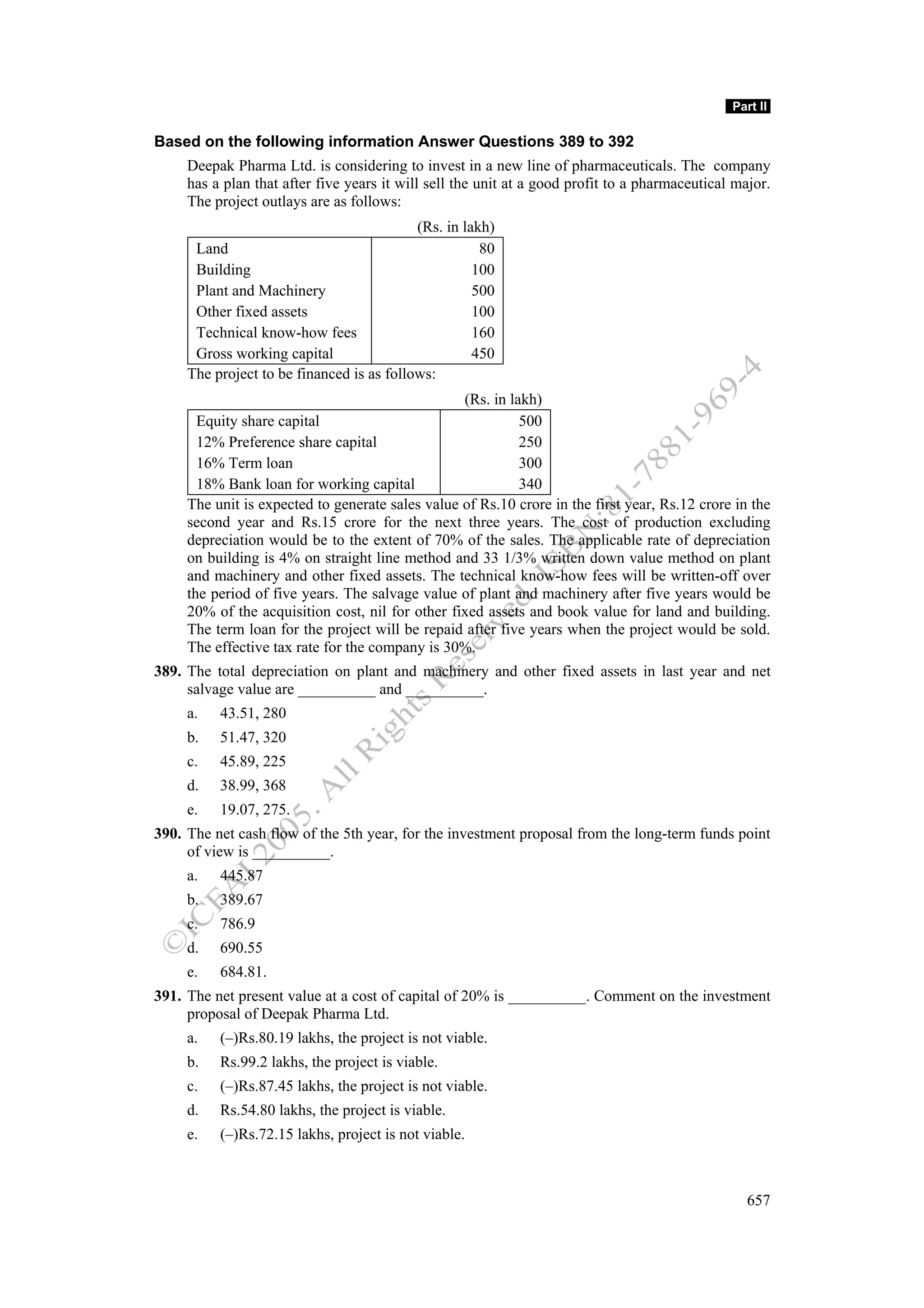

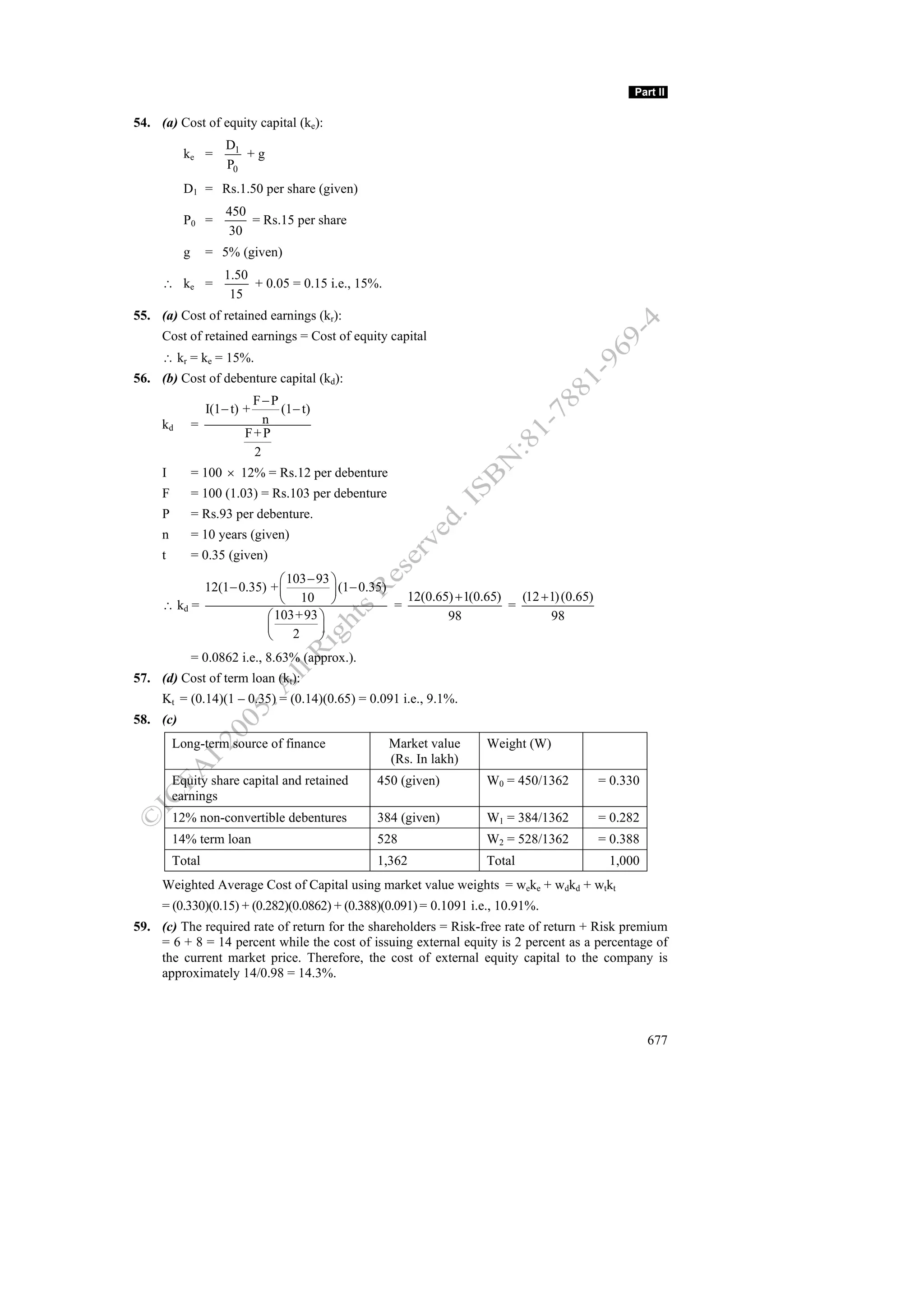

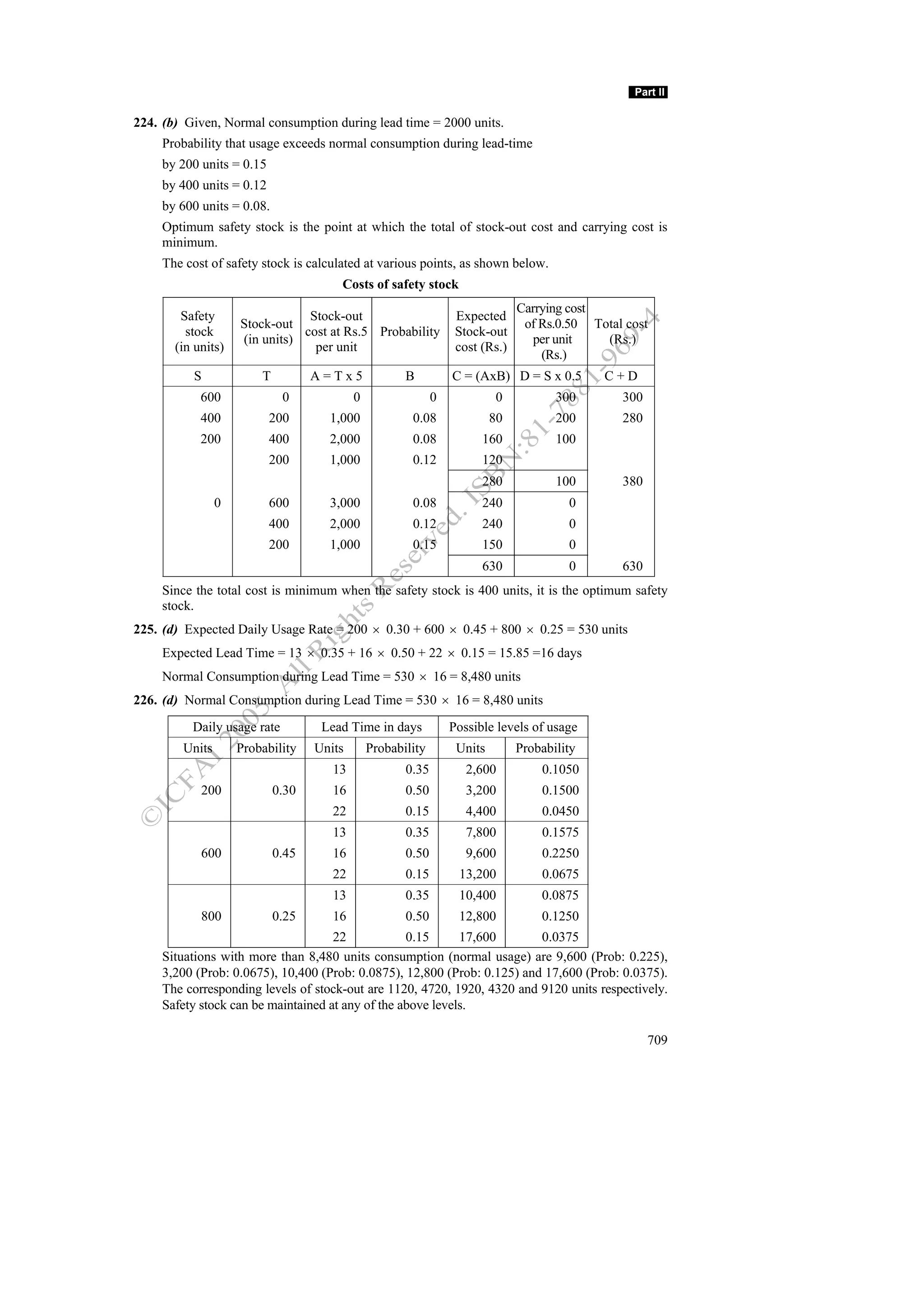

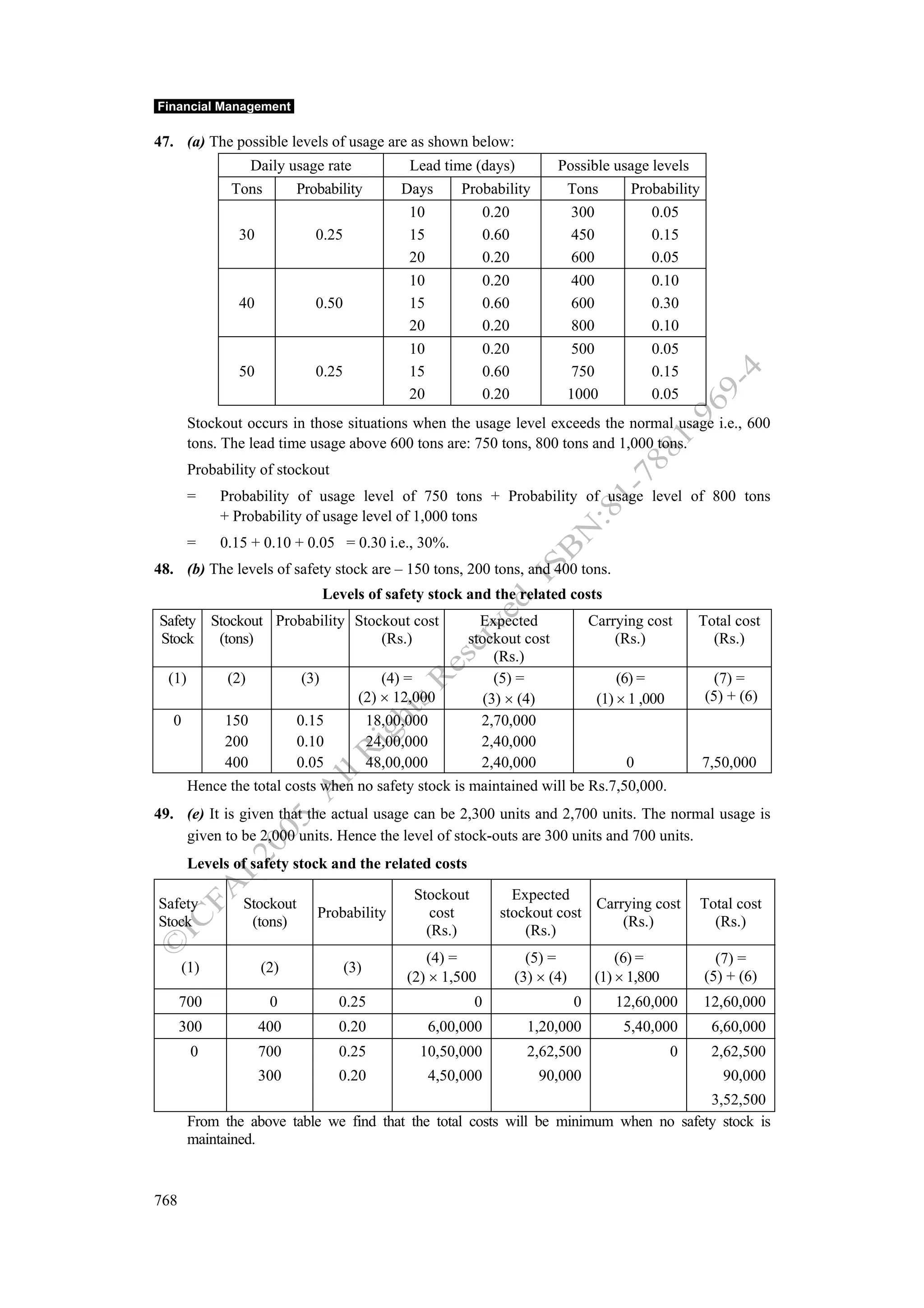

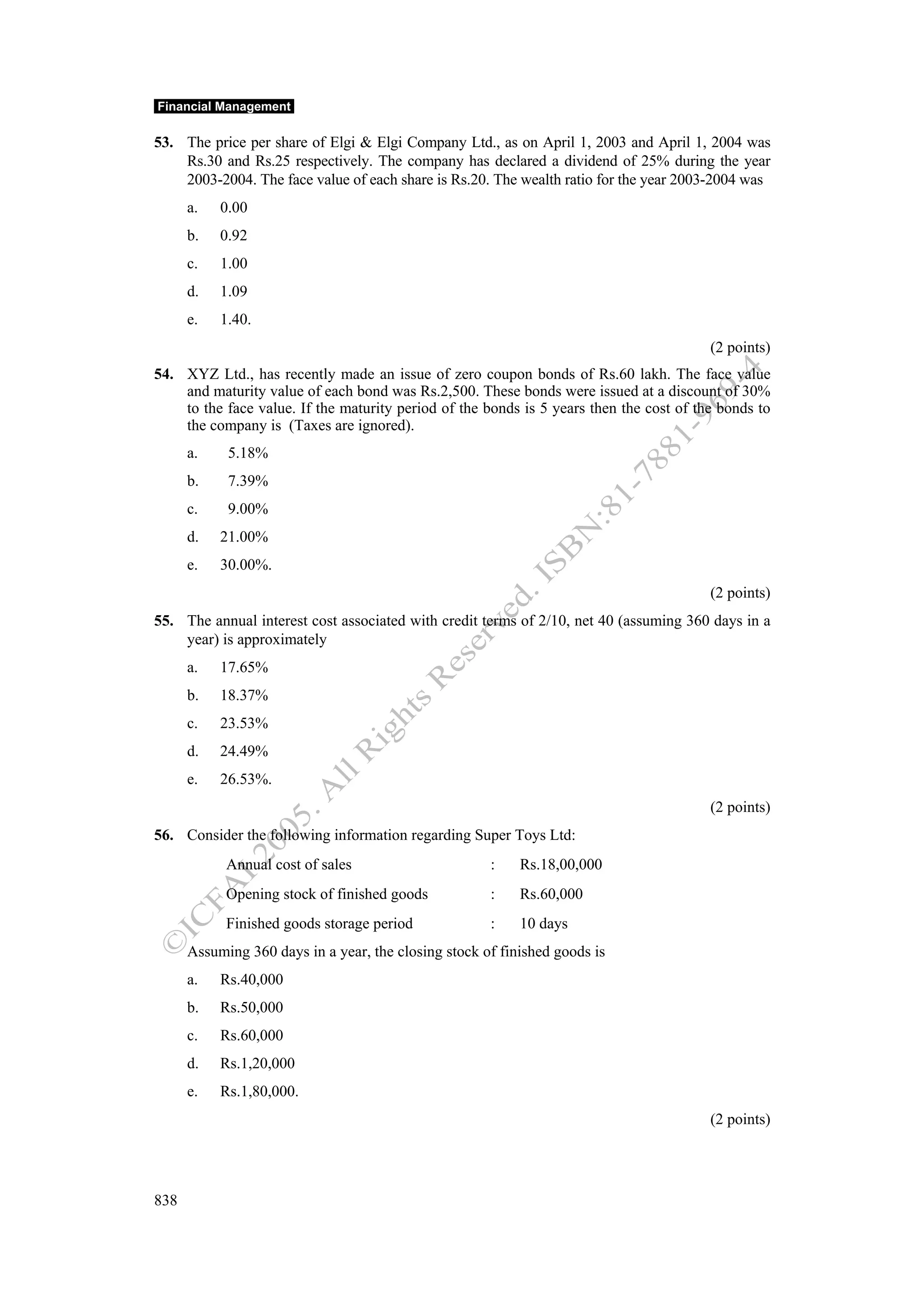

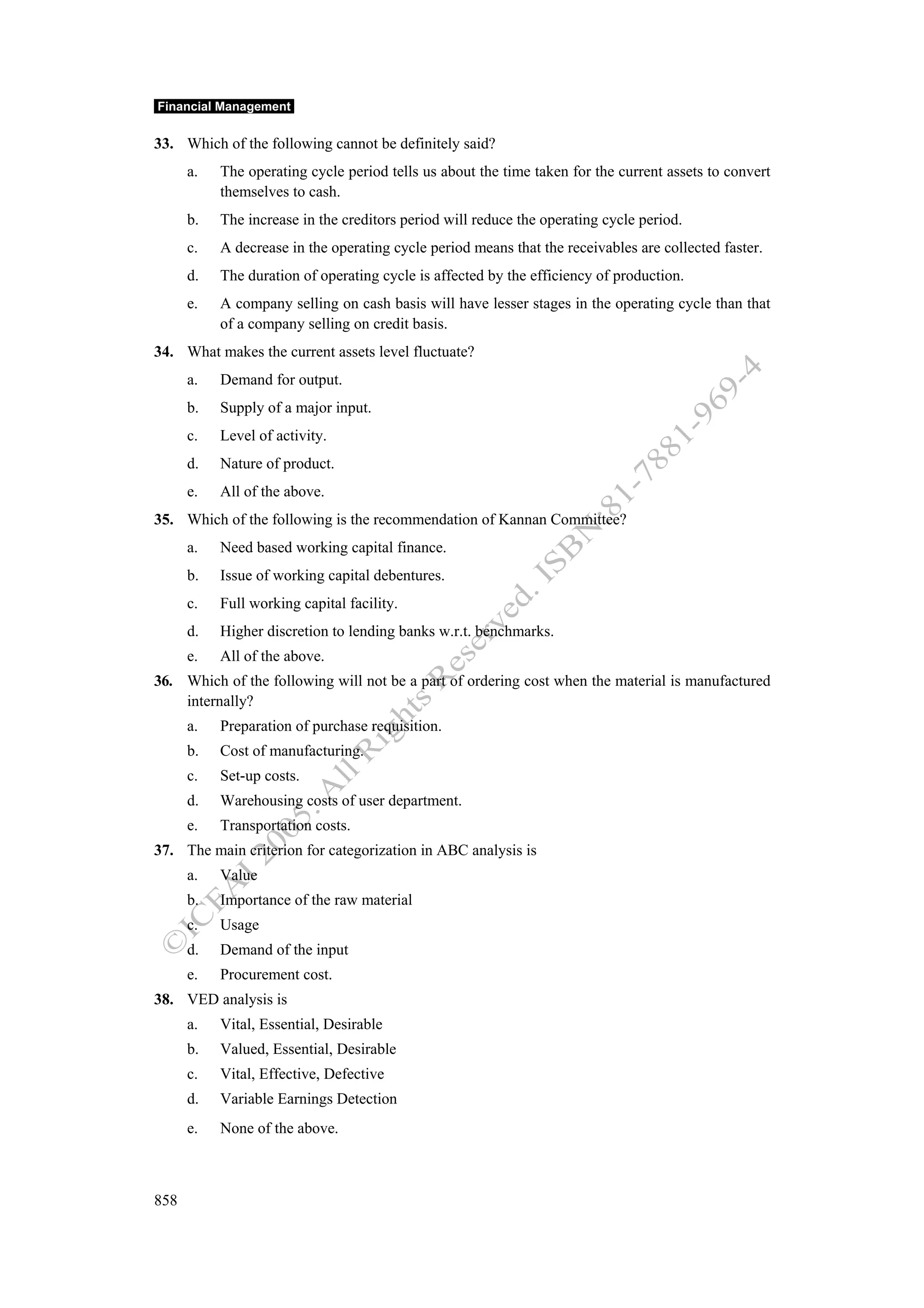

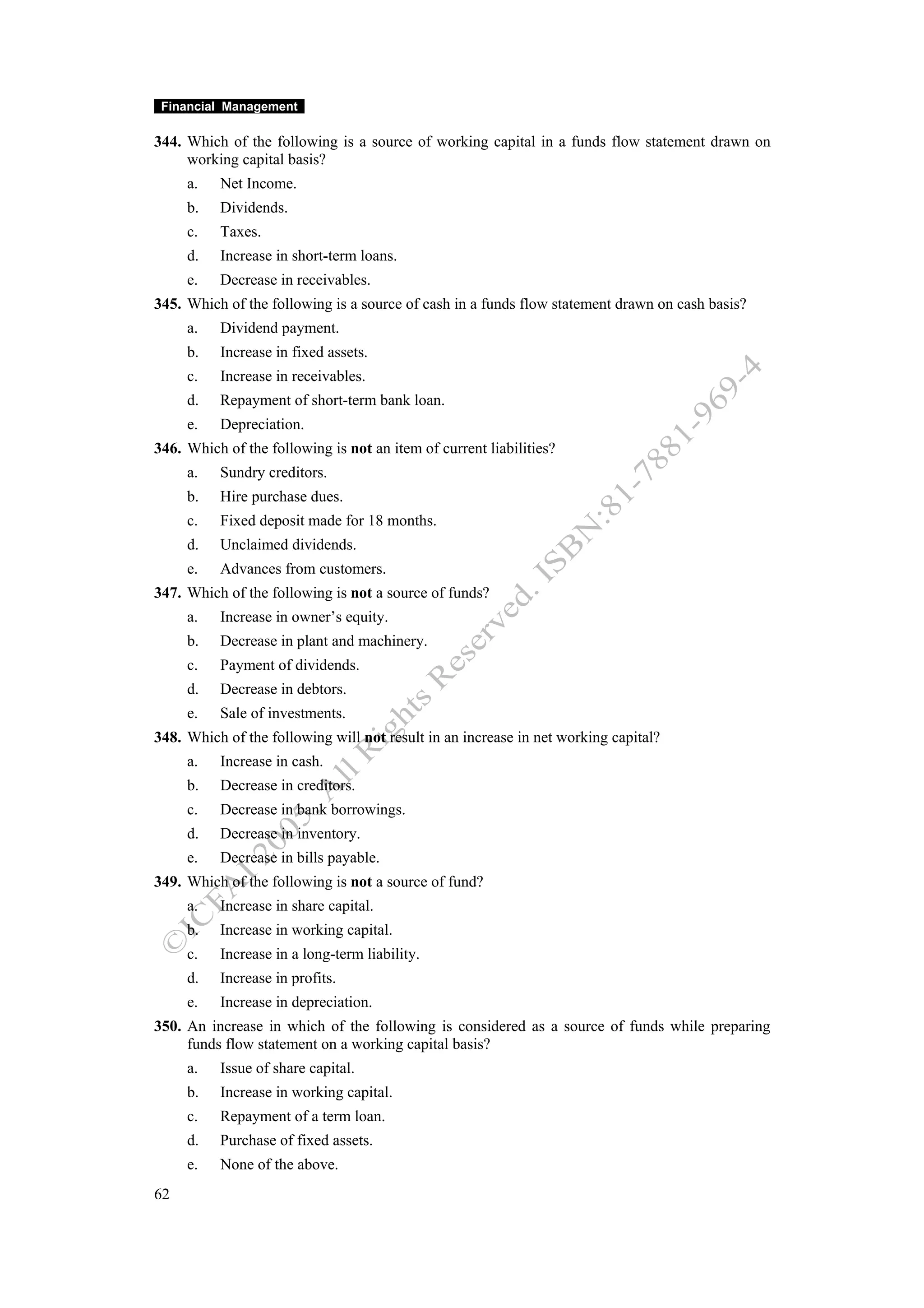

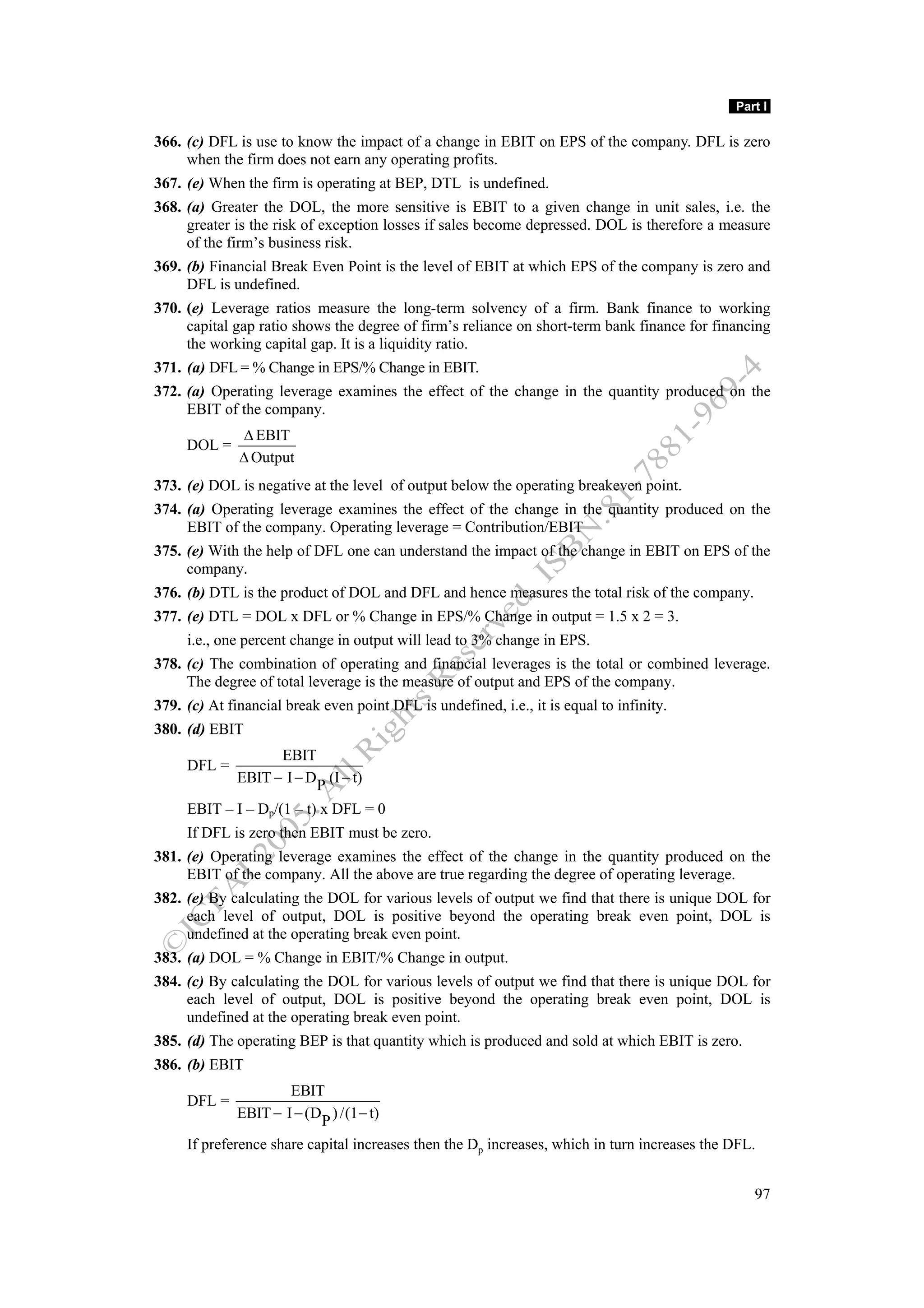

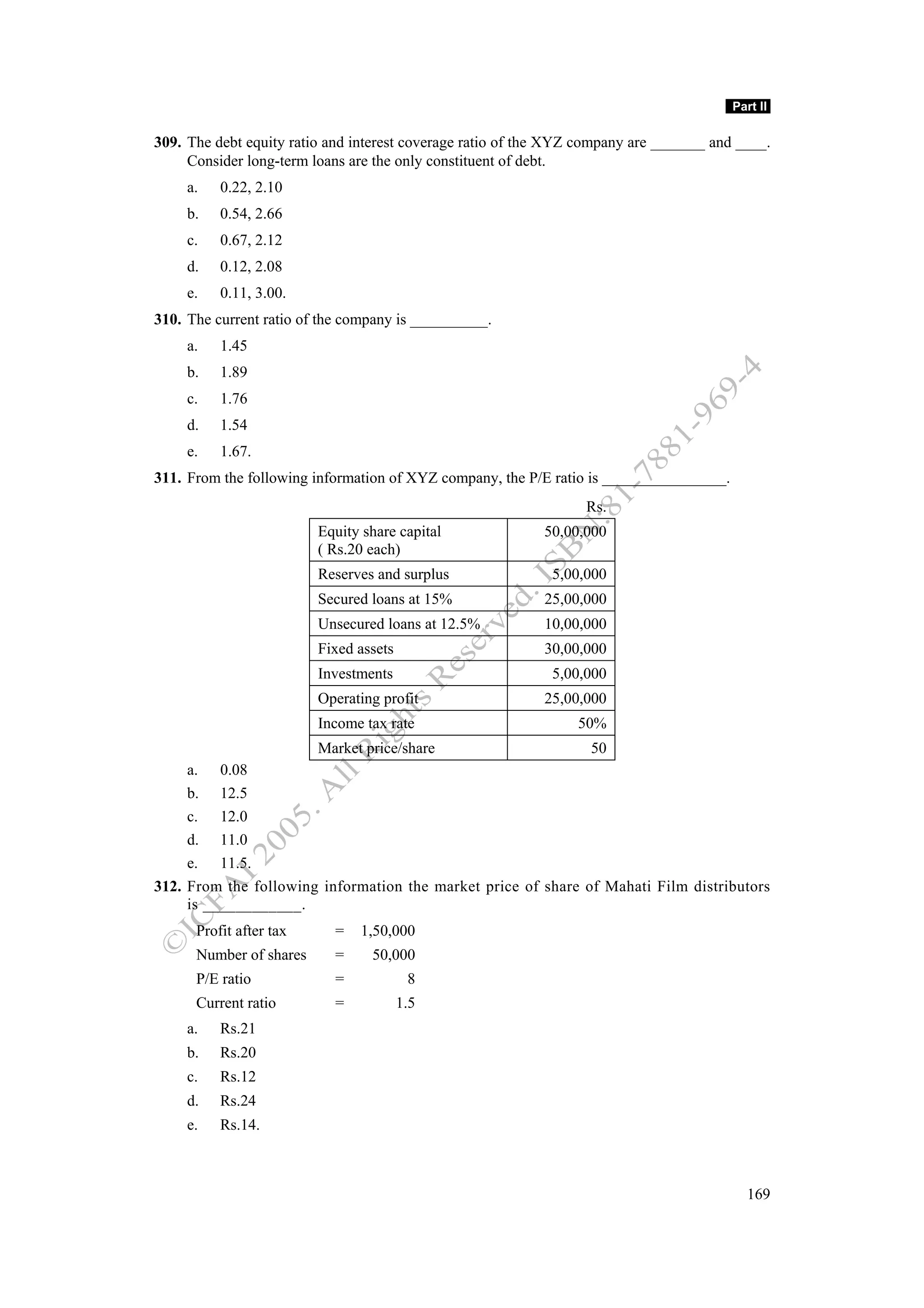

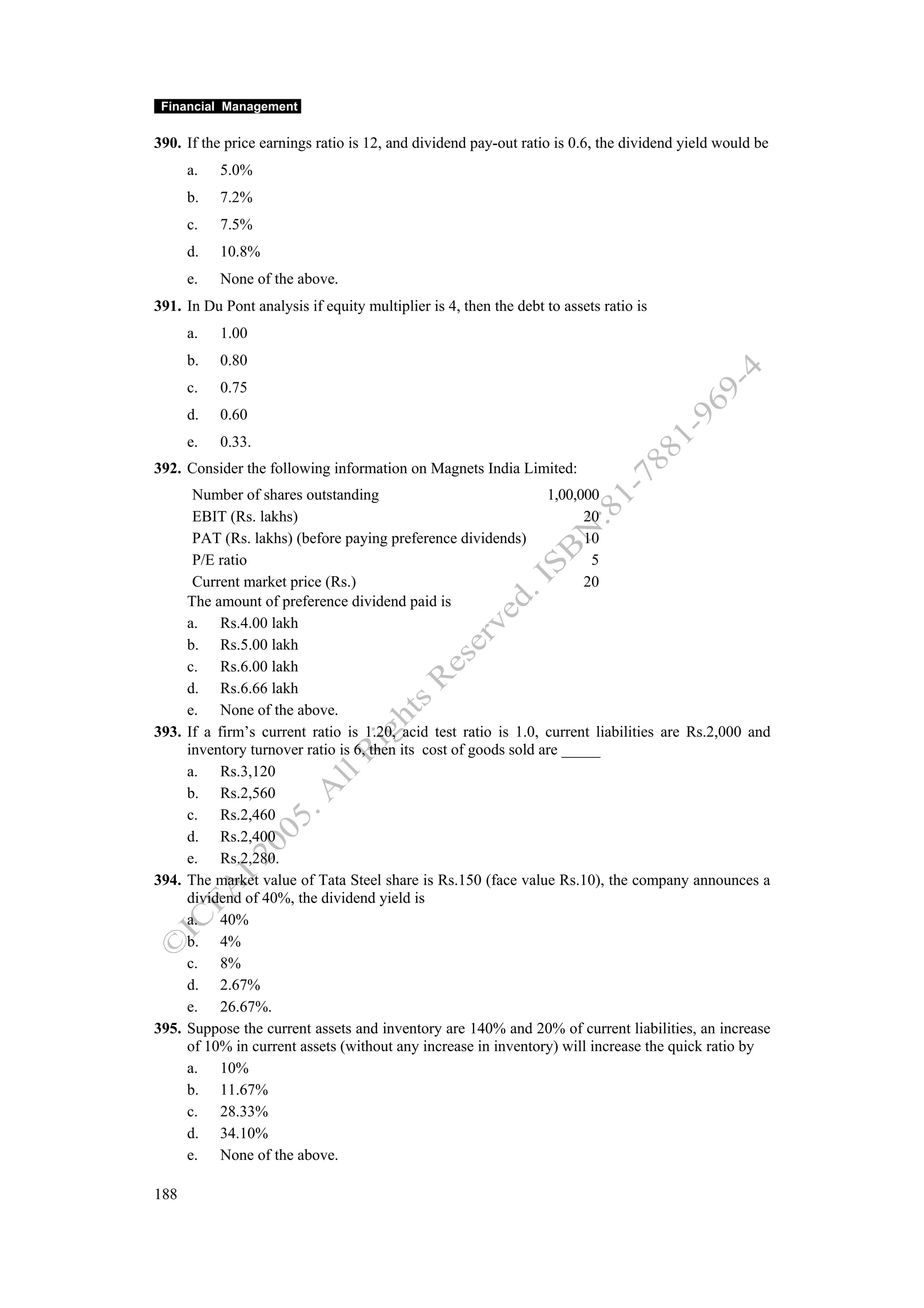

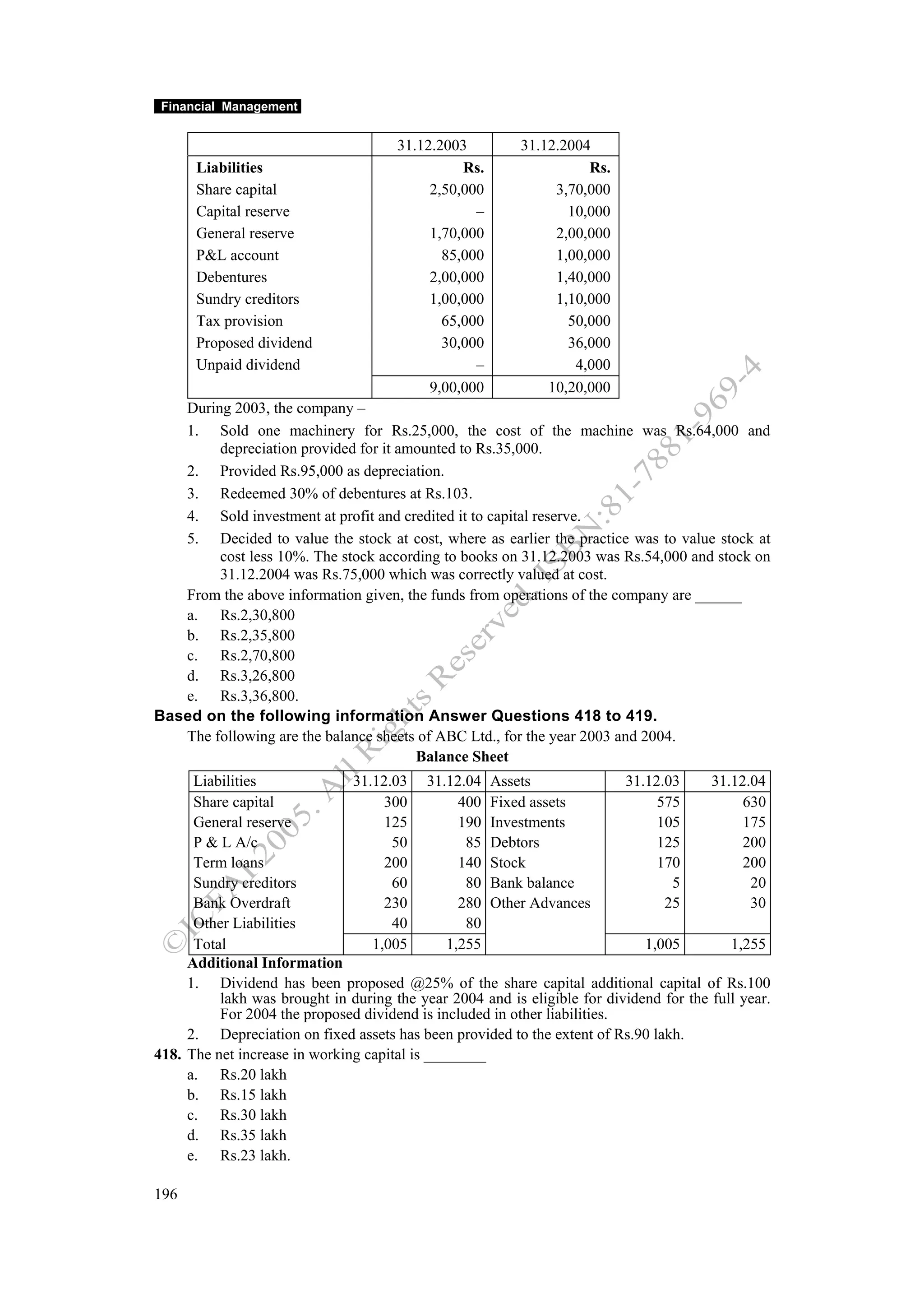

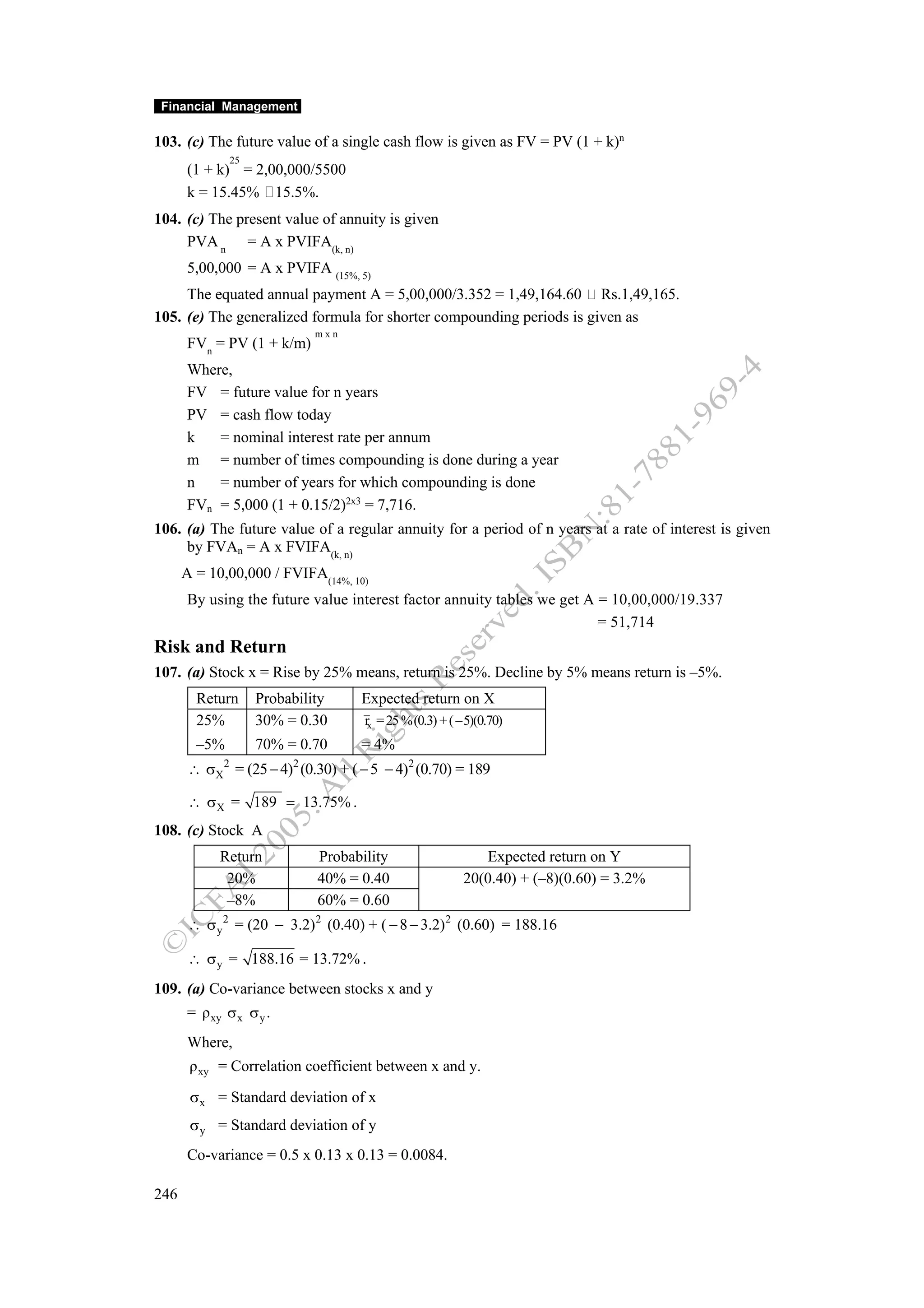

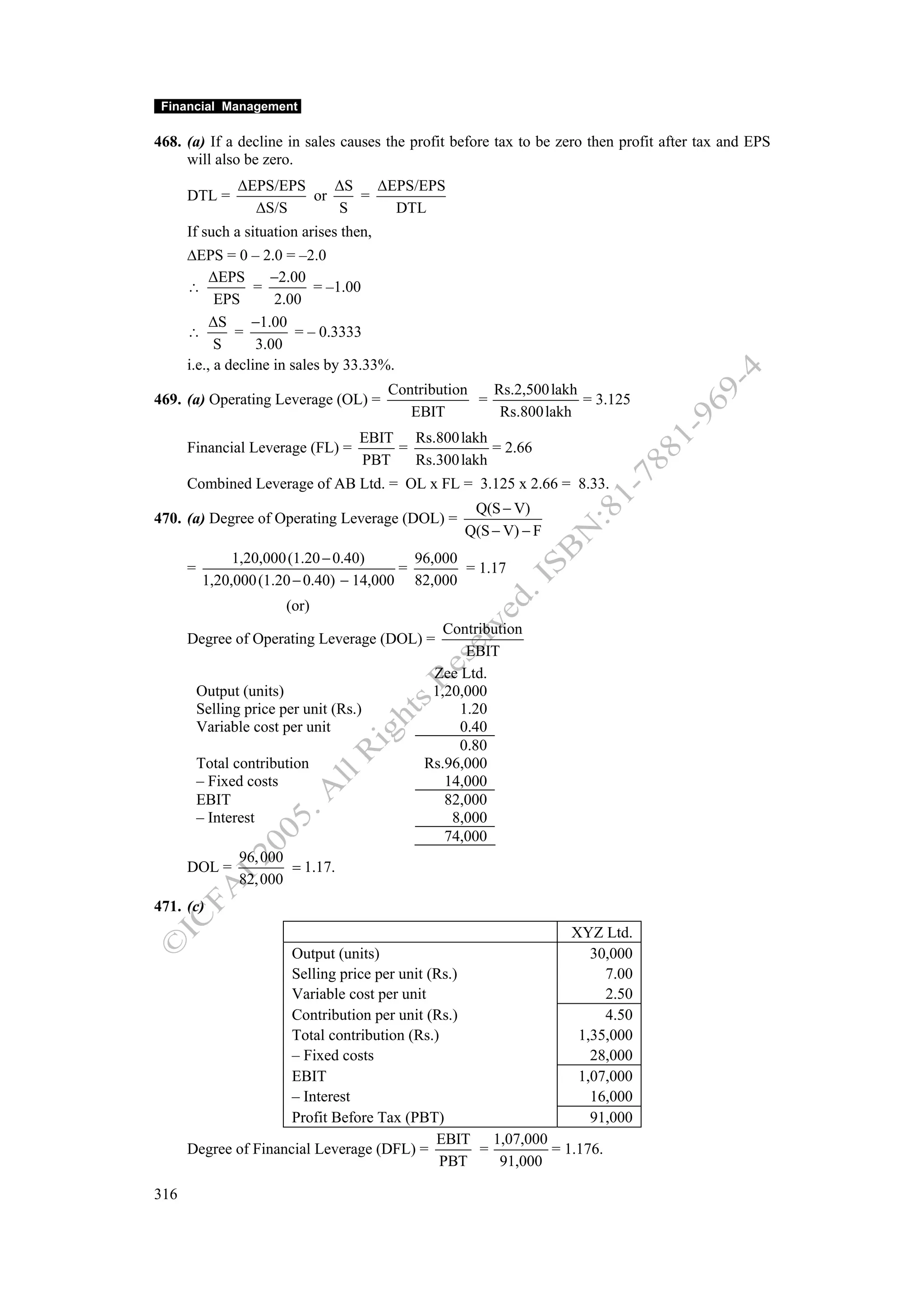

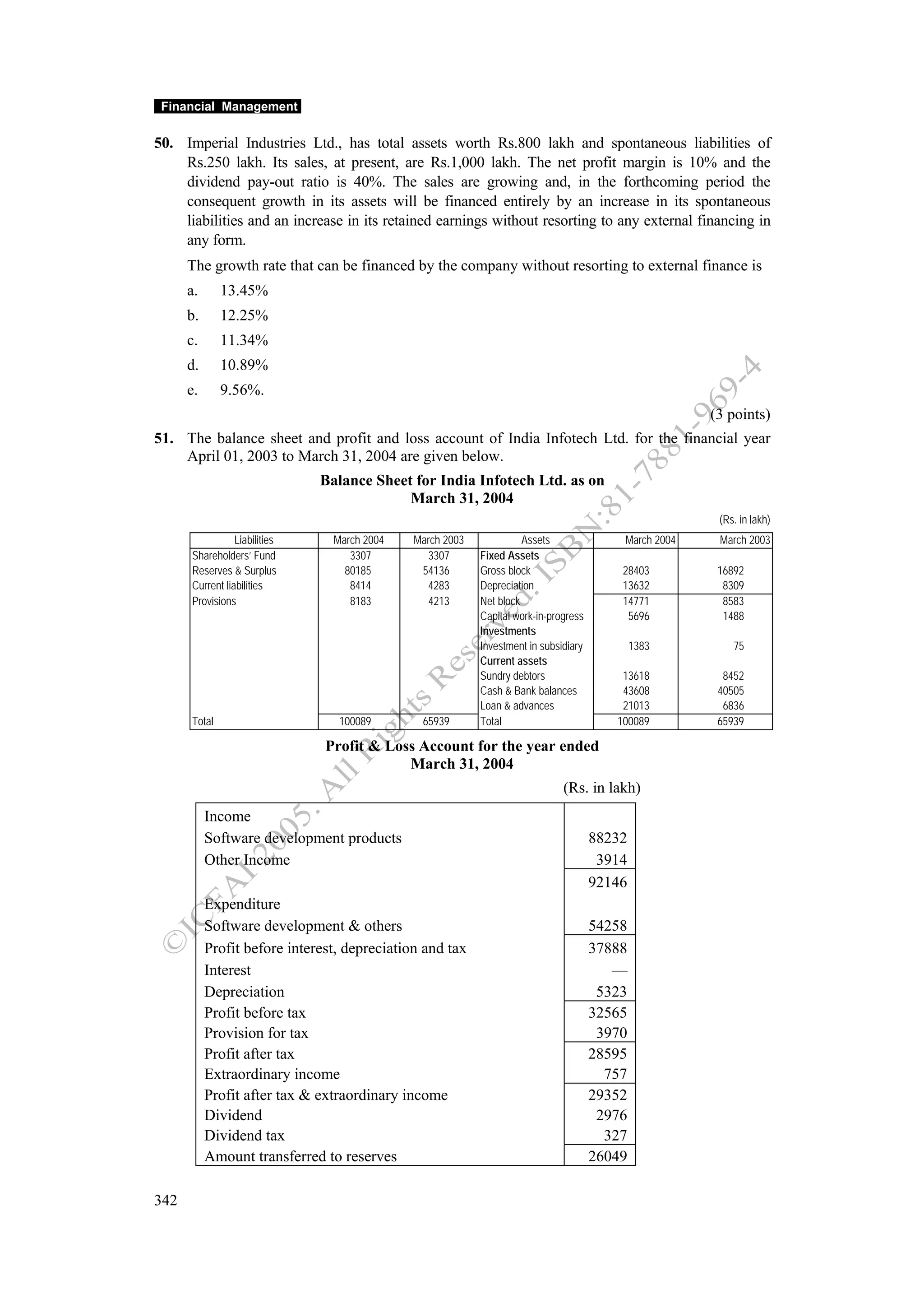

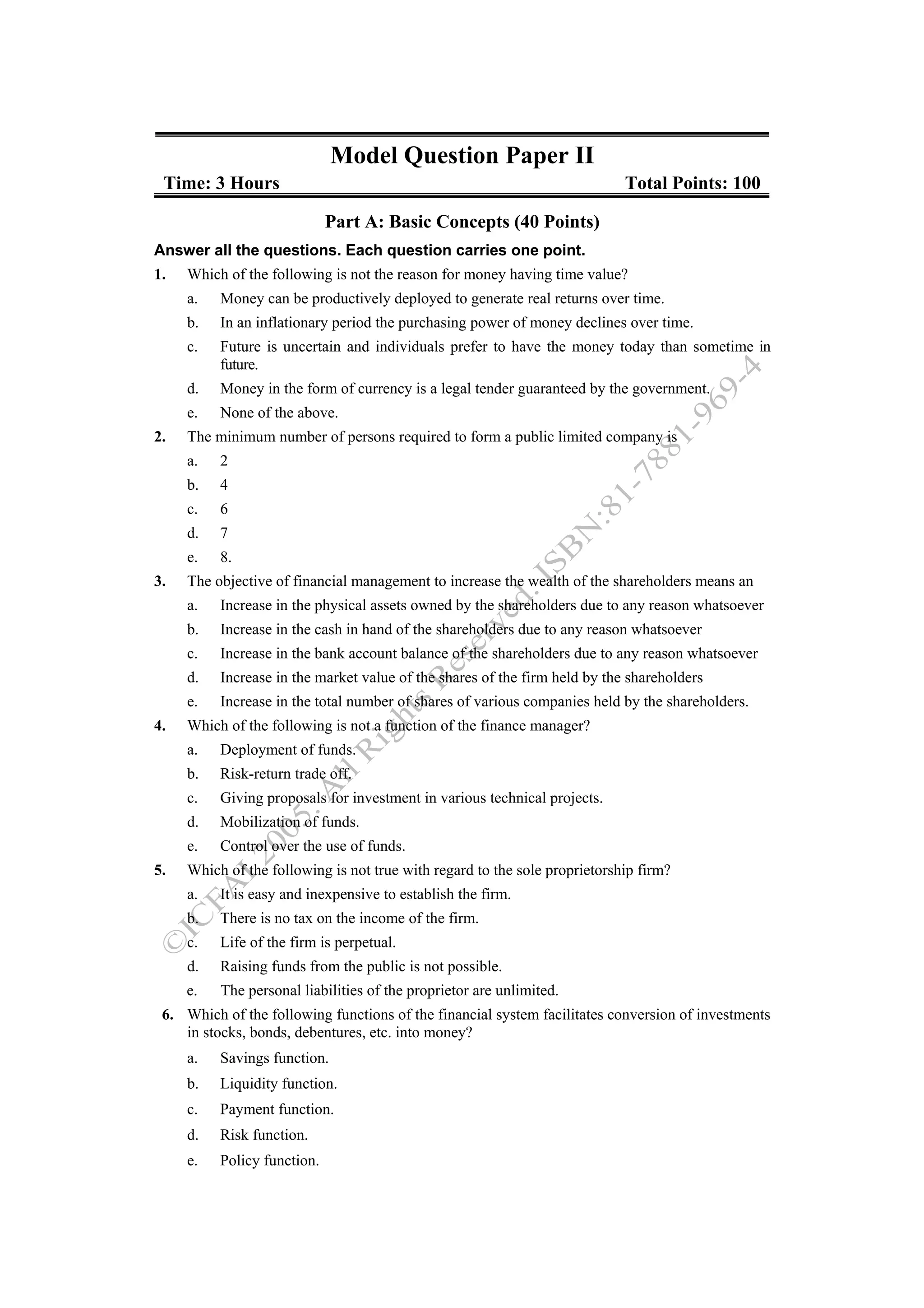

![5. DTL = % change in EPS / % change in output

= ( Δ EPS / EPS) ( Δ Q/Q)

DTL = DOL x DFL

= {[Q(S – V)]/[Q(S – V) – F]} x {[Q(S – V) – F]/ Q(S – V) – F – I – [Dp/1–T)]}

Q(S − V)

=

DP

Q(S − V) − F − I −

(1 − T)

6. The overall break even point is that level of output at which the DTL will be underfined and

EPS is equal to zero. This level of output can be calculated as follows:

DP

F +1+

(1 − T)

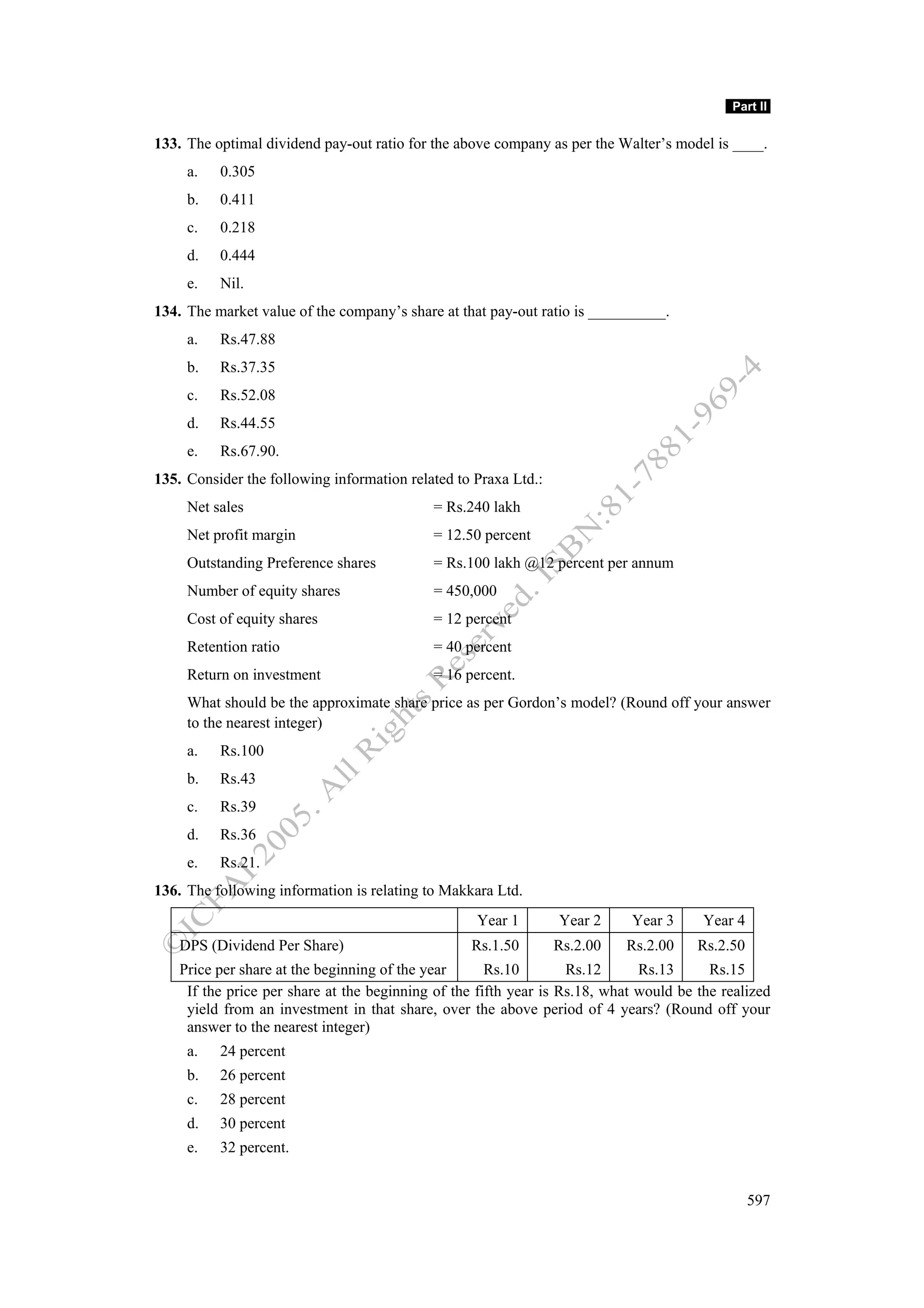

Q =

(S − V)

Financial Forecasting

A L

1. EFR = (ΔS) − (ΔS) − mS1 (1 − d)

S S

Where,

EFR = External financing requirement

A/S = Current assets and Fixed assets as proportion of sales

ΔS = Expected increase in sales

L/S = Spontaneous liabilities as proportion of sales

m = Net profit margin

S1 = Projected sales for next year

d = Dividend pay-out ratio.

m(1 − d)A / E

2. g= .

A / S0 − m(1 − d)A / E

107](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-112-2048.jpg)

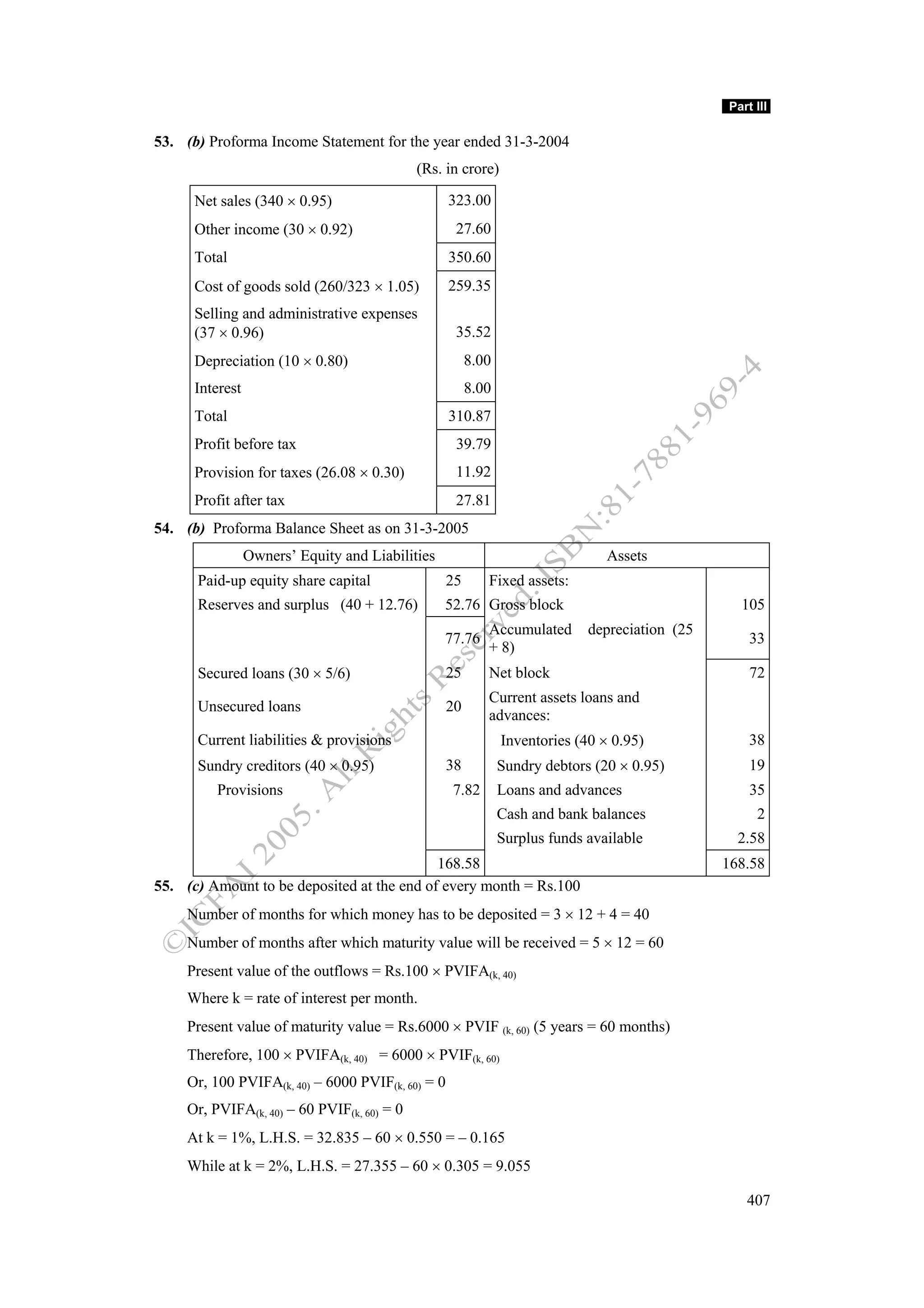

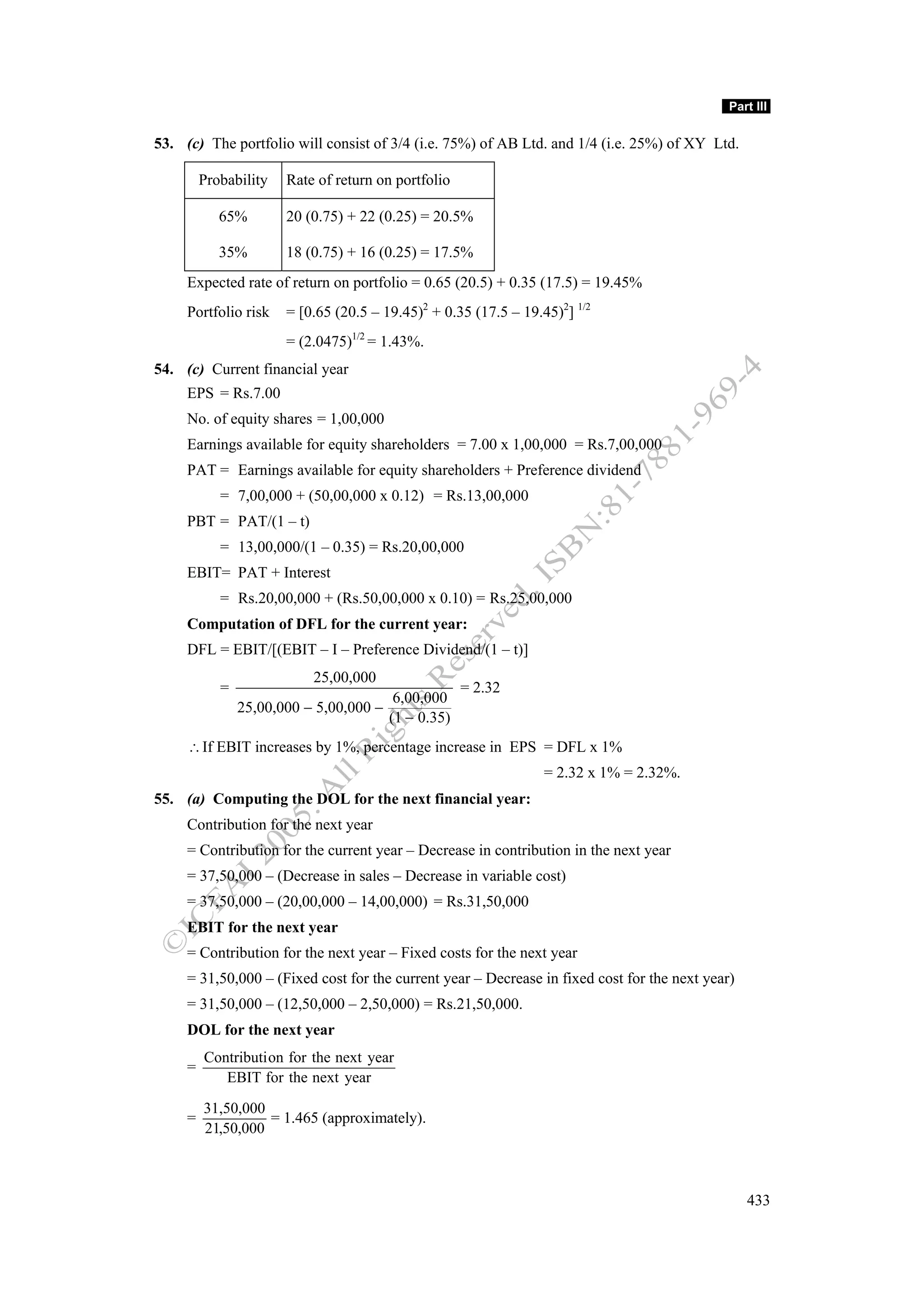

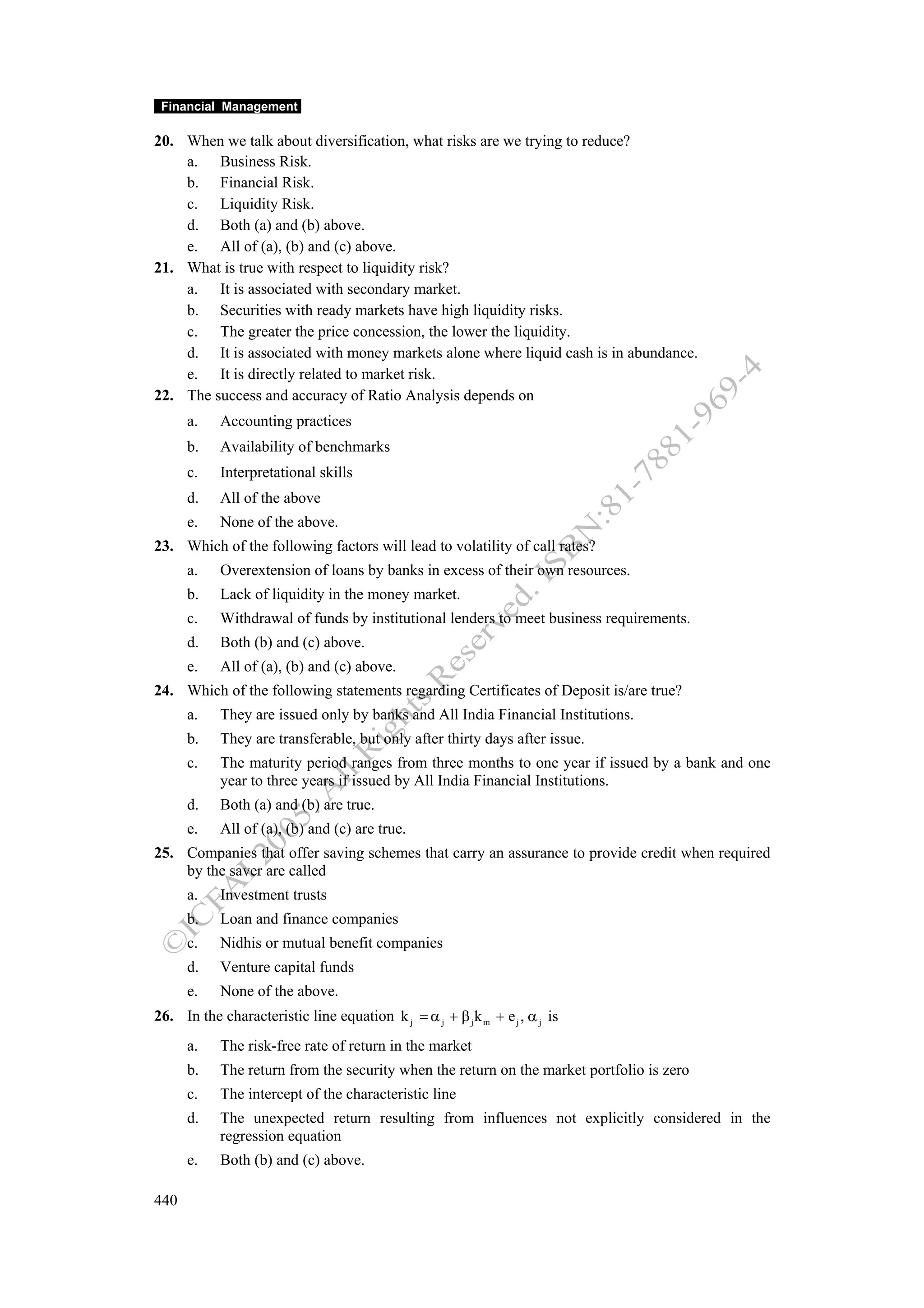

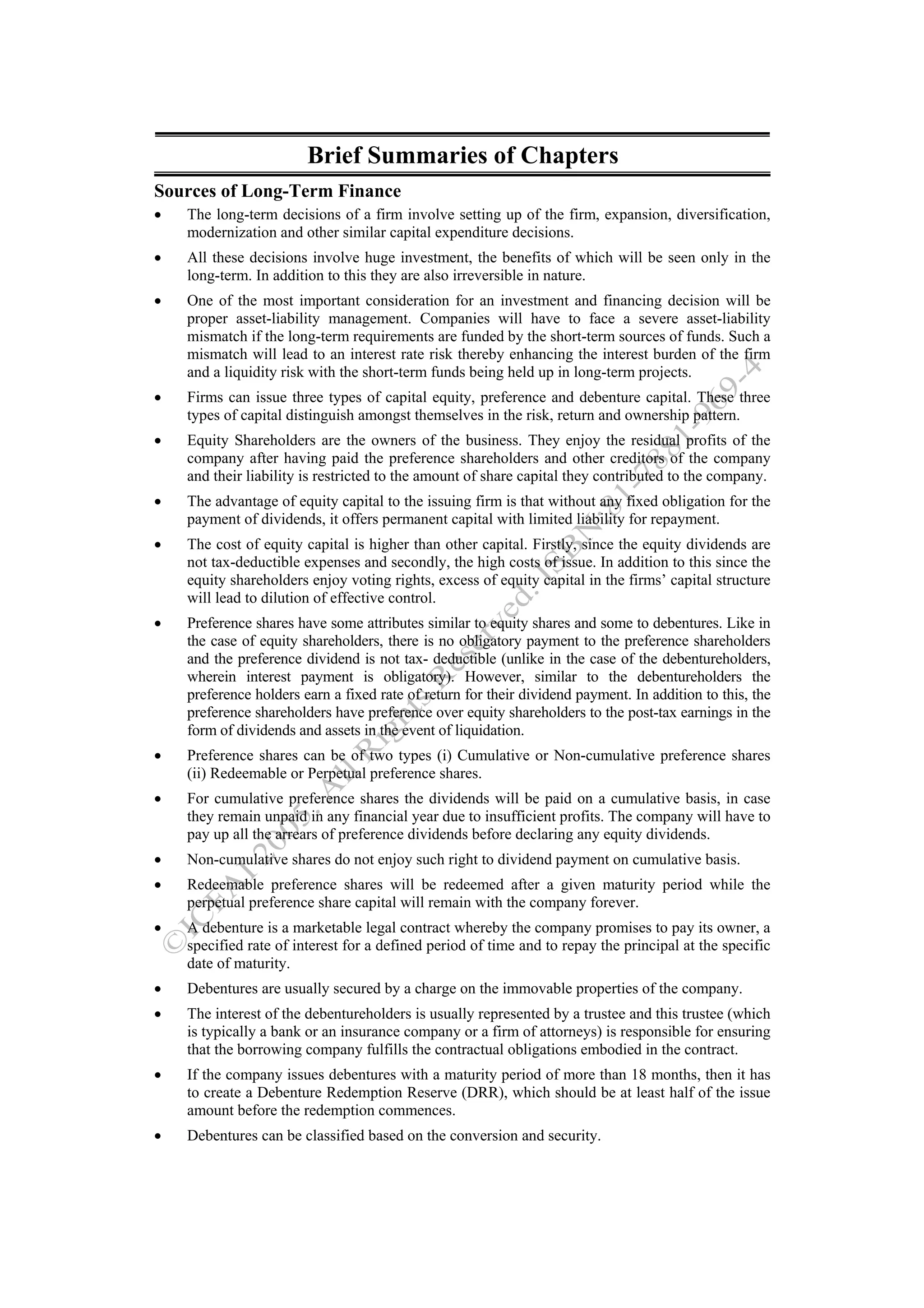

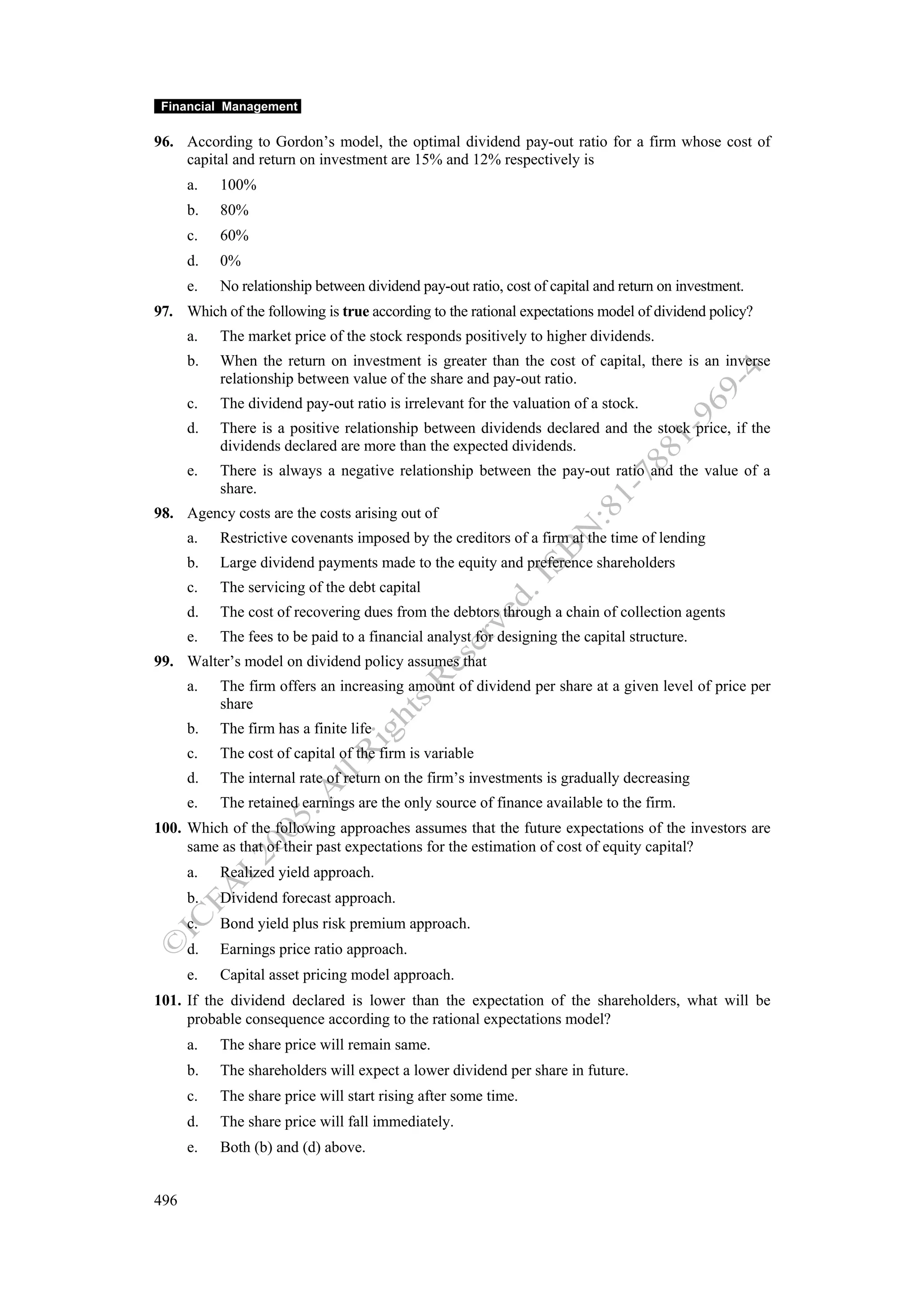

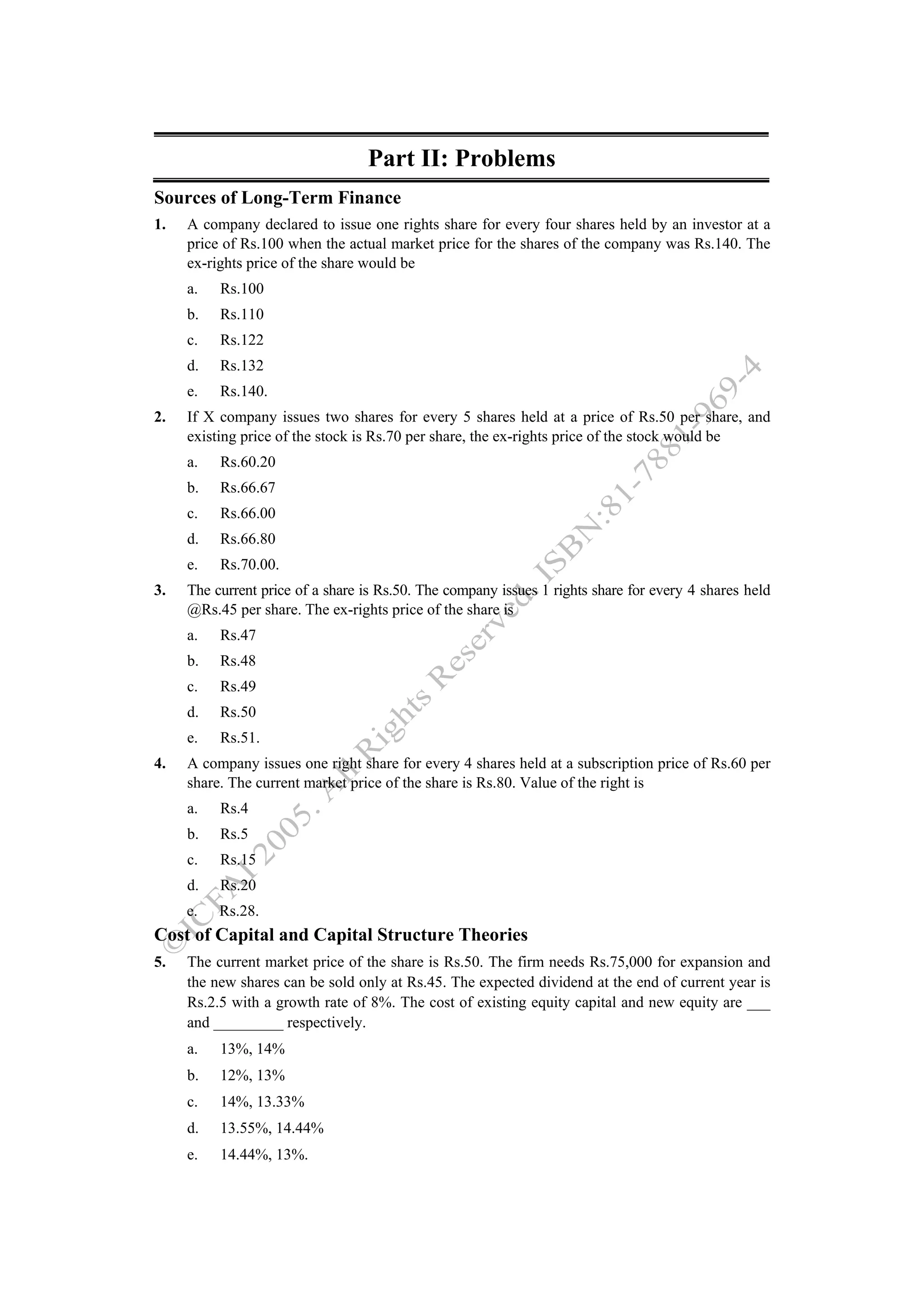

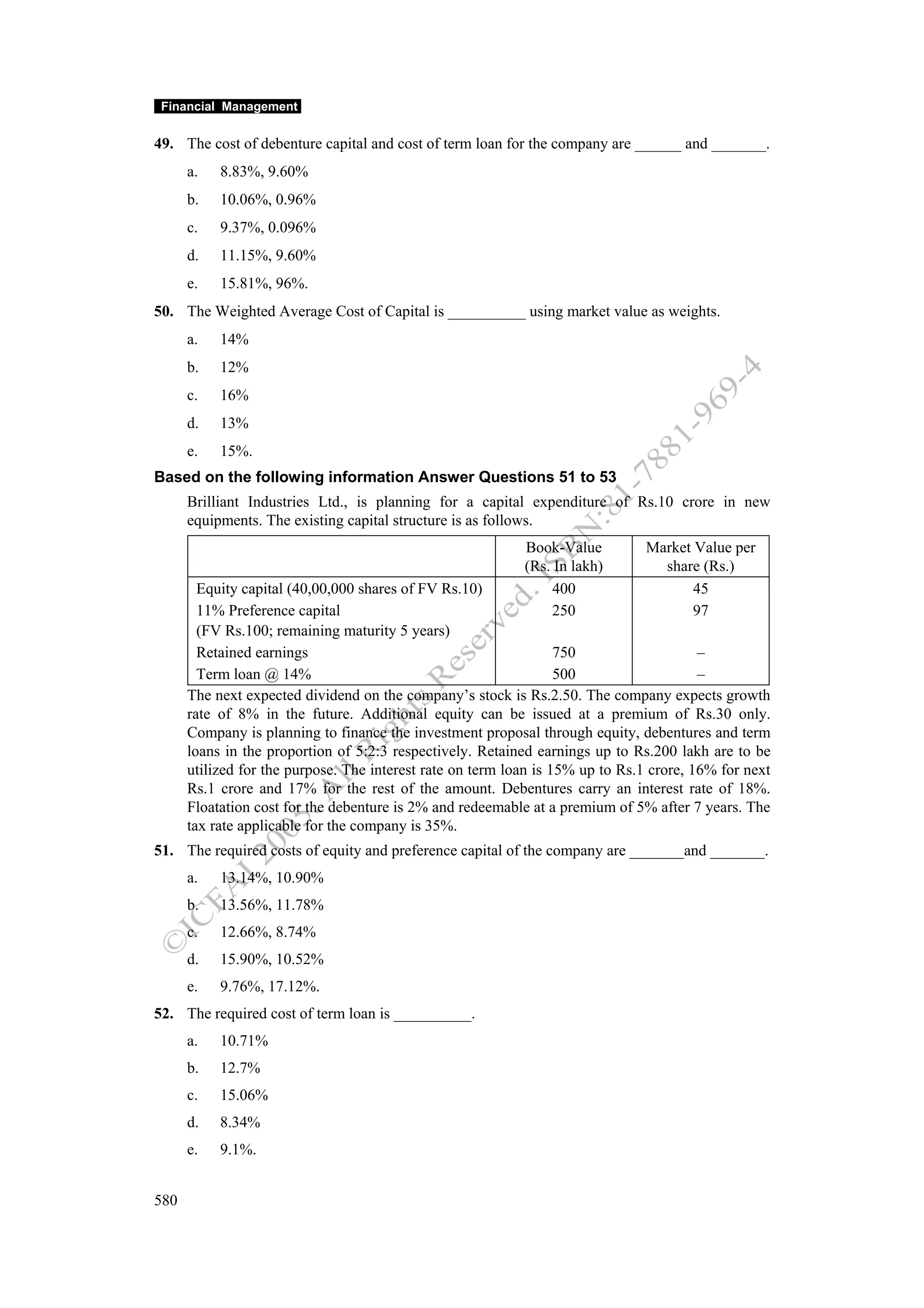

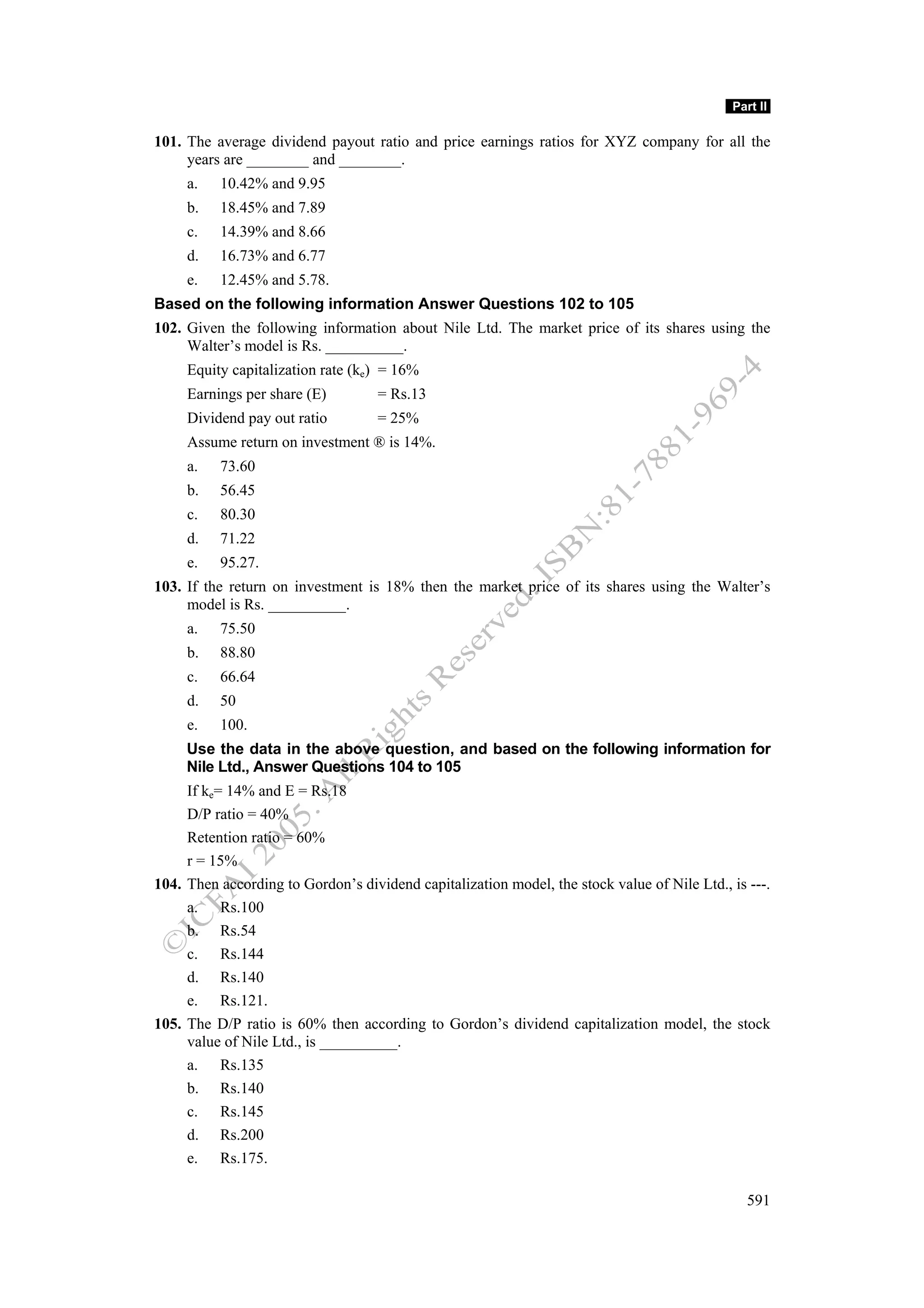

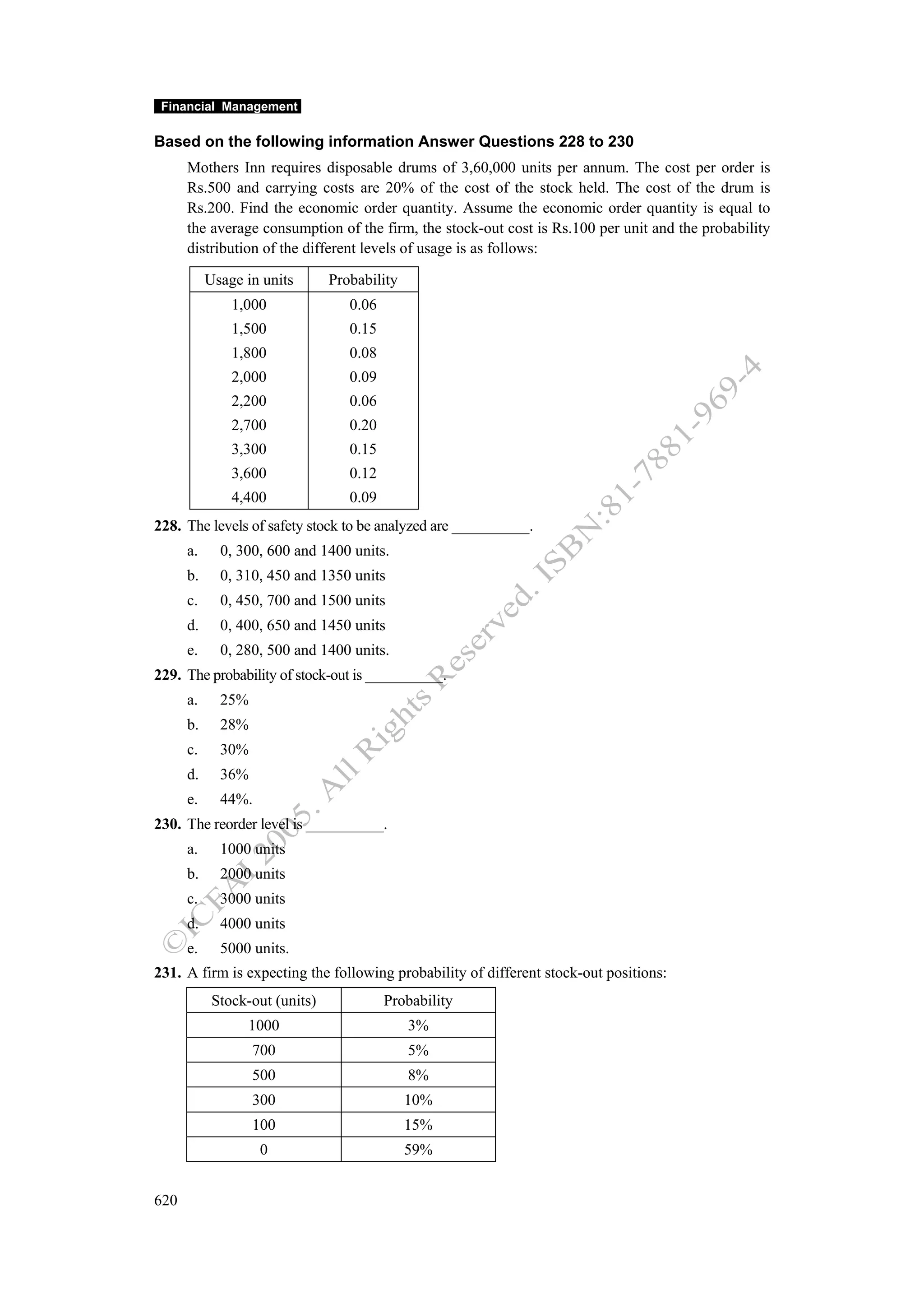

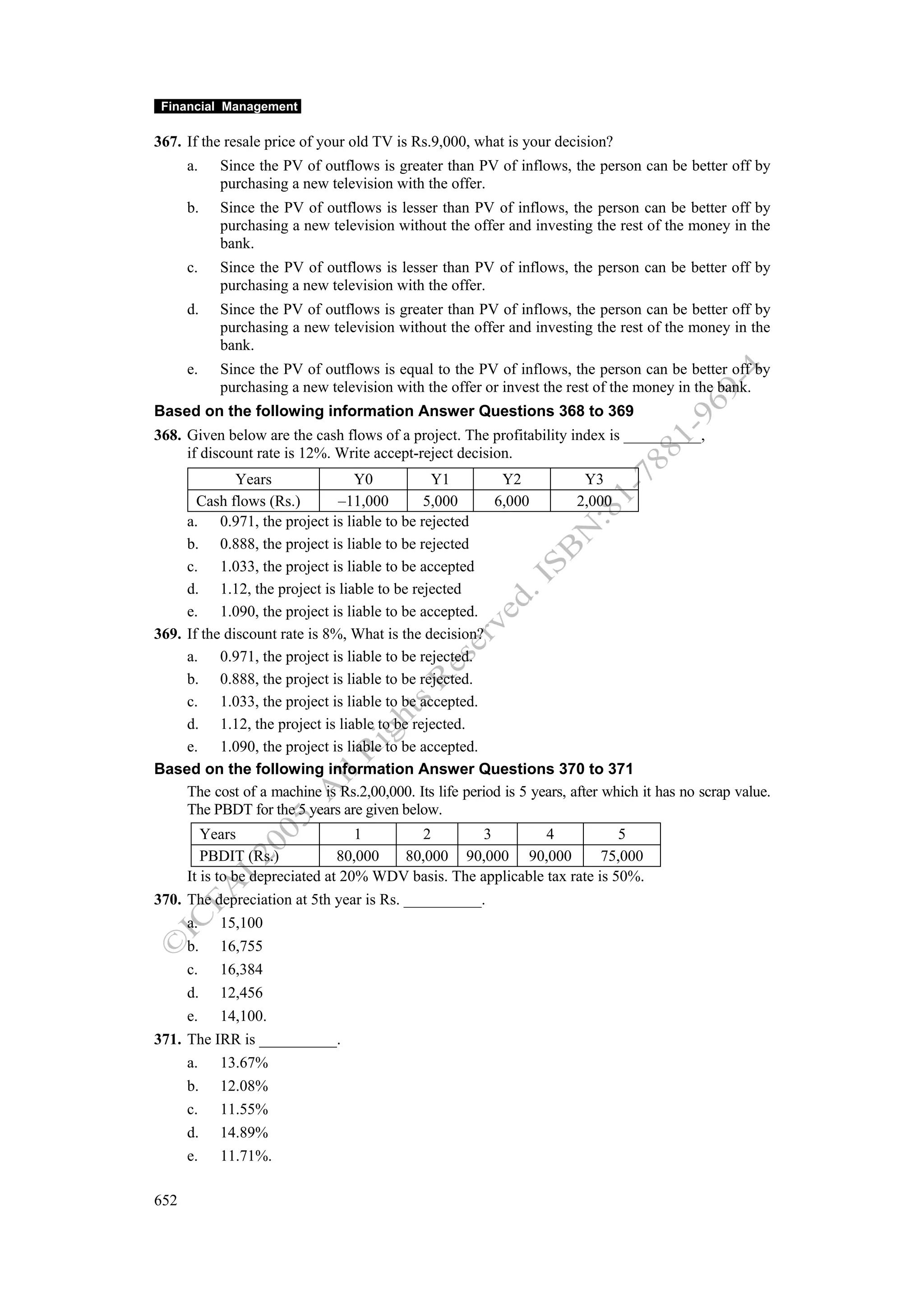

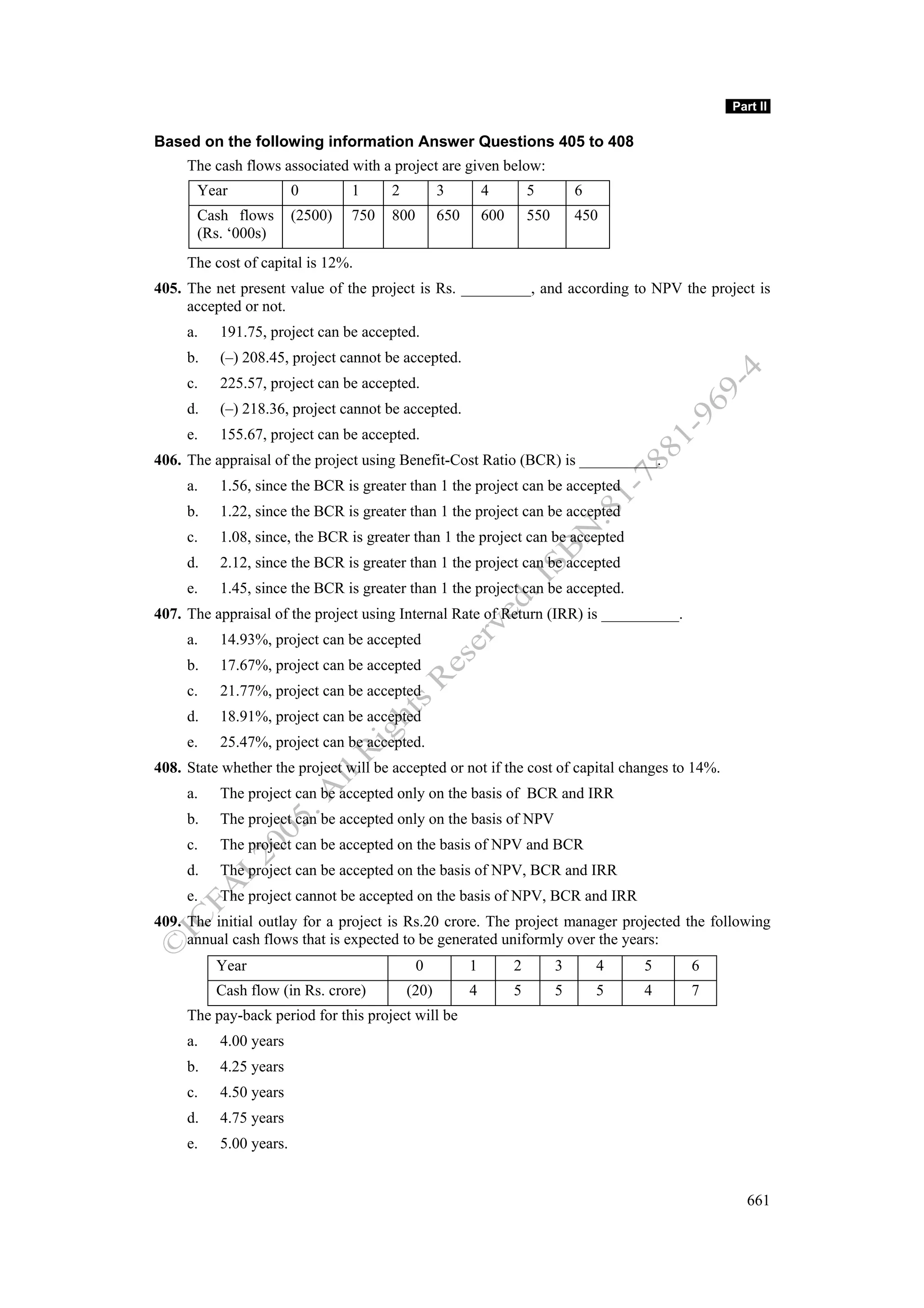

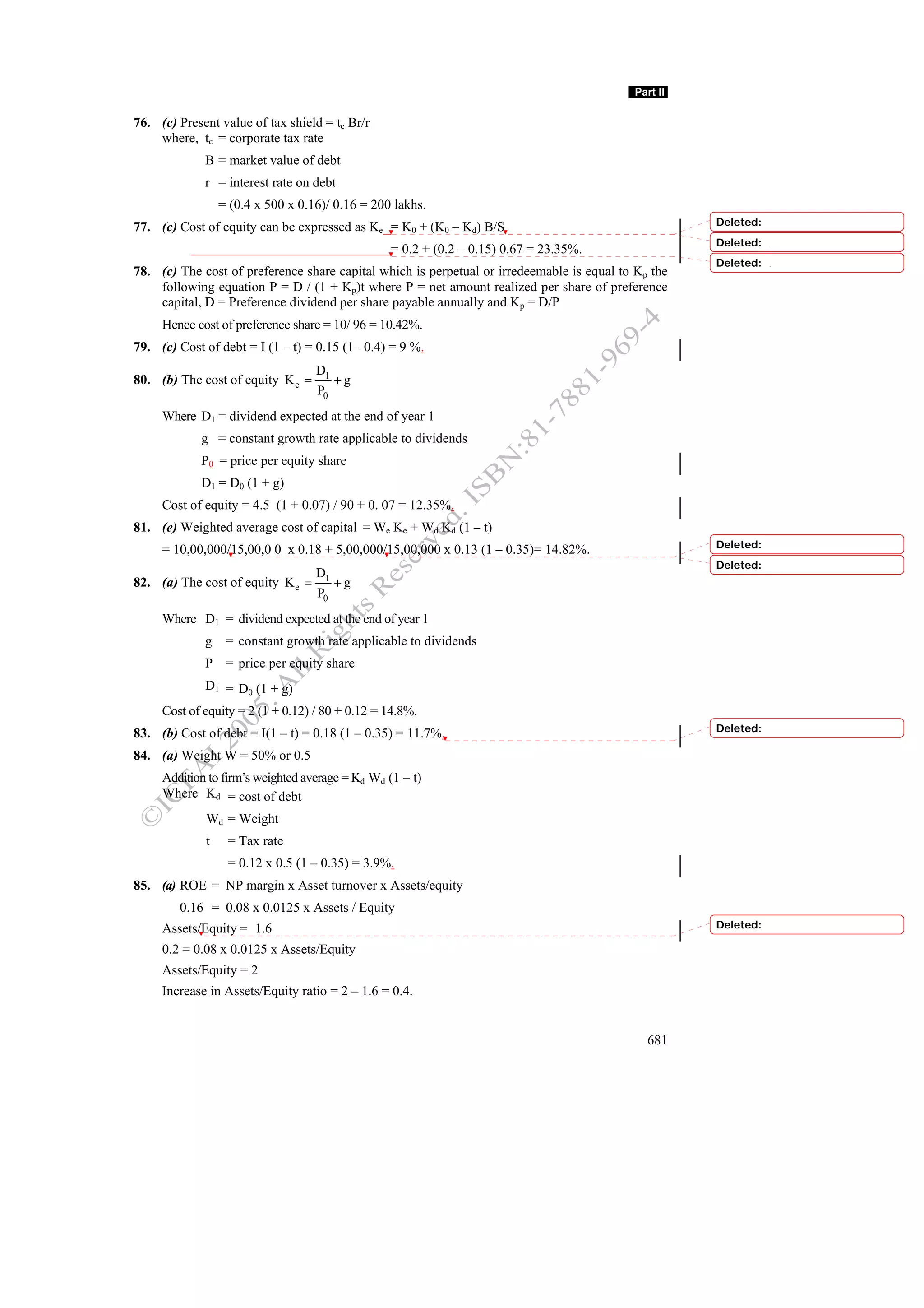

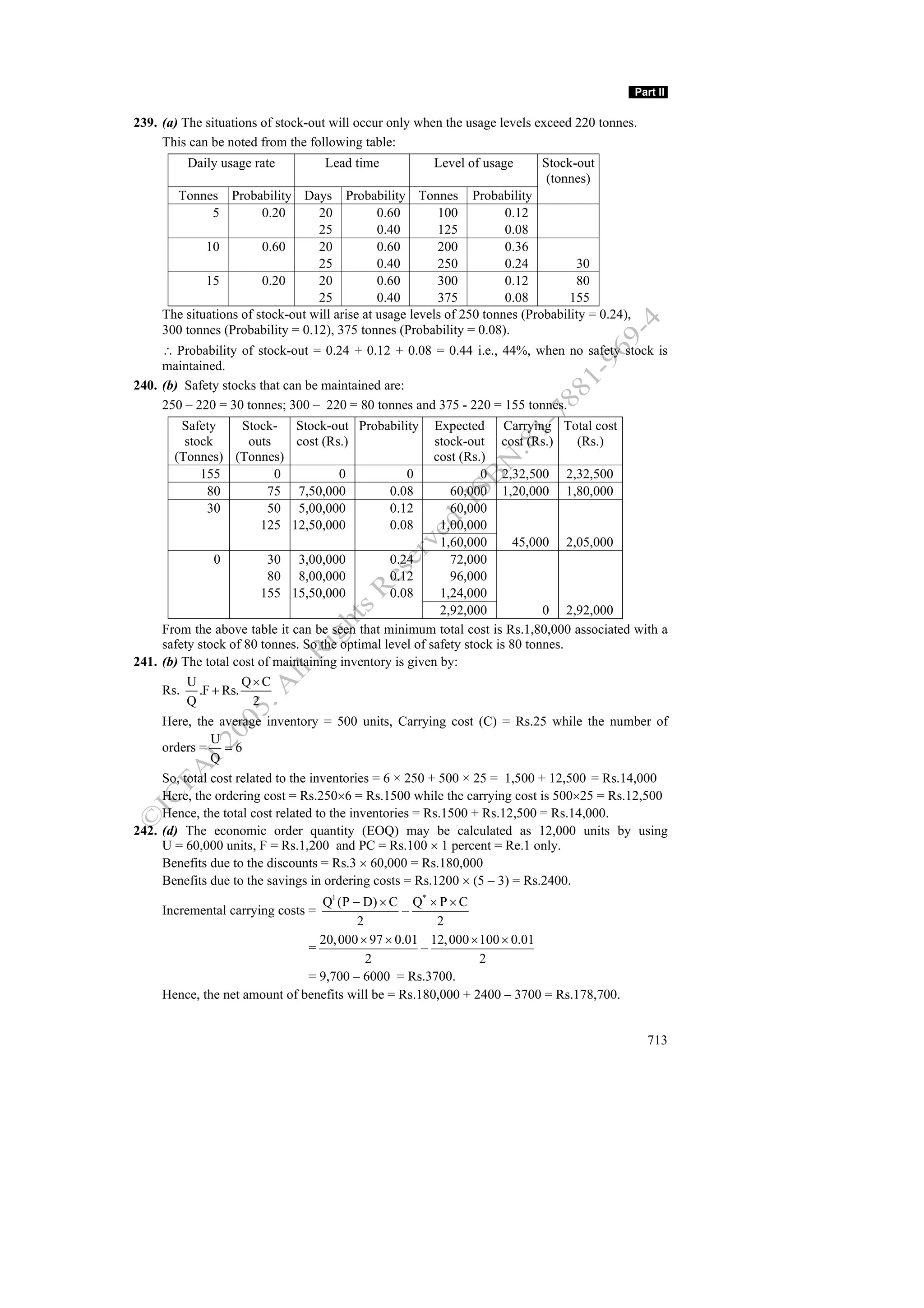

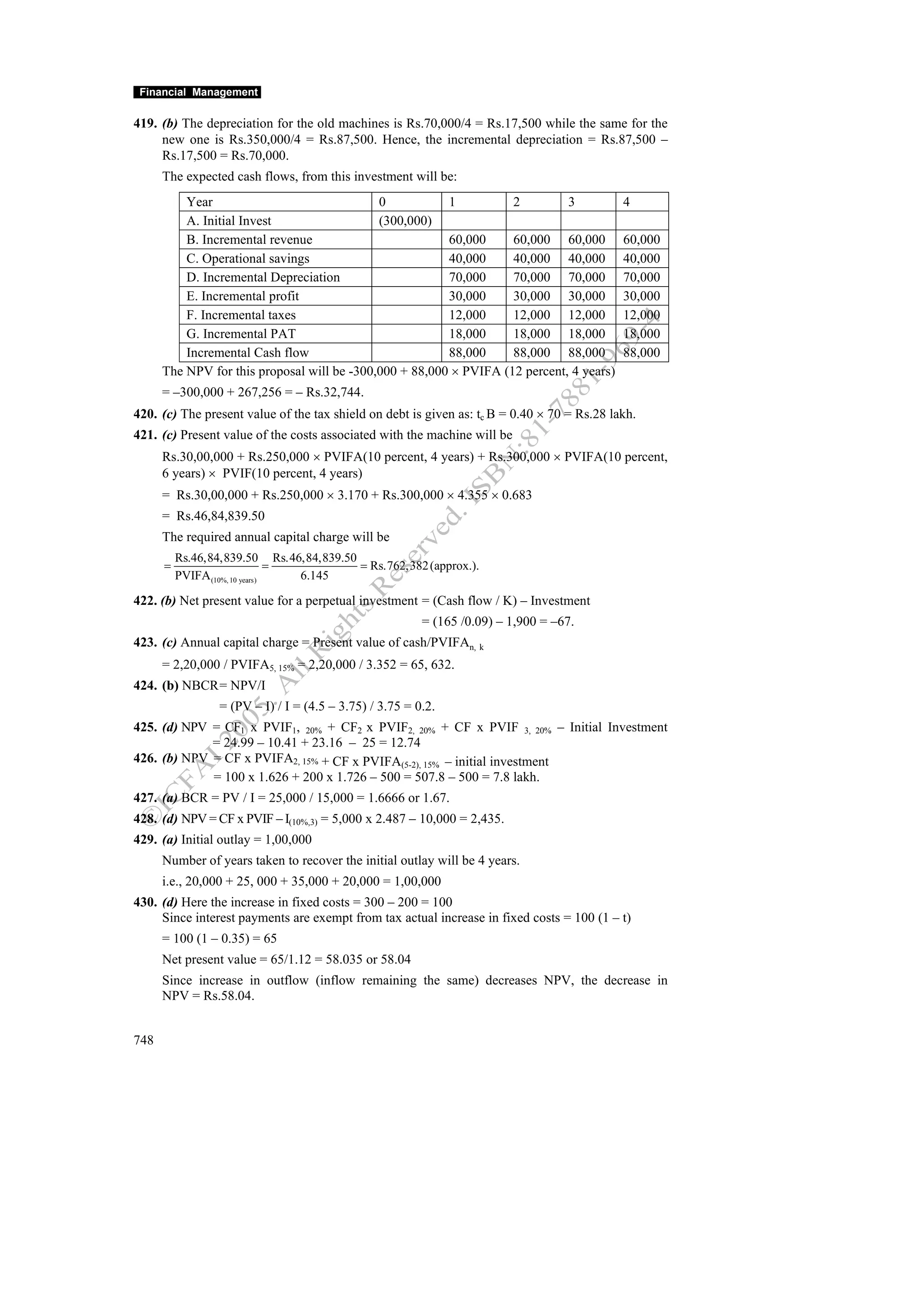

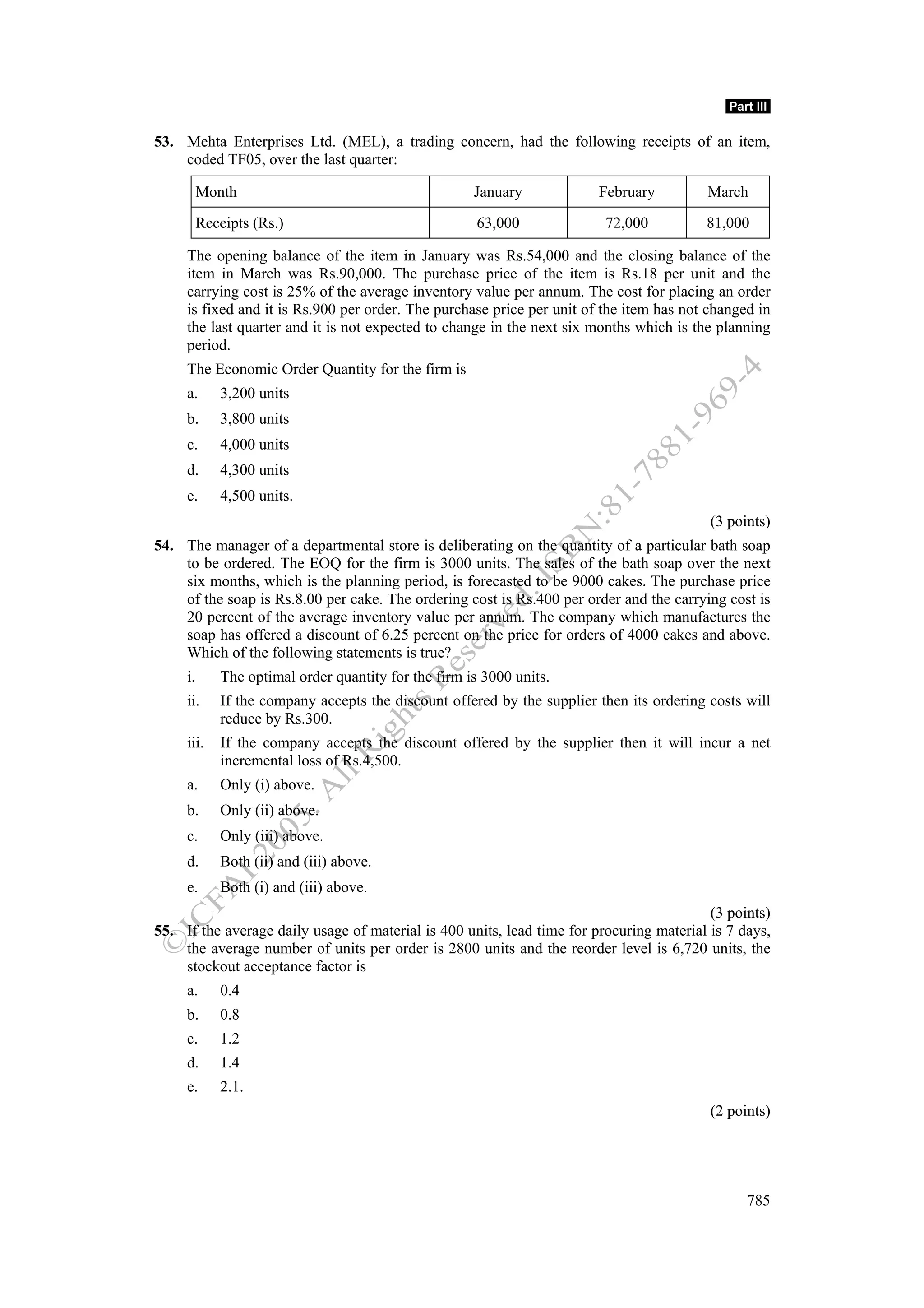

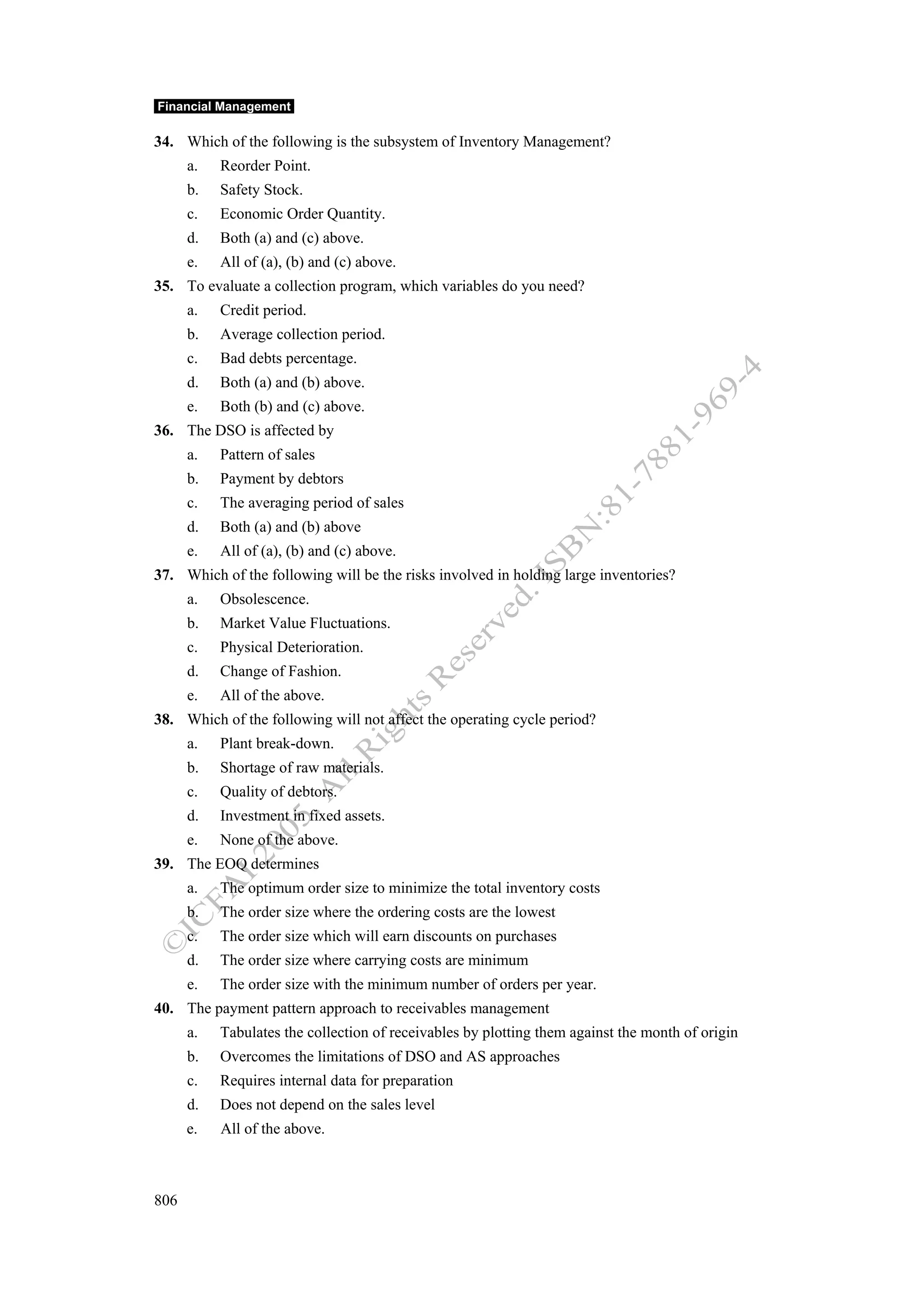

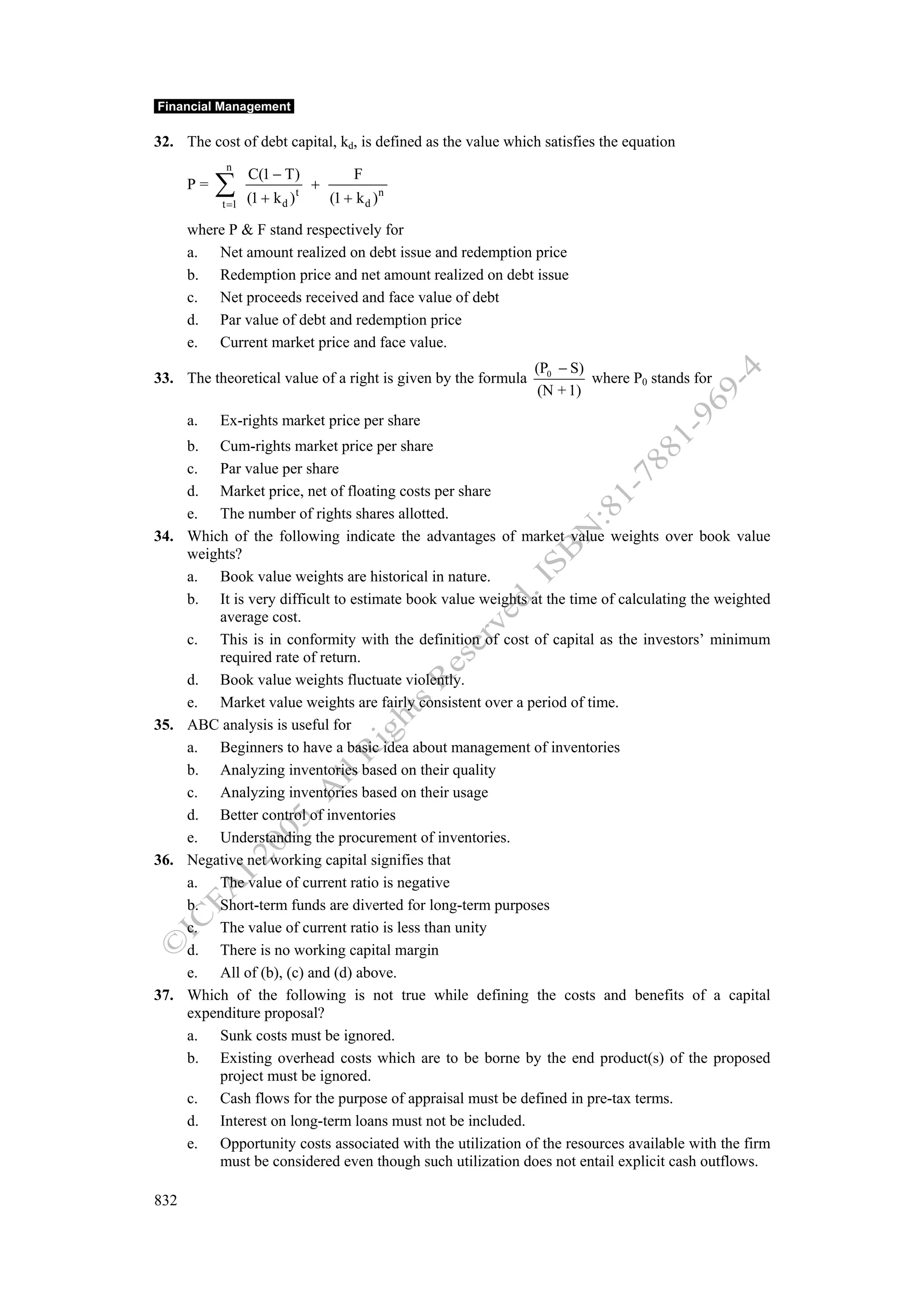

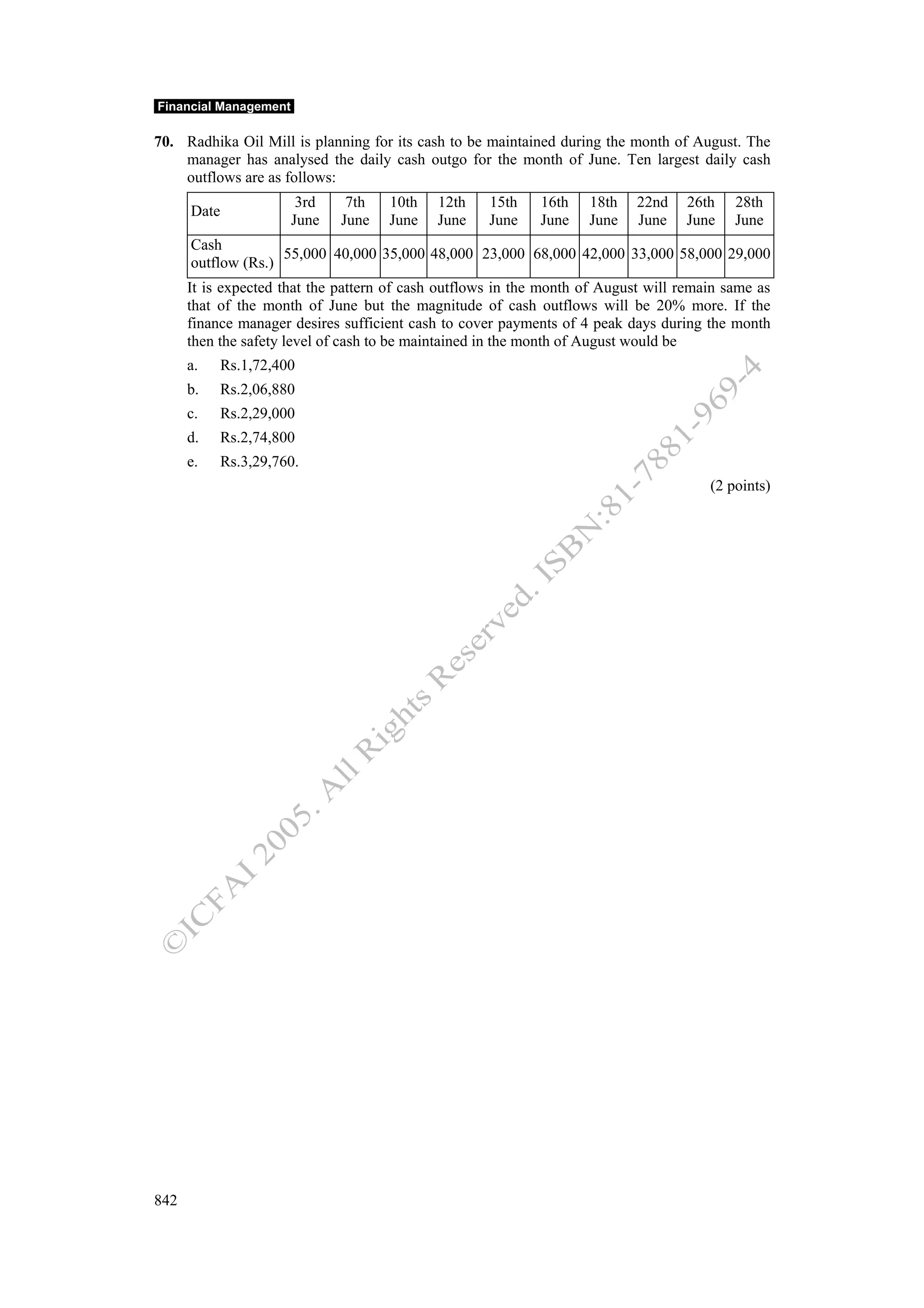

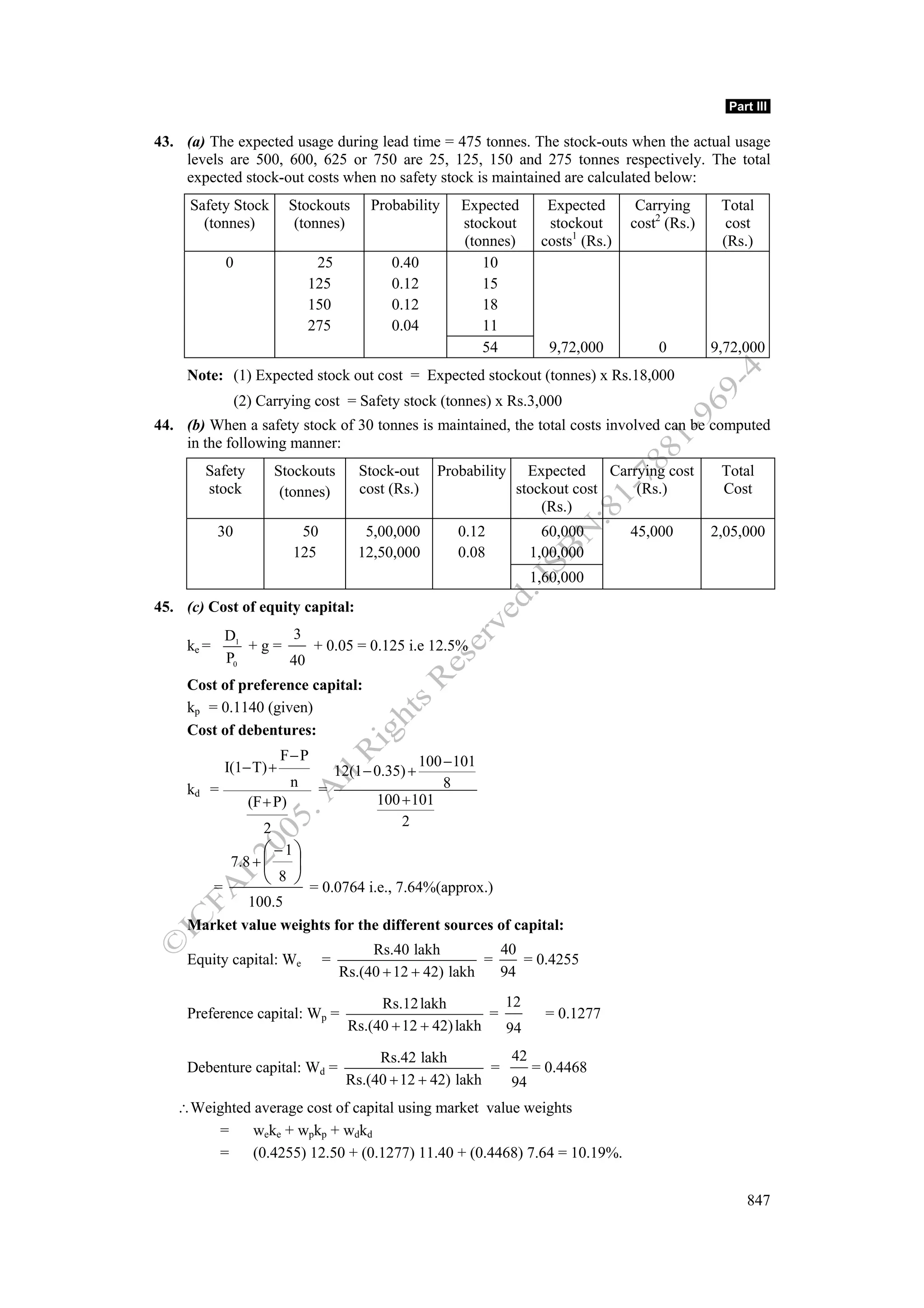

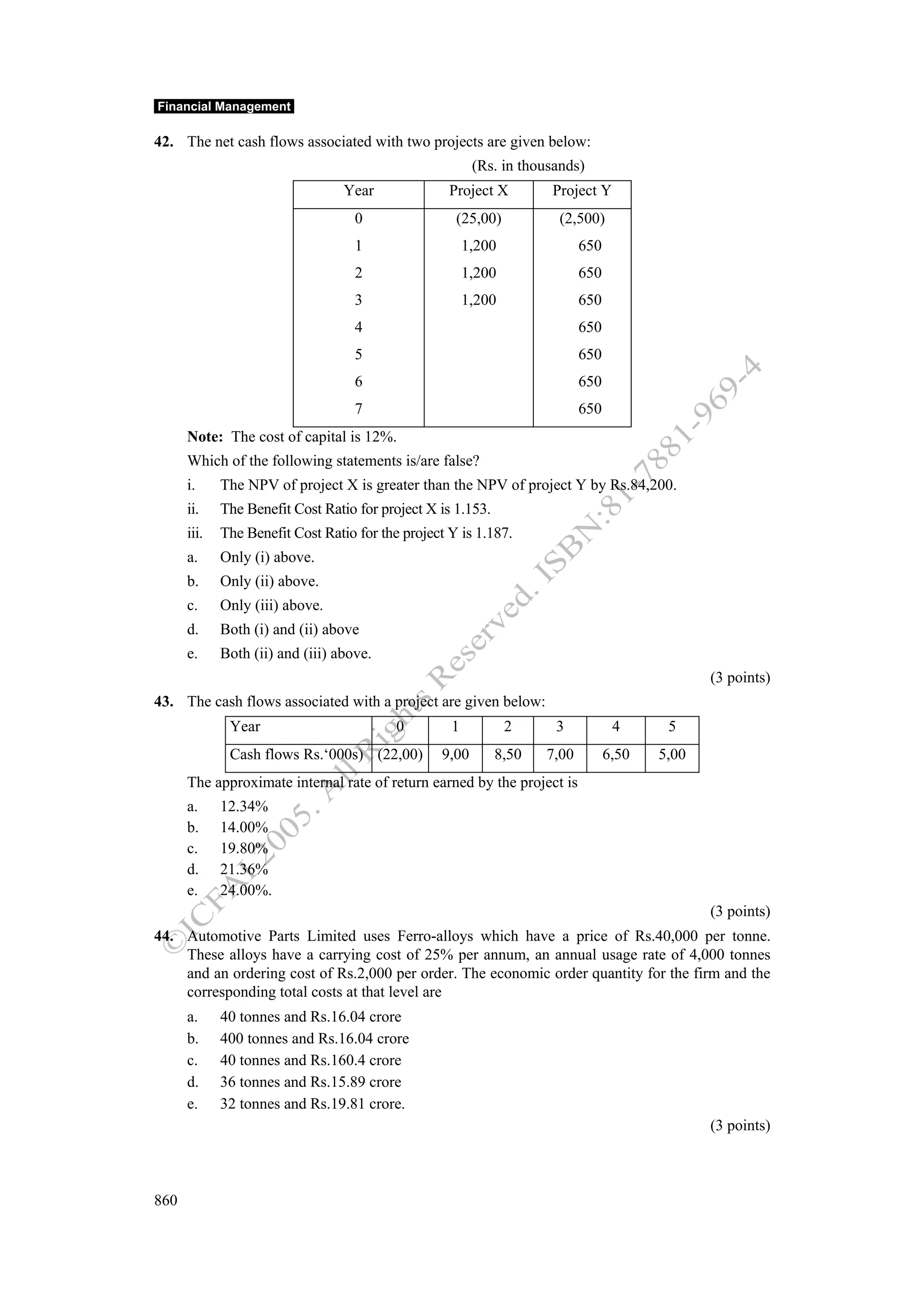

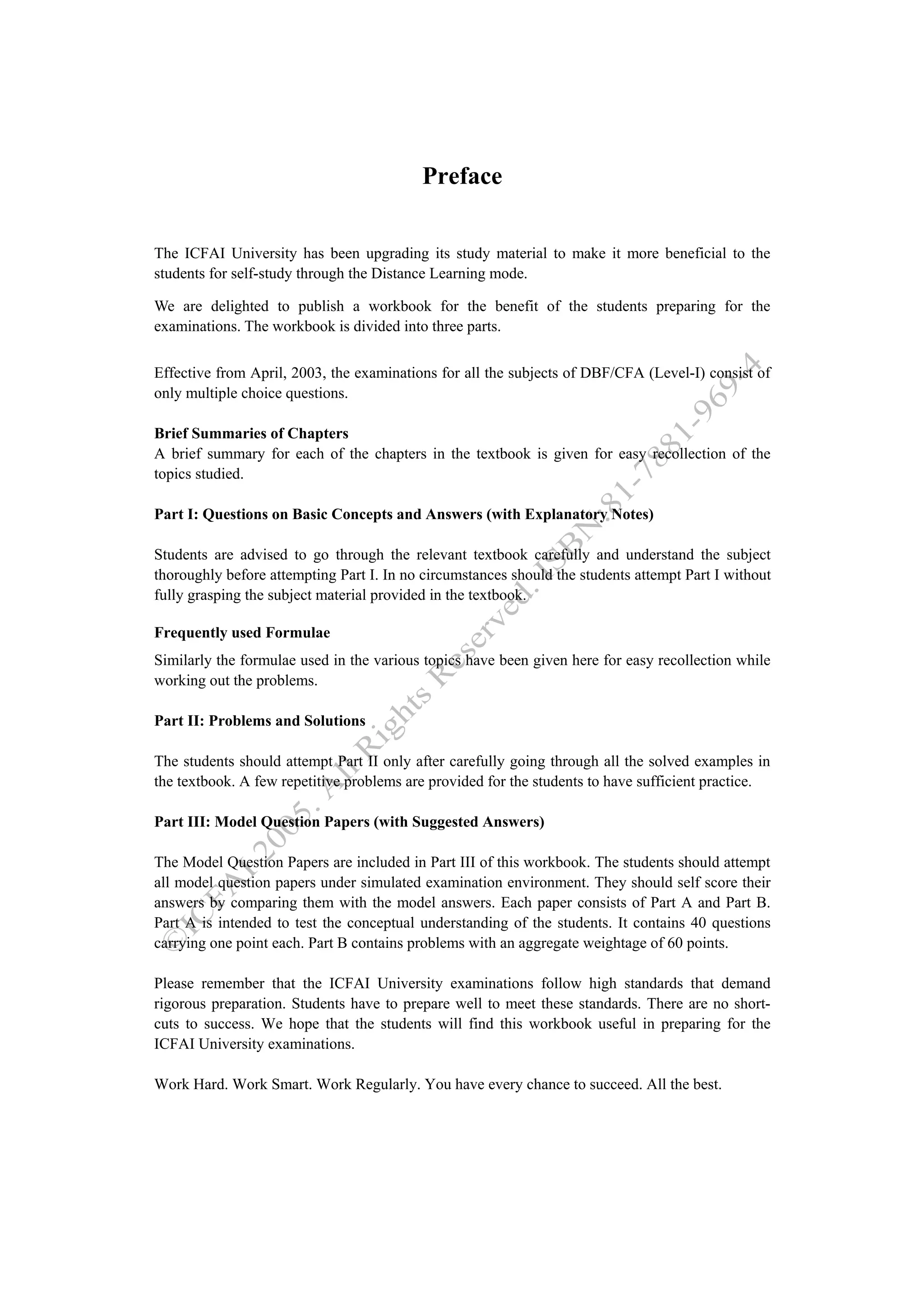

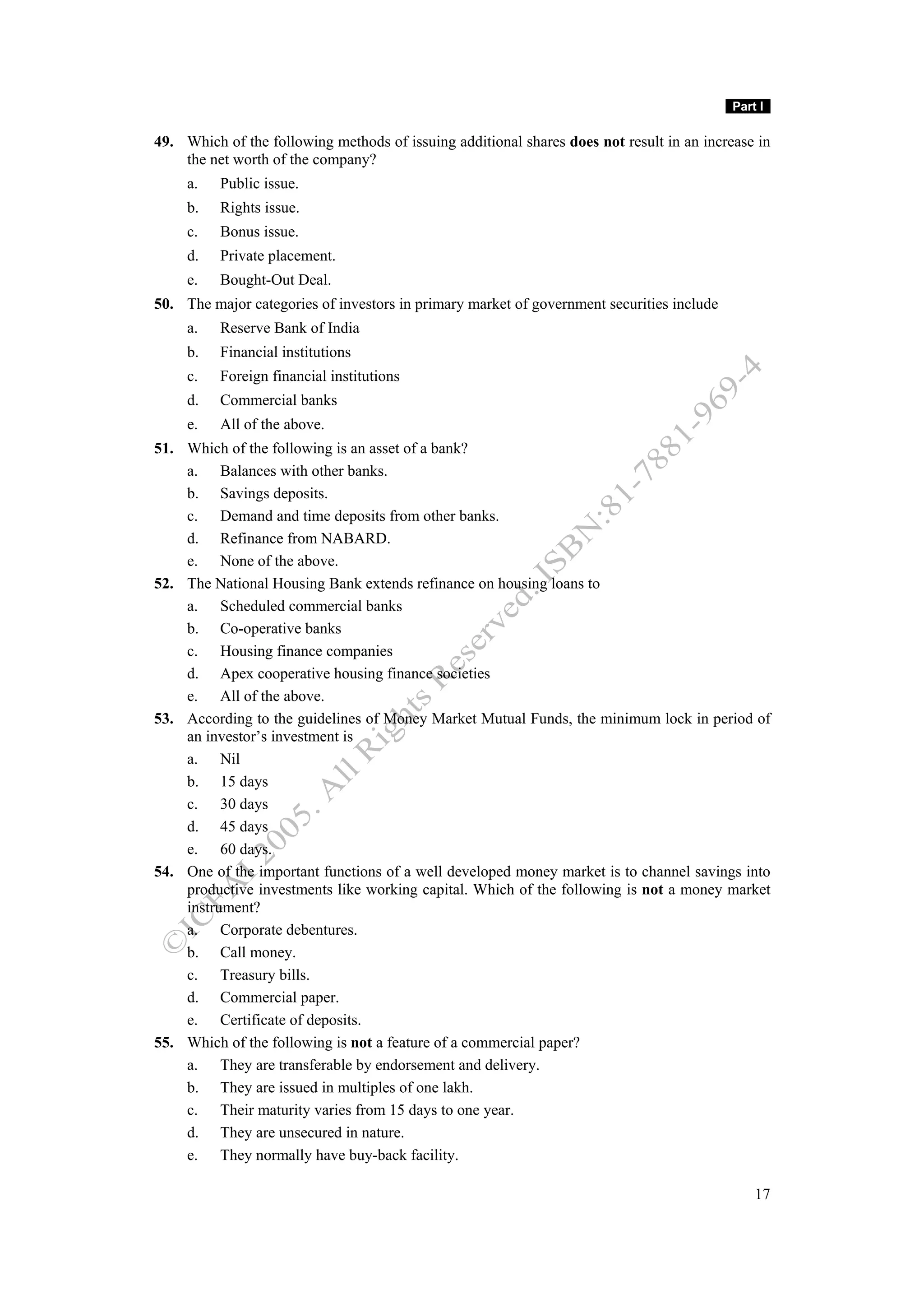

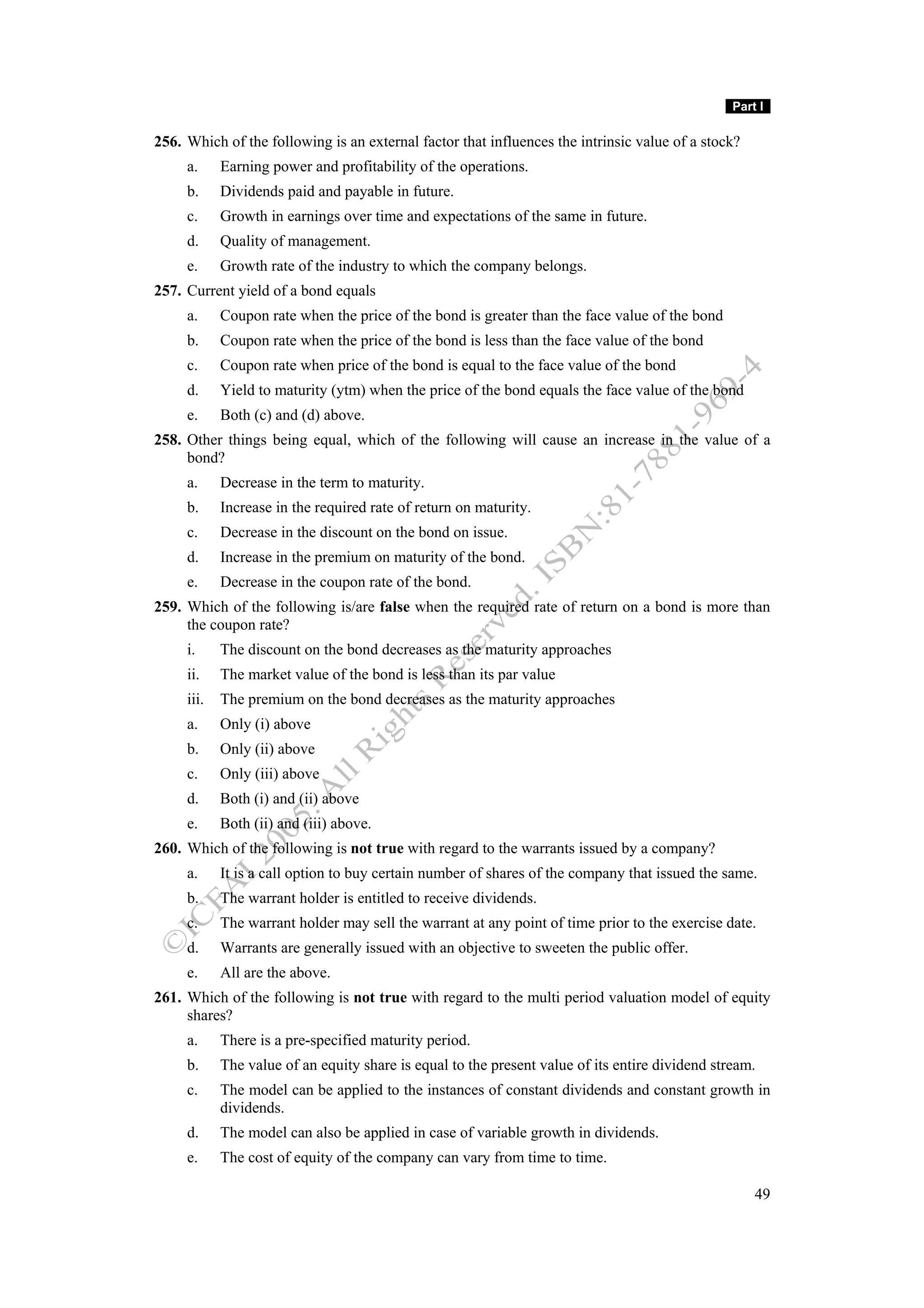

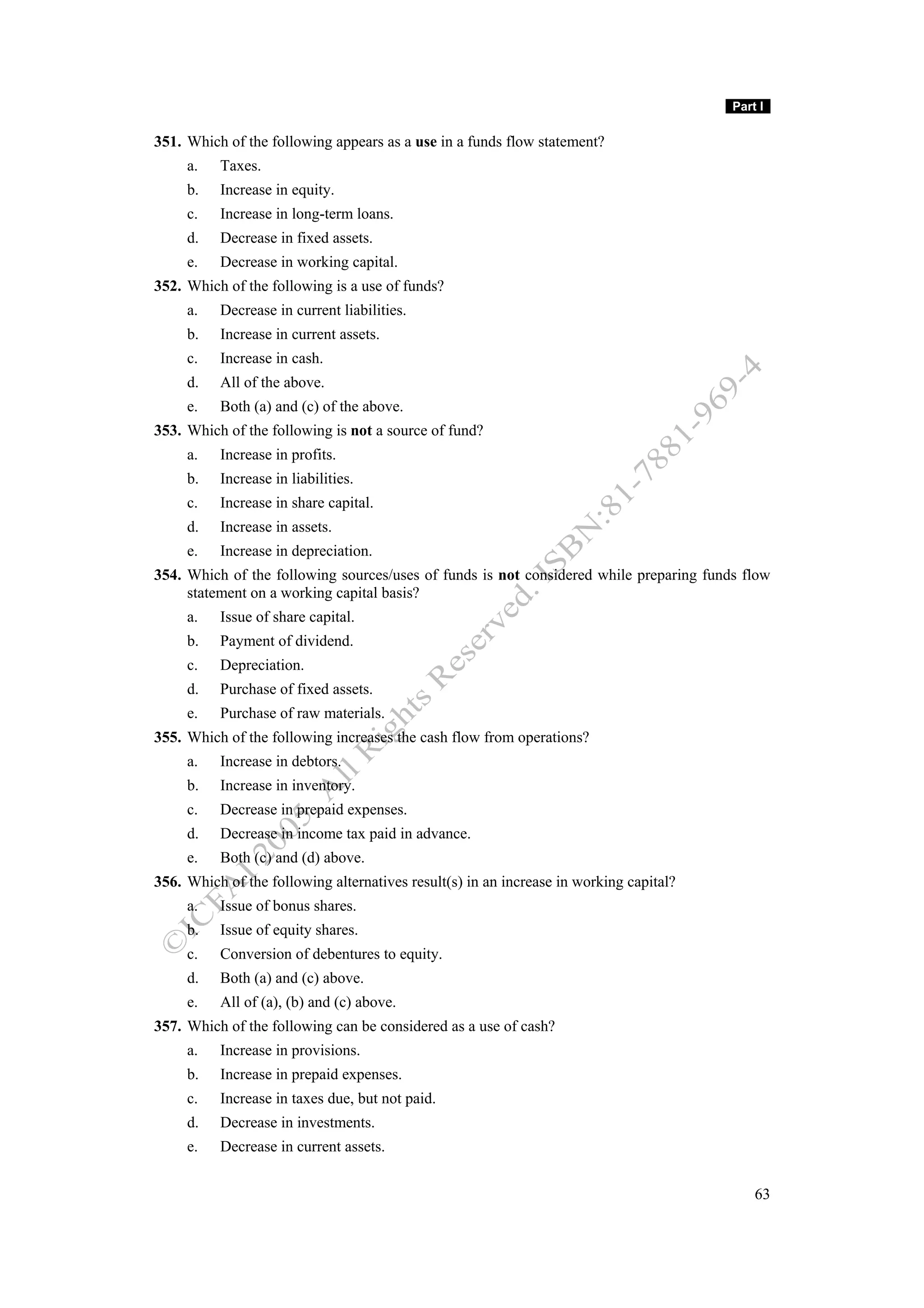

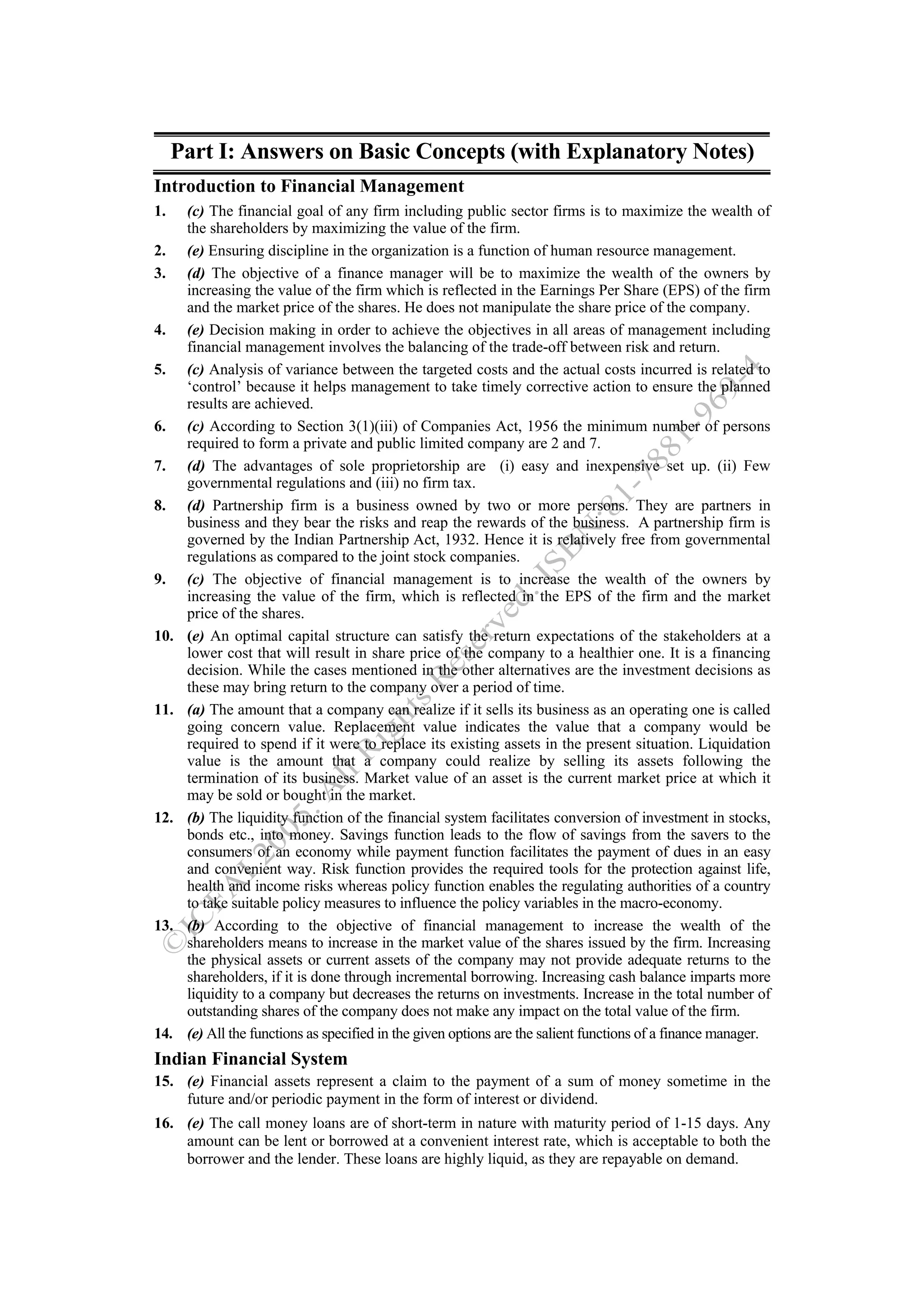

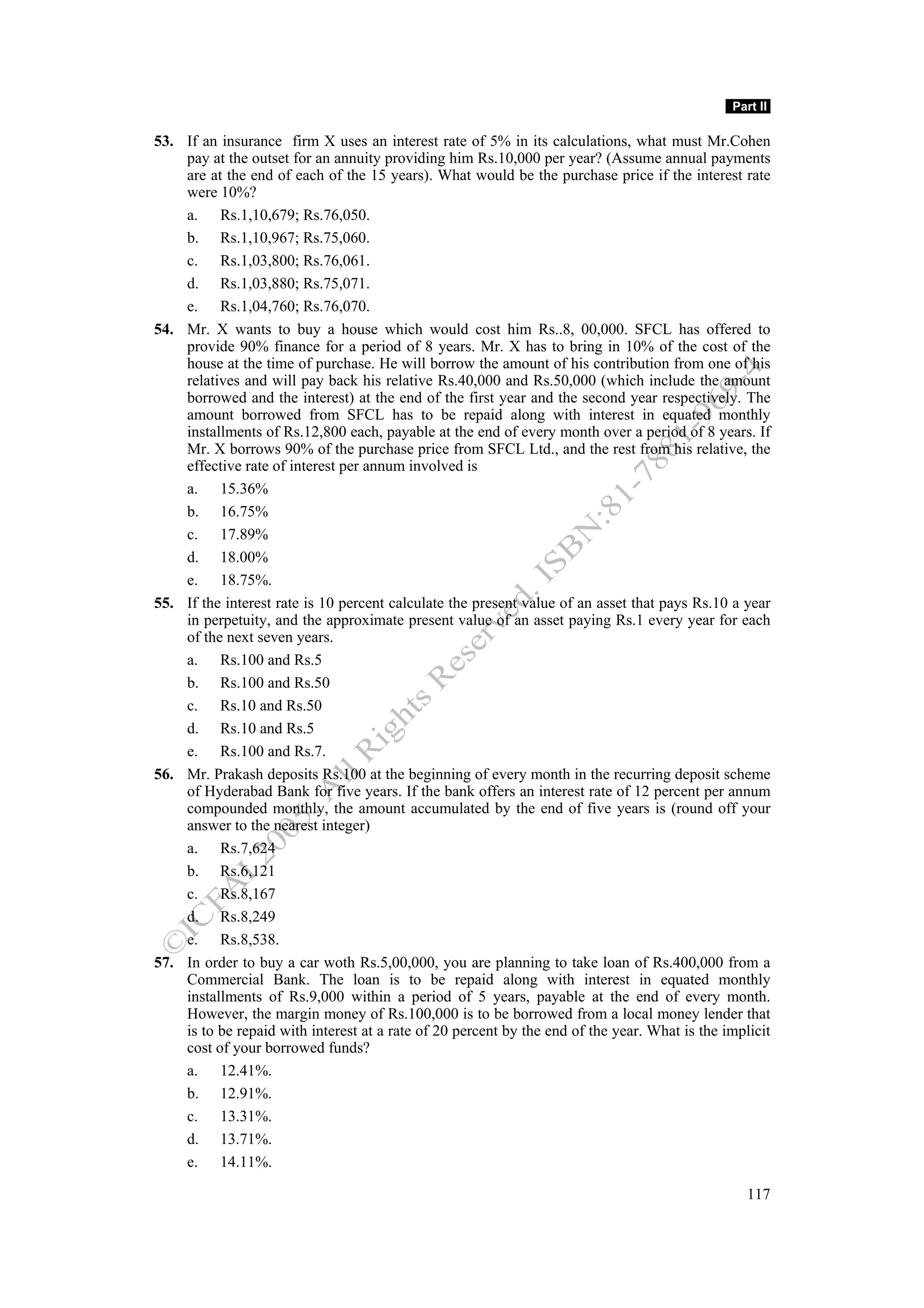

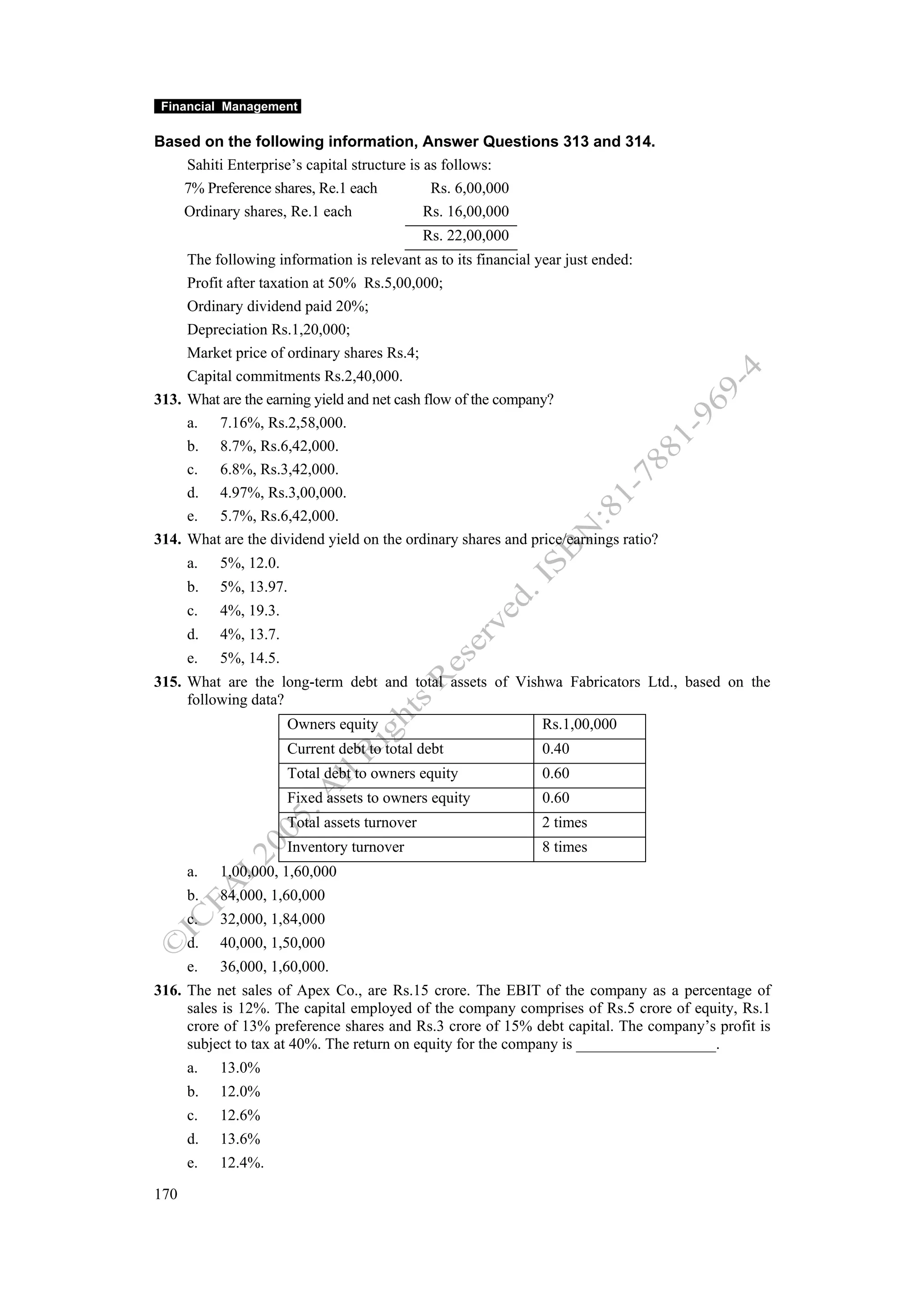

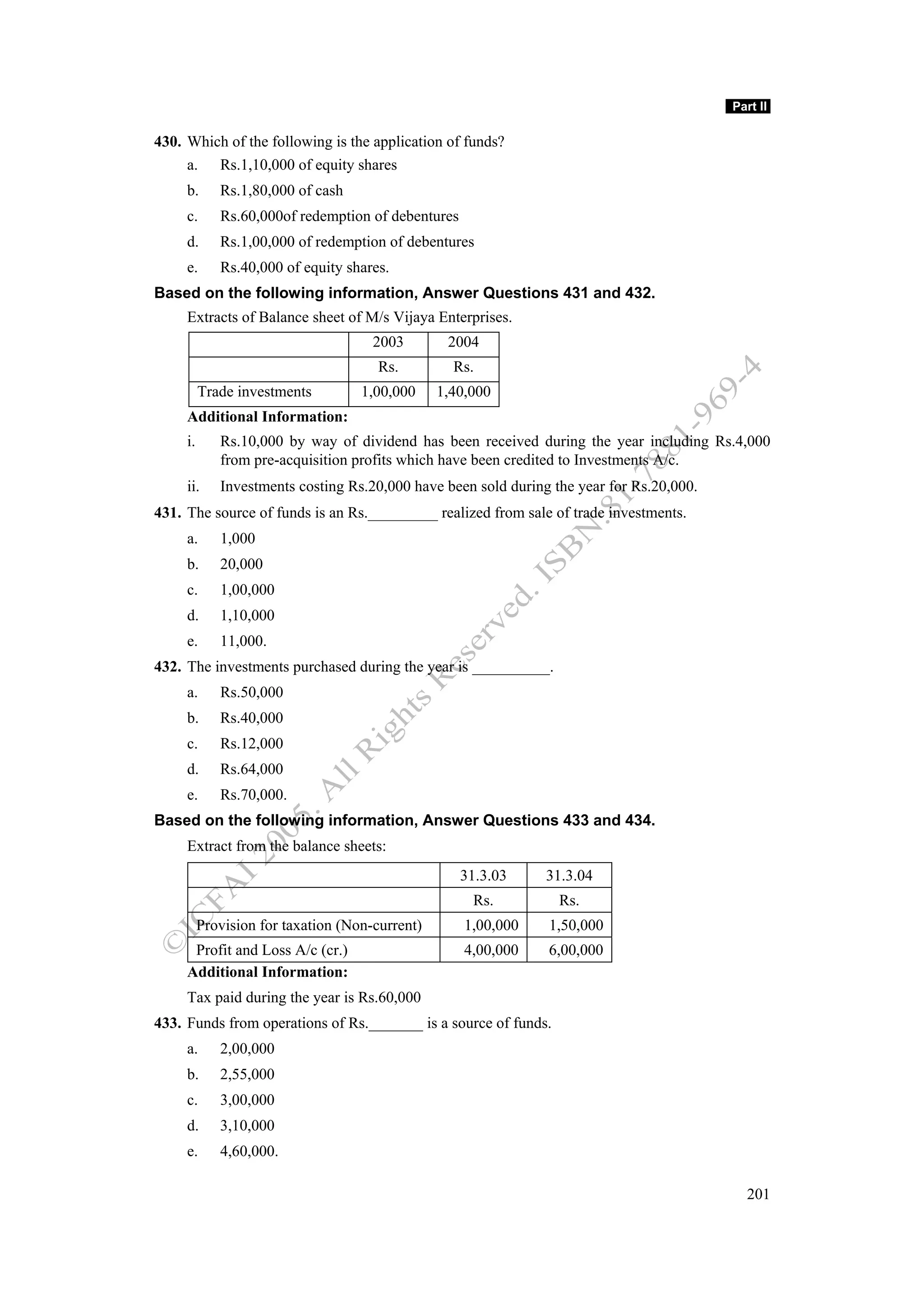

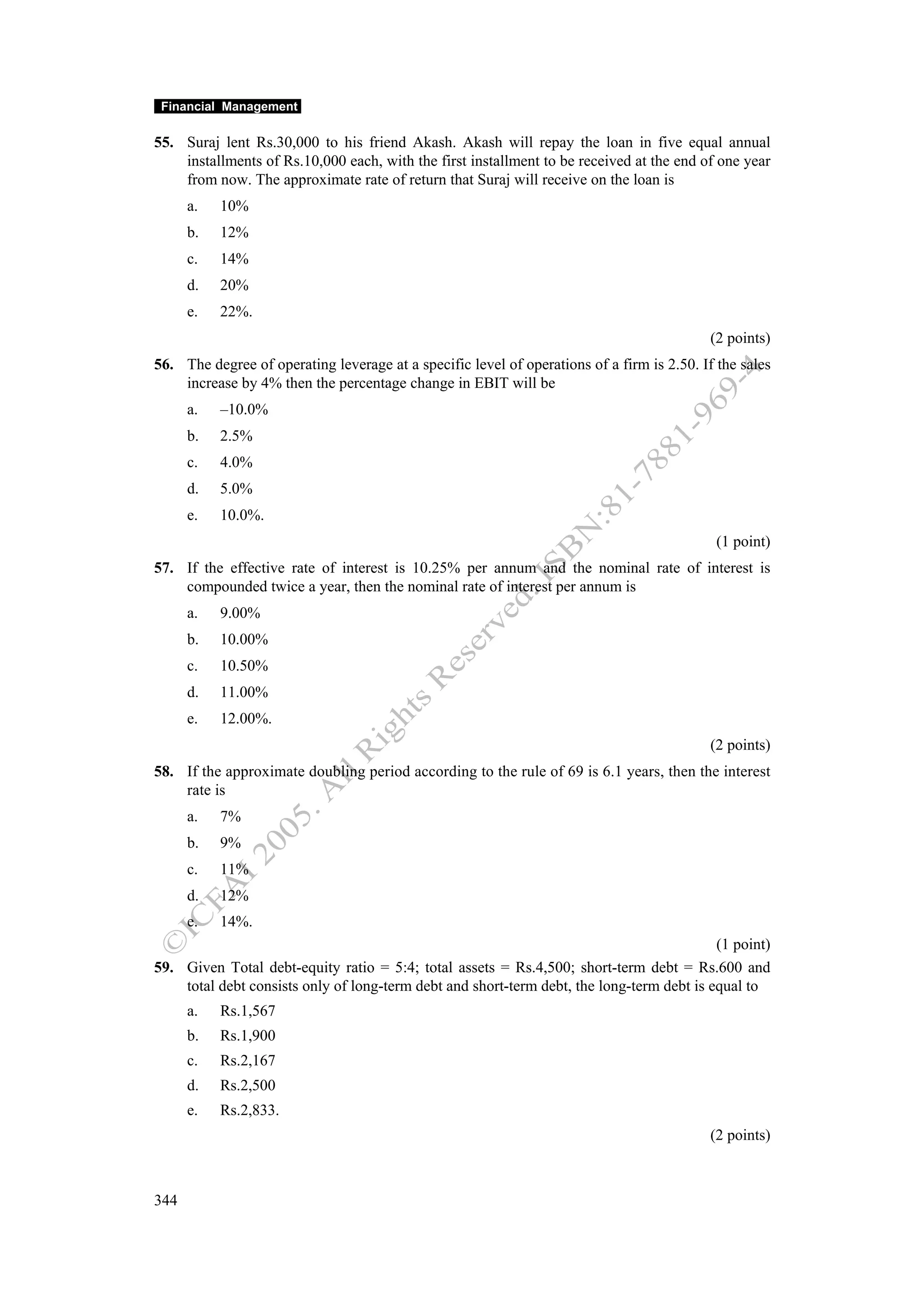

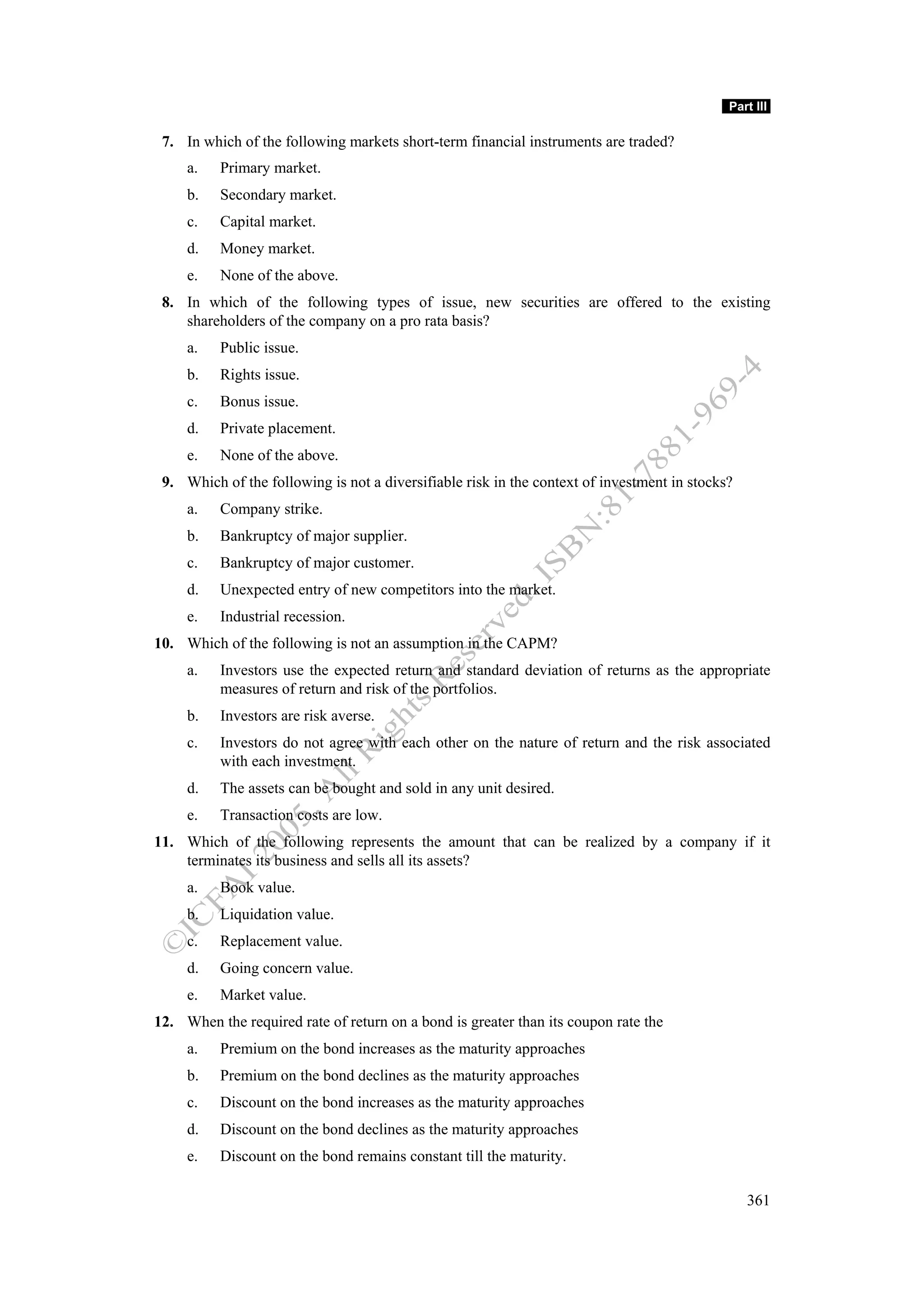

![Part II: Solutions

Indian Financial System

1. (c) Yield on a treasury bills is given as

(F − P) 365

k= x

P d

Where

K = yield

F = face value

P = price

D = maturity period in days.

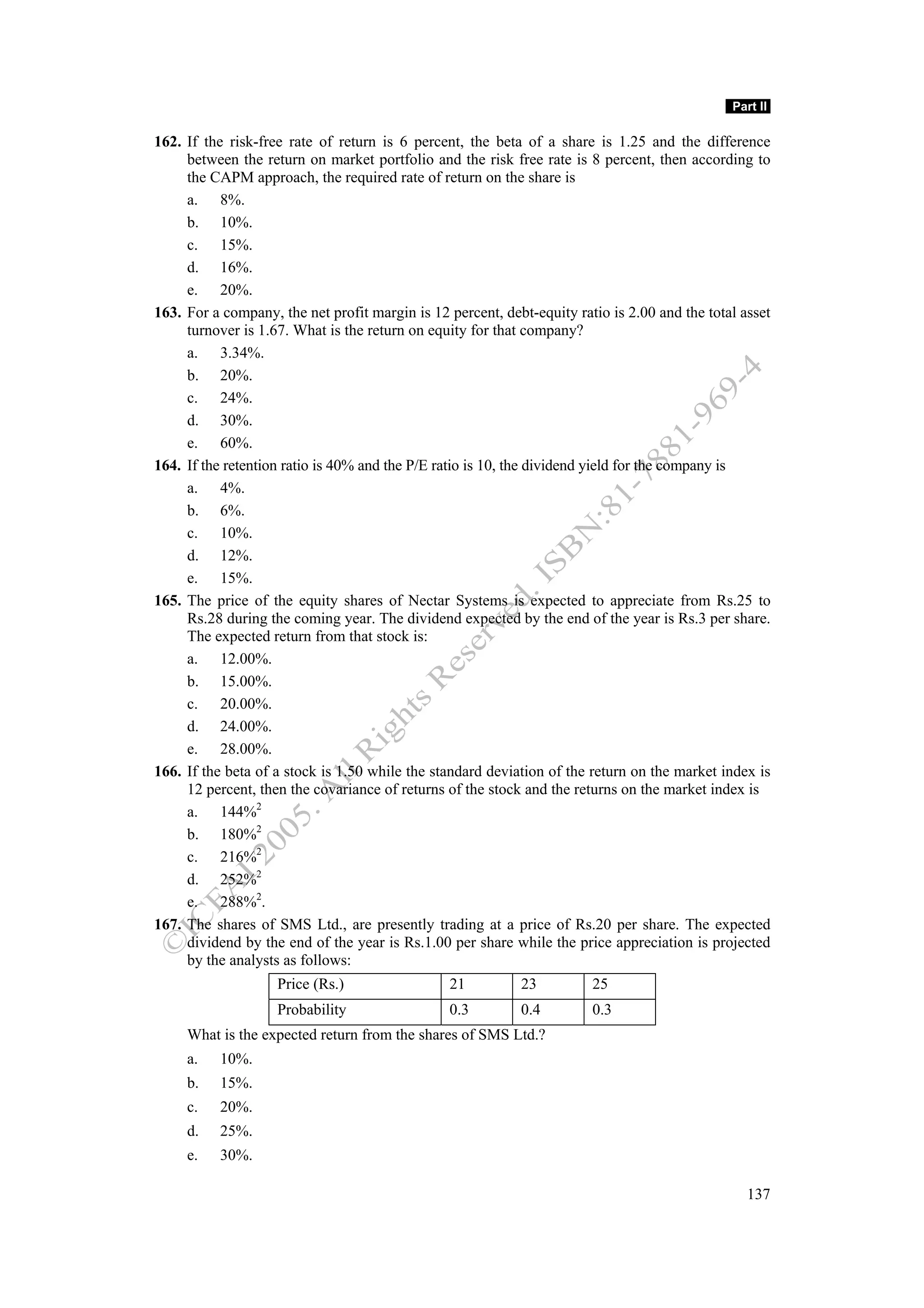

100 − 96.52 365

K = x

96.52 182

Hence we get yield = 7.23%.

(F − P) 365

2. (c) Yield on a treasury bill is given as k = x

P d

Where

K = yield

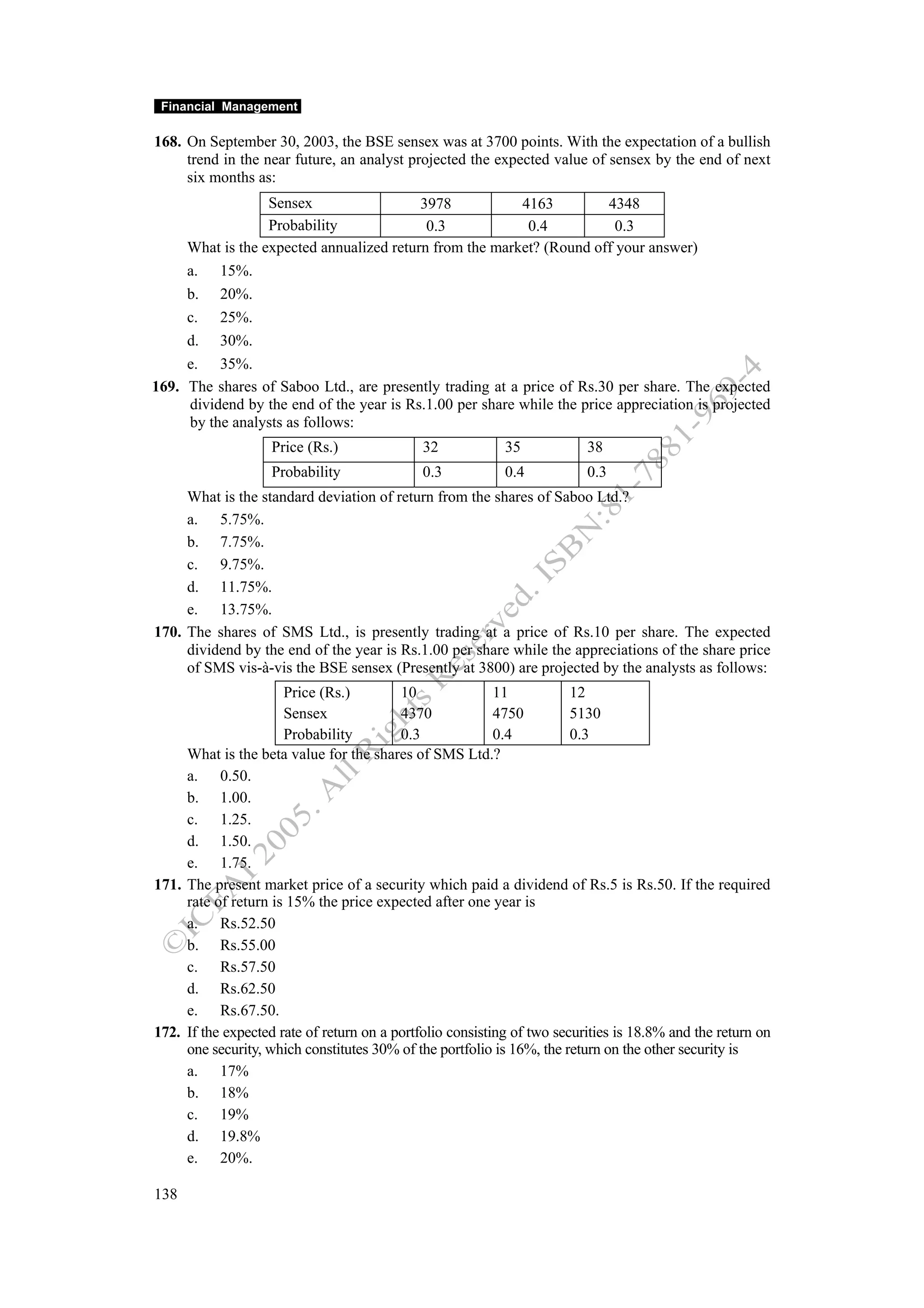

F = face value

P = price

D = maturity period in days.

100 − P 365

0.1150 = x

P 364

Hence P = Rs.89.71

(F − P) 365 (100 − 88.24) 365

3. (e) Yield is given by k = x = x

P d 88.24 364

11.76 365

= x = 0.13327 x 1.0027 = 13.3636 or 13.364%.

88.24 364

(F − P) 365 100 − 98.12 365

4. (e) Yield, k = x = x ⇒ 11.46%.

P d 98.12 61

Time Value of Money

5. (c) PVO = R(PVIFAkn)

1,00,000 = 16,274(PVIFAk10)

Approximate k = 10%.

6. (c) PV of cash inflows in case of scheme A

= (Rs.2.5 lakh – 2.5 lakh x 10%) = Rs.2.25 lakh

PV of cash flows in case of Scheme B

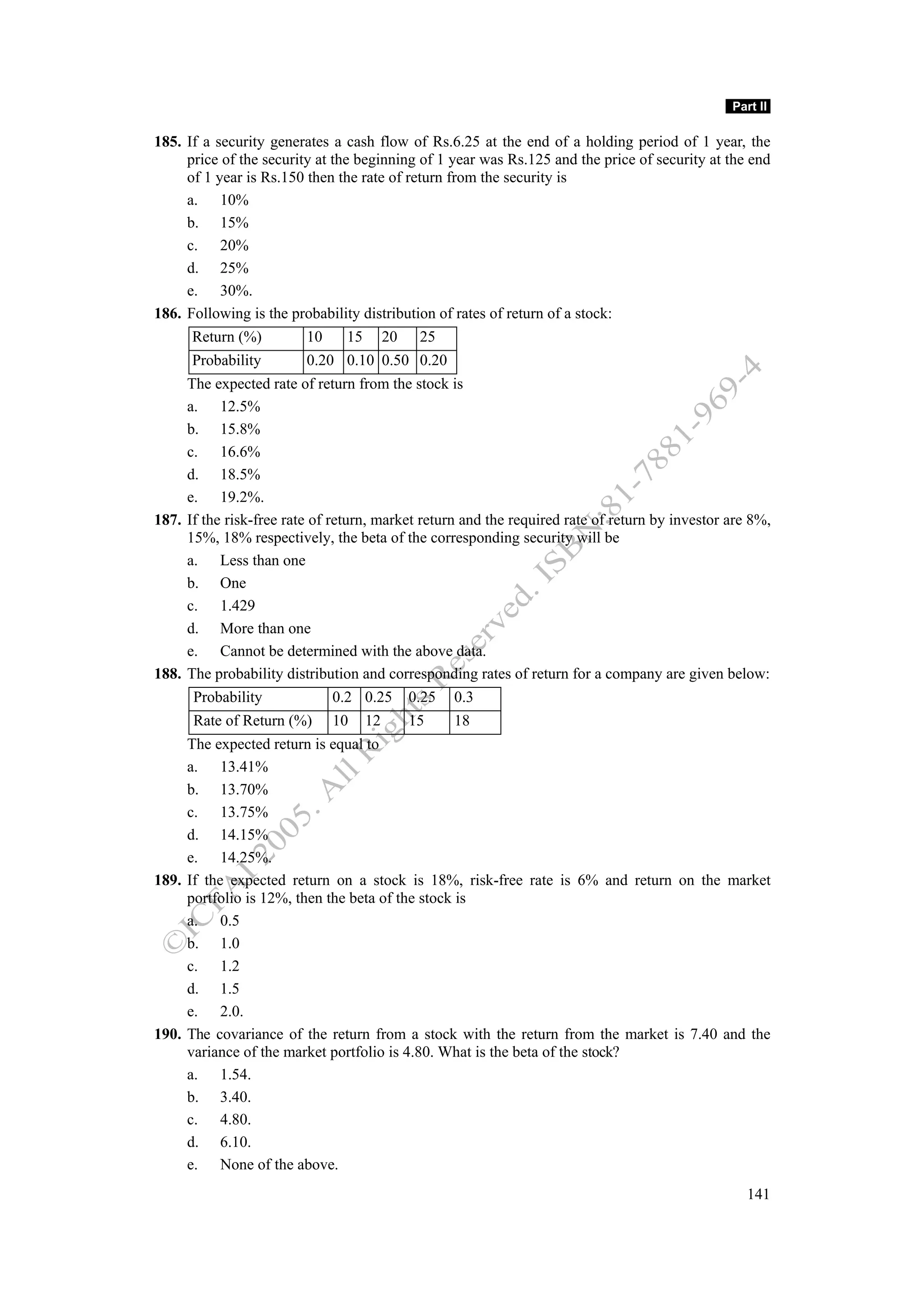

= 18,000 + PVIFA(K,60) x 4,100

= [Where, K= (1.09)1/12 – 1 = 0.0072 i.e., 0.72%]

= Rs.18,000 + (48.581 x Rs.4,100)

= Rs.18,000 + Rs.19,9182.10 = Rs.2,17,182.10

Hence (c) is the answer.](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-237-2048.jpg)

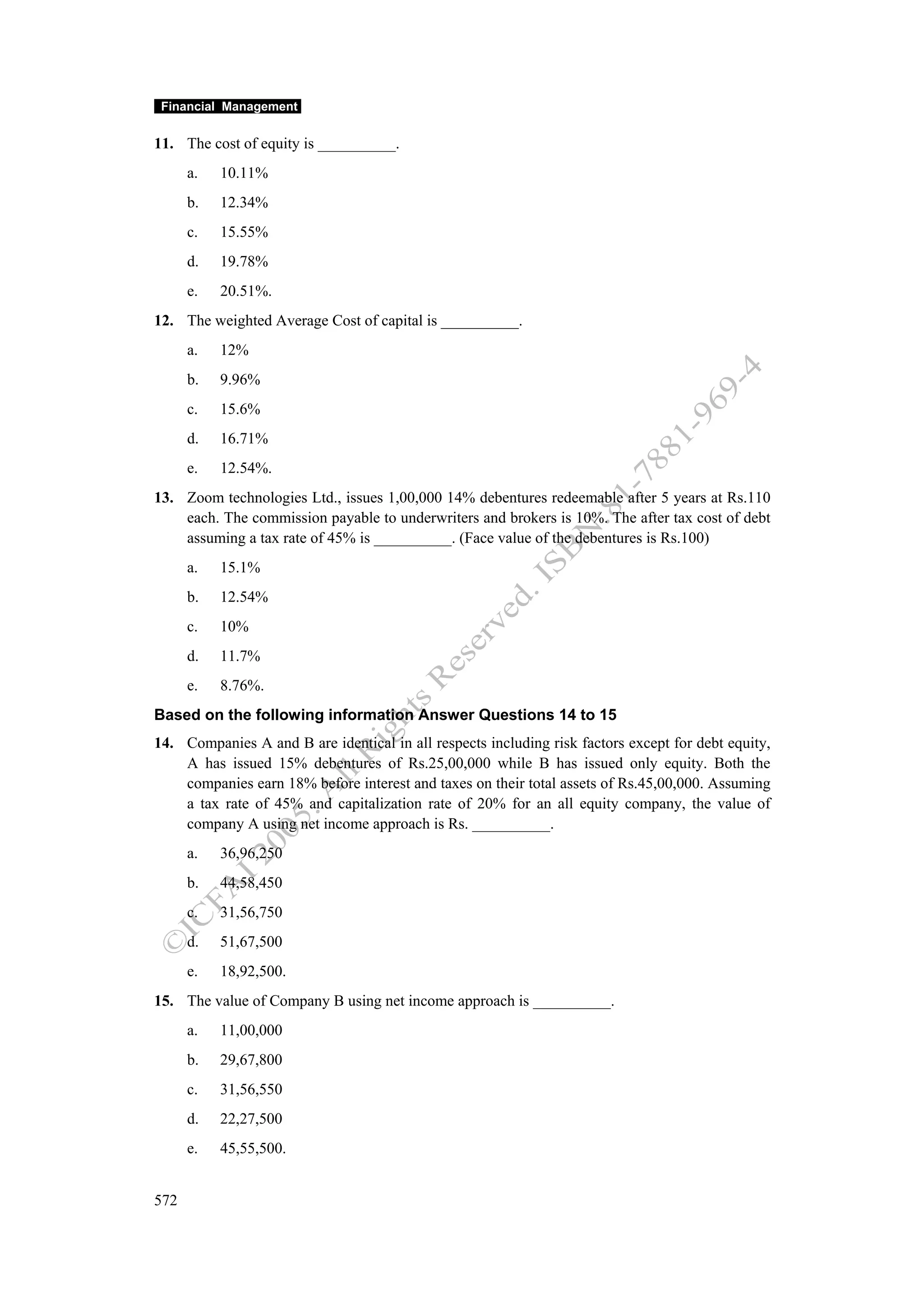

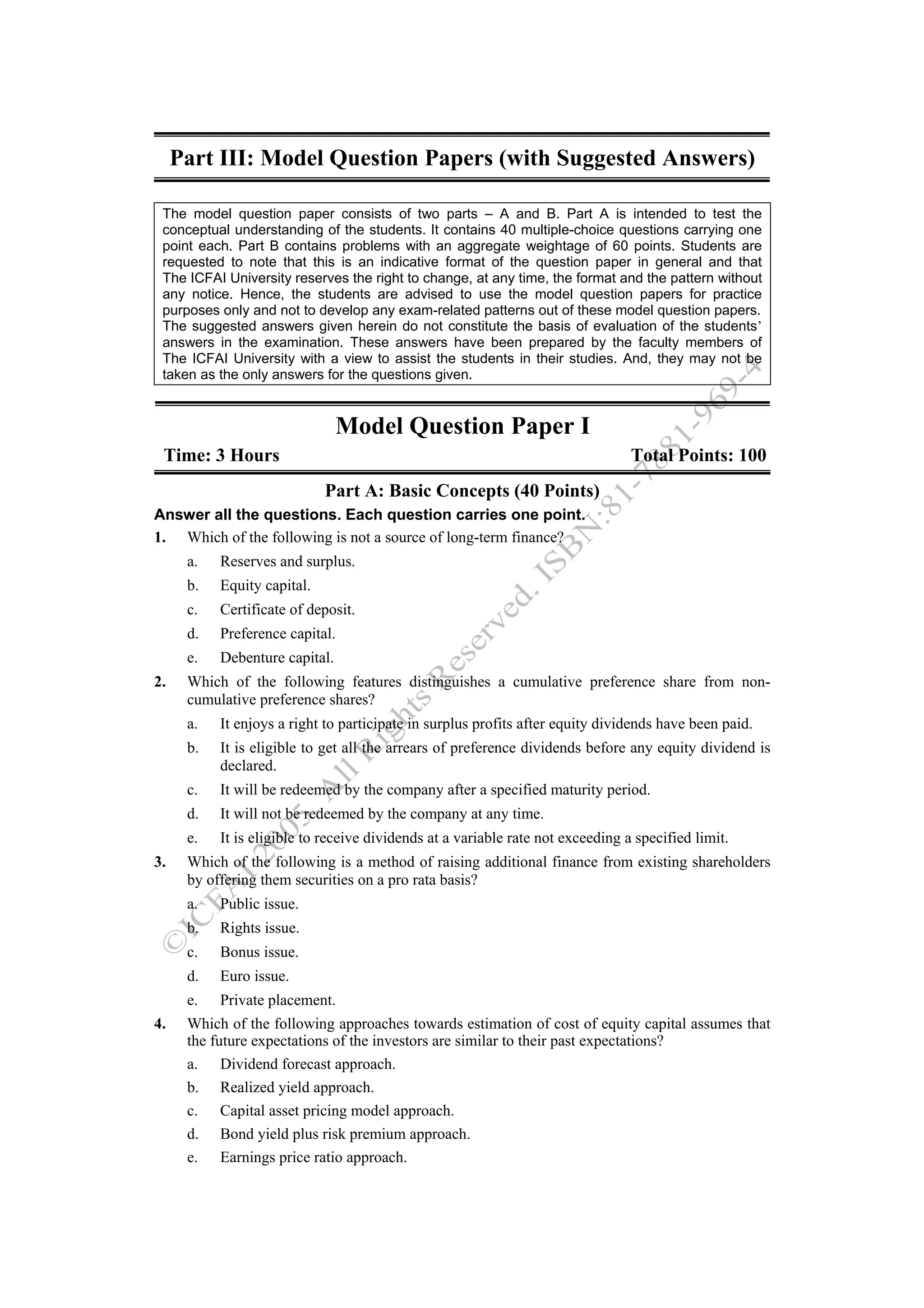

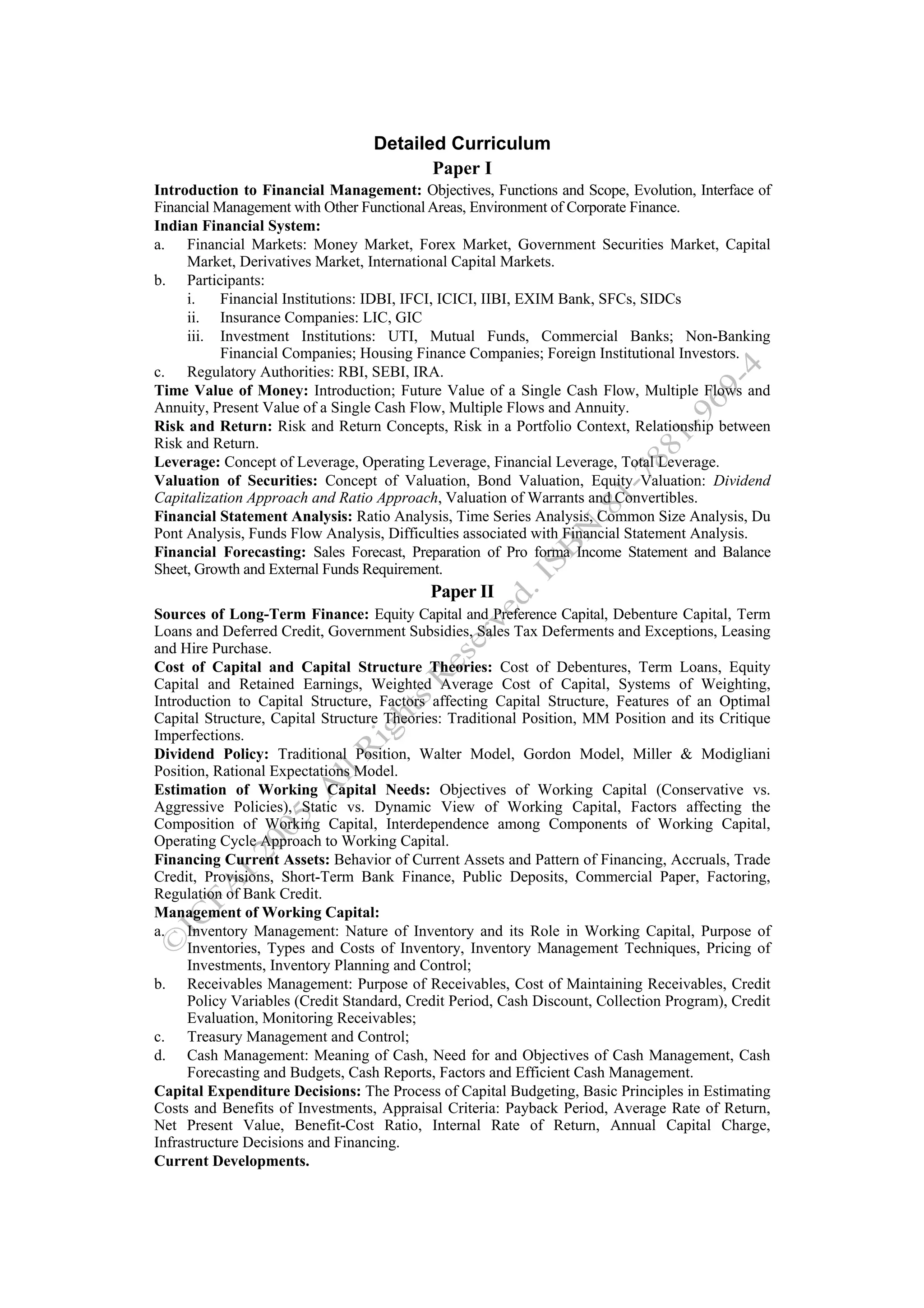

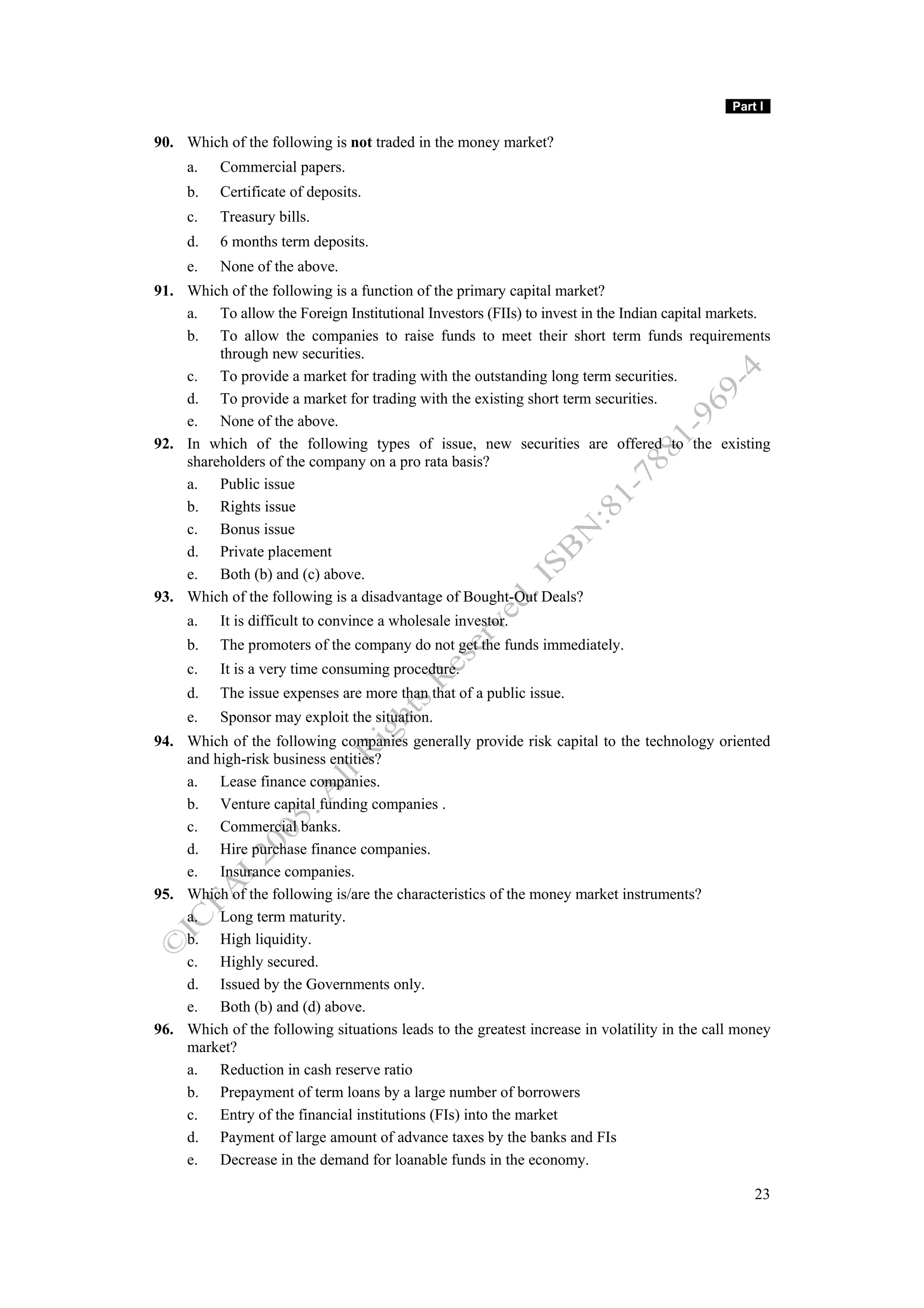

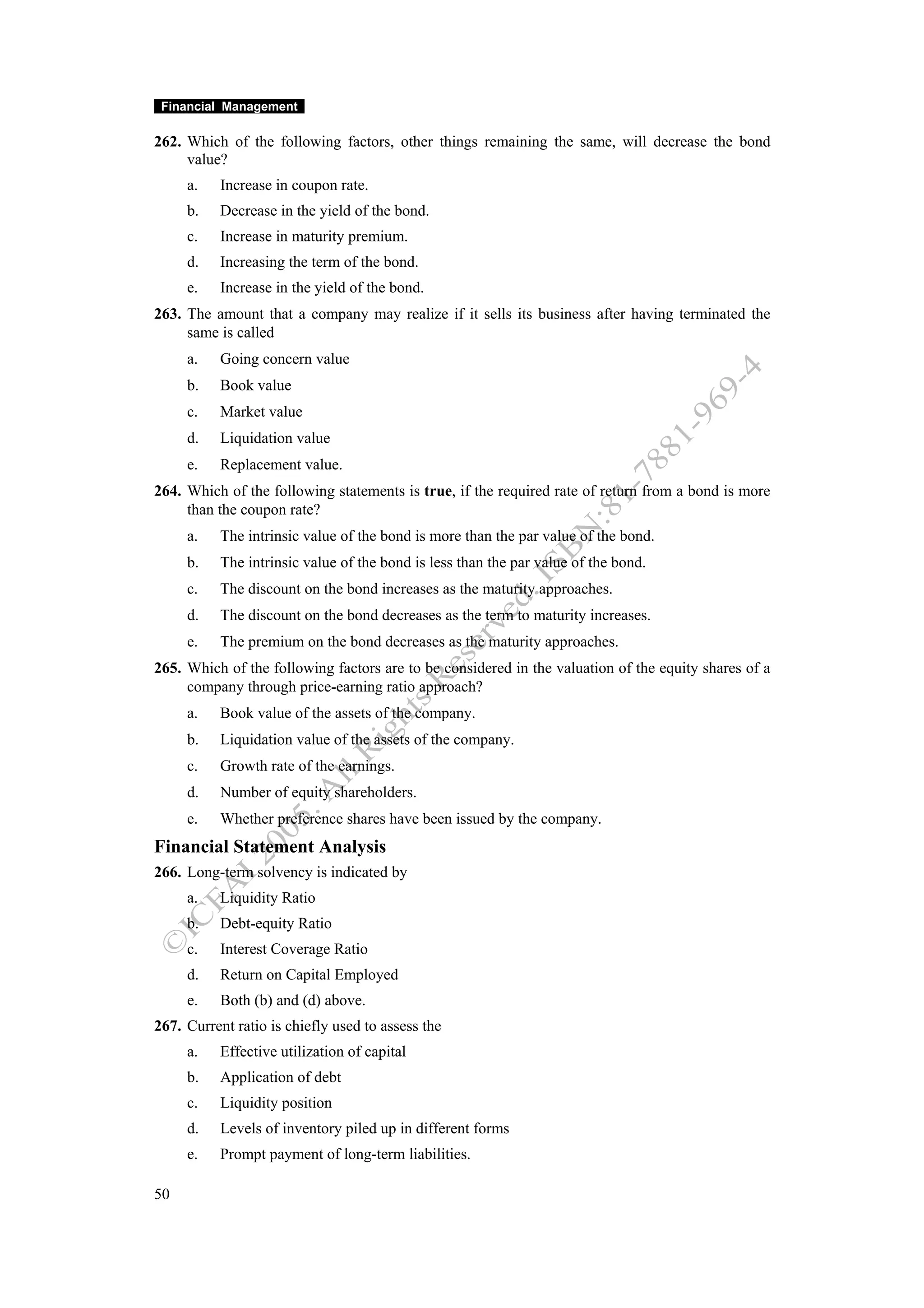

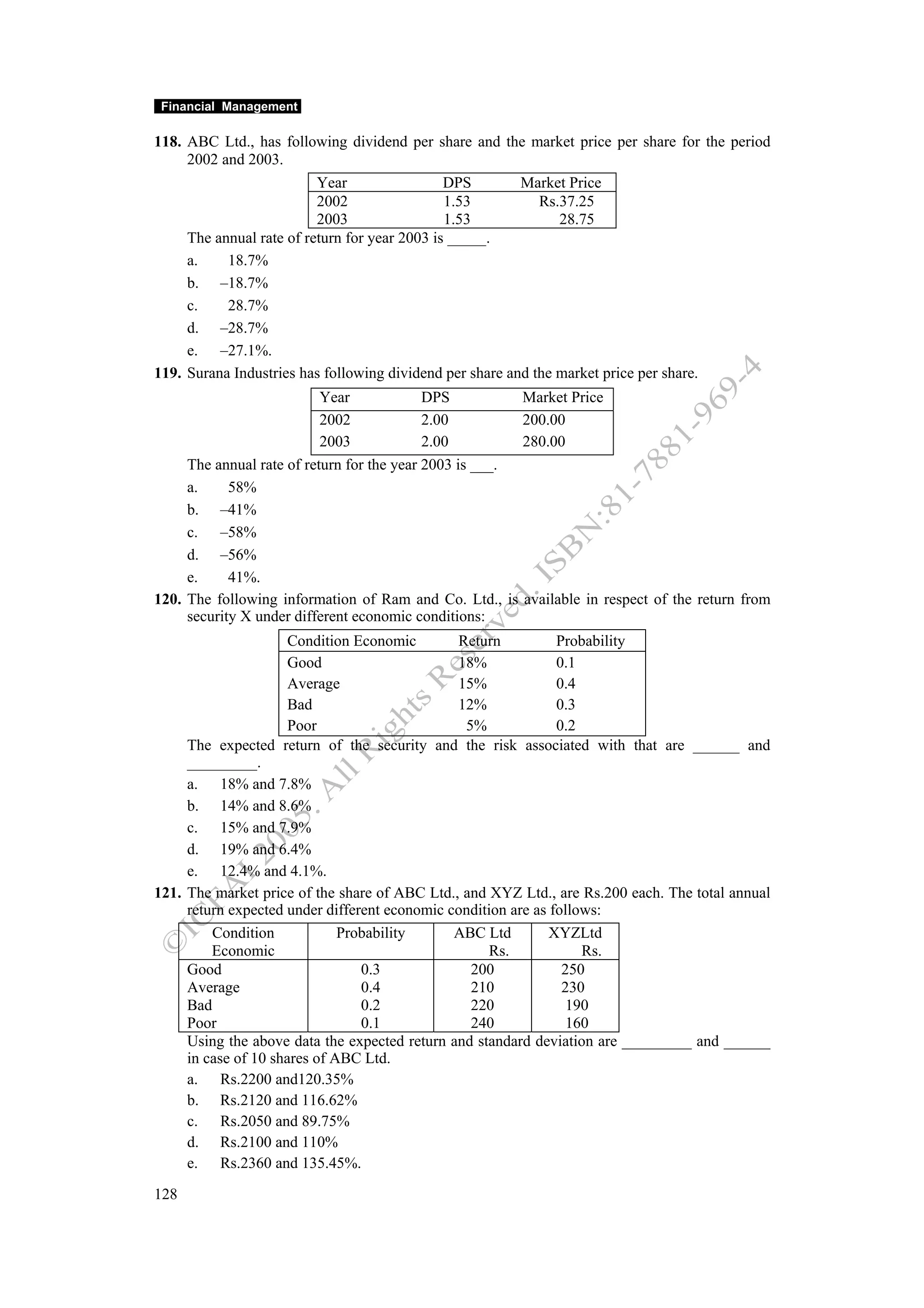

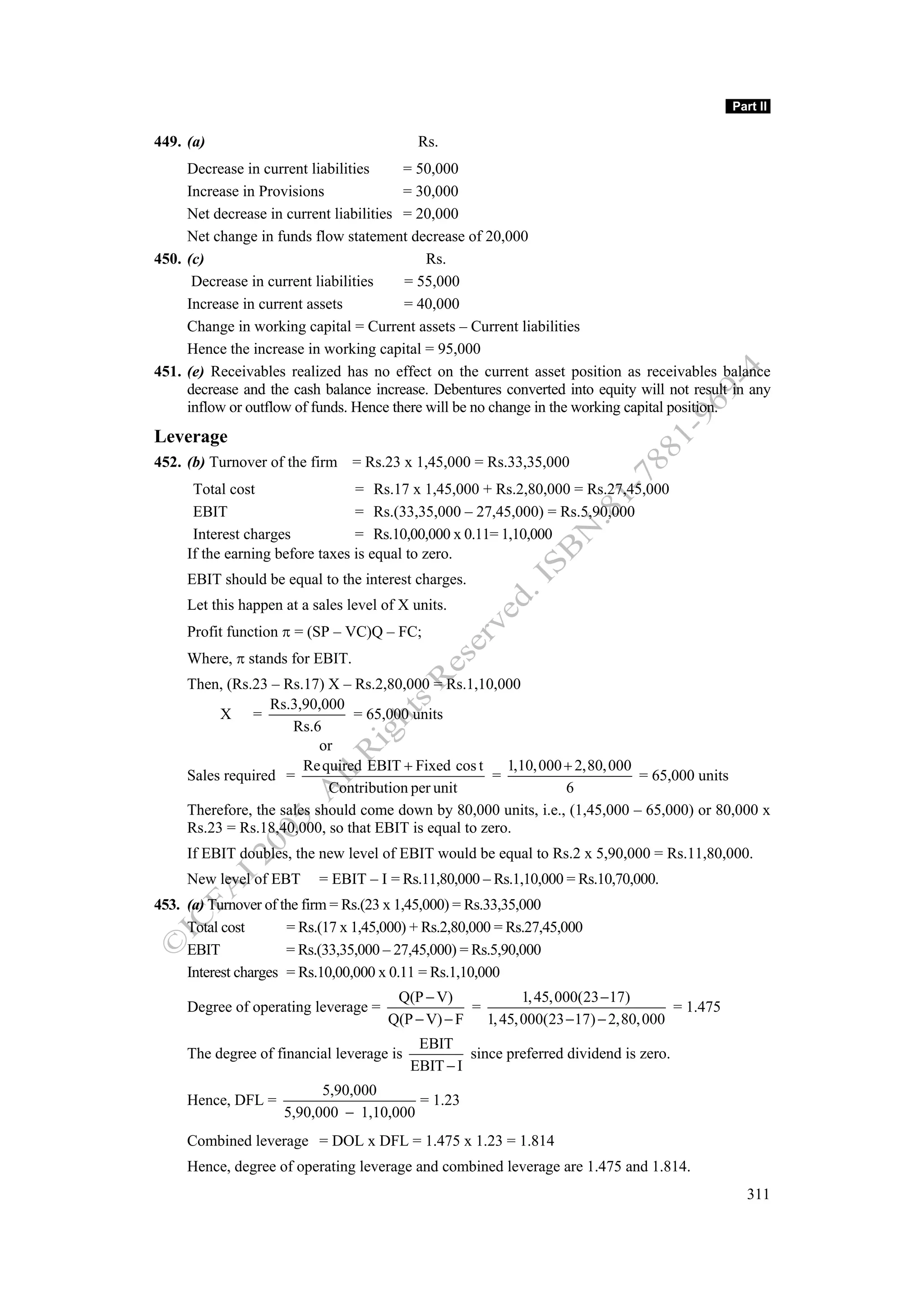

![Part II

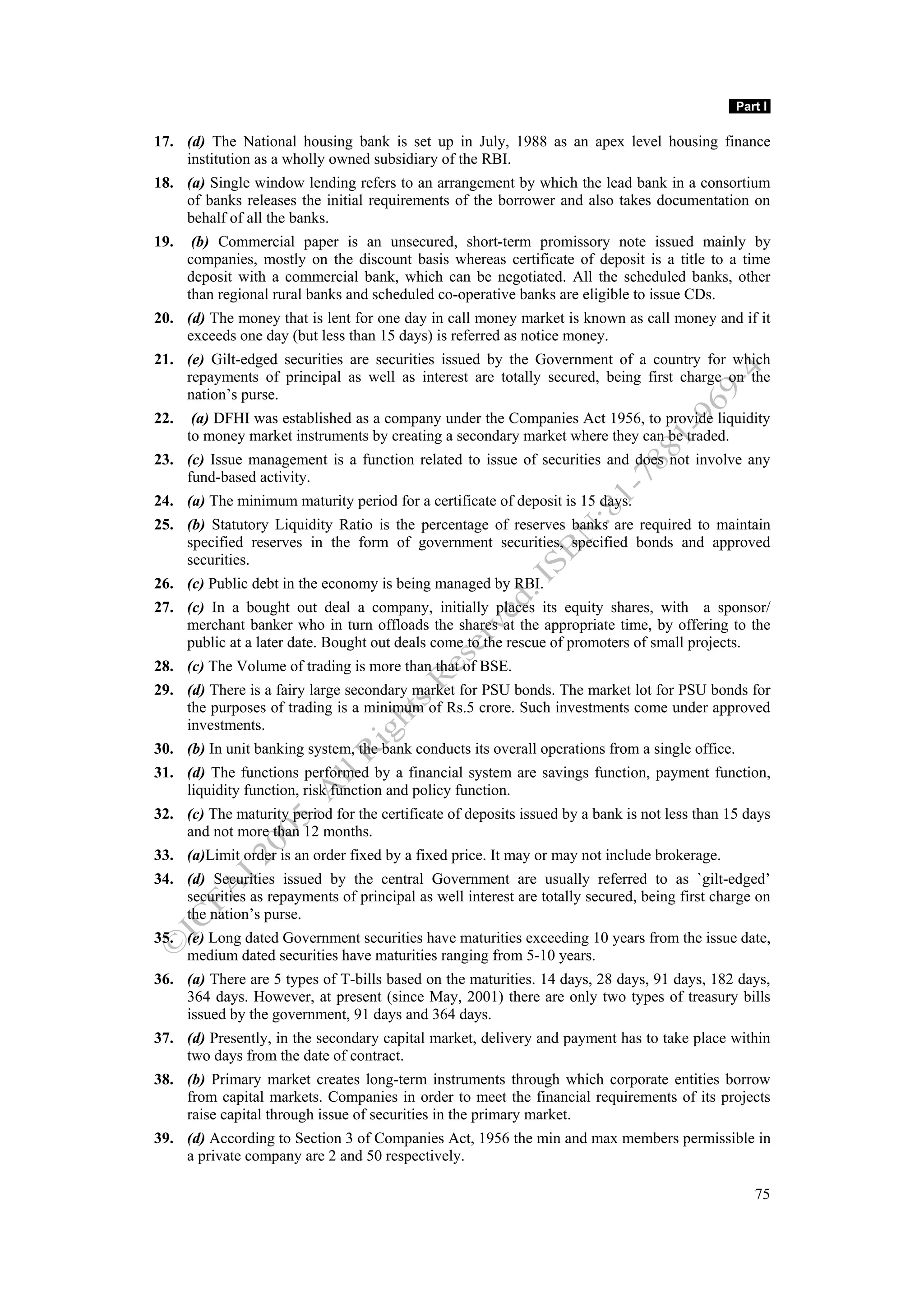

7. (b) Option 1:

At the end of 4th year, he would get

⎛ 5, 000 − 4, 000 ⎞

= Rs.7,000 + Rs.5,000 x ⎜ ⎟ = (Rs.7,000 + 1,250) = Rs.8,250

⎝ 4, 000 ⎠

Option 2:

At the end of 4th year he would get = Rs.5,000 x FVIF(15%,4)

4

⎛ 15 ⎞

= Rs.5,000 ⎜1 + ⎟ = Rs.5,000 x 1.749 = Rs.8,745.

⎝ 100 ⎠

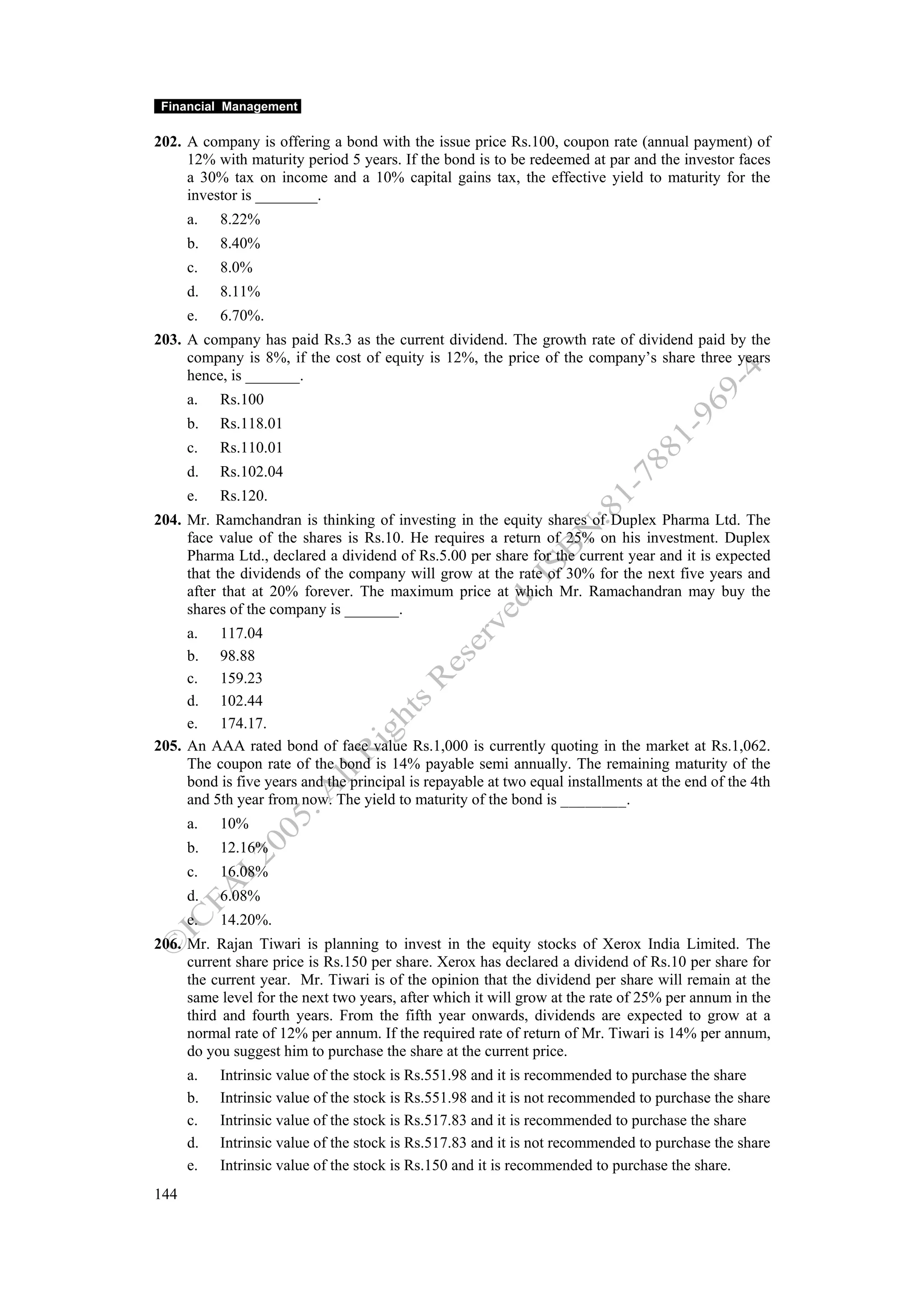

8. (c) (a) Present Value = Rs.1,00,000

(b) Present Value = Rs.2,00,000 x PVIF (14,6)

= Rs.2,00,000 ÷ (1.14)6 = Rs.91,117

15, 000

(c) Present Value = Rs. = Rs.1,07,143

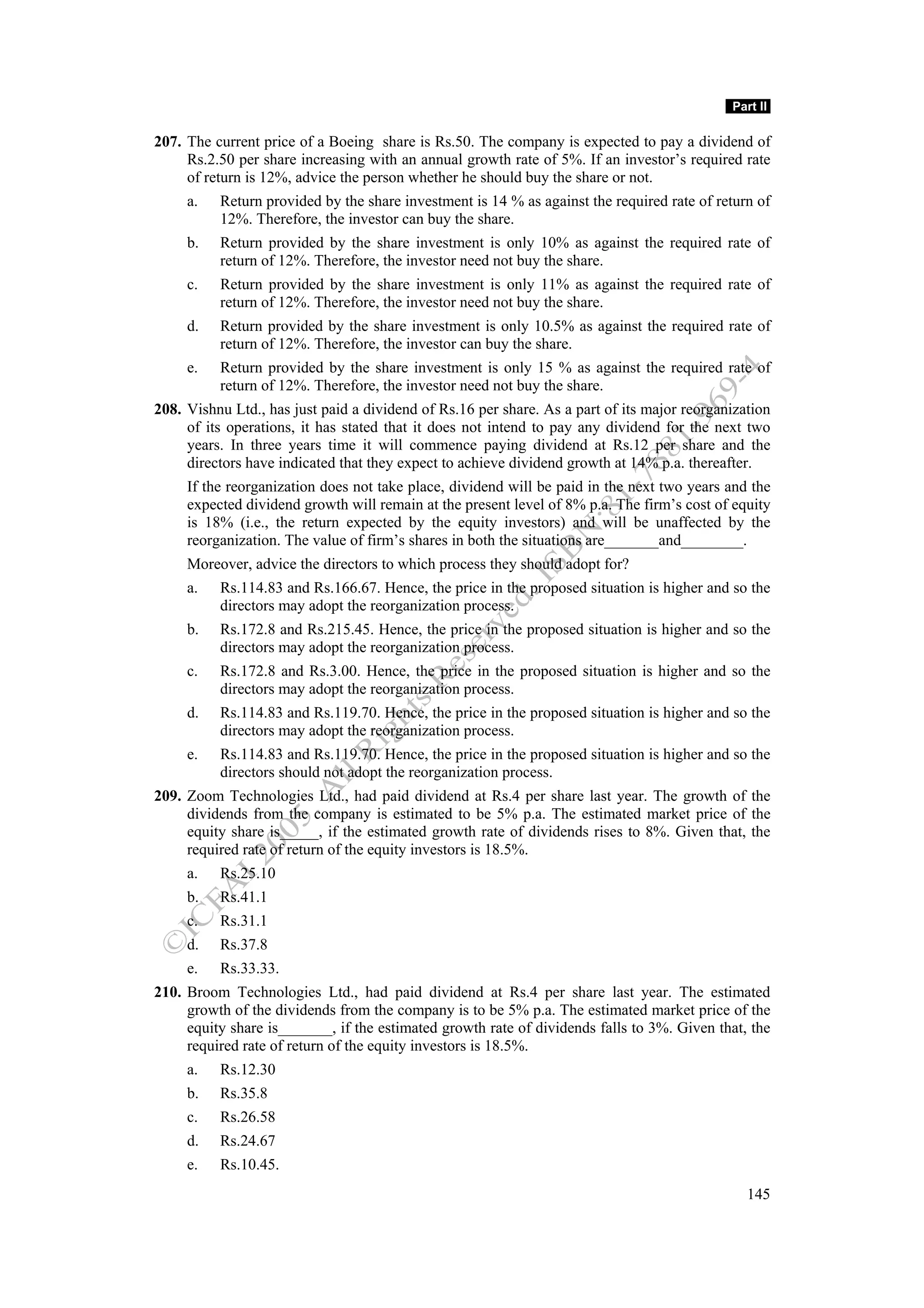

0.14

(d) Present Value = Rs.(PVIFA(K,12) x 1,000) + (PVIF(14%,1) x 95,000)

[Where, K = (1.14)1/12 – 1]

= Rs.[(11.186 x 1,000) + 83,333] = Rs. 94,51945edfc

(e) Present Value = Rs.(PVIFA(14%,10) x 18,000) = 5.216 x 18,000 = Rs.93,888

Therefore, choice (c) gives the highest return.

9. (d) Let X be the amount to be deposited today

Then,

2

X = Rs. 5, 000 + 5, 000(1.04) + 5, 000(1.04) + .....α

2 3

(1.14) (1.14) (1.14)

=> Rs. ⎛ 5, 000 1

⎜ +

1.04

+

(1.04)2 ⎞

+ .........α ⎟

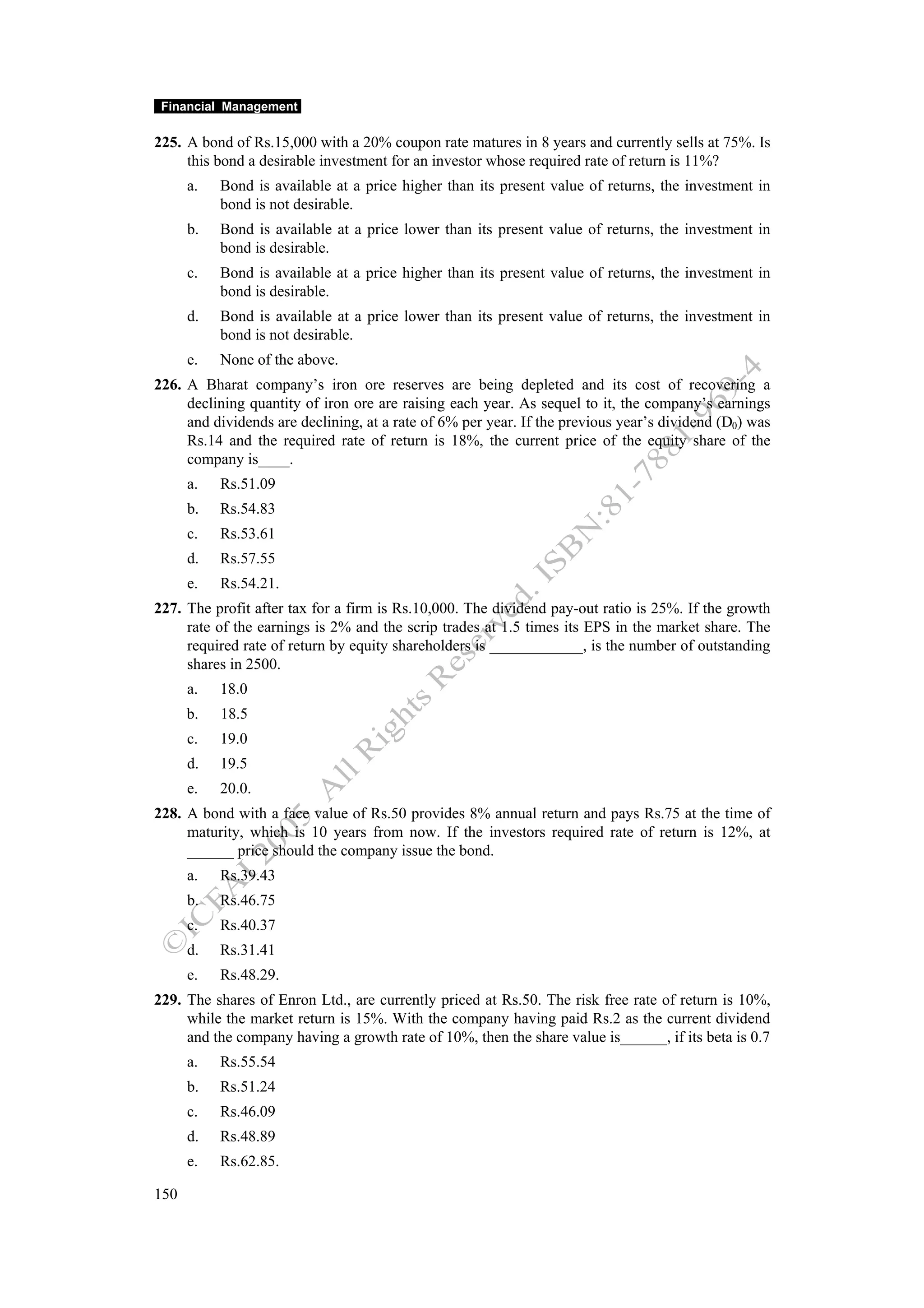

⎜ (1.14) (1.14)2 (1.14)3 ⎟

⎝ ⎠

The terms in the brackets represent a geometric progression of infinite terms with

1 1.04

initial term ‘a’ = and decreasing by r =

1.14 1.14

a

Hence, it is in the form of a, ar, ar2 ……..α terms and the sum of this series is given by .

1− r

Where, r < 1

1

Hence, Sum = 1.14 = 10

1.04

1−

1.14

Therefore, X = Rs.5,000 x 10 = Rs.50,000.

Hence, Rs.50,000 is to be deposited today to receive a sum of Rs.5,000 next year which

grows at the rate of 4% per year forever.

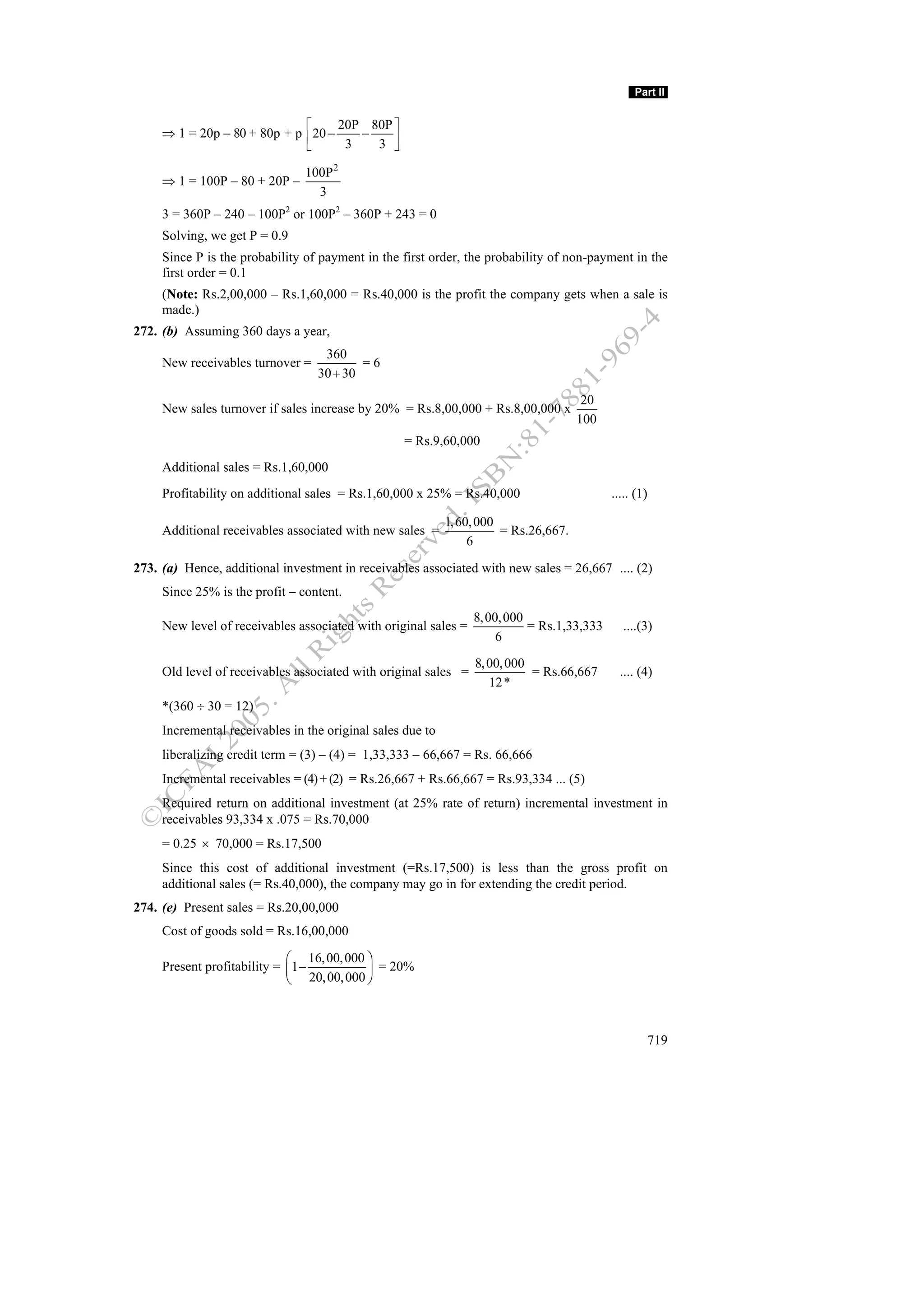

10. (a) 23,905 = 1500(FVIFAi,10)

∴ i = 10%

233](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-238-2048.jpg)

![Financial Management

11. (b) The implied interest rate in the two schemes can be calculated as follows:

Scheme A:

[10,000 x FVIFA(i,4)] FVIF(i,6) = 1,00,000

If 13%, LHS = 100970.43

At 12%, LHS = 94335.46

100, 000 − 94335.46

i = 12 + x1 = 12.85%

100,970.43 − 94335.46

Scheme B:

[5,000 x FVIFA(i,8)] FVIF(i,2) = 1,00,000

At i= 17%. LHS = 1,01,115.54

At i = 16% LHS = 95807.35

1,00,000 − 95807.35

i= × 1 = 16.79%

10,1115.54 − 95807.35

Hence, answer is (b).

12. (b) Let the amount which she can withdraw annually be ‘X’. Then,

5,00,000 = X x PVIFA(15%, 15)

5,00,000

X = = 85,514.

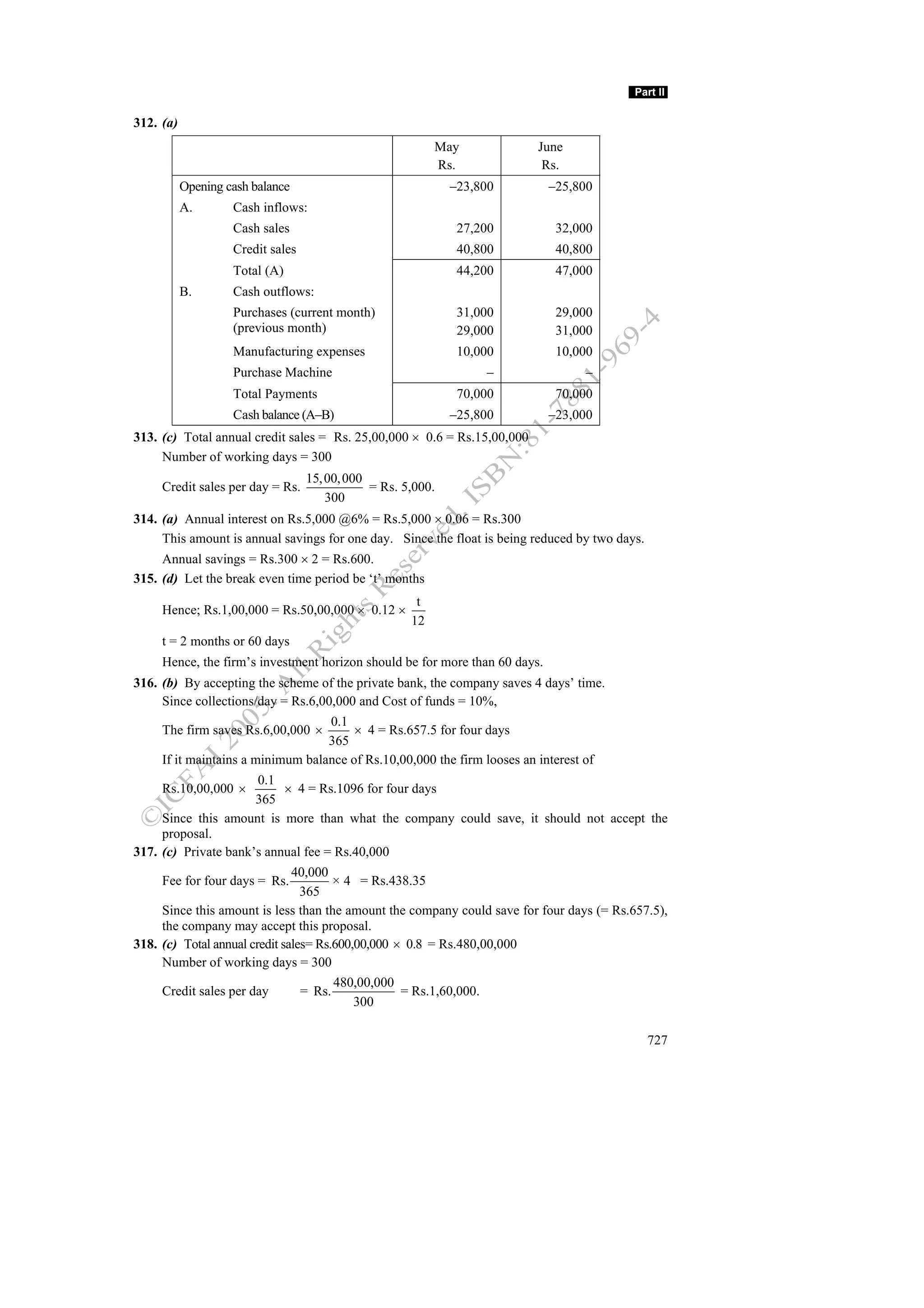

PVIFA (15%,15)

13. (a) Let ‘X’ be the annual investment. Then,

⎡ 90, 000 ⎤

X x FVIFA(15%,10) = [60,000 x PVIFA(15%,5)] + ⎢ x PVIF(15%,5) ⎥

⎣ 0.15 ⎦

20.304X = 4,99,320 = Rs.24,592.

14. (b)

a. X x 1.12 x FVIFA(12,5) = 10

10

X= = 1.41

1.12 x 6.353

b. Amount to be borrowed = 10 x PVIF(24,5) = 10 x 0.341 = Rs.3.41 lakh

Installment to be paid is X.

X x 1.18 x PVIFA(18,5) = Rs.3.41

3.41

X= = 0.92

1.18 x 3.127

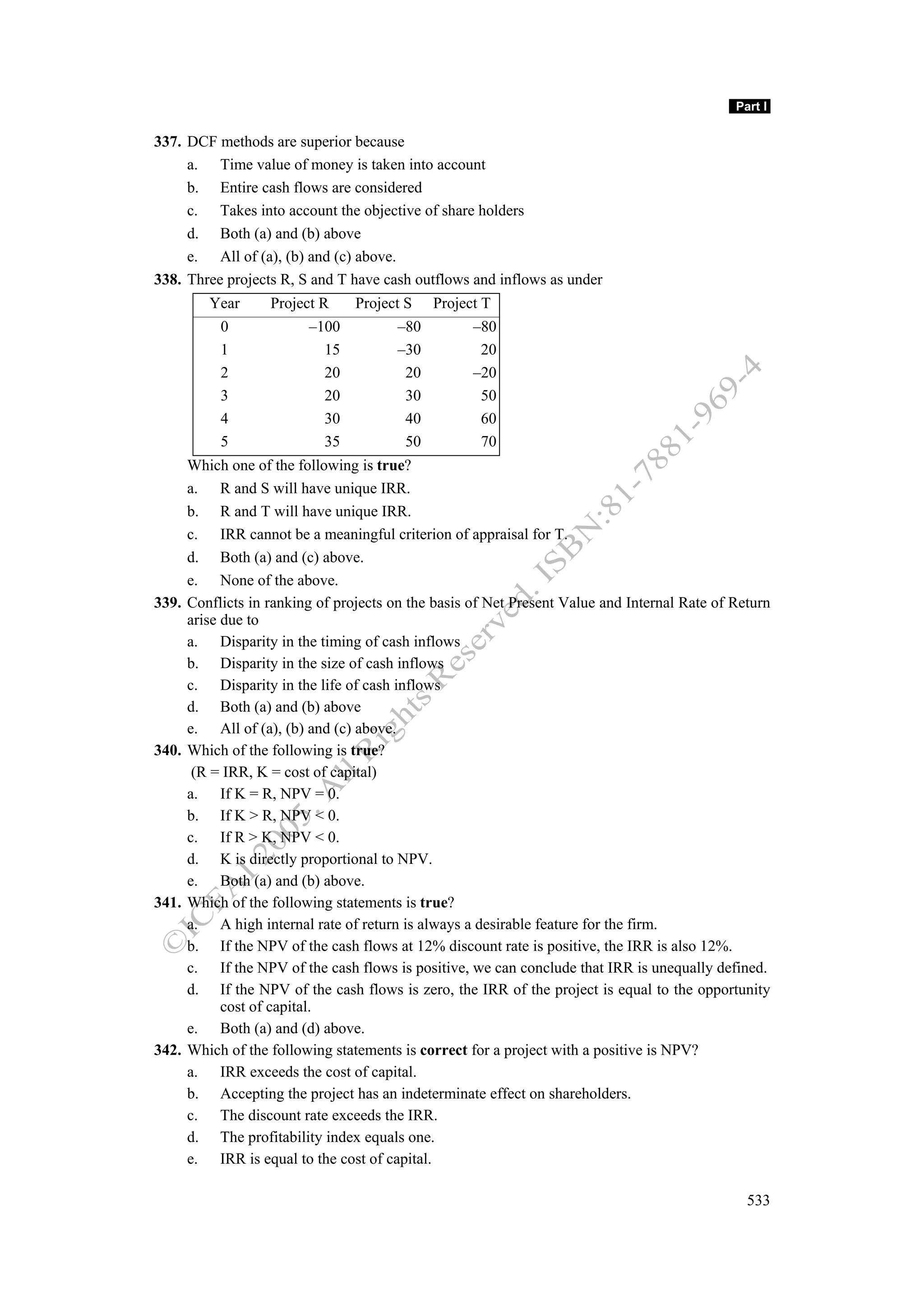

Hence (b) is the answer.

15. (c) Let the insured amount be Rs.1,000. Terminal value of cash outflows

= 62 x FVIFA(K,20)

Terminal value of cash inflows

= 250 x FVIF(K,15) + 250 x FVIF(K,10) + 250 x FVIF(K,5) + 250 + 400

Equating above two equations, we get

62 x FVIF(K,20) = 250 x FVIF(K,15) + 250 x FVIF(K,10) + 250 x FVIF(K,5) + 650

250 [FVIF(K,15) + FVIF(K,10) + FVIF(K,5)] + 650 – 62 x FVIFA(K,20) = 0

234](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-239-2048.jpg)

![Part II

For K = 10%,

LHS = 250 [4.177 + 2.594 + 1.611] + 650 – 62 (57.275)

= 2,095.5 + 650 – 3551.05 = –805.55

For K = 2%,

LHS = 250[1.104 +1.219 + 1.346] + 650 – 62 x 24.297 = 60.836

60.836 60.834

Therefore, K = 2% + (10 – 2) % x =2+8x = 2.56%

60.836 +805.55 656.46

Therefore, the return from the policy is only 2.56%, whereas bank interest rate is 11%. So, it

is not advisable for Mr. Singh to go for the money back policy.

16. (d) If cash flows are expected for grow @ 4% p.a. forever, the present value of the cash flows

Cash flow at the end of one year

=

k − g

Where,

K = Mr. Farooq’s required rate of return = 12% p.a.

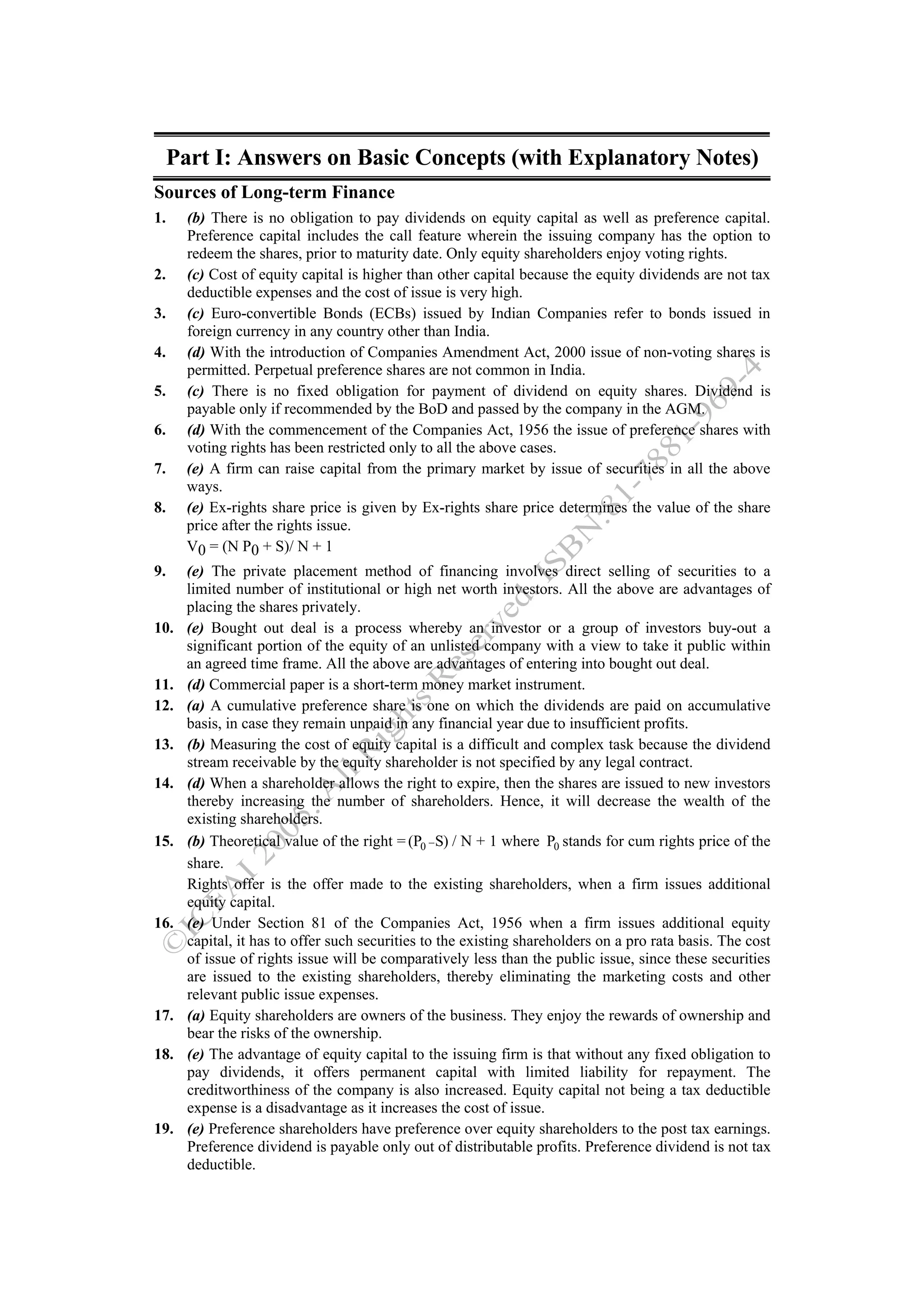

g = Annual growth rate in cash flows = 4% p.a.

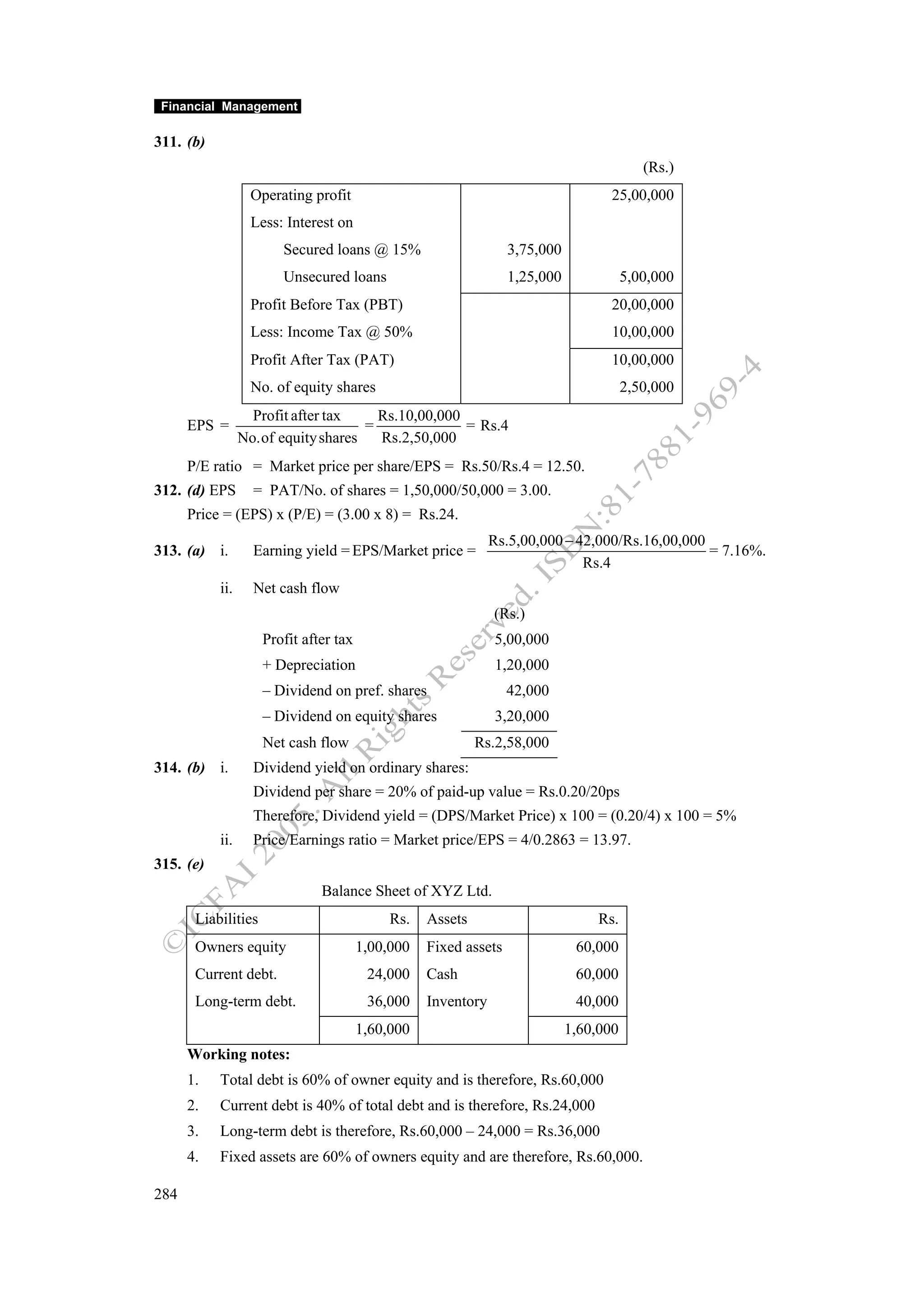

4,00,000 4,00,000

Therefore, the amount to be paid by Mr. Farooq = = = Rs.50,00,000.

0.12 − 0.04 0.08

17. (b) If the complex is sold at the end of four years at Rs.40 lakh, then the present value of the

future cash flows will be:

Year Cash flow Rs. PVIF @ 12% PV (Rs. )

1 4,00,000 0.893 3,57,200

2 4,16,000 0.797 3,31,552

3 4,32,640 0.712 3,08,040

4 4,49,946 0.636 2,86,166

4 40,00,000 0.636 25,44,000

38,26,958

Hence, Mr. Farooq would be willing to pay Rs.38,26,958.

18. (c) The company has to accumulate a sum ‘S’ by the end of 7 years from now so that the

present value of the payment made at the end of 8th, 9th and 10th year is equal to S. Let X

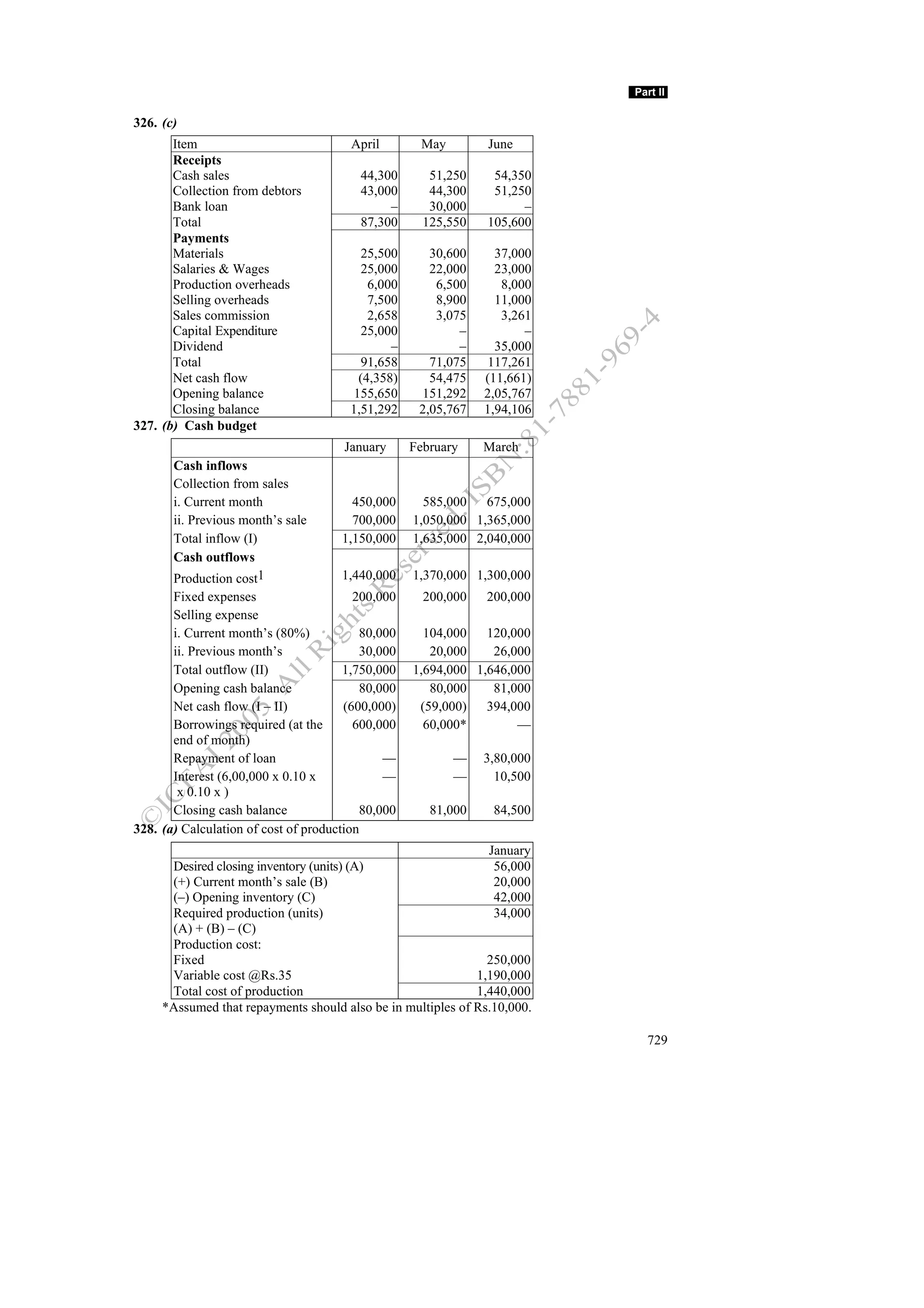

be the amount saved per year

(Rs. in lakh)

30 30 40

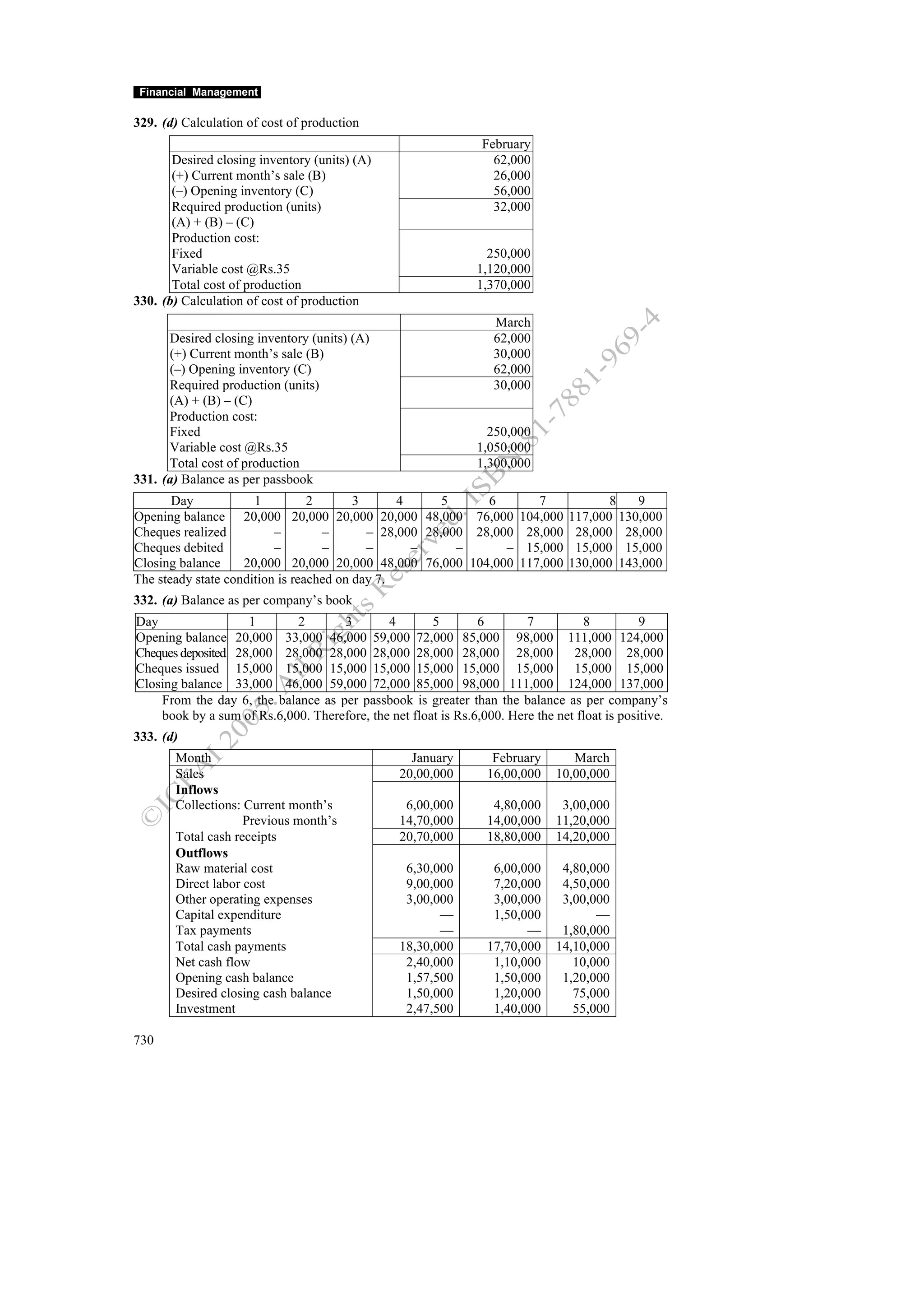

0

Year 1 2 3 4 5 6 7 8 9 10

∴ X. FVIFA(8%, 7) = S

30 30 40

and S = + 2

+ = 85.251

1.08 (1.08) (1.08)3

X (8.923) = 85.251

85.251

or, X = = 9.5541 lakh (approximately) per year, i.e., Rs.9,55,410(approx) per year.

8.923

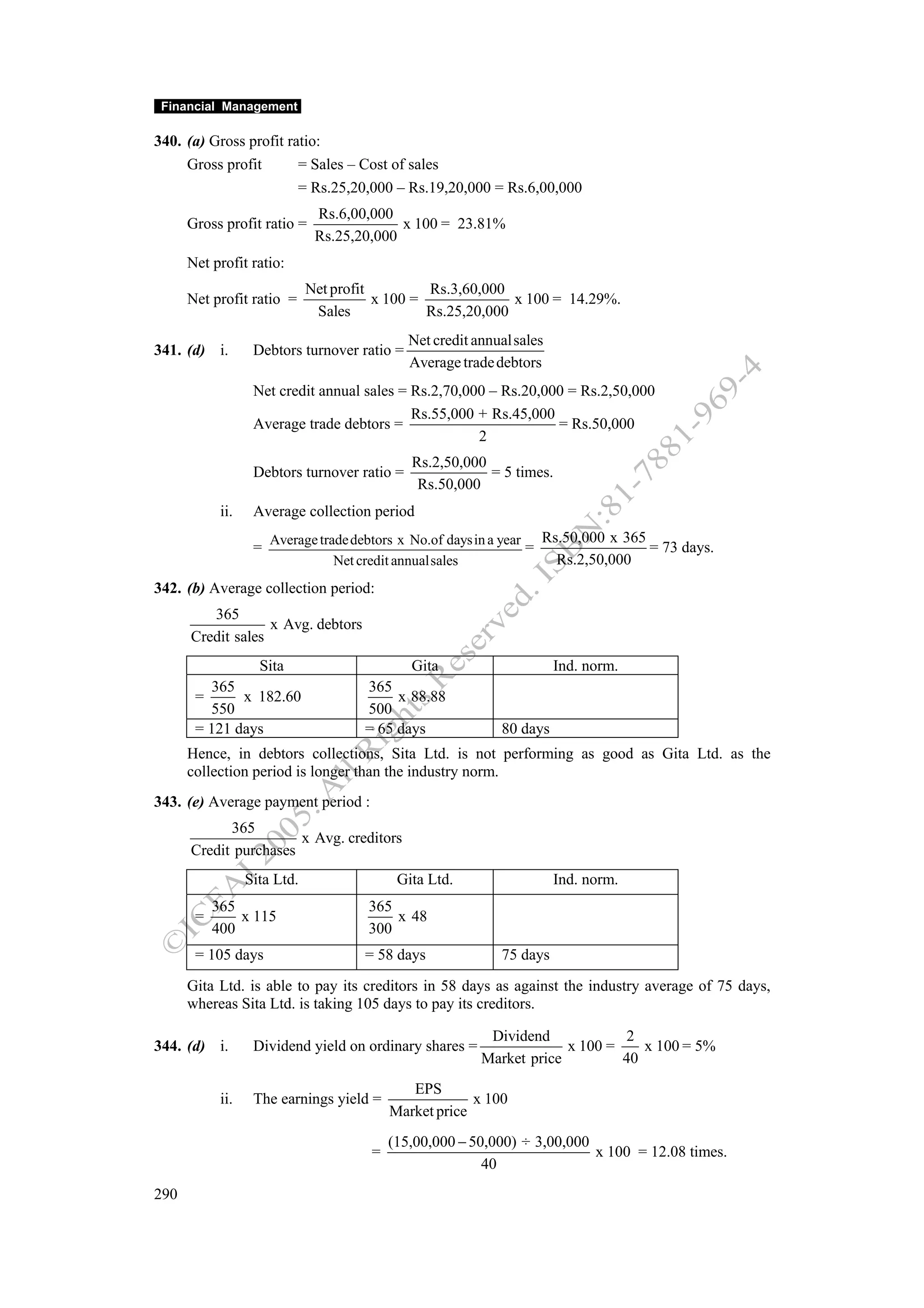

19. (c) The present value of perpetual stream of cash flows may be found by dividing the annual

cash flow by the discount rate i.e., annual cash flow ÷ r

So, the present value of stream of Rs.950 per annum @8% is = Rs.950/0.08 = Rs.11,875

The present value of stream of Rs.950 per annum @10% is = Rs.950/0.10 = Rs.9,500

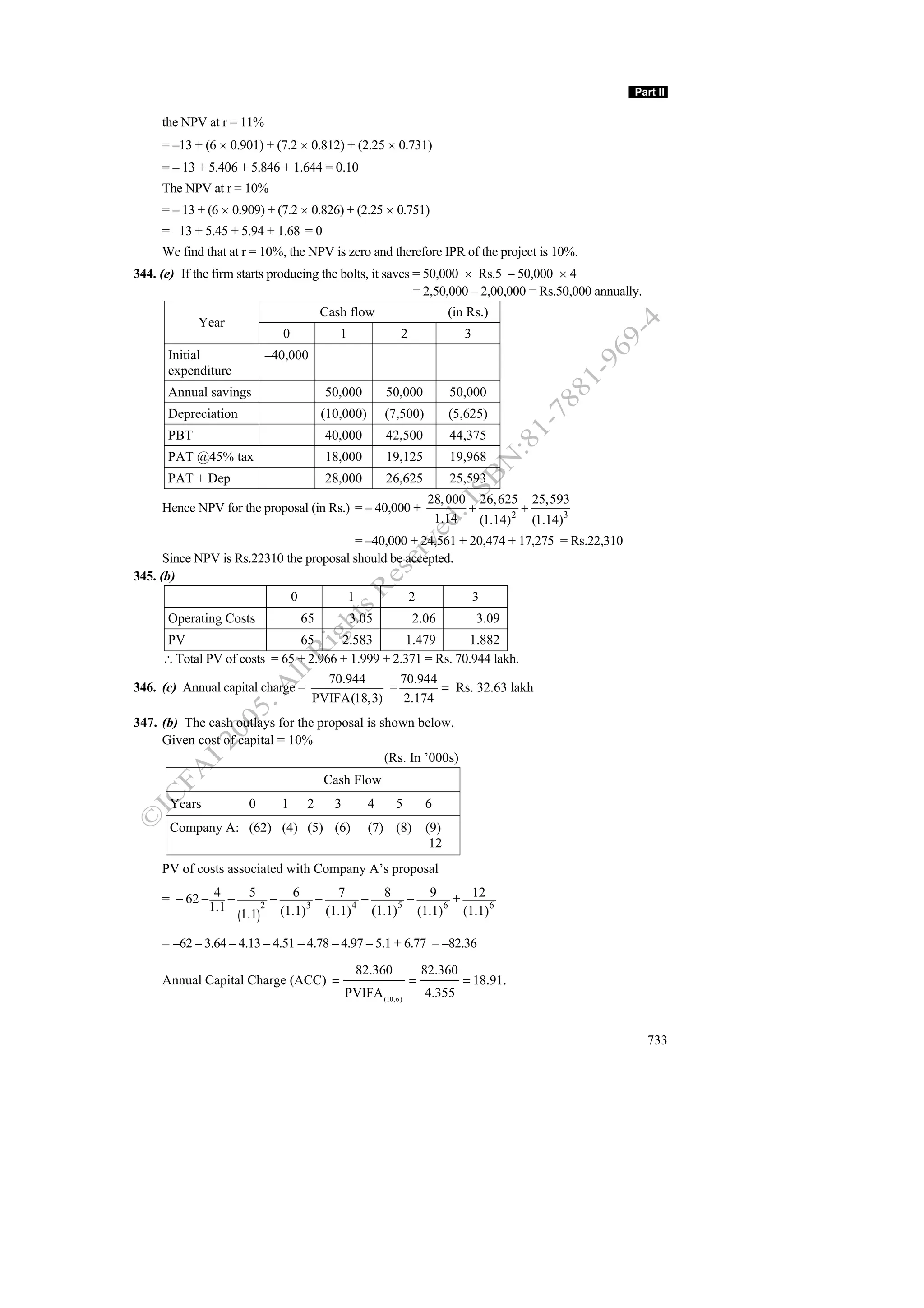

20. (c) Present Value of Rs.4,500 receivable in 7 years @15% is

PV = Rs.4,500 x PVIF(15%, 7y) = Rs.4,500 x 0.376 = Rs.1692.

235](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-240-2048.jpg)

![Financial Management

(1.0074)120 − 1 1.422

Now, PVIFA(0.0074%, 120) = = = 79.348

(0.0074) × (1.0074) 120 0.0074 × 2.422

Hence, the required amount of monthly installment is

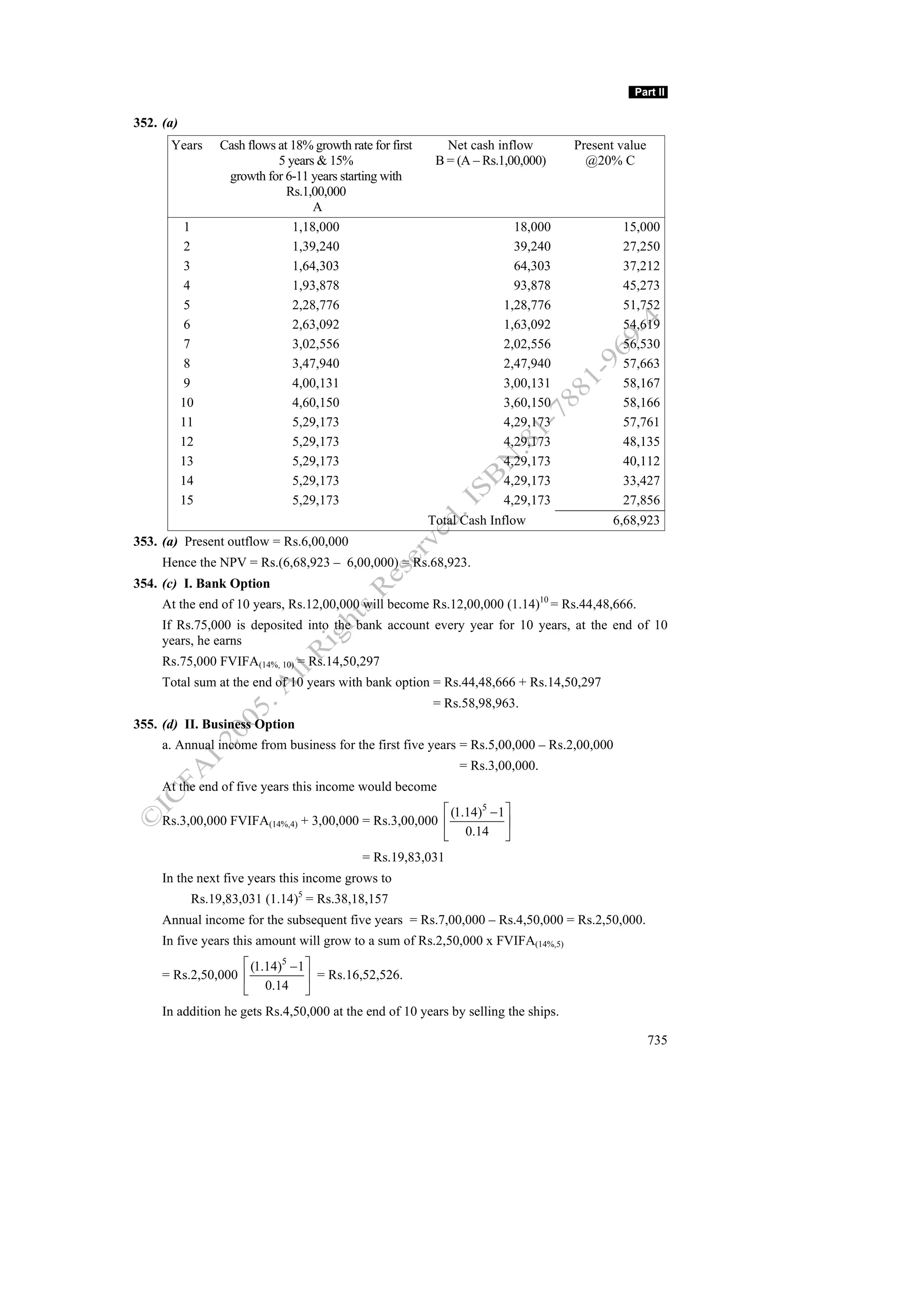

Rs.400, 000

= = Rs.5041.10 or Rs.5041 (approx.).

79.348

67. (b) The present value of annuity A receivable at the end of every year for a period of n years

at a rate of interest k is equal to PVA n = A x PVIFA k, n

3,00,000 = A x PVIFA (12%, 6)

3, 00, 000

A = = 72,975 .

4.111

68. (e) 10,000 = 1,000 x PVIFA(12year, r)

10 = PVIFA (12year, r)

[10.575 − 10] 0.575

By interpolation we get = 2 + =2 + = 2.925% p.m

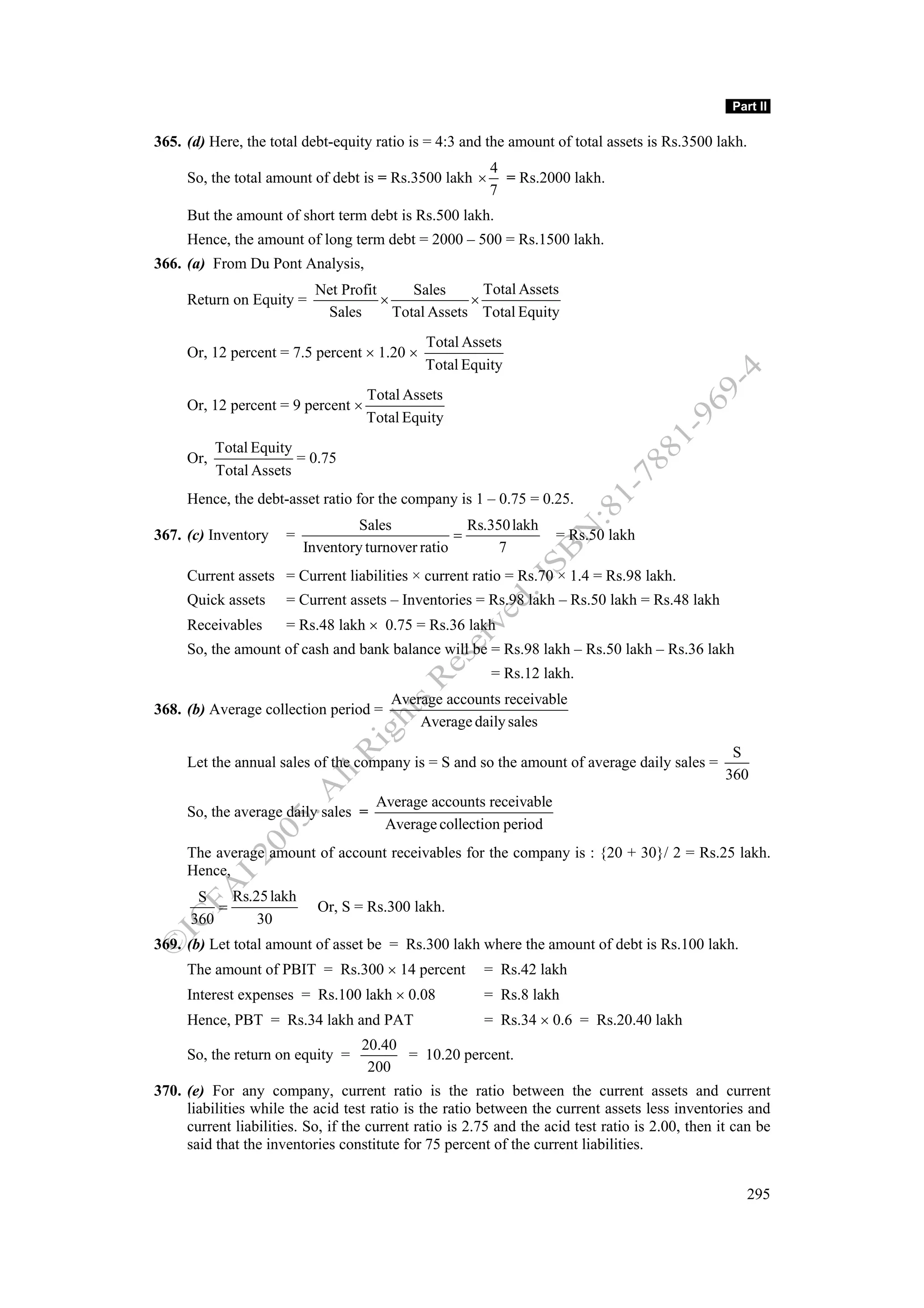

(10.575 − 9.954) 0.621

Hence interest rate per annum = 2.925 x 12 = 35.1%.

69. (c) The general relationship between the effective and nominal rate of interest is as follows:

r = (1 + k/m) m – 1

Where

r = effective rate of interest

k = nominal rate of interest

m = frequency of compounding per year.

r = (1 + 0.12/12)12 – 1= 12.68%

4

⎛ 0.12 ⎞

For quarterly compounding, ⎜1 + ⎟ −1 = 12.55%

⎝ 4 ⎠

∴ The difference between the monthly and quarterly compounding = 0.13%.

70. (b) The present value of an annuity A receivable at the end of every year for a period of n

years at a rate of interest k is given as PV = A x PVIFA (11%, 5 years)

PV = 200 x 3.696 = 739.2.

71. (b) The general relationship between the effective and nominal rate of interest is as follows:

= (1 + k/m)m – 1

Where,

r = effective rate of interest

k = nominal rate of interest

m = frequency of compounding per year.

r = (1 + 0.01/2)2 – 1 = 0.1025 or 10.25%.

72. (e)

Year Amount PVIFA PV

1-3 2000 2.322 4644

4-6 3000 1.567 4701

(3.889–2.32)

9345

242](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-247-2048.jpg)

![Part II

91. (c) According to the ‘Rule of 69’ doubling period = 0.35 + 69/interest rate

Hence, the doubling period = 0.35 + 69/16 = 4.7 years.

92. (d) According to the ‘Rule of 69’ doubling period = 0.35 + 69/interest rate

Hence, the doubling period = 0.35 + 69/6 = 11.85 years.

93. (d) The present value of annuity is given

PVA n = A x PVIFA (k, n)

Hence the amount to be invested today to earn annuity of Rs.1000 will be

1,000 x PVIFA (12%, 5) = Rs.3,605.

94. (c) An annuity of infinite duration is known as perpetuity. The PV of such perpetuity can be

expressed as Pa = A x PVIFA(k, a) = A x 1/k

The amount to be deposited now to earn a constant annual income for an indefinite period

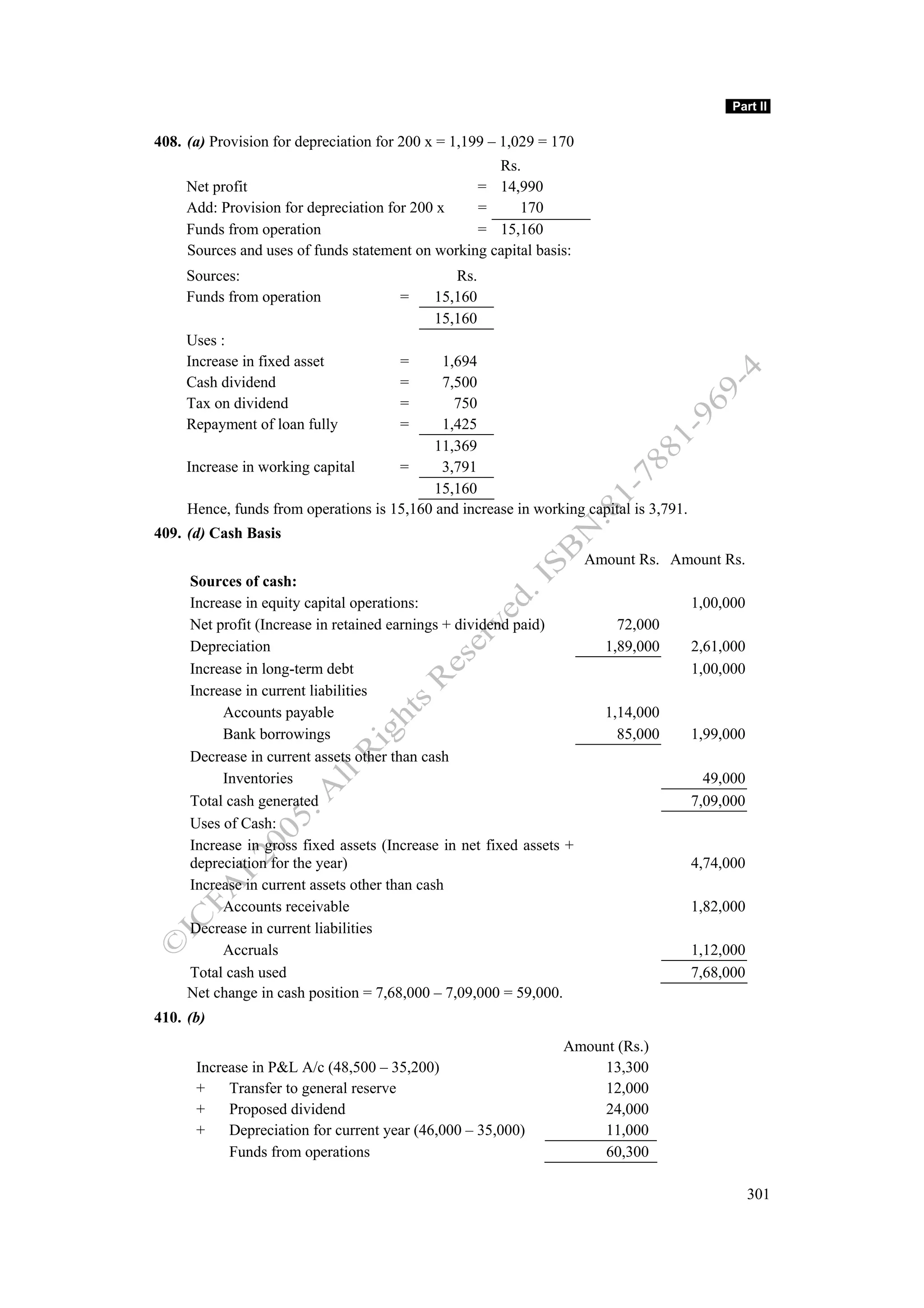

will be 10,000 x 1 / 0.10 = 1,00,000.

95. (b) The general relationship between effective and nominal rate of interest is given by

r = (1 + k/m)m – 1

r = (1 + 0.16/4)4 – 1 = 0.1699 or 16.99%.

96. (d) The future value of a regular annuity for a period of n years at a rate of interest is given

by the formula

A[(1+ k)n − 1]

FVAn =

K

where,

A = Amount deposited/invested at the end of every year for n years

k = Rate of interest (expressed in decimals)

n = Time horizon

FVAn = Accumulation at the end of n years

This can be rewritten as A = FVAn {k/(1+ k)n – 1}

Therefore, the amount to be invested every year will be A = 10,00,000{0.14/(1+ 0.14)5 – 1}

= 1,51,283.55 Rs.1,51,284.

97. (e) The doubling period according to ‘Rule of 69’ is given by 0.35 + 69/interest rate

= 0.35 + 69/r = 4.75

The rate of interest will be r = 15.68%.

98. (a) The doubling period as per Rule 72 is given as 72/interest rate. Hence the doubling period

here will be 72/16 = 4.5 years.

99. (b) An annuity of infinite duration is known as perpetuity. The PV of such perpetuity can be

expressed as = A x 1/k = 1,000 x 12 x 1/0.12 = 1,00,000.

100. (a) Amount to be earned today to earn an annuity of Rs.1,000 for five years commencing

from the end of two years

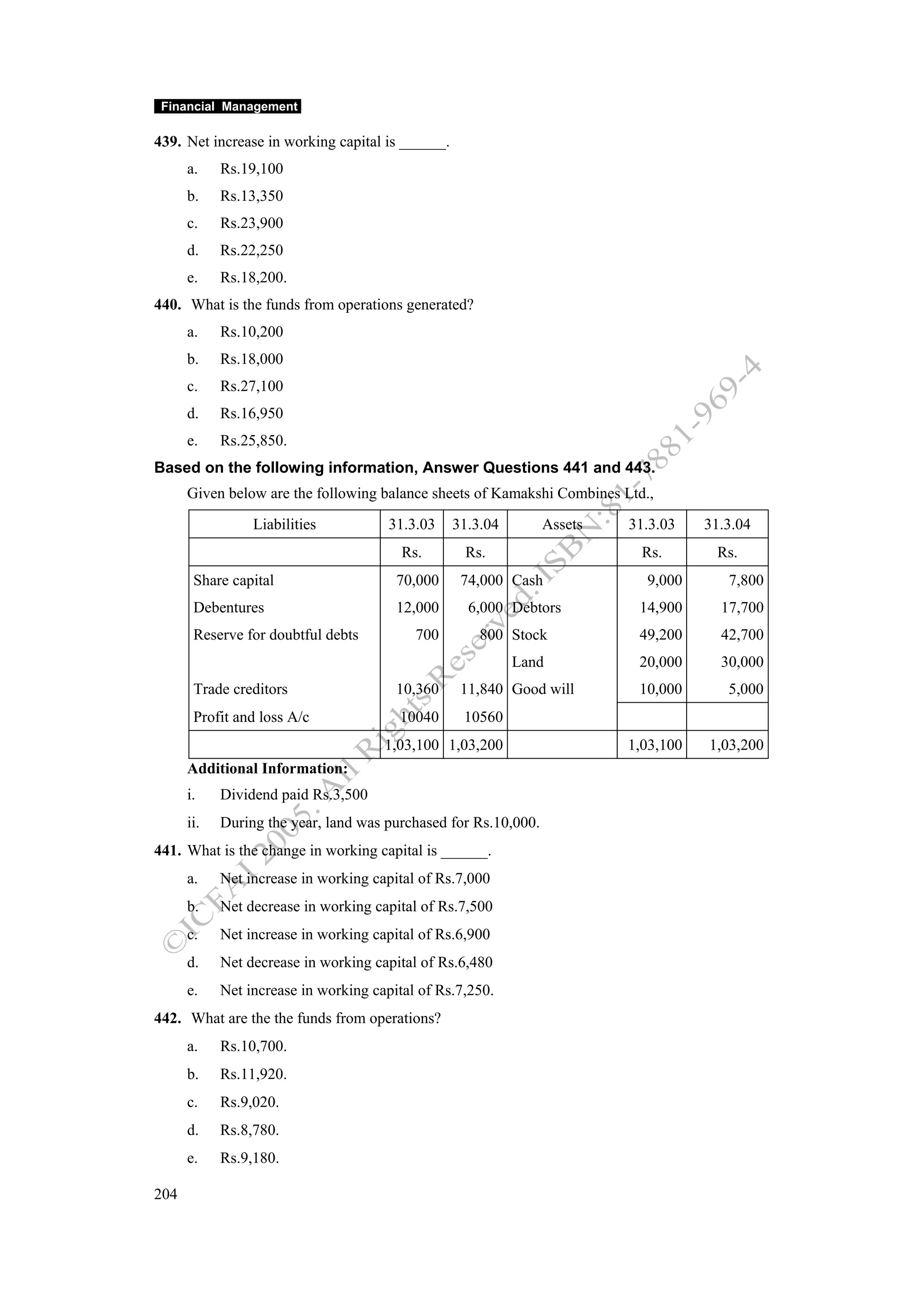

1000 x PVIF (12%, 2) + 1,000 x PVIF (12%, 3) + 1000 x PVIF (12%, 4) + 1,000 x PVIF (12%, 5)

+ 1000 x PVIF (12%, 6)

= 797 + 712 + 636 + 567 + 507 = 3,219.

101. (a) A rupee expected to be received one year from now with no risk of default would be

discounted at a lower rate and would be worth less than Re 1.

102. (c)The doubling period according to the rule of 69 is given as 0.35 + 69/interest rate

0.35 + 69/15.

Hence the doubling period will be r = 4.95 years.

245](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-250-2048.jpg)

![Financial Management

0.5 x 0.24 x 0.20

Hence, β = = 0.6

0.04

Given,

rf = 6%

rm = 16%

Hence,

rj = 6 + 0.6 (16 – 6) = 12%

Therefore, the return on Greaves Ltd. = 12%.

113. (a) The beta of Mr. Ramesh’s portfolio is the weighted average of the betas of individual

stocks in his portfolio.

Hence, β portfolio = 0.95 x 0.15 + 1.1 x 0.2 + 1.25 x 0.3 + 0.8 x 0.05 + 1.05 x 0.2 + 0.7 x 0.1

= 1.0575

Using CAPM Rf = 4% + 1.0575 (14 – 4)%

Return on portfolio = 14.575%.

114. (d) Using dividend capitalization model,

D1

We have, P =

Ke − g

Where,

Ke is the required rate of return on the stock A

Ke can be found out using CAPM, as

Ke = Rf + β(Rm – Rf)

Substituting the values of Rf, β and Rm

Ke = 10 + 1.2 (15 – 10) = 16%

Therefore, plugging the values of Ke, Po and D1

30 = 4

0.16 − g

∴ g = 2.67%.

115. (c)

Scenario ri (%) P [ri – E (r)]2 [ri – E(r)]2 P

Recession –10 0.3 225 67.5

Low growth 5 0.4 0 0

High growth 20 0.3 225 67.5

Expected return = –10(0.3) + 5(0.4) + 20(0.3) = 5%

σ = 135 = 11.62% .

116. (a) E(rp) = (10 x 0.5) + (20 x 0.5) = 15%

σp 2

= (2)2 (0.5)2 + (5)2 (0.5)2 + (2 x 0.4 x 2 x 5 x 0.5 x 0.5) = 9.25

σP = 9.25 = 3.04%.

117. (c) Ke = rf + β(rm – rf ) = 9 + 1(18 – 9) = 18%

2.5 (1.06)

Po = = Rs. 22.08.

0.18 − 0.06

248](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-253-2048.jpg)

![Part II

ke = Rf + β (Rm – Rf) = 20 + 1.4 (25 – 20) = 27%.

Substituting the values ke, P0 and D1

10

40 = ⇒ 10.8 – 40g = 10 ⇒ 10.8 – 10 = 40g ⇒ 0.8 = 40g

0.27 − g

g = 0.02 or 2%.

147. (a) E(rp) = (15 x 0.5) + (25 x 0.5) = 7.5 + 12.5 = 20%

σ 2 = (3)2 (0.5)2 + (6)2(0.5)2 + (2 x 0.6 x 3 x 6 x 0.5 x 0.5) = 2.25 + 9 + 5.4 = 16.65

p

σp = 16.65 = 4.08%.

148. (d) ke = 13 + 2(16 – 13) = 19%

4.5 (1.09)

P0 = = Rs.49.05.

0.19 − 0.09

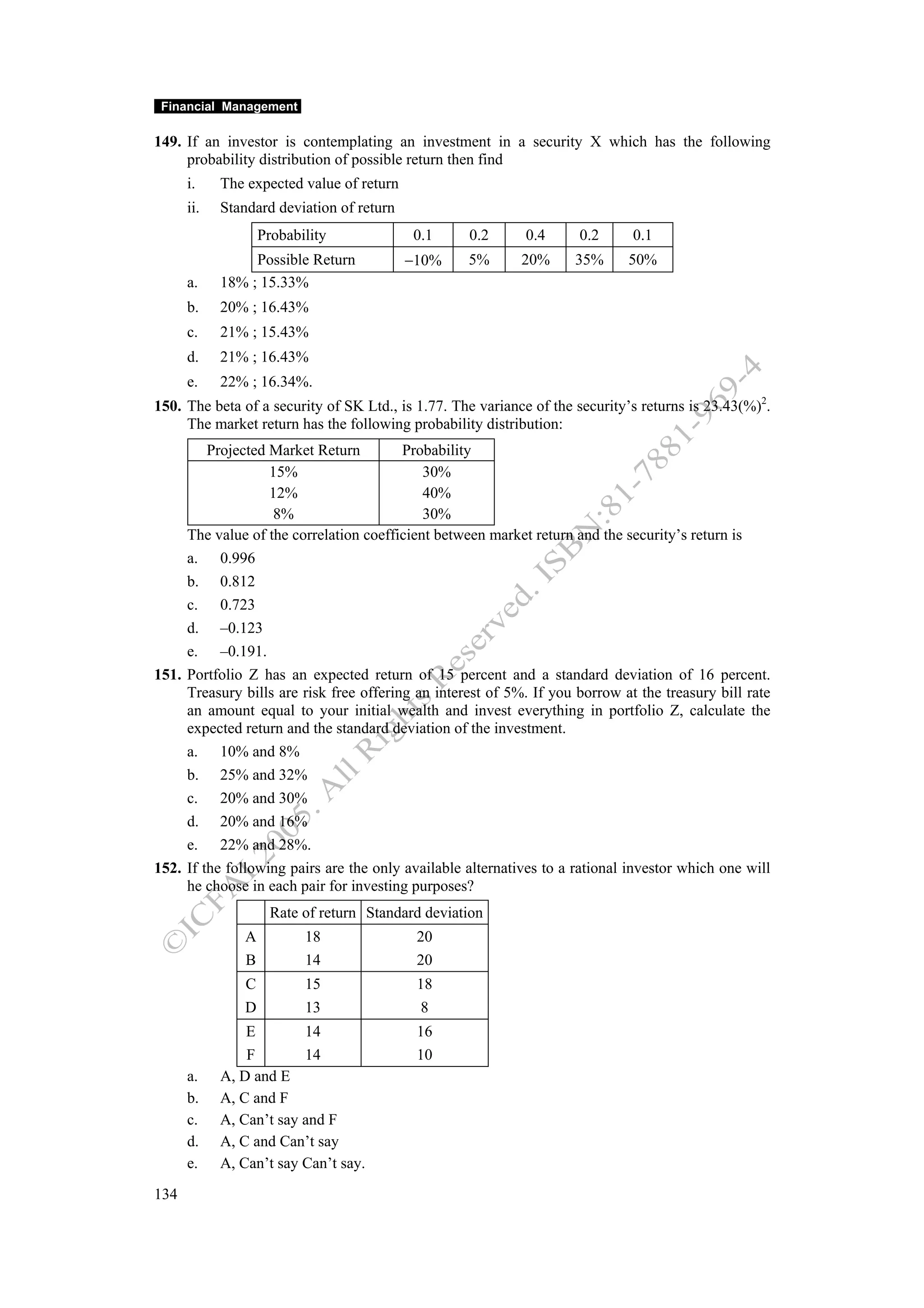

149. (b)

Return Probability RXP R – 20 (R – 20)2 x P

–10 0.1 –1 –30 90

5 0.2 1 –15 45

20 0.4 8 0 0

35 0.2 7 15 45

50 0.1 5 30 90

20 270

S.D 270 16.43

150. (a)

Cov(i,m) ρσ i σ m

β= 2

=

σ m σ2 m

Expected return from the market = Σpikm = 0.30 (15) + 0.40 (12) + 0.30 (8) = 11.70%

Risk for the market, σm = [Σpi (k m − k m ) 2 ]1/2

= [(15 – 11.70)2 (0.30) + (12 – 11.70)2 (0.40) + (8 – 11.70)2 (0.30)]1/2

= [3.267 + 0.036 + 4.107]1/2 = (7.41)1/2 = 2.72%.

Given σi2 = 23.43(%)2

∴ σi = 23.43 = 4.84%

ρ (4.84)(2.72)

i.e. 1.77 =

7.41

1.77 × 7.41

Therefore, ρ = = 0.996.

4.84 × 2.72

151. (b) Expected. Return = (2 x expected return on portfolio Z ) – (1 x Interest rate on treasury bils)

= (2 x 15) – 5 = 25%

Standard deviation = (2 x standard deviation of Z ) – (1 x standard deviation of T. Bills)

= (2 x 16) – 0 = 32

152. (c) In portfolio A and B - A as higher return for same risk

In portfolio C and D - can’t say depend on investor attitude

In portfolio E and F - F as lower risk for same return

253](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-258-2048.jpg)

![Part II

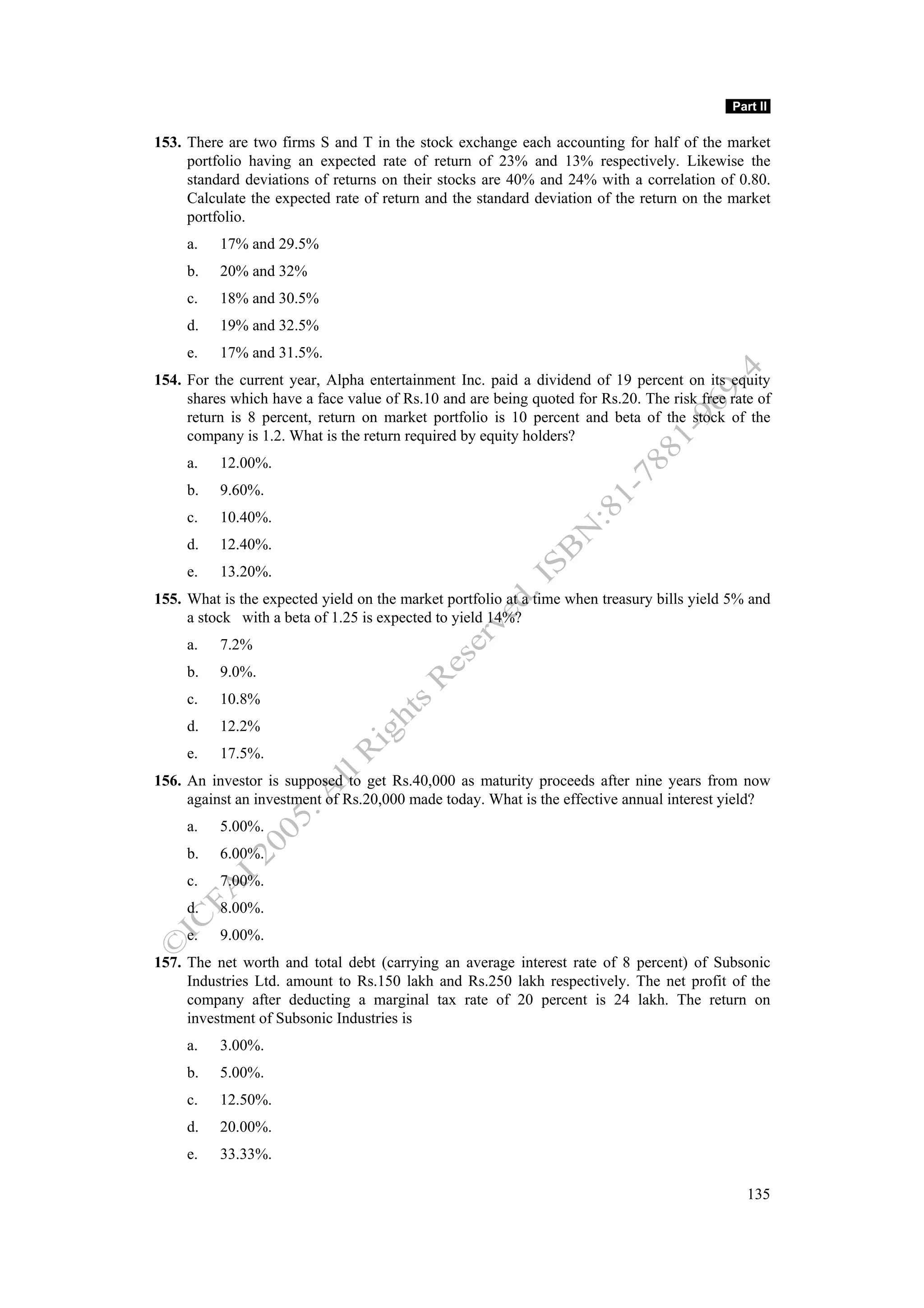

So, the expected return is 10 × 0.30 + 20 × 0.40 + 30 × 0.30 = 3 + 8 + 9=20 percent.

Expected return from the shares of SMS Ltd is = 20 percent

Returns from the market under various scenarios can be estimated as

Sensex 4370 4750 5130

4370 − 3800

× 100 ⎛ 4750 − 3800 ⎞ ( 5130 − 3800 ) × 100

Return 3800 ⎜ 3800 ⎟ × 100

⎝ ⎠ 3800

= 15 percent = 25 percent = 35 percent

Probability 0.3 0.4 0.3

Hence, the expected return = 15 × 0.3 + 25 × 0.4 + 35 × 0.3 = 25 percent.

And the expected return from sensex is = 25 percent

So, the variance on the market return can be calculated as

{

σ m 2 = 0.3 × (15 − 25 ) + 0.3 ( 25 − 25 ) + 0.3 ( 35 − 25 )

2 2 2

} = 60

Now, the covariance between the return from the share and return form the market can be

calculated as

= 0.30 ×(10 – 20)(15 – 25) + 0.4 × (20-20)(25 – 25) + 0.3(30 – 20)(35 – 25)

= 0.3 × 100 + 0.3 × 100 = 60

Hence, the beta value for the shares of SMS Ltd is

covariancr brtween the returns from the shares and market 60

= = = 1.00.

var iance on the market returns 60

171. (a) The general equation to calculate the rate of return k= [D1 + (P1 – Pt – 1)]/Pt – 1

where,

k = rate of return

P1 = price of the security at the time t

i.e., at the end of the holding period

Pt –1 = price of the security at time t – 1,

i.e., at beginning of the holding period or purchase price

Dt = income or each cash flows receivable from the security at the time

0.15 = [5 + (Pt – 50)]/50

Pt = 52.5.

172. (e) Expected rate of return K = Σ Pi Ki.

The expected rate of return for any asset is the weighted average return using the probability

of each rate of return as the weight.

0.188 = 0.30 x 0.16 + 0.70 x r

r = 0.14/0.7 = 0.2 or 20%.

173. (e)

rxy = Covariancexy /σx σy

0.4 = 0.8 / σx × 0.2

σx = 0.8/0.08 = 10

2 2

Variance = σ = 10 = 100.

257](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-262-2048.jpg)

![Financial Management

n

174. (d) Expected rate of return K = ∑ Pi K i

t =1

Probability 0.20 0.50 0.20 0.10

Price 120 140 160 180

Rate of return 0.5 0.75 1.00 1.25

K = Pt – Pt –1 / Pt-1

Rate of return

= 0.20 x 0.5 + 0.50 x 0.75 + 0.20 x 1 + 0.10 x 1.25

= 0.1 + 0.375 + 0.2 + 0.125 = 0.80 or 80%.

175. (e)

Convariance (K j K m )

Beta =

Variance (K m )

Variance = (Standard deviation)2

β = 514.92/264.06 = 1.95.

176. (a) The general equation to calculate the rate of return k = [Dt + (Pt – Pt–1)]/Pt–1

Where k = Rate of return

Pt = Price of the security at the time t i.e. at the end of the holding period

Pt-1 = Price of the security at time t –1 i.e. at beginning of the holding period or

purchase price

Dt = Income or each cash flows receivable from the security at the time t

K = [15 + (1,000)]/ 5,000 = 20.30%.

Convariance (K J, K m ) 177.85

177. (c) Beta = = = 1.469 .

Variance (K m ) 121

n

178. (a) Expected rate of return K = ∑ Pi K i

t =1

= 0.25 x 0.15 + 0.35 x 0.18 + 0.25 x 0.20 + 0.15 x 0.13 = 0.17 or 17%.

179. (d) The general equation to calculate the rate of return k = [Dt + (Pt – Pt-1 )]/Pt-1

Where,

k = Rate of return

Pt = Price of the security at the time t i.e. at the end of the holding period

Pt – 1 = Price of the security at time t–1 i.e. at beginning of the holding period or purchase price

Dt = Income or each cash flows receivable from the security at the time t

K = [2.5 + (35 – 21)]/21 = 78.57.

180. (b) The CAPM is represented by

kj = Rf + βj (km – Rf)

Where,

kj = expected or required rate of return on security j

Rf = risk-free rate of return

βj = beta coefficient of security j

km = return on market portfolio

Required rate of return = 0.09 + 1.5 (0.15 – 0.09) = 0.18 or 18%.

258](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-263-2048.jpg)

![Part II

181. (b) The general equation to calculate the rate of return k = Dt + (Pt – Pt-1)/Pt–1

k = [15 + (115 – 120)]/120 = 8.33%.

n

182. (e) Expected rate of return K = ∑ PiKi

t =1

k = 0.25 x 0.19 + 0.35 x 0.12 + 0.20 x 0.18 + 0.10 x 0.20 + 0.1 x 0.24

= 0.1695 or 16.95%.

183. (d) The CAPM is represented by

kj = Rf + βj (km – Rf)

Where,

kj = expected or required rate of return on security j

Rf = risk-free rate of return

βj = beta coefficient of security j

km = return on market portfolio

Require rate of return = 0.08 + 1.4 (0.15 – 0.08) = 0.178 or 17.8%.

184. (b)

Convariance (K J, K m )

Beta =

Variance (K m )

221

β = = 1.82 .

121

185. (d) The general equation to calculate the rate of return k = Dt + (Pt – Pt-1 )/Pt

6.25 + (150 − 125)

The rate of return = = 0.25 or 25%.

125

n

186. (d) Expected rate of return K = ∑ Pi K i

t =1

k = 0.10 x 0.20 + 0.15 x 0.10 + 0.20 x 0.5 + 0.25 x 0.20 = 0.185 or 18.5%.

187. (c) The CAPM is represented by

kj = Rf +βj (km – Rf)

0.18 = 0.08 + βj (0.15 – 0.08)

Beta = 1.429.

n

188. (d) Expected rate of return K = ∑ Pi K i

t =1

= 0.2 x 0.10 + 0.25 x 0.12 + 0.25 x 0.15 + 0.3 x 0.18

= 0.1415 or 14.15%.

189. (e) The CAPM is represented by

kj = Rf +βj (km – Rf)

0.18 = 0.06 + βj (0.12 – 0.06)

β =2

Convariance (K J, K m )

190. (a) Beta =

Variance (K m )

β = 7.4/4.8 = 1.54

259](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-264-2048.jpg)

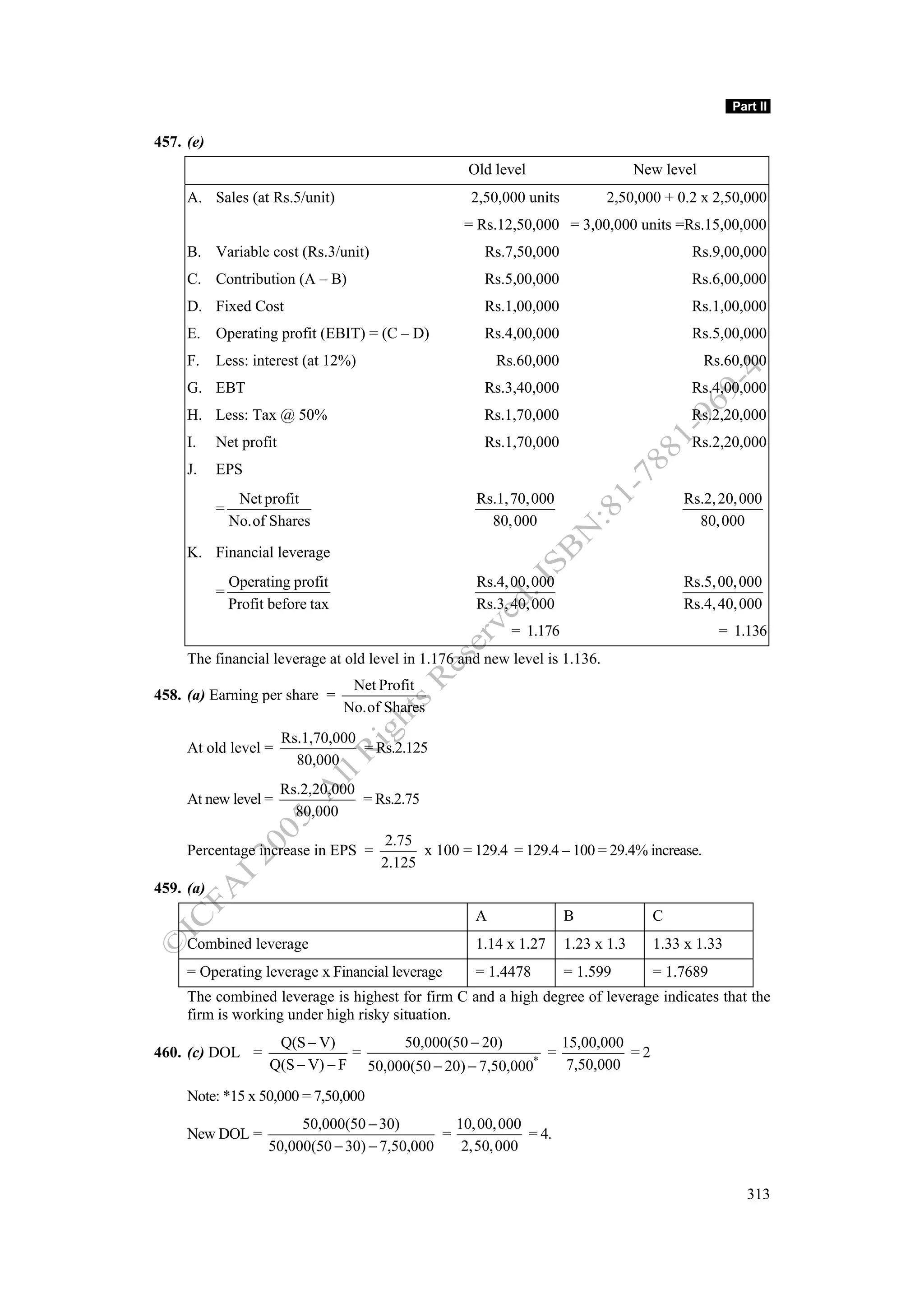

![Part II

Share capital (Liabilities – total debt) = Rs.2,50,000

Number of shares = 25,000 [2,50,000/10]

Gross profit = Total sales × Gross profit margin

= Rs.50,000

Cost of goods sold = Total sales – Gross profit

= Rs.1,50,000

PAT Rs.20, 000

EPS = = = Rs. 0.80 or 80 paise.

No. of Share Rs.25, 000

298. (c)

Gross profit Rs. 60,000

i. Sales = = = Rs. 3,00,000

Gross profit margin 20%

ii. Cost of goods sold = Rs.(3,00,000 – 60,000) = Rs.2,40,000

Cost of goods sold Rs.2,40,000

iii. Average stock = = = Rs.40,000

Inventory turnover 6

iv. Total stock = Rs.40,000 x 2 = Rs.80,000

Given, opening stock is Rs.5,000 less than closing stock.

Let opening stock = x

Closing stock = x + 5000

∴ x + x + 5000= 80,000

2x = 75000

x = 37,500

∴ Opening stock = Rs.37,500

Closing stock = 80,000 – 37,500 = 42,500

Closing stock = Rs.42,500

Opening stock = Rs.37,500

Rs.3,00,000 x 2

v. Accounts receivable = = Rs.50,000

12

(Assuming all sales are credit sales)

Sales Rs.3,00,000

vi. Fixed assets = = = Rs.75,000

Fixed assets turnover 4

Since, it is a manufacturing company.

Purchases on credit = Cost of goods sold + Increase in inventory

(Assuming all purchases are credit sales) = Rs.2,40,000 + Rs.5,000 = Rs.2,45,000.

Purchases x Creditors payment period

Creditors = = Rs.49,000

365

Cost of goods sold Rs.2,40,000

Equity = = = Rs.1,20,000.

Capital turnover 2

Balance Sheet

Liabilities Amount Assets Amount

Equity 1,20,000 Fixed Assets 75,000

Reserves & Surplus 20,000 Inventory 42,500

Long-term Liabilities 60,000 Current Assets (balancing figure) 81,500

Creditors 49,000 Accounts Receivable 50,000

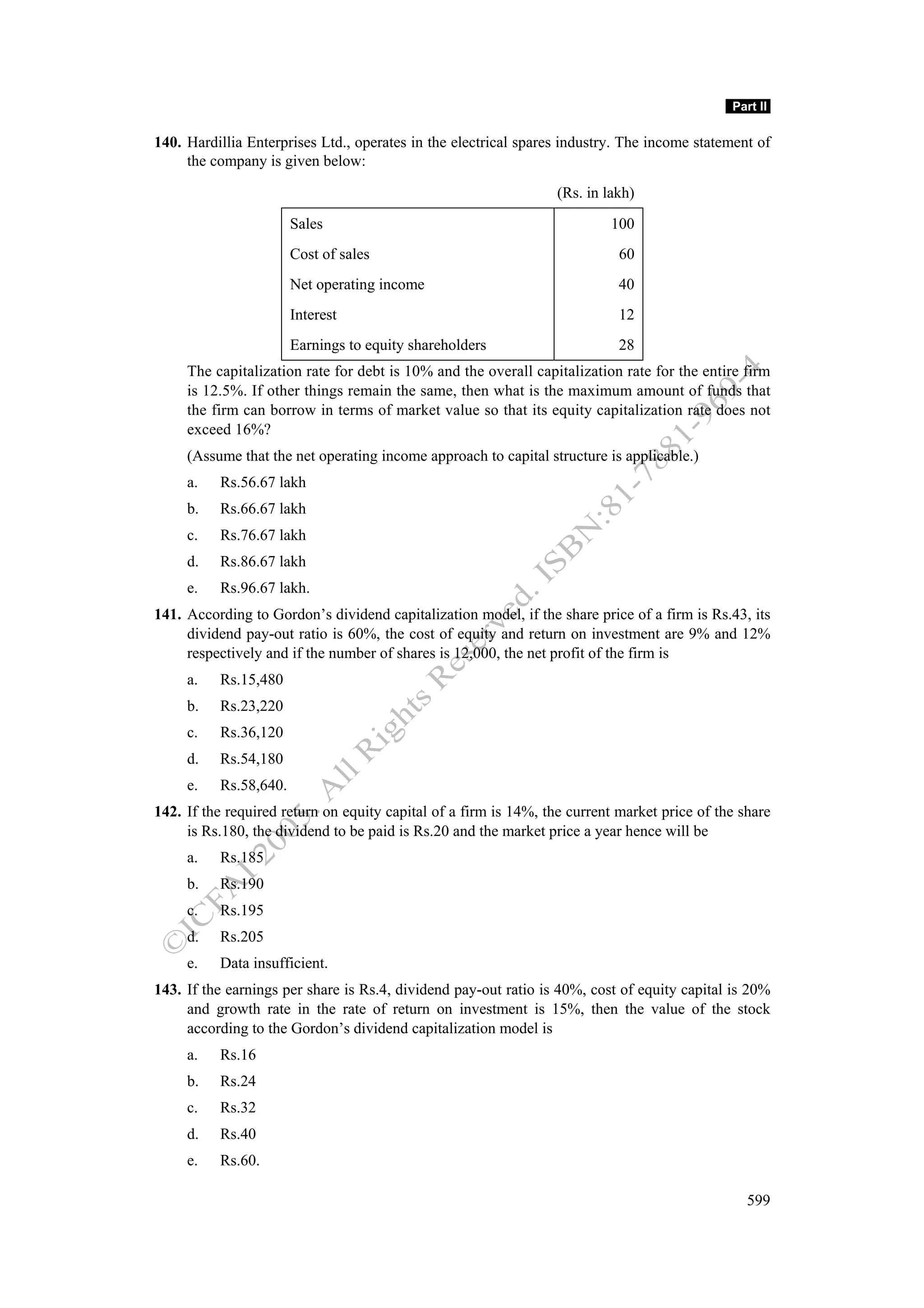

2,49,000 2,49,000

279](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-284-2048.jpg)

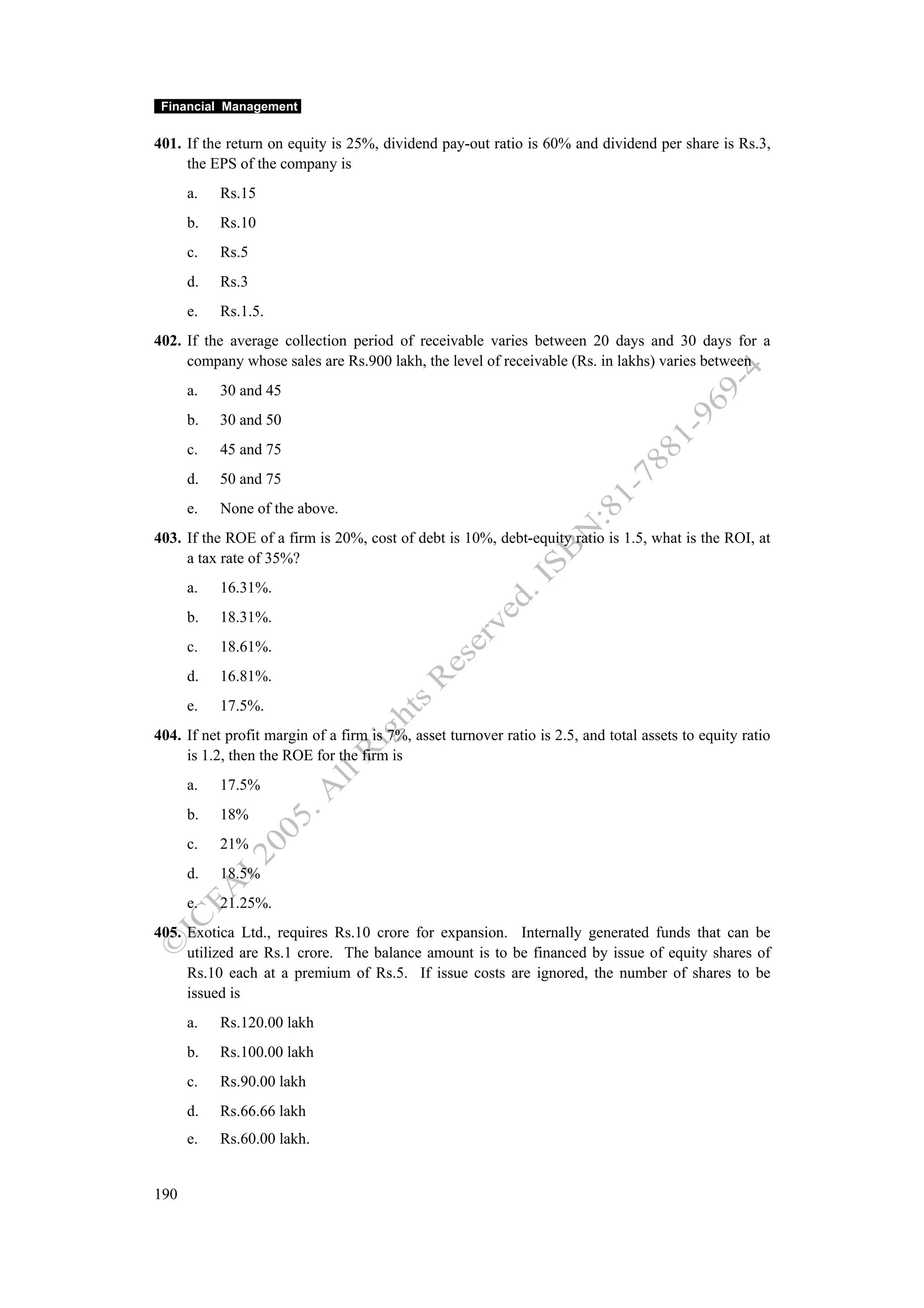

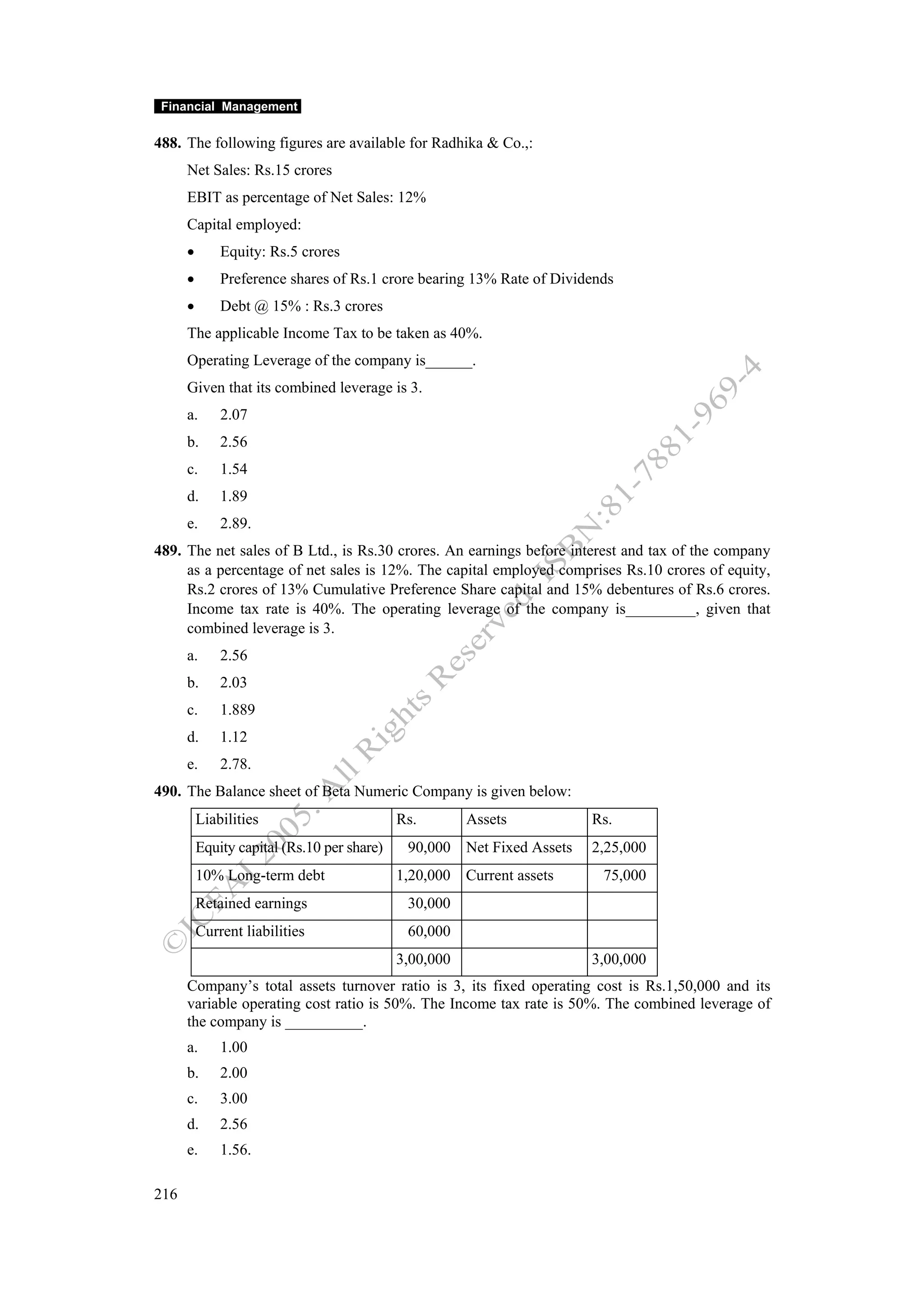

![Part II

397. (a) Current ratio = Current assets/Current liabilities = 160/100 = 1.6.

After an increase of 10% in current assets the figure changes to 176, i.e. (160 + 16).

Current ratio = 176 / 100 = 1.76

Increase in current ratio = (1.76 – 1.6) / 1.6 = 10%.

398. (b) Return on equity = Net profit margin x Asset turnover ratio x Asset – Equity ratio

0.14 = 0.08 x Asset turnover ratio x 1.2

Asset turnover ratio = 1.46

When the net profit margin and asset-equity ratio are changed and ROE remains unchanged

then 0.14 = 0.04 x Asset turnover ratio x 1.5

Asset turnover ratio = 2.33.

399. (d) Return on investments = EBIT/Total assets

Net profit margin = Net profit / Sales,

Total assets turnover = Sales/Average total assets

Return on investments = Net profit margin x Total assets turnover = 0.05 x 2 = 0.1 or 10%.

400. (a) Average collection period = Average accounts receivable/Average daily sales

Current ratio = CA/CL

CA = 1.3 x 16,00,000 = 20,80,000.

Average accounts receivable = 60% of 20,80,000 = 12,48,000.

Asset turnover ratio = Sales/Average assets

Sales = 1.2 x 52,00,000 = 62,40,000

Average daily sales = 62,40,000/360 = 17,333

Average collection period = 12,48,000/17,333 = 72 days.

401. (c) Dividend pay-out ratio = Dividend per share/Earnings per share

0.6 = 3/Earnings per share

Earnings per share = 3/0.6 = 5.

402. (d) Average collection period = Average accounts receivable/Average daily sales

Average daily sales = 9,00,000/360 = 2,50,000

When the average collection period is 20 days Average accounts receivable will be

2,50,000 x 20 = 50,00,000

When the average collection period is 30 days Average accounts receivable will be

2,50,000 x 30 = 75,00,000.

403. (b) ROE = [(ROI + (ROI – r ) D/E)] (1 – t)

0.2 = [(ROI + (ROI – 0.1) 1.5)] (1 – 0.35)

ROI = 18.304 or 18.31%.

404. (c) Return on equity = Net profit margin x Asset turnover ratio x Asset to Equity ratio

ROE = 0.07 x 2.5 x 1.2 = 0.21 or 21%.

405. (e) Number of shares = Capital required/Issue price = 9 crore/15 = 60 lakh.

Capital required = Total requirement – Funds generated internally.

299](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-304-2048.jpg)

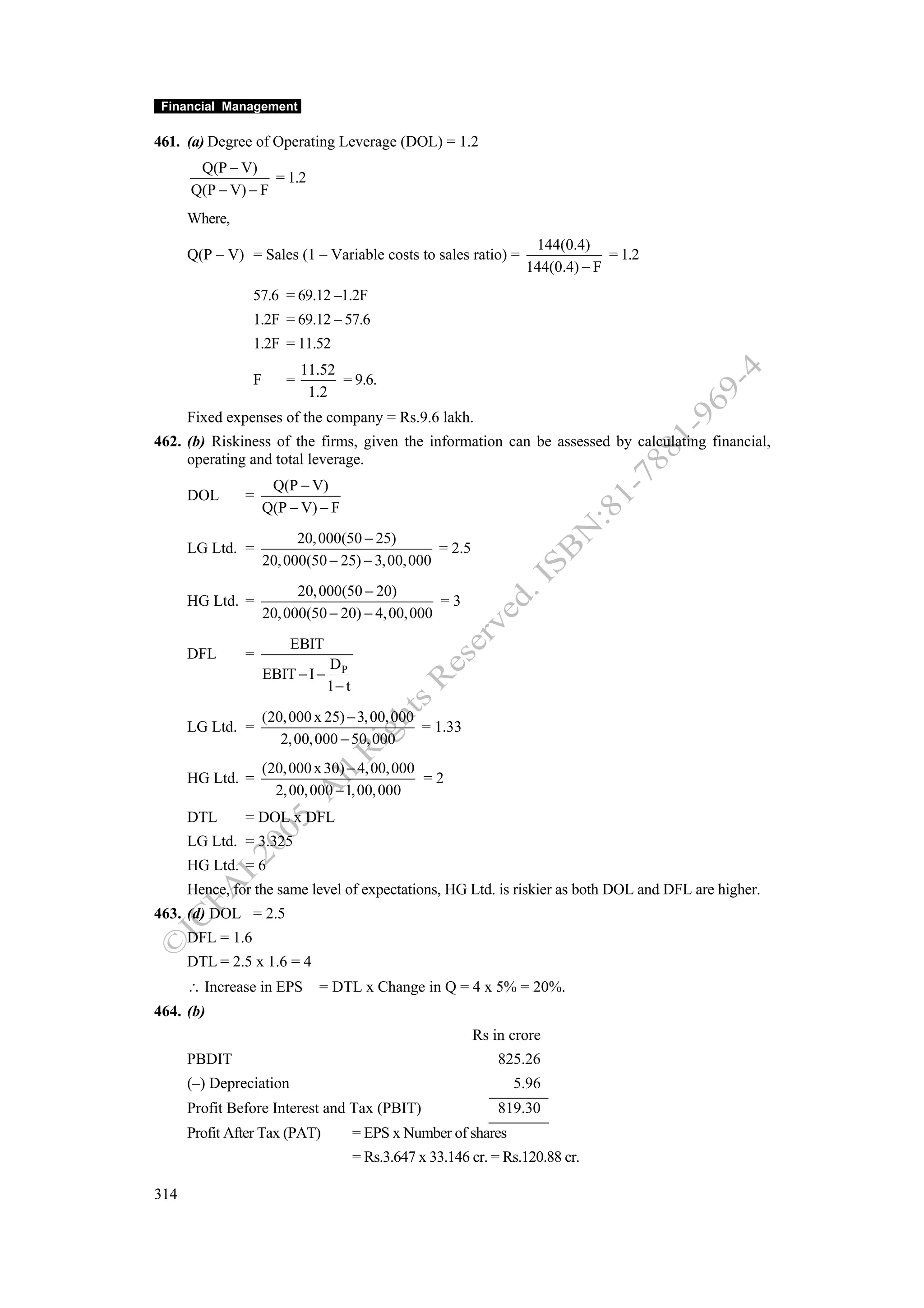

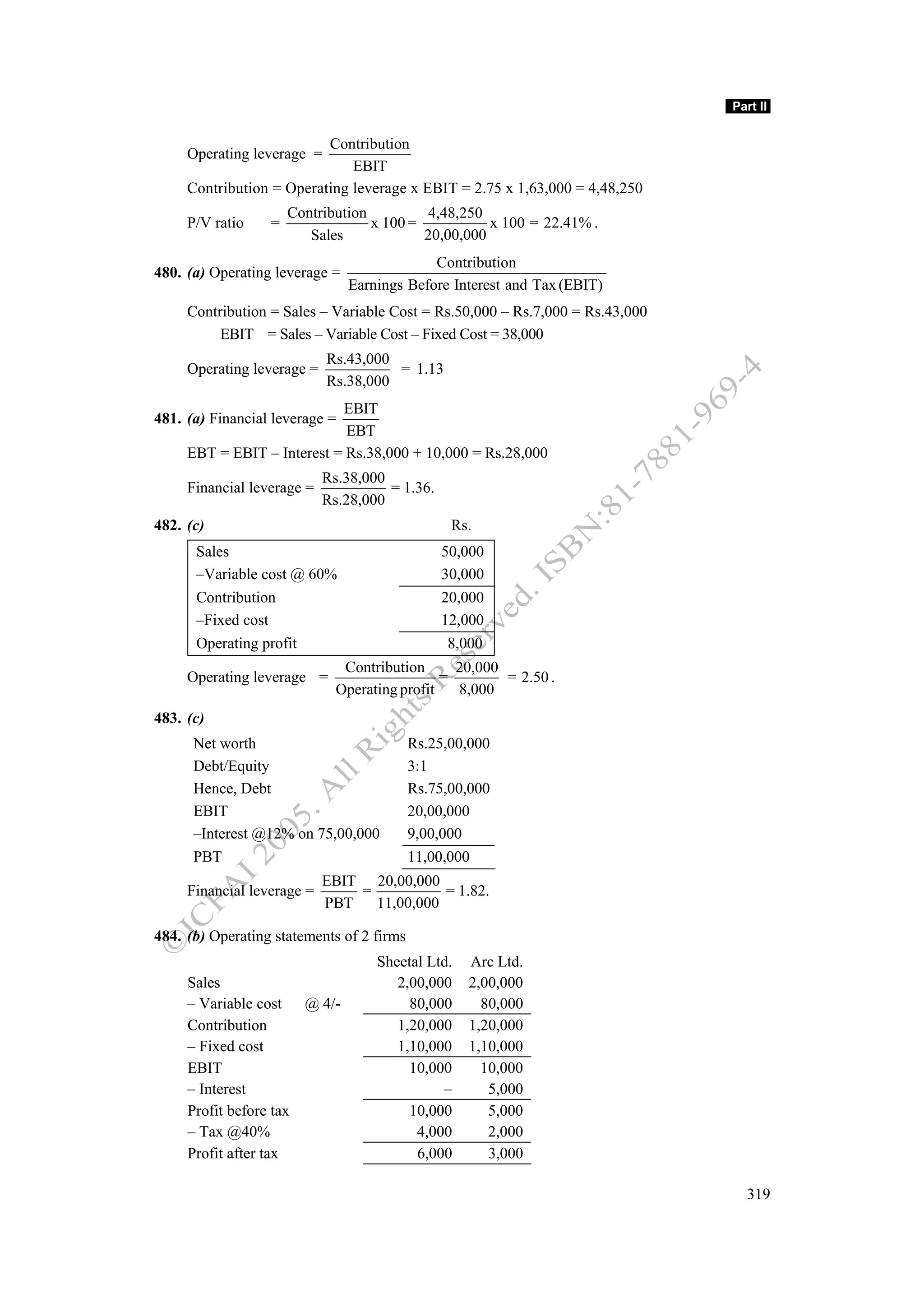

![Financial Management

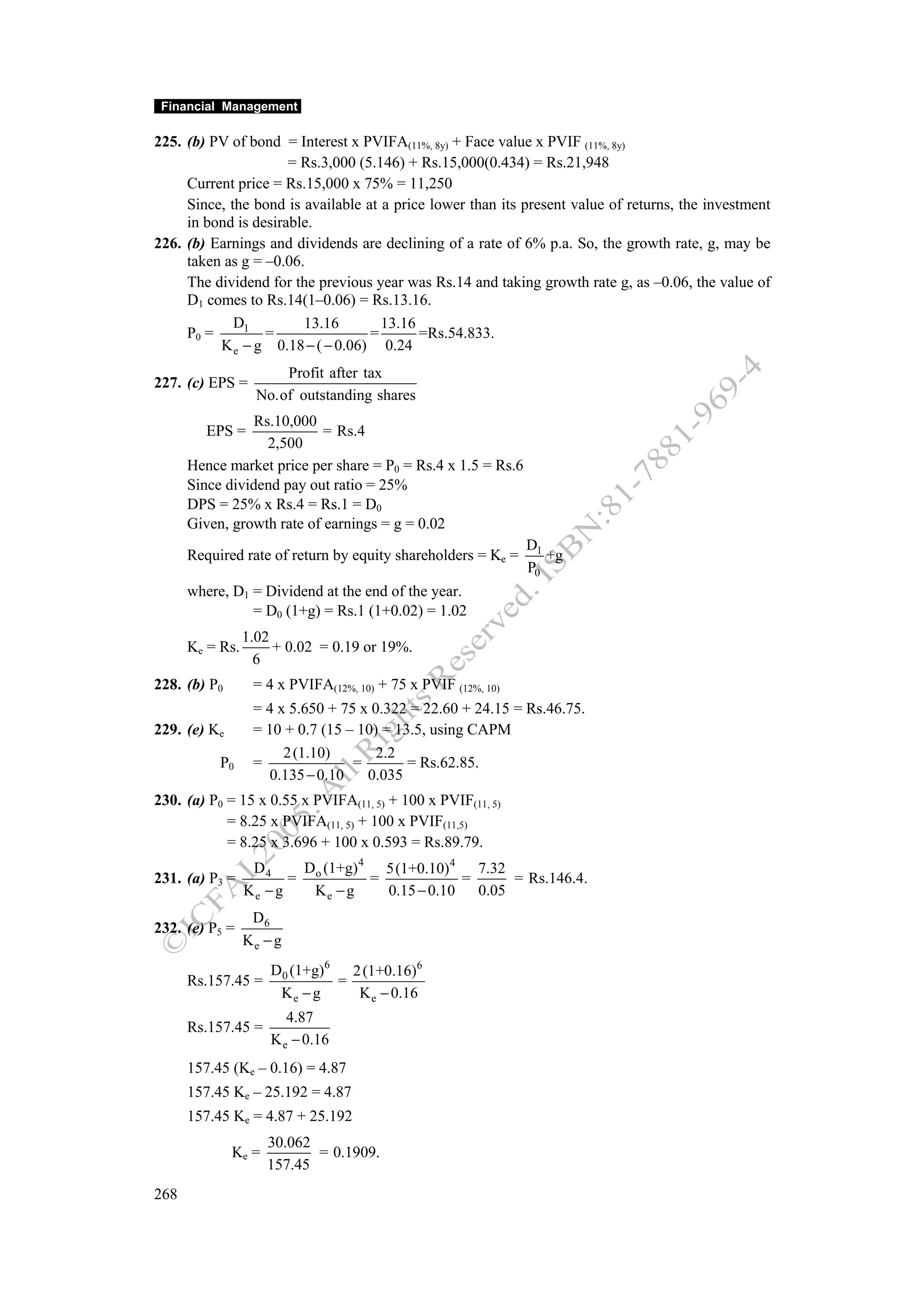

503. (d) DTL = % change in EPS/% change in output

3 = % change in EPS / 0.10

Change in EPS = 30%.

504. (a) DOL = % Change in EBIT/% Change in Quantity = 0.3/0.18 = 1.67.

505. (a) Q (S – V)/Q(S – V) – F

DOL = [5,000(3,25,000 – 1,80,000)]/ [5,000(3,25,000 – 1,80,000)] – 3 crore = 1.043.

506. (b) DTL = DOL x DFL = 2.5 x 3.5 = 8.75.

507. (a) DTL = DOL x DFL or % Change in EPS/% Change in output = 3.5 x 1.2 = 4.2

i.e. one percent change in output will lead to 4.2 % change in EPS.

508. (e) Financial BEP = Dp/1– t = 2000 x 100 x 0.15/(1– 0.4) = 50,000.

509. (d) DTL = % Change in EPS / % Change in output

3.5 = Change in EPS/0.25

Change in EPS = 87.5%.

EPS next year = 2.5 + 87.5% of 2.5 = 2.5 + 2.187 = 4.687 4.69

510. (c) DOL = Contribution/EBIT = 100/50 = 2.

511. (b) Contribution = S – V

Sales per unit = 500

Variable cost per unit = 200

Contribution per unit = S – V = 500 – 200 = 300.

512. (c) DTL = % Change in EPS/% Change in output = 0.20/0.10 = 2.

513. (a) DOL = Contribution/EBIT = 100/50 = 2.

514. (c) Q (S – V)

Q(S − V) − A

DOL = = 50,000 x 7/50,000 x 7 – 50,000 = 1.166 or 1.67% 1.17%.

Q(S − V) − F

515. (b) DOL = Total contribution/EBIT

Contribution = Q (S – V)

100

DOL = =2

50

F + I + D p /(1 − t)

516. (a) Overall BEP (Q) =

S− V

Financial BEP = Dp/ 1– t + I

Operating BEP= F/S–V

S–V= 20,000/2,500 = 8

Overall BEP = (20,000 + 4,000)/8 = 3,000.

324](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-329-2048.jpg)

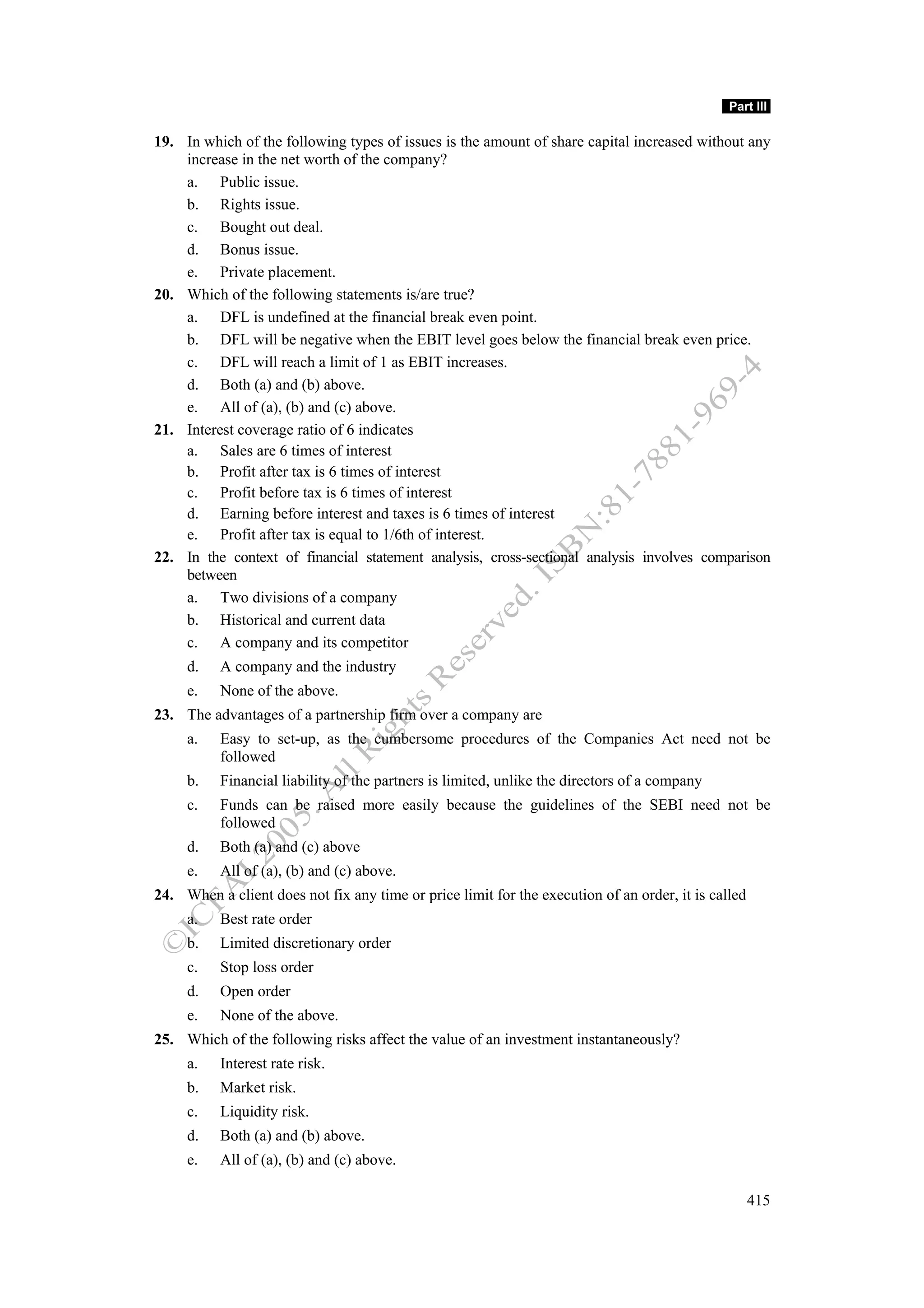

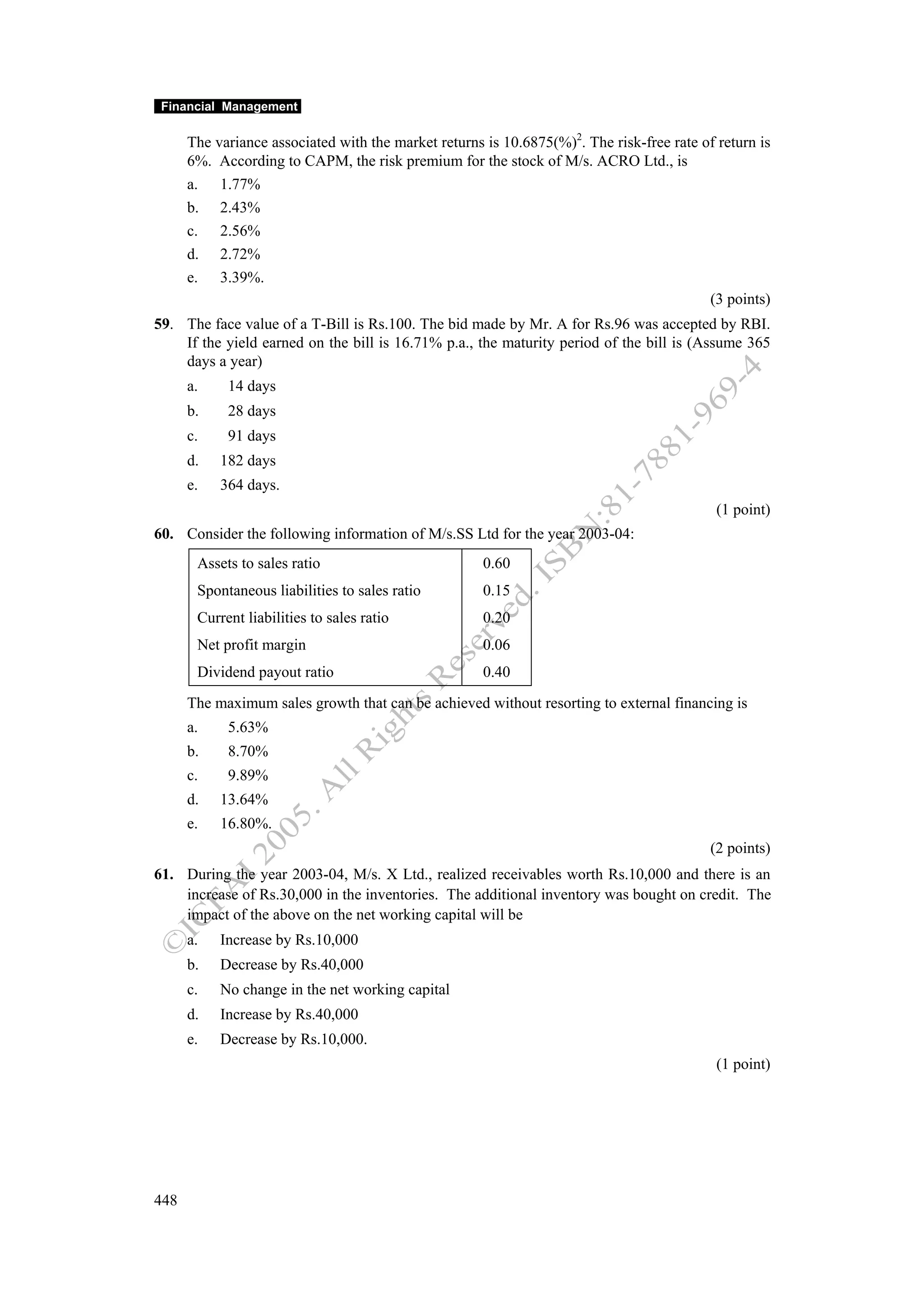

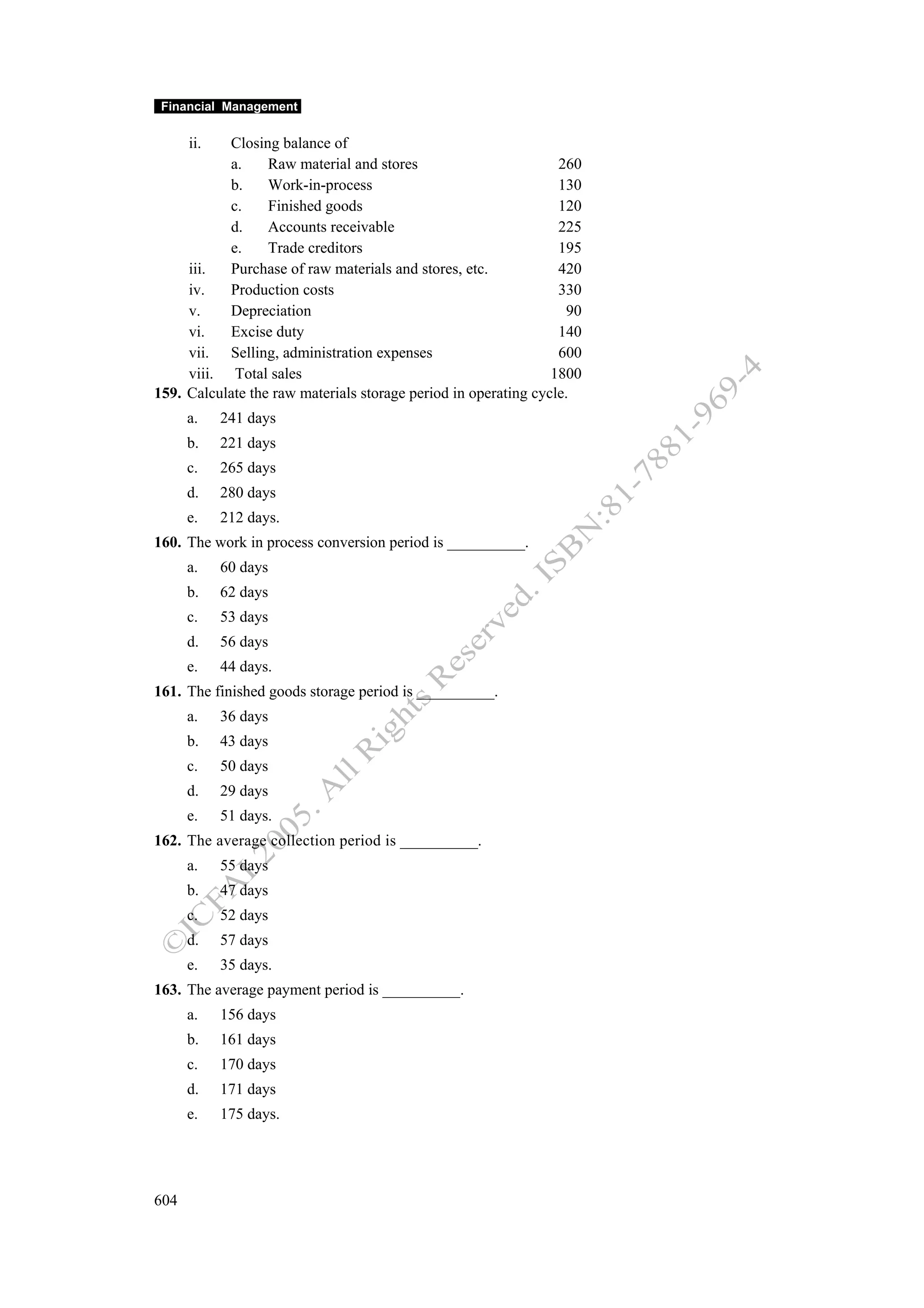

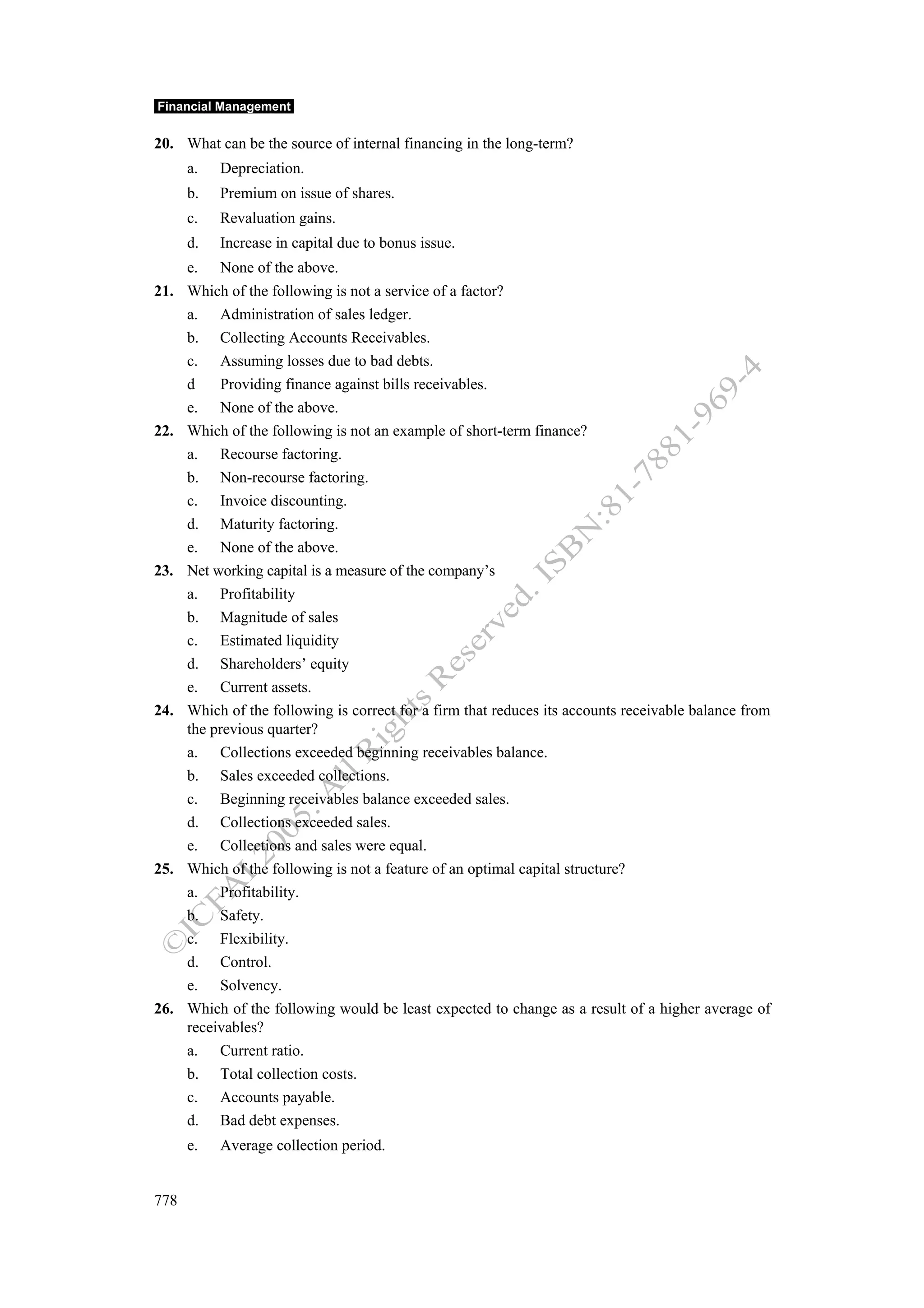

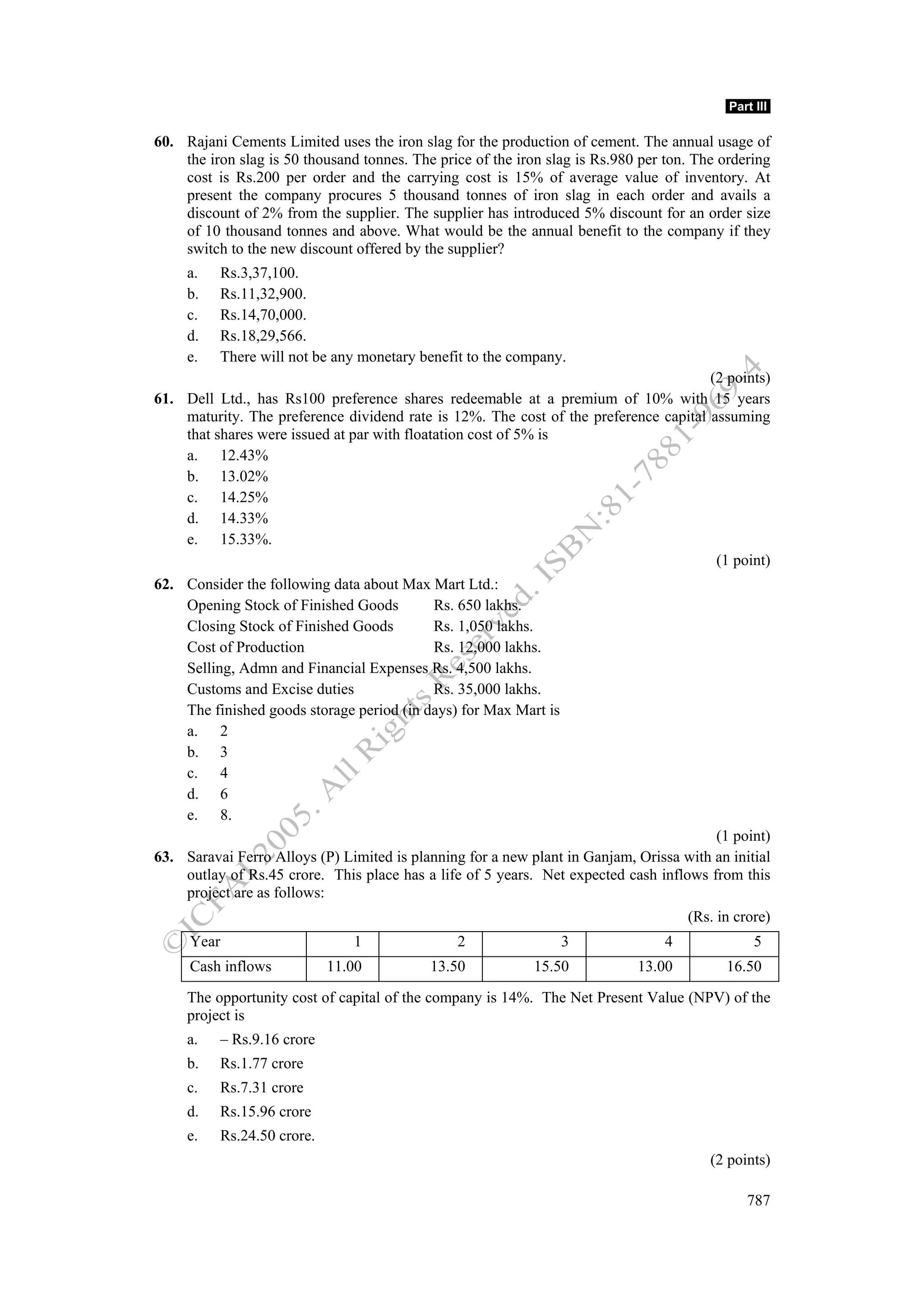

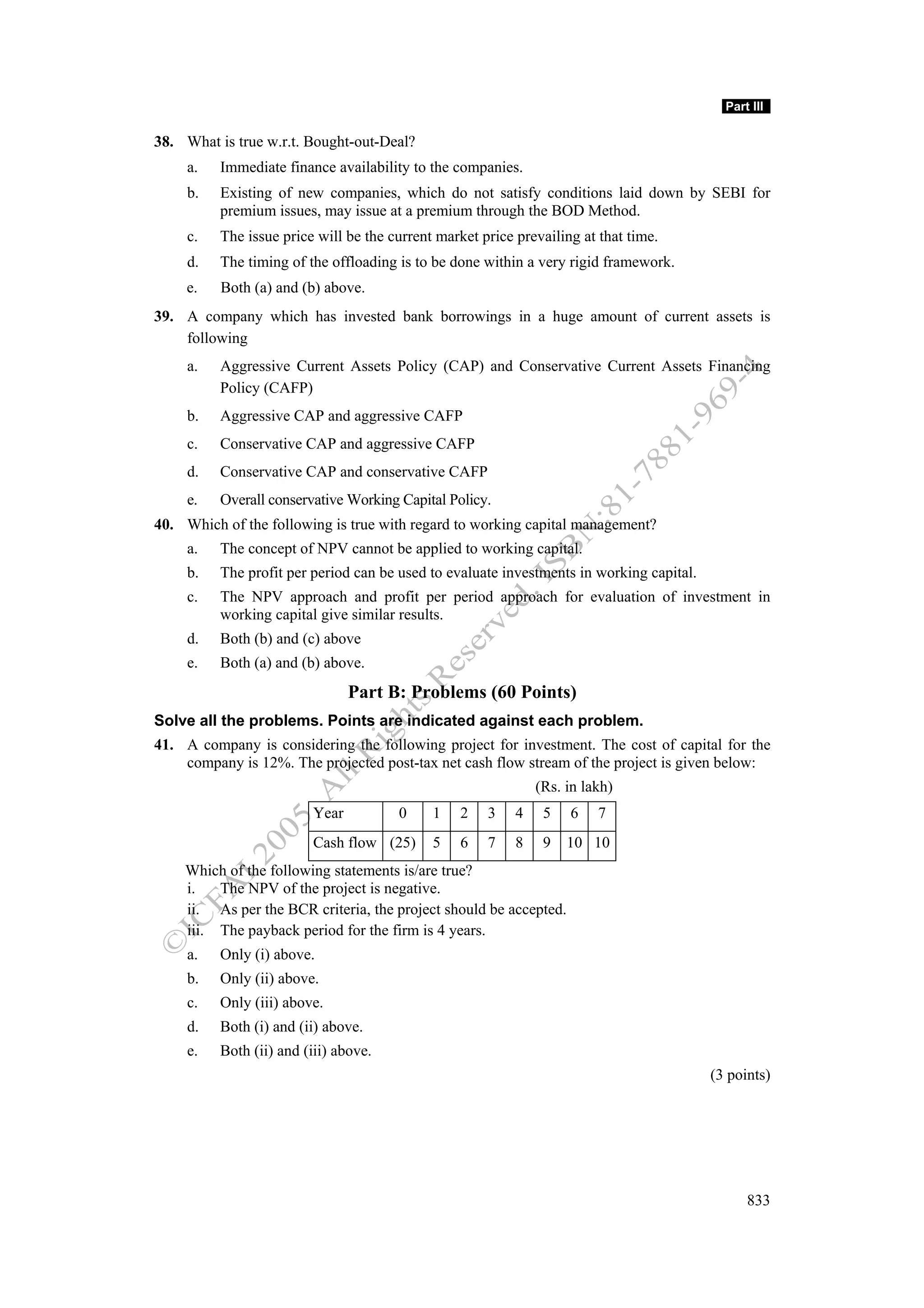

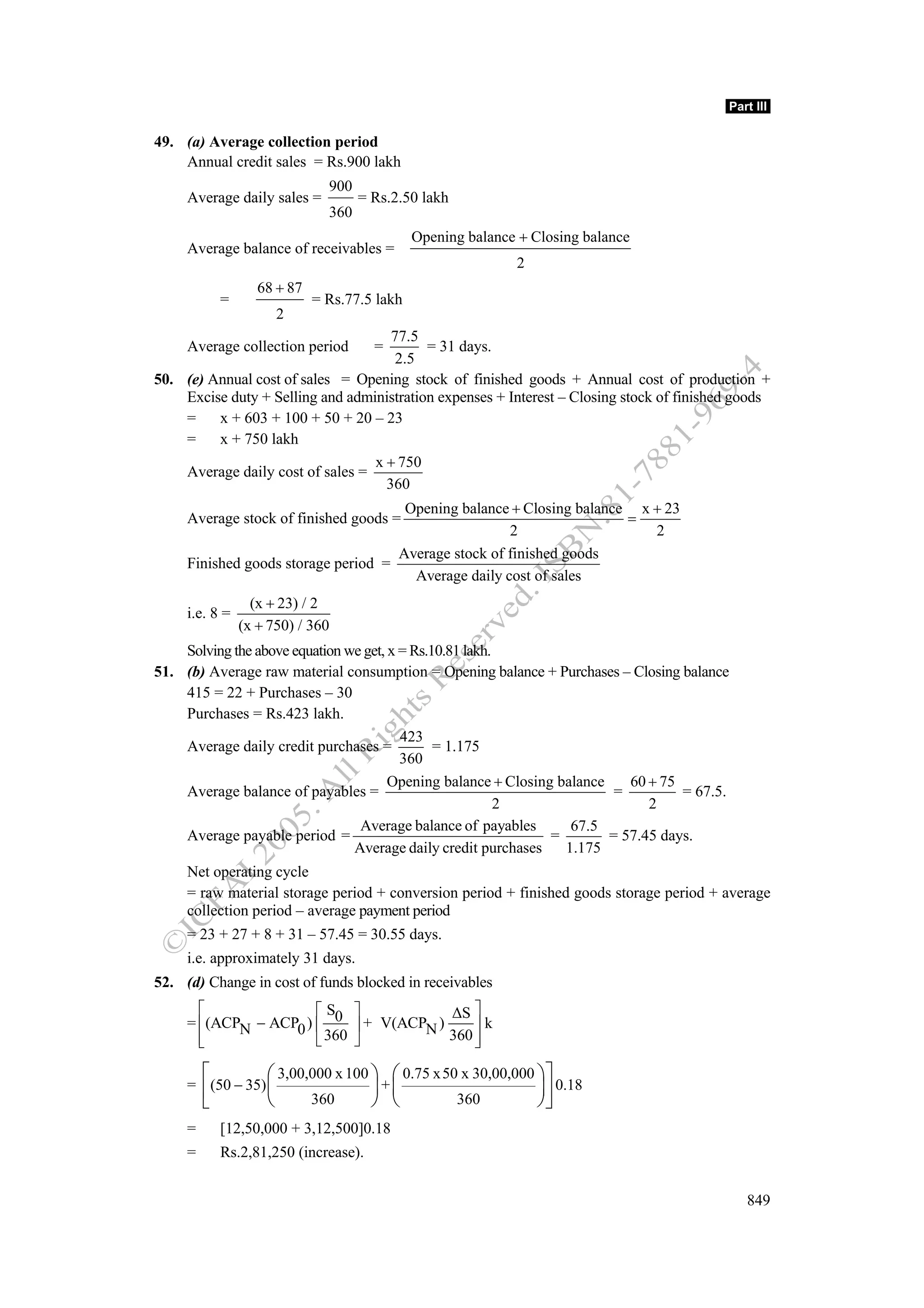

![Part III

Part B: Problems

41. (c)

Expected return for ATCO

= 30(0.35) + 25(0.30) + 40(0.15) + 20(0.20) = 28%

Variance of returns for ATCO Ltd.

= (30 – 28)2 (0.35) + (25 – 28)2 (0.30) + (40 – 28)2 (0.15) + (20 – 28)2 (0.20)

= 38.50 (%)2.

The variance of market returns is given to be 42.2 (%)2.

Hence, the variance of market returns is more than the variance of returns on a security of

ATCO Ltd.

In other words, risk associated with market returns is more than the risk associated with

ATCO Ltd. Hence option (a) is wrong.

Standard deviation (ATCO) Ltd.= 38.50 = 6.20%

Standard deviation for market returns = 42.20 = 6.50% (approximately)

Hence the standard deviation of the returns on the shares of ATCO Ltd. is lesser than the

standard deviation for the market returns by 0.30% (approximately).

The market returns have a wider probability distribution than the returns on the shares of

ATCO Ltd. (as clearly indicated by the higher standard deviation of the market returns).

42. (a)

Cov(i,m) ρσi σ m

β= =

σ2

m σ2m

Expected return from the market = Σpikm

= 0.30 (15) + 0.40 (12) + 0.30 (8) = 11.70%

Risk for the market, σm = [Σpi (k m − k m ) 2 ]1/2

= [(15 – 11.70)2 (0.30) + (12 – 11.70)2 (0.40) + (8 – 11.70)2 (0.30)]1/2

= [3.267 + 0.036 + 4.107]1/2 = (7.41)1/2 = 2.72%.

Given σi2 = 23.43(%)2

∴ σi = 23.43 = 4.84%

ρ (4.84)(2.72)

i.e. 1.77 =

7.41

1.77 × 7.41

Therefore, ρ = = 0.996.

4.84 × 2.72

43. (d) Risk-free rate (rf) = 10%,

Market return (rm) = 15%

Scrip Expected Return (%) Required return (%) = rf + β j (rm − rf )

AB Ltd. 17.0 10 + 1.3(15 – 10) = 16.5

CD Ltd. 14.5 10 + 0.8(15 – 10) = 14.0

EF Ltd. 15.5 10 + 1.1(15 – 10) = 15.5

GH Ltd. 18.0 10 + 1.7(15 – 10) = 18.5

On the basis of the above information, we find that the expected return in case of GH Ltd. is

less than the required rate of return. Hence it is not advisable to buy the security of GH Ltd.

351](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-356-2048.jpg)

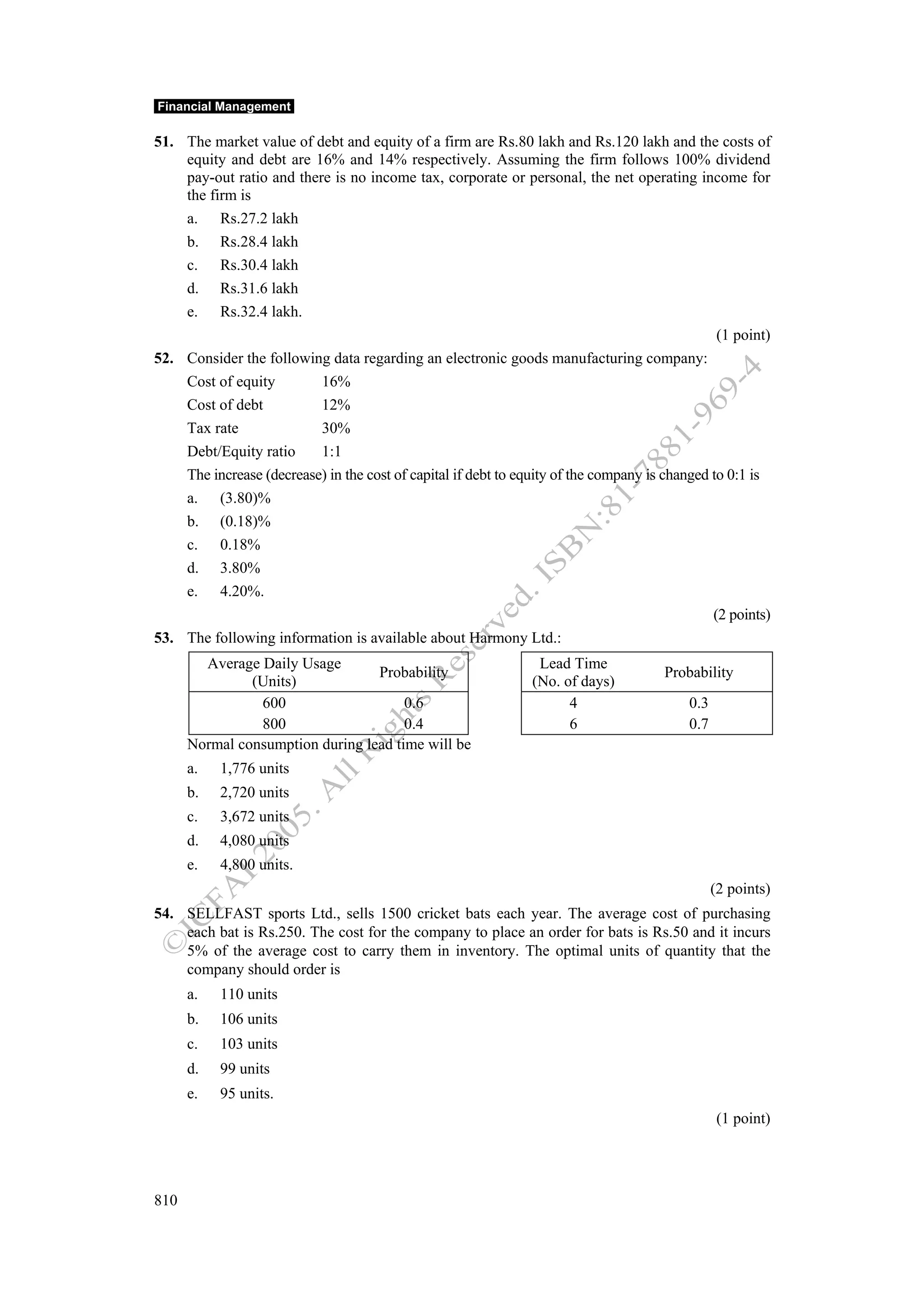

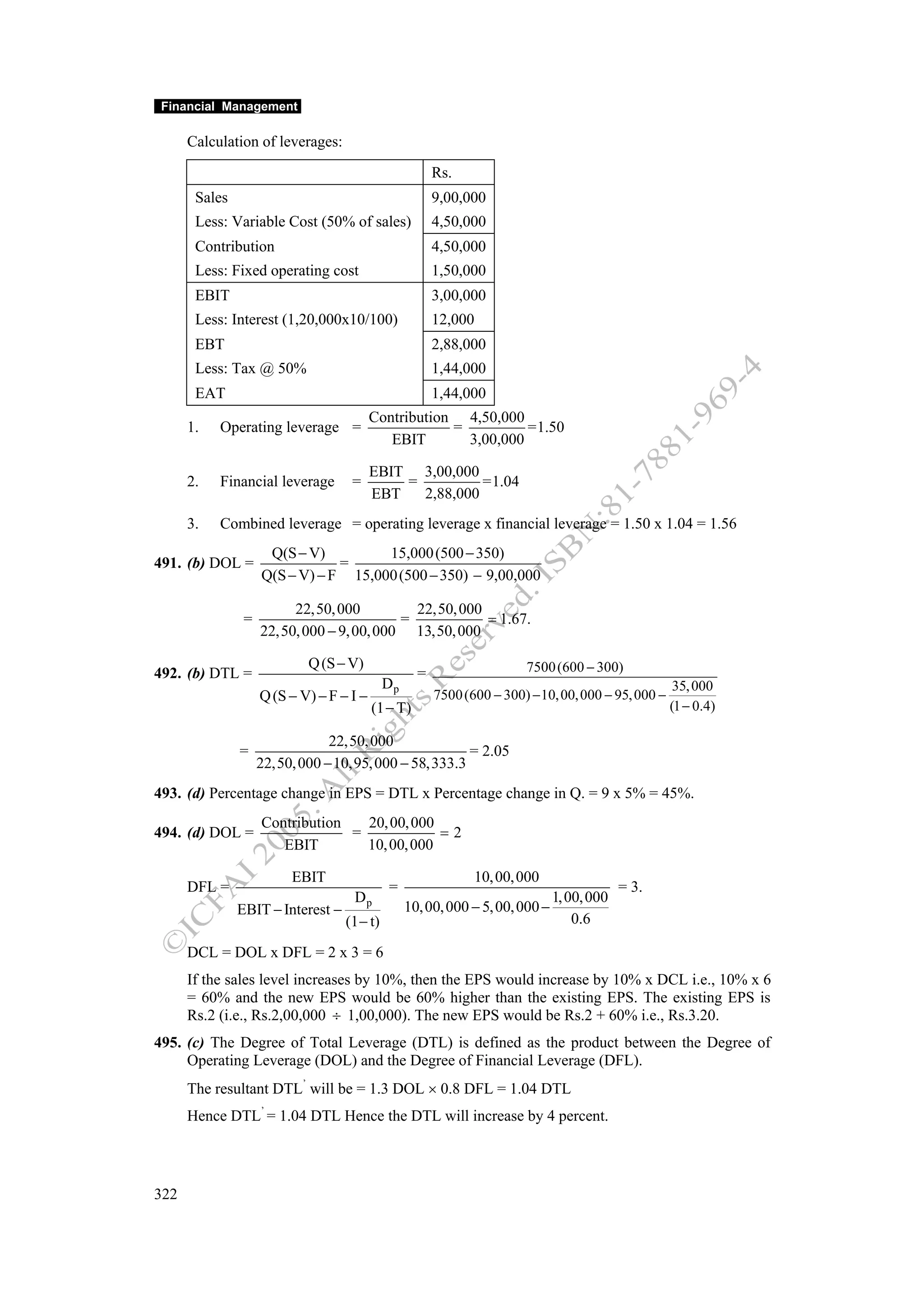

![Part III

Receivables balance

69. (d) Average collection period =

Average daily credit sales

Sales

Average daily credit sales =

365

Receivables balance

∴ Average collection period = x 365

Credit sales

Average collection period=25 days (given)

25 + 15

Average Receivables balance = = Rs.20 lakh.

2

20

∴ 25= x 365

Credit sales

20 x 365

or Credit sales = = Rs.292 lakh.

25

292

∴ Total sales = = Rs.365 lakh.

0.8

(1.10)2

70. (a) Effective rate of interest of Bank A = 1 + = 10.25%

2

Nominal rate of interest of Bank B = [(1.1025)]1/12 − 1] × 12 = 9.80.

385](https://image.slidesharecdn.com/financialmanagementworkbook-121105064928-phpapp01/75/Financial-management-work-book-390-2048.jpg)