The document provides an overview of key concepts in economics, including:

1) Economists study how to meet unlimited wants with scarce resources by analyzing trade-offs and opportunity costs.

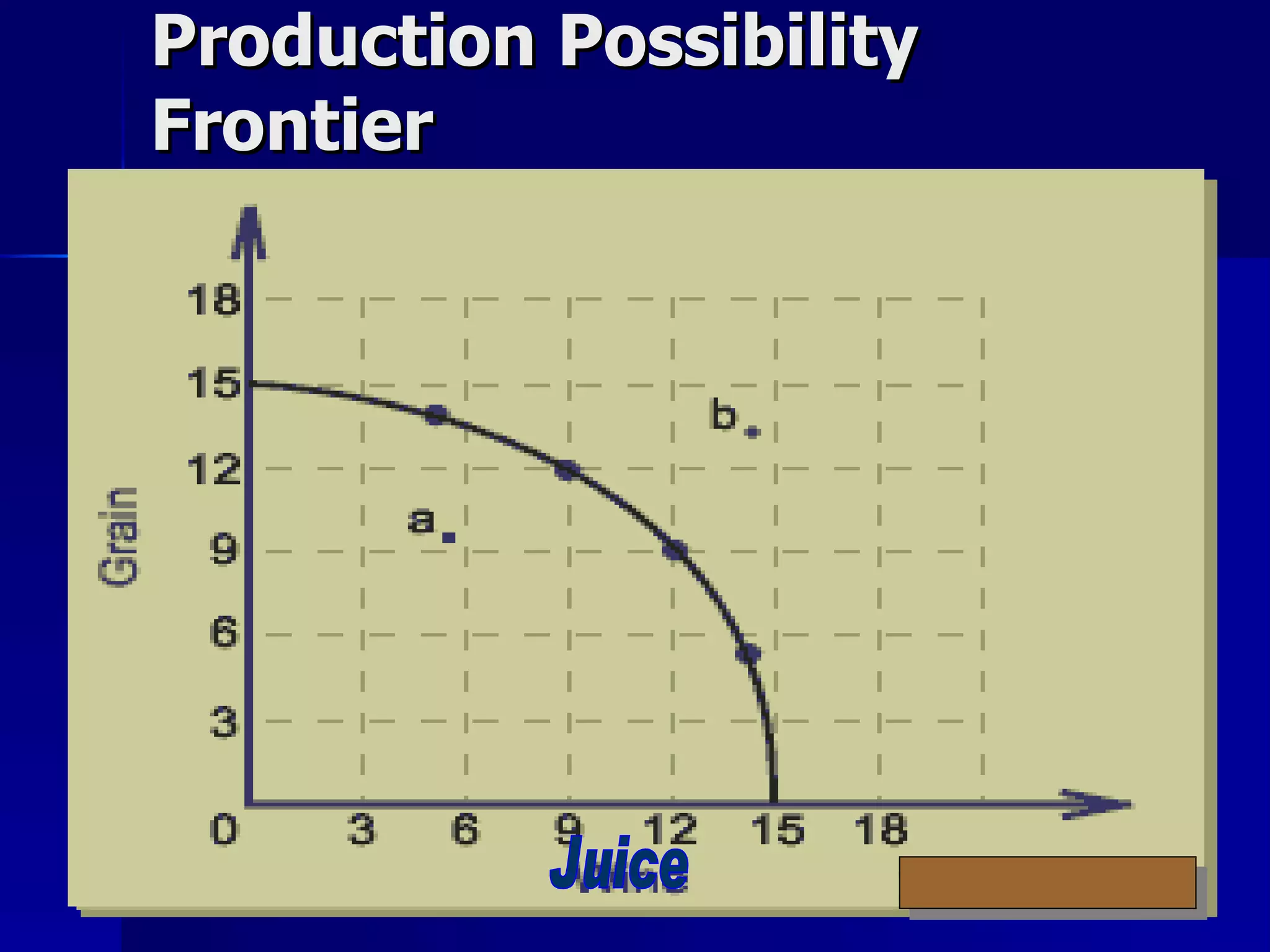

2) Production possibility frontiers and opportunity costs demonstrate the trade-offs of allocating resources.

3) Different economic systems answer questions about what, how, and for whom to produce in different ways, such as through tradition, government command, or market forces.

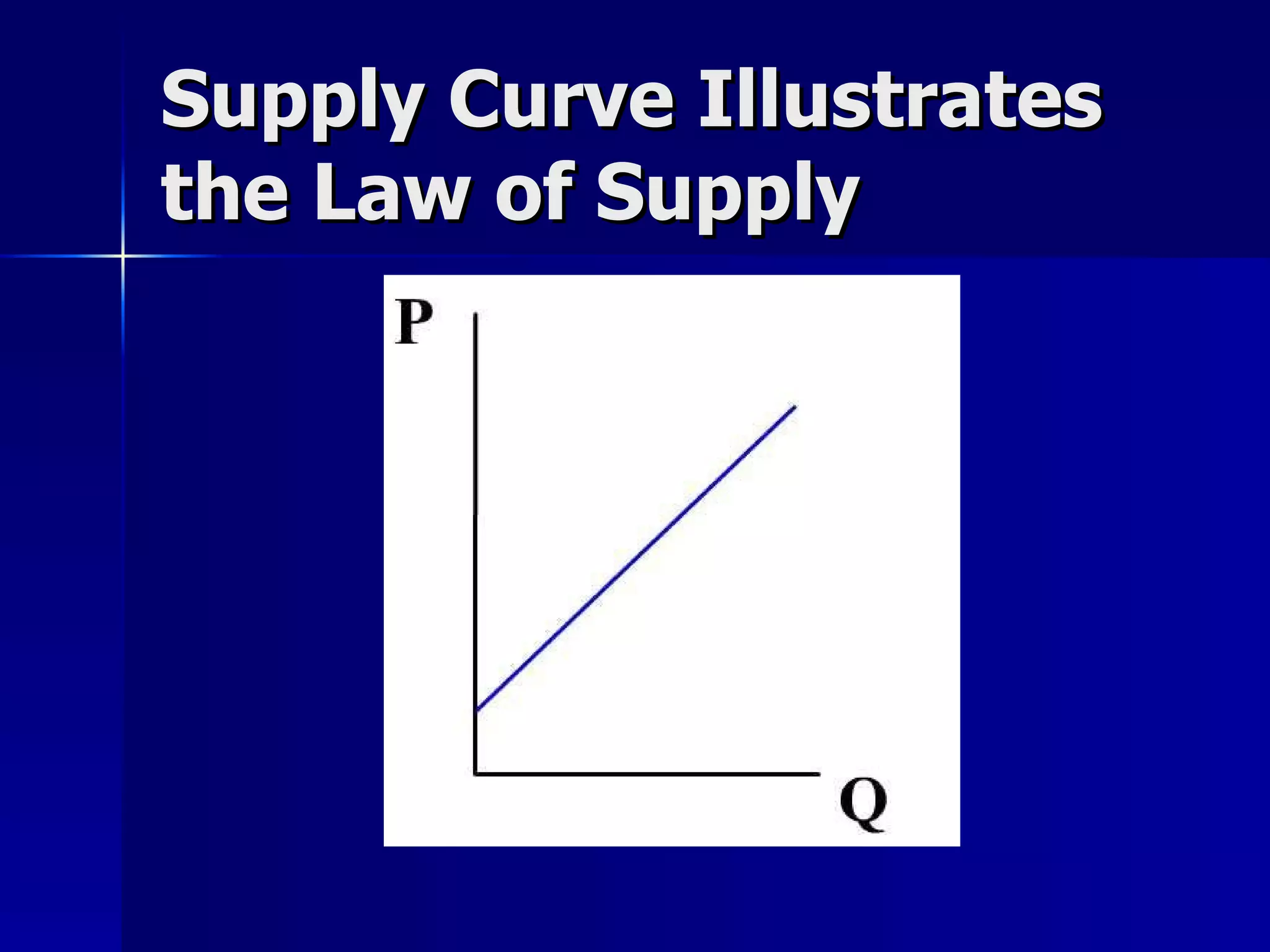

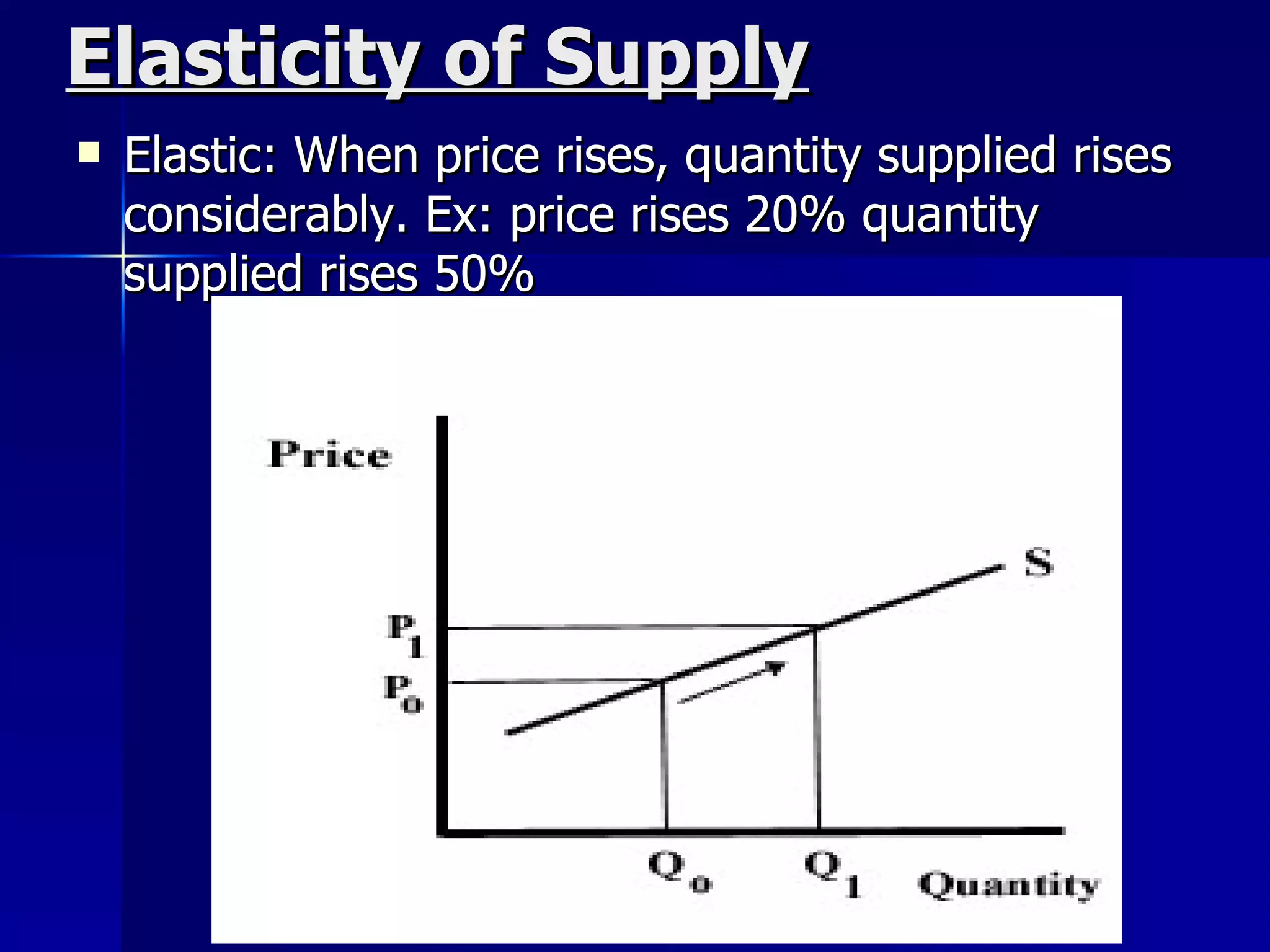

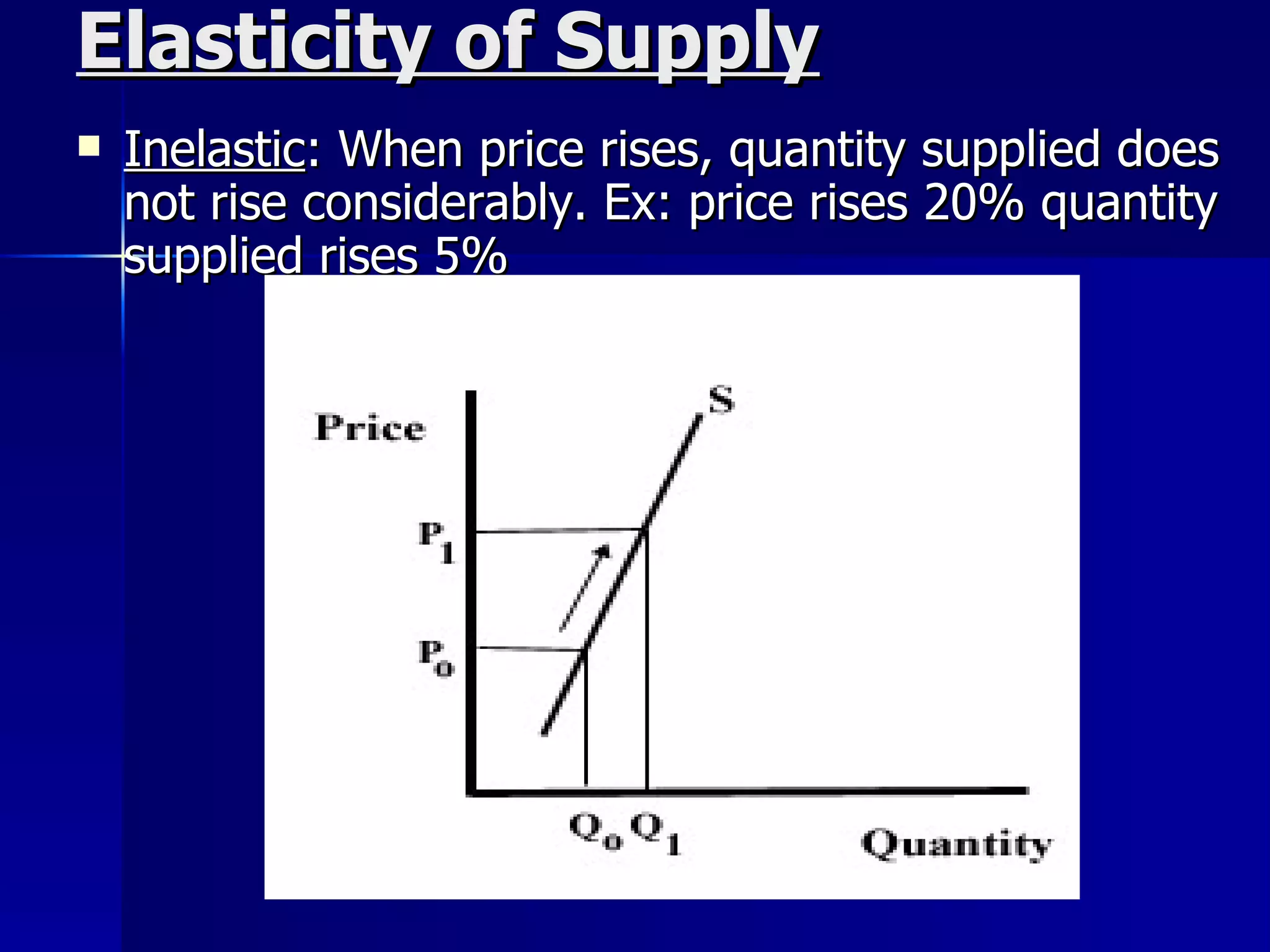

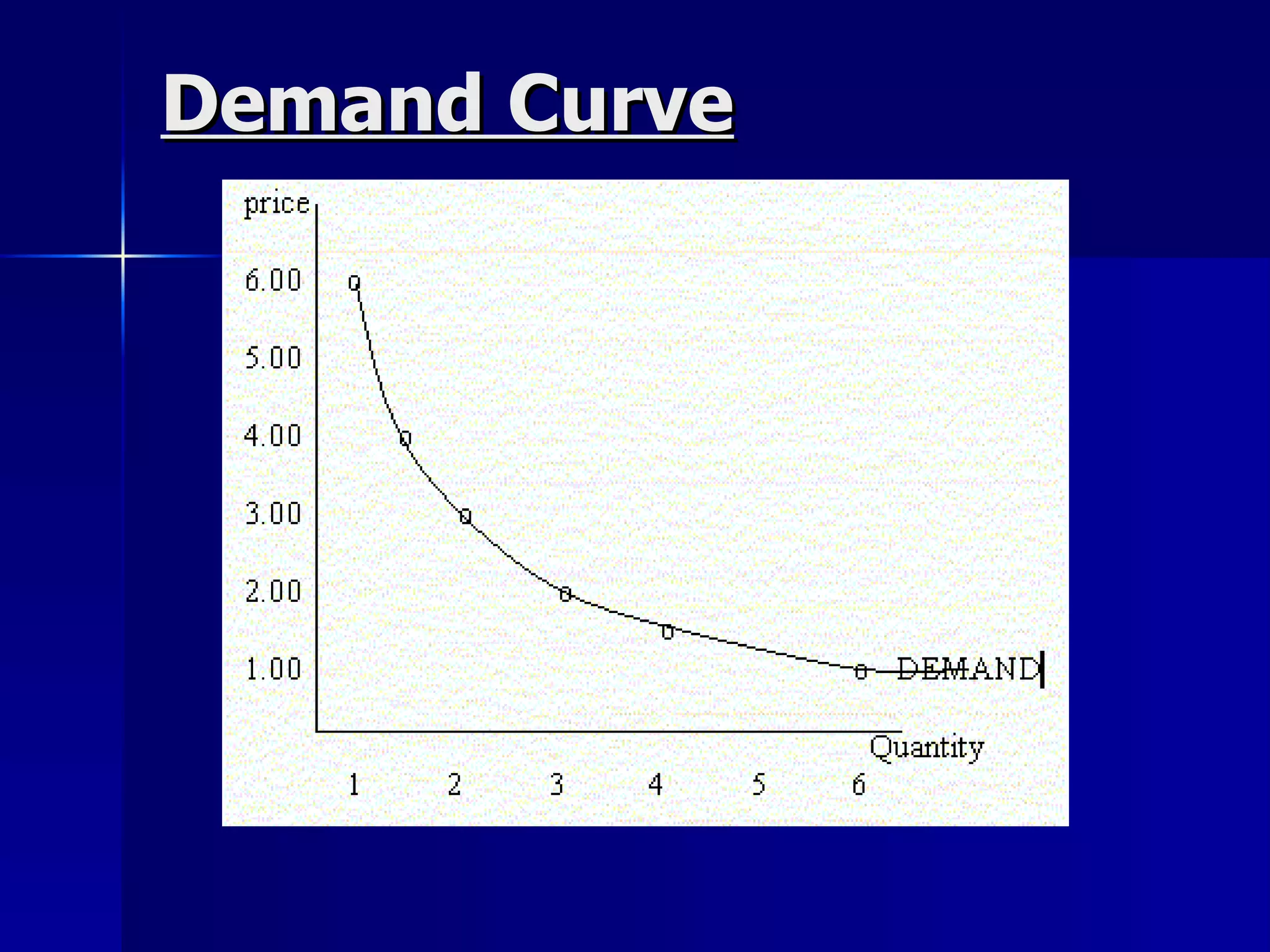

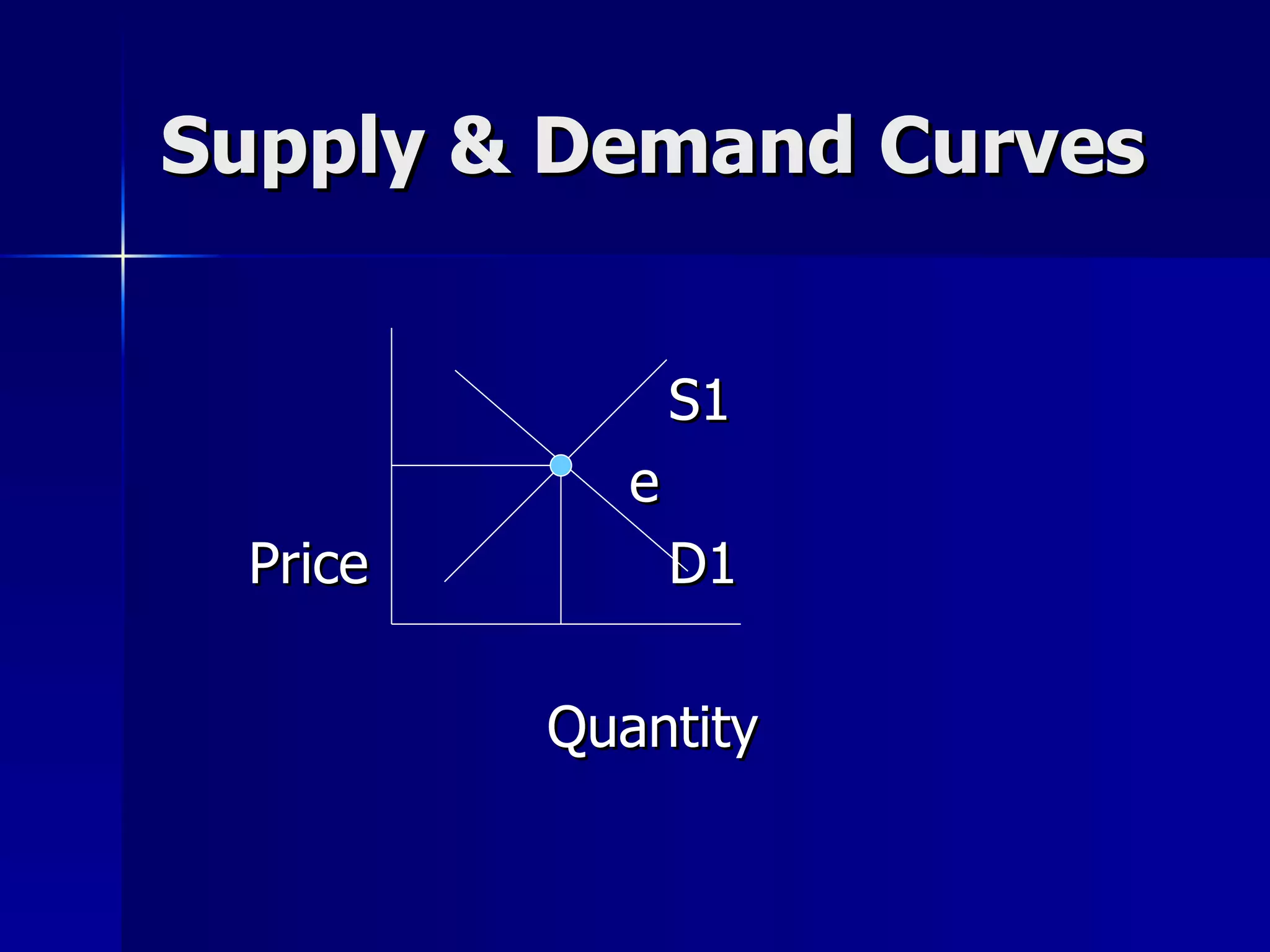

4) Supply and demand determine prices in a market economy through the interaction of producers and consumers.