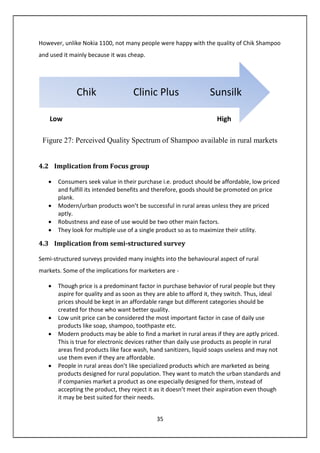

This document summarizes a study on using product innovation as an effective strategy to penetrate rural markets in India. It begins with an introduction on the rural Indian market and consumers. It then reviews literature on rural marketing strategies and targeting bottom of the pyramid consumers. Three innovative products are analyzed in depth: Tata Swach water purifier, Nokia 1100 mobile phone, and Chik shampoo. Qualitative research through focus groups and surveys in rural areas is presented to understand perceptions of these products and assess their success factors. The findings suggest that affordability, awareness, availability and acceptability are key for product success in rural markets. Product innovation can effectively cater to diverse rural needs and help companies access this large untapped market.

![3

The Rural Indian Consumer

Rural India was a complete heterogeneous market, but it was homogeneous region wise,

and thus it was bounded by cultural and traditional values of that region. They had a lower

level of traditional education but their awareness levels were moving up with the entering

of media and education of youth and their migration to urban areas. Rural Indian consumers

were believed to be conservative, thus it implied that they were high value conscious. With

low per capita income, the rural consumer is more risk averse, thus does not spend unless

the true value for money is perceived by the person. The increased movement of the

branded goods indicated that the consumer was ready to spend a little extra because he

saw a value added in the good, but was not open to change drastically, but was not limiting

itself to being fully conservative.

Rural households form 72% of the total households. This puts the rural market at roughly

720 million customers. Total income in rural India (about 43% of total national income) is

expected to increase from around US$220 billion in 2004-2005 to US$650 billion by 2014-

2015, a CAGR of 12%. Some 42 million rural households use banking services against 27

million urban households. There are 41 million Kisan credit cardholders [credit cards issued

to farmers for purchase of agricultural goods] against some 22 million card users in urban

markets. Be it automobile, telecom, insurance, retail, real estate or banking, the future

drivers of growth are rural. No marketer can afford to ignore the possibilities of rural India.

Maruti Suzuki, India's leading automobile manufacturer, today sells 7% of its vehicles in the

rural markets. The company expects this number to rise to 15% in the next three years.

The urban markets have started saturating. Godrej, a family-owned conglomerate, saw its

sales of white goods drop by over a tenth in big cities in the past fiscal year. But sales in

towns of less than 100,000 people rose by 19%, and in villages by over 40%. Bajaj, another

conglomerate, says small-town and rural sales have risen handily in recent years, to a

quarter of its home-appliances business. Sales of motorbikes and mopeds have decelerated

more gently than cars, an urban luxury. Be it FMCG (34% share in total FMCG consumption),

Telecom (CAGR of 34%), Retail (40% market share), automobile(50% share of Hero Honda

sales), the rural area is showing a huge growth. Such a huge market should not be left out

due to unavailability of data. This study, thus, tries to provide some information to the

marketers on the factors that are important for success in these areas.](https://image.slidesharecdn.com/finalreport-130609145706-phpapp01/85/Product-Innovation-An-Effective-Strategy-To-Penetrate-Into-Small-Towns-And-Rural-Markets-11-320.jpg)