Embed presentation

Download to read offline

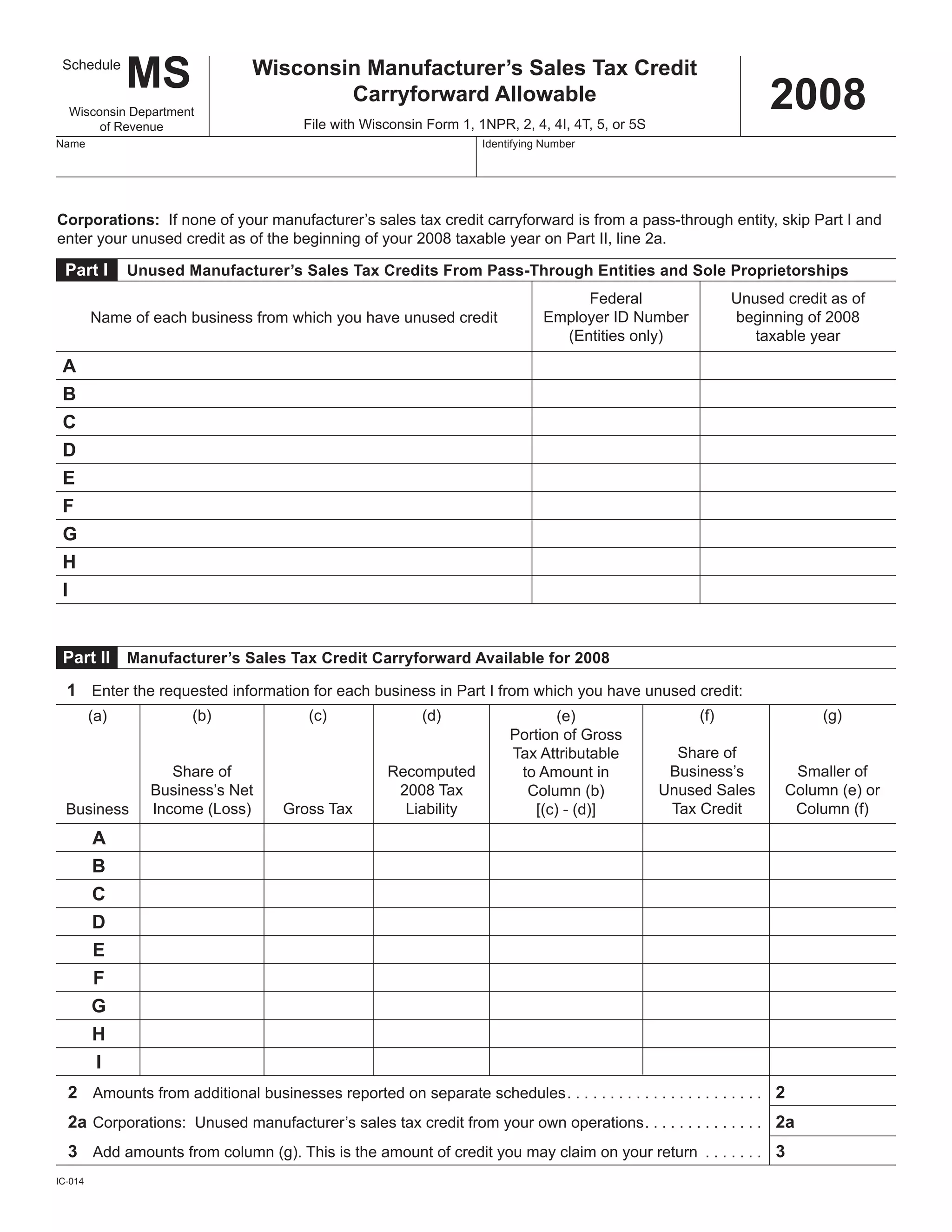

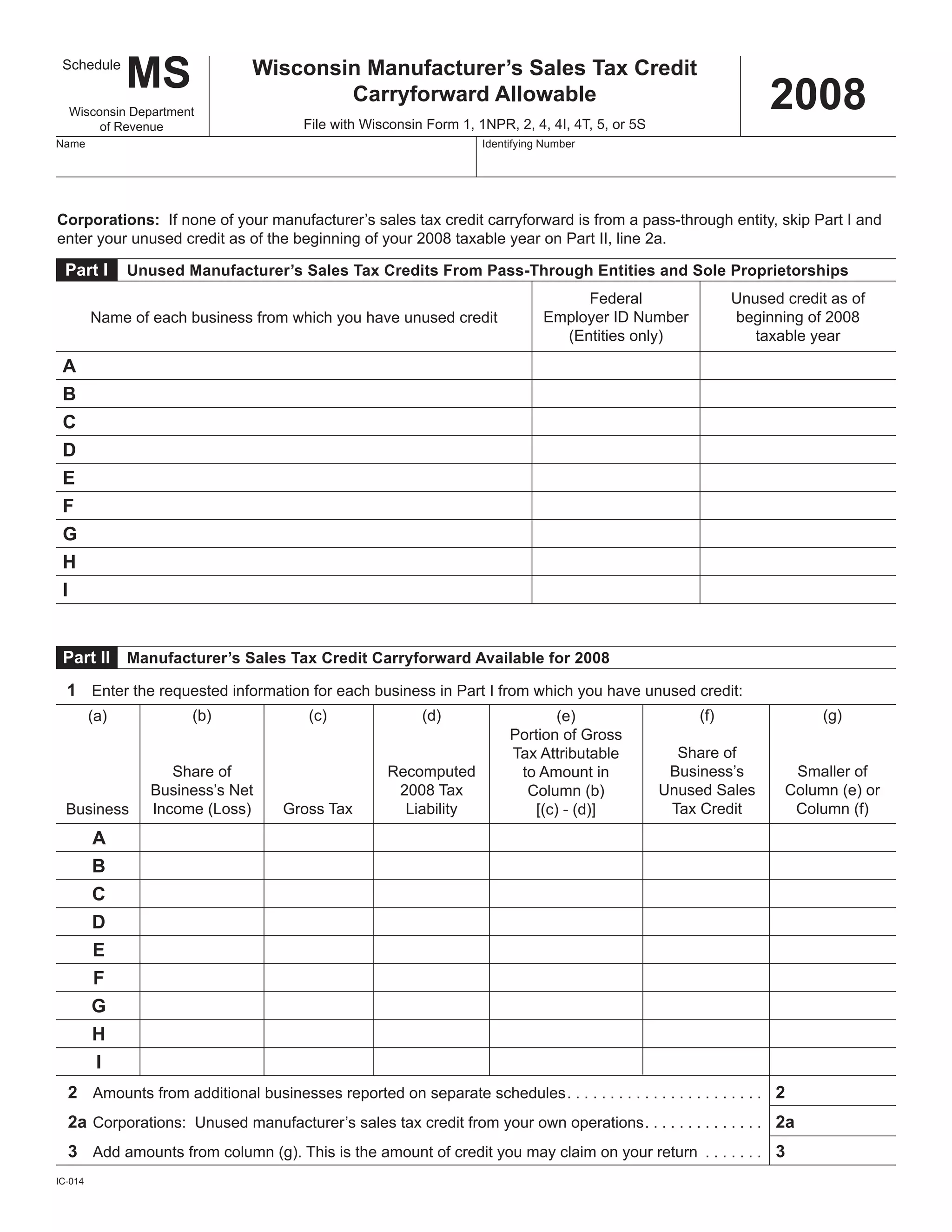

This document is a form for carrying forward unused Wisconsin Manufacturer's Sales Tax credits from previous years. It has two parts. Part I is for unused credits received from pass-through entities. Taxpayers must provide identifying information for these entities. Part II calculates the allowable carryforward amount, which is the smaller of the taxpayer's share of unused credit or the recomputed tax liability for each pass-through entity. The total allowable carryforward is entered on line 3.