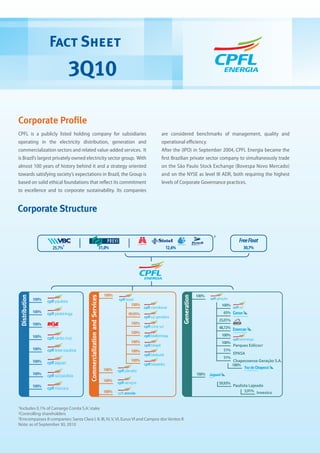

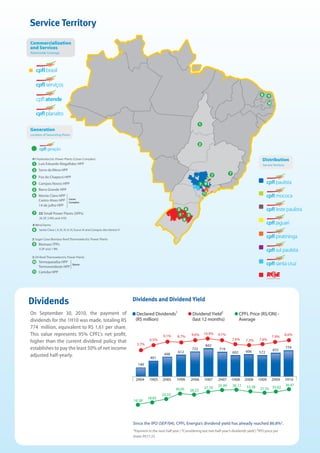

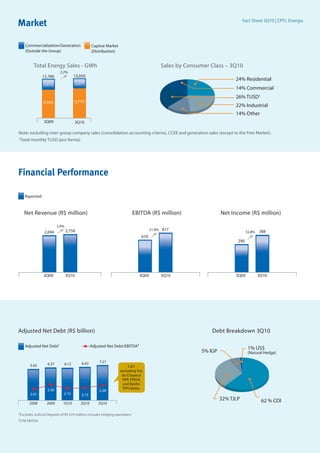

CPFL is Brazil's largest privately owned electricity sector group. It operates in electricity distribution, generation and commercialization sectors. CPFL became the first Brazilian private sector company to trade on the São Paulo Stock Exchange and NYSE, requiring the highest levels of corporate governance. The company has a nationwide presence in Brazil through its subsidiaries operating in distribution, generation, commercialization and related services.