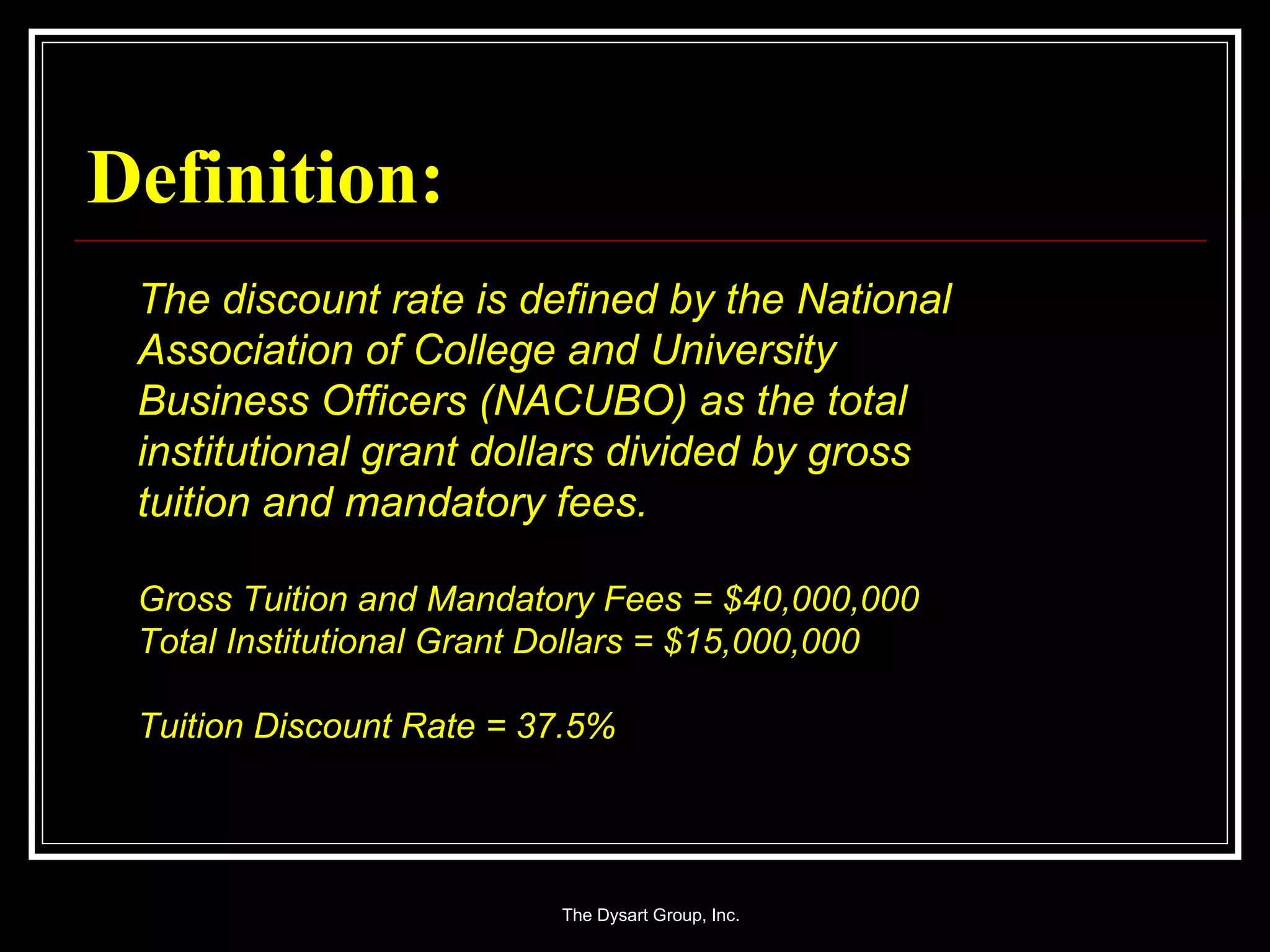

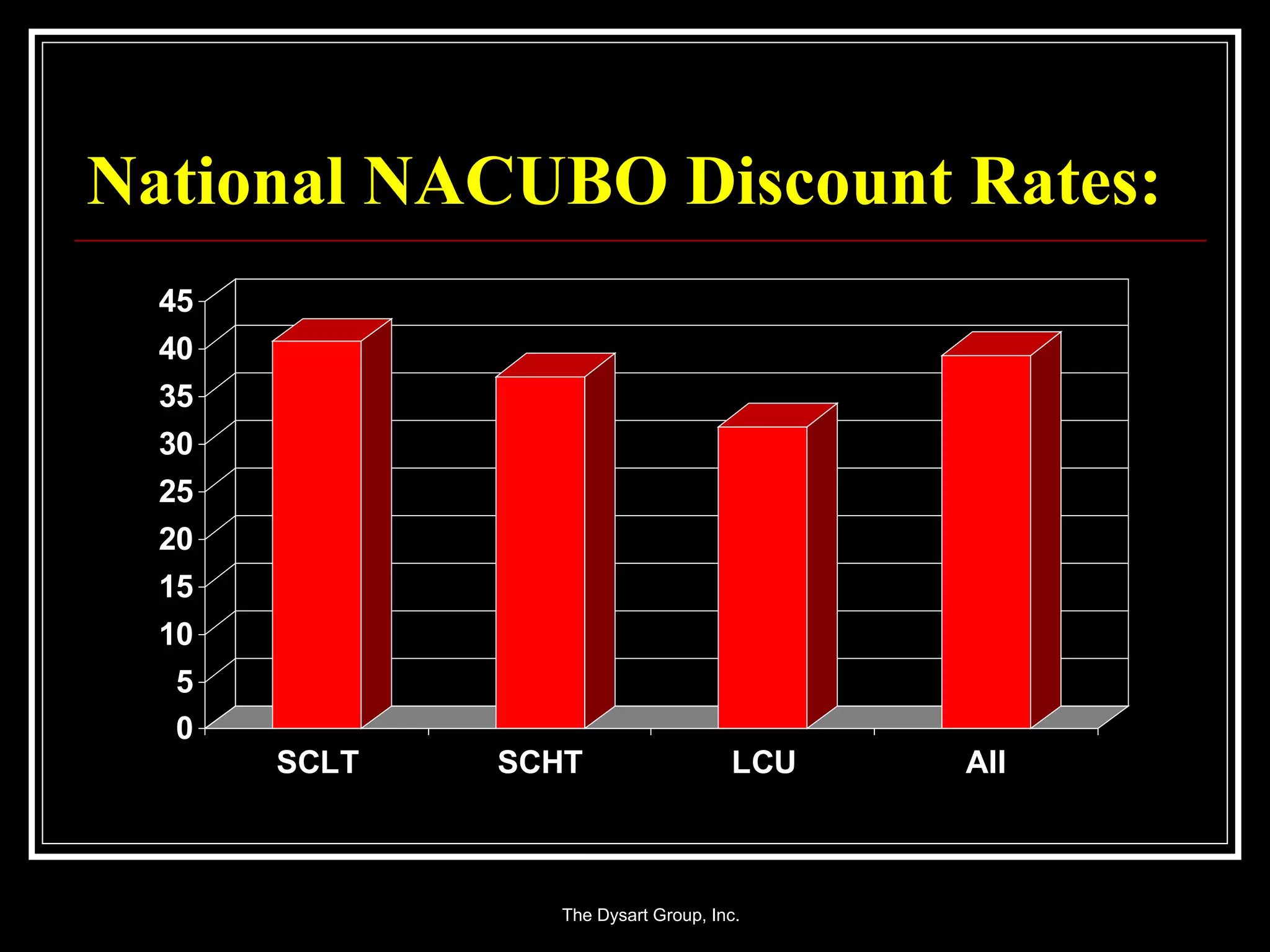

The document discusses the concept of the discount rate in higher education, defined as the total institutional grant dollars divided by gross tuition and mandatory fees. It outlines various factors influencing discount rates, including geographic diversity, athletic scholarships, academic quality, and institutional missions. Additionally, the authors raise questions about the reporting of discount rates, their implications for institutional financial health, and the focus on net revenue versus discount rates.