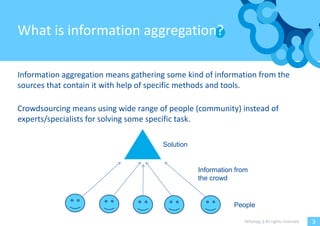

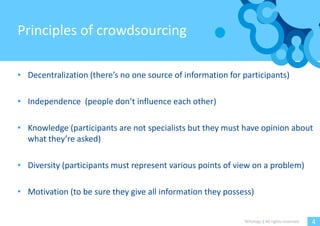

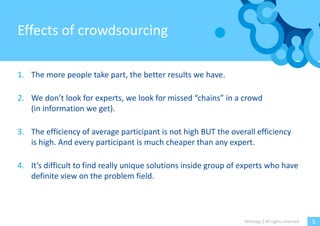

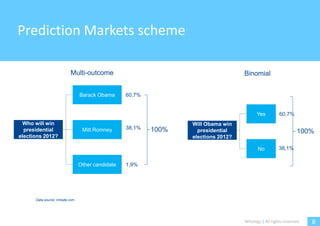

This document discusses how prediction markets use crowdsourcing and collective intelligence to aggregate information and predict future events. Prediction markets allow participants to buy and sell contracts tied to particular outcomes, and the resulting market prices are interpreted as probabilities of those outcomes occurring. Prediction markets have been shown to accurately predict election results and aggregate insider information. However, they face challenges around liquidity and legal issues in some jurisdictions. The document provides examples of social prediction markets and companies that utilize prediction markets internally.