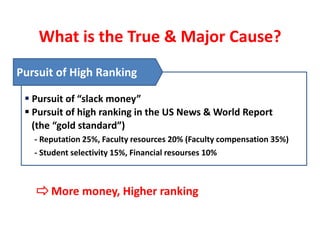

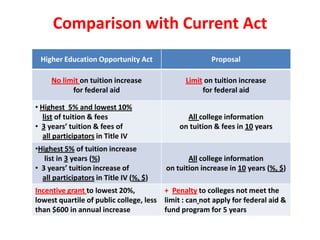

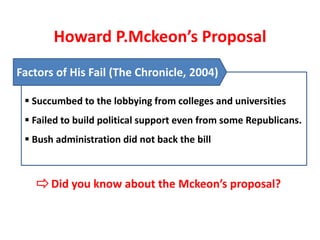

The document discusses proposals to limit rising college tuition costs. It proposes mandating that tuition increases be limited to the rate of inflation or colleges would lose eligibility for federal aid. Specifically, it proposes:

1) Putting a limit on annual tuition increases so they do not exceed the average inflation rate of the past 3 years.

2) If colleges increase tuition beyond this limit, they would be disqualified from receiving all federal funds for the next 5 years, with exemptions for increases under $600 or for colleges with tuition under $6,000.

3) This proposal aims to make college more affordable by curbing tuition growth and shifting power back from colleges to students/consumers. It could impact