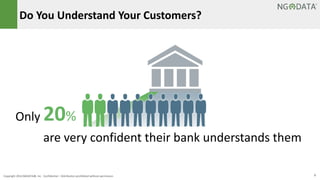

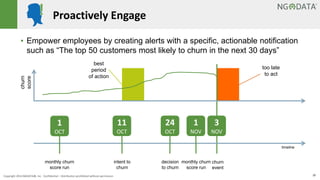

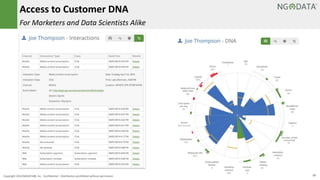

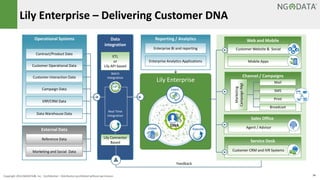

The document asserts that customer service is the most valued aspect for banking customers, even more than financial rates. It emphasizes the necessity for banks to utilize and leverage existing customer data to create personalized experiences and build customer loyalty. The collective insights recommend a shift towards a customer-centric approach, advocating for multi-channel engagement and proactive customer interaction to enhance satisfaction and retention.