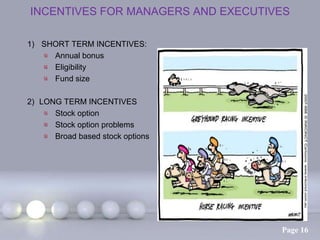

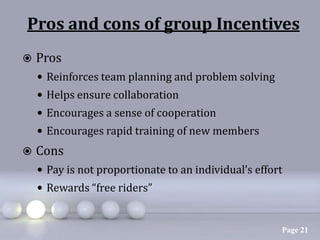

The document discusses different types of incentives that can be used to motivate employees, including financial incentives like profit sharing plans and stock ownership plans as well as non-financial incentives. It also covers incentives for specific groups like salespeople and managers, and explores the benefits and drawbacks of individual versus group incentive structures. The overall purpose is to analyze various incentive programs that can be implemented within an organization to improve performance.