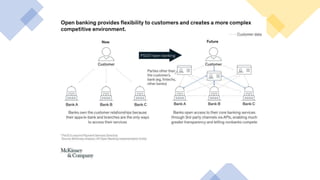

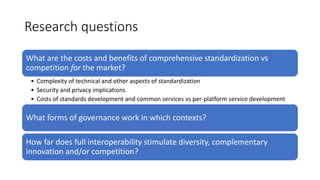

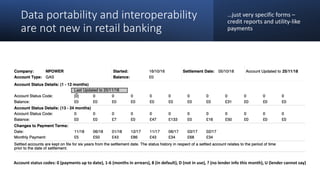

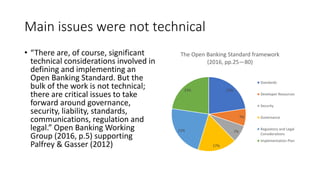

The document discusses the importance of interoperability in UK open banking, emphasizing how it can enhance competition and user experience by allowing customers to use services from different providers seamlessly. It explores various forms of interoperability governance, the complexities involved in standardization, and technical challenges faced in implementation while highlighting that most issues are not technical but relate to governance and security. The conclusion suggests that while open banking could prompt significant changes, it may not directly address the vulnerabilities of certain consumer groups.