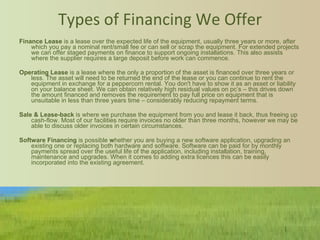

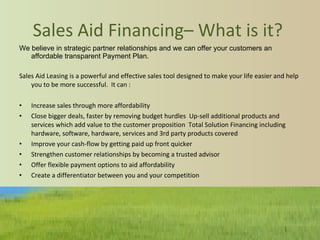

e-Financing Solutions offers financing options like leasing and operating leases to help customers overcome budget constraints and improve cash flow. Their financing can cover costs associated with acquiring software, hardware, services, and training in a single transaction. They also offer a technology refresh option that allows customers to easily upgrade equipment without impacting budgets or causing obsolescence issues. Their goal is to work with each customer to develop a customized payment plan that best meets the customer's specific needs.