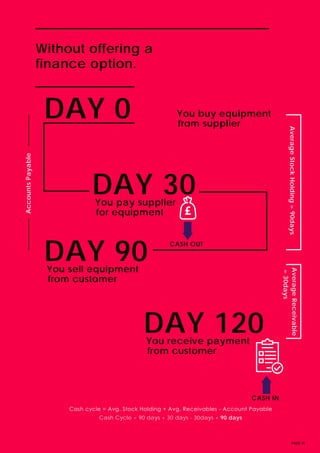

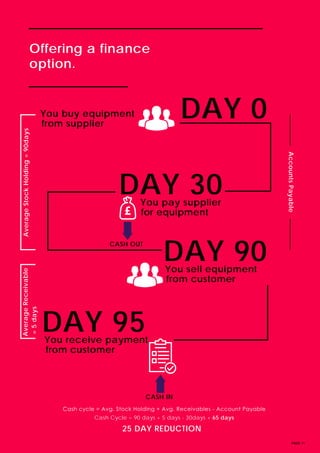

Sales aid leasing can transform businesses by making purchases easier for customers. Offering financing options reduces customers' upfront costs and allows them to spread payments over time. This helps drive sales and improves cash flow for suppliers. However, as businesses grow and change, their financing needs may also change. It's important to periodically review financing options to ensure they keep pace with the business and allow access to new markets and customer types. Conducting a gap analysis by comparing business goals to the capabilities of current financing partners can help identify any limitations and ensure financing continues fueling growth.