New Amnesty Scheme 2014

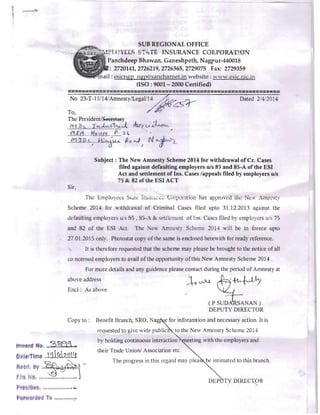

- 1. -------------------------------------------------------------------------------------------------------------------------- SUB REGIONAL OFFICE TC:YEES S~p,TE INSURANCE COn.PORAT~ON Panchdeep Bhawan, Ganeshpeth, Nagpur-440018 : 2720141,2726219,2726365,2729075 Fax: 2729359 il : esicngp ngp@sancharnet.in website: '''-.esic.ru ,m (ISO: 9001 - 2000 Certified) No 23-T-1lI14/Amnesly/LegaV14 ~?~ Dated 2/4 2014 To, The Presidentl~ecretaFY ('fJ!.J) c r.,~-tu':{ thro(J ~ /tIft HJ) $'--<. P- 1.(, '" M:r.D L ) f..C.lA.jUA Ro"') I N r Subject: The New Amnesty Scheme 2014 for withdrawal of Cr. Cases ftled against defaulting employers u/s 85 and 85-A of the ESI Act and settlement of Ins. Cases /appeals filed by employers u/s 75 & 82 ofthe ESI ACT Sir, Scheme 2014 for withdra'al of Criminal Cases filed upto 31.12.2013 against the J faulting employers u 85.85-.-' & cuiemen[ oflns., Cases filed by employ r- ul 75 and 82 of the EST Act. The 'ew Amn s y S heme 2014 will be in forece upto 27,01.2015 only. Photostat copy of the same is enclosed here'ith for ready reference, It is therefore requested that the scheme may please be brought to the notice of all co ncerned employers to avail of the opportunity of this New Amnesty Scheme 2014 , For more dctails and any guidence please contact during the period of Amnesty at above address ,_-+' v--le' ~f-1l)Ene!: As ahove (P SUDA:RSANAN) DEPUTY DIRECTOR Copy to: Benetlt Branch, SRO, Nag r for inforamtion and necessary action. It is ff'questcd to give wide pUblici / to the New Amensty Scheme 2014 by holding continuous interaction eeting with the employers and fflWtlfd No. ...3m3... their Trade Union! Association etc. tilA Ifl " J.~.t.~L7:2J.~ The progress in this regard may plea be intimated to this branch, ~~:"N:'Y":'~~:'~ DEP TY DIRECTOR '. .."I'"'. t.'•... ··-~ ''' ..,.........;.

- 2. ~~~ {~-j EMPLOYEE,S.STATE INSURANCE CORPORATIO~ PANC:A'l>EEP B~WAN, Cl.G. ROAD 'NEW,'DELID-110002 Website - esic.in Ph ; (011) 23234092 No, P-11114/32/2013-Rev-II Dated : 28/2/2014 3>l':3.b.~l'-t The Regional DirectorlDirector lIC/ Joint Director lIC ESI Corporation Regional Office/Sub-Regional OfficelDivisional Office Sub: The New Amnesty Scheme 2014, for withdrawal ofcriminal cases filed against the Insured Persons and Employers under Sec 84, 85 and 85 A ofESI Act 1948 and settlement ofcases filed by,employers under Sec 75 ofESI Act 1948 Sir!. fa Th;; Co:-poration in its 161s( meeting held on 281112014 and 1412/2014 has approved tile launching of Amnesty Scheme 2014 1. to r: ~~u,:e ~h"!!iHmber of liti!:!'l ~jon by providing a mechanism for resolution of disputes outside the COUlt. ' 2, To eam goodwill of stakeholders and thus enhance the brand image of the Corp ra ion, Keeping in view above factors, the iew Amnesty Scheme 2014 provides for (he withdrawal of all--prosecution cases filed u/s 84 and 85 ofESr Act and court cases U/S 7? and 82 of the ES] Act upto 31st December 2013 subject to following terms and condition~', - : , : ' I . A. SETTuEMENI QF ~pURT CtiSES FILEUllIS,75. AND APPEAL U/S ~2 't , .. ' ; 1. DISPUTE OF COVERAGE ThlScheme srulll inClude all cases filed in which the employer has disputed the'coverageowhich may be settlbd subjec.t to the following conditions: - In case e[closetl Units,. , Unit is closed for more than 5 years iIs-'oh 31st December 2013 , Case is pending for more than 5 years as on 31st December 20U , No assessment has been made for the period under dispute apd :itip~!~!! !,eriodLlpto ,the date of commencement of Amne~ty Scheme 2014. ESIC ChinUl se Mukti

- 3. : 2 : • In case ofrunning units , If the factory is functioning and the employer produces genuine records to substantiate his plea regarding non-coverage o} coverage from later date. I 2. DISPUTE OF CONTRIBUTION This Scheme shall also include cases in which the employer has disputed the detennination or recovery of contribution in the Employees' State Insurance Court, uls 75 of the ESI Act and appeal uls 82 Upto 31st December 2013, subject to the fulfillment of the following conditions : i. The employer shall file a petition before the court where he has raised the dispute and seek permission of Hon'ble Court for out of settlement of matter under litigation. If court allows, then the matter shall be settled as per this Scheme. The employer/IP shall apply for the scheme in the enclosed proforma of Annexure 'A'. lL The employer shall paj both the Employees' and Employers' share o contribution in full as per their records, which he shall produce fore the assessing oft1cers if the contribution has been assessed on assumed wages and he shall comply with other provisions of the Act. iii. In case the relevant records are not available with the employer; tb~y sh?.1l rrod'lce alternative records such as Income Tax Record etc and shan pay the contriburion accordingly as per thai record. iv. However, if the employer is not able to produce any records and the assessment has been made in respect of wages other han the wages sho'.. in Regulation 32 Registe~. he shaH pay !.he omriburioD hich s!1" no' be less tha.~ 30- o ' rile assess~d amount of comribu(o 0 The _ where assessmen has already0 been made as per Hqrs instruction KO. P-llt13i97-Ins-IV date~ 2615/2003 or where the contribution has been assessed on actual bases will not fall under the purview of this Scheme. v. The employer pays the Interest in full vi. No damages shall be levied. I vii. The employer shall also furnish an unde~ng t~ th~ Corporation to the effect that he/she shall be regular m complIance in the provisions of ESI Act in future or else he/she shall forfei the right to avail of such amnesty scheme. I I / I I

- 4. : 3 : B. CASES WHERE EMPLOYER HAS DISPUTED THE LEVY OF DAMAGES "Il There are cases where employer has disputed levy of damages in th,~ court of law after making payment of contribution and interest. These cases filed upto 31st December 2013 may also be considered fo withdrawal with benefit of 50% waiver in damages since court insist on proof of.contwnacious conduct for upholding orders passed under 85-B (Proof of which is difficult). C. SCHEME TO WITHDRAW COURT CASES FILED VIS 84, 85, 85-A 011 ESI ACT. 1948 1. Cases filed against the Insured Person under section 84 of the EST Act. Prosecution filed against the IPs uis 84 of the ESI Act for givin~ wrong declaration/statement resulting in excess payment to him/her max be withdrawn subject to the condition that I :lie entire amount paid in excess to the Insured person is refunded i~ -'. be himiher to the Corporation ,I. );0 interest will be claimed iii. An undertaking is also given by Insured Person to the effect that he/she would not give wrong declaration/statement in future. 2. Cases filed against the employers unoel' st:cti,on 85 and 85-",·t of the ESI Act upto 31st December 2013 Prosecu ion cases filed against t..'1e employers u's 85 and 85-... of t e ESI Act upto 31s December 20 3 may be ; tbdra. bject (0 ll:e fa :owing conditions : 1. The employer shall pay both the Employees' and Employers' share of contribution in fu.l as per his records, which he shall produce befor the assessing officers, if the contribution has been assessed 0 assumed wages. ii. rn case the relevant records are not available with the employer, hel' shall produce alternative records such as Income Tax Returns etc and shall pay the contribution as per that record. However, if the, employer is not able to produce any records, he shall pay contribution on the basis of following, in the same order, (i.e only in cases where the records as per. option 'a' is ~ot available, ~own below alternatives, in the same order IS to be exerCised for assessmg dues.) 1

- 5. : 4 : a) The rate of monthly contribution paid for the month prior [Q the month from which default started. OR b) Monthly wages declared in form-Ol OR c) Monthly wages reported by SSO in the Survey Report OR d) Minimum wages applicable in the Sra,elRegion iii. The employer pays the interest due for the per.od of p~o mion ir. full. iv. No damages shall be levied. v. The employer shall also furnish an undertaking to the Corporano :0 the effect that he/she shall be regular in compliance w:rh u .~ provisions of ESI Act in future or else he/she shall forfeit the rig:-.l :0 avail of such Amnesty Scheme. The scope of Amnesty Scheme 2014 is enhanced to include cases as :1 e~ 1. Cases me u/s 85 (3 & ~) '. There are large numbers of old pending cases which are pending lor more than 15 years as on 31st December 2013. In many of such cases the dues involved are very meager as compared to expenditure and manpower involved in handling such cases in court of law. These cases may alsu be wiisid(!red f'1r withnrawal subject to the following conditions: " For closed units "III. The uni: is cI ed or its Vi ereabout is not knov.rn,and. "III. The outstanding contribution (excluding Interest & Damages) is UplO Rs. 5000 • For runnin~ units ..... Ifunit is functioning, the unit should make upto date, and• ..... The outstanding contribution (excluding Interest & Damages) is upto Rs. 5000/- and, ..... 30% of contribution only to be paid "

- 6. : 5: 2. Cases filed uJ 85 (e) - non-submission of return of i contribution only There are cases where ESlC has filed a criminal case against th . employer for non-submission of return of contribution. As thes cases do not have any financial implication and ESI has now don~ away with submission of Return of Contribution, such cases filed up,to 31st December 2013 may be considered for withdrawal subject to following conditions : • For closed units ..... The unit is closed or its whereabouts is not known, and, ..... Employer has deposited cO:1tribution and interest for th period of return • For runnin~ units ..... If the unit :s running anJ compliance is upto date, and. ..... Employer has deposited comributior: and interest for (he period of return. (D) All cases are required to be settled as per this scheme, within 3 months from the date of filling of appiication by th" 'riIH:f~l Empby",,:,11>.l£lIr__tfj Person (E) The Scheme will also be available to those employers/insured persons who have already availed of the benefits of earlier Amnesty Schemes. (F) The iew Amnesty Scheme-2014 will be in force from 281112014 to 271112015. (G) The Regional DirectorslDirector IICs/Joint Director IIC of RO/SROID arei fully empowered to accord sanction for withdrawa1lsettlement of cases as I per para (A) to (B) on receipt ofcompliance as per the Scheme (H) The Regional DirectorslDirector IICs/Joint Director IIC of RO/SROID.O Iare requested to give vide publicity to the Scheme through l advertisement/press release in leading local newspapers and by hOlding/ continuous interaction/meeting with Employer and Trade Union etc. The contents ofthe new Amnesty Scheme 2014 must also be posted on thel Regional Web Site. The members ofRegional BoardILocal Committet!lWorkers Union and Employers Association must also be : infonned about launch of New Amnesty Scheme 2014. (1) Regional ilireclors/Dir.-:c.or lfCsi" oint Dirc!:to!' I/C of RO/SROID.oi need not refer any case to Hqrs.

- 7. : 6 (1) The Corporation has also approved that incentive as mentioned below may · also be giveu 'C) Panel Advocate for their contribution ill withdrawal ofcases during the Scheme. a) Incentive ofRs. 2,000/- for cases filed U/S 75 b) Incentive of Rs 500/- for cases filed U/S 85 (a) to 85 (g) of ESI Act. c) Further, regions which succeed in withdrawal of 25% of . their pending cases may be given certificate of merit I (K) Monthly Progress report in this regard should reach this office by 10th of every I month. (L) They are advised to form a monitoring cell at their level, to implement Isuccessfully and smoothly, the contents of this Scheme, including for reporting to Hqrs M The receipt of this communication may be acknowledged. Yours faithfully, c--:# "< L- (AKUN KuiVlAl) ADDL. COMMISSIONER (REV> Copy forwarded to 1. All Divisional Heads in Hqrs office 2. All SSMCs/SMCs - for infonnation 3. loint DirectorslDy. Director (Fin) ESI Corporation. RO/SRO ___ _ 4. A.C (Vigilance), Hqrs office 5. Dir (Vig)/JD(V)(NZ)/JD(V)(WZ)/JD(V)(SZ) - for infonnation 6. Website Manager - with the request to post the matter in the Official WEbsite Iof ESI Corporation I 7. All branches in Hqrs office for infonnation. I II

- 8. ANNEXURE-A PROFQRMA FQR WITHPRAWAL OF COURT CASES 1. Name and ~.dcres.:: of the Insured perso~/employer II. Employer Code No./Insurance No. III. Date of Institution of case, IV. Name of the Court/Forum in which case is pendi 9 V. Section of ESI Act 1948 under w ich the case VI. Present status of the case and e iss es VII. Details of amount involved with per-ad. I 5 No.I Nature of default Compliance made T , , I I , ,I -j , I I i I i , I L VIII. IX. COPY of court order permitting out of court litigation u/s 75 and appeal u/s 82 of the Act. 'Proof & Details of deposit of the amount. settleme innt case of I The above information is true and correct to t e best of my knowledge, I also undertake that I shall be regular in compliance in the provisions of ESI Act in future or else shall forfeit the right to a avail of such Amnesty scheme, Signature of the Applican~ Name:Date: Status:Place: