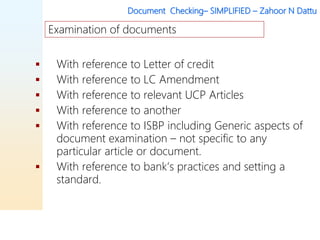

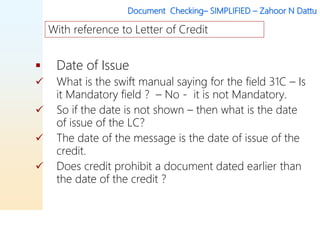

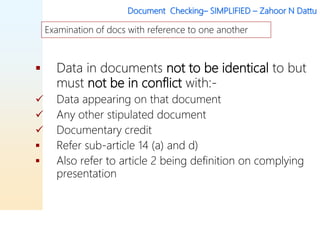

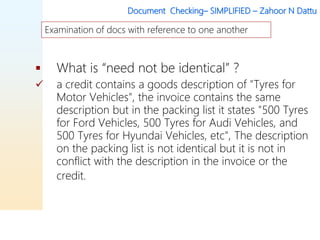

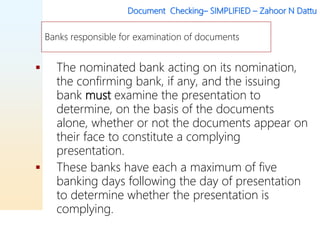

This document discusses key principles for examining documents presented under letters of credit. It addresses topics like determining the issuing and confirming banks responsible for examination, standards for assessing whether documents comply based on their face alone and consistency with each other and credit terms, generic examination practices informed by UCP 600 and ISBP, and discretion afforded to nominated banks. The overarching message is that document examination requires applying standard banking practices and rules like UCP 600 to make objective compliance determinations based solely on document content.

![Document Checking– SIMPLIFIED – Zahoor N Dattu

Corrections and alterations - Para A-7

• b. i. Any correction of data in a document, other than

in a document issued by the beneficiary, is to appear

to have been authenticated by the issuer or an entity

acting as agent, proxy or for [or on behalf of] the

issuer. Such authentication is to indicate the name of

the entity authenticating the correction either by use

of a stamp incorporating its name, or by the addition

of the name of the authenticating entity accompanied

by its signature or initials. In the case of authentication

by an agent or proxy, the capacity of acting as agent

or proxy for [or on behalf of] the issuer is to be stated.

Generic aspects of document examination – not

specific to any particular article or document](https://image.slidesharecdn.com/finalpresentationondocumentcheckingmay2021-210521162157/85/Final-presentation-on-document-checking-may-2021-50-320.jpg)