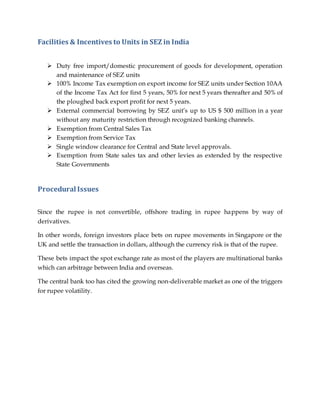

The document discusses the Indian government's proposal to set up financial services special economic zones (SEZs) in India. It notes that the finance minister proposed this idea before the 2015 budget to create high-value jobs and connect India to global financial markets. Financial SEZs would offer tax breaks and exemptions from certain taxes to attract financial firms. They would allow activities like brokerage, investment management, and establishing international exchanges for trading various assets. The government hopes this can help develop India as a global financial center and reduce offshore trading of the rupee. One such proposed financial SEZ is the Gujarat International Finance Tec-City (GIFT) project in Gujarat.