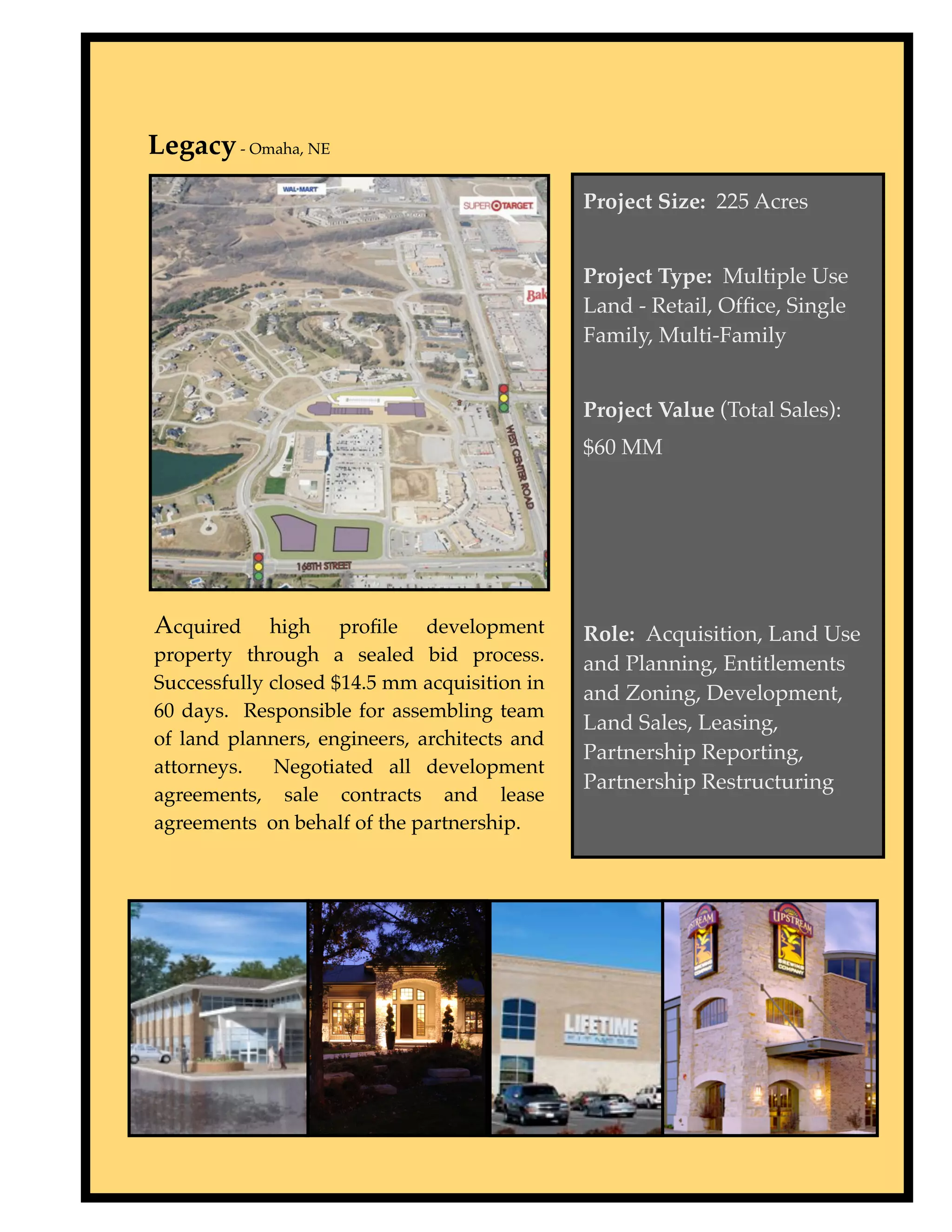

This document summarizes the professional experience of an individual with over 17 years of experience in real estate investment, development, finance, leasing, and operations totaling over 4.5 million square feet of commercial property. They have expertise in areas such as joint ventures, financial modeling, debt and equity structuring, development, leasing, acquisitions, and asset management. They have experience identifying investment opportunities, structuring joint ventures, negotiating anchor store agreements, closing property sales, and structuring financing.