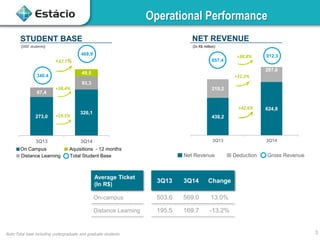

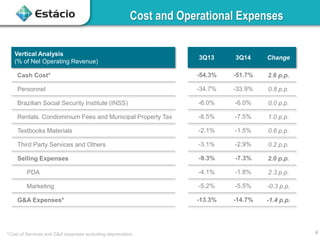

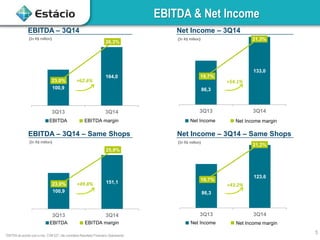

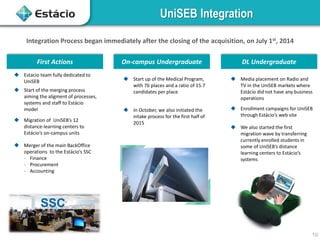

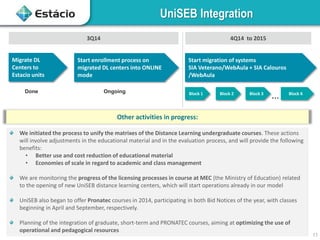

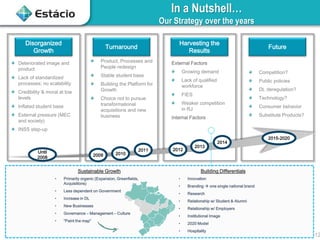

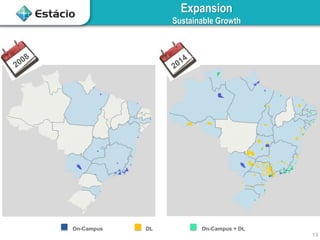

Estácio Participações reported strong financial results for 3Q14, with net revenue up 42.6% and EBITDA increasing 62.6% compared to 3Q13. Key highlights included a 37.7% rise in student enrollment, integration of the UniSEB acquisition, and the opening of two new on-campus units. Costs and expenses declined as a percentage of revenue, contributing to a 54.1% increase in net income. Management remains focused on organic expansion, increasing distance learning programs, and building the company's brand and reputation through innovation.