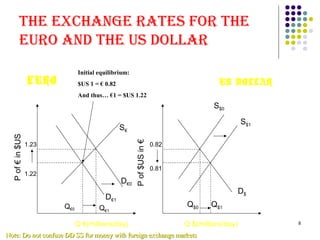

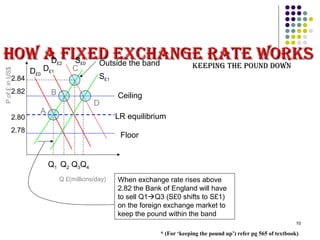

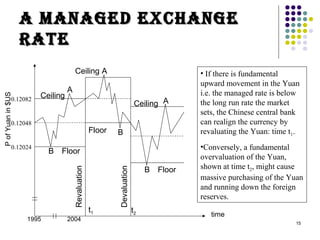

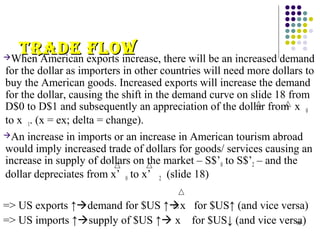

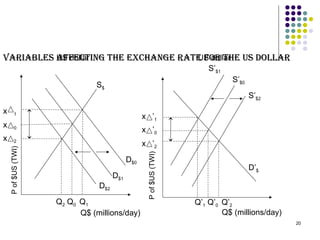

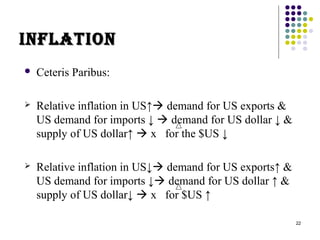

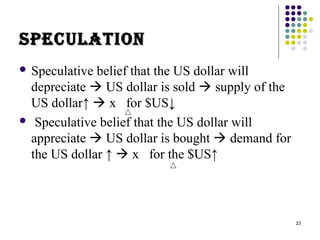

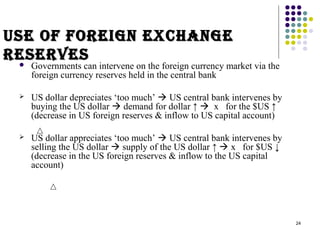

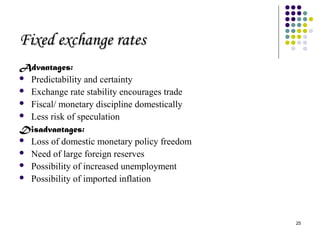

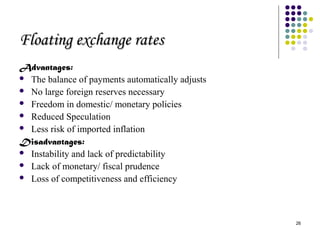

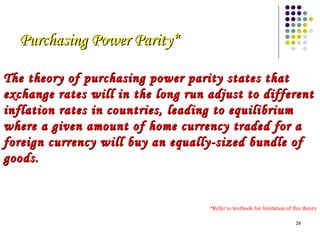

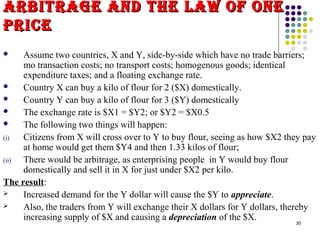

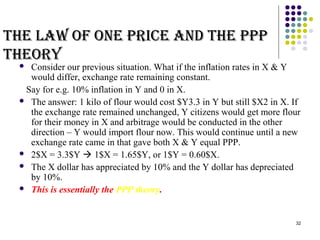

The document discusses exchange rates, defining them as the price of one currency in terms of another, and explains how they are influenced by demand and supply factors in the foreign exchange market. It outlines types of exchange rate systems, including fixed, floating, and managed exchange rates, detailing central bank interventions and factors affecting currency values. Additionally, the document touches on concepts like appreciation and depreciation of currencies, as well as the role of speculation and interest rates in determining exchange rates.