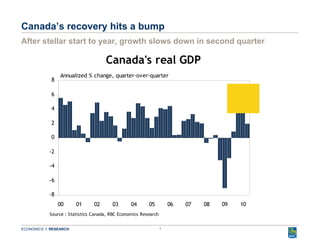

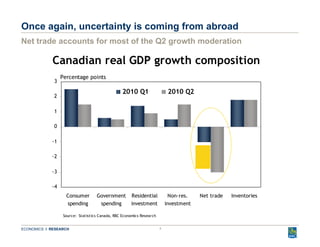

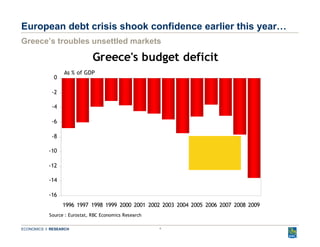

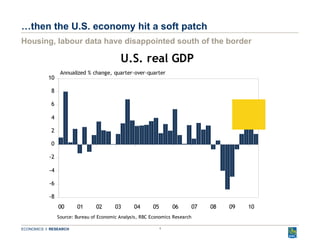

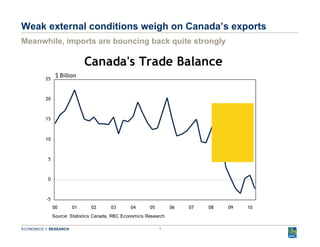

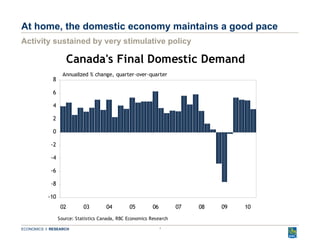

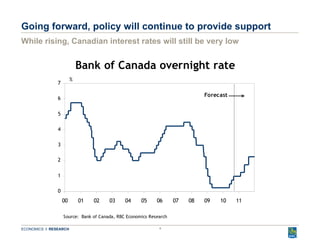

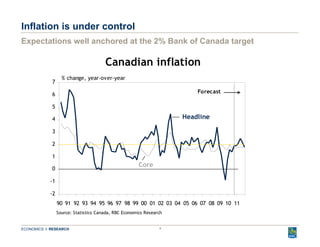

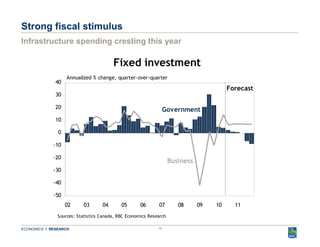

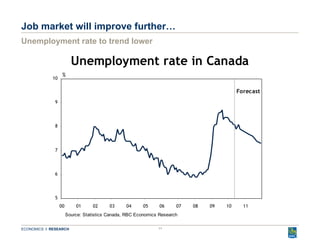

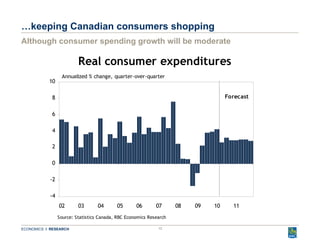

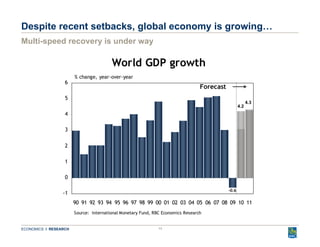

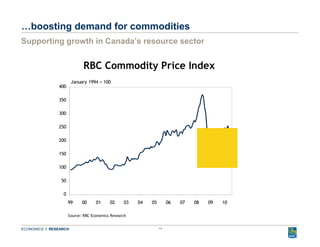

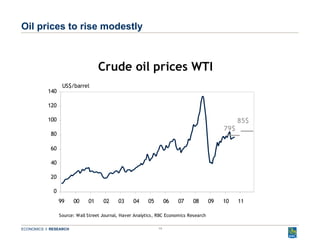

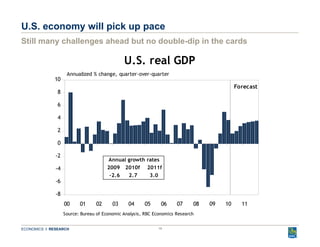

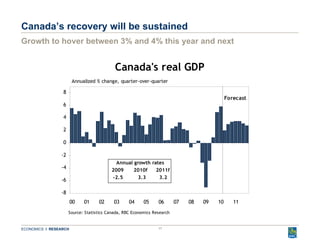

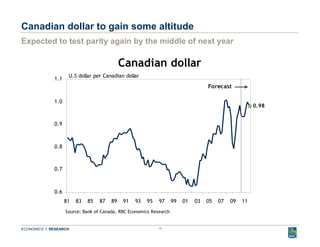

Canada's economic recovery slowed in the second quarter after a strong start to the year, with net trade accounting for most of the moderation due to weak external conditions weighing on exports and strong import growth. However, domestic economic activity is being sustained by stimulative monetary and fiscal policies, and growth is expected to hover between 3-4% in 2010 and 2011, supported by a strengthening job market and consumer spending. Commodity prices are also expected to support growth in Canada's resource sector.

![Who said the recovery would be easy? Outlook for Canada’s Economy ECONOMICS I RESEARCH Robert Hogue Senior Economist [email_address] Transportation Strategy: Planning for 2011 in Uncertain Times Mississauga, September 14, 2010](https://image.slidesharecdn.com/roberthogue-100915150812-phpapp02/75/Outlook-for-Canada-s-Economy-1-2048.jpg)