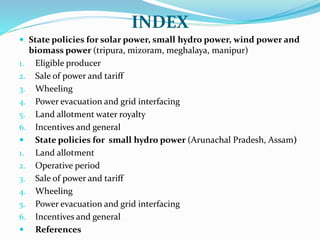

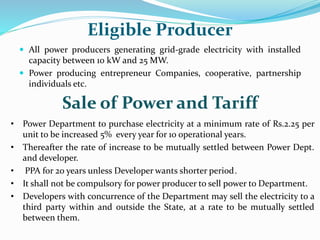

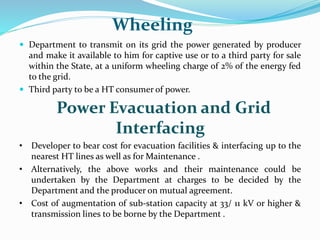

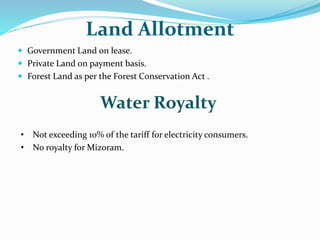

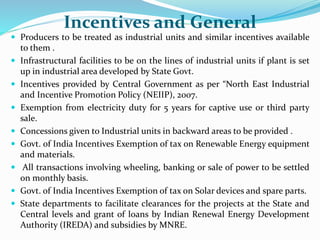

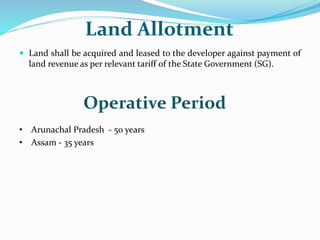

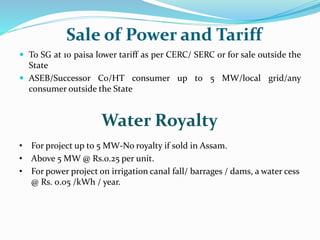

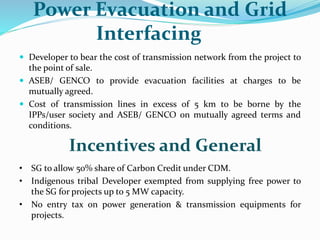

This document summarizes renewable energy policies for several North Eastern Indian states. It outlines the key policies regarding eligible renewable energy producers, tariffs for power sales, wheeling charges, responsibilities for power evacuation and grid interfacing, land allocation, water usage fees, and available incentives. Eligible producers can generate electricity between 10 kW to 25 MW. States will purchase power at rates starting between Rs. 2.25 to 2.5 per unit, increasing annually. Developers are responsible for evacuation infrastructure up to substations and may sell power to third parties within the state. Various incentives like tax exemptions and infrastructure support are also provided.