More Related Content

Similar to Ch04.soln (20)

Ch04.soln

- 1. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

CHAPTER 4

Posted with permission from John Wiley & Sons Canada, Ltd.

REPORTING FINANCIAL PERFORMANCE

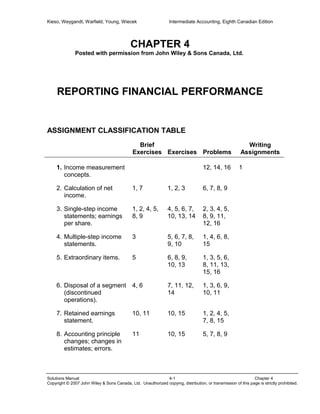

ASSIGNMENT CLASSIFICATION TABLE

Brief

Exercises Exercises Problems

Writing

Assignments

1. Income measurement

concepts.

12, 14, 16 1

2. Calculation of net

income.

1, 7 1, 2, 3 6, 7, 8, 9

3. Single-step income

statements; earnings

per share.

1, 2, 4, 5,

8, 9

4, 5, 6, 7,

10, 13, 14

2, 3, 4, 5,

8, 9, 11,

12, 16

4. Multiple-step income

statements.

3 5, 6, 7, 8,

9, 10

1, 4, 6, 8,

15

5. Extraordinary items. 5 6, 8, 9,

10, 13

1, 3, 5, 6,

8, 11, 13,

15, 16

6. Disposal of a segment

(discontinued

operations).

4, 6 7, 11, 12,

14

1, 3, 6, 9,

10, 11

7. Retained earnings

statement.

10, 11 10, 15 1, 2, 4, 5,

7, 8, 15

8. Accounting principle

changes; changes in

estimates; errors.

11 10, 15 5, 7, 8, 9

Solutions Manual 4-1 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 2. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

ASSIGNMENT CLASSIFICATION TABLE (CONTINUED)

Brief

Exercises Exercises Problems

Writing

Assignments

9. Comprehensive

income.

7, 12 16, 17 11

10. Cash basis* 13 18 17, 18 2

* This material is covered in an Appendix to the chapter.

Solutions Manual 4-2 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 3. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Item Description

Level of

Difficulty

Time

(minutes)

E4-1 Calculation of net income. Simple 18-20

E4-2 Calculation of net income – proprietorship Simple 18-20

E4-3 Income statement items. Simple 18-20

E4-4 Single-step income statement. Moderate 20-25

E4-5 Multiple-step and single-step. Simple 30-35

E4-6 Multiple-step and single-step. Moderate 30-40

E4-7 Combined single-step. Moderate 25-30

E4-8 Multiple-step and extraordinary items. Moderate 30-35

E4-9 Condensed income statement. Moderate 20-25

E4-10 Multiple-step statement, with retained

earnings.

Simple 30-40

E4-11 Discontinued operations. Moderate 15-20

E4-12 Discontinued operations. Moderate 20-25

E4-13 Earnings per share. Simple 20-25

E4-14 Earnings per share. Moderate 15-20

E4-15 Retained earnings statement. Simple 20-25

E4-16 Comprehensive income Simple 15-20

E4-17 Comprehensive income Simple 15-20

*E4-18 Cash and accrual basis Moderate 10-15

P4-1 Multiple-step income statement and retained

earnings statement.

Moderate 40-45

P4-2 Single-step income statement and retained

earnings statement.

Simple 25-30

P4-3 Irregular items. Moderate 35-45

P4-4 Multiple- and single-step income statement

and retained earnings

Moderate 45-55

P4-5 Irregular items. Moderate 30-35

P4-6 Comprehensive combined statement of

income and retained earnings

Moderate 45-50

P4-7 Retained earnings statement, correction of

error and change in accounting principle.

Moderate 25-35

P4-8 Income statement and irregular items. Moderate 35-45

P4-9 Income statement and irregular items. Moderate 25-35

P4-10 Discontinued operations. Moderate 35-45

P4-11 Identification of income statement

deficiencies.

Simple 35-45

P4-12 Identify income statement deficiencies. Simple 20-25

P4-13 Extraordinary items. Moderate 20-25

Solutions Manual 4-3 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 4. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

(CONTINUED)

Item Description

Level of

Difficulty

Time

(minutes)

P4-14 Earnings management. Moderate 20-25

P4-15 All-inclusive vs. current operating. Moderate 35-45

P4-16 Identification of income statement

weaknesses.

Moderate 30-40

*P4-17 Cash and accrual basis. Moderate 35-40

P4-18 Cash and accrual basis. Complex 40-50

Solutions Manual 4-4 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 5. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 4-1

Portables Inc.

Income Statement

For the Year Ended December 31, 2008

Revenues

Sales $890,000

Expenses

Cost of goods sold $395,000

Wages expense 120,000

Other expenses 10,000

Income tax expense 115,000

Total expenses 640,000

Net income $250,000

Earnings per share $2.50

Solutions Manual 4-5 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 6. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-2

Alley Corporation

Income Statement

For the Year Ended December 31, 2008

Revenues

Net sales $2,780,000

Investment revenue __103,000

Total revenues 2,883,000

Expenses

Cost of goods sold 2,190,000

Selling expenses 272,000

Administrative expenses 211,000

Interest expense 76,000

Income tax expense 40,000

Total expenses 2,789,000

Net income $ 94,000

Earnings per share $9.40

Solutions Manual 4-6 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 7. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-3

Alley Corporation

Income Statement

For the Year Ended December 31, 2008

Net sales $2,780,000

Cost of goods sold 2,190,000

Gross profit 590,000

Operating expenses

Selling expenses $272,000

Administrative expenses 211,000 483,000

Income from operations 107,000

Other revenues and gains

Investment revenue 103,000

210,000

Other expenses and losses

Interest expense 76,000

Income before income tax 134,000

Income tax expense 40,000

Net income $ 94,000

Earnings per share $9.40

BRIEF EXERCISE 4-4

Income from continuing operations $12,600,000

Discontinued operations

Loss from operation of discontinued

restaurant division (net of tax) $315,000

Loss from disposal of restaurant

division (net of tax) 89,000 404,000

Net income $12,196,000

Earnings per share:

Income from continuing operations $1.26

Discontinued operations (.04 )

Net income $1.22

Solutions Manual 4-7 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 8. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-5

Income before income tax and extraordinary item $7,300,000

Income tax 2,190,000

Income before extraordinary item 5,110,000

Extraordinary loss from casualty, net of

$381,000 in taxes 889,000

Net income $4,221,000

Earnings per share:

Income before extraordinary item $1.02

Extraordinary loss (.18 )

Net income $ .84

BRIEF EXERCISE 4-6

In order to qualify for separate presentation as discontinued

operations on the income statement, the restaurants must be a

component of the entity where the operations, cash flows, and

financial elements are clearly distinguishable from the rest of

the company. A key element is that the group of assets

generates its own net cash flows and is operationally distinct.

Selling the corporate owned stores to franchisees would qualify

for discontinued operations treatment. The stores generate their

own cash flows and are operationally distinct from the

franchised restaurants.

Solutions Manual 4-8 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 9. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-7

DougieDoug Limited

Statement of Shareholders’ Equity

For the Year Ended December 31, 2007

Total

Compre-hensive

Income

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Common

Shares

Beginning balance $520,000 $ 90,000 $80,000 $350,000

Comprehensive income

Net income* 120,000 $120,000 120,000

Other comprehensive

income

Unrealized holding loss (60,000) (60,000 ) _______ (60,000) _______

Comprehensive income $ 60,000

Ending balance $580,000 $210,000 $20,000 $350,000

*($700,000 – $500,000 – $80,000).

Solutions Manual 4-1 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 10. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-8

The number of common shares outstanding at December 31,

2008 is 44,000 (40,000 – 8,000 + 12,000)

Weighted average number of shares:

January 1 – April 1 40,000 X 3/12 = 10,000

April 1 – August 31 32,000 X 5/12 = 13,333

August 31 – Dec. 31 44,000 X 4/12 = 14,667

38,000

BRIEF EXERCISE 4-9

$1,200,000 – $250,000 190,000 = $5.00 per share

BRIEF EXERCISE 4-10

Global Corporation

Retained Earnings Statement

For the Year Ended December 31, 2008

Balance, January 1 $ 529,000

Add: Net income 1,646,000

2,175,000

Deduct: Dividends declared 660,000

Balance, December 31 $1,515,000

Solutions Manual 4-1 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 11. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

BRIEF EXERCISE 4-11

Global Corporation

Retained Earnings Statement

For the Year Ended December 31, 2008

Balance, January 1, as reported $ 529,000

Correction for amortization error (net of tax) 25,000

Balance, January 1, as adjusted 554,000

Add: Net income 1,646,000

2,200,000

Less: Dividends declared 660,000

Balance, December 31 $1,540,000

BRIEF EXERCISE 4-12

(a) Net Income = $8,000 (dividend revenue)

(b) Comprehensive Income = Net income + Other

Comprehensive Income = $8,000 + $5,000 = $13,000

(c) Other Comprehensive Income = $5,000

(d) Accumulated Other Comprehensive Income = Beginning

Balance + Other Comprehensive Income = $0 + $5,000 =

$5,000

Solutions Manual 4-2 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 12. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

*BRIEF EXERCISE 4-13

(a)

Cash Receipts

from Customers

- Beginning accounts

receivable

+ Ending accounts

receivable

= Revenue on

accrual basis

$152,000 - 13,000 + 18,600 = $157,600

(b)

Cash payments

for operating

expenses

+ Beginning prepaid

expenses

- Ending prepaid

expenses

= Operating

expenses on

accrual basis

$97,000 + 17,500 - 23,200 = $91,300

Solutions Manual 4-3 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 13. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 4-1 (18-20 minutes)

Calculation of net income:

Increase in assets: $74,000 + $45,000 +$137,000 – $47,000 = $209,000

Increase in liabilities: $82,000 – $56,000 = 26,000

Increase in shareholders’ equity: $183,000

Change in shareholders’ equity accounted

for as follows:

Net increase $183,000

Increase in common shares $125,000

Increase in contributed surplus 13,000

Decrease in retained earnings due to

dividend declaration (19,000)

Net increase accounted for 119,000

Increase in retained earnings due to net income $ 64,000

Solutions Manual 4-4 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 14. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-2 (18-20 minutes)

Jan. 1,

2008

Dec. 31,

2008

Chang

e

Cash $23,000 $ 20,000 $ 3,000

Accounts receivable 19,000 36,000 17,000

Other assets (derived) 33,000 45,000 12,000

Total assets 75,000 101,000 26,000

Liabilities (1/1/08 derived) (37,000 ) (41,000 ) (4,000 )

Capital (12/31/08 derived) $38,000 $ 60,000 $22,000

Calculation of net income:

Capital account Dec. 31, 2008 $60,000

Capital account Jan. 1, 2008 38,000

Increase 22,000

Add: Withdrawals made $11,000

Less: Cash investment made 5,000 6,000

Net income $28,000

Solutions Manual 4-5 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 15. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-3 (18-20 minutes)

(a) Total net revenue:

Sales $390,000

Less: Sales discounts $ 7,800

Sales returns 12,400 20,200

Net sales 369,800

Dividends earned 71,000

Rental revenue 6,500

Total net revenue $447,300

(b) Net income:

Net revenues (from a) $447,300

Expenses:

Cost of goods sold 184,400

Selling expenses 99,400

Administrative expenses 82,500

Interest expense 12,700

Total expenses 379,000

Income before taxes 68,300

Income taxes 31,000

Net income $ 37,300

(c) Dividends declared:

Ending retained earnings $134,000

Beginning retained earnings 114,400

Net increase 19,600

Less net income (37,300 )

Dividends declared $ 17,700

Solutions Manual 4-6 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 16. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-3 (Continued)

ALTERNATE SOLUTION

Beginning retained earnings $114,400

Add net income 37,300

151,700

Deduct dividends declared (derive) ?___

Ending retained earnings $134,000

Dividends declared must be $17,700

($151,700 – $134,000)

Solutions Manual 4-7 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 17. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-4 (20-25 minutes)

Geneva Inc.

Income Statement

For Year Ended December 31, 2008

Sales $2,100,000

Less sales discounts 15,000

Net sales 2,085,000

Expenses

Cost of goods sold 420,000

Selling expenses 336,000

Administrative expenses 84,000

Interest expense 20,000

Total expenses 860,000

Income before taxes 1,225,000

Income taxes 428,750

Net income $ 796,250

Earnings per share $53.08

Determination of amounts:

Administrative

expenses

=

20% of cost of good sold

$84,000 = 20% of $420,000

Gross sales X 4% = administrative expenses

Gross sales = $2,100,000 ($84,000 / 4%)

Selling expenses = four times administrative expenses.

(operating expenses consist of selling

and administrative expenses; since

selling expenses are 4/5 of operating

expenses, selling expenses are 4

times administrative expenses.)

= 4 X $84,000

= $336,000

Per share $53.08 ($796,250 ¸ 15,000)

Solutions Manual 4-8 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 18. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-5 (30-35 minutes)

(a) Multiple-Step Form

Singh Corp.

Income Statement

For the Year Ended December 31, 2008

(In thousands, except earnings per share)

Sales $106,500

Cost of goods sold 58,570

Gross profit 47,930

Operating Expenses

Selling expenses

Sales commissions $7,280

Amortization of sales

equipment

6,48

0

Transportation-out 2,290 $16,050

Administrative expenses

Officers’ salaries 3,900

Amortization of office

furniture and equipment 3,560 7,460 23,510

Income from operations 24,420

Other Revenues and Gains

Rental revenue 15,230

39,650

Other Expenses and Losses

Interest expense 1,860

Income before taxes 37,790

Income taxes 9,070

Net income $28,720

Earnings per share $.94*

Solutions Manual 4-9 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 19. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

*($28,720,000 ¸ 30,550,000)

Solutions Manual 4-10 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 20. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-5 (Continued)

(b) Single-Step Form

Singh Corp.

Income Statement

For the Year Ended December 31, 2008

(In thousands, except earnings per share)

Revenues

Net sales $ 106,500

Rental revenue 15,230

Total revenues 121,730

Expenses

Cost of goods sold 58,570

Selling expenses 16,050

Administrative expenses 7,460

Interest expense 1,860

Total expenses 83,940

Income before taxes 37,790

Income taxes 9,070

Net income $ 28,720

Earnings per share $.94

(c) Single-step:

1. Simplicity and conciseness.

2. Probably better understood by user.

3. Emphasis on total costs and expenses and net

income.

4. Does not imply priority of one expense over another.

Multiple-step:

1. Provides more information through segregation of

operating and non-operating items.

2. Expenses are matched with related revenue.

Solutions Manual 4-11 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 21. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-6 (30-40 minutes)

(a) Multiple-Step Form

Ying-Wai Corporation

Income Statement

For the Year Ended December 31, 2008

Sales Revenue

Sales $930,000

Less: Sales returns and allowances 15,000

Net sales 915,000

Cost of Goods Sold

Merchandise inventory, January 1, 2008 $120,000

Purchases $600,000

Less purchase discounts 10,000

Net purchases 590,000

Add transportation-in 14,000 604,000

Total merchandise available for sale 724,000

Less merchandise inventory,

December 31, 2008

137,00

0

Cost of goods sold 587,000

Gross profit 328,000

Operating Expenses

Selling expenses

Sales salaries 71,000

Amortization expense—store

equipment

18,00

0

Store supplies expense 9,000 98,000

Administrative expenses

Officers’ salaries 39,000

Amortization expense—building 28,500

Office supplies expense 9,500 77,000 175,000

Income from operations 153,000

Other Revenues and Gains

Dividends revenue 20,000

173,000

Solutions Manual 4-12 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 22. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-6 (Continued)

Other Expenses and Losses

Interest expense 9,000

Income before taxes and extraordinary item 164,000

Income taxes 55,760

Income before extraordinary item 108,240

Extraordinary item

Loss from flood damage 50,000

Less applicable income tax reduction 17,000 33,000

Net income $ 75,240

Earnings per share:

Income before extraordinary item $5.41

Extraordinary item (1.65)

Net income $3.76

Solutions Manual 4-13 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 23. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-6 (Continued)

(b) Single-Step Form

Ying-Wai Corporation

Income Statement

For the Year Ended December 31, 2008

Revenues

Net sales $915,000

Dividends revenue 20,000

Total revenues 935,000

Expenses

Cost of goods sold 587,000

Selling expenses 98,000

Administrative expenses 77,000

Interest expense 9,000

Total expenses 771,000

Income before taxes and extraordinary item 164,000

Income taxes 55,760

Income before extraordinary item 108,240

Extraordinary item

Loss from flood damage $50,000

Less applicable income tax reduction 17,000 33,000

Net income $ 75,240

Earnings per share:

Income before extraordinary item $5.41

Extraordinary item (1.65)

Net income $3.76

Solutions Manual 4-14 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 24. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-6 (Continued)

(c) Single-step:

1. Simplicity and conciseness.

2. Probably better understood by user.

3. Emphasis on total costs and expenses and net

income.

4. Does not imply priority of one expense over another.

Multiple-step:

1. Provides more information through segregation of

operating and non-operating items.

2. Expenses are matched with related revenue.

Solutions Manual 4-15 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 25. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-7 (25-30 minutes)

(a) Evelyn Roberts Inc.

Income Statement

for the Year Ended December 31, 2008

Revenues

Sales $1,900,000

Rent revenue 40,000

Total revenues 1,940,000

Expenses

Cost of goods sold 850,000

Selling expenses 300,000

Administrative and general expenses 240,000

Total expenses 1,390,000

Income from continuing operations before taxes 550,000

Income taxes 187,000

Income from continuing operations 363,000

Discontinued operations:

Loss from operation of Micron Division

(net of $25,000 in tax recovery) 50,000

Income before extraordinary items 313,000

Extraordinary items:

Gain from expropriation (net of $29,000 in taxes) 66,000

Loss from flood (net of $18,000 in tax recovery) (42,000)

Net Income $ 337,000

Earnings per share:

Income from continuing operations $14.52

Discontinued operations (2.00 )

Income before extraordinary items 12.52

Extraordinary items 0.96

Net income $13.48

Solutions Manual 4-16 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 26. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-7 (Continued)

(b) Evelyn Roberts Inc.

Statement of Income and Retained Earnings

for the Year Ended December 31, 2008

Revenues

Sales $1,900,000

Rent revenue 40,000

Total revenues 1,940,000

Expenses

Cost of goods sold 850,000

Selling expenses 300,000

Administrative and general expenses 240,000

Total expenses 1,390,000

Income from continuing operations before taxes 550,000

Income taxes 187,000

Income from continuing operations 363,000

Discontinued operations:

Loss from operation of Micron Division

(net of $25,000 in tax recovery) 50,000

Income before extraordinary items 313,000

Extraordinary items

Gain from expropriation (net of $29,000 in taxes) 66,000

Loss from flood (net of $18,000 in tax recovery) (42,000)

Net Income $ 337,000

Retained earnings, January 1 600,000

937,000

Less: Dividends declared 70,000

Retained earnings, December 31 $ 867,000

Earnings per share:

Income from continuing operations $14.52

Discontinued operations (2.00)

Income before extraordinary items 12.52

Extraordinary items 0.96

Net income $13.48

Solutions Manual 4-17 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 27. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-8 (30-35 minutes)

Voisine Corp.

Income Statement

For the Year Ended December 31, 2008

Sales Revenue

Sales $1,380,000

Less: Sales returns and allowances $150,000

Sales discounts 45,000 195,000

Net sales revenue 1,185,000

Cost of goods sold 621,000

Gross profit on sales 564,000

Operating Expenses

Selling expenses 194,000

Administrative and general expenses 97,000 291,000

Income from operations 273,000

Other Revenue and Gains

Interest revenue 86,000

359,000

Other Expenses and Losses

Interest expense 60,000

Income before taxes and extraordinary item 299,000

Income taxes 131,560

Income before extraordinary item 167,440

Extraordinary item

Loss from earthquake damage 150,000

Less applicable tax reduction 66,000 84,000

Net income $ 83,440

Earnings per share:

Income before extraordinary item $0.84

Extraordinary item (0.42 )

Net income $0.42

Solutions Manual 4-18 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 28. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-9 (20-25 minutes)

Sooyoun Corporation

Income Statement

For the Year Ended December 31, 2007

Net sales $4,162,000

Cost of goods sold 2,665,000

Gross profit 1,497,000

Selling expense $636,000

Administrative expense 491,000 1,127,000

Income from operations 370,000

Other revenue 240,000

Other expense 176,000 64,000

Income before taxes 434,000

Income taxes* 147,560

Income before extraordinary item 286,440

Extraordinary loss, net of $23,800 taxes 46,200

Net income $ 240,240

Earnings per share:

Income before extraordinary item** $3.18

Extraordinary item (0.51 )

Net income $2.67

Supporting calculations:

* Income taxes ($434,000 x 34%) = $147,560

** $286,440 divided by 90,000 common shares.

Sales Revenue

Sales $4,275,000

Less: Sales discounts $34,000

Sales returns 79,000 113,000

Net sales $4,162,000

Solutions Manual 4-19 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 29. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-9 (Continued)

Cost of Goods Sold:

Merchandise inventory, Jan. 1, 2007 $535,000

Purchases $2,786,000

Less purchase returns (15,000)

Less purchase discounts (27,000)

Net purchases 2,744,000

Add transportation-in 72,000 2,816,000

Total merchandise available for sale 3,351,000

Less merchandise inventory Dec. 31, 2007 686,000

Cost of Goods Sold $2,665,000

Selling expenses:

Sales salaries $284,000

Sales commissions 83,000

Travel and entertainment 69,000

Advertising 54,000

Transportation-out 93,000

Amortization of sales equipment 36,000

Telephone - sales 17,000 $636,000

Administrative Expenses:

Office salaries $346,000

Accounting and legal services 33,000

Insurance 24,000

Amortization of office 48,000

Utilities - office 32,000

Miscellaneous office expenses 8,000 $491,000

Solutions Manual 4-20 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 30. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-10 (35-40 minutes)

(a) Gottlieb Corp.

Income Statement

For the Year Ended December 31, 2008

Sales Revenue

Net sales $1,300,000

Cost of goods sold 780,000

Gross profit 520,000

Operating Expenses

Selling expenses $65,000

Administrative expenses 48,000 113,000

Income from operations 407,000

Other Revenue and Gains

Dividend revenue 20,000

Interest revenue 7,000 27,000

434,000

Other Expenses and Losses

Write-off of inventory due to

obsolescence

80,000

Income before taxes and extraordinary item 354,000

Income taxes 155,760

Income before extraordinary item 198,240

Extraordinary item

Casualty loss 50,000

Less applicable tax reduction 22,000 28,000

Net income $ 170,240

Earnings per share:

Income before extraordinary item $4.96

Extraordinary item (0.70 )

Net income $4.26

Solutions Manual 4-21 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 31. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-10 (Continued)

(b) Gottlieb Corp.

Retained Earnings Statement

For the Year Ended December 31, 2008

Balance, January 1, as reported $ 980,000

Correction for overstatement of net income in prior

period (amortization error) (net of $24,200 tax) (30,800)

Balance, January 1, as restated 949,200

Add: Net income 170,240

1,119,440

Less: Dividends declared 45,000

Balance, December 31 $1,074,440

(c)

Dr) Retained Earnings 30,800

Dr) Income taxes payable/receivable 24,200

Cr) Accumulated Amortization 55,000

Solutions Manual 4-22 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 32. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-10 (Continued)

(d) Gottlieb Corp.

Statement of Income and Retained Earnings

For the Year Ended December 31, 2008

Sales Revenue

Net sales $1,300,000

Cost of goods sold 780,000

Gross profit 520,000

Operating Expenses

Selling expenses $65,000

Administrative expenses 48,000 113,000

Income from operations 407,000

Other Revenue and Gains

Dividend revenue 20,000

Interest revenue 7,000 27,000

434,000

Other Expenses and Losses

Write-off of inventory due to obsolescence 80,000

Income before taxes and extraordinary item 354,000

Income taxes 155,760

Income before extraordinary item 198,240

Extraordinary item:

Casualty loss (net of $22,000 in taxes) 28,000

Net income 170,240

Retained earnings, January 1, as

previously reported 980,000

Correction for overstatement of net

income in prior period

(amortization error)

(net of $24,200 tax) 30,800

Retained earnings, January 1, as restated 949,200

1,119,440

Less: Dividends declared 45,000

Retained earnings, December 31 $1,074,440

Solutions Manual 4-23 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 33. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-10 (Continued)

Earnings per share:

Income before extraordinary item $4.96

Extraordinary item (0.70 )

Net income $4.26

(e) Advantages: Since typically few transactions or adjustments

are made to retained earnings, users have all of the changes

to shareholders’ equity (except for share transactions) on

one page. The combined statement also shows how net

income flows to the balance sheet since the bottom number

is the ending retained earnings balance that corresponds to

the balance sheet. The format can also save on printing costs

by eliminating an extra page.

Disadvantage: The presentation is not as comprehensible

when the combined statements are too long or when

adjustments are required to the opening balance of retained

earnings. The presentation would also not be useful where

the company reports comprehensive income since the other

comprehensive income flows to accumulated other

comprehensive income, whereas net income is closed to

retained earnings.

Solutions Manual 4-24 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 34. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-11 (15-20 minutes)

(a)

2007:

Loss from beginning of year to September 30 $(1,900,000)

Loss from September 30 to December 31 (700,000)

Estimated loss on impairment of net assets on

June 1, 2008, net of tax (150,000)

Total loss $(2,750,000)

2008:

No gain or loss on disposal reported in 2008. However, if

applicable, any gains or losses from operating the subsidiary

from January 1, 2008 to the disposal date would be reported in

2008.

(b)

Discontinued operations (2007):

Loss from operations of CBTV subsidiary,

net of tax $2,600,000

Loss on impairment of net assets of CBTV,

net of tax 150,000

Loss from discontinued operations $2,750,000

(c)

The correction of the gain or loss from disposal of a segment

reported in 2007 should be reported in 2008 in the discontinued

operations section of the income statement, net of tax and with

separate EPS disclosure, supported by an explanation in a note

to the financial statements. The correction receives the same

treatment as a change in estimate.

Solutions Manual 4-25 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 35. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-12 (20-25 minutes)

(a) The income statement and related footnote are as follows:

Income from continuing operations before income taxes $144,000

Income taxes 43,200

Income from continuing operations 100,800

Discontinued operations (Note XX)

Income from operations of the discontinued

Song and Elwood Division, less applicable

income taxes $1,800 $4,200

Loss on impairment of assets of

discontinued operations, less applicable

income taxes of $6,000 (14,000) (9,800)

Net income $91,000

Note XX—Discontinued Operations. On October 5, 2008, the

board of directors decided to dispose of the Song and Elwood

Division by auction on May 10, 2009.

(b)

The cleaning equipment would be shown separately on the

balance sheet as part of noncurrent assets as “noncurrent asset

related to discontinued operations. The asset would be valued at

the lower of its carrying value and fair value less cost to sell. In

this case this means the cleaning equipment would be

remeasured at its estimated selling price of $5,000, which is net

of selling costs.

Solutions Manual 4-26 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 36. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-13 (20-25 minutes)

Calculation of net income:

2009 net income after tax $43,000,000

2009 net income before tax

[$43,000,000 ¸ (1 – .44)] 76,785,714

Add back major casualty loss 15,000,000

Income from operations 91,785,714

Income taxes (44% X $91,785,714) 40,385,714

Income before extraordinary item 51,400,000

Extraordinary item:

Casualty loss 15,000,000

Less applicable income tax reduction 6,600,000

8,400,000

Net income $43,000,000

Net income $43,000,000

Less cumulative preferred dividends

(8% of $4,500,000) 360,000

Income available for common 42,640,000

Common shares ¸ 10,000,000

Earnings per share $4.26

Income statement presentation

Earnings per share:

Income before extraordinary item $5.10a

Extraordinary item (0.84)b

Net income $4.26

a $51,400,000 – $360,000 = $5.10 10,000,000

b $8,400,000 = $0.84 10,000,000

Solutions Manual 4-27 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 37. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-14 (15-20 minutes)

Net income:

Income from continuing operations

before taxes

$23,650,000

Income taxes (35%) 8,277,500

Income from continuing operations 15,372,500

Discontinued operations

Loss before taxes $3,225,000

Less applicable income tax 1,128,750 2,096,250

Net income $13,276,250

Preferred dividends declared: $ 1,075,000

Weighted average common shares outstanding:

12/31/07–3/31/08 (4,000,000 x 3/12) 1,000,000

4/1/08–12/31/08 (4,400,000 x 9/12) 3,300,000

Weighted average 4,300,000

Earnings per share:

Income from continuing operations $3.33*

Discontinued operations (.49 )**

Net income $2.84***

*($15,372,500 – $1,075,000) ¸ 4,300,000.

**$2,096,250 ¸ 4,300,000.

***($13,276,250 – $1,075,000) ¸ 4,300,000.

Solutions Manual 4-28 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 38. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-15 (20-25 minutes)

Holiday Corporation

Retained Earnings Statement

For the Year Ended December 31, 2008

Balance, January 1, as reported $270,000*

Correction for amortization error

(34,7

(net of $22,230 tax)

70)

Retroactive adjustment for change in inventory

method (net of $14,430 tax) 22,570

Balance, January 1, as adjusted 257,800

Add net income 207,400 **

465,200

Deduct dividends declared 100,000

Balance, December 31 $365,200

*($55,000 + $135,000 + $160,000) – ($30,000 + $50,000)

**[$340,000 – (39% X $340,000)]

Solutions Manual 4-29 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 39. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-16 (15-20 minutes)

Rosy Randall Corporation

Income Statement

For the Year Ended December 31, 2007

Net sales $1,200,000

Cost of goods sold 750,000

Gross profit 450,000

Operating expenses

Selling and administrative expenses 320,000

Net income 130,000

Other comprehensive income

Unrealized holding gains, net of tax 18,000

Comprehensive income $148,000

Solutions Manual 4-30 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 40. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-17 (15-20 minutes)

Kelly Corporation

Statement of Shareholders' Equity

For the Year Ended December 31, 2008 (all amounts in thousands)

Total

Comp.

Income

Preferred

Shares

Common

Shares

Contr.

Surplus

Retained

Earnings

Acc.

Other

Comp.

Inc.

Beginning Balance $22,240 $1,526 $2,591 $2,425 $13,692 $2,006

Comprehensive Income:

Net income 4,352 $4,352 4,352

Other comprehensive

income

Unrealized holding loss (348) (348) (348)

Comprehensive Income $4,004

Dividends to shareholders:

Preferred (23) (23)

Common (7) (7)

Issue of Common shares 170 170

Ending Balance $26,384 $1,526 $2,761 $2,425 $18,014 $1,658

Solutions Manual 4-31 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 41. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

EXERCISE 4-17 (Continued)

(b) Kelly Corporation

Balance Sheet (Partial)

December 31, 2008

(‘000)

Share capital:

Preferred shares $ 1,526

Common shares 2,761

Total share capital 4,287

Contributed surplus 2,425

Total paid-in capital 6,712

Retained earnings 18,014

Accumulated other comprehensive income 1,658

Total shareholders’ equity $26,384

Solutions Manual 4-32 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 42. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

*EXERCISE 4-18 (10-15 minutes)

(a) Portmann Corp.

Income Statement (Cash Basis)

For the Year Ended December 31,

2007 2008

Sales $320,000 $515,000

Expenses 225,000 247,000

Net income $ 95,000 $268,000

(b) Portmann Corp.

Income Statement (Accrual Basis)

For the Year Ended December 31,

2007 2008

Sales* $510,000 $445,000

Expenses** 277,000 230,000

Net income $233,000 $215,000

*2007: $320,000 + $160,000 + $30,000 = $510,000

2008: $355,000 + $90,000 = $445,000

**2007: $185,000 + $67,000 + $25,000 = $277,000

2008: $40,000 + $135,000 + $55,000 = $230,000

Solutions Manual 4-33 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 43. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

TIME AND PURPOSE OF PROBLEMS

Problem 4-1 (Time 40-45 minutes)

Purpose—to provide the student with an opportunity to prepare an income

statement and a retained earnings statement. A number of special items such as

loss from discontinued operations, unusual items, and extraordinary losses are

presented in the problem for analysis purposes. The problem also requires

calculating the tax effect of special item from a net-of-tax amount.

Problem 4-2 (Time 25-30 minutes)

Purpose—to provide the student with an opportunity to prepare an income

statement and retained earnings statement using the single-step format.

Problem 4-3 (Time 35-45 minutes)

Purpose—to provide the student with an opportunity to analyse a number of

transactions and to prepare a partial income statement. The problem includes

discontinued operations, extraordinary item, and earnings per share. The student

must also prepare a statement of retained earnings and then discuss the impact

of GAAP classification rules on the assessment of the quality of earnings.

Problem 4-4 (Time 45-55 minutes)

Purpose—to provide the student with the opportunity to prepare a multiple-step

and single-step income statement and a retained earnings statement from the

same underlying information. The problem emphasizes the differences between

the multiple-step and single-step income statement.

Problem 4-5 (Time 30-35 minutes)

Purpose—to provide the student with a problem on the income statement

treatment of (1) a usual but infrequently occurring charge, (2) an extraordinary

item and its related tax effect, (3) a change in estimate, and (4) earnings per

share. The student is required to identify the proper income statement treatment

and to provide the rationale for such treatment. A revised income statement must

be prepared.

Solutions Manual 4-34 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 44. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

TIME AND PURPOSE OF PROBLEMS (CONTINUED)

Problem 4-6 (Time 45-50 minutes)

Purpose—to provide the student the opportunity to distinguish between different

scenarios involving discontinued operations, extraordinary items and changes in

accounting policy. Three different scenarios are proposed and a combined

statement of income and retained earnings must be prepared. The problem

involves intraperiod tax allocation. This problem is comprehensive.

Problem 4-7 (Time 25-35 minutes)

Purpose—to provide the student with an opportunity to prepare a retained

earnings statement. A number of special items must be reclassified and reported

in the income statement. This problem illustrates the fact that ending retained

earnings is unaffected by the choice of disclosing items in the income statement

or the retained earnings statement, although the income reported would be

different.

Problem 4-8 (Time 35-45 minutes)

Purpose—to provide the student with the opportunity to correct a multi-step

income statement. The student must determine which of the items presented

should be presented in the income statement and must prepare a proper income

statement. A combined statement of income and retained earnings is also

required. This statement includes an adjustment to the beginning retained

earnings balance for a change in policy. The student must also discuss the

purpose of intraperiod tax allocation.

Problem 4-9 (Time 25-35 minutes)

Purpose—to provide the student with a problem to determine the reporting of

several items, which may get special treatment as irregular items. This is a good

problem for a group assignment.

Problem 4-10 (Time 35-45 minutes)

Purpose—to provide the student with a discontinued operations problem that

requires discussion of balance sheet and income statement disclosure along with

an illustration of the income statement presentation. The student is also required

to discuss the factors applied to justify the use of the discontinued operations

treatment and the impact on users of financial information.

Solutions Manual 4-35 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 45. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

TIME AND PURPOSE OF PROBLEMS (CONTINUED)

Problem 4-11 (Time 35-45 minutes)

Purpose—to provide the student with the opportunity to comment on deficiencies

in an income statement format. The student is required to comment on such

items as inappropriate heading, incorrect classification of special items, proper

net of tax treatment, and presentation of per share data. The student is also

required to prepare a correct income statement.

Problem 4-12 (Time 20-25 minutes)

Purpose—to provide the student a real company context to identify factors that

make income statement information useful. The focus is on overly aggregated

information in a condensed income statement. Additional detail would seem to be

warranted either on the face of the statement or with reference to the notes.

Problem 4-13 (Time 20-25 minutes)

Purpose—to provide the student with an understanding of conditions where

extraordinary item classification is appropriate. In this problem, it should be

emphasized that in situations where extraordinary item classification is not

permitted, a classification as an unusual item may still be employed.

Problem 4-14 (Time 20-25 minutes)

Purpose—to provide the student an illustration of how earnings can be managed.

The case allows students to see the effects of warranty expense timing on the

trend of income and illustrates the potential use of accruals to smooth earnings.

Problem 4-15 (Time 35-45 minutes)

Purpose—to provide the student with an understanding of the difference between

the current operating and all-inclusive income statement. In addition, the student

is to comment on the income statement presentation of a number of special

items. Presentation of the proper earnings per share is also emphasized. A

revised income statement presentation is required as well as a revised retained

earnings statement.

Solutions Manual 4-36 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 46. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

TIME AND PURPOSE OF PROBLEMS (CONTINUED)

Problem 4-16 (Time 30-40 minutes)

Purpose—to provide the student with the opportunity to comment on deficiencies

in a single-step income statement. This case includes discussion of extraordinary

items, tax reassessments, and ordinary gains and losses. The problem provides

a broad overview to a number of items discussed in the textbook.

*Problem 4-17 (Time 35-40 minutes)

Purpose—to provide an opportunity for the student to prepare and compare (a)

cash basis and accrual basis income statements, (b) cash basis and accrual

basis balance sheets, and (c) to discuss the weaknesses of cash basis

accounting.

*Problem 4-18 (Time 40-50 minutes)

Purpose—to provide an opportunity for the student to determine income on an

accrual basis. The student is asked to write a letter indicating what was done to

arrive at an accrual basis net income.

Solutions Manual 4-37 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 47. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 4-1

Barkley Corp.

Income Statement

For the Year Ended December 31, 2008

Sales $36,500,000

Less cost of goods sold 28,500,000

Gross profit 8,000,000

Less selling and administrative expenses 4,700,000

Income from operations 3,300,000

Other revenues and gains

Interest revenue $170,000

Gain on the sale of investments in trading

securities 110,000 280,000

3,580,000

Other expenses and losses

Write-off of goodwill 520,000

Assessment of additional income taxes 500,000 1,020,000

Income from continuing operations before

income taxes 2,560,000

Income taxes**** 1,074,000

Income from continuing operations 1,486,000

Discontinued operations

Loss from operations, net of taxes of

$38,571* 90,000

Loss from disposition, net of taxes of

$188,571** 440,000 530,000

Income before extraordinary item 956,000

Extraordinary loss from flood damage, net of

taxes of $167,143*** 390,000

Net income $ 566,000

Earnings per share:

Income from continuing operations $ 1.77a

Discontinued operations (0.66)b

Extraordinary loss (0.49) c

Net income $ 0.62d

Solutions Manual 4-38 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 48. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-1 (Continued)

a $1,486,000 – $70,000 800,000 shares = $1.77

b ($530,000) = ($0.66) 800,000 shares

c ($390,000) = ($0.49) 800,000 shares

d $566,000 – $70,000 = $0.62 800,000 shares

* $38,571 = [$90,000 / (100% - 30%)] - $90,000

** $188,571 = [$440,000 / (100% - 30%)] - $440,000

*** $167,143 = [$390,000 / (100% - 30%)] - $390,000

**** Income tax expense = ($2,560,000 + $520,000 + $500,000) X

30% = $1,074,000. The goodwill and 2006 additional income

taxes are not tax-deductible.

Barkley Corp.

Retained Earnings Statement

For the Year Ended December 31, 2008

Beginning balance of retained earnings $1,980,000

Add net income 566,000

2,546,000

Less dividends

Preferred shares $ 70,000

Common shares 250,000 320,000

Ending balance of retained earnings $ 2,226,000

Solutions Manual 4-39 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 49. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-2

McLean Corporation

Income Statement

For the Year Ended December 31, 2009

Revenues

Net sales* $1,368,000

Gain on sale of land 30,000

Rent revenue 18,000

Total revenues 1,416,000

Expenses

Cost of goods sold** 785,000

Selling expenses 432,000

Administrative expenses 99,000

Total expenses 1,316,000

Income before taxes 100,000

Income taxes 38,500

Net income $ 61,500

Earnings per share $2.05

* ($1,400,000 – $14,500 – $17,500)

**Cost of goods sold:

Merchandise inventory, January 1 $ 89,000

Purchases $810,000

Less purchase discounts 10,000

Net purchases 800,000

Add freight-in 20,000 820,000

Merchandise available for sale 909,000

Less merchandise inventory, December 31 124,000

Cost of goods sold $785,000

Solutions Manual 4-40 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 50. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-2 (Continued)

McLean Corporation

Retained Earnings Statement

For the Year Ended December 31, 2009

Retained earnings at beginning of the year $ 260,000

Plus net income 61,500

321,500

Less cash dividends declared 45,000

Retained earnings at end of the year $ 276,500

Solutions Manual 4-41 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 51. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-3

(a) Charyk Inc.

Income Statement (Partial)

For the Year Ended December 31, 2008

Income from continuing operations before taxes $1,738,500*

Income taxes 673,800 **

Income from continuing operations: 1,064,700

Discontinued operations:

Loss from disposal of recreational division $115,000

Less applicable income tax reduction 46,000 69,000

Income before extraordinary item 995,700

Extraordinary item:

Major casualty loss 80,000

Less applicable income tax reduction 32,000 48,000

Net income $947,700

Earnings per share:

Income from continuing operations $13.31

Discontinued operations (0.86 )

Income before extraordinary items 12.45

Extraordinary item (0.60)

Net income $11.85

*Calculation of income from continuing operations before taxes:

As previously stated $1,790,000

Loss on sale of securities (107,000)

Gain on proceeds of life insurance policy

($100,000 – $46,000) 54,000

Error in calculation of amortization:

As calculated ($54,000 ¸ 6) $9,000

Corrected ($54,000 – $9,000) ¸ 6 7,500 1,500

As restated $1,738,500

**Calculation of income tax:

Income from continuing operations before income tax $1,738,500

Nontaxable income (gain on life insurance) (54,000 )

Taxable income 1,684,500

Tax rate X .40

Tax expense $673,800

Solutions Manual 4-42 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 52. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-3 (Continued)

(b) Charyk Inc.

Retained Earnings Statement

For the Year Ended December 31, 2008

Retained earnings, January 1, 2008, as reported $2,540,000

Correction of amortization overstatement

(net of tax of $1,200) * 1,800

Retroactive adjustment for change in inventory

method (net of tax of $16,000) ** 24,000

Retained earnings, January 1, 2008, as adjusted $2,565,800

Add: Net income 947,700

3,513,500

Deduct Dividends declared 175,000

Retained earnings, December 31, 2008 $3,338,500

* Error in calculation of amortization:

As calculated ($54,000 ¸ 6) $9,000

Corrected ($54,000 – $9,000) ¸ 6 7,500

Understatement of net income per year 1,500

X 2

Total understatement of beginning retained earnings 3,000

After-tax understatement ($3,000 X [1-40%]) $1,800

**Understatement of 2006 income $60,000

Overstatement of 2007 income (20,000)

Net understatement of beginning retained earnings 40,000

After-tax understatement ($40,000 X [1-40%]) $24,000

Solutions Manual 4-43 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 53. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-3 (Continued)

(c) The GAAP classification rules assist in assessing the quality

of earnings by separating extraordinary items and

discontinued operations from continuing and non-extraordinary

results of operations. Extraordinary items

involve non-recurring unusual transactions and separating

them from regular operations helps users assess the results

of transactions within management’s control. Discontinued

operations are also presented separately to provide

predictive value. By separating the results of operations that

are being discontinued from ongoing operations, users can

assess ongoing operations and more easily predict future

performance. Results from continuing operations usually

have greater significance for predicting future performance

than do results from nonrecurring activities.

The GAAP classification rules also apply to financial

statement elements and separate revenues and expenses

from gains and losses. This separation helps users assess

the past performance and profitability based on recurring,

regular transactions and predict sustainability of earnings.

GAAP also requires various other items of the income

statement to be disclosed. These also provide information to

users to assess the quality, recurrence and sustainability of

earnings and management’s performance. For example:

government assistance, goodwill impairment, income taxes,

etc.

Solutions Manual 4-44 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 54. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-4

(a) Reid Corporation

Income Statement

For the Year Ended June 30, 2008

Sales Revenue

Sales $1,928,500

Less: Sales discounts $31,150

Sales returns 62,300 93,450

Net sales 1,835,050

Cost of Goods Sold 1,071,770

Gross profit 763,280

Operating Expenses

Selling expenses

Sales commissions $97,600

Sales salaries 56,260

Travel expense 28,930

Entertainment expense 14,820

Freight-out 21,400

Telephone and Internet 9,030

Amortization of sales equipment 4,980

Building expense 6,200

Bad debt expense 4,850

Miscellaneous selling expense 4,715 248,785

Administrative Expenses

Real estate and other local taxes 7,320

Building expense 9,130

Amortization of office

furniture and equipment 7,250

Office supplies used 3,450

Telephone and Internet 2,820

Miscellaneous office expenses 6,000 35,970 284,755

Income from operations 478,525

Other Revenues and Gains

Dividend revenue 38,000

516,525

Other Expenses and Losses

Bond interest expense 18,000

Income before taxes 498,525

Income taxes 133,000

Net income $ 365,525

Earnings per share* $1.98

* ($365,525 – $9,000 of preferred dividends ¸ 180,000 shares)

Solutions Manual 4-45 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 55. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-4 (Continued)

Reid Corporation

Retained Earnings Statement

For the Year Ended June 30, 2008

Retained earnings, July 1, 2007, as reported $292,000

Correction of amortization understatement

(net of tax) 17,700

Balance July 1, 2004 adjusted $274,300

Add: Net income 365,525

639,825

Deduct:

Dividends declared on preferred shares 9,000

Dividends declared on common shares 32,000 41,000

Retained earnings, June 30, 2008 $598,825

(b) Reid Corporation

Income Statement

For the Year Ended June 30, 2008

Revenues

Net sales $1,835,050

Dividends revenue 38,000

Total revenues 1,873,050

Expenses

Cost of goods sold 1,071,770

Selling expenses 248,785

Administrative expenses 35,970

Bond interest expense 18,000

Total expenses 1,374,525

Income before taxes 498,525

Income taxes 133,000

Net income $ 365,525

Earnings per share $1.98

Solutions Manual 4-46 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 56. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-5

(a)

1. The usual but infrequently occurring charge of $10,500,000

should be disclosed separately, assuming it is material.

This charge is shown above income before extraordinary

items and would not be reported net of tax. This item

should be separately disclosed to inform the user of the

financial statements that this item is not frequently

recurring and therefore may not impact next year's results.

Furthermore, trend comparisons may be misleading if such

an item is not highlighted and adjustments made. The item

should not be considered extraordinary because it is usual

in nature.

2. The extraordinary item of $9,000,000 should be reported

net of tax in a separate section for extraordinary items. An

adjustment should be made to income taxes to report this

amount at $22,400,000. The $3,000,000 tax effect of this

extraordinary item should be reported with the

extraordinary item. The reason for the separate disclosure

is much the same as that given above for the separate

disclosure of the usual, but infrequently occurring item.

Readers must be informed that certain revenue and

expense items may be unusual and infrequent such that

their likelihood for affecting operations again in the future

is unlikely. Separate earnings per share information must

also be presented for the extraordinary item.

3. The adjustment required for correction of an error is

inappropriately labelled and also should not be reported in

the retained earnings statement. Changes in estimate

should be handled in current and prospective periods

through the income statement. Catch-up adjustments are

not permitted. To restate financial statements every time a

change in estimate occurred would be extremely costly

and confusing. In addition, adjusting the beginning balance

of retained earnings is inappropriate, as the increased

charge in this case would never be run through current or

future income statements.

Solutions Manual 4-47 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 57. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-5 (Continued)

4. Earnings per share should be reported on the face of the

income statement or in the notes to the financial

statements according to the CICA Handbook Sec 3500.61.

Because such importance is ascribed to this ratio, the

profession believes it necessary to highlight the earnings

per share figure. In this case it should report both income

before extraordinary item, extraordinary item and net

income on a per share basis.

Solutions Manual 4-48 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 58. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-5 (Continued)

(b)

Pereira Corp.

Combined Statement of Income and Retained Earnings

For the Year Ended December 31, 2009

($000 omitted)

Net sales $640,000

Cost and expenses:

Cost of goods sold 500,000

Selling, general and administrative

expenses (a) 55,500

Loss due to write-down of inventory 10,500

Other, net (b) 8,000

574,000

Income before taxes and extraordinary item 66,000

Income taxes 22,400

Income before extraordinary item 43,600

Extraordinary item:

Extraordinary loss (net of taxes of $3,000) 6,000

Net income 37,600

Retained earnings, at beginning of the year 141,000

178,600

Less: Dividends on common shares 12,200

Retained earnings, at end of the year $166,400

(a) $66,000 - $10,500 = $55,500

(b) $17,000 - $9,000 = $8,000

Solutions Manual 4-49 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 59. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-6

SITUATION A:

Olive Miller Ltd.

Combined Statement of Income and Retained Earnings

For the Year Ended December 31, 2008

Sales ($5,700,000 - $1,200,000) $4,500,000

Cost of goods sold ($2,900,000 - $600,000) 2,300,000

Gross margin 2,200,000

Selling, general and administrative expenses

($1,800,000 - $450,000 - $620,000) 730,000

Income before income taxes 1,470,000

Income taxes 441,000

Income from continuing operations 1,029,000

Discontinued operations:

Income from apparel division (net of

income taxes of $45,000)* $105,000

Loss on disposal of apparel division

(net of income taxes of $186,000) 434,000 329,000

Income before extraordinary item 700,000

Extraordinary item:

Extraordinary loss (net of taxes of

$210,000) 490,000

Net income 210,000

Retained earnings, January 1 700,000

Retained earnings, December 31 $910,000

* ($1,200,000 - $600,000 - $450,000)

Solutions Manual 4-50 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 60. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-6 (Continued)

SITUATION B:

Olive Miller Ltd.

Combined Statement of Income and Retained Earnings

For the Year Ended December 31, 2008

Sales $5,700,000

Cost of goods sold 2,900,000

Gross margin 2,800,000

Selling, general and administrative expenses* 1,902,600

Income from operations 897,400

Other losses:

Loss on disposal of equipment

($490,000 + $210,000) 700,000

Income before income taxes 197,400

Income taxes 59,220

Net income 138,180

Retained earnings, January 1 700,000

Retained earnings, December 31 $838,180

* The amount recorded as bad debts expense

represents the 1.2% rate

($68,400 / $5,700,000 = 1.2%)

Revised bad debts expense = $5,700,000 X 3% = $171,000

Bad debts expense previously recorded 68,400

Increase in bad debts expense $102,600

Solutions Manual 4-51 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 61. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-6 (Continued)

SITUATION C:

Olive Miller Ltd.

Combined Statement of Income and Retained Earnings

For the Year Ended December 31, 2008

Sales $5,700,000

Cost of goods sold 2,900,000

Gross margin 2,800,000

Selling, general and administrative expenses* 1,786,000

Income from operations 1,014,000

Other expenses:

Loss due to labour disruption ($490,000 + $210,000) 700,000

Income before income taxes 314,000

Income taxes 94,200

Net income 219,800

Retained earnings, January 1, as

previously reported $700,000

Cumulative increase in prior years’

income from change in depreciation

policy (net of income taxes of

$24,000) 56,000

Retained earnings, January 1, restated 756,000

Retained earnings, December 31 $975,800

* Change in accounting policy:

Double-declining

Straight-line

2006: $500,000 X 2/10 $100,000 $50,000

2007: ($500,000 - $100,000) X 2/10 80,000 50,000

Total for prior years $180,000 $100,000

Net decrease in depreciation expense

= $180,000 - $100,000 = $80,000

2008: ($500,000 - $180,000) X 2/10 $64,000 $50,000

Net decrease in depreciation expense in 2008

= $64,000 - $50,000 = $14,000

Solutions Manual 4-52 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 62. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-7

Byron Corp.

Retained Earnings Statement

For the Year Ended December 31, 2008

Retained Earnings, January 1, as reported $257,600

Correction of error from prior period (net of tax) 25,400

Retroactive adjustment for change in amortization

method (net of tax) (18,200)

Adjusted balance of retained earnings at January 1 264,800

Add net income 107,300 *

372,100

Deduct cash dividends declared 32,000

Retained earnings, December 31 $340,100

*$107,300 = ($129,500 + $41,200 + $21,600 – $25,000 – $60,000)

(b) 1. Gain on sale of investment in trading securities—

body of income statement, possibly unusual item

2. Refund of litigation—body of income statement,

possibly unusual item.

3. Loss on discontinued operations—body of the

income statement, following the caption, “Income

from continuing operations, shown net of tax”

4. Write-off of goodwill—body of income statement,

possibly unusual item.

Solutions Manual 4-53 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 63. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-8

Hamad Corporation

Income Statement

For the Year Ended December 31, 2008

Sales $9,500,000

Cost of goods sold 5,900,000

Gross profit 3,600,000

Selling and administrative expenses $1,280,000 *

Loss due to write-down of inventory 112,000 **

Total operating expenses 1,392,000

Income before taxes and extraordinary item 2,208,000

Income taxes 662,400 ***

Income before extraordinary item 1,545,600

Extraordinary item:

Major casualty loss (net of taxes of

$69,429****) 162,000

Net income $1,383,600

Earnings per share:

Income before extraordinary item $3.86

Extraordinary item (.40 )

Net income $3.46

* The 2007 sales commissions of $20,000 are deducted.

** The $112,000 may be identified as an unusual item if

unusual or infrequent in nature. However, it cannot be

considered extraordinary.

*** (30% of $2,208,000).

**** The extraordinary loss before taxes = $162,000 / [100% -

30%] = $231,429. Income taxes = $231,429 - $162,000 =

$69,429.

Solutions Manual 4-54 Chapter 4

Copyright © 2007 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

- 64. Kieso, Weygandt, Warfield, Young, Wiecek Intermediate Accounting, Eighth Canadian Edition

PROBLEM 4-8 (Continued)

Hamad Corporation

Statement of Income and Retained Earnings

For the Year Ended December 31, 2008

Sales $9,500,000

Cost of goods sold 5,900,000

Gross profit 3,600,000

Selling and administrative expenses $1,280,000

Loss due to write-down of inventory 112,000

Total operating expenses 1,392,000

Income before taxes and extraordinary item 2,208,000

Income taxes 662,400

Income before extraordinary item 1,545,600

Extraordinary item:

Major casualty loss (net of taxes of

$69,429) 162,000

Net income 1,383,600

Retained earnings, January 1,

as reported 2,800,000

Cumulative effect on prior years of

change in amortization method

(net of taxes of $36,563) 85,312

Correction of error in prior year’s

income (net of taxes of $6,000) 14,000

Retained earnings, January 1, as restated 2,700,688

4,084,288

Less: Cash dividends 700,000

Retained earnings, December 31 $3,384,288

Earnings per share:

Income before extraordinary item $3.86

Extraordinary item (.40 )

Net income $3.46

Solutions Manual 4-55 Chapter 4