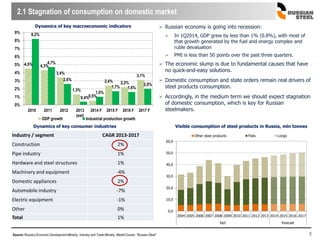

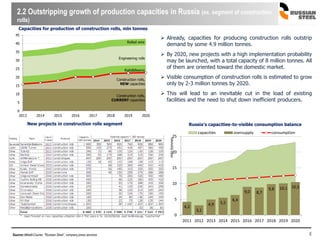

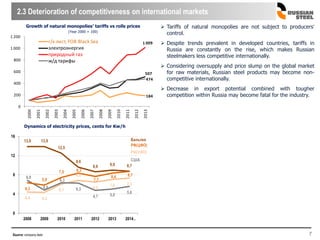

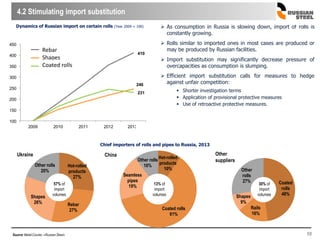

The steel industry in Russia faces challenges of stagnating domestic demand, growing overcapacity, and decreasing competitiveness in international markets. Major Russian steelmakers have invested in new projects to expand production, but this risks further overcapacity as demand is expected to grow slowly. State support is needed to stimulate infrastructure projects and import substitution to boost domestic consumption. Steelmakers must also cut costs, develop new products, and move up the value chain to improve competitiveness. The future of the industry depends on balancing capacity growth with demand as well as implementing policies to support investment and regulate natural monopoly tariffs.