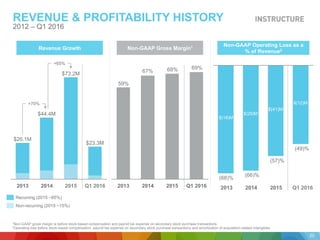

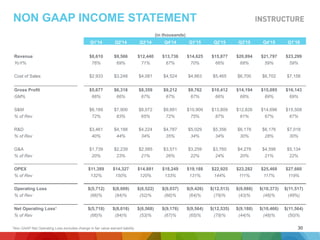

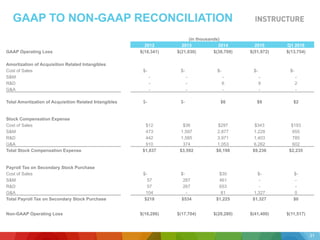

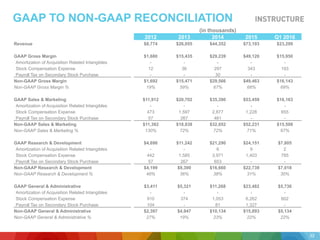

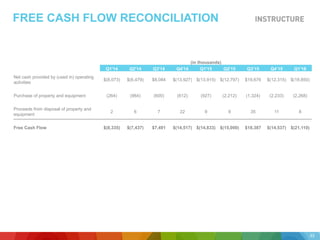

The document discusses forward-looking statements and non-GAAP measures. It notes that forward-looking statements involve risks and uncertainties that may cause actual results to differ from expectations. Non-GAAP measures are presented in addition to GAAP measures and have limitations when compared to GAAP. The document provides reconciliations of non-GAAP measures to the most directly comparable GAAP measures.