This document covers basic macroeconomic relationships including:

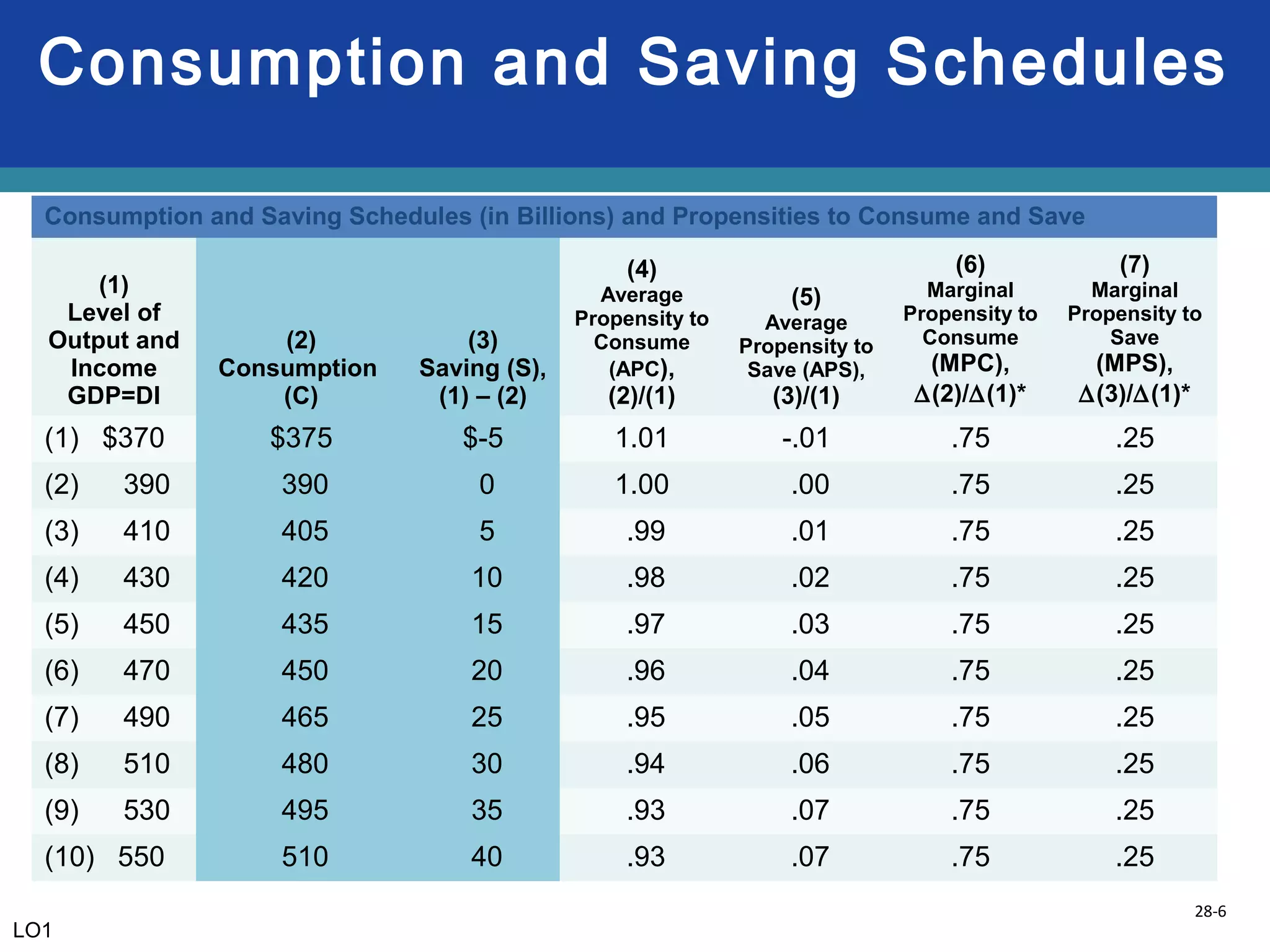

1) How consumption and saving are primarily determined by disposable income, with consumption directly related to and saving inversely related to income levels.

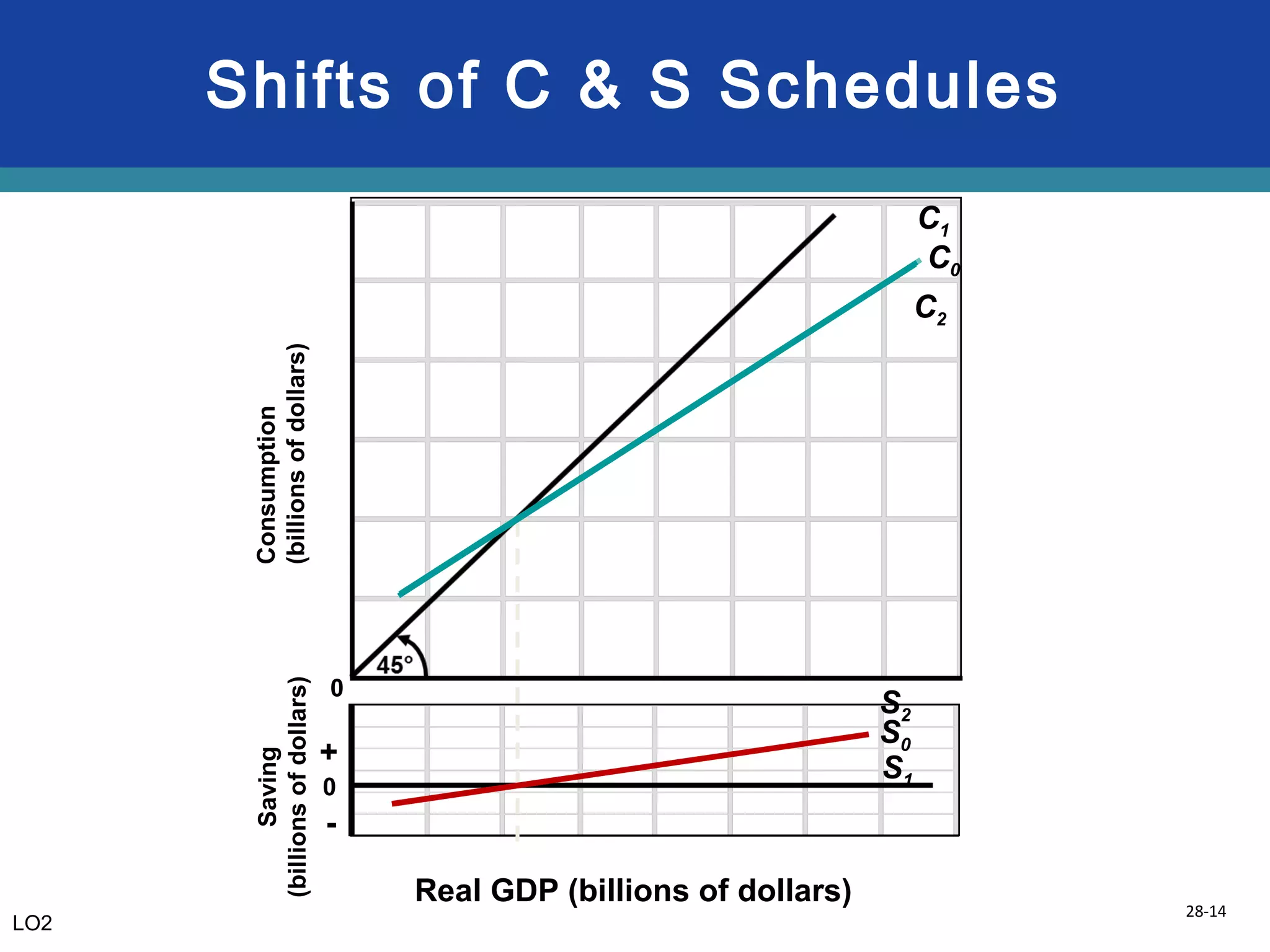

2) Other factors besides income that can affect consumption and saving such as wealth, borrowing, expectations, and interest rates.

3) How investment is directly related to real interest rates, with lower rates stimulating more investment, and various other non-interest factors that can affect investment levels.

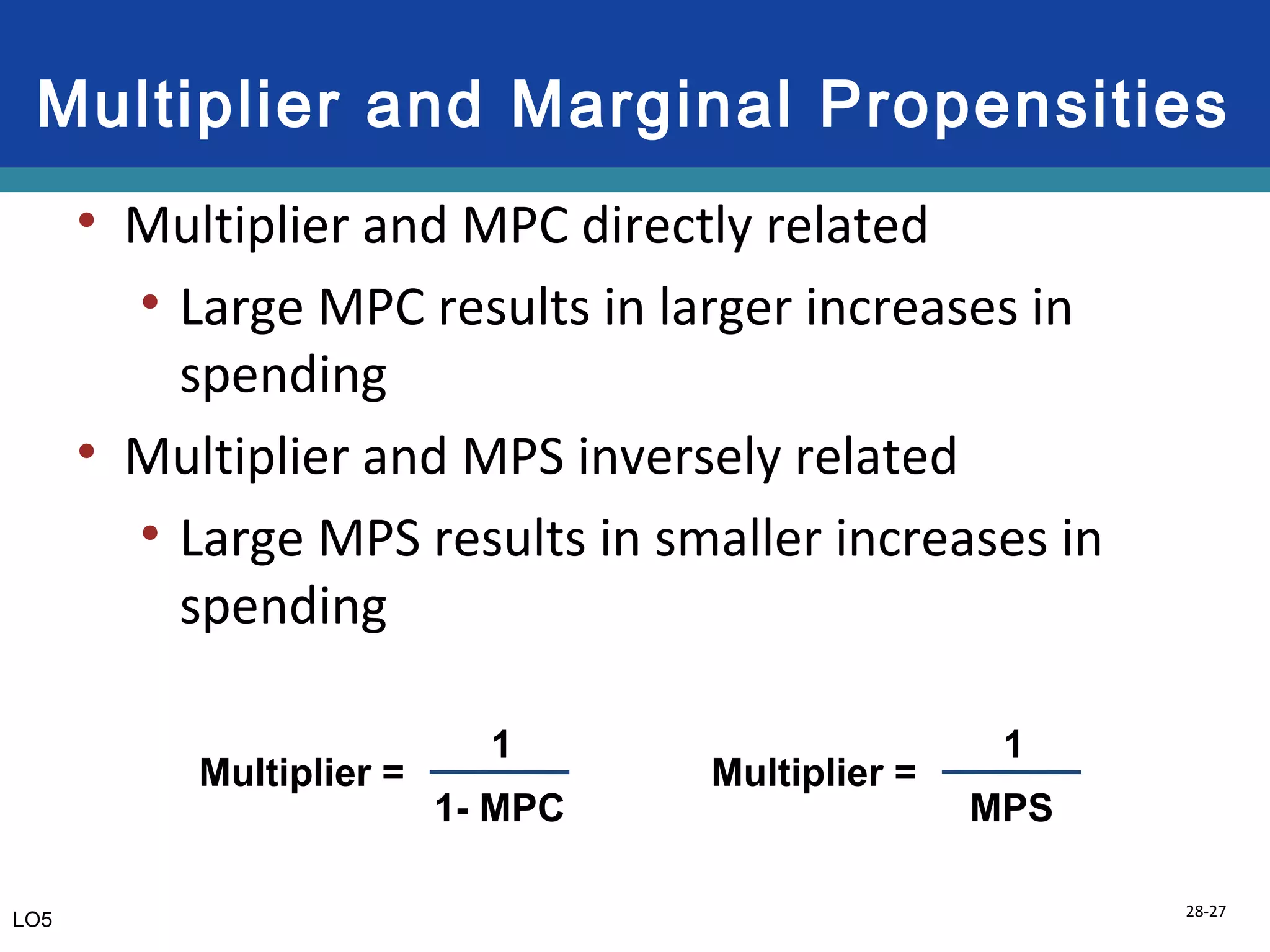

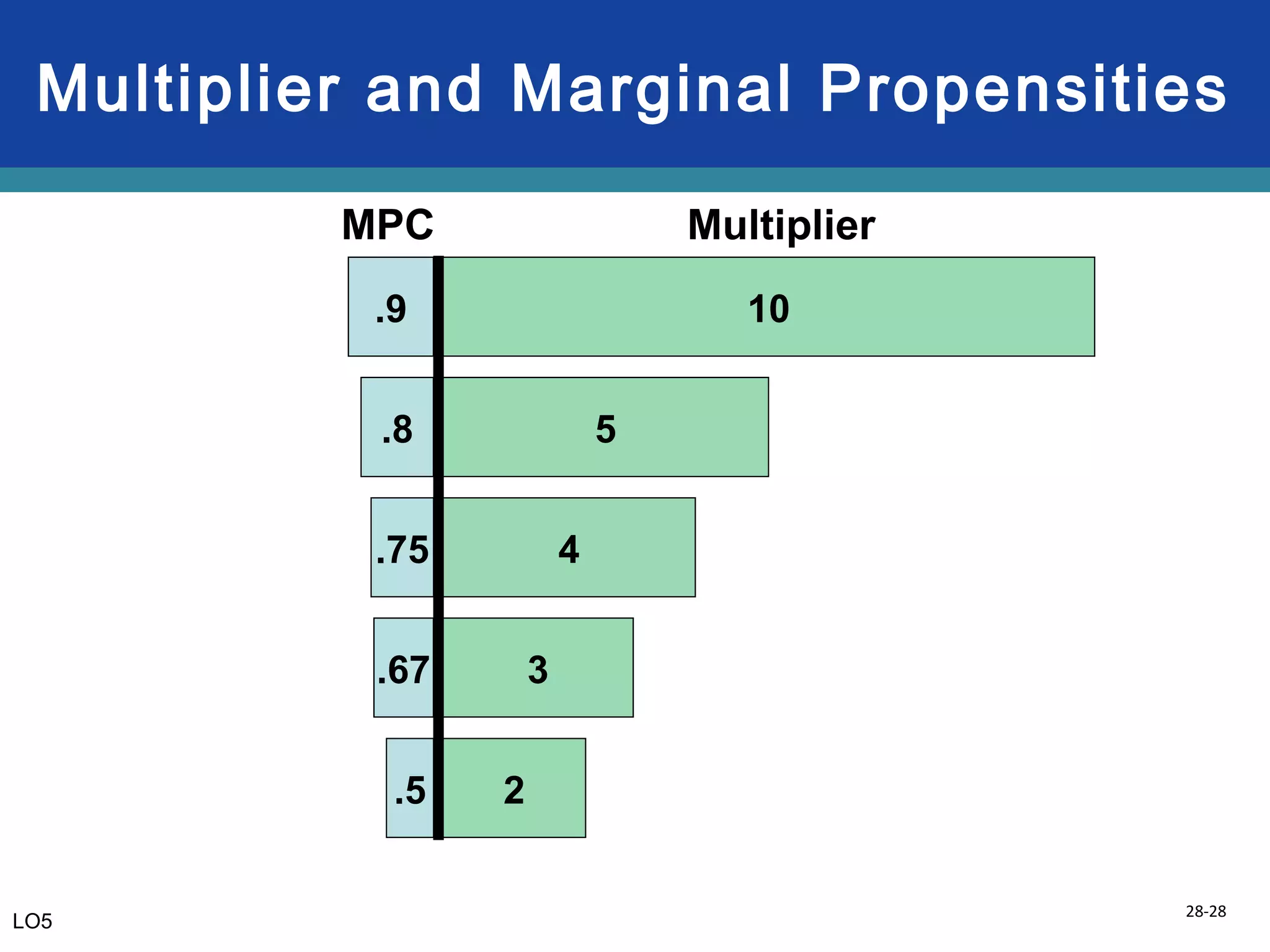

4) How changes in investment or other spending components can multiply, with the multiplier effect magnifying the initial change in spending into a larger change in real GDP.