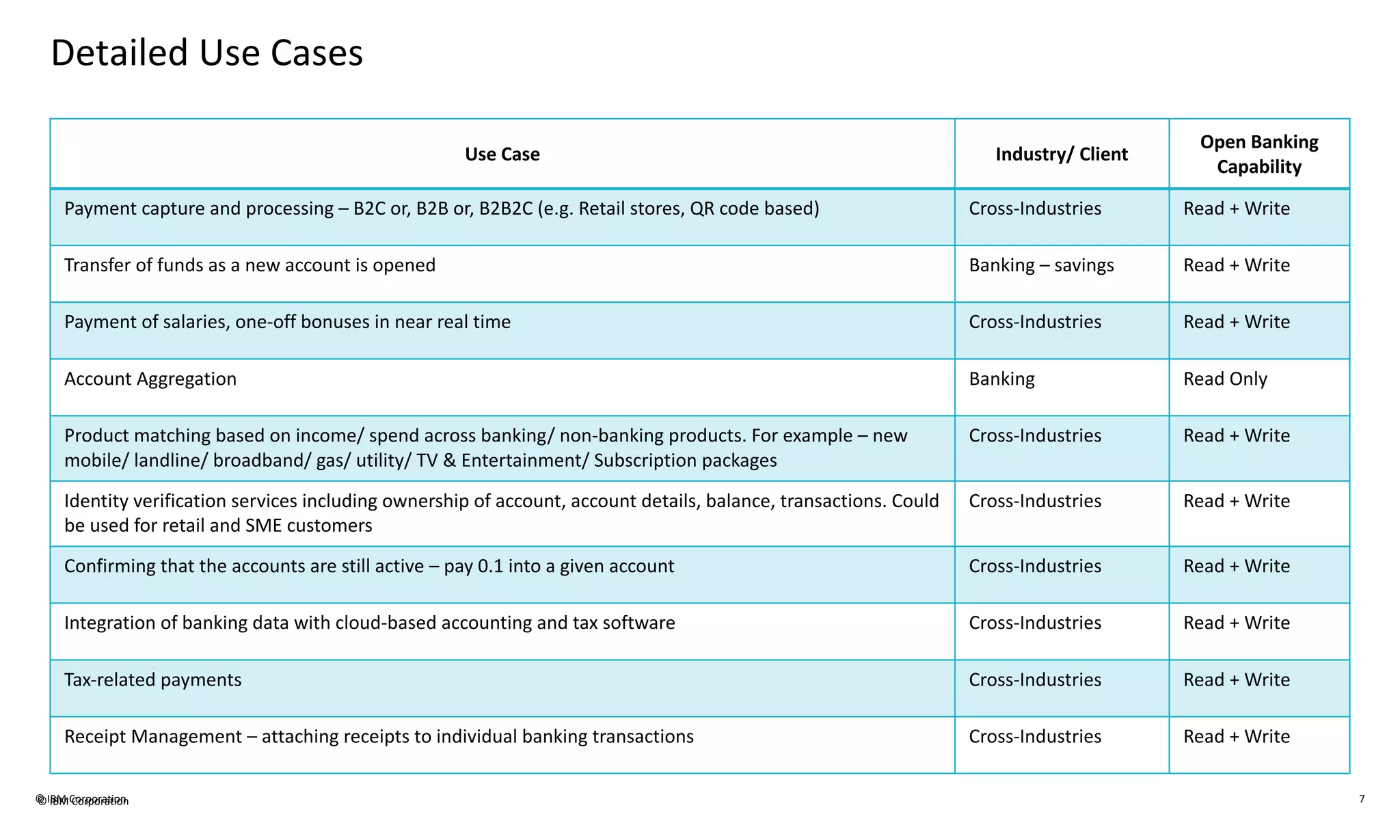

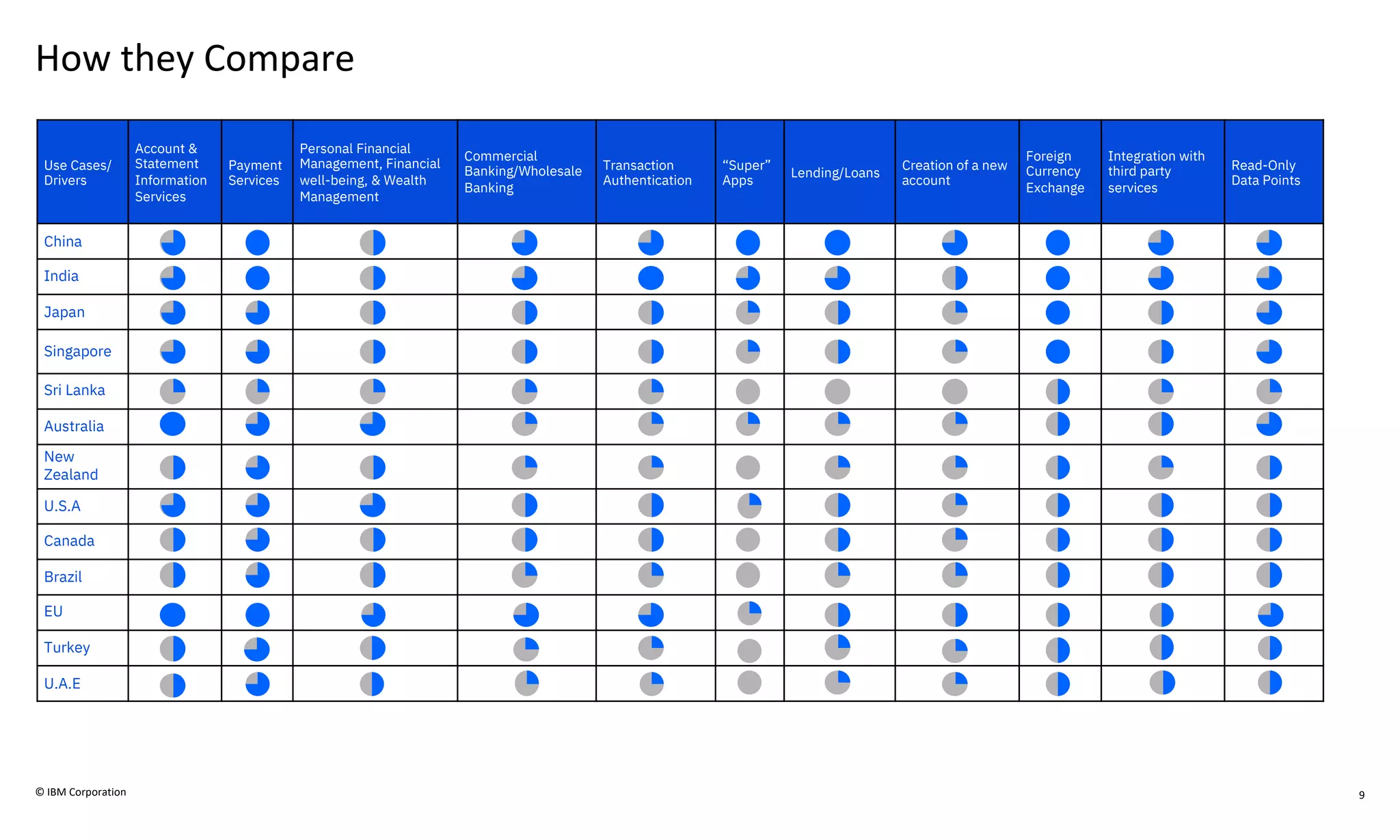

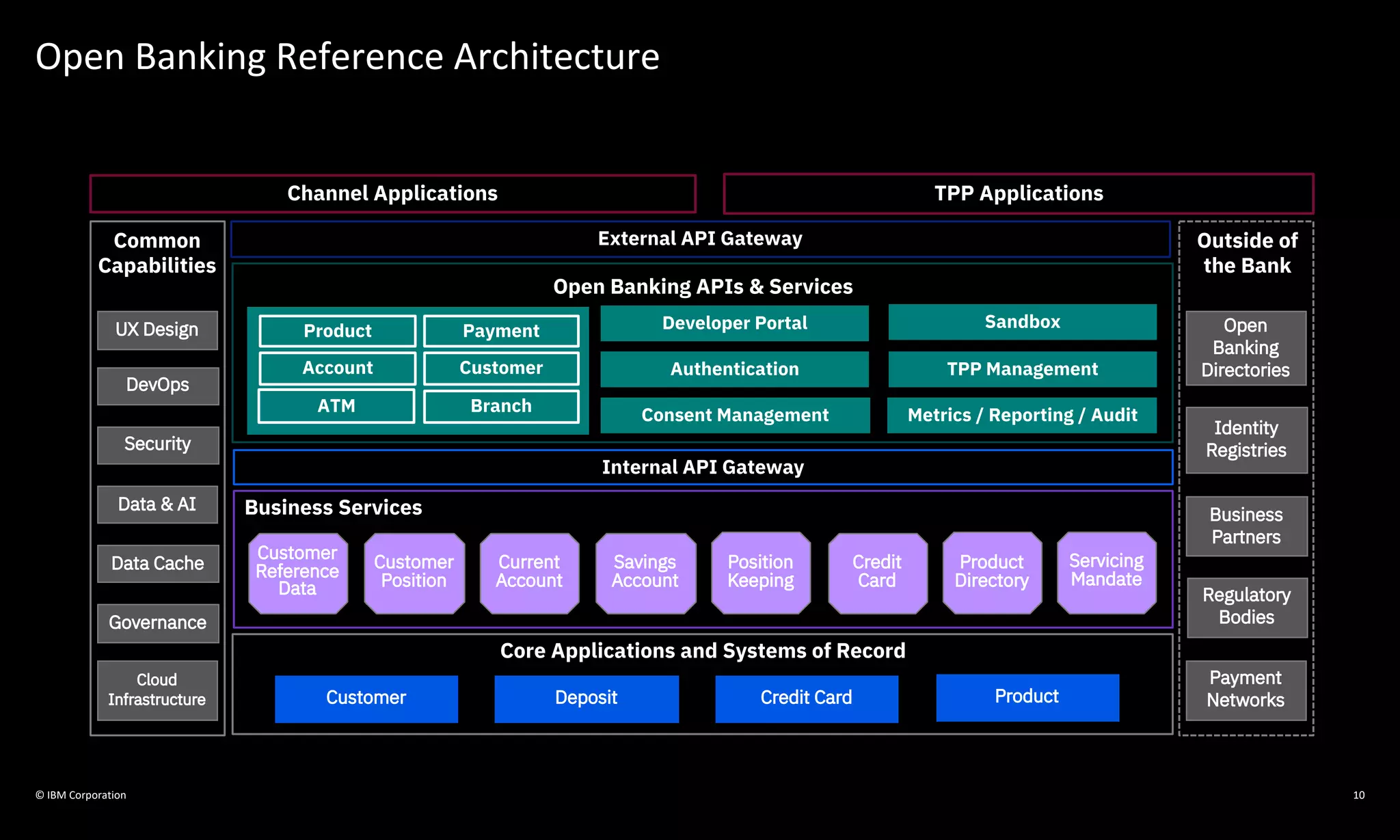

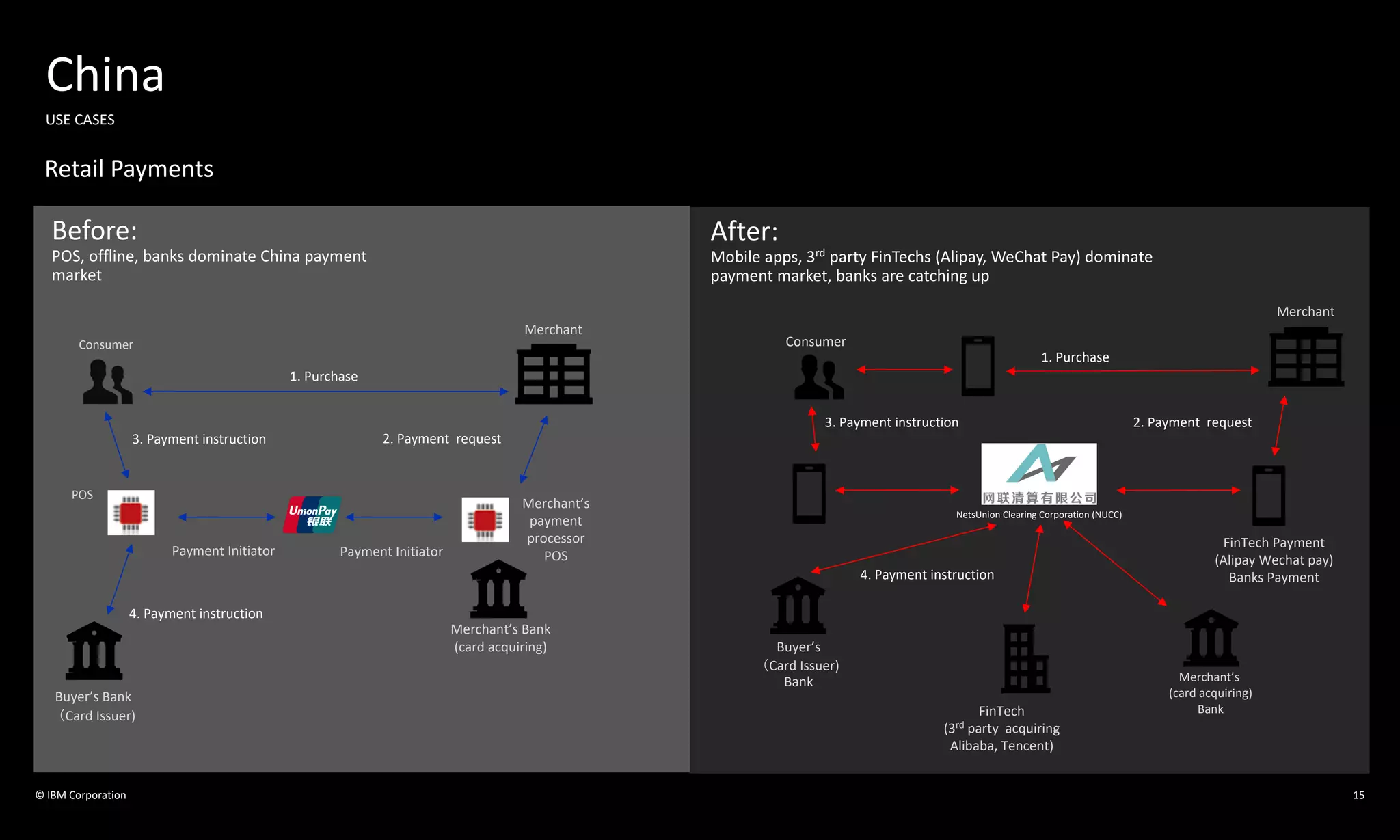

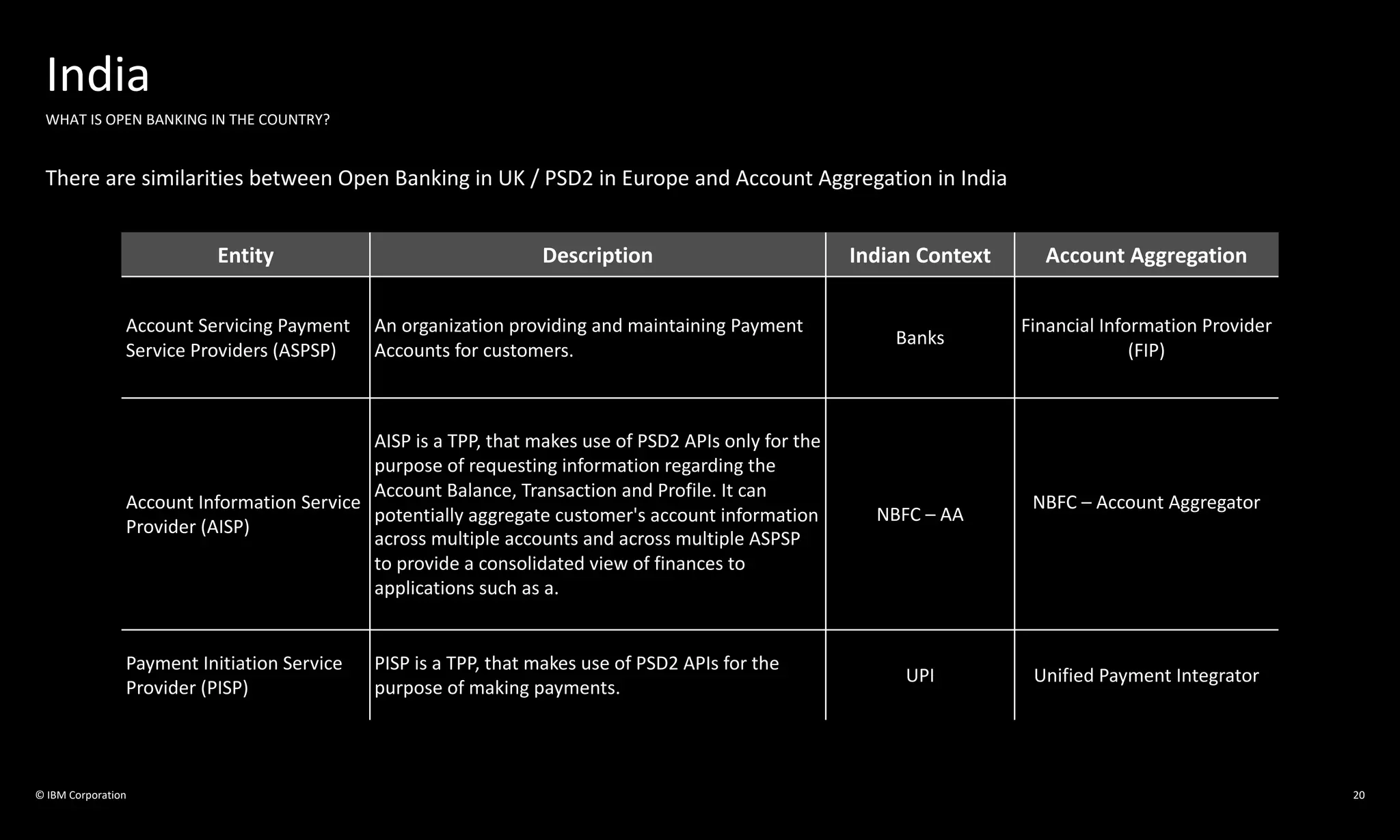

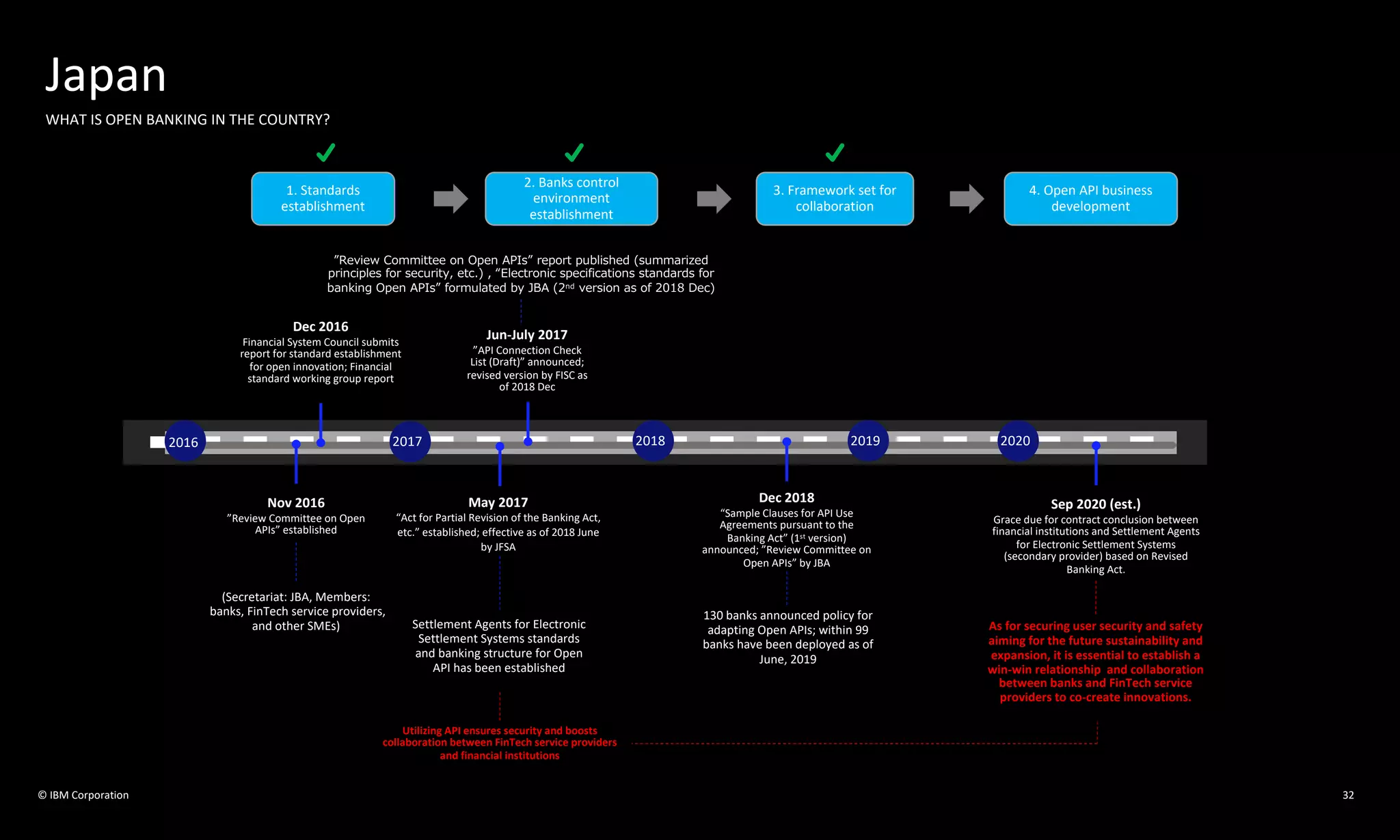

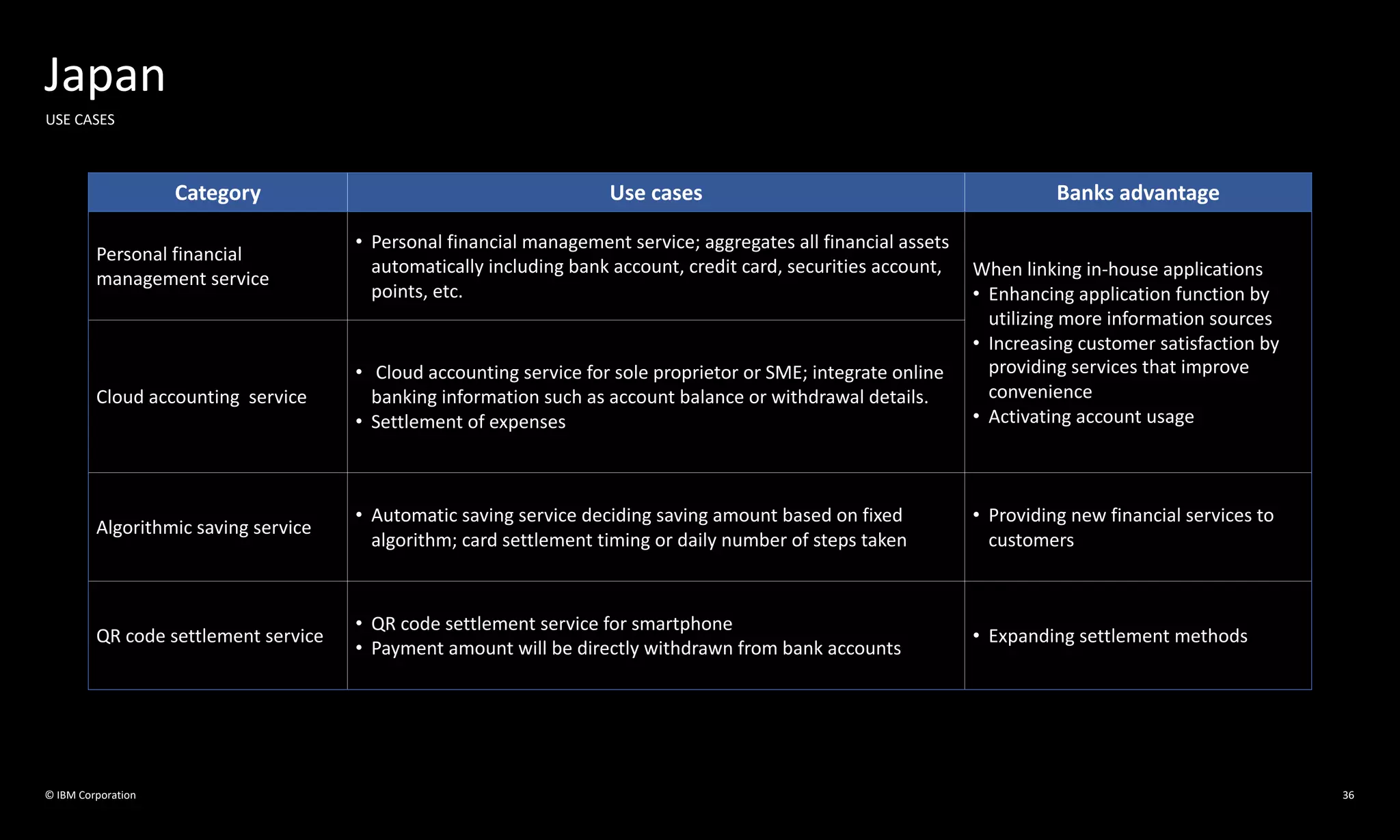

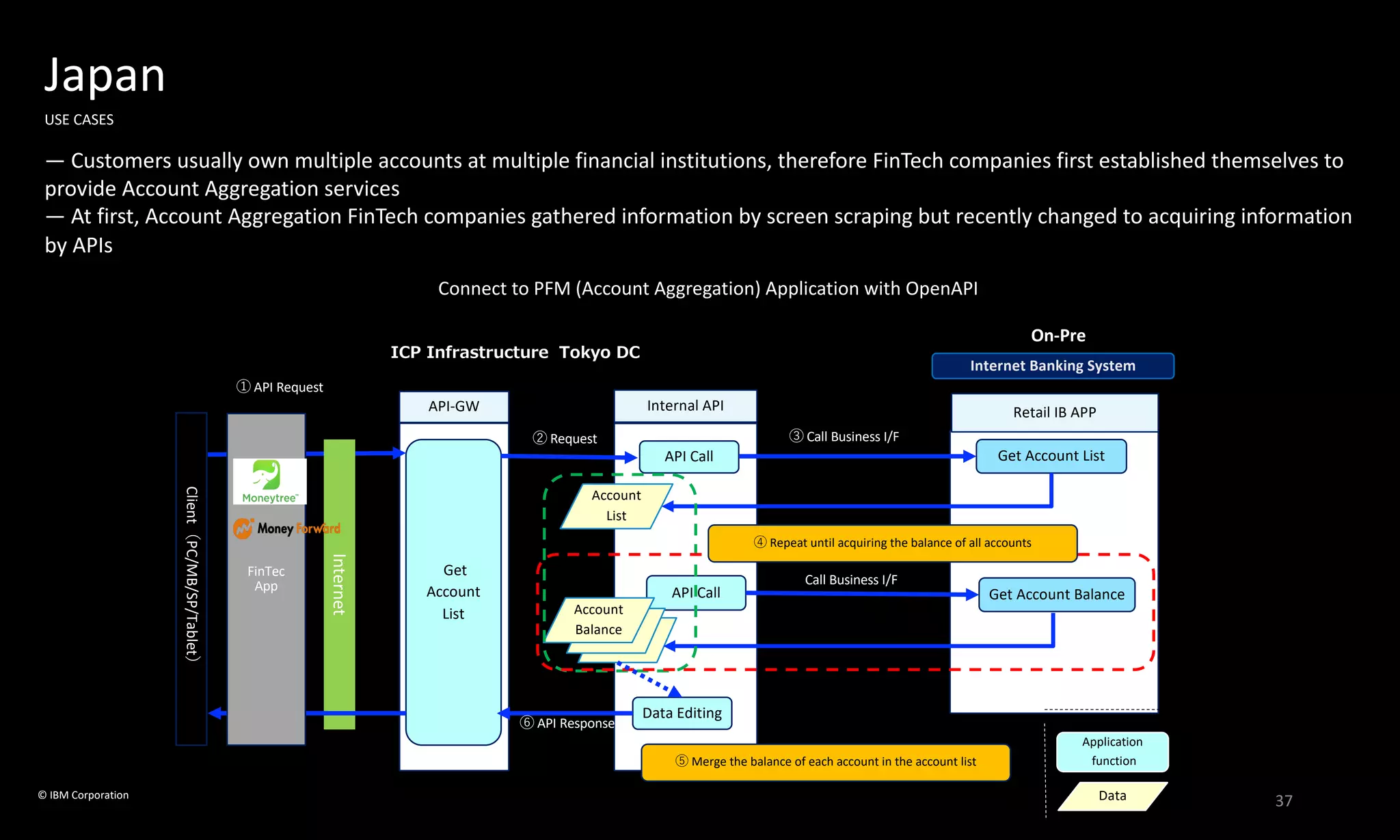

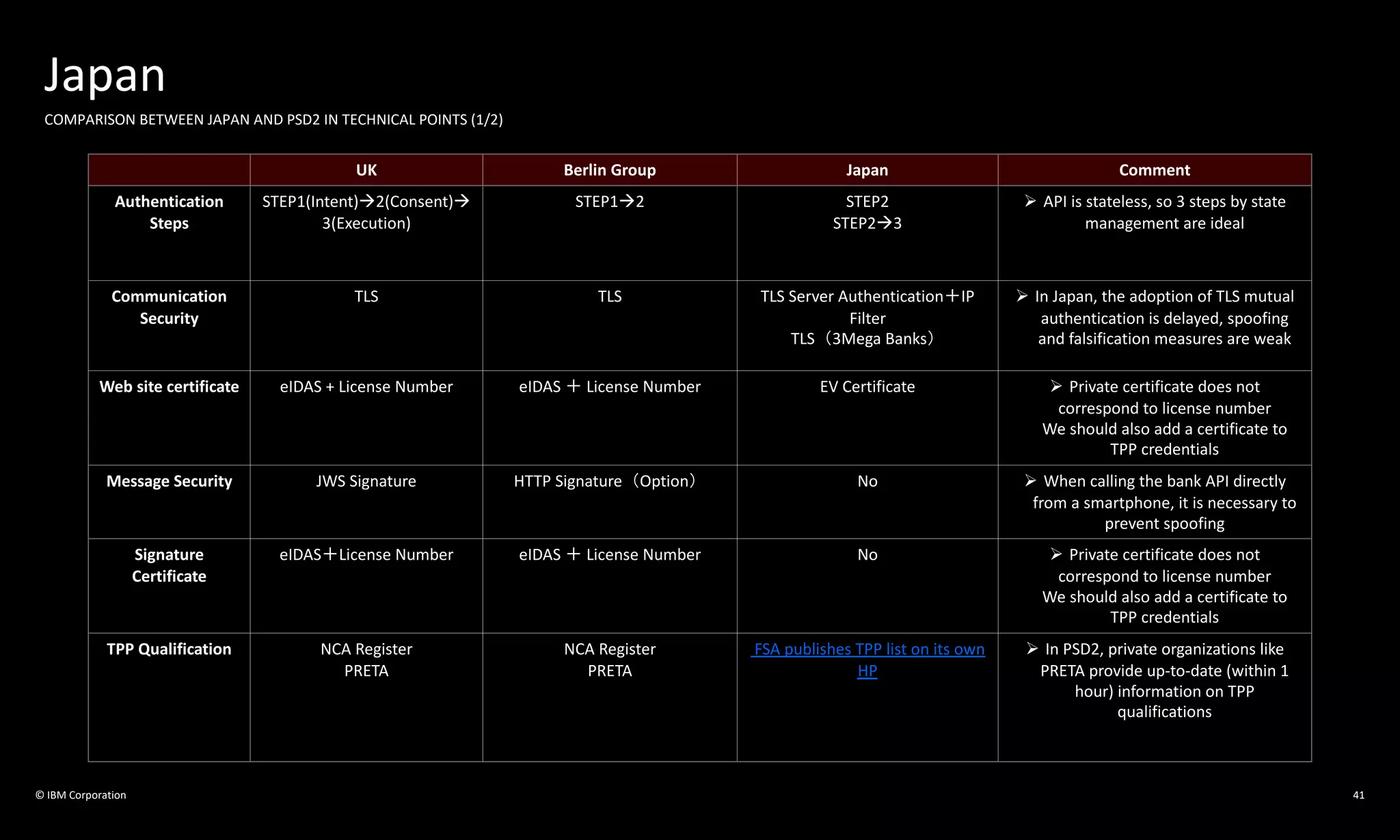

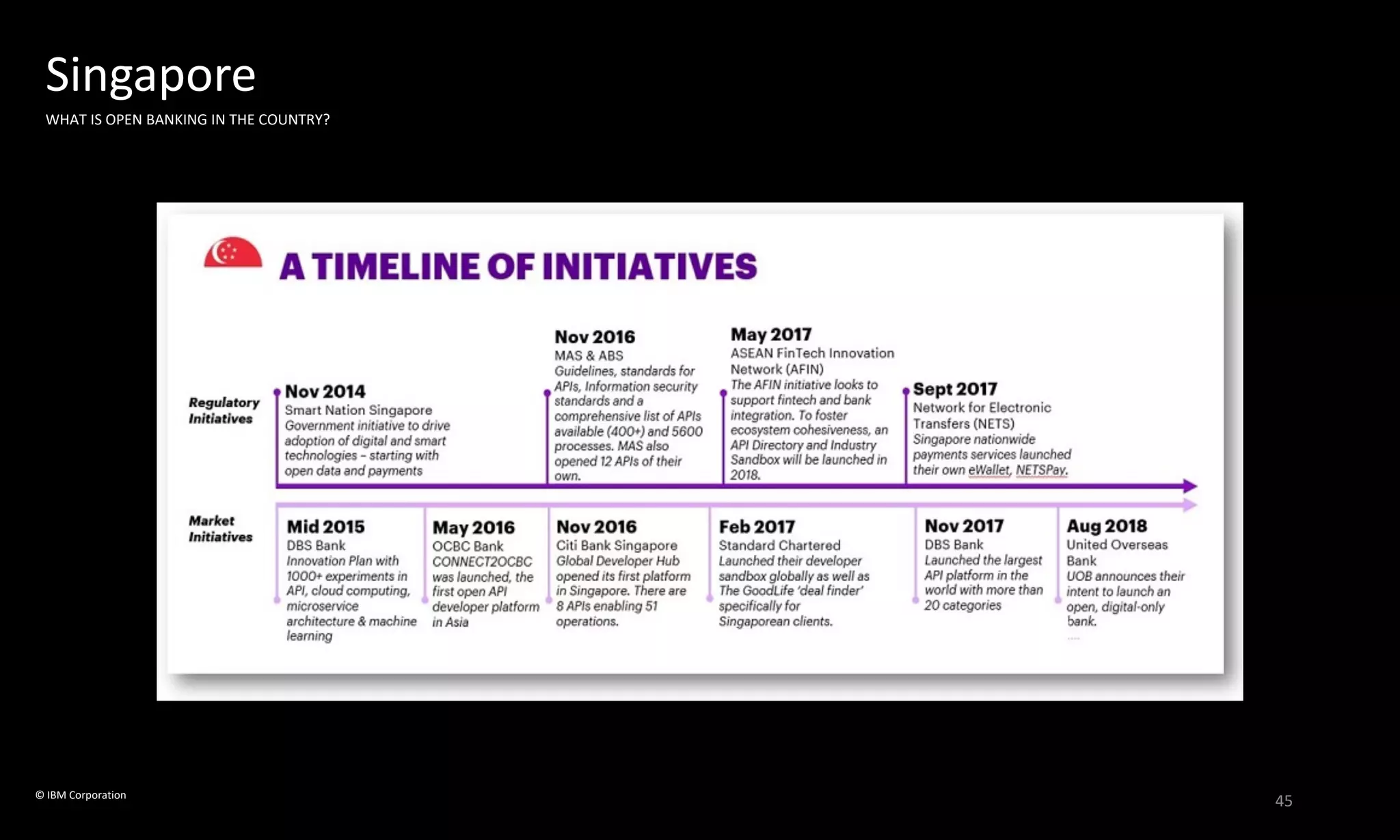

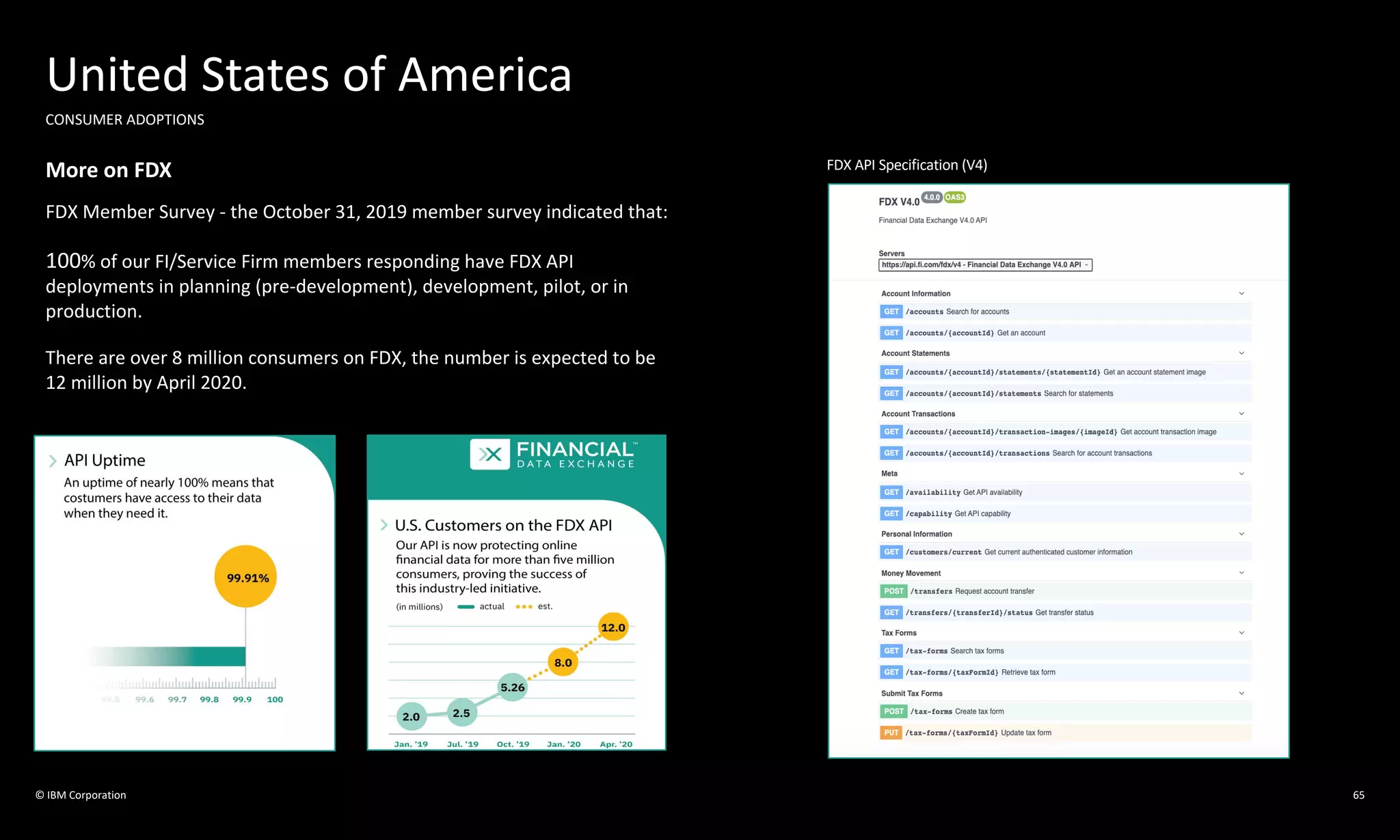

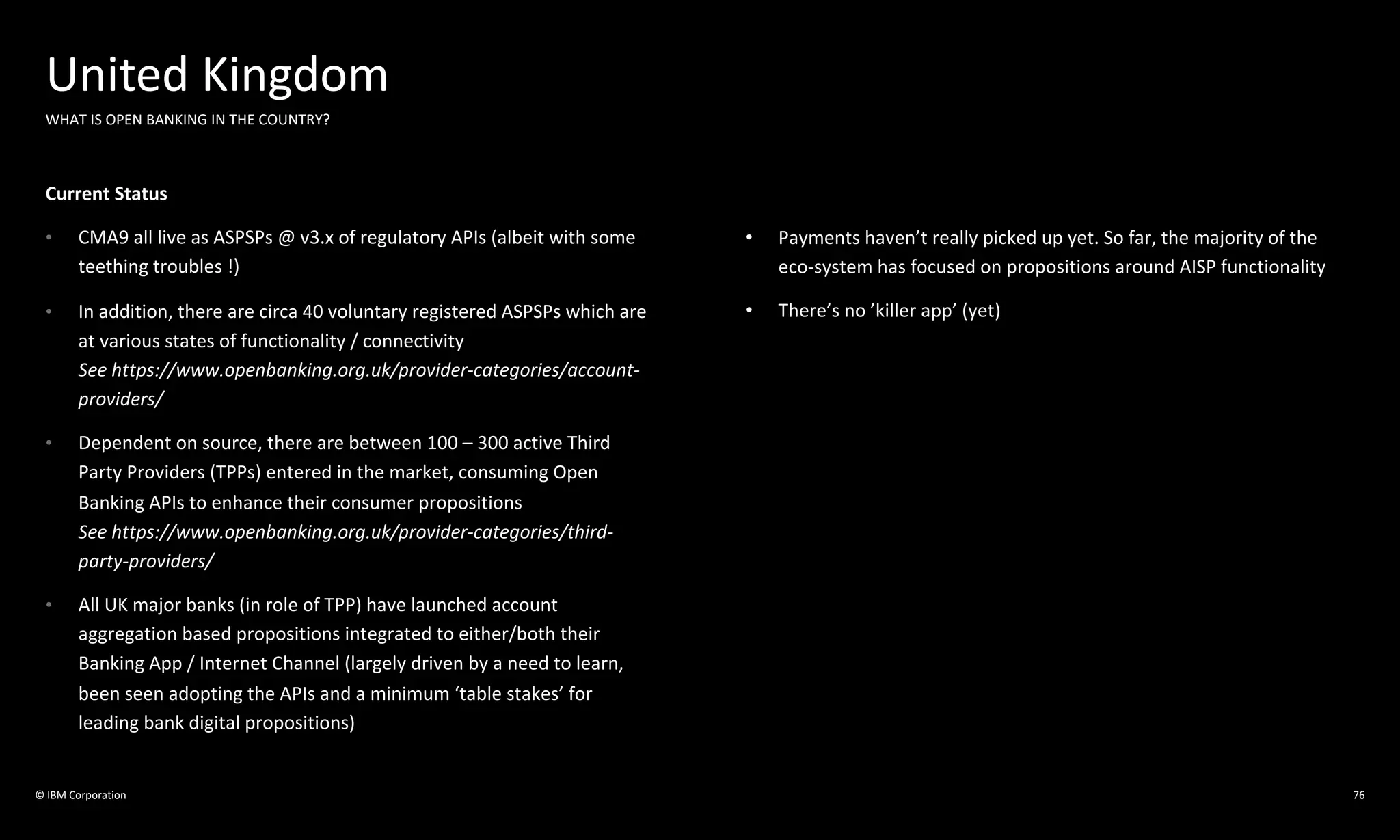

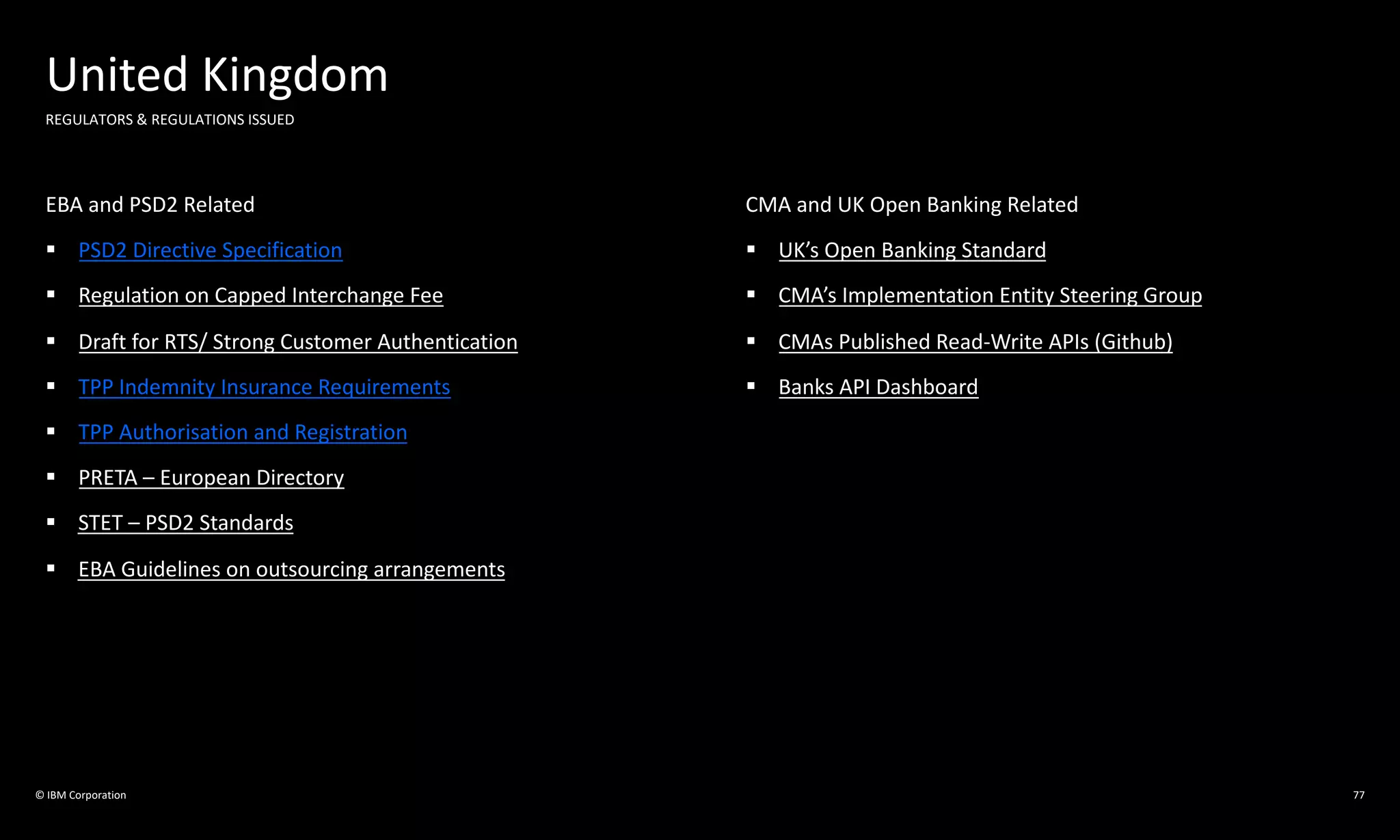

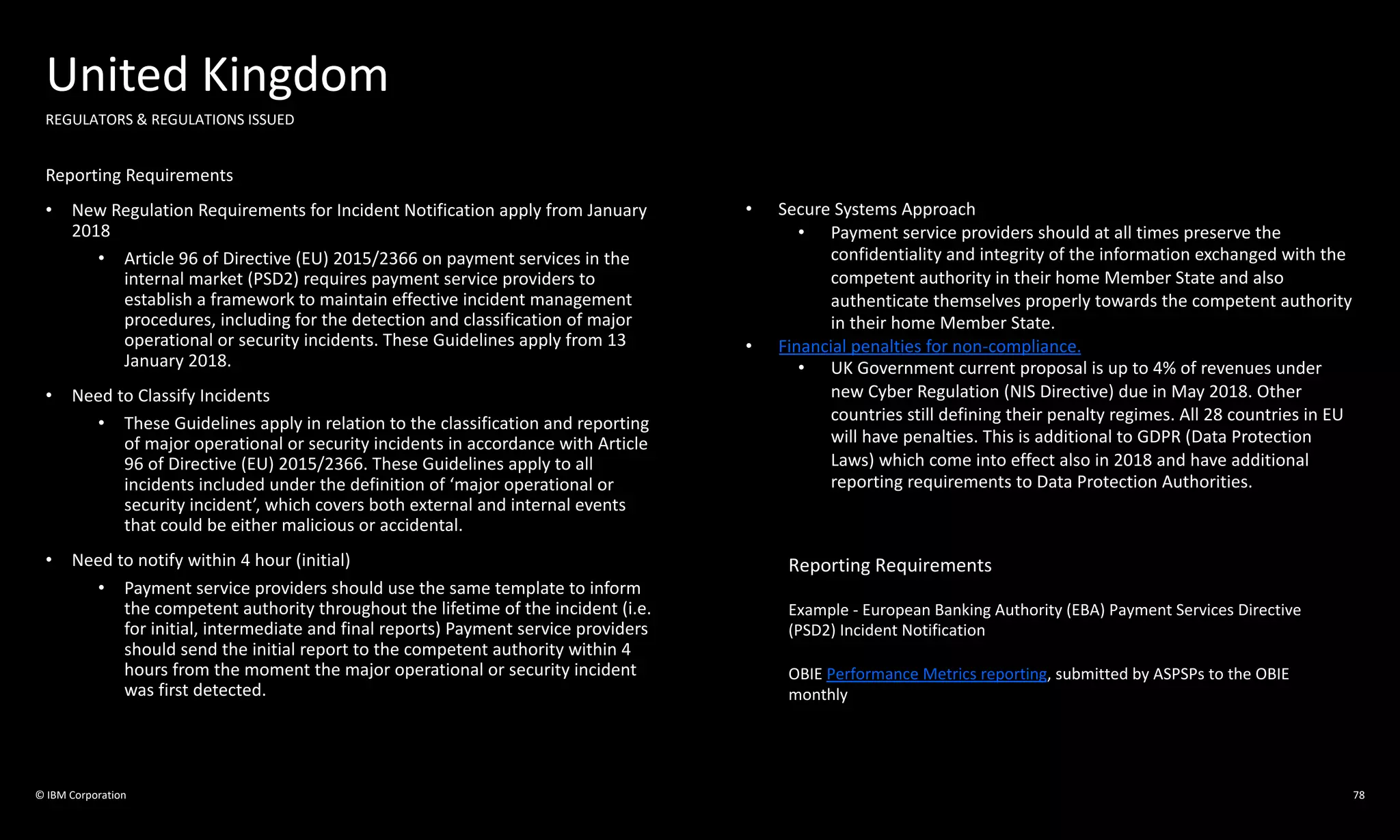

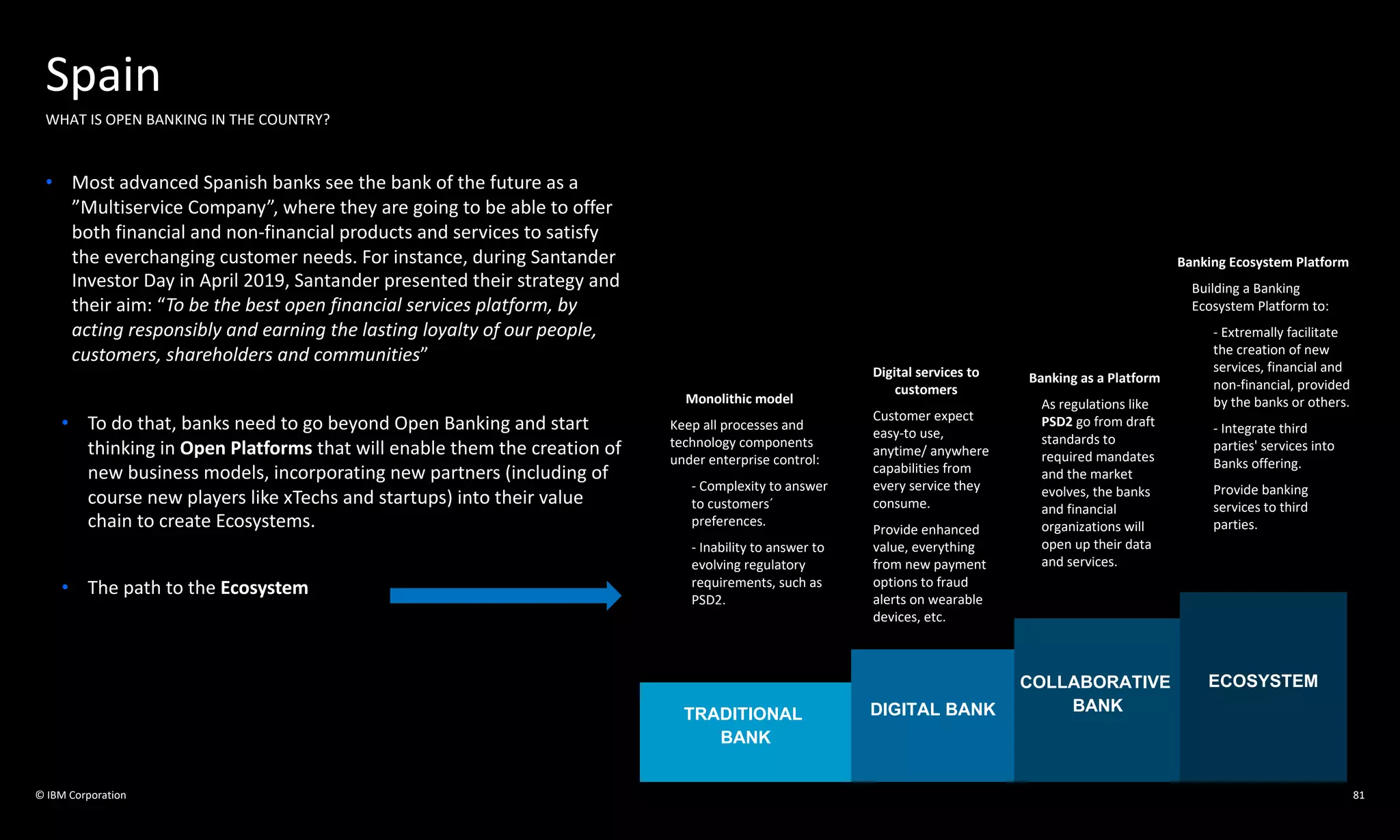

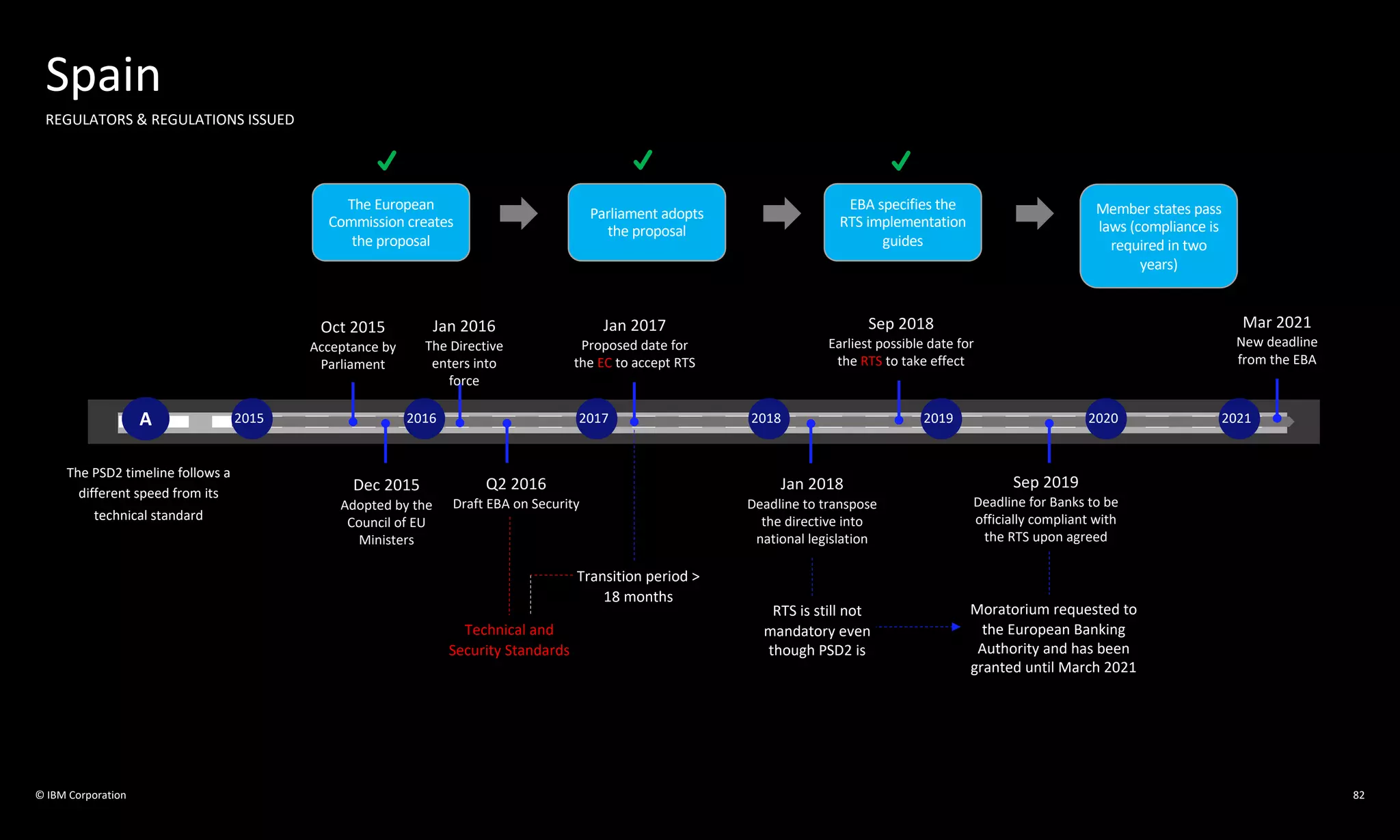

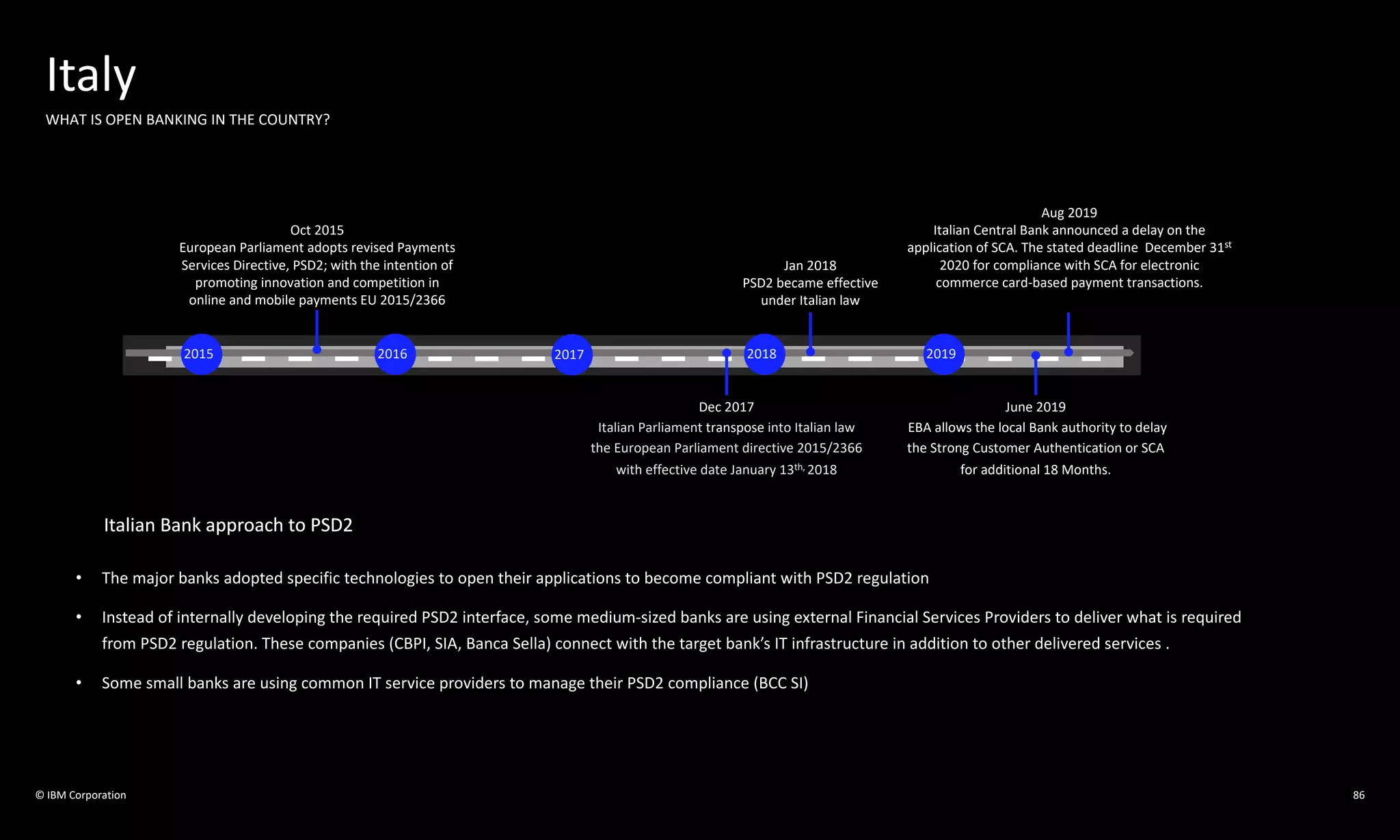

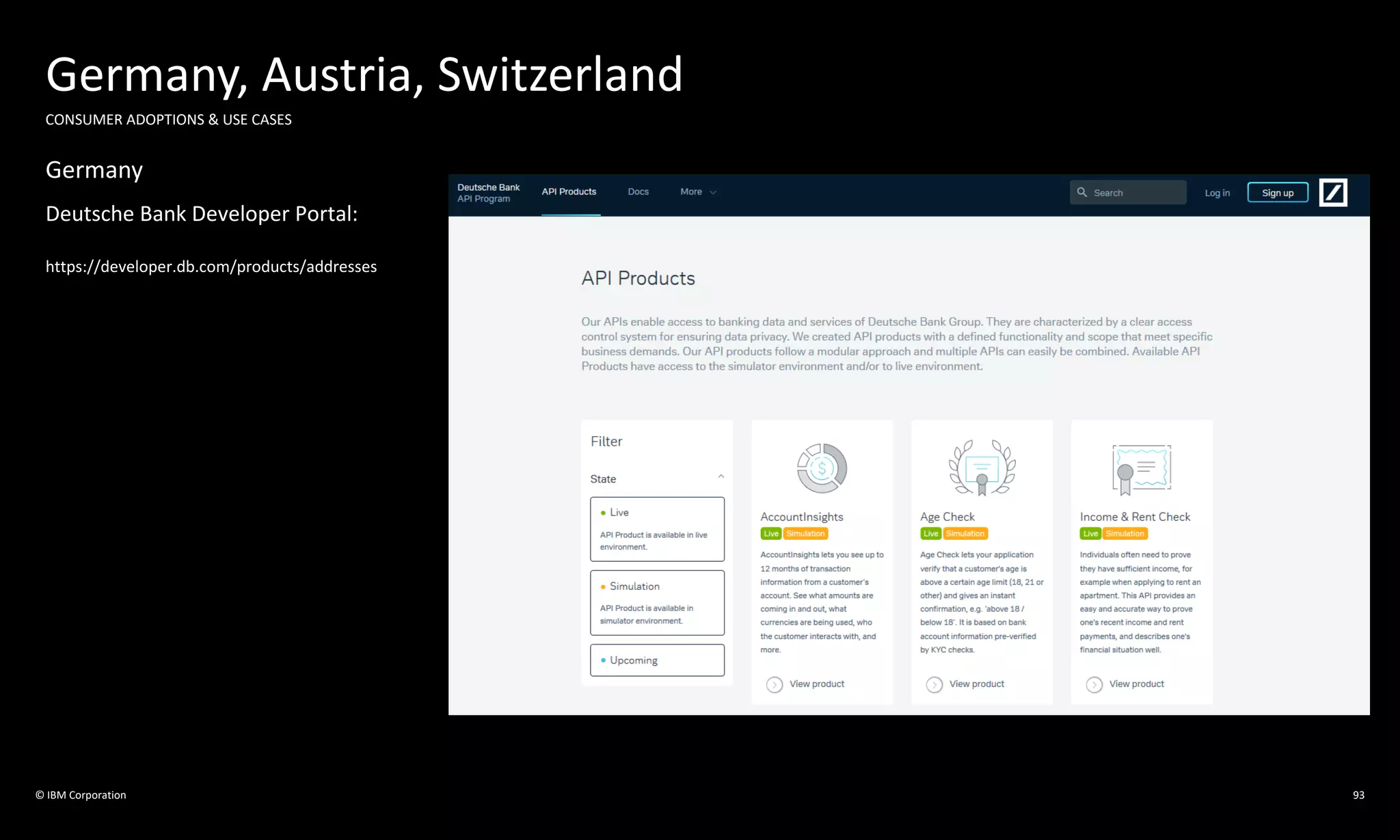

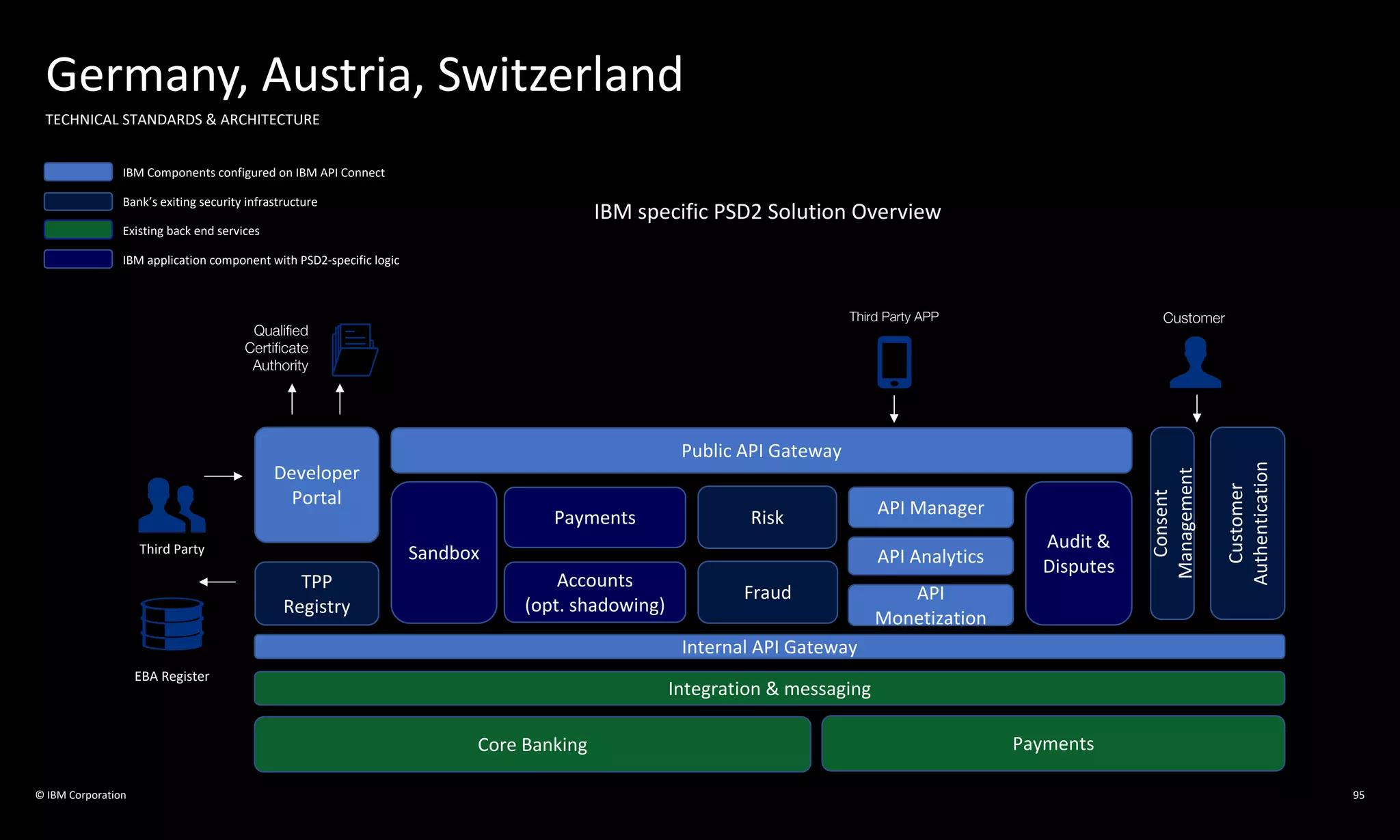

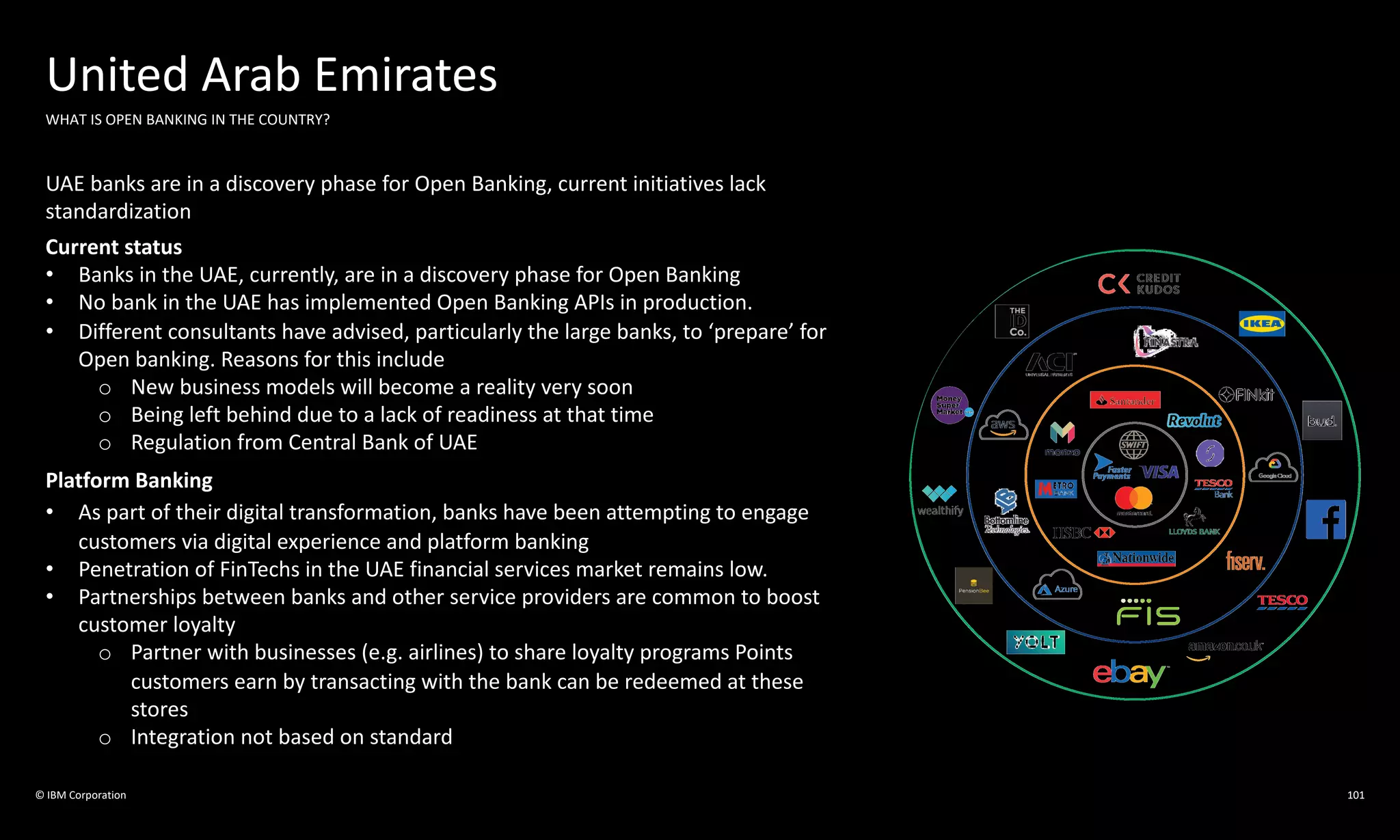

The document presents a comprehensive analysis of the global open banking landscape as of June 2020, detailing a joint initiative by IBM to evaluate the approaches of various countries towards open banking. It highlights the regulatory and market-driven initiatives, security challenges, and numerous use cases across multiple regions, alongside the technological frameworks that support open banking. Key outcomes include a consolidated view of opportunities for innovation, collaboration among banking entities, and a prioritization matrix relevant to financial services and fintech developments.