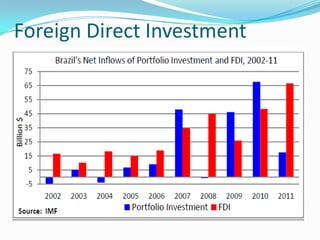

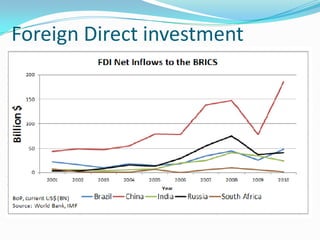

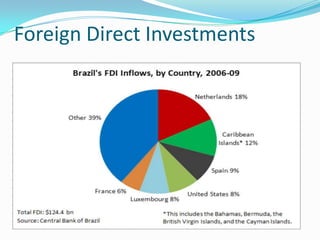

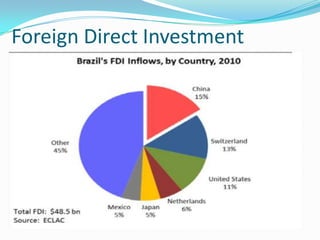

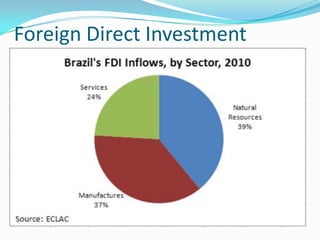

This document provides an overview of Brazil, including its general facts, foreign direct investment, and hot topics. Brazil gained independence in 1822 and is located in South America. It has a population of over 193 million people and its capital is Brasilia. Brazil receives large amounts of foreign direct investment as the 5th largest recipient globally and 8th largest economy. However, it also faces challenges like wealth disparity and a complex regulatory environment. Hosting the 2014 World Cup and 2016 Olympics will drive infrastructure improvements and boost Brazil's economy and tourism.