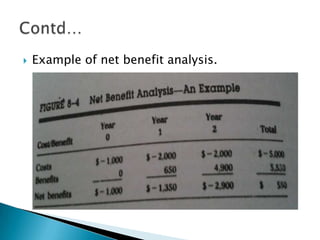

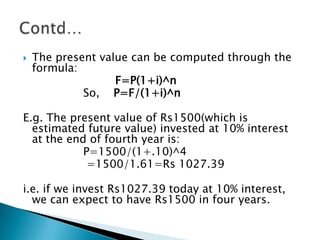

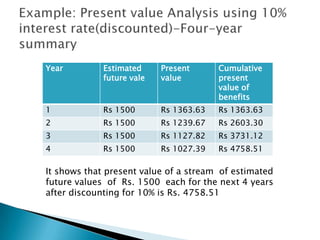

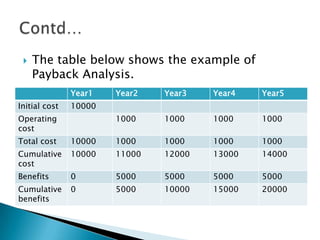

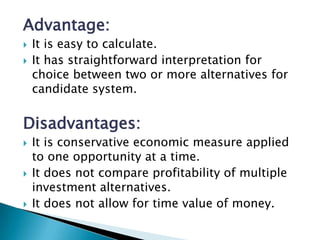

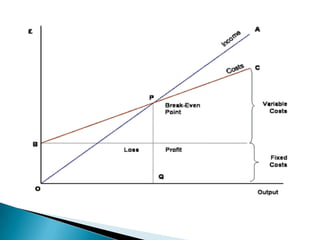

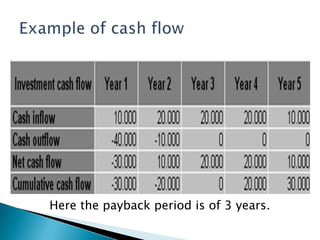

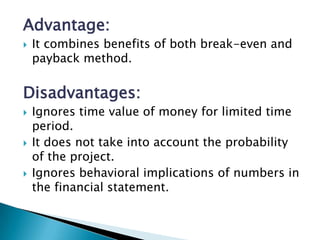

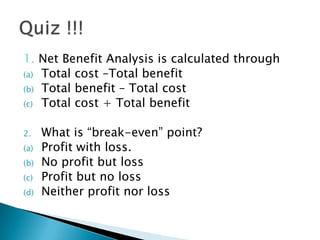

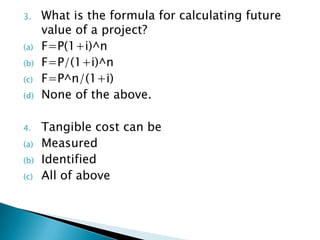

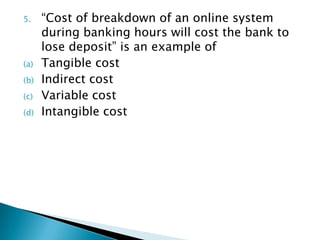

The document discusses cost-benefit analysis and various methods used to evaluate costs and benefits of projects. It defines key terms like tangible/intangible and direct/indirect costs and benefits. Several evaluation methods are described - net benefit analysis, present value analysis, net present value, payback period analysis, break-even analysis and cash flow analysis. Their formulas, examples and advantages/disadvantages are provided. The document concludes that cost-benefit analysis involves identifying, categorizing and evaluating costs and benefits to interpret results and take action regarding alternative systems.