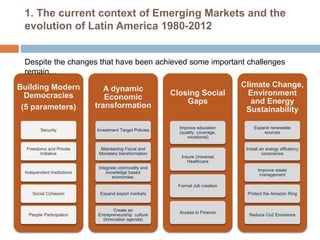

1. The document discusses how policies can dramatically impact the development of emerging markets, using Latin America as a case study.

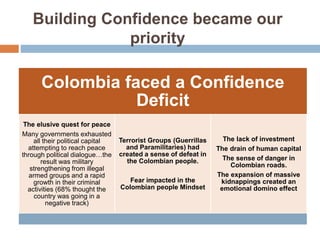

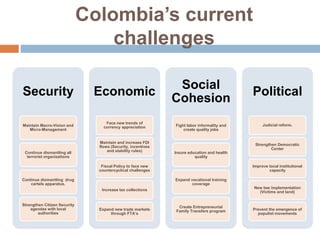

2. It outlines two main policy paths in Latin America - the ALBA model of Venezuela, Ecuador, Bolivia, Nicaragua and Cuba, which is anti-US, anti-free trade and lacks investment confidence; and the modern democratic center countries that cooperate with the US, support free trade and have greater political stability.

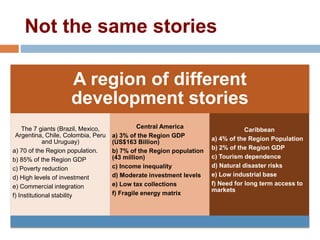

3. The democratic center countries leading investment and growth are Mexico, Brazil, Chile, Colombia and Peru. The document analyzes some of the main policy challenges still facing countries in the region like improving education and social programs in Peru, and restoring fiscal credibility in Argentina