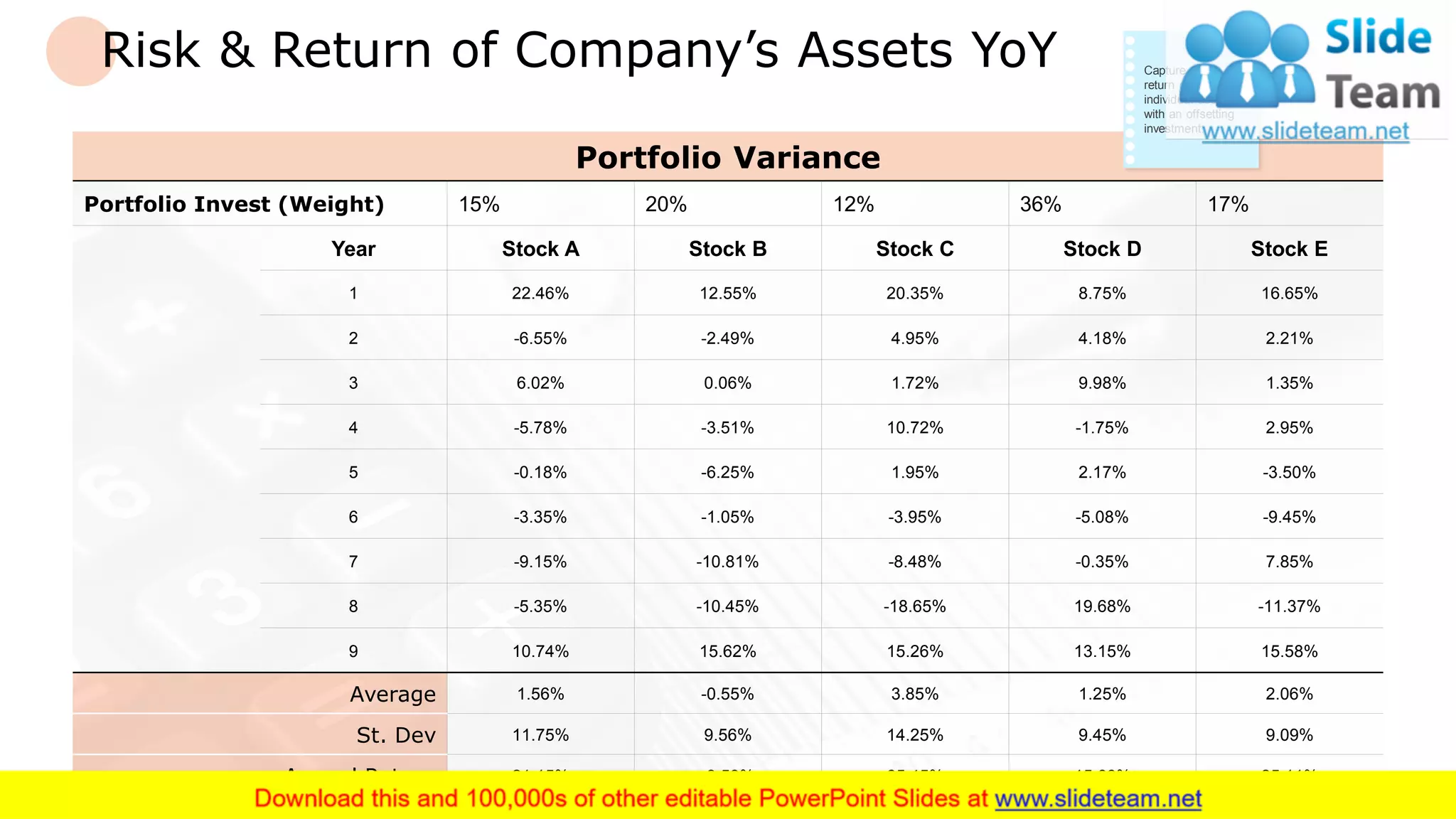

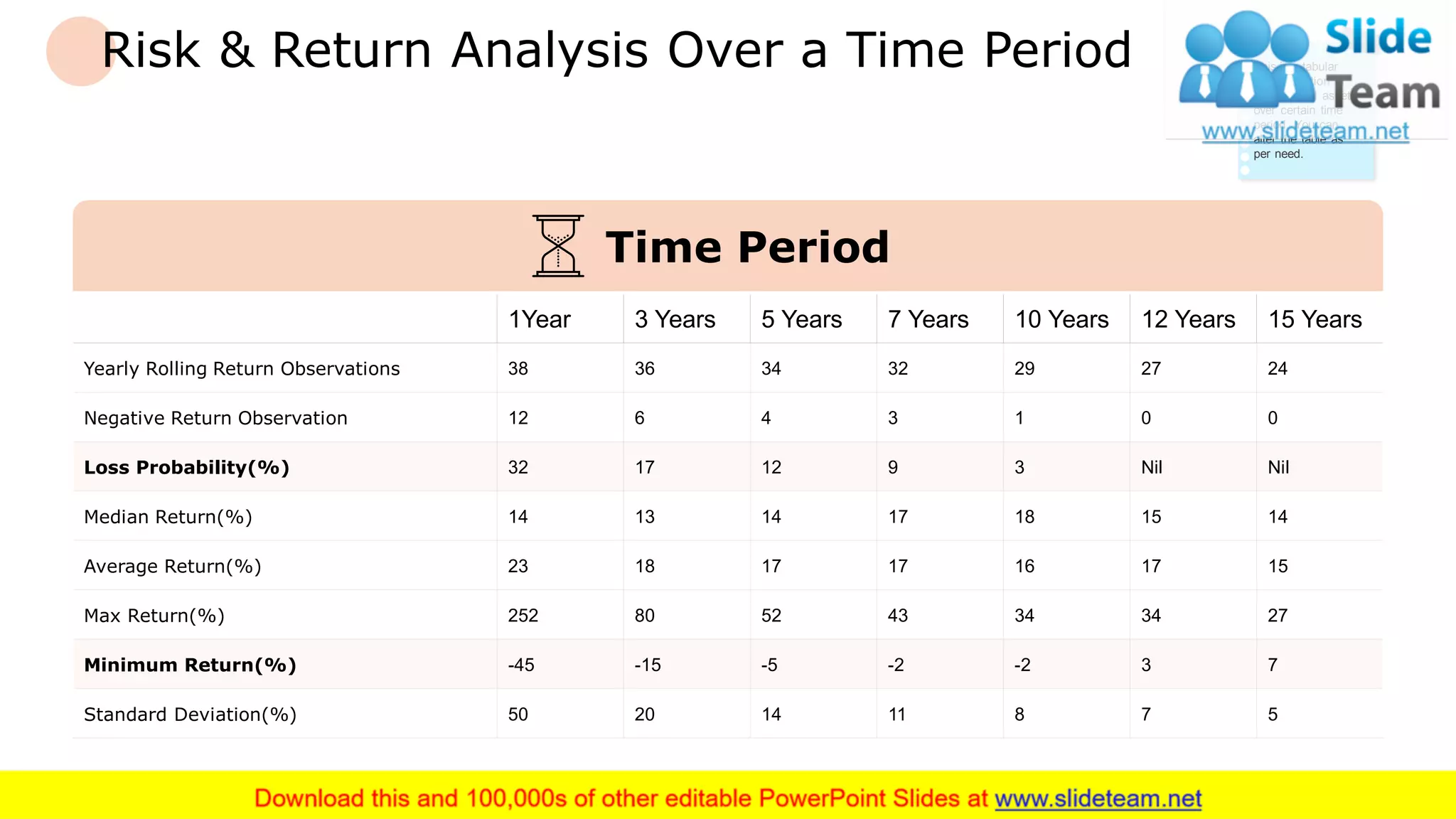

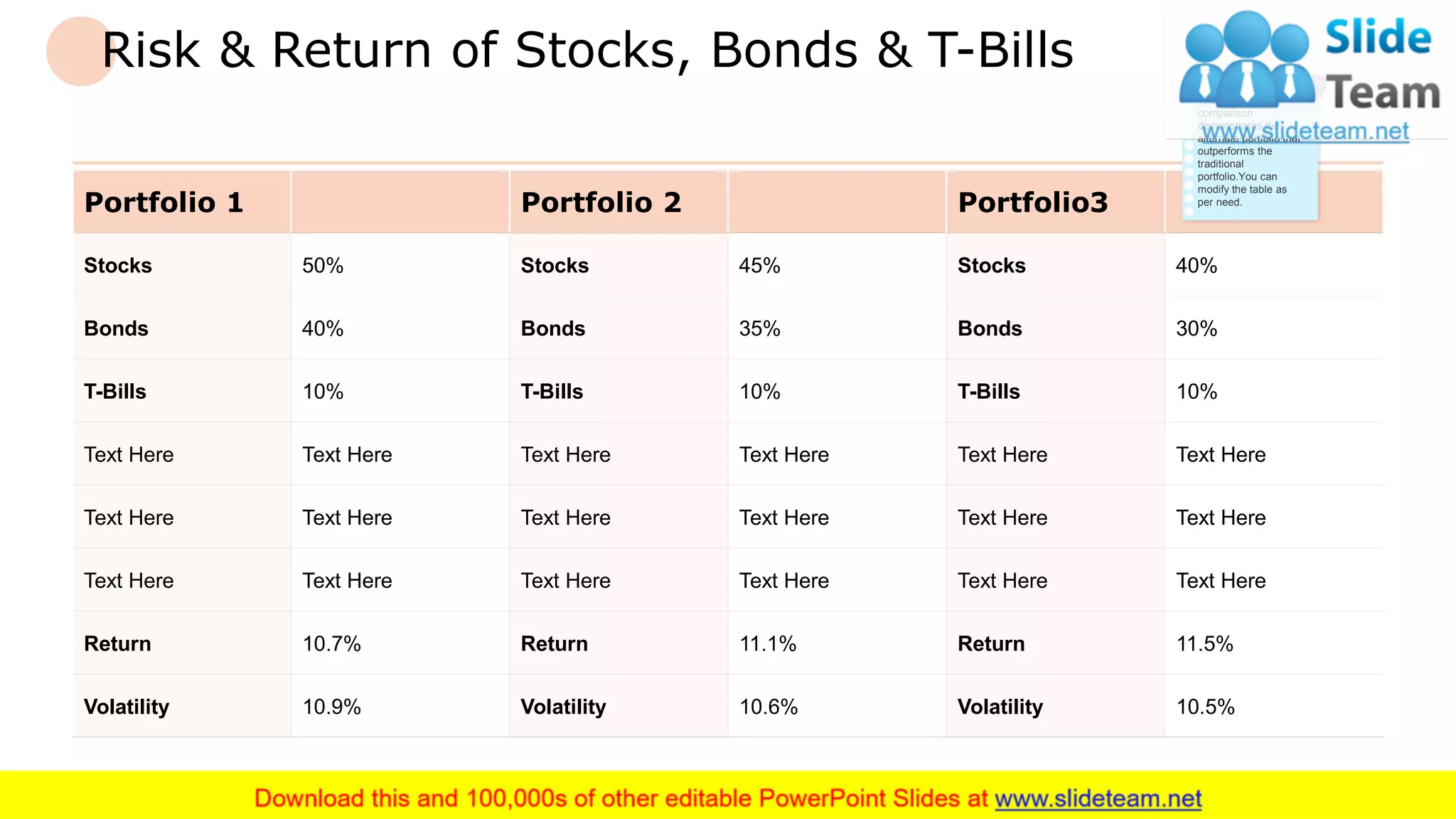

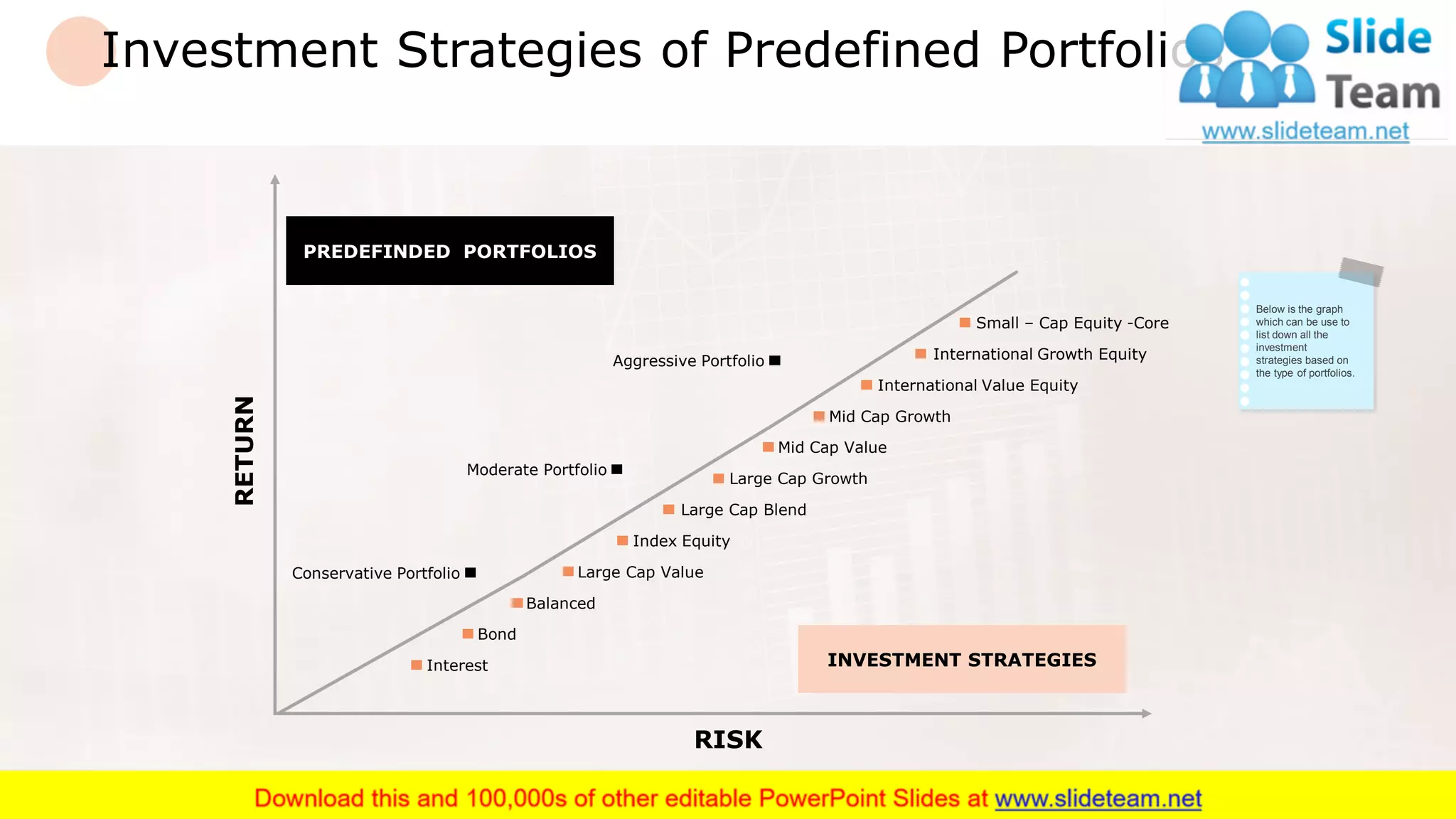

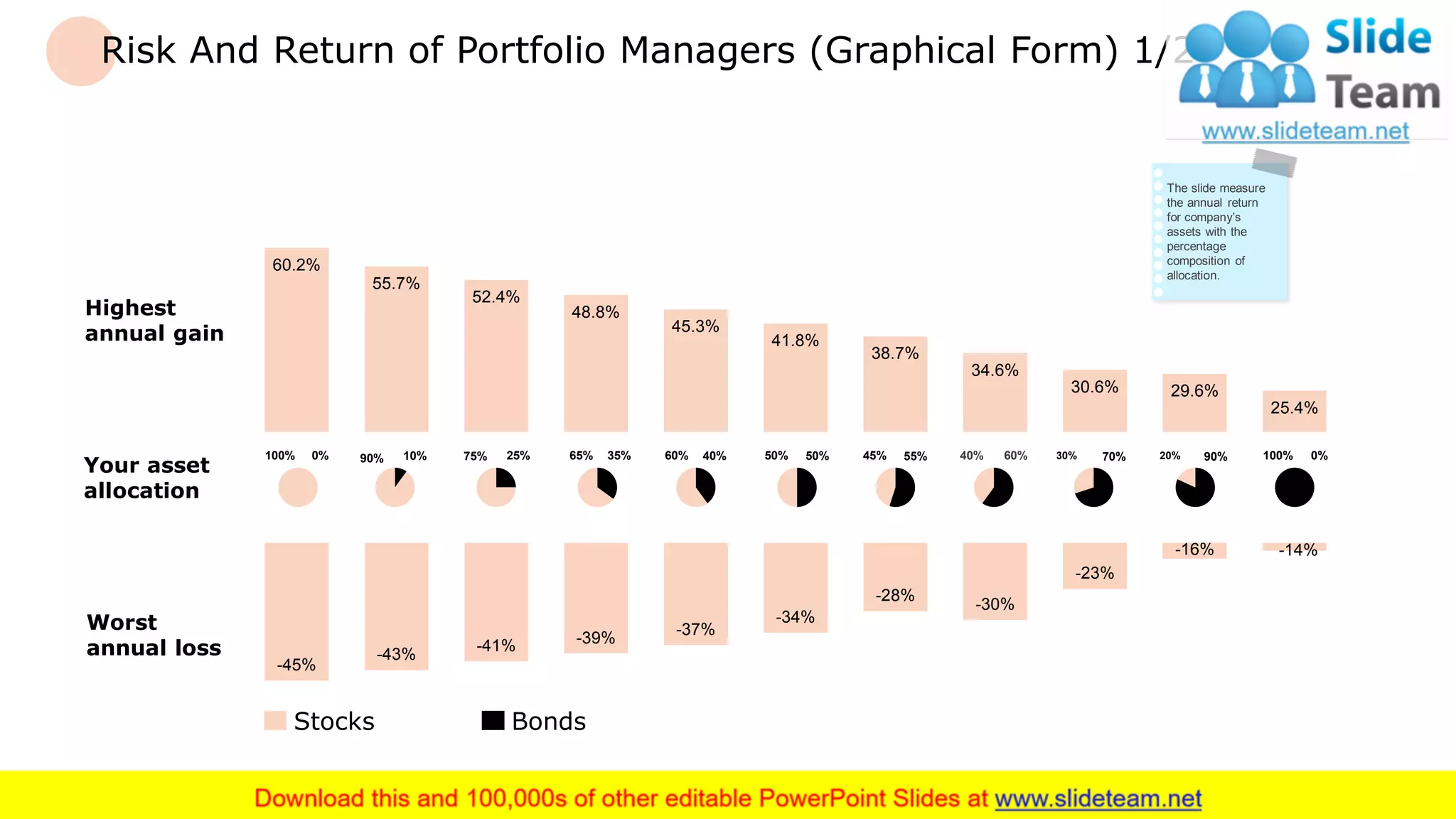

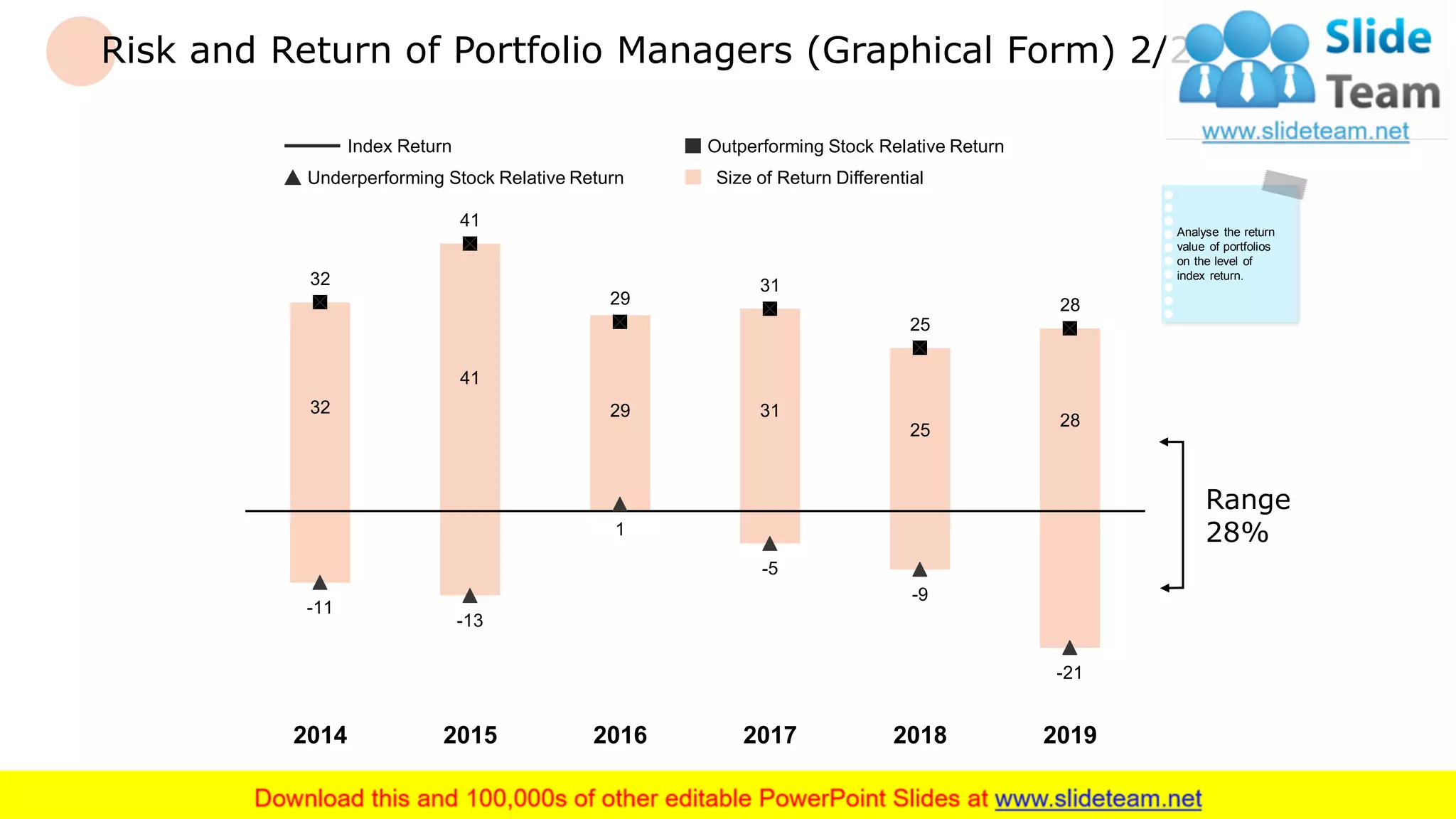

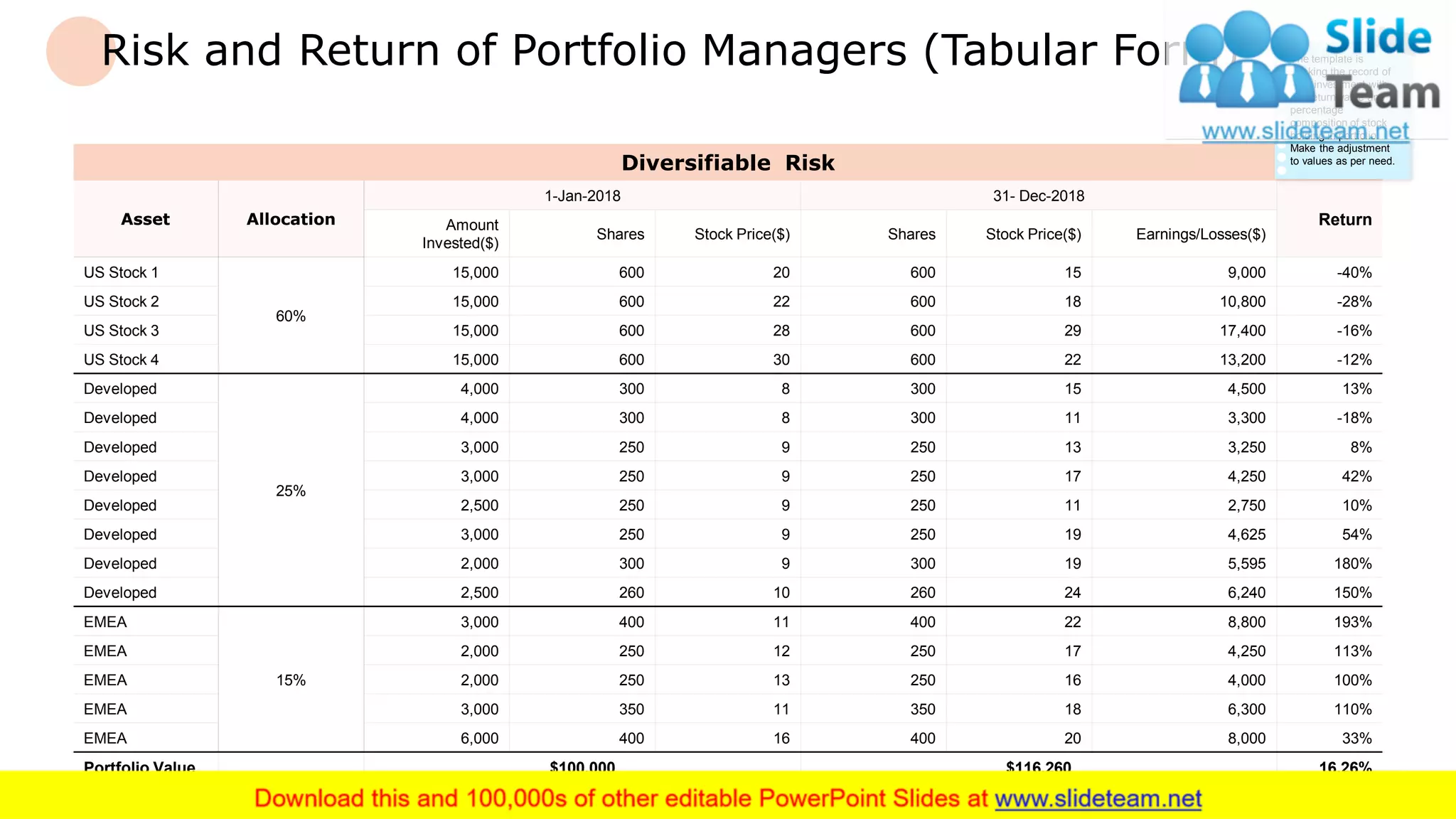

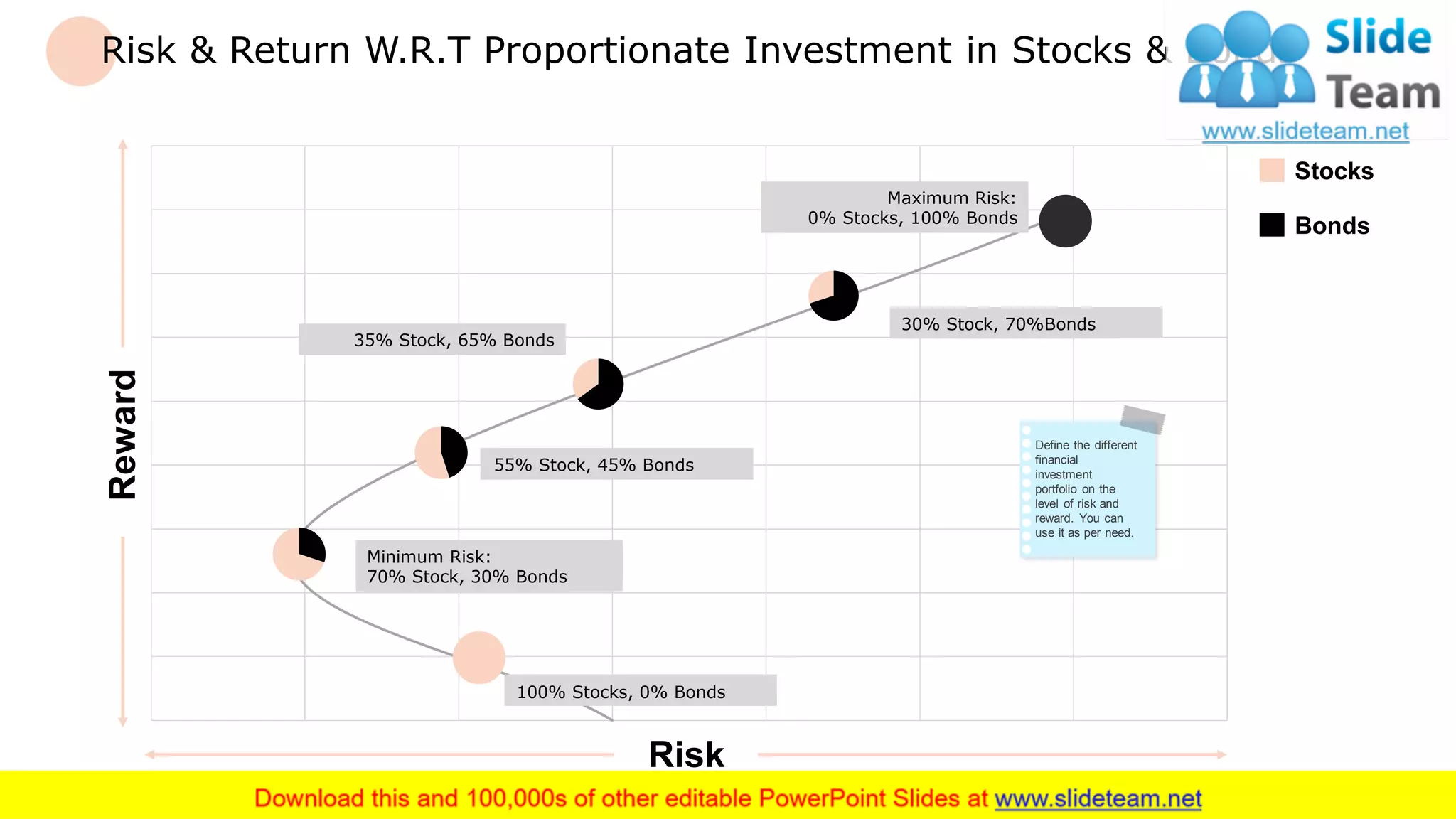

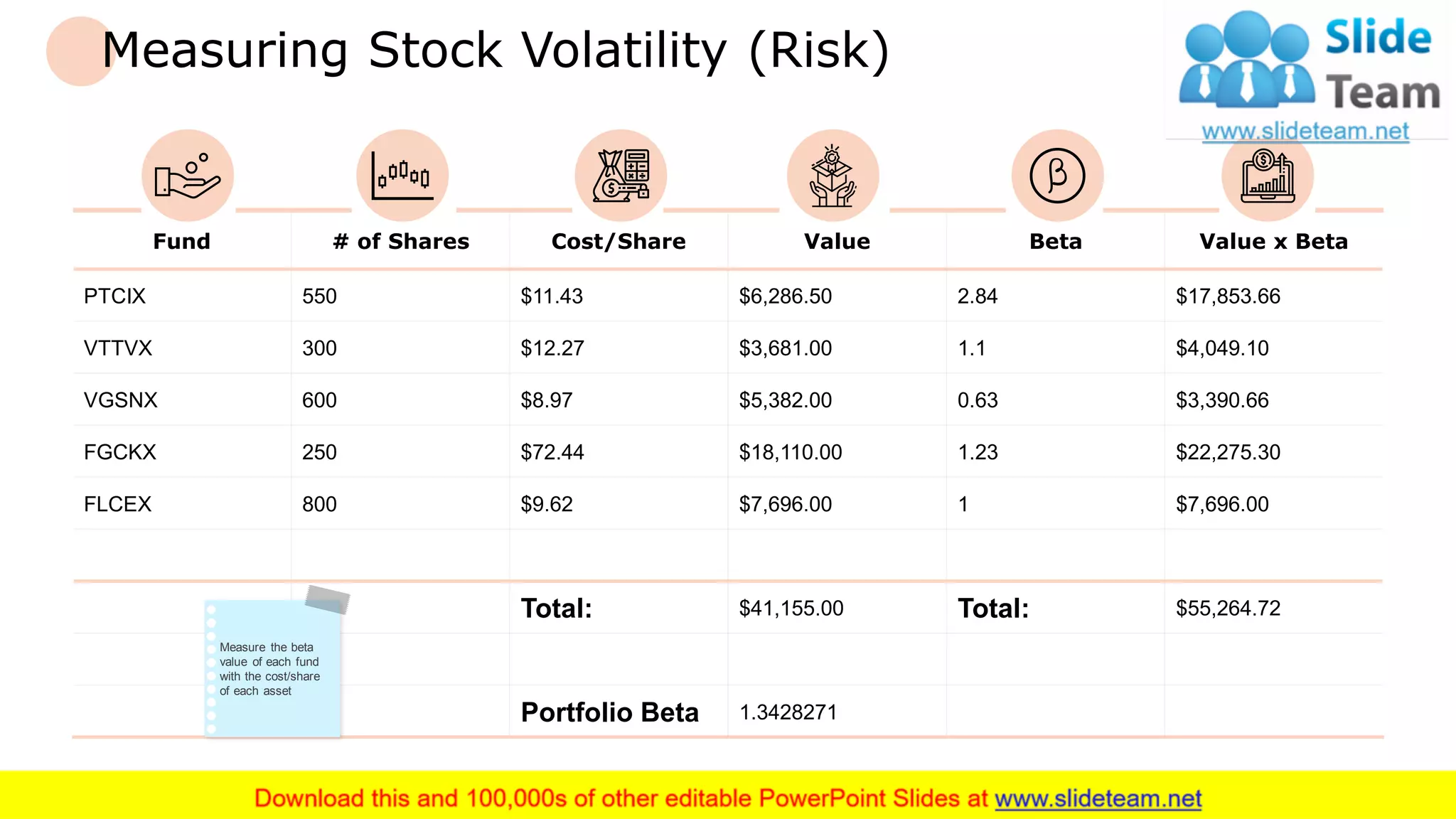

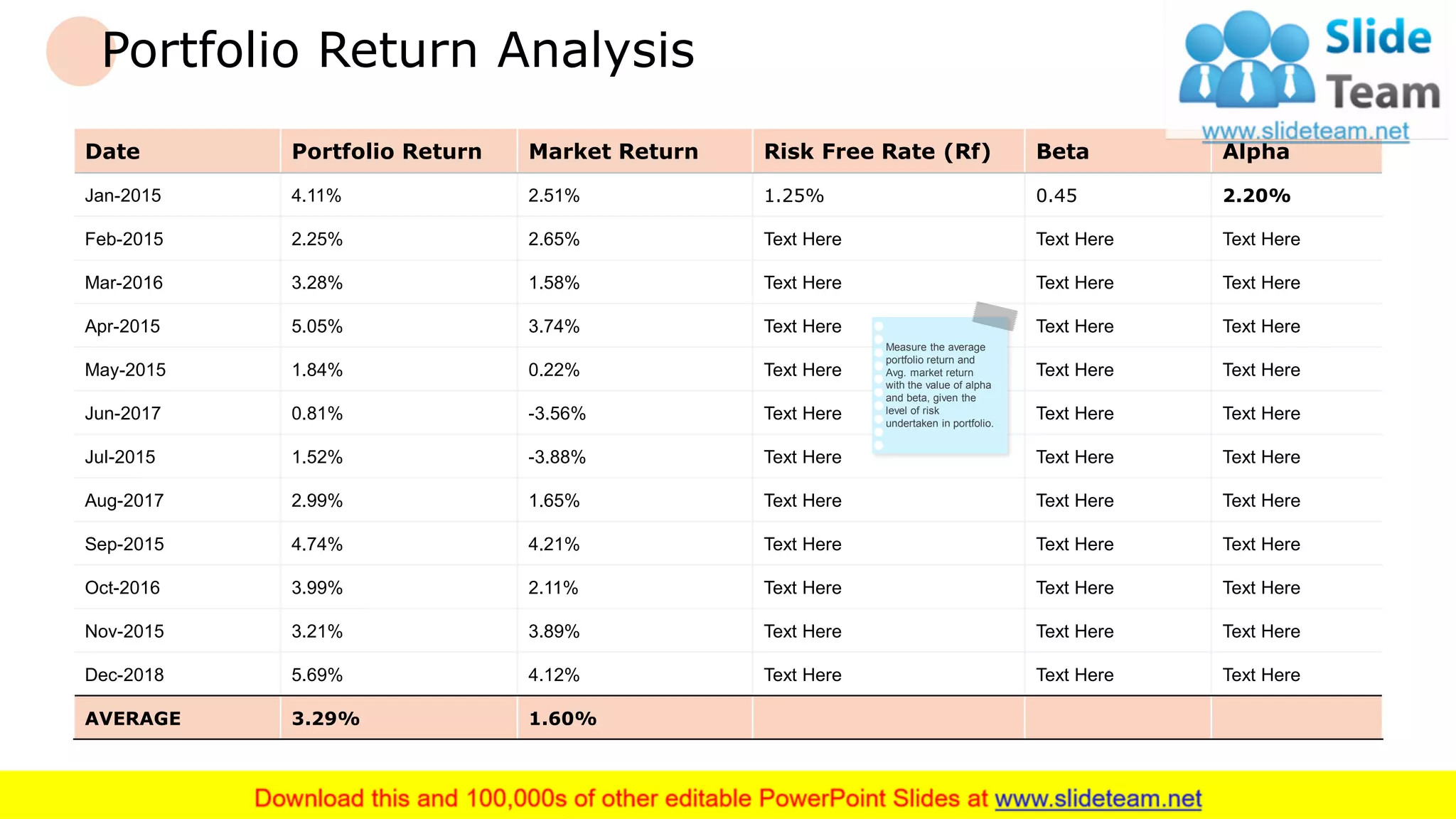

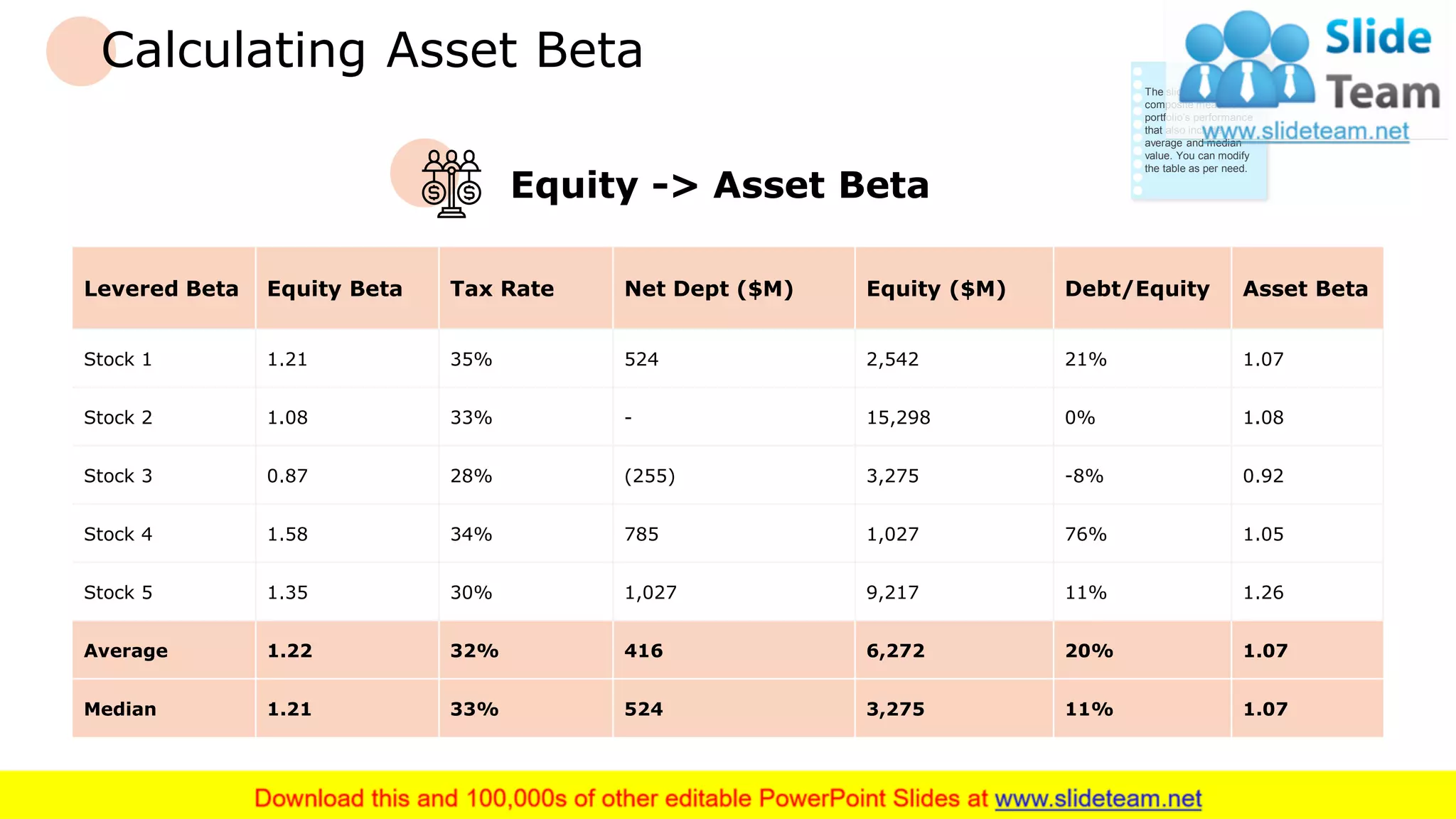

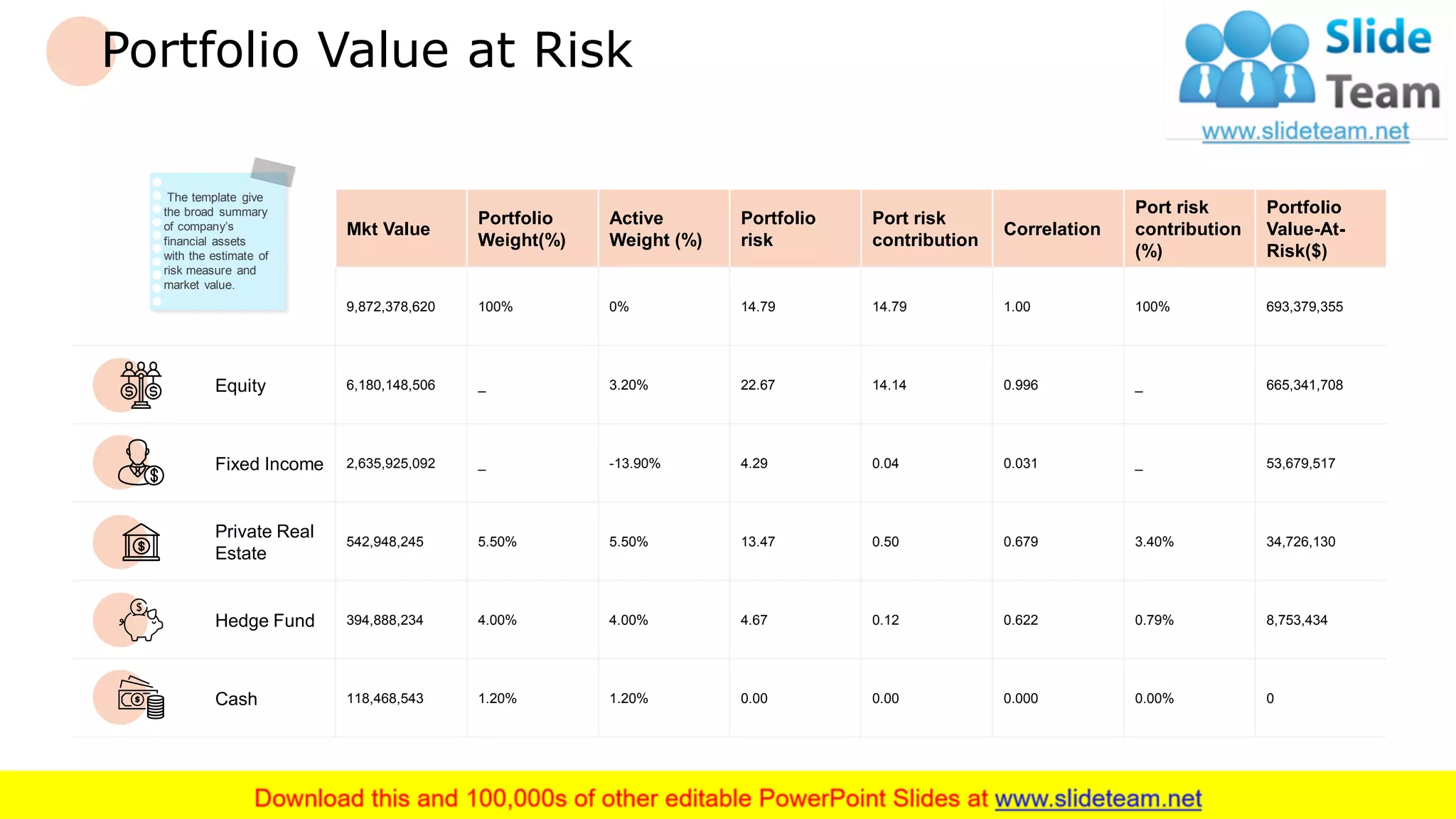

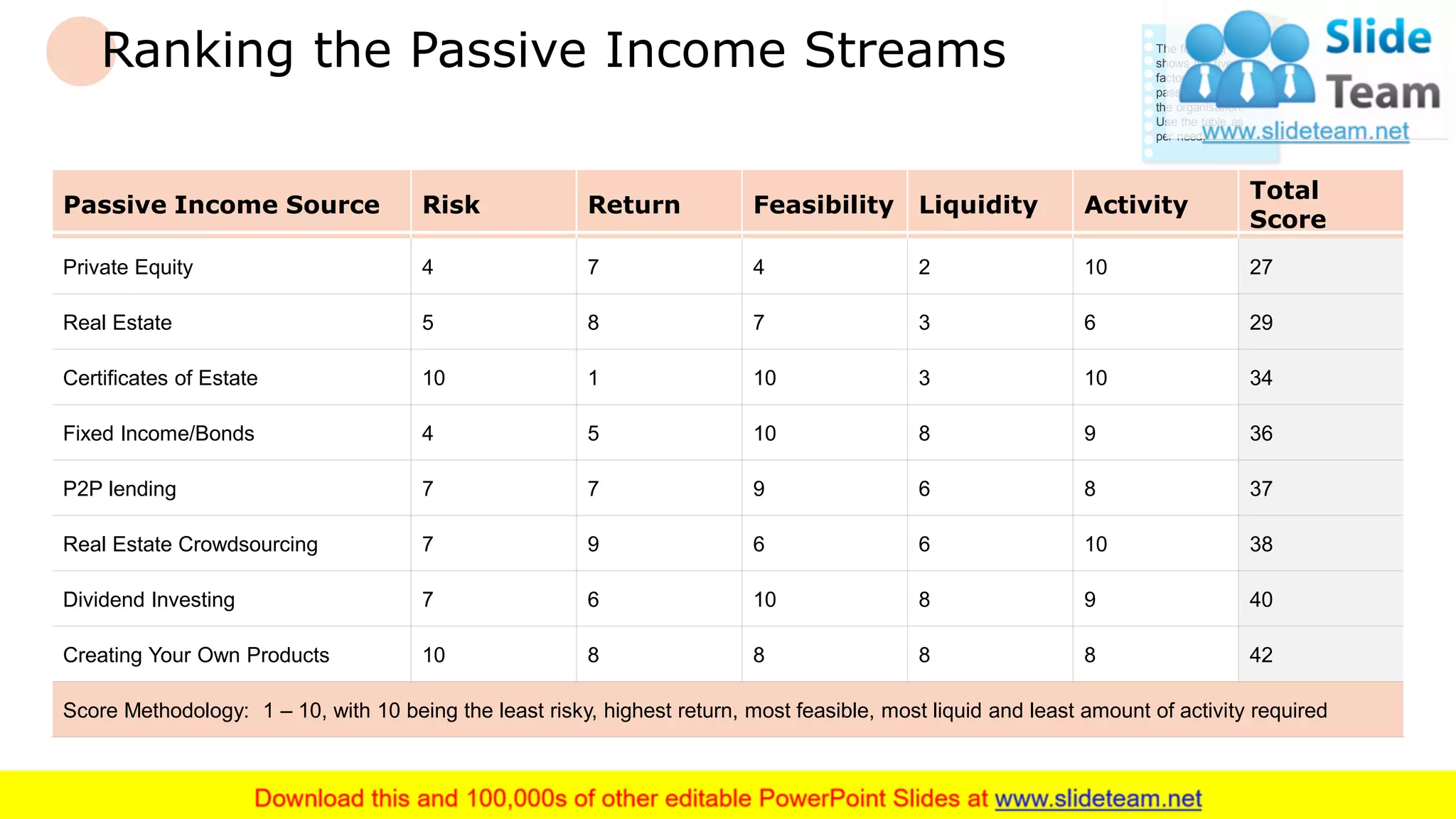

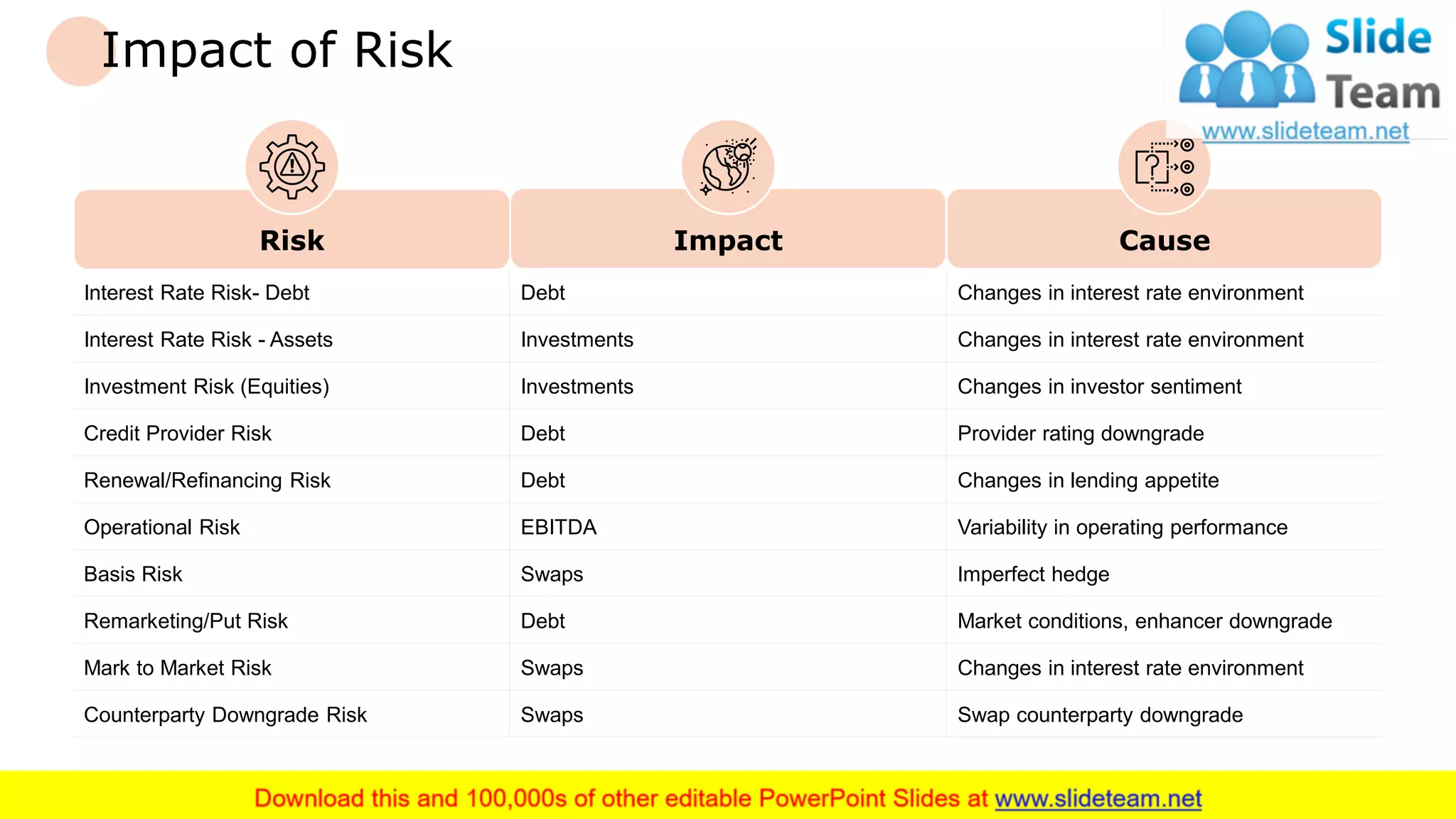

The document provides a comprehensive analysis of financial assets, focusing on risk and return measurements over various time periods. It includes investment strategies, portfolio monitoring, and performance metrics for predefined portfolios in stocks, bonds, and other asset classes. Additionally, the document features tables and graphical representations to illustrate the historical performance, volatility, and passive income rankings of different investment options.