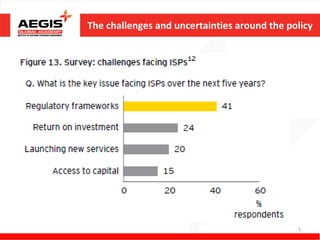

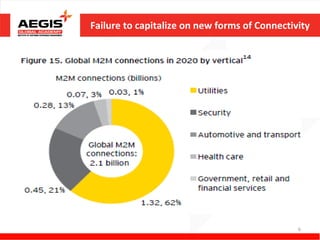

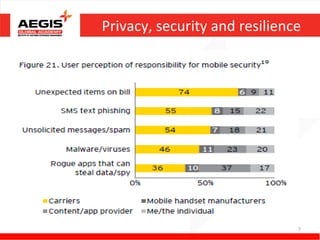

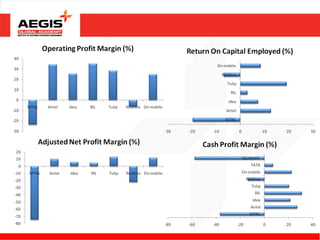

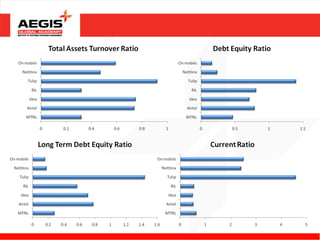

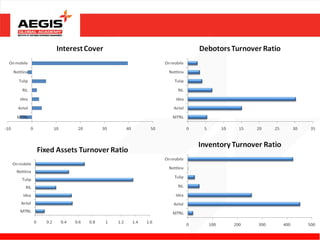

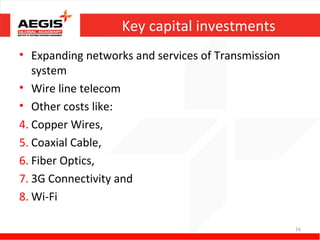

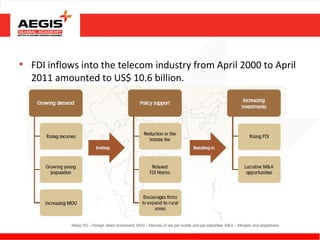

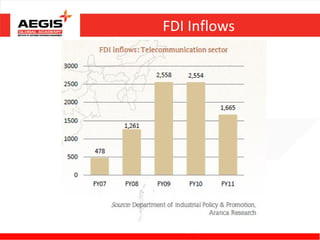

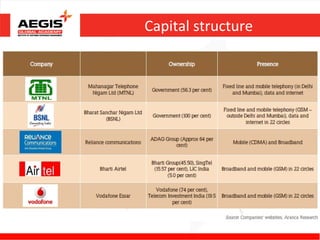

This document discusses risks and opportunities in the Indian telecom sector. It analyzes risks at the macro, sector, and firm levels, including economic conditions, regulation, competition, and strategic partnerships. Key drivers of growth are identified as low prices, effective regulation, and changing customer behavior. Financial metrics are presented for major telecom companies. The document also covers capital investments, foreign investment, mergers and acquisitions, and capital structure issues in the Indian telecom industry.