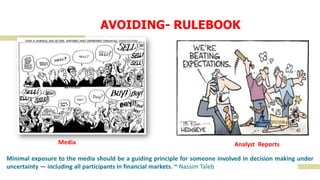

Amit Kumar Gupta has over a decade of experience in investment analysis and portfolio management. He has worked as a business consultant for leading companies and currently acts as a fund manager. The presentation discusses different types of market players like entertainment seekers, casino players, and investors. It emphasizes the importance of saving before investing, understanding compounding, avoiding leverage and media reports, focusing on asset allocation, and creating one's own investment framework. The key message is that investing requires a long-term mindset and discipline.