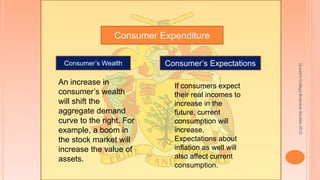

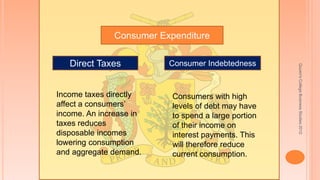

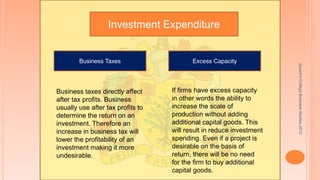

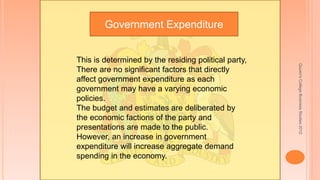

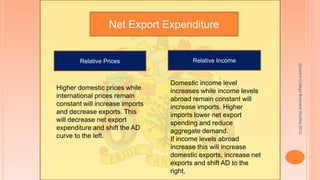

The document discusses factors influencing consumer spending and investment in the economy, including consumer wealth, expectations, taxes, and interest rates. It highlights how an increase in wealth can boost aggregate demand, while rising taxes and interest rates can reduce consumption and investment. Additionally, it addresses the effects of government expenditure and exchange rates on net exports and overall economic demand.