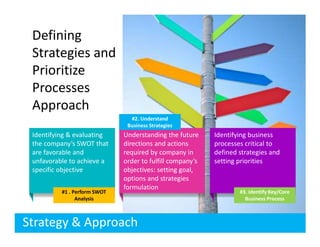

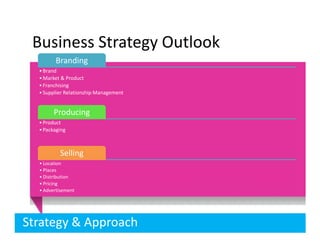

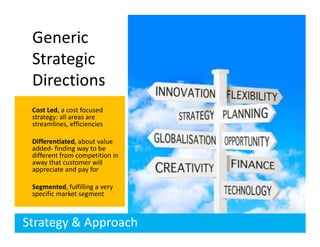

This document discusses strategies for fashion retail in Indonesia. It provides background on Indonesia's economy and the textile industry. Retail sales are forecast to grow substantially through 2015 due to economic growth, population expansion, and rising incomes. International brands are entering the market. Successful strategies include understanding business objectives, identifying core processes, and developing brand, product, and distribution strategies. Recommendations for market growth include integrating online and offline experiences, understanding customer segments, and redefining retail locations using technology and unique designs. The future of Indonesian retail is promising due to a growing middle class seeking quality fashion brands.